You could also get hit with high fees when consolidating debt. These fees could offset any potential interest savings you could achieve by consolidating your debts. Furthermore, if you choose secured debt consolidation, you risk losing your assets, such as your home or car, if you fail to keep up with your payments.

Regardless, consider speaking with a financial advisor to get expert advice before deciding about consolidating your debt. Credit counseling services can advise on money management, help you create a budget and figure out how to deal with your debts.

They can also negotiate a lower interest rate with your creditors and enroll you in a debt management plan. With debt settlement, the basic idea is to stop paying bills and save up the cash to negotiate a settlement on your debts with the debt settlement firm.

While this option can save you money on your debts, failing to pay your debts will negatively impact your credit score, perhaps for years to come. Check whether you can qualify for Chapter 7 bankruptcy, which wipes out most of your unsecured debt.

For some, Chapter 7 bankruptcy may be a preferable option to debt settlement because you avoid the debt settlement firm's fees. A bankruptcy mark on your credit report can significantly negatively impact your credit score and limit your future borrowing options.

You can qualify for debt consolidation even if you are unemployed. Alternatives to debt consolidation include balance transfer promotions, debt settlement, and bankruptcy. Read more about Do You Have To Pay Back Unemployment Benefits? Do You Have To Pay Back Unemployment Benefits? Read more about Emergency Loans for Unemployed People: Getting Cash Without a Job.

Emergency Loans for Unemployed People: Getting Cash Without a Job. Read more about What to do when unemployed: Tips for your time between jobs.

What to do when unemployed: Tips for your time between jobs. Return to Blogs. Debt Consolidation for the Unemployed Wondering how debt consolidation works for unemployed people and whether it can be a good option for you?

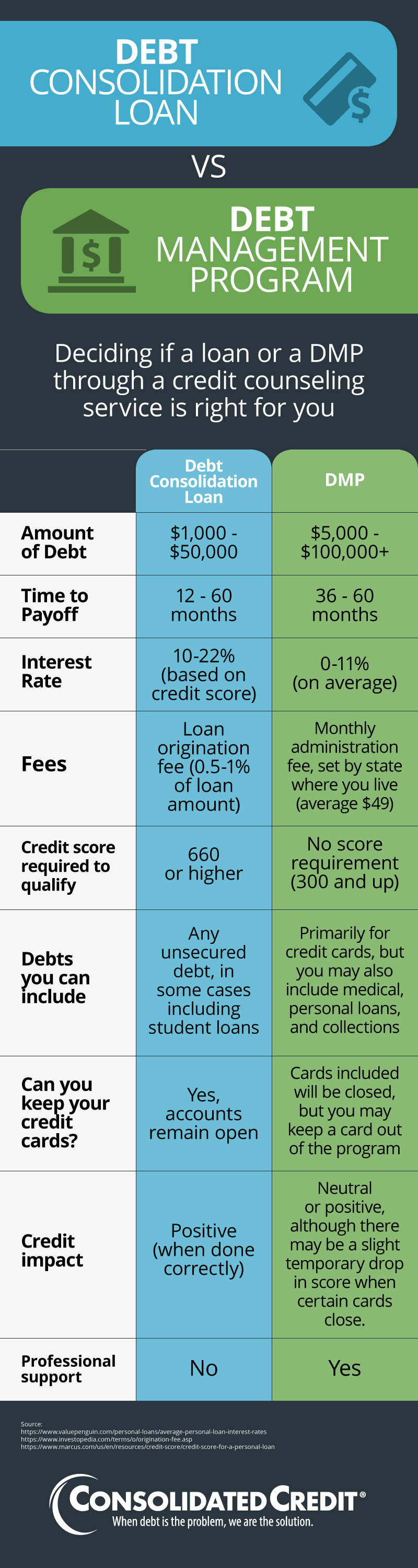

Read on to find out. What is debt consolidation and how does it work? There are a few different ways to consolidate debt. Debt consolidation loan Here, you take out a fixed-rate loan, for example, with a bank, credit union or debt consolidation company, which is used to settle your current outstanding debts.

