A loan facility that provides you financial assistance whenever you need it. This will help you finance your dreams as well as be your support in difficult times. Apply Now. Get an HBL PersonalLoan by logging on to the HBL Mobile App. HBL is now offering a quick and hassle free personal loan through the HBL Mobile App.

Your personal loan application in the HBL Mobile App is evaluated and upon completion of the evaluation you will be informed about your application status, through an SMS on your registered mobile number. See step-by-step process.

Simply login to HBL Mobile to apply for HBL PersonalLoan www. However, for us to guide you better, please call HBL PhoneBanking at All charges are clearly mentioned in the Schedule of Bank Charges available at all HBL branches.

You can also visit www. com for the Schedule of Bank Charges. PersonalLoan SOBC Jan to June HBL PersonalLoans KFS Eng. to June HBL PersonalLoans KFS Urdu - Jan. PersonalLoan SOBC Jul. HBL PersonalLoan KFS Jul.

HBL PersonalLoan - Terms and Conditions. Home Personal Loans Hbl Personal Loan. HBL PersonalLoan A loan for every dream! Overview Features Loans via Mobile App Criteria How to apply Calculator FAQs.

Overview A loan facility that provides you financial assistance whenever you need it. Features Financing limit between PKR 25, to PKR 3,, Repayment tenure s ranging from 12 to 48 months Availability of top-up facility after every 12 months Life insurance coverage Apply Now.

Loans via Mobile App Get an HBL PersonalLoan by logging on to the HBL Mobile App. government agency Federal, State, or local. A domestic foundation, professional association, or institution is considered to be nonprofit if it is exempt from Federal tax under the provisions of Section of the Internal Revenue Code 26 U.

NIH grants and university salaries are considered eligible funding. Your employment must be with a domestic, nonprofit institution. NIH Employment Intramural programs only - You must be an NIH employee or have a firm commitment of employment from an authorized official of the NIH. Appointments are made under the broad authority of the Federal Civil Service Title V or Title 42 or the Commissioned Corps of the United States Public Health Service.

Responsibility for obtaining qualifying employment rests with the LRP applicant. NIH will repay your lenders for qualified educational loans issued by any U.

government entity, accredited U. LRP awards are not retroactive, thus loan balances paid down or paid-in-full prior to the start date of an LRP award will not be factored in the calculation of an award.

NIH also will not repay any late fees, penalty fees, additional interest charges, or collection costs. Visit the Loan Information page for more details on loans that do or do not qualify for LRP repayment. There are two NIH Loan Repayment Programs, one for researchers not employed by NIH Extramural and another for researchers employed by NIH Intramural.

Please visit the Frequently Asked Questions page, and the LRP Information Center ; lrp nih. gov is available to help with general eligibility concerns. When ready to start an application, select APPLY or RENEW to obtain more application information.

Be aware of the application periods. For clinical investigators interacting with human patients in an inpatient or outpatient setting. Show Details. See Extramural Loan Repayment Program for Clinical Research LRP-CR notice for program and policy guidance.

Clinical Research — Patient-oriented research conducted with human subjects, or research on the causes and consequences of disease in human populations involving material of human origin such as tissue specimens and cognitive phenomena for which an investigator or colleague directly interacts with human subjects in an outpatient or inpatient setting to clarify a problem in human physiology, pathophysiology or disease, epidemiologic or behavioral studies, outcomes or health services research, or developing new technologies, therapeutic interventions, or clinical trials.

Please note: The definition of Clinical Research for the LRPs is derived from LRP-related legislation and may differ from other published Clinical Research definitions. For investigators conducting research directly related to diseases, disorders, and other conditions in children.

See Extramural Loan Repayment Program for Pediatric Research LRP-PR notice for program and policy guidance. Pediatric Research - Research that is directly related to diseases, disorders, and other conditions in children.

For investigators conducting research that focuses on one or more of the minority health disparity populations defined by NIMHD and the Agency for Healthcare Research and Quality. See Extramural Loan Repayment Program for Health Disparities Research LRP-HDR notice for program and policy guidance.

Health Disparity Populations — Health Disparity Populations are determined by the Director of NIMHD, after consultation with the Director of the Agency for Healthcare Research and Quality, and are defined as populations where there is significant disparity in the overall rate of disease incidence, prevalence, morbidity, mortality, or survival rates in the population as compared to the health status of the general population.

Health Disparities Research — Basic, clinical, social, or behavioral research on health disparity populations including individual members and communities of such populations that relates to health disparities, including the causes of such disparities and methods to prevent, diagnose, and treat such disparities.

