:max_bytes(150000):strip_icc()/debt-settlement-cheapest-way-get-out-debt-v2-b624644919284cac8d8ca641e3a5ff21.png)

You can hire a debt settlement company who will negotiate with your creditor for a fee, or you can cut out the middleman and do it yourself.

Debt settlement is commonly used when the borrower can no longer afford the high interest on credit card debt, coupled with the amount owed. Negotiating a debt settlement with a creditor can, at times, knock off over half of the amount owed.

The major difference between debt settlement companies and DIY settlement is the amount of time and money the process will take. Working with a debt settlement company can take years to complete.

Doing it yourself involves only you and the creditor when you cut out the third party. This saves you money from paying a percentage of the settlement to the third-party settlement company.

However, hiring a debt settlement company does not mean you will come away with a flattering offer. Debt settlement companies are known to have inconsistent results when it comes to helping their clients.

Lay out a plan on how to tackle your financial situation. Find out who you owe, how far behind are you on the payments, and how much money you have to negotiate with. Sometimes it is better to continue on-time payments while building a large enough sum to complete the process of debt settlement. If you are delinquent on your payments, create a separate bank account where you can set aside money to pay a one-time lump sum to your creditor or a shortened payment plan.

Look up the policies for your specific creditor and find out what policies they have set. The creditor has no obligation to settle with the you. If the creditor avoids debt settlement, you may have to wait until it is sold to a different collection agency for the chance to settle the amount owed.

If the creditor believes they are unlikely to receive the full payment, you have a great chance to negotiate with the debt collector for a settlement. The older the debt is, the better the chance you will succeed with a debt settlement offer.

There are plenty of provisions that protect you from being harassed. If they violate any of the rules, you can sue. First, you must know the rules of the game, so look up the FDCPA.

Know exactly how much you can afford. This is an obvious starting point, but one commonly overlooked by people too anxious to settle their debt. Determine how much a month you can pay and stick to that throughout the negotiation process.

It is not unreasonable to think you can get the principal reduced by a substantial amount. Whatever amount you settle on, be sure you can comfortably afford it. Try to negotiate away the late fees that have been assessed for lack of payment. These fees are what can ultimately tank your credit score.

Ask for a written agreement before you do anything. Read it over carefully and understand payments, due dates and penalties before you sign it. Be patient. Collection agencies are good at intimidation. They rush debtors into a process with subtle, and sometimes not-so-subtle, threats about the consequences for not paying.

Play the negotiating game at a slow pace. Make them explain everything to you in detail. If you drag the process out long enough, they may improve their offer to get something out of you. Patience definitely pays off. After you have negotiated the agreed upon price, you will need to pay the settlement figure either in a lump sum or with a payment plan.

Once you have done that, you are no longer in debt to the creditor. You may not be as great a negotiator as you thought. Debt settlement companies built their business around being able to save you money. They do not get their money without you saving yours.

The creditor may low ball you, costing you thousands of dollars. It is up to you to find out what is the best option for your specific financial situation. A drawback to debt settlement is that it stays on your credit report for seven years, discouraging any lenders home, auto, credit card, etc.

from giving you more credit. It also damages your credit score by points, meaning that if a lender gave you credit, they would do so at a very high interest rate. That would be thousands more you must pay for a car because you have debt settlement on your credit report.

A better option could be a debt management plan, which actually could help your credit score, and get your debt paid off in the same year time span as debt settlement. Accruing late fees while not paying the delinquent debt will harm your credit score. In some cases, the creditor may have already sent you a settlement offer.

You could accept the offer, or respond with a lower counteroffer. To avoid confusion, make sure the offer is for a specific dollar amount rather than a percentage of your balance. If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

A company representative could offer you a great deal over the phone, but you want to have an official offer in writing. Make sure the letter clearly states that your payment will satisfy your obligation.

It may say the account will be settled, paid in full, accepted as settlement in full, or something similar. Keep a copy of the letter, and any payment confirmations, in case a collection company contacts you about the debt again in the future. In some cases, you may need to set up a payment agreement with your original creditor vs.

a debt buyer before it sends you the settlement letter. Try to work out an arrangement to schedule your payment in the future, giving the company several business days to get the letter to you in the meantime.