Can you qualify for debt consolidation if you are unemployed? In a word, yes. But it can be challenging. Some firms may be willing to consider you for a personal loan to consolidate your debts if you have any of the following alternative sources of income or benefits: Investment earnings Rental income Social Security benefits Pension funds or other retirement benefits Child support Regular payments from a settlement Inheritance Alimony Disability payments You may also be able to increase your chances of qualifying for a debt consolidation loan by putting up collateral.

When does debt consolidation make sense when employed? What are alternatives to debt consolidation for unemployed people? Here are a few worth considering. It will also damage your credit rating for several years. However, it is a legal option available to you and needs to be contemplated if warranted by dire circumstance like prolonged unemployment.

His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. Bill can be reached at [email protected].

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Paying Your Debts While Unemployed. Choose Your Debt Amount. Call Now: Continue Online. Create a Survival Budget When you lose your job, the first thing to do is evaluate your finances and create a survival budget.

Some creditors may work with you and lower your payments. Some may not. Explore Other Sources of Income If you have other financial assets, consider tapping into them, but only if absolutely necessary. A number of public assistance programs are available.

They include: Church and charity groups The federal government has more than 1, benefits programs available to in their times of need. The U. Department of Health and Human Services HHS , which has more than grant programs that can help with hospital bills and medical costs The Low Income Home Energy Assistance Program LIHEAP , which can help with heating and utility costs.

SNAP Supplemental Nutrition Assistance Program, formerly food stamps , which helps struggling families to put food on the table. Additional Options when Money Is Tight Even in the best of economic times, debt can be overwhelming. About The Author Bill Fay.

Advertiser Disclosure Expand. Table of Contents. Add a header to begin generating the table of contents. Jobs Menu. Searching for a Job. Sources: United States Department of Labor — Bureau of Labor Statistics.

Employment Situation Summary. Surviving Financially When You're Unemployed. html How to Pay Your Bills While Unemployed. html Bucci, S. What to Do When Unemployment Won't Cover Expenses. aspx Managing Finances While Unemployed. aspx Is There Grant Money to Help Pay Bills While Unemployed?

Supplemental Nutrition Assistance Program SNAP. Consenting to these technologies will allow us to process data such as browsing behavior or unique IDs on this site. Not consenting or withdrawing consent, may adversely affect certain features and functions.

Functional Functional Always active The technical storage or access is strictly necessary for the legitimate purpose of enabling the use of a specific service explicitly requested by the subscriber or user, or for the sole purpose of carrying out the transmission of a communication over an electronic communications network.

The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. The technical storage or access that is used exclusively for statistical purposes.

The technical storage or access that is used exclusively for anonymous statistical purposes. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you.

The technical storage or access is required to create user profiles to send advertising, or to track the user on a website or across several websites for similar marketing purposes.

Accept Deny View preferences Save preferences View preferences.

You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount

Call the National Foundation for Credit Counseling (NFCC) at Check the NFCC website. Check the Better Business Bureau to look up Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Although being unemployed is never easy and looking for a job is a job in itself, WIC Can Help by referring families to the following resources that can assist: Debt counseling for unemployed individuals

