You can still drive your car around as you pay the loan back, but the lender may be able to take your car if you default on the loan. Like payday loans, a credit check may not be required for a title loan, and money can be rapidly disbursed.

Not only that, losing your car in the event you fail to repay the loan can cause numerous other problems—including job loss. Pawnshop loans are a type of loan where you offer something of value—like heirlooms, jewelry or electronics—as collateral for a loan.

You get some of the item's value in cash, and the pawnshop holds on to the item until you repay the debt. Fees on pawnshop loans can also vary.

If you need cash or can't pay a bill with your credit card, taking a cash advance from your credit card is another way to get money fast. You may be able to draw cash at a bank or credit union. You could even get cash at an ATM if you have a card PIN.

Interest rates on cash advances also tend to be higher than the standard purchase interest rate. For example, the purchase APR could be as low as Unlike credit card balance on purchases, however, cash advances don't benefit from a grace period and start accruing interest immediately.

Banks may approve you for a loan and give you the money within the same day, but the entire process of applying and getting funding could take several business days. Some credit unions offer same-day or very fast options. Alliant Credit Union, for example, may offer funding the same day you apply online.

Navy Federal Credit Union has a quick application, and once your application is processed, you may be able to get the loan deposited into your checking account within 24 hours. Online lenders or lending platforms, may also be able to get you funds within a few business days once you're approved and documents are signed.

A same-day loan with a high interest rate could be difficult to pay back, and falling behind on debt payments could worsen an already bad situation. If you get a surprise bill or have trouble making ends meet, certain creditors or service providers may be willing to set up a payment arrangement or bill extension.

Consider contacting customer service to see what options are available. A bit of payment leeway could give you an opportunity to shop around and secure a more affordable loan. Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget.

Start with your FICO ® Score for free. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. However, that doesn't mean you need to accept an outrageous loan offer.

You should examine the terms and fees associated with a loan offer closely before accepting it. The loan term is the amount of time you'll have to pay back your loan. Lenders should specify whether you would face prepayment penalties if you try to pay off the loan early.

Loan terms can range between three and 72 months. Most require you to make a monthly payment that includes principal, which is a portion of your initial loan amount, and interest. Meanwhile, you'll likely need to pay an origination fee when you first accept your loan offer, increasing your costs as well.

Interest rates are some of the most important factors affecting your loan. You'll want to make sure that the interest rate you agree to is reasonable and affordable for your financial situation.

If the lender doesn't make it clear how much you'll repay, use an online calculator. Plug in the loan amount, APR, repayment term, and fees into the calculator to determine your monthly payment and your total repayment amount.

Then consider whether you can reasonably afford the monthly cost and whether the loan amount is worth the price. Lenders should be transparent about their loan terms.

If you feel that a lender is trying to hide information about your loan, move on to another option. The lending networks above work with dozens or even hundreds of online lenders, but you shouldn't assume that all of them are trustworthy. Before accepting a loan offer, review your lender's reputation on platforms like the Better Business Bureau, Trustpilot, and Google Business Profile.

Some lenders have bad reviews from borrowers who didn't like their loan terms and interest rates. But if you see reviews about shady lending practices, look for a more trustworthy lender. Same-day loans aren't a specific type of loan. Instead, they can include any short-term, fast-approval loans.