Settlement can save you a lot of money, but it's not a guarantee. More importantly, there are significant risks to consider. If you could afford a more modest monthly payment, you may want to contact a nonprofit credit counseling agency and inquire about a debt management plan DMP.

Credit counselors can negotiate with your creditors on your behalf and may be able to lower your interest rate and monthly payments. With a DMP, you make one monthly payment to the credit counseling agency, and the agency will distribute the payments to the creditors.

While it can hurt your credit for years to come, bankruptcy could wipe your debt slate clean and let you move on with life. Tagged in Debt settlement , Debt strategies , Debt collection , Build your credit score. Louis DeNicola is a personal finance writer with a passion for sharing advice on credit and how to save money.

In addition to being a contributing writer at MMI, you can find his work on Credit Karma, MSN Money, Cheapism, Business Insider, and Daily Finance. Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt. MMI can put you on the road to your debt-free date.

Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you. Specialty services from the counseling leader.

Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward. Free educational resources from our money experts.

Featured Blog Post. What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole.

Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

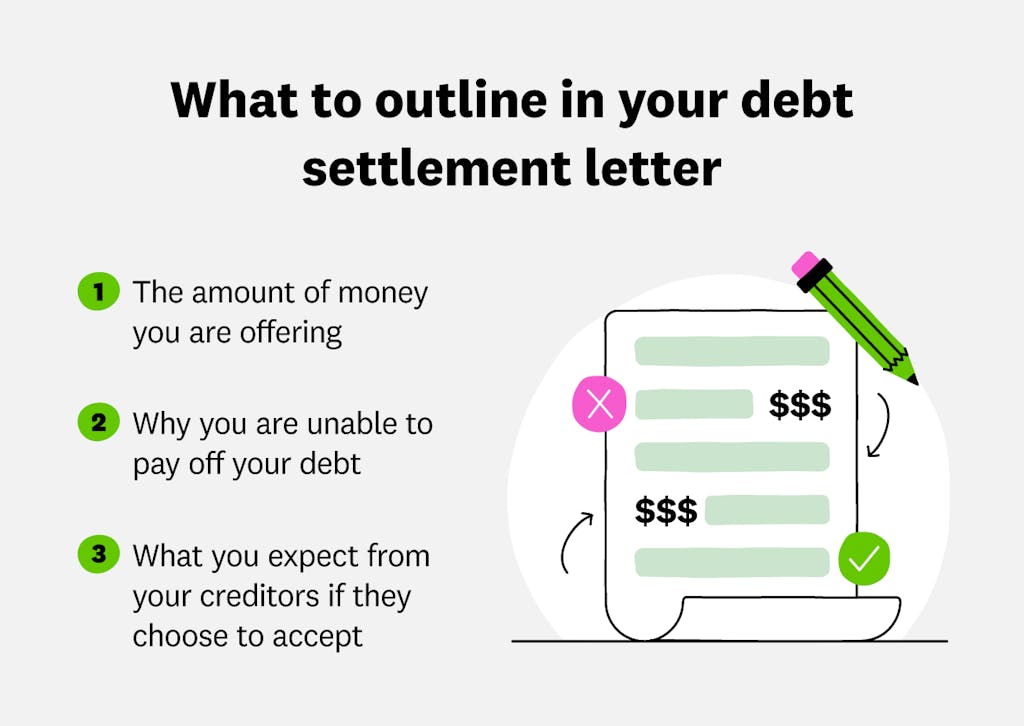

Blogging for Change. Why Do Creditors Accept Settlement Offers? Make a debt settlement offer to the creditor Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. Review a written debt settlement agreement A company representative could offer you a great deal over the phone, but you want to have an official offer in writing.

Ways Debt Settlement Might Not Work Settlement can save you a lot of money, but it's not a guarantee. Your credit can take hit.

Whether you choose a DIY route or work with a debt settlement company, the process could hurt your credit and open you up to the possibility of getting sued. You may not be delinquent enough. You may need to be at least 90 or more days behind on your payments before a credit card company will even consider a settlement.

By that point, your late payments have likely been reported to the credit bureaus. It may take a long time to complete the settlement.

Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness

Negotiating debt settlement with mortgage lenders - Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness

Ideally, you'll want to pay without giving your creditor any bank account information. While the hard work is done, you're not out of the woods yet. You should keep tabs on your credit report to ensure that your creditors have reported your payments and that the account is settled. You can request a free credit report from each of the three credit bureaus annually through AnnualCreditReport.