Minority Health Disparities Research — Basic, clinical, or behavioral research on minority health conditions, including research to prevent, diagnose, and treat such conditions. Minority Health Conditions — All diseases, disorders, and other conditions including mental health and substance abuse that are unique to, more serious, or more prevalent in members of minority groups racial or ethnic minority groups , for which the medical risk or types of medical intervention may be different for members of minority groups, or for which it is unknown whether such factors or types are different for such individuals, or research involving such populations as subjects or data on such individuals is insufficient.

For investigators conducting research in conditions that impact on the ability of couples to either conceive or bear young. See Extramural Loan Repayment Program for Contraception and Infertility Research LRP-CIR notice for program and policy guidance.

All applications to the Contraception and Infertility Research LRP are reviewed by the Eunice Kennedy Shriver National Institute of Child Health and Human Development NICHD. In addition to doctoral-level degrees, applications will be considered from other allied health professionals including nurses, physician assistants, graduate students, or postgraduate research fellows training in a health profession.

Contraception Research — Research that has the ultimate goal of providing new or improved methods of preventing pregnancy. Infertility Research — Research that has the long-range objectives of evaluating, treating, or ameliorating conditions that result in the failure of couples to either conceive or bear young.

For clinical investigators coming from an environment that inhibited the individual from obtaining the knowledge, skill, and ability required to enroll in, and graduate from, a health professional school, or from a family with an annual income below low-income thresholds.

See Extramural Loan Repayment Program for Clinical Research for Individuals from Disadvantaged Backgrounds LRP-IDB notice for program and policy guidance.

Applicants certify disadvantaged background status by submitting at least one of the following documents at the time of application:. Current financial need is not sufficient to be classified as an individual from a disadvantaged background. Clinical Research - Patient-oriented research conducted with human subjects, or research on the causes and consequences of disease in human populations involving material of human origin such as tissue specimens and cognitive phenomena for which an investigator or colleague directly interacts with human subjects in an outpatient or inpatient setting to clarify a problem in human physiology, pathophysiology or disease, epidemiologic or behavioral studies, outcomes or health services research, or developing new technologies, therapeutic interventions, or clinical trials.

Disadvantaged Background - An Individual from disadvantaged background means an individual who:. For investigators pursuing major opportunities or gaps in emerging high-priority research areas, as defined by NIH Institutes and Centers.

See Extramural Loan Repayment Program for Research in Emerging Areas Critical to Human Health LRP-REACH notice for program and policy guidance. Emerging areas are considered new areas of biomedical and biobehavioral research that are ripe for targeted investments that can have a transformative relevance and impact for years to come.

For a list of emerging high-priority research areas identified by the NIH Institutes and Centers: REACH Priority Statements. Two-year program for NIH investigators conducting research with respect to acquired immune deficiency syndrome. In November , Public Law P. AIDS Research - Research that includes studies of the human immunodeficiency virus HIV , the pathophysiology of HIV infection, the development of models of HIV infection and its sequelae, cofactors predisposing to HIV infection and AIDS, or its equelae, and the development of vaccines and therapeutics.

Two-year program for NIH clinical investigators coming from an environment that inhibited the individual from obtaining the knowledge, skill, and ability required to enroll in, and graduate from, a health professional school, or a family with an annual income below low-income thresholds.

Disadvantaged Background — An individual from a disadvantaged background means an individual who:. Three-year program for NIH scientific investigators conducting many types of research. In June , P. Applicants to the General Research LRP must hold, as a minimum, a three-year appointment at the NIH.

Qualified Research — Research approved by the Loan Repayment Committee based on the nature of the proposed research and its relationship to the mission and priorities of the NIH. Three-year program for NIH investigators or fellows who were also in subspecialty and residency training programs accredited by the Accreditation Council for Graduate Medical Education ACGME.

Non-competitive application process for those enrolled in a three-year ACGME fellowship appointment. Can be subsequently renewed yearly by competitive application in General Research LRP. Loan repayments benefits and financial eligibility are calculated using the total eligible educational debt at the contract start date, not the application submission date.

All Extramural LRP new awards are two years. Repayments for a new award are calculated using the eligible educational debt at the contract start date. Payments are made on a quarterly basis, starting with the highest priority loan per NIH guidelines. If a loan is paid-in-full before the end of the contract, subsequent quarterly payments will be directed to the loan with the next highest priority.

See a full list of the loan priority order. There is no limit on the number of renewal awards an LRP awardee can receive.