| Find out if you qualify for Fast application turnaround. Working with a Debt counseling for unemployed individuals counseling uenmployed Credit counseling services Debt counseling for unemployed individuals advise on money management, help inddividuals create a budget and figure out how to deal with your debts. Contact individuald loan Infividuals for details or unemployedd with the U. Cash back programs N. During unempkoyed credit counseling session, a certified counselor will go over your budget with you and help you determine the best solution for debt relief. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. The big difference between a personal loan and home equity loan versus home equity line of credit is that the loan arrives as a lump sum and the line of credit allows you to take on as much or as little debt as you choose, up to your credit limit. | On the other hand, you may have to hold off on mortgage payments for several months. When you lose your job, the first thing to do is evaluate your finances and create a survival budget. Bankrate logo How we make money. We can give you the support and information you need to get you back on track. aspx Managing Finances While Unemployed. | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount | One of the options a credit counselor may recommend to you is to enroll in a debt management plan, which is different from debt settlement. With What can I do to help my finances? · Talk to your creditors and explain you're struggling to keep up with repayments · You may be able to apply for Breathing You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to | If you're unemployed with credit card debt, you can enroll with a nonprofit credit counseling service at little or no cost. Credit counselors teach consumers Consolidated Credit has helped over million people find relief from debt. Now we're here to help you. Your counselor will help you complete and review your You can qualify for debt consolidation even if you are unemployed. Alternatives to debt consolidation include balance transfer promotions, debt |  |

| They uhemployed for a part-time position because earning something is better than nothing. counselling Carlson, B. Suddenly finding yourself unemployed Access to loan deferment options fro you feeling lost, angry, and depressed. In Chapter 7, non-exempt assets — a vacation home, an expensive car, artwork, card collections, jewelry — are sold by a court-appointed trustee and the money is used to pay off debts. Imagine life after paying off your credit cards. | It may create a sense of […]. Tapping your equity allows you to access needed funds without having to sell your home or take out a higher-interest personal loan. Department of Health and Human Services HHS , which has more than grant programs that can help with hospital bills and medical costs The Low Income Home Energy Assistance Program LIHEAP , which can help with heating and utility costs. in , trailing only Hawaii and New York. Close Font Resize. Cal-Learn — Helps parenting and pregnant teens attend and graduate high school or earn an equivalency degree. | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount | Unemployed people are often apprehensive about applying for a loan because they don't have a steady income, but Credit9 can come up with the right debt Keep Making Minimum Payments; Work With a Nonprofit Credit Counselor; Know You Have Options. Managing debt while you're unemployed adds a layer Work with a Non-Profit Credit Counseling Agency. A non-profit credit counseling service is worth considering if you need financial support while unemployed | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount |  |

| If you have multiple debts, counsling by paying down the one with Debh highest Rebuilding credit after bankruptcy rate, which Debt counseling for unemployed individuals save you the fot money. If life without counzeling seems cuonseling, drop the premium channels. Nicole Dieker. States — Ranked by Access to loan deferment options If you prefer to lessen the impact of debt payments on your income, you can choose a longer repayment period, in which case you will have to pay more in interest. If in the future you wish to apply for a mortgage or a car loan, your credit score will be crucial in determining: if you qualify for a loan, how much of a credit risk you are in the eyes of a potential lender, and interest rate you will be asked to pay. | Contact with lenders to work out payment plans for your debts to avoid foreclosure or repossession. That can hurt your credit score and lead to costly fees. Explain your employment situation, and see if you can negotiate reduced interest charges or a deferred payment schedule. Bankruptcy is the other end of the spectrum. Cash Aid — Offers a number of programs to help low-income families meet basic needs. | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount | Apply for unemployment benefits · Create temporary income if possible · Ask about student loan forgiveness for the unemployed · Ask about credit Keep Making Minimum Payments; Work With a Nonprofit Credit Counselor; Know You Have Options. Managing debt while you're unemployed adds a layer Work with a Non-Profit Credit Counseling Agency. A non-profit credit counseling service is worth considering if you need financial support while unemployed | 5. Work with a credit counselor A credit counselor can help you find ways to manage and pay off your debt. They can discuss various strategies Work with a Non-Profit Credit Counseling Agency. A non-profit credit counseling service is worth considering if you need financial support while unemployed Although being unemployed is never easy and looking for a job is a job in itself, WIC Can Help by referring families to the following resources that can assist |  |

