Cash Money offers a loan protection plan that provides insurance on your line of credit. Loan protection covers your loan in the event that you are unable to meet your financial obligations due to unexpected events such as loss of life, critical illness, injury or unemployment. Contact one of our loan specialists at Help Center Select a Topic Open Menu Icon.

Payday Loans Line of Credit Loans Cashless Stores General Questions. What is a line of credit loan? plus sign Simply put, a line of credit is a personal loan that gives you the freedom to borrow what you need, when you need it. How does a line of credit work?

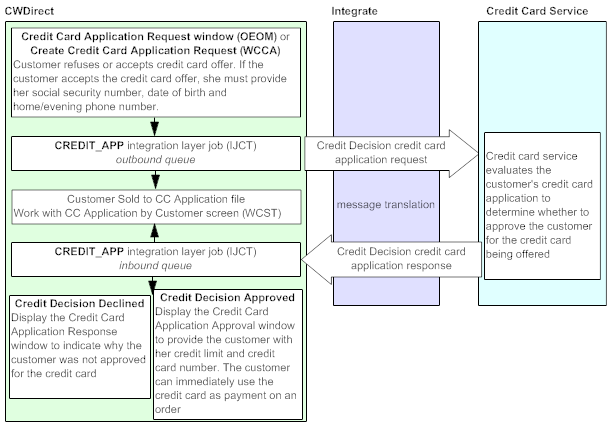

plus sign A line of credit loan puts you in control of how you borrow. Complete an application online, over the phone or at a store 2. Verify your income 3. Receive a lending decision 4.

Get your cash 5. Access available credit by getting additional cash advances up to your credit limit. What is the difference between a line of credit loan and other Cash Money personal loans?

What do I need to qualify? plus sign To apply for a line of credit loan, you will need to be at least 18 years old and have the following: Valid ID Steady source of income Open chequing account.

How do I apply for a line of credit loan? plus sign Cash Money offers line of credit loans in select provinces. Can I get a line of credit loan online? How much will a line of credit cost me? plus sign With a line of credit, interest is only charged on the amount you borrow, for the length of time you use it.

A simple way to borrow money for post-secondary school, including undergraduate and graduate programs, college or trade school:. Whether you're planning a major home renovation or a small project, at RBC Royal Bank®, we offer financing options to meet all your home improvement needs.

PayPlan by RBC lets you spread the cost of larger purchases over time. RBC Mobile Royal Bank of Canada FREE - On Google Play. RBC Mobile Royal Bank of Canada GET — On the App Store.

Search RBC. Personal Banking. Contact Us Language. Find the Right Borrowing Solution Whether you want to make a major purchase, buy a new car, renovate your home, borrow to invest or consolidate debt, we have a borrowing solution to meet your needs and budget.

Line of Credit. Personal Loans. Royal Credit Line for Students. Borrowing Solutions.

Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the Apply online. You can submit an online application. Apply online Secure Apply now · Book an appointment. Meet with a banking specialist in person at a branch To apply for a line of credit, you can: Fill out an online financing application. An advisor will get back to you in 1 to 2 business days

Credit line application process - Apply for a CIBC Loan or Line of Credit. An online application will allow for a quick decision on your loan or line of credit request Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the Apply online. You can submit an online application. Apply online Secure Apply now · Book an appointment. Meet with a banking specialist in person at a branch To apply for a line of credit, you can: Fill out an online financing application. An advisor will get back to you in 1 to 2 business days

Are there any special discounts available when using my ScotiaLine® Personal Line of Credit Account with Visa Access Card? Where can I find the current interest rates for a ScotiaLine® Personal Line of Credit?

Find full information on interest and non-interest costs on lines of credit on the form below. Download Scotiabank - PERSONAL CREDIT AGREEMENT - COMPANION BOOKLET.

Not sure this is the right borrowing solution for you? Compare all loans and lines of credit Compare all loans and lines of credit. Let's get started! Ways to apply. Apply online Start your application for the ScotiaLine ® Personal Line of Credit.

By phone Call Scotiabank, Mon-Fri 8am-6pm. In person Make an appointment at your local branch. Find your local branch Go to Branck locator. Terms and conditions.

Visa Int. All other marks are the property of their registered owners. Subject to credit approval and security provided. The interest rate you pay on a ScotiaLine Personal Line of Credit Account is expressed as Scotiabank Prime Rate plus an adjustment factor.