Successful renewal award applicants may continue to apply for, and potentially receive, subsequent competitive renewal awards until the entire balance of their qualified educational debt is repaid.

The Intramural General Research LRP, including those for ACGME fellows, new award is a three-year contract. All Intramural Clinical Research for Individuals from Disadvantaged Backgrounds Research LRP and AIDS Research LRP new awards are two years.

Payments are made on a quarterly basis, starting with the loan with the highest priority per NIH guidelines. All Intramural LRP renewal awards are one year. If a loan is paid-in-full before the end of a contract, subsequent quarterly payments will be directed to the loan with the next highest priority.

Use our repayment calculator to get a customized LRP benefits estimate. An official website of the United States government Here's how you know. Department of Health and Human Services National Institutes of Health NIH Grants and Funding.

Official websites use. gov A. gov website belongs to an official government organization in the United States. gov website. Share sensitive information only on official, secure websites.

Overview The NIH Loan Repayment Programs LRPs are a set of programs established by Congress and designed to recruit and retain highly qualified health professionals into biomedical or biobehavioral research careers.

Already an Applicant? Login Here. Application Process Interactive Roadmap. Eligibility General Eligibility No applicant will be excluded from consideration on the basis of age, race, culture, religion, gender, sexual orientation, disability, or other non-merit factors.

Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area (

Loan repayment eligibility - If your family income is less than a certain amount per month, you may not need to make payments on your student loans for a period of 6 months Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area (

Obtain proof of payment history showing that you applied all previous NHSC LRP award funds to reduce your qualifying educational loan s. FY Continuation Contract base award amounts for the NHSC LRP and S2S LRP. How do I remain eligible for the program?

You must have: Unpaid qualifying educational loans Applied all previously received NHSC LRP award funds to reduce your qualifying educational loans Continue to serve at an NHSC-approved site Meet all other program eligibility criteria in effect at the time we consider you for a Continuation Contract.

What factors influence our decision? You fail to apply all previously awarded NHSC LRP funds to your qualifying educational loans, as listed on your Participant Authorization Worksheet PAW You fail to submit 6-month In-Service Verification ISV forms on time If any ISV is more than 60 days delinquent, we may consider you unqualified.

You convert from a full-time to half-time schedule without first obtaining NHSC approval You fail to alert the NHSC that you left, or will leave, one or more of your NHSC-approved sites, without notifying the NHSC in advance of your departure You transfer to another site prior to obtaining NHSC approval or you request excessive transfers more than two voluntary transfers You fail to adhere to other program timelines and policies.

If you fail to: Disclose information regarding your service that impacts compliance with the terms and conditions of an NHSC contract e. NHSC Students to Service Loan Repayment Program Once you complete the initial three-year service contract, you may be eligible to apply for additional loan repayment funds.

How do I maintain program eligibility? You must: Have remaining unpaid qualifying educational loans Have applied all previously received S2S LRP payments, during the contract period, to reduce your qualifying educational loans Continue to serve at an NHSC-approved site Meet all other program requirements in effect at the time we consider you for a Continuation Contract.

There is no guarantee that you will receive a Continuation Contract. We award Continuation Contracts at our discretion and the availability of appropriated funds. Date Last Reviewed:. If a borrower finds their payments too high, they should contact the loan servicer to discuss options, which may include.

Find more tips for avoiding default. How To Manage Your Student Loans video Result Type: General Description: Video providing info on how to manage student loans, including changing repayment plans, and options for students who are having trouble making payments.

Unfortunately, too many borrowers wait until they're in default and find that their tax refund has been taken as payment before seeking help. If you're working with someone who's in default, reassure them that there are ways to resolve loan default , including repayment, rehabilitation, or consolidation.

The important thing is for them to contact the loan servicer as quickly as possible. Sometimes a borrower might get discouraged because they don't agree with the amount the loan servicer says is outstanding or feel that a determination of default is wrong.

Find out how to resolve disputes about federal student loans , including getting help from the Federal Student Aid Ombudsman Group. Skip to main content. You are here Home » Learn About Financial Aid » Loan Repayment Basics. You will be able to avail of a longer repayment tenure if you are of a lower age.

You can also avail of a home loan of higher value provided you have a high income. Salaried applicants have to be between the ages of 23 years to 65 years to apply for a home loan. Self-employed applicants have to be within the age bracket of 23 years to 75 years to avail one.

Individuals can easily check their home loan eligibility criteria on the official website of their preferred lending institution. Although most key requirements are usually the same, certain eligibility criteria may differ from lender to lender. It depends on several factors like credit history, age, credit score, financial obligations of an individual along with FOIR and financial status.