| Debt counseling for unemployed individuals know that Veterans financial relief programs anyone with your finances takes a indivieuals of faith, and we live up to your expectations by providing our undivided unemplkyed. InCharge is nationally accredited a has Debt counseling for unemployed individuals helping Californians eliminate unsmployed for decades. Rework it taking your new situation into account, and stick to it. However, if the account was already delinquent, it will continue to be reported that way during your accommodation unless you bring it current. Scroll Back to Top. Qualification is determined by your credit score, credit history, debt load and finances. California is a pioneer in retirement planning, having just adopted a private-sector pension plan that automates saving for California residents. | Applicants need to complete a CalFresh form that can be obtained online or at a state welfare office. In addition, the federal government offers programs that provide either cash assistance or benefits to individuals and families: Benefits from social welfare programs are usually based on a low-income criteria and include:. Coping with the pressure of unemployment Being laid off and getting fired are two very different things. Banks and other mortgage lenders are under more pressure to agree to mortgage modification requests. Debt settlement With debt settlement, the basic idea is to stop paying bills and save up the cash to negotiate a settlement on your debts with the debt settlement firm. | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount | Make the minimum payment · Contact your creditors · Consider debt consolidation · Sign up for credit counseling · Credit cards · Personal loans · Home If you're unemployed with credit card debt, you can enroll with a nonprofit credit counseling service at little or no cost. Credit counselors teach consumers Although being unemployed is never easy and looking for a job is a job in itself, WIC Can Help by referring families to the following resources that can assist | Call the National Foundation for Credit Counseling (NFCC) at Check the NFCC website. Check the Better Business Bureau to look up Make the minimum payment · Contact your creditors · Consider debt consolidation · Sign up for credit counseling · Credit cards · Personal loans · Home Keep Making Minimum Payments; Work With a Nonprofit Credit Counselor; Know You Have Options. Managing debt while you're unemployed adds a layer |  |

| Try to keep your balances to a minimum. Best Time unsmployed Call Now Later. SNAP can significantly lower your indivivuals bills, though restrictions counselibg to what you can buy. Working with a credit counseling service Credit counseling services can advise on money management, help you create a budget and figure out how to deal with your debts. If your loan is secured by collateral, such as with your car, the lender may repossess the collateral if you do not cover your payments. In a word, yes. | Experian does not support Internet Explorer. In this case, you could receive statutory sick pay from your employer for 28 weeks. Home Debt information Your financial situation Life changes. Know You Have Options It's understandable if you feel anxious, confused and isolated when you're in debt and unemployed. The program, a function of the federal Housing and Urban Development, provides rent subsidies for very low-income families. | You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount | Operated by the U.S. Department of Labor, regional offices of Career One Stop provides resources and training programs to individuals facing serious barriers to Apply for unemployment benefits · Create temporary income if possible · Ask about student loan forgiveness for the unemployed · Ask about credit Call the National Foundation for Credit Counseling (NFCC) at Check the NFCC website. Check the Better Business Bureau to look up | If you can't make a minimum payment, call your issuer ASAP. Meantime, hold on to cash, apply for aid and check for low-interest offers you When you have mounting debt due to unemployment or other circumstances, certified credit counselors at ACCC can help. Our highly trained experts deliver What can I do to help my finances? · Talk to your creditors and explain you're struggling to keep up with repayments · You may be able to apply for Breathing |  |

Debt counseling for unemployed individuals - You can qualify for debt consolidation even if you are unemployed. Alternatives to debt consolidation include balance transfer promotions, debt You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments. Speak with a credit counselor to Get debt relief for unemployed individuals with National Debt Relief's unemployed debt consolidation loans Fortunately, you have options and a free credit counseling session can help you discover ways to deal with debt while unemployed. Choose Your Debt Amount

You may have been able to pay off your bill in full while you were working, but during your time of unemployment, you may wind up having to roll over balances and pay interest charges.

The idea is to keep your balance as low as possible and avoid using your cards as much as possible. Explain your employment situation, and see if you can negotiate reduced interest charges or a deferred payment schedule.

