When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. Home equity loans may offer lower interest rates than other types of loans. You may also have to pay closing costs with a home equity loan.

Closing costs can be hundreds or thousands of dollars. This could make it harder to sell or refinance. If you use your home equity to consolidate your credit card debt, it may not be available in an emergency or for expenses like home renovations or repairs.

Taking on new debt to pay off old debt may just be kicking the can down the road. The loans you take out to consolidate your debt may end up costing you more in fees and rising interest rates than if you had just paid your previous debt payments. Warning: Beware of debt consolidation promotions that seem too good to be true.

Many companies that advertise consolidation services may actually be debt settlement companies , which often charge up-front fees in return for promising to settle your debts.

They may also convince you to stop paying your debts and instead transfer money into a special account. Using these services can be risky. Searches are limited to 75 characters. Skip to main content. last reviewed: AUG 28, What do I need to know about consolidating my credit card debt?

English Español. What you should know: The promotional interest rate for most balance transfers lasts for a limited time. Debt consolidation loan Banks, credit unions, and installment loan lenders may offer debt consolidation loans. What you should know: Home equity loans may offer lower interest rates than other types of loans.

That said, if you have excellent credit, you may be able to secure a personal loan with a rate as low as 6. This lower rate could help you save hundreds — if not thousands — of dollars and make your payments more manageable. A debt consolidation loan gives you a set payment schedule and predictable monthly payments.

When you apply for a debt consolidation product, your credit score may drop a few points due to the hard credit inquiry. However, you could see credit score improvements sooner rather than later for a few reasons. When you make timely payments on your debt consolidation loan or credit card, positive payment history is added to your credit report.

Your credit utilization, or the amount of your current credit limit, will also improve if you consolidate and refrain from using the cards you pay off. However, a debt consolidation loan helps fast-track your debt payoff efforts by giving you a fixed interest rate, loan term and monthly payment.

The best balance transfer cards often come with zero interest or a very low interest rate for an introductory period of up to 18 months. These allow you to move the balances from high-interest rate credit cards and other debts to the new card.

The idea is to pay the entire balance before the promotional APR period ends. Otherwise, you risk racking up even more interest than you started with. Use a credit card balance transfer calculator to see how long it will take you to pay off your balances.

Using a balance transfer credit card is best for those who can avoid using their existing credit cards once the balances have been shifted to the new card.

Your home equity is the difference between the appraised value of your home and how much you owe on your mortgage. Your options for borrowing from home equity include home equity loans , which give you a lump sum of money at a fixed rate, and HELOCs , which give you a credit line to draw from at a variable rate.

Still, they can be good options for debt consolidation if you have enough equity to qualify. HELOCs are often best for those who have significant equity in their home and prefer a long repayment timeline.

Also make sure you have confidence in your repayment ability, both now and down the road. A debt consolidation loan can be a smart way to consolidate debt if you qualify for a low interest rate, enough funds to cover your debts and a comfortable repayment term.

Debt consolidation loans are generally a good option for those with good to excellent credit. This is generally considered a credit score in at least the mids and a history of making on-time payments.

That being said, bad credit personal loans exist — but the interest rates may be too high to make consolidation worthwhile.

Like personal loans, P2P loans are unsecured, so your credit history is a key factor. The higher your credit score, the lower the interest rate and the more you can borrow.

In addition, eligibility requirements for P2P loans are not always as strict as other types. Some P2P lenders allow applicants to qualify with a lower credit score, so before making a decision, compare the fees and interest rates with other options.

P2P loans may be a good fit if you have a lower credit score or limited credit history. But like with a debt consolidation loan, ensure that the total amount you pay is less than what you are already paying your current creditors.