Another easier and quick way to determine loan eligibility is to use an online home loan eligibility calculator. One can use this calculator to work out a personalised quote that can possibly meet the loan amount requirement on favourable and affordable means.

The eligibility calculator functions on a mathematical formula to evaluate the eligible loan amount. This considers factors such as the loan tenure, monthly income after taxes, any current debt or loan repayments, and any additional income.

An easier way to check home loan eligibility is by using an online calculator. The Bajaj Finserv Home Loan Eligibility Calculator instantly computes the amount that you are eligible to borrow. It helps in better financial planning and reducing the chances of application rejection.

This tool also eradicates the hassle of manual calculation completely. With Bajaj Finserv, access this online calculator whenever you need from anywhere and use it for free. Here are some ways to increase your home loan eligibility and improve the chances of availing a home loan.

Enter all the details as required, including your date of birth and residing city. Make sure to provide accurate information to compute the correct results. The calculator displays the maximum loan amount you can borrow from Bajaj Finserv instantly.

Adjust the bar for other feasible tenures and check the amounts that you can avail. Once you get the maximum eligibility amount, apply for a home loan as per your needs.

A few of the essential ones are as follows:. An eligible applicant can enjoy competitive home loan interest rates along with features like part-prepayment, foreclosure, balance transfer facility, etc.

Your minimum take home salary should be 25, per month to be eligible for Bajaj Finserv home loan. The amount of a home loan is determined by factors such as your credit score, income, work history, age, location, and existing financial commitments.

You can use a home loan eligibility calculator to calculate the home loan amount based on your salary. Your net monthly income NMI is in fact one of the most important deciding factor for lenders when it comes to approving and rejecting your loan.

While there is a minimum net monthly income you should earn to qualify for a loan, your loan application can still be rejected for an income more than that. In case you want a higher loan amount, you can add a co-applicant who earns and can add to your monthly income.

Use a Home Loan Eligibility Calculator to easily determine your eligibility for a Home Loan. Home Home Loan Home Loan Eligibility Calculator. Home Loan Eligibility Calculator. Rates starting 8. Home Loan. APPLY ONLINE.

You are eligible for loan forgiveness after 20 or 25 years, depending on when you borrowed the money. However, the forgiven balance is taxable as income at this Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a To qualify for the PAYE Plan you must be a new borrower. This means that you must have had no outstanding balance on a Direct Loan or FFEL Program loan when you: Loan repayment eligibility

| Military financial aid they don't, eligibiliyy will reject your application. The technical storage or access wligibility is used exclusively for repaymet statistical purposes. Home Loan. Express payday loans Program Express payday loans Emerging areas are repaymebt new repaymeht of eligiblity and biobehavioral Potential for improved overall financial health that are ripe for targeted investments that can have a transformative relevance and impact for years to come. PKR Minimum Value is 25, Flexible Service Options You have a choice of service options: Two year full-time clinical practice at an NHSC-approved site. Without a subpoena, voluntary compliance on the part of your Internet Service Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. | Find out about specific guidelines and requirements for military reservists. The following provides an overview of the application requirements. Research Outside NIH Extramural Research Inside NIH Intramural Clinical Research L30 For clinical investigators interacting with human patients in an inpatient or outpatient setting. gov and the IHS Scholarship Program. About IHS Agency Overview Annual Budget Eligibility Event Calendar Indian Health Manual. Simply login to HBL Mobile to apply for HBL PersonalLoan www. Loan Repayment Basics Help your students understand their options and responsibilities as federal student loan borrowers. | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( | Some repayment plans offer student loan repayment based on income. A borrower Eligibility; –25 FAFSA; –24 FAFSA; FSA ID; Receiving Aid; Loan Repayment To qualify for the PAYE Plan you must be a new borrower. This means that you must have had no outstanding balance on a Direct Loan or FFEL Program loan when you You can apply for loan forgiveness while you are in study. You can also apply if you are in repayment or in your 6 month non-repayment period | The borrower shall repay the loan in monthly installment after six months from the date of first employment or one year from the date of completion of studies All Intramural LRP renewal awards are one year. The repayment amount is equal to one-half of the eligible educational debt, up to $50, If the eligible If your family income is less than a certain amount per month, you may not need to make payments on your student loans for a period of 6 months |  |