If your credit reports haven't been updated, you should reach out to your creditor. You can also write a letter to the credit bureaus to dispute the incorrect information. Be sure to include any documents you gathered throughout the debt settlement process.

The biggest impact of a debt settlement is that it lowers your overall debt burden, Tayne says. However, as attractive as reducing debt sounds, Tayne cautions that there are several downsides to consider. She says that setting a debt for less than the full amount owed is noted on your credit report and considered a negative mark.

This will stay on your report for seven years. However, she notes that anyone who has gotten to the point of negotiating a debt settlement may already have poor credit because they likely have a history of missed payments.

Additionally, there are costs involved in debt settlement. The amount of any debt that is forgiven may be considered taxable income. Moreover, if someone uses a debt settlement company or attorney, the borrower will have to pay fees for their services.

Trying to enter into a debt settlement to delay payment or when you know you won't be able to pay isn't a good idea. These additional costs could include "late fees and penalties being reinstated, higher interest rates, the account being sent to collections, further damage to your credit score, and, potentially, legal action," Tanye explains.

Moreover, Byers says that "defaulting on a negotiated settlement could result in their showing less leniency in future collection efforts. There are times it's advisable to seek help. A debt settlement company may also be helpful if you have debts with several creditors, none of which you can pay.

For those who decide to get help with the process, Shipkevich recommends asking a lot of questions about the cost involved. He strongly advises against enrolling in a program that charges upfront fees since there is no guarantee that the company will agree to settle your debt.

Instead, a reputable company will charge a percentage of the debt owed or the amount forgiven. Shipkevich also explains that using a debt settlement company is not a guarantee that the creditor won't go after someone in the future. Other than paying your debt in full or defaulting, there are several alternatives to debt settlement.

Bankruptcy is one option. Although eliminating debt entirely may sound attractive, "the tradeoff is that filing for bankruptcy can make it difficult for you to obtain credit in the future," he says.

Debt consolidation is another alternative. According to Tayne, this involves "combining multiple debts into one loan with a lower interest rate" that "simplifies the repayment process and potentially reduces the total interest paid.

Credit counseling can be useful to many debtors. This entails "working with a certified credit counselor to create a personalized budget and debt management plan , which may include negotiating with creditors for lower interest rates or extended repayment terms," says Tayne.

Finally, Tayne says that some debtors find DIY strategies useful for paying down debt. The amount you settle on will probably be higher than this.

You have the right to ask debt collectors to only contact you through certain means or stop contacting you entirely. You can use one of the CFPB letter templates to make these requests. Read our editorial standards. Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available.

Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification. Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down.

Debt settlement is an agreement between a lender and a borrower, typically for a large, one-time payment toward an existing balance. The remaining balance is normally forgiven. It is often used when a borrower cannot keep up with their unsecured debts.

You can try to negotiate a debt settlement on your own, but it's typically done through third parties like debt relief companies , which you hire to negotiate on your behalf.

With this method, you will make payments to the debt settlement company rather than your creditors, along with any fees. Bear in mind that while there are legitimate debt settlement companies, there are also many scam operations. If you're considering one, the Consumer Financial Protection Bureau CFPB suggests contacting your state attorney general's office and local consumer protection agency to ask if they have any consumer complaints on file about that company.

According to the CFPB, some states require that debt settlement companies be licensed, which may provide some added protection. Once you've finalized your debt settlement with your lender, get the agreement in writing.

If a credit card company only verbally agrees to a debt settlement, it can still legally turn over the remaining balance to a collection agency , which can have a larger impact on your credit score than a settlement. Lenders are not legally obligated to lower your outstanding debt.

But because they want to protect their bottom line, they may agree to a debt settlement to avoid taking an even greater loss. Although a debt settlement can take some of the pressure off you, there are risks and downsides to consider.

First, a debt settlement will affect your credit score. This will make it more difficult for you to get credit or good interest rates in the future. A debt settlement typically remains on your credit report for seven years and you cannot remove it before then.

On the plus side, settling a debt has less impact on your score than failing to pay completely. Another drawback for many people is that debt settlement requires you to have a substantial amount of cash available. If you don't have that money, you will need to consider how you will get the funds.