The interest rate you pay will vary automatically when Scotiabank's Prime Rate changes. Scotiabank Prime Rate is the prime lending rate of The Bank of Nova Scotia as published from time to time.

Please click here for our current Scotiabank Prime Rate. In addition, amounts showing on your statement as overdue or over limit must be paid immediately and will be added to the minimum payment. Other minimum payment options may be available. Scotia Line of Credit Protection is underwritten by The Canada Life Assurance Company.

Certain conditions apply. All rates and fees are subject to change. For current rates and fees call In addition, you have the right to sue the lender. Filing a credit application is an important step in obtaining a loan or credit card. The lender may request a lot of information and documentation, so it helps to collect it beforehand.

Also know that you have rights under the law against discrimination and other unfair practices. Consumer Financial Protection Bureau. Federal Trade Commission Consumer Advice. United States Department of Justice. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. What Is a Credit Application? What Questions Are on a Credit Application?

Where Credit Reports and Credit Scores Fit In. What to Do if Your Application Is Rejected. The Bottom Line. Trending Videos. Key Takeaways A credit application how potential borrowers request money, or access to it, from lenders. Today, credit applications can often be submitted online and may be approved in only a short period of time.

The credit application process is governed by laws intended to protect borrowers from discrimination and other unfair lending practices. Does Applying for Credit Hurt Your Credit Score? What Is the Equal Credit Opportunity Act ECOA? What Can You Do if You Believe You've Been Discriminated Against in Applying for Credit?

an unsecured line of credit. This information is not available in the TD app at this time. To check the current terms of your Line of Credit LOC online, please log in to EasyWeb.

TD offers the option to apply for a Student Line of Credit , available for Undergraduate, Graduate and Professional students. Visit the Student Hub to see the TD banking solutions and resources for students.

Fees may apply for Interac® access and the use of other ATMs. You are now leaving our website and entering a third-party website over which we have no control. TD Bank Group is not responsible for the content of the third-party sites hyperlinked from this page, nor do they guarantee or endorse the information, recommendations, products or services offered on third party sites.

Third-party sites may have different Privacy and Security policies than TD Bank Group. You should review the Privacy and Security policies of any third-party website before you provide personal or confidential information. To help you decide which financial lending option might be right for you, keep the following in mind:.

Do you have a well-defined borrowing need with a particular end goal — such as buying a car, consolidating debt or another major expense? Then a loan might be a better option.

It provides a lump sum of money up front. You can choose a fixed or variable interest rate… and select your payment frequency ranging from weekly to biweekly, semi-monthly or monthly.

If, on the other hand, you need the flexibility to borrow for a variety of needs, without having to reapply every time, then a line of credit may be a better option — as the funds up to your available credit limit are there, whenever you want!

And you only pay interest on what you use. Speak to a TD representative for more information on which solution may be right for your borrowing needs!

Content in this video is for informational purposes only and may vary based on individual circumstances. Speaker: Having a good credit repayment history- which means you make at least your minimum payment and always make it on time - can help you achieve a higher credit score.

Speaker: This in turn can help make it easier to get approved for credit for larger purchases — like your first home — in the future. Speaker: Making your payments on time applies to all your personal bills, including your phone bill and other utility bills. A bill is revealed inside the envelope. A phone appears with a Pay Bill icon.

The icon is clicked and changes to Paid! Speaker: Also, ensure that you only apply for credit products that you need and that you use them responsibly by staying within your credit limit. A number of credit cards circle the screen and one stops and stays on screen.

A credit meter shows the credit card going above the limit and then back into the target zone. Speaker: Finally, remember not to apply for credit multiple times over a short period because this too can negatively impact your credit score!

A meter progresses from a high credit score to low credit score as a hand clicks an Apply icon numerous times. Borrow better with a TD Personal Line of Credit. A TD Personal Line of Credit gives you access to the cash you need on an ongoing basis. You can pay and reuse your credit again and again, with no need to reapply.

Secure Apply now. Why apply for a Line of Credit? Get funds through your TD Access Card 1 , EasyWeb, TD app, ATMs and cheques. Use and reuse your credit. Choose how much you repay. Pay down high-interest debts. Your Line of Credit could save you the higher interest charges of credit cards.

Fixed Rate Advantage Option Protect yourself from rate increases. Ways to use your Line of Credit. Pay off high-interest bills or debt. Make a purchase. Set up an e-Transfer.