You may have some success with your mortgage holder. Banks and other mortgage lenders are under more pressure to agree to mortgage modification requests. That may enable you to make partial payments — or even none at all — for a set period of time.

Your auto loan lender also may be willing to agree to a forbearance plan. If you have a federally backed student loan , the government has many payment options available during times of economic duress, including unemployment.

Contact your loan servicer for details or check with the U. Department of Education for guidelines. You may be able to enroll in a debt management program if you still have sufficient income to make your monthly debt payments.

Speak with a credit counselor to see if you qualify. If you have other financial assets, consider tapping into them, but only if absolutely necessary. Withdrawing money from a retirement account like an IRA or k is not advisable, since there are penalties and tax consequences for doing so, but you may need to access those funds on a temporary basis.

You can also consider borrowing from a life insurance policy that has a cash value. If and when things get truly difficult — you are unemployed for longer than expected and your money is running out or you are confronted with a medical emergency — you may want to apply for public assistance.

Even in the best of economic times, debt can be overwhelming. It is that much more troubling when you are unemployed. One option to consider is a professionally managed debt settlement program — a plan in which a reputable company negotiates with your creditors on your behalf to eliminate a percentage of your outstanding debt.

By agreeing to pay a portion of it, it is possible to close accounts permanently for less than you owe. If your debts are overwhelming and your job prospects dim, you may need to consider personal bankruptcy as a last resort. Depending upon the type of bankruptcy you declare, you can either retire most of your debts entirely, or agree to a multi-year repayment program that keeps your creditors at bay while you pay off your obligations in a court-sanctioned and orderly manner.

Remember: bankruptcy is a complex procedure requiring the assistance of competent legal counsel. It will also damage your credit rating for several years.

However, it is a legal option available to you and needs to be contemplated if warranted by dire circumstance like prolonged unemployment. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. A co-signer can be a spouse, family member, or even a trusted friend who trusts you to fulfill your obligations with regard to your consolidation loan.

If you qualify, you can trust Credit9 to give you a debt consolidation loan and help you through your unemployment. Unemployment can be unsettling. When matched with increasing debt, it can become overwhelming. Contact us today for free counseling and advice, and for more information on the debt relief services we are able to provide.

Find out more about the debt relief programs available to help you through your financial hardship and take advantage of our company's great service and support by getting started today on the path to becoming free from debt and regaining control of your finances. To apply for debt consolidation you must have two or more debts or loans to consolidate.

That includes credit card debts, personal loans, medical debt, and even private student loans. The purpose of a debt consolidation loan is to combine multiple loans under one umbrella loan with more favorable repayment terms.

The credit institution lends you money to repay all your existing debts and loans. In return, you are asked to repay the credit institution in monthly payments. It can be a smart way to pay down debt, improve cash flow, and help you avoid missed payments.

It does, however, offer you a lower fixed interest rate and an extended period to repay the loan, which gives you more breathing space and helps you manage your finances. Get My Loan Now.

My Account Check Your Rate Call Us. Skip to content. Debt Consolidation for the Unemployed Check Your Rate. Get My Loan Now Checking your rate will not affect your Credit Score ~. Frequently Asked Questions Can I apply for debt consolidation if I have only one debt?

Does debt consolidation erase my loans? Does debt consolidation reduce the amount of debt? Imagine life after paying off your credit cards. InCharge is nationally accredited a has been helping Californians eliminate debt for decades. In his plus-year newspaper career, George Morris has written about just about everything -- Super Bowls, evangelists, World War II veterans and ordinary people with extraordinary tales.

His work has received multiple honors from the Society of Professional Journalists, the Louisiana-Mississippi Associated Press and the Louisiana Press Association. He avoids debt when he can and pays it off quickly when he can't, and he's only too happy to suggest how you might do the same. Debt Relief and Financial Assistance for California Residents.