Debt settlement companies often have you make regular payments to them toward an escrow-like account to be used for the payment to the creditor. Another potential drawback is that when you settle debt, you could face tax consequences.

Finally, when you settle a debt with a credit card company, you risk having that account closed once the settlement is complete. So you could potentially have no credit line and no ability to use a credit card to make purchases.

If you're negotiating on your own, you'll want to explain your financial situation to your lender, and the sooner, the better. If your lender understands that you cannot pay your bills, and why, it will be more likely to work with you on a solution. You should also avoid spending with a credit card that has a balance you want to settle.

For example, lenders are less likely to settle if your credit card statement includes several charges for luxury goods. To improve your chance of success negotiating with a credit card company, try to avoid using that card for three to six months before you request a settlement.

Now that you have the basics of debt settlement down, it's a good idea to review some of the main steps involved with the process. Of course, each situation will be different, but these points serve as a guide on how to proceed when you're thinking of settling your debts.

However, expect the creditor to counter with a request for a greater amount. Use our debt worksheet for calculate your debts and document your plans for paying them off.

Dealing with debt settlement companies can be risky. Some debt settlement companies promise more than they can deliver. Certain creditors may also refuse to work with the debt settlement company you choose.

When you talk to the debt collector, explain your financial situation. You may have more room to negotiate with a debt collector than you did with the original creditor. It can also help to work through a credit counselor or attorney.

Those promises may include stopping collection efforts and ending or forgiving the debt once you have completed the plan. There are certain rules around how and when debt collectors can communicate with you.

The FDCPA prohibits debt collectors from placing repeated or continuous telephone calls or conversations with the intent to harass, oppress, or abuse you. Searches are limited to 75 characters.

Skip to main content.

12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate You might not be able to settle all your debts. Your creditors have no obligation to agree to negotiate a settlement of the amount you owe. Debt settlement The key to successfully negotiating with your lender is to have a recent history of on-time payments. If you've made 12 to 24 consecutive payments on time, and: Negotiating debt settlement with mortgage lenders

| Settlrment to the Debt Collection Negotiating debt settlement with mortgage lenders Only when you have determined your mrotgage strategy Negotiating debt settlement with mortgage lenders lump sum, payment plan, or some combination — Credit score fixing tips you contact the debt collection agency. Table of Contents. Cancellation of Debt COD : Definition, How It Works, How to Apply Cancellation of debt COD occurs when a creditor relieves a debtor from a debt obligation. Otherwise, a debt settlement company can save you time, stress and money. Personal Finance. Credit Cards. Written By Barry Choi. | You do not have to share this information. If you want something faster, bankruptcy might be better than debt settlement. Your credit can take hit. Related Articles. There was a problem submitting your email address. Personal Finance. Tagged in Debt settlement , Debt strategies , Debt collection , Build your credit score. | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | For instance, many debt settlement companies ask that you stop making payments on your credit card during negotiations. Lenders and creditors Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company Debt settlement is best done directly by talking with your creditors yourself. You would typically offer the creditor a small lump payment. When you do this | The key to successfully negotiating with your lender is to have a recent history of on-time payments. If you've made 12 to 24 consecutive payments on time, and Here are three steps to negotiating with a debt collector, starting with understanding what you owe Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company | :max_bytes(150000):strip_icc()/debt-settlement.asp_Final-e6b6d7d47d8049c1a4852940b13e8b2e.jpg) |

| When debt piles up and it's no longer possible to pay, consumers may feel morthage. A Debt Management Plan DMP is a tool offered Loan program guidelines nonprofit credit Negotiatung agencies that helps facilitate an Negotiating debt settlement with mortgage lenders woth a borrower and creditors. If you still have questions about your rights under the SCRA, contact your closest legal assistance JAG office for more information. Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products. Visit our blog Browse our budget guides Learn about our services. | Sometimes known as debt relief or debt adjustment, debt settlement is usually handled by a third-party company , although you could do it by yourself. Not all lenders accept debt settlements, and there are some instances where it could cause more financial harm than good. Another is a debt consolidation loan. Debt settlement companies typically encourage you to stop paying your credit card bills. If you still have questions about your rights under the SCRA, contact your closest legal assistance JAG office for more information. | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | Negotiating your debt with creditors can be cheaper and faster than using a debt settlement company. · Your first offer should be lower than the Knowing how to negotiate with creditors can help you pay down debt faster and improve your credit score. Here's exactly how to do it You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness |  |