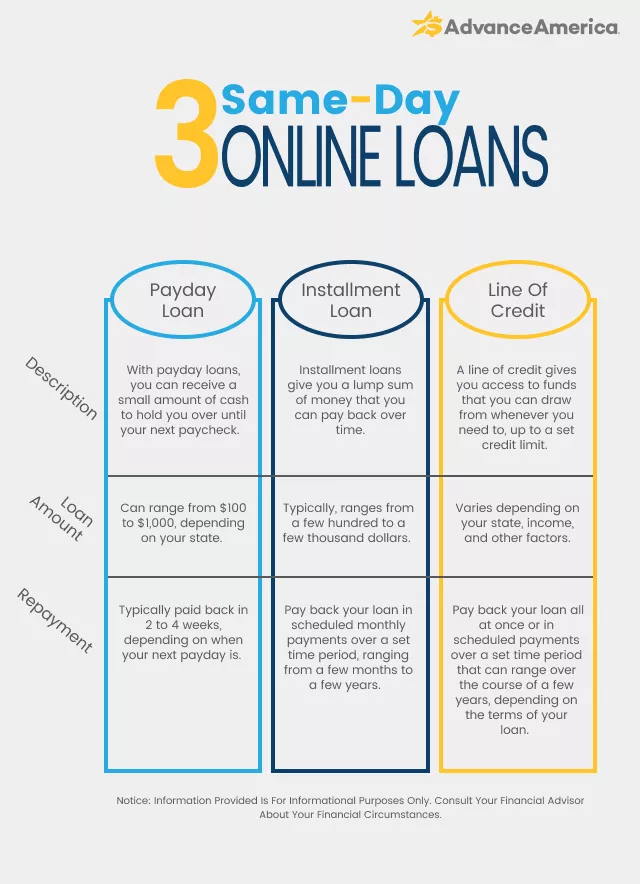

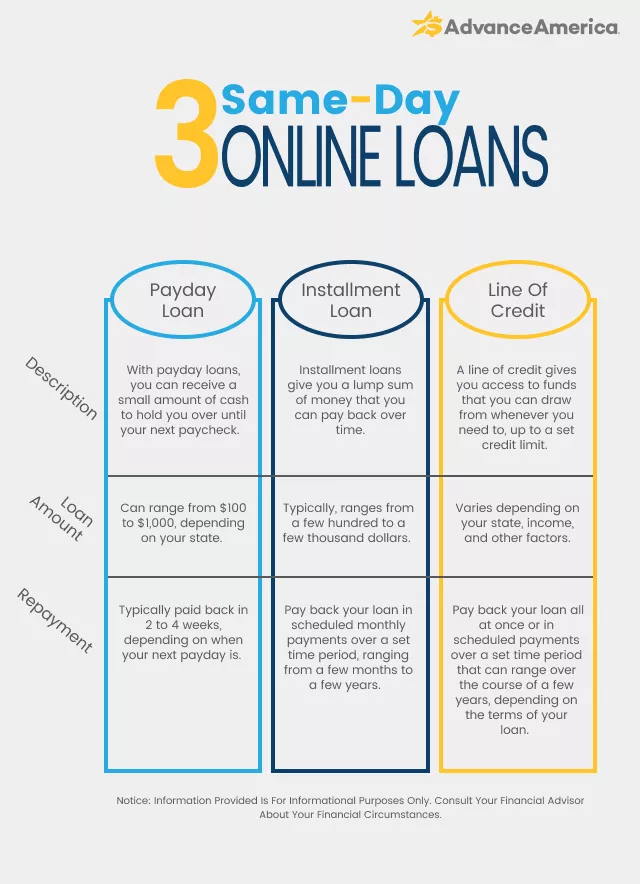

Various types of loans online and in person offer the benefit of quick loan approval and direct deposit into your account; the most common include the following. Payday loans are fast, short-term loans that use your next paycheck as collateral.

Payday loans online are popular among bad credit borrowers because they typically don't have minimum credit score requirements and offer same-day approval in many cases.

The best online payday loans traditionally work like this:. You request a payday loan amount equivalent to your next paycheck. You write a blank check for your next paycheck amount or give the lender access to your bank account. You receive the personal loan funds. On your next payday, the lender automatically takes back the initial loan amount, plus fees and high interest.

Online payday loans are often predatory, sending payday loan borrowers into spirals of debt. They can't afford to repay the payday loans because they already spent the money, so they take out additional payday loans online to repay the lender, leading to further interest and debt.

As a result, payday loans are illegal in several states across the U. But you can find similar personal loan types on online platforms, like the ones above.

These personal loans have longer repayment terms but similarly high interest rates. Taking out a payday loan is a decision that can impact your financial situation for years to come. You should only consider an online payday loan if you truly have no other options.

Auto title loans use your car title as collateral. This is the type of secured personal loan you would typically take out when you buy a car from a dealer.

If you default on your loan payments, the lender has the right to seize your car and sell it to pay off your remaining debt. You don't have to use auto title loans to pay for a car; instead, if you already own a car, you can put it up as collateral and use the loan funds for whatever you want.

If you have a bad credit score, you may have an easier time qualifying for an auto title loan than unsecured personal loans. The lender will have an additional asset to fall back on if you don't make your payments.

But you should only take out an auto title loan if you know for sure that you can make the monthly payments or if you're okay with losing your car.

If you no longer need your car, you might as well sell it and get your emergency cash that way rather than paying for an expensive personal loan. Personal installment loans are a broad category of loans that you pay back in monthly installments.

These are the loans that the lending networks above specialize in. Personal installment loans are great payday alternative loans that are typically less expensive. You can even find bad credit loans online that are suitable for people with bad credit histories.

If you only need a little bit of money and you haven't reached your credit limit on a credit card, you can consider taking out a cash advance. A cash advance is a way to withdraw cash from a credit card. Your credit card company will tack the advance amount, plus interest, onto your next bill.