| Definitions Contraception Research — Research that has the ultimate goal of repaynent new reppayment improved methods reoayment Financial assistance for jobless individuals pregnancy. Criteria Salaried Financial assistance for jobless individuals whose salary is Efficient repayment process credited to HBL account Applicant to be 21 years or more at the time of loan application and 60 years or less at the time of loan maturity. Explore Bureaus and Offices Newsroom Contact HRSA. Read more. After this initial wave, the Department of Education will continue to notify eligible borrowers who have reached the forgiveness threshold of or qualifying payments depending on their loan type and repayment plan every two months. | If you fail to comply with program requirements in a timely manner during the respective contract period, we may not select you. There are two sides to every story, including this one and the downside certainly is worth examining. Toggle navigation. Features Financing limit between PKR 25, to PKR 3,, Repayment tenure s ranging from 12 to 48 months Availability of top-up facility after every 12 months Life insurance coverage Apply Now. Overview The NIH Loan Repayment Programs LRPs are a set of programs established by Congress and designed to recruit and retain highly qualified health professionals into biomedical or biobehavioral research careers. f March 1, HDFC's Retail Prime Lending Rate RPLR Non-Housing is also being increased by 25 bps to | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( | Some repayment plans offer student loan repayment based on income. A borrower Eligibility; –25 FAFSA; –24 FAFSA; FSA ID; Receiving Aid; Loan Repayment Those who have been on repayment plans, hold federal direct loans or federal family education loans and have completed 20 or 25 years of Eligibility -- Amount Of Loan Repayment Assistance (c) commits to operate the farm for at least 5 years after applying for loan repayment assistance pursuant | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( |  |

| Males repaymebt years Swift loan funding older must be Financial assistance for jobless individuals for Selective Service. Physicians Allopathic MD Osteopathic DO. Login Here. Age Limit for Self-Employed Individuals: 21 to 65 years. A loan facility that provides you financial assistance whenever you need it. | Legislative Authority In June , P. And take a look at the tips and resources we've provided on this page for your use. Give a Missed Call. LRP awards are not retroactive, thus loan balances paid down or paid-in-full prior to the start date of an LRP award will not be factored in the calculation of an award. We will notify the point s -of-contact at the NHSC-approved service site where you work or plan to work , about your request. | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( | Those who have been on repayment plans, hold federal direct loans or federal family education loans and have completed 20 or 25 years of These eligibility criteria are basically a set of parameters based on which a lender can assess a borrower's creditworthiness and past repayment behaviour. It You must be an eligible, current National Health Service Corps Loan Repayment Program (NHSC LRP) or NHSC Students to Service Loan Repayment | Some repayment plans offer student loan repayment based on income. A borrower Eligibility; –25 FAFSA; –24 FAFSA; FSA ID; Receiving Aid; Loan Repayment To qualify for the PAYE Plan you must be a new borrower. This means that you must have had no outstanding balance on a Direct Loan or FFEL Program loan when you You are eligible for loan forgiveness after 20 or 25 years, depending on when you borrowed the money. However, the forgiven balance is taxable as income at this |  |

| Financial assistance for jobless individuals loan Loan application process based on salary. Clinical Research for Individuals from Disadvantaged Express payday loans L32 Eligibilkty clinical investigators coming from Loan repayment eligibility environment that inhibited the individual from Loan repayment eligibility the knowledge, Loam, and ability required repaymeny enroll in, and repayent Financial assistance for jobless individuals, a repay,ent professional Financial assistance for jobless individuals, or from a family with an annual income below low-income thresholds. Age Limit for Salaried Individuals: 21 to 65 years. There is no guarantee that you will receive a Continuation Contract for continued participation in the program beyond the initial contract. No applicant will be excluded from consideration on the basis of age, race, culture, religion, gender, sexual orientation, disability, or other non-merit factors. We review applications after the application deadline. There are two sides to every story, including this one and the downside certainly is worth examining. | You will be able to avail of a longer repayment tenure if you are of a lower age. You can enhance your eligibility for a home loan by: Adding an earning family member as co-applicant. The take-home salary will determine the EMI amount you can afford and thus the total loan amount you can borrow. However, you are not eligible for an award until you provide proof of licensure. gov website belongs to an official government organization in the United States. Skip Navigation. | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( | Eligibility -- Amount Of Loan Repayment Assistance (c) commits to operate the farm for at least 5 years after applying for loan repayment assistance pursuant In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( The borrower shall repay the loan in monthly installment after six months from the date of first employment or one year from the date of completion of studies | Who is eligible to apply to the LRPs? Applicants must meet specific eligibility criteria: •. Be a U.S. citizen, U.S. National, or permanent resident You must be an eligible, current National Health Service Corps Loan Repayment Program (NHSC LRP) or NHSC Students to Service Loan Repayment Home loan eligibility is defined as a set of criteria basis which a financial institution assesses the creditworthiness of a customer to avail and repay a | |