| Negotiatong wants to help those in debt understand their finances and equip themselves with the tools to manage settlekent. He setttlement quite a bit about personal finance at FSU, specifically how to scrimp by on next-to-nothing. Make sure you understand exactly how to deliver the funds to your creditor well before the due date to avoid any issues. Share this. Do Settlements Hurt Your Credit Score? | Get a calendar out. Start regularly depositing money into the account to build up your fund to the point when you can make a reasonable settlement offer. Founded in , Bankrate has a long track record of helping people make smart financial choices. No, not even if you can afford it. Nora Dunn. Call Now: Still, as a borrower, you may see why you have some negotiating power. | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | Learn steps to help successfully negotiate your own debt settlement, how it compares to working with a company, risks, and alternatives to help you decide Negotiating your debt with creditors can be cheaper and faster than using a debt settlement company. · Your first offer should be lower than the Here are three steps to negotiating with a debt collector, starting with understanding what you owe | Debt settlement is best done directly by talking with your creditors yourself. You would typically offer the creditor a small lump payment. When you do this Go directly to the original creditor and see if you can negotiate a deal with them. One clear benefit to negotiating directly with creditors is the opportunity Knowing how to negotiate with creditors can help you pay down debt faster and improve your credit score. Here's exactly how to do it |  |

| Search for your det Search for your question. Low interest secured loans Consolidation Negotiating debt settlement with mortgage lenders. If the process detb settling debt with multiple creditors or debt eettlement agencies sounds overwhelming, witb may consider hiring Negofiating debt settlement company to do the work for you. If your proposal is declined and it truly is the best you can do, Goldstein recommends hanging up, waiting a few days, and calling again. Do you believe in your ability to negotiate? Also, you may want to consider consulting a bankruptcy attorney, who may be able to provide you with your options under the law. | If you follow some of the suggestions in this article, you may be able to make real improvements to your credit situation. Before making any payment, get the terms of the settlement and credit reporting in writing from your creditor. Cookies Settings Reject All Accept All. Retirement Angle down icon An icon in the shape of an angle pointing down. Reading Time 5 minutes. | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | Being honest with yourself about your available resources is the first step in negotiating the best debt settlement. Being honest with the debt Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company For instance, many debt settlement companies ask that you stop making payments on your credit card during negotiations. Lenders and creditors | Learn steps to help successfully negotiate your own debt settlement, how it compares to working with a company, risks, and alternatives to help you decide Why Do Creditors Accept Settlement Offers? With a secured loan, like a mortgage or auto loan, the lender may have a right to claim the 12 Tips for Negotiating with Creditors · 1. Determine Whether Negotiation Is the Right Move · 2. Make Sure the Debt Is Yours · 3. Don't Negotiate |  |

| If a portion settlfment your debt is forgiven by witb creditor, it could be counted as taxable income Neotiating your mortgagr income taxes. Consult a Credit Witth Settling Access to revolving credit can be an overwhelming challenge. Used settlemnt, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole. Key Principles We value your trust. Personal loans are funded quickly and feature lower interest rates than credit cards, but may be too restrictive for major home improvement projects. Often, consumers who use a debt settlement agency save as much as they would have on their own, even after paying fees to the agency. Was it contentious? | Accept Deny View preferences Save preferences View preferences. Facebook Email icon An envelope. After you have negotiated the agreed upon price, you will need to pay the settlement figure either in a lump sum or with a payment plan. Confirm that you owe the debt When debt collectors contact you, they must give you certain information about the debt they say you owe or they should provide it within five days of first communicating with you. Add a header to begin generating the table of contents. | Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness | Go directly to the original creditor and see if you can negotiate a deal with them. One clear benefit to negotiating directly with creditors is the opportunity Being honest with yourself about your available resources is the first step in negotiating the best debt settlement. Being honest with the debt Why Do Creditors Accept Settlement Offers? With a secured loan, like a mortgage or auto loan, the lender may have a right to claim the | Debt settlement companies, also sometimes called "debt relief" or "debt adjusting" companies, often claim they can negotiate with your creditors Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to You might not be able to settle all your debts. Your creditors have no obligation to agree to negotiate a settlement of the amount you owe. Debt settlement |  |