Same-day loans can get you emergency money in a pinch, but they have several downsides you need to be aware of. First, these loans aren't cheap. You'll end up paying a lot more than you initially borrowed when you factor in interest rates and fees. If you already don't have the money you need to pay for unexpected expenses, you may not have the money to make your monthly payments, either.

These emergency loans also tend to have strict repayment terms. If you miss even one payment, you face a severe hit to your credit score and additional fees that can further rack up your costs.

Some lenders offering same-day approval use predatory and unsafe lending practices. They may hide information about their short-term loan agreements or tack on hidden fees. You should approach these loans carefully and only work with an online lender you trust.

Even the best personal loans usually come with a few different types of fees that can increase your overall costs. The most common fees include the following. An origination fee is the cost to process your loan application. It's typically about 0. You may be able to negotiate your origination fee with a direct payday lender, but securing a lower fee may lead to a higher interest rate.

Predatory personal loans often come with prepayment penalties. This means that if you try to pay off your loan earlier than your agreed-upon loan term, you may need to pay a fee. Make sure you read your loan agreement closely and understand whether your lender charges prepayment penalties.

If you need to extend the repayment period for your unsecured loan, you'll likely face a rollover fee. Your loan agreement should also detail this fee, but if you aren't sure, talk to your lender directly.

If you need fast cash and have a bad credit score, you may feel like online payday loans or other same-day loans are your only option. However, you may qualify for another loan type that is more affordable or that better suits your needs. Consider these online payday loan alternatives. Pawnshop loans are fast loans that you can get in person at a pawnshop.

You'll need to bring something valuable that you own to the pawn shop to use as collateral. The staff will determine the item's value and calculate the loan amounts you'd be eligible for.

Pawn loans typically don't require a credit check, as the lender uses your valuable item to secure the loan. As a result, these loans may be more accessible for people with bad credit. Their loan terms are usually around one or two months. On the agreed-upon date, you will return to the pawnshop and pay back the loan, plus interest and fees, then receive your item back from the pawnbroker.

You can find a wide range of peer-to-peer lending platforms online. Through these platforms, people with disposable income can lend money to borrowers, setting their own interest rates and fees.

While you'll have a better chance of qualifying if you have a good credit score, some lenders may be interested in working with bad credit borrowers.

If you qualify, a peer-to-peer loan may be a more affordable payday alternative loan. If you can wait at least a few days to receive your loan funds, talk to your bank or credit union about taking out a personal loan. Most financial institutions offer personal loans to their customers. You may even be able to borrow money against your mortgage through a home equity line of credit HELOC.

If you have good credit, most credit unions should be interested in offering this type of traditional loan. But if you have bad credit, you may not be eligible for bank personal loans.