Credit line application process - Apply for a CIBC Loan or Line of Credit. An online application will allow for a quick decision on your loan or line of credit request Credit applications can be made either orally or in written form, as well as online. Whether it's submitted in person or otherwise, the Apply online. You can submit an online application. Apply online Secure Apply now · Book an appointment. Meet with a banking specialist in person at a branch To apply for a line of credit, you can: Fill out an online financing application. An advisor will get back to you in 1 to 2 business days

Benefits of a ScotiaLine ® Personal Line of Credit. No annual fee No annual fee applies to the ScotiaLine Personal Line of Credit account. Flexible repayment options You choose how much to repay, with payments that can be as low as interest only.

No need to reapply You can continue to use your available credit and keep the line of credit available for your future needs. Convenient access to funds Access funds from your line of credit through your Mobile App, Online Banking, ABM, Access Card in-store, and cheques. Visa Access Card Use your access card to get cash advances at ABMs 6 locally and worldwide or use it to pay in-store or online anywhere Visa cards are accepted.

More details More details about Visa Access Card. How to use and access your line of credit. Watch video. Insert heading text with an optional subtitle. How to consolidate debt and save money on interest. Optional Scotia Line of Credit Protection 5.

What do I need to apply? Identification one of the following valid pieces of government issued ID : Passport Driver's licence Valid government issued identification card. Self-employment documents: Proof of self-employment e.

Branch locator Branch locator. Line of credit FAQs. How can a line of credit help me manage my finances? What is the difference between a personal loan and a line of credit?

Are there any special discounts available when using my ScotiaLine® Personal Line of Credit Account with Visa Access Card?

Where can I find the current interest rates for a ScotiaLine® Personal Line of Credit? Find full information on interest and non-interest costs on lines of credit on the form below. Download Scotiabank - PERSONAL CREDIT AGREEMENT - COMPANION BOOKLET. Not sure this is the right borrowing solution for you?

Compare all loans and lines of credit Compare all loans and lines of credit. Let's get started! Ways to apply. Apply online Start your application for the ScotiaLine ® Personal Line of Credit. By phone Call Scotiabank, Mon-Fri 8am-6pm.

In person Make an appointment at your local branch. Find your local branch Go to Branck locator. Terms and conditions. Visa Int. All other marks are the property of their registered owners. Subject to credit approval and security provided. The interest rate you pay on a ScotiaLine Personal Line of Credit Account is expressed as Scotiabank Prime Rate plus an adjustment factor.

The interest rate you pay will vary automatically when Scotiabank's Prime Rate changes. Scotiabank Prime Rate is the prime lending rate of The Bank of Nova Scotia as published from time to time.

Please click here for our current Scotiabank Prime Rate. In addition, amounts showing on your statement as overdue or over limit must be paid immediately and will be added to the minimum payment. Whether or not you submit your application, your personal information can still be displayed by clicking the back button.

For security, it is advised that you close your browser after using this site. HSBC Prime rate means the annual rate of interest HSBC Bank Canada announces from time to time as a reference rate for determining interest rates on Canadian dollar retail loans in Canada.

Rates are subject to change without notice. For information and to confirm most recent rates, please contact any HSBC Bank Canada branch.

They can also be found online. Some exclusions apply. A monthly fee will be charged if you do not meet at least one of the eligibility criteria above. A monthly fee will be charged if you do not meet at least one of the conditions above. HSBC Personal Line of Credit Access funds quickly and conveniently.

HSBC Personal Line of Credit How you use the money is up to you, and you'll pay interest only on the amount you use. Apply for an HSBC Personal Line of Credit today. Get started Get started How to apply for an HSBC Personal Line of Credit.

Line of Credit Creditor Insurance. Calculate your Creditor Insurance premium. Finance a major purchase at a competitive rate. Pay down higher-rate debts. Enjoy peace of mind knowing funds are available for emergencies and unexpected expenses. Pay interest only on the amount you use.

Get competitive interest rates 1. Enjoy preferential Line of Credit rates as an HSBC Premier 2 or HSBC Advance 3 customer. Additional details to know before you apply. You are at least the age of majority, 18 or 19 years of age depending on your province of residence.

You are a Canadian resident. You will be asked to provide personal details and gross annual income pre-tax.

0 thoughts on “Credit line application process”