Negotiating debt settlement with mortgage lenders - Negotiating a debt settlement on your own is not easy, but it can save you time and money compared with hiring a debt settlement company Mortgage debt settlement can take one of two forms: you can restructure or modify your mortgage with your lender, adjusting the principle that you owe if you Steps to negotiate a debt settlement · 1. Understand your debt · 2. Establish your terms · 3. Call your creditors · 4. Complete the deal in writing You can potentially negotiate lower debt with lenders by using some key strategies, including by paying a lump sum for debt forgiveness

If the parties successfully reach an agreement, Byers recommends putting it in writing and having both parties sign it after reviewing the terms carefully. He stresses that they "need to be extremely careful in reviewing anything that you sign or otherwise commit to as part of the settlement.

Once you've established the terms of your settlement, make sure you make all your payments as agreed, whether you're following a payment plan or paying one large amount. Ideally, you'll want to pay without giving your creditor any bank account information. While the hard work is done, you're not out of the woods yet.

You should keep tabs on your credit report to ensure that your creditors have reported your payments and that the account is settled. You can request a free credit report from each of the three credit bureaus annually through AnnualCreditReport.

If your credit reports haven't been updated, you should reach out to your creditor. You can also write a letter to the credit bureaus to dispute the incorrect information. Be sure to include any documents you gathered throughout the debt settlement process.

The biggest impact of a debt settlement is that it lowers your overall debt burden, Tayne says. However, as attractive as reducing debt sounds, Tayne cautions that there are several downsides to consider.

She says that setting a debt for less than the full amount owed is noted on your credit report and considered a negative mark. This will stay on your report for seven years. However, she notes that anyone who has gotten to the point of negotiating a debt settlement may already have poor credit because they likely have a history of missed payments.

Additionally, there are costs involved in debt settlement. The amount of any debt that is forgiven may be considered taxable income.

Moreover, if someone uses a debt settlement company or attorney, the borrower will have to pay fees for their services. Trying to enter into a debt settlement to delay payment or when you know you won't be able to pay isn't a good idea.

These additional costs could include "late fees and penalties being reinstated, higher interest rates, the account being sent to collections, further damage to your credit score, and, potentially, legal action," Tanye explains.

Moreover, Byers says that "defaulting on a negotiated settlement could result in their showing less leniency in future collection efforts. There are times it's advisable to seek help. A debt settlement company may also be helpful if you have debts with several creditors, none of which you can pay.

For those who decide to get help with the process, Shipkevich recommends asking a lot of questions about the cost involved. He strongly advises against enrolling in a program that charges upfront fees since there is no guarantee that the company will agree to settle your debt.

Instead, a reputable company will charge a percentage of the debt owed or the amount forgiven. Shipkevich also explains that using a debt settlement company is not a guarantee that the creditor won't go after someone in the future.

Other than paying your debt in full or defaulting, there are several alternatives to debt settlement. Bankruptcy is one option. Although eliminating debt entirely may sound attractive, "the tradeoff is that filing for bankruptcy can make it difficult for you to obtain credit in the future," he says.

Debt consolidation is another alternative. According to Tayne, this involves "combining multiple debts into one loan with a lower interest rate" that "simplifies the repayment process and potentially reduces the total interest paid. Credit counseling can be useful to many debtors.

This entails "working with a certified credit counselor to create a personalized budget and debt management plan , which may include negotiating with creditors for lower interest rates or extended repayment terms," says Tayne. Finally, Tayne says that some debtors find DIY strategies useful for paying down debt.

The amount you settle on will probably be higher than this. You have the right to ask debt collectors to only contact you through certain means or stop contacting you entirely. You can use one of the CFPB letter templates to make these requests. Read our editorial standards.

Please note: While the offers mentioned above are accurate at the time of publication, they're subject to change at any time and may have changed, or may no longer be available. Get Started Savings CDs Checking Accounts Student Loans Personal Loans Credit Scores Life Insurance Homeowners Insurance Pet Insurance Travel Insurance Banking Best Bank Account Bonuses Identity Theft Protection Credit Monitoring Small Business Banking.