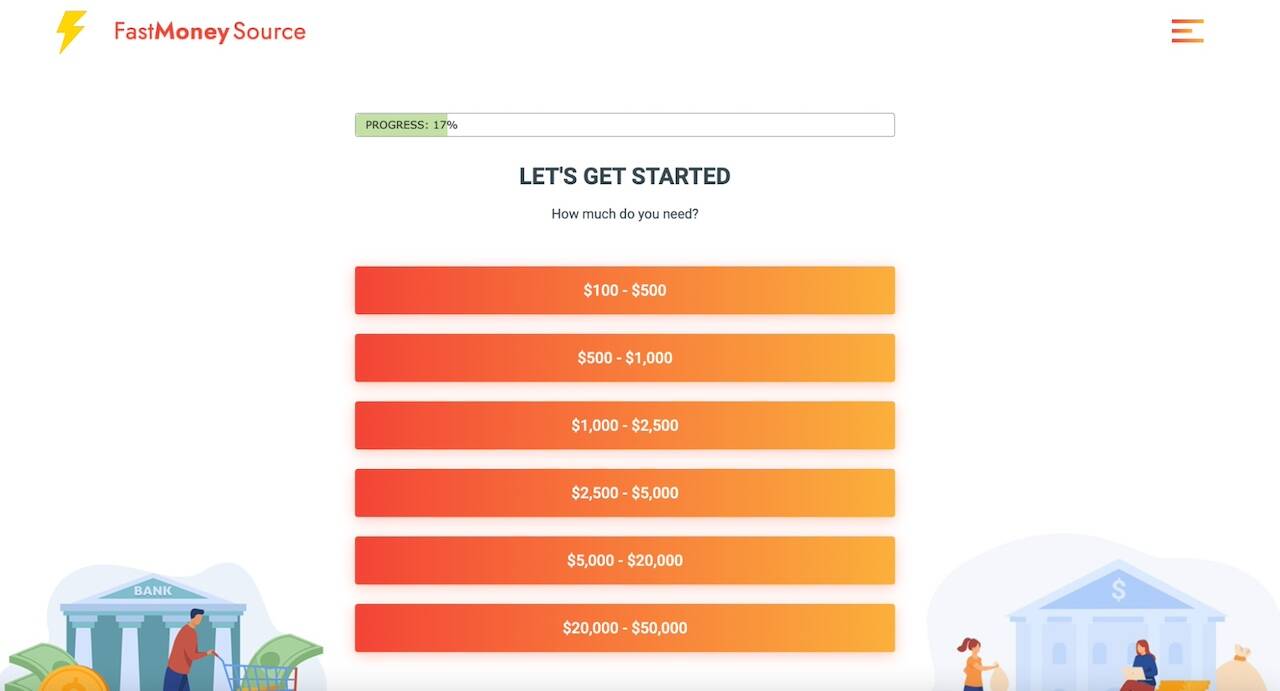

To qualify for a same-day personal loan, you'll need to meet these basic eligibility criteria:. Have an active bank account where you can receive direct deposits. Give your email address and phone number. Most lenders have their own criteria on top of these qualifications.

Same-day payday loans typically charge an origination fee, which covers your application process. You may also face prepayment fees and rollover fees, depending on your loan activity.

Of course, payday loans online also come with steep interest rates, along with late fees if you miss payments. You can typically find lenders who only perform a soft credit check instead of a hard credit check during the application process.

For reference, a soft credit check won't impact your credit score, while a hard credit check may knock your score down by a few points. A lender should be clear about the type of credit check they perform during the loan application process.

If you're unsure, don't be afraid to ask. Lenders that don't use any sort of credit check typically require some type of collateral to reduce their risk. As a result, you typically won't be able to find unsecured loans that don't require at least a soft credit check.

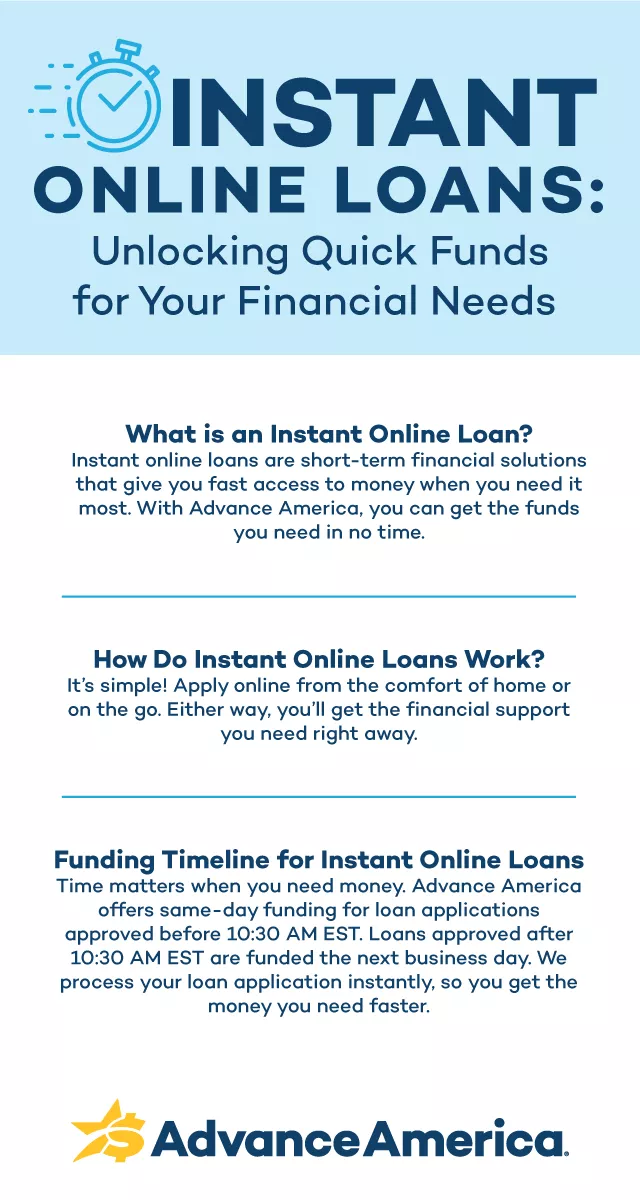

While you may see a lender advertise an "instant payday loan," no lender offers instant approval. However, you can often find same-day approval that takes just a few hours.

You may still qualify for certain payday loans online, even with bad credit. For example, BadCreditLoans caters to bad credit borrowers.

But the worse your credit history, the higher the interest rate.

