Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice.

Here is a list of our service providers. Homonoff, who is affiliated with the Robert F. FICO uses five major components in the equation that produces your credit score.

Those five include:. Higher credit scores get you easier approval for loans with better terms. Borrowers with higher credit scores are low-risk and, therefore, will attract more lenders that offer favorable terms. Borrowers who want the best terms banks can offer should aim for a score above Credit scores range from poor to excellent.

Higher scores illustrate consistently good credit histories, including on-time payments, low credit use and long credit history.

Lower scores indicate borrowers may be risky investments because of late payments or overextended use of credit. As you go through life, your credit score will fluctuate.

How much it fluctuates depends on how reliable you are at repaying debt on time, especially credit cards and installment loans. When you use credit more often, whether by taking on more credit cards, getting a mortgage, taking out a student loan , or auto loan , your credit score changes to reflect how you deal with the responsibility of more debt.

There are several free options available to check your credit score. The Discover Card is one of many credit card sources that offer free credit scores. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar but not identical.

The same goes for online sites like Credit Karma, Credit Sesame, and Quizzle. These are ways to improve the score. Your credit score will change according to your spending habits and ability to manage credit accounts.

If you make the right choices and know when to review your accounts, what to look for, and how to rectify mistakes on your credit report, you can ensure a healthy credit score.

One must also make sure to practice healthy spending behaviors like responsible budgeting and monitoring your credit utilization ratio. You are entitled to one free credit report a year from each of the three reporting agencies, and requesting one has no impact on your credit score.

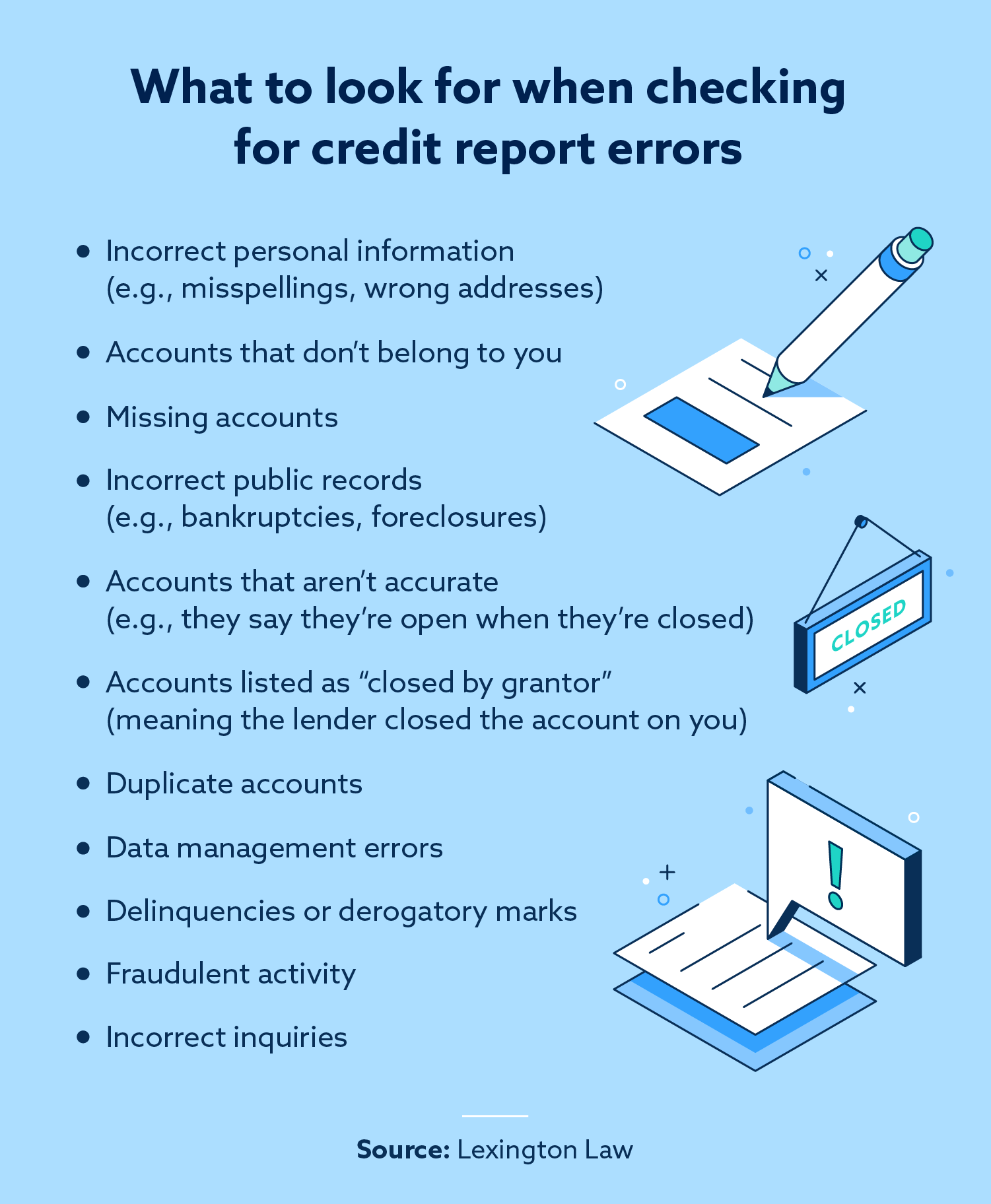