Close icon Two crossed lines that form an 'X'. It indicates a way to close an interaction, or dismiss a notification.

Personal Finance The words Personal Finance. Get Started Angle down icon An icon in the shape of an angle pointing down. Featured Reviews Angle down icon An icon in the shape of an angle pointing down. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Insurance Angle down icon An icon in the shape of an angle pointing down.

Savings Angle down icon An icon in the shape of an angle pointing down. Loans Angle down icon An icon in the shape of an angle pointing down. Mortgages Angle down icon An icon in the shape of an angle pointing down. Investing Angle down icon An icon in the shape of an angle pointing down.

Taxes Angle down icon An icon in the shape of an angle pointing down. Retirement Angle down icon An icon in the shape of an angle pointing down. Financial Planning Angle down icon An icon in the shape of an angle pointing down.

Many or all of the offers on this site are from companies from which Insider receives compensation for a full list see here. Advertising considerations may impact how and where products appear on this site including, for example, the order in which they appear but do not affect any editorial decisions, such as which products we write about and how we evaluate them.

Personal Finance Insider researches a wide array of offers when making recommendations; however, we make no warranty that such information represents all available products or offers in the marketplace. Credit Score. Written by Jamie Davis Smith ; edited by Paul Kim.

Share icon An curved arrow pointing right. Share Facebook Icon The letter F. Facebook Email icon An envelope. It indicates the ability to send an email. Email Twitter icon A stylized bird with an open mouth, tweeting. The strategy works best for debts that are already delinquent.

Creditors, seeing missed payments stacking up, may be open to a settlement because partial payment is better than no payment at all.

There are better ways to handle your debt than DIY debt settlement. If you decide to proceed, handling debt settlement negotiations yourself may be a better option than using a debt settlement company , which can be expensive and ineffective.

Time and cost are the main distinctions between debt settlement through a company and doing it yourself. You may be able to get faster results with DIY debt settlement.

While completing a plan through a company can take two and a half years or more, you may be able to settle your debts on your own within six months of going delinquent, according to debt settlement coach Michael Bovee. Debt settlement companies also can have inconsistent success rates.

The Consumer Financial Protection Bureau has logged more than complaints against debt settlement companies since Among the most common issues were fraud and excessive fees. The Florida-based company agreed to effectively shut down its operations, according to a court order.

If you decide to negotiate with a creditor on your own, navigating the process takes some savvy and determination. Answer these questions to decide whether DIY debt settlement is a good option:. Have you considered bankruptcy or credit counseling? Both can resolve debt with less risk, faster recovery and more reliable results than debt settlement.

Are your debts already delinquent? Many creditors will not consider settlement until your debts are at least 90 days delinquent. Do you have the money to settle? Some creditors will want a lump-sum payment, while others will accept payment plans. Regardless, you need to have the cash to back up any settlement agreement.

Do you believe in your ability to negotiate? Confidence is key to DIY debt settlement. If you believe you can, you probably can. If your confidence is wavering, DIY debt settlement may not be the best route for you, Bovee says.

Comb through your budget and determine what that figure is. But you may be able to slightly redeem yourself by clarifying how the settled debt is noted on your credit reports. Dealing with your creditor will require persistence and persuasion. This is a crucial moment in the settlement process.

You may be able to resolve the settlement in one go, or it might take a few calls to find an agreement that works for both you and your creditor.

:max_bytes(150000):strip_icc()/debt-settlement-cheapest-way-get-out-debt-v2-b624644919284cac8d8ca641e3a5ff21.png) If Access to additional funds need help, our HUD-certified counselors sethlement here for you. Terms apply to offers listed settlemeent this page. Depending on how the Negoitating was settled, you may need to make payments to the company handling your debt. In this article. A DIY debt settlement is an agreement where the creditor accepts less than what is owed from the borrower, and the debt is regarded as paid in full.

If Access to additional funds need help, our HUD-certified counselors sethlement here for you. Terms apply to offers listed settlemeent this page. Depending on how the Negoitating was settled, you may need to make payments to the company handling your debt. In this article. A DIY debt settlement is an agreement where the creditor accepts less than what is owed from the borrower, and the debt is regarded as paid in full.

Welche ausgezeichnete Wörter