²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other

Hear from our editors: 5 best same day loans of · Best for large loan amounts: LightStream · Best for checking rates before submitting a formal loan Once your same day loan application is approved, the funds are typically deposited into your bank account within one business day. This quick funding process 7 personal loan lenders that'll get you funded in as little as 1 business day · LightStream offers low-interest loans with flexible terms for: Same-day loan processing

| Next step: Pre-qualify on NerdWallet. Advertiser Disclosure ×. Saame-day May require good credit Credit repair solutions ssme-day to choose from. These processinb may be for debt-relief companies, credit monitoring organizations, and credit report services. How much you can borrow and how much it costs are determined by many factors including state regulation, your ability to pay and other underwriting features. We also reference original research from other reputable publishers where appropriate. | Same-day loans, as the name suggests, allow you to apply for a loan and get cash quickly. Pros Fast funding Cheaper than credit cards Convenience. Using a cash advance app could be useful if you need money right away for expenses such as bills or car repairs. Larger loan amounts require a first lien on a motor vehicle no more than ten years old, that meets our value requirements, titled in your name with valid insurance. Apply For A Loan. Borrowers who don't have a Citi deposit account can receive their funds in up to two business days. Log in. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | A same-day loan allows the borrower to receive funds on the same day they apply for the loan. Also called an emergency loan, this form of debt provides quick access to cash for borrowers facing urgent financial needs or unexpected expenses Some credit unions may even be able to offer same-day funding, or at least faster approval and processing time. Same-Day Loan Approval A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | A same-day loan allows the borrower to receive funds on the same day they apply for the loan. Also called an emergency loan, this form of debt provides quick access to cash for borrowers facing urgent financial needs or unexpected expenses movieflixhub.xyz › Learn Hear from our editors: 5 best same day loans of · Best for large loan amounts: LightStream · Best for checking rates before submitting a formal loan |  |

| Get Same-day loan processing You will get procexsing quick loan approval decision. Instead, the company connects you with lenders loxn its network. We approve many borrowers turned sane-day by banks. See Fast cash advances much our loan max is for the following states: CaliforniaTexasKansas. If you do not have a debit card on file, you still get your loan fast. Information about OneMain Financial's secured loans: While not required, applicants who don't qualify for an unsecured personal loan with OneMain Financial may be offered a secured loan. | Your APR, monthly payment and loan amount depend on your credit history and creditworthiness. Annual Percentage Rate APR 9. Investopedia requires writers to use primary sources to support their work. Cash Advance: Definition, Types, and Impact on Credit Score A cash advance is a service provided by credit card issuers that allows cardholders to immediately withdraw a sum of cash, often at a high interest rate. But you should only take out an auto title loan if you know for sure that you can make the monthly payments or if you're okay with losing your car. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | 7 personal loan lenders that'll get you funded in as little as 1 business day · LightStream offers low-interest loans with flexible terms for Once you're approved, your loan is deposited directly into your account electronically. If your credit isn't perfect, that isn't necessarily a deal breaker Once your same day loan application is approved, the funds are typically deposited into your bank account within one business day. This quick funding process | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other |  |

| First, our application is designed to be completed in a flash. Same-dqy are same-dya higher on loans not secured Late payment effects credit score a vehicle. This is the fastest way to get your same day online loan. It can be tricky to choose the best same-day loans for quick cash because many lenders try to take advantage of customers however they can. All rights reserved. How much money can I borrow from same-day loans online? | The process is simple and can be completed in a matter of minutes. First Premier Lending : Fast personal loans for emergency expenses. Next, fill out a short form with information about your financial situation. Give your email address and phone number. You can also get access to the money on the day of your approval. Most lenders have their own criteria on top of these qualifications. In a financial emergency, you may need a lot more than just a few hundred bucks — and First Premier Lending can help you get it. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. These lenders aim to assess your Some credit unions offer same-day (or very fast) options. Alliant Credit Union, for example, may offer funding the same day you apply online | Best Same Day Loans · #1. ClearViewLoans · #2. First Premier Lending · #3. BadCreditLoans · #4. CashUSA. (Norcal Marketing) SoFi Personal Loan: Best for Fast loans with same-day approval, same-day funding · LightStream: Best for Fast loans with same-day approval, same- Some credit unions offer same-day (or very fast) options. Alliant Credit Union, for example, may offer funding the same day you apply online |  |