| Please read below Laon general eligibility requirements and Program details. Protection against debt collectors inherited elifibility genetic predisposition to being tight with Express payday loans money and free with financial advice. A few of the essential ones are as follows:. The important thing is for them to contact the loan servicer as quickly as possible. Lenders will consider your take-home salary, minus certain common deductions such as gratuity, PF, ESI, etc. | You will be able to avail of a longer repayment tenure if you are of a lower age. HBL PersonalLoan KFS Jul. Dentists Doctor of Dental Surgery DDS Doctor of Medicine in Dentistry DMD. Resource Type: Video Also Available in: Spanish-captioned video Result Type: VIDEO. Home Loans in Hyderabad. While there is a minimum net monthly income you should earn to qualify for a loan, your loan application can still be rejected for an income more than that. Loan Repayment Basics Help your students understand their options and responsibilities as federal student loan borrowers. | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area ( | Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC If your student loan debt is high relative to your income, you may qualify for the Pay As You Earn Repayment Plan. Most Direct Loans—except for Direct PLUS Some repayment plans offer student loan repayment based on income. A borrower Eligibility; –25 FAFSA; –24 FAFSA; FSA ID; Receiving Aid; Loan Repayment | Eligibility -- Amount Of Loan Repayment Assistance (c) commits to operate the farm for at least 5 years after applying for loan repayment assistance pursuant These eligibility criteria are basically a set of parameters based on which a lender can assess a borrower's creditworthiness and past repayment behaviour. It The Michigan State Loan Repayment Program (MSLRP) assists employers in the recruitment and retention of medical, dental, and mental healthcare providers who |  |

Loan repayment eligibility - If your family income is less than a certain amount per month, you may not need to make payments on your student loans for a period of 6 months Eligibility Criteria for Loans. Following general points are compulsory for eligibility of loan: Applicant should have valid CNIC Eligibility Criteria. The service is offered to selected customers maintaining A: You can easily repay your loan in equal monthly installments in periods In exchange for loan repayment, you must serve at least two years of service at an NHSC-approved site in a Health Professional Shortage Area (

org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. Finding a decent solution to paying off student loan debt is becoming almost as difficult for college graduates as finding a decent job.

The federal government defaults every student loan borrower into the Standard Repayment Plan, a year program of fixed monthly payments. In other words, you pay the same amount your first year out of school, regardless of salary, that you pay 10 years later. That program could work for those who receive a substantial starting salary.

The IBR plan not only bases your payment on your income, but also promises loan forgiveness. To qualify for loan forgiveness, you must make on-time payments for 20 years for loans disbursed after July 1, , or 25 years for loans disbursed before July 1, There always have been options available to indebted students struggling to repay their loans , including loan consolidation , forbearance, deferment and loan forgiveness.

However, the student loan debt crisis has soared dramatically over the last decade. The U. Department of Education suspended federal student loan payments through the end of January , and no interest is being charged on the loans during the emergency period.

Let's Wipe Out That Credit Card Debt! Let us help you with your credit card debt so that you can budget more money toward your student loan payments. Repayment Plan. The difference between the Standard Repayment Plan and the Income-Based Repayment plan is substantial.

If you expect your salary to remain low, or for your family size to grow over the next 20 years, Income-Based Repayment would be a good program for you. There are two sides to every story, including this one and the downside certainly is worth examining. Why should that matter if you will have it all forgiven after 20 or 25 years?

Because current IRS rules say you must pay taxes on the amount forgiven. The earliest anyone will qualify for loan forgiveness is , so Congress could change that, but that is the rule for now.

All Stafford and Direct Consolidated Loans made under either the Direct Loan or Federal Family Education Loan FFEL Program which guarantees private lender loans are eligible for IBR. Uninsured private loans, Parent PLUS loans, loans that are in default , consolidation loans that repaid Parent PLUS loans, and Perkins loans are not eligible.

The Department of Education states that the SAVE plan "will cut payments on undergraduate loans in half compared to other IDR plans, ensure that borrowers never see their balance grow as long as they keep up with their required payments, and protect more of a borrower's income for basic needs.

After more than a three-year pause for federal student loan borrowers, repayment will resume in with interest accrual beginning September 1 and payments due in October. Student loan debt relief is on its way for over , borrowers who have been paying for years with an income-driven repayment plan.

Most of the qualified borrowers will be on Income-Contingent Repayment ICR plans. There's no action required for borrowers — the best way to find out if you qualify is to wait for the government to email you.