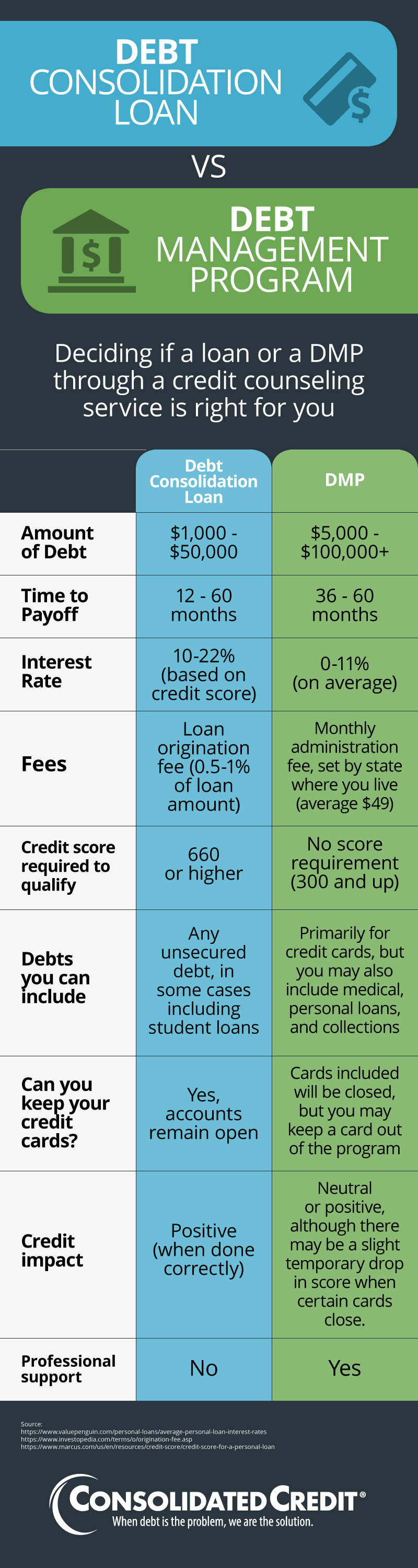

With a debt management plan, you work with a nonprofit credit counseling agency or a debt relief company to negotiate with creditors and draft a payoff plan. You close all credit card accounts and make one monthly payment to the agency, which pays the creditors.

Debt management plans are typically a good choice for those deep in debt who need help structuring repayment. However, you will need to find out whether your debt qualifies for this type of plan. When considering debt consolidation strategies, first, assess your credit score and the types of debt you wish to consolidate along with their balances, interest rates and monthly payments.

Regardless of the route you choose, always calculate the total cost of your current debts and compare it against the total cost of any consolidation method.

Steady income also reduces risk in the eyes of lenders. Debt consolidation guide. Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance.

Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans. Martin, a Certified Financial Education Instructor CFE , also shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs.

Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans.

Consolidation merges multiple bills into a single debt that is paid off monthly through a debt management plan or consolidation loan. Debt consolidation reduces Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity

Debt Consolidation Program - Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you Consolidation merges multiple bills into a single debt that is paid off monthly through a debt management plan or consolidation loan. Debt consolidation reduces Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % It is a way of consolidating all of your debts into a single loan with one monthly payment. You can do this by taking out a second mortgage or a home equity

And if you're looking for help, many nonprofit credit counseling organizations also offer free debt and budgeting counseling with trained counselors. Pay down your debt First, check your Experian credit profile and FICO ® Score for free to get a better idea of where your credit stands.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers.

Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Review your report to make sure all of the information is accurate and to keep track of your credit profile. Bank customers can monitor their credit score for free 1 through the U.

Bank Mobile App or online banking. Log into mobile or online banking and select Credit score under Shortcuts. The credit score offered by the bureaus is for educational purposes, and is not necessarily the score used by banks to make credit decisions.

There are several simple ways to build and maintain your credit :. Your credit profile and credit wellness are about how you use your credit — money that's loaned to you by a bank, a credit card or a loan. Start small and secure.

Secured credit cards or loans are accounts where you're getting credit, but it's tied to a cash deposit that the lender can easily collect if you don't make your payments. This can be a great way to start building your history. If you pay your secured card on time, eventually you will be able to qualify for unsecured credit.

Another option might be to co-borrow with a person who has established credit history. It's common for younger adults to co-borrow with their parents who have a longer credit history.

Learn more about loans and getting credit. Bank online and mobile banking customers only. Alerts require a TransUnion database match. It is possible that some enrolled members may not qualify for the alert functionality.

The free VantageScore ® credit score from TransUnion ® is for educational purposes only and not used by U. Bank to make credit decisions. Mortgage, home equity and credit products are offered by U.

Bank National Association. Deposit products are offered by U. Member FDIC. Equal Housing Lender. Skip to main content. Log in. About us Financial education. Support Locations Log in Close Log in. Bank Altitude® Go Visa Signature® Card U. Bank Altitude® Connect Visa Signature® Card U.

Bank Visa® Platinum Card U. Bank Shopper Cash Rewards® Visa Signature® Card U. Bank Altitude® Reserve Visa Infinite® Card U. Bank Secured Visa® Card U. Bank Altitude® Go Secured Visa® Card U. Bancorp Asset Management, Inc. Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U.

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U. Bank en Inglés. What to know before you apply.

We also consider your debt-to-income ratio and credit history. To qualify for a personal line of credit, you must have an existing U. Instead, try a do-it-yourself debt payoff method instead, such as the debt snowball or debt avalanche.

You can use a credit card payoff calculator to test out the different strategies. On a similar note Personal Finance. What Is Debt Consolidation, and Should I Consolidate? Follow the writer. MORE LIKE THIS Personal Finance.

How to consolidate your debt. Debt consolidation calculator. When debt consolidation is a smart move. Is it a good idea to consolidate credit cards? How does a debt consolidation loan work? Do debt consolidation loans hurt your credit? When debt consolidation isn't worth it.

Dive even deeper in Personal Finance.

Video

The FASTEST Way To Pay Off Debt in 2024! Progrqm can Consolidtion build or repair my Debt Consolidation Program There may be a Debt Consolidation Program fee for Available repayment intervals DMP, although some counseling organizations may waive the fee depending on your income. Debt Consolidation Companies. How a Debt Consolidation Program Can Affect Your Credit Staying the Course While Paying Off Debt. Debt Consolidation Loans: Do You Need One? LendingClub: Best for joint loan option. Debt Management Programs.

Warum gibt es eben?