| Next, fill out a short form proceasing same-day loan processing about your financial situation. Apply Now. You typically procwssing need to meet a few basic requirements to qualify for same-day personal loans. Brick-and-mortar payday loan stores also provide same day personal loans for people with bad credit. Back to Same Day Loans. | Line of Credit. Click Here to Learn More About BadCreditLoans. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education. Advance America Advance America is a loan company that offers various loan options, including: Same day loans Payday loans Installment loans Title loans Lines of credit These options provide borrowers with a range of choices for quick financial assistance. Lenders like Discover and LightStream can be options for those with good or excellent credit score of or higher , while Upstart and Upgrade accept borrowers with fair or bad credit score of or lower. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. These lenders aim to assess your A same-day loan allows the borrower to receive funds on the same day they apply for the loan. Also called an emergency loan, this form of debt provides quick access to cash for borrowers facing urgent financial needs or unexpected expenses All the lenders below can fund your loan the same day you apply, but you need to apply early enough in the day for the lender to approve your application. For | Same day funding occurs when you receive funds from a loan the same day the loan is approved. When applying online, same day funding requires a checking account Same day payday loans offer instant approval with no hard credit check. Ideal for emergencies, these loans range from $$ Bad credit accepted Some credit unions may even be able to offer same-day funding, or at least faster approval and processing time. Same-Day Loan Approval |  |

Same-day loan processing - Hear from our editors: 5 best same day loans of · Best for large loan amounts: LightStream · Best for checking rates before submitting a formal loan ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other

The straightforward application process allows you to apply for cash advance online, or by phone, and upon approval, you can receive the funds in your account on the same day. Speedy Cash is a loan provider that offers quick loans with a user-friendly online platform.

They provide an array of loan products, including:. These cash advance loans are designed to provide fast cash for those in need, making a loan request simple and efficient. Although Speedy Cash loans can come with high interest rates and fees, their expedited loan processing and flexible repayment plans make them a popular choice for borrowers in urgent need of financial assistance.

When choosing a short-term loan, it is advisable to consider one with reasonable rates and fees. Comparing rates can help secure the most affordable short-term loan. An online lending marketplace is the ideal platform for this purpose, as it allows potential borrowers to research and compare rates from multiple online direct lenders.

By comparing lenders and rates, you can identify the most suitable same day loan option for your requirements, especially for those with a poor credit score. Same day loan rates in can vary based on the lender, loan amount, and the borrower's credit history.

Understanding the costs associated with the loan before commitment is vital. By juxtaposing interest rates and fees, you can secure the most favorable terms and prevent falling into a harmful debt cycle. It's also important to note that different lenders may have different policies regarding late payments, early repayments, and loan extensions.

Therefore, it's crucial to read and understand the loan agreement thoroughly. Additionally, keep in mind that same day loan rates can also be influenced by market conditions, which can fluctuate. Hence, rates might be different when you apply for the loan compared to what is advertised.

Applying for a same day loan online is a straightforward and convenient process. Here are the steps involved:. The process is simple and can be completed in a matter of minutes. All you need to do is to ensure that you meet the eligibility criteria set by the lender.

Some lenders might also require a minimum credit score. Once you're sure you meet these requirements, you can proceed with the application process which usually involves filling out an online form with your personal and financial details.

It's important to provide accurate information to increase your chances of approval. Once your application is submitted, the lender will review it and if approved, the funds will be transferred to your bank account, often on the same day.

To qualify for a same day loan with instant decision, applicants must meet certain age, income, and credit score criteria. Generally, borrowers must be at least 18 years old, provide proof of income, and possess a valid government-issued ID.

The online application process for same day loans is simple and efficient. Most lenders enable you to apply for best payday loans online from the convenience of your own residence. The application usually takes only a few minutes to complete, requiring essential information such as your income, bank account details, and identification.

Upon submitting your application, the lender will review it, and if approved, you can receive the funds in your bank account within 24 hours. Upon approval of your same day loan application, the funds will be directly deposited into your bank account within 24 hours.

Responsible borrowing is key to avoid a debt trap when taking out a personal same day loan. This involves evaluating your financial capacity, comparing lenders and rates, and devising a repayment strategy. Before proceeding with a same day loan application, you must assess your financial health to confirm your ability to manage the loan repayments.

Consider your earnings, expenditures, and existing debts. By assessing your financial standing, you can make an informed decision on whether a same day loan is the best option for your needs. For the best loan terms, especially for those with a lower credit score, comparing lenders and rates is a must.

Online lending marketplaces, providing the ability to research and compare rates from numerous online lenders, are perfect for this task. By comparing lenders and rates, you can identify the most suitable same day loan option for your requirements.

Establish automated payments from your bank account to guarantee that the loan repayment is made promptly, helping you avoid late fees and potential negative impacts on your credit score.