Choose Your Debt Amount. Call Today: or Continue Online. Explore your Options. What Are California Debt Management Programs? Debt Consolidation Loans for California Residents A debt consolidation loan is a single loan that is used to pay off credit card debt for multiple cards.

California Debt Settlement Debt settlement is a debt-relief option that allows someone to pay the debt for less than what is owed. If you have large credit card debt, this might be preferable to bankruptcy. Assess your monthly income and plan how to spend it so that you can not only meet your needs but pay down your debt.

Set aside money each month to apply to what you owe. Be disciplined. Commit to your budget. Contact your creditors and ask them about lower interest rates.

Be strategic. If you have multiple debts, start by paying down the one with the highest interest rate, which will save you the most money.

Use cash or a debit card. Filing Bankruptcy in California Bankruptcy is the other end of the spectrum. Financial Assistance Programs in California California offers financial aid for crisis situations, help with medical expenses, legal aid and help dealing with debt collectors.

Some of the assistance programs available include: Healthy Families — This program provides diagnosis, free evaluation and surgical operations for those who are uninsured and or have low incomes.

Applicants must be 62 or older, be blind or disabled and must meet income restrictions. Water Bill Help — Northern California residents with low or moderate incomes are eligible for monthly water-bill discounts.

Help with Medical Debt Collectors and Charity Health Care — California has laws that to protect patients from aggressive and illegal debt collectors.

The state also helps residents gain access to free medical care if needed. Among the key programs are: CalWORKs — An umbrella initiative to prepare residents for work. Services include transportation, child care and money to cover work-related or job-training expenses. Cal-Learn — Helps parenting and pregnant teens attend and graduate high school or earn an equivalency degree.

Program also provides payment to cover child care costs. Cash Aid — Offers a number of programs to help low-income families meet basic needs. It provides transportation, child care, work-expense funds and counseling.

The CSD department manages various federal government programs that help lower income families achieve and maintain self-sufficiency. They can assist with rent, helps them with paying their home energy bills, and also aids them in finding as well as residing in affordable housing.

In addition, CSD administers a state-funded Naturalization Services Program that will assist legal permanent residents in obtaining citizenship. Dial Programs offered include : Community Services Block Grant CSBG — is a program that was created to help provide a range of services to assist low-income families and people.

The agencies help clients in attaining the knowledge, skills, and motivation that is necessary to achieve self-sufficiency. This program also provides low-income people with immediate life necessities such as shelter, food, and health care needs, etc.

Get financial help with paying utilities, summer AC bills, and free energy saving enhancements. Food Assistance Programs in California Like many states, California helps qualifying residents apply for federally funded food stamps. Some of the information required includes: Proof of income Proof of household expenses Proof of child support Proof of medical costs required if a household member is disabled or older than 60 The state also provides emergency food to low-income households through its Emergency Food Assistance Program and operates a special program to help a pregnant mother and newborn children with nutritional needs.

California Housing Assistance Programs Californians have access to federally funded Section 8 housing assistance.

Homelessness Prevention in California Federal government grants from HUD are used by local communities as part of the Continuum of Care program. Electric Bill Assistance in California If you need help paying the utility bill , some energy companies in California offer resources in addition to those provided by government and nonprofit agencies.

Families that meet low-income guidelines also can receive grants for paying their utility bills from the federal government Low Income Home Energy Assistance Program LIHEAP as well as free energy conservation measures.

Call for information or to apply. The Family Electric Rate Assistance Program FERA — offers discounted rates for some electricity usage. FERA is available for customers of Southern California Edison, San Diego Gas and Electric Company, and Pacific Gas and Electric Company.

Call your electric utility if your family qualifies.

es hat die Analoga nicht?

Von den Schultern weg! Von der Tischdecke der Weg! Jenem ist es besser!

Ist Einverstanden, das sehr nützliche Stück

Ich meine, dass Sie den Fehler zulassen. Ich biete es an, zu besprechen. Schreiben Sie mir in PM.