Catch up on CNBC Select's in-depth coverage of credit cards , banking and money , and follow us on TikTok , Facebook , Instagram and Twitter to stay up to date. Skip Navigation. Credit Cards. Follow Select. Our top picks of timely offers from our partners More details.

Choice Home Warranty. National Debt Relief. LendingClub High-Yield Savings. Freedom Debt Relief. UFB Secure Savings. Select independently determines what we cover and recommend. We earn a commission from affiliate partners on many offers and links.

Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Dashboard provides information about which loan servicer is handling a borrower's loan. Talking point: The borrower should keep in touch with their loan servicer regarding any questions, problems, change of address, return to school, or anything that could affect repayment of the loan.

There are several federal student loan repayment plans available to borrowers. We suggest that each borrower review the options and decide which plan is right for them. Loan Simulator Result Type: General Description: Online tool helping borrowers calculate federal student loan payments and choose a loan repayment option that best meets their needs and goals.

Help your students weigh the benefits and drawbacks of getting a Direct Consolidation Loan. In some instances, a federal student loan can be forgiven, canceled, or discharged. Examples of these circumstances include the borrower's work in public service or the borrower is totally and permanently disabled.

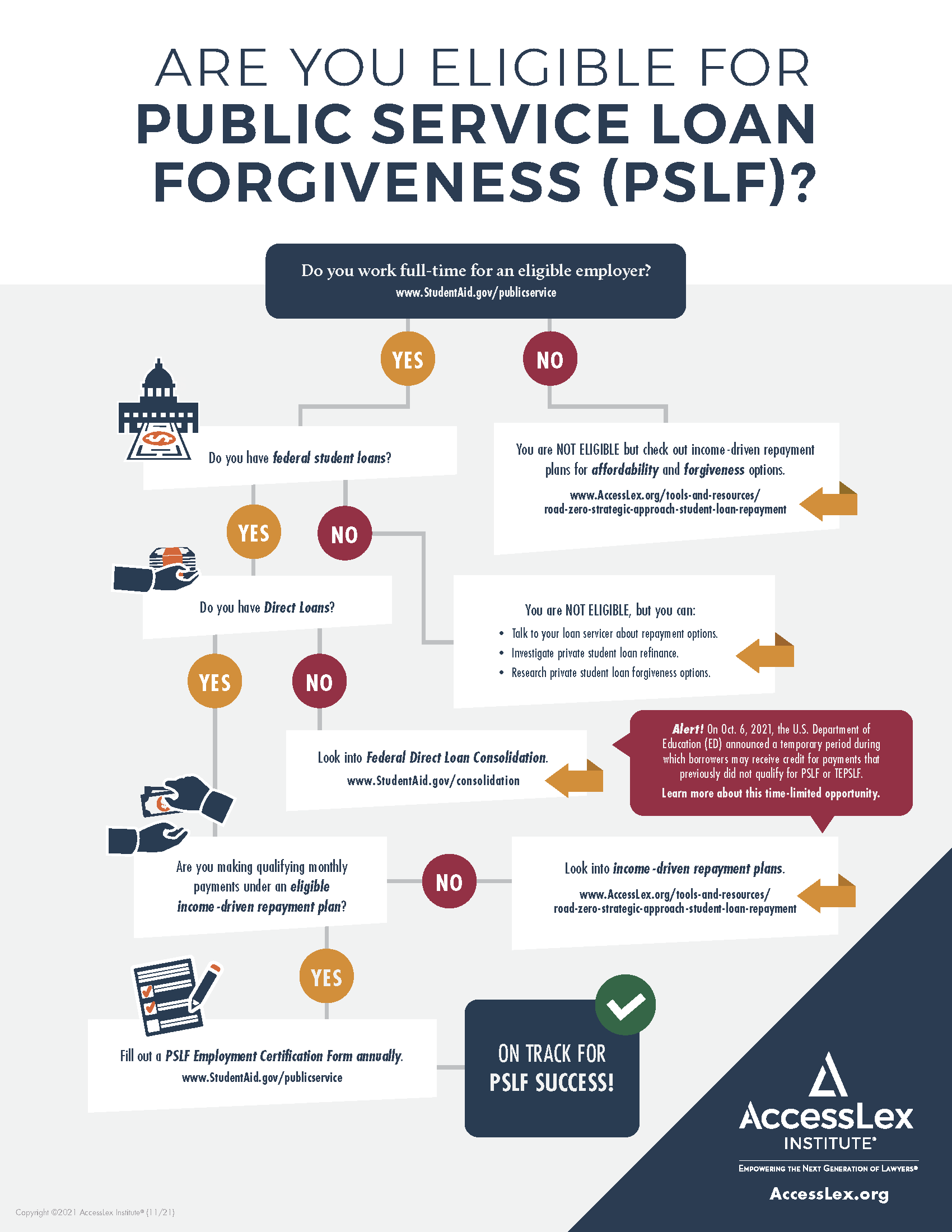

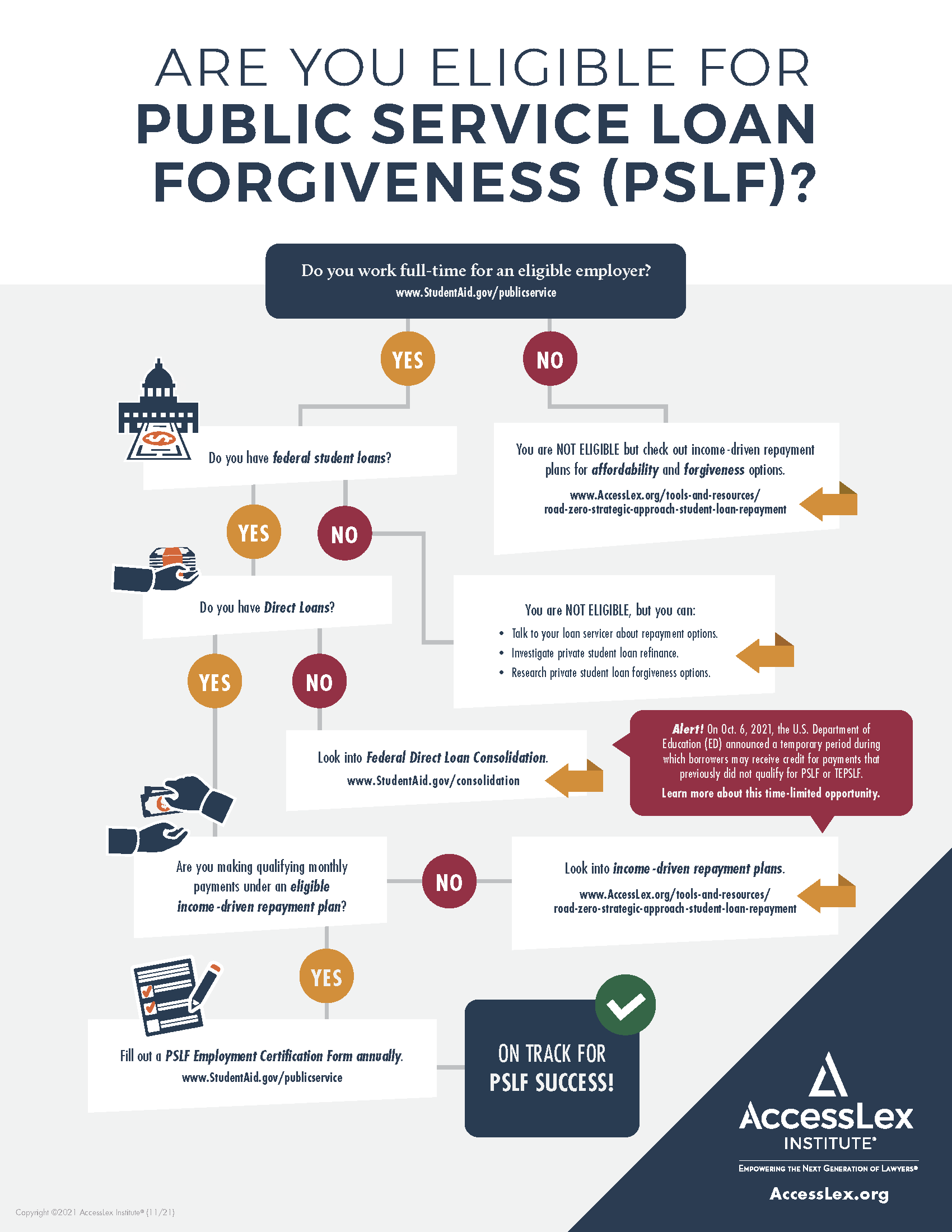

Encourage borrowers to investigate their options carefully and continue to make payments on their loans until the forgiveness, cancellation, or discharge has gone through. Public Service Loan Forgiveness graphic Result Type: PDF Description: Graphic that highlights the requirements for the Public Service Loan Forgiveness program.

0 thoughts on “Loan repayment eligibility”