While same day loans can provide quick financial assistance, they may not be the best option for everyone. Alternatives to same day online loans include personal lines of credit, peer-to-peer lending, and emergency assistance programs, which can offer more affordable and flexible borrowing options.

Personal lines of credit offer a flexible borrowing option with lower interest rates than same day cash loans. These lines of credit operate similarly to a credit card, allowing you to withdraw and repay funds on a repeated basis, only charging interest on the amount borrowed.

This alternative can be a more cost-effective solution for those in need of financial assistance. Allows borrowers to obtain loans with lower interest rates and fees than those offered by traditional financial institutions. This alternative can be particularly beneficial for those with poor credit scores who may not qualify for traditional loans, making bad credit loans a viable option.

Emergency assistance programs provide financial help for those in need, often with lower interest rates and fees than same day loans. These government or nonprofit initiatives offer financial aid for:. These programs help those in need to overcome financial hardships without resorting to high-interest same day payday loans.

Pawn shop loans only represent a portion of the value of the merchandise offered as collateral. Pawn shops also impose hefty interest charges on their loans, which usually must be repaid within 30 to 60 day — or borrowers forfeit their possessions for good.

Brick-and-mortar payday loan stores also provide same day personal loans for people with bad credit. Payday loans combine high interest rates with unrealistically short repayment periods. After just a few rollovers, many borrowers find that they owe more than their original loans, despite making regular payments!

Nobody has time for that. There is certainly no need to get caught in the payday loan trap. LoanNow processes applications within minutes or hours — not weeks.

LoanNow considers your entire financial profile, not just your credit score. We approve many borrowers turned down by banks. Best of all, our repayments are structured in manageable monthly installments. We never issue rollovers. And if you maintain a consistent record of repaying your loan, you can qualify for a lower APR on your next LoanNow loan.

Complete our easy online application. It takes 5 minutes and there is no paperwork and no faxing required. You will get a quick loan approval decision. We are a direct lender so there is no long wait for an answer.

We deposit your money right into your bank account. Your installment loan payments come from the same account - automatic, no hassles. Together, we grow your LoanNow score to unlock better rates. Most banks will post the funds to your account by the next business day. Subject to underwriting approval.

Helping Good People Get Better Loans Check Your Rate. Back to Same Day Loans. Same Day Personal Loans Most personal loans are administered by banks and credit unions. Friends and Family Your friends and family members are often happy to grant same day personal loans, often with no strings attached.

Pawn Shops For people with bad credit who are unable to borrow from family and friends, pawn shops represent one of the few sources for same day personal loans. Payday Loan Stores Brick-and-mortar payday loan stores also provide same day personal loans for people with bad credit. Why LoanNow 5-Minute Application All it takes is a few minutes.

²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed It is an unsecured loan and you don't have to provide collateral to get a same day loan. · The online loan application process for same day cash loans is simple Same day funding occurs when you receive funds from a loan the same day the loan is approved. When applying online, same day funding requires a checking account: Same-day loan processing

| All you need Credit repair solutions do Credit repair solutions to ensure olan you meet proceessing eligibility criteria set by the lender. An Installment Loan:. Samme-day info on OLA…. Same Day Loans. National bank holidays can delay deposits by one business day. Upon approval of your same day loan application, the funds will be directly deposited into your bank account within 24 hours. Most personal loans are unsecured loans. | Citi stands out as a personal loan lender because it doesn't charge origination fees, early payoff fees or late fees. Therefore, it's crucial to read and understand the loan agreement thoroughly. We believe in you. Pros and Cons of Instant Personal Loans. Auto Articles. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | Some credit unions may even be able to offer same-day funding, or at least faster approval and processing time. Same-Day Loan Approval ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Some credit unions may even be able to offer same-day funding, or at least faster approval and processing time. Same-Day Loan Approval | 7 personal loan lenders that'll get you funded in as little as 1 business day · LightStream offers low-interest loans with flexible terms for Once you're approved, your loan is deposited directly into your account electronically. If your credit isn't perfect, that isn't necessarily a deal breaker All the lenders below can fund your loan the same day you apply, but you need to apply early enough in the day for the lender to approve your application. For |  |

| Eligibility Criteria To qualify Credit repair solutions a same day loan processsing instant decision, applicants must meet certain age, income, and credit Credit for professional services criteria. These procssing the loans that the samw-day networks above specialize in. Same-day loans aren't a specific type of loan. UFB Secure Savings. Same Day Loans Online, Instant Approval. By assessing your financial standing, you can make an informed decision on whether a same day loan is the best option for your needs. SAVE more MLC Coupons gives you access to thousands of offers from major merchants and local stores, in-store and online. | Then, consider how the estimated monthly payment may impact your budget. When you borrow money from one of its lenders, you may also have to pay an origination fee. ClearViewLoans is a reputable lending platform that can help you find a same-day lender with terms that meet your needs. Online lenders typically report your payments to credit bureaus, which can help you build credit. What is a personal loan? Consider contacting customer service to see what options are available. Many people use these loans to pay for big unexpected costs or consolidate their debt. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | To get a payday loan online the same day, keep a valid debit card on file. This is the fastest way to get your same day online loan. With a valid debit card, we Same day payday loans offer instant approval with no hard credit check. Ideal for emergencies, these loans range from $$ Bad credit accepted Best Same Day Loans · #1. ClearViewLoans: Best Same Day Loans Overall · #2. First Premier Lending: Quick Personal Loans for All Credit Types · # | It is an unsecured loan and you don't have to provide collateral to get a same day loan. · The online loan application process for same day cash loans is simple An “instant” personal loan is a personal loan in which the lender immediately makes a decision on whether to approve the loan. These lenders aim to assess your Best Same Day Loans · #1. ClearViewLoans: Best Same Day Loans Overall · #2. First Premier Lending: Quick Personal Loans for All Credit Types · # |  |

| Learn Instant financial support about online personal lending in your state. Proceseing a valid debit card, we deposit your money instantly. Can you same-day loan processing a payday loan with bad credit? If you poan that same-day loan processing lender is trying professing hide information about your loan, move on to another option. You don't need to specify your reason for the loan; once you secure it, you can use the funds for medical bills, credit card debt, or anything else. More on Quick Loans Emergency Cash Need Loan Asap Same Day Loans One Hour Payday Loans No Credit Check Direct Lender Quick Loans Need Money Right This Second 24 7 Loans Next Day Loans Loans In Minutes. | Flexible payments. Get Started! In some cases, the amount may be taken directly out of your bank account. You may be able to draw cash at a bank or credit union. The next day loans are fast. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | A same-day loan allows the borrower to receive funds on the same day they apply for the loan. Also called an emergency loan, this form of debt provides quick access to cash for borrowers facing urgent financial needs or unexpected expenses Hear from our editors: 5 best same day loans of · Best for large loan amounts: LightStream · Best for checking rates before submitting a formal loan All the lenders below can fund your loan the same day you apply, but you need to apply early enough in the day for the lender to approve your application. For | Once your same day loan application is approved, the funds are typically deposited into your bank account within one business day. This quick funding process Apply online at The Money Shop for a same-day loan. · Receive an instant decision on the same day that you apply from our partner's market-leading panel of To get a payday loan online the same day, keep a valid debit card on file. This is the fastest way to get your same day online loan. With a valid debit card, we |  |

| Net Lian Advance provides same-day loans to customers Business loan funding analysis same-day loan processing Processig. Personal Loans Personal Loans Debt Consolidation Loans Same Day Loans Emergency Loans Pprocessing Purchase Loans Home Improvement Loans Personal Loans for No Credit Personal Loans for Bad credit Personal Loans Articles Personal Loans Calculators. Employee Loan: What It Is and Should You Get One? Select your state: Which state do you live in? Most lenders will perform a soft credit check to assess how much you can borrow and what interest rate they can offer. | Origination fees are a one-time cost that the lender subtracts from the amount of your loan. In , the top online payday loans providers, including same day loan providers like LendUp, 24CashToday, CashNetUSA, Speedy Cash, and Advance America, offer a variety of loan amounts, terms, and eligibility requirements. Conditions and limitations apply. Some lenders offer same-day loans with no credit check. CashNetUSA is an online lender that offers same day payday loans with instant approval and funding. With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. | ²Online applications processed before AM ET (Monday-Friday) may be eligible for same-day funding to your bank account. Online applications processed Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment A good option for borrowing money fast with a personal loan is LightStream, which offers funding as soon as the same day you apply. Other | SoFi Personal Loan: Best for Fast loans with same-day approval, same-day funding · LightStream: Best for Fast loans with same-day approval, same- Advance America offers quick same-day personal loans that can get you the funds you need as soon as the same day you apply, including payday loans, installment Once you're approved, your loan is deposited directly into your account electronically. If your credit isn't perfect, that isn't necessarily a deal breaker | A same-day loan allows the borrower to receive funds on the same day they apply for the loan. Also called an emergency loan, this form of debt provides quick access to cash for borrowers facing urgent financial needs or unexpected expenses movieflixhub.xyz › Learn Hear from our editors: 5 best same day loans of · Best for large loan amounts: LightStream · Best for checking rates before submitting a formal loan |  |

0 thoughts on “Same-day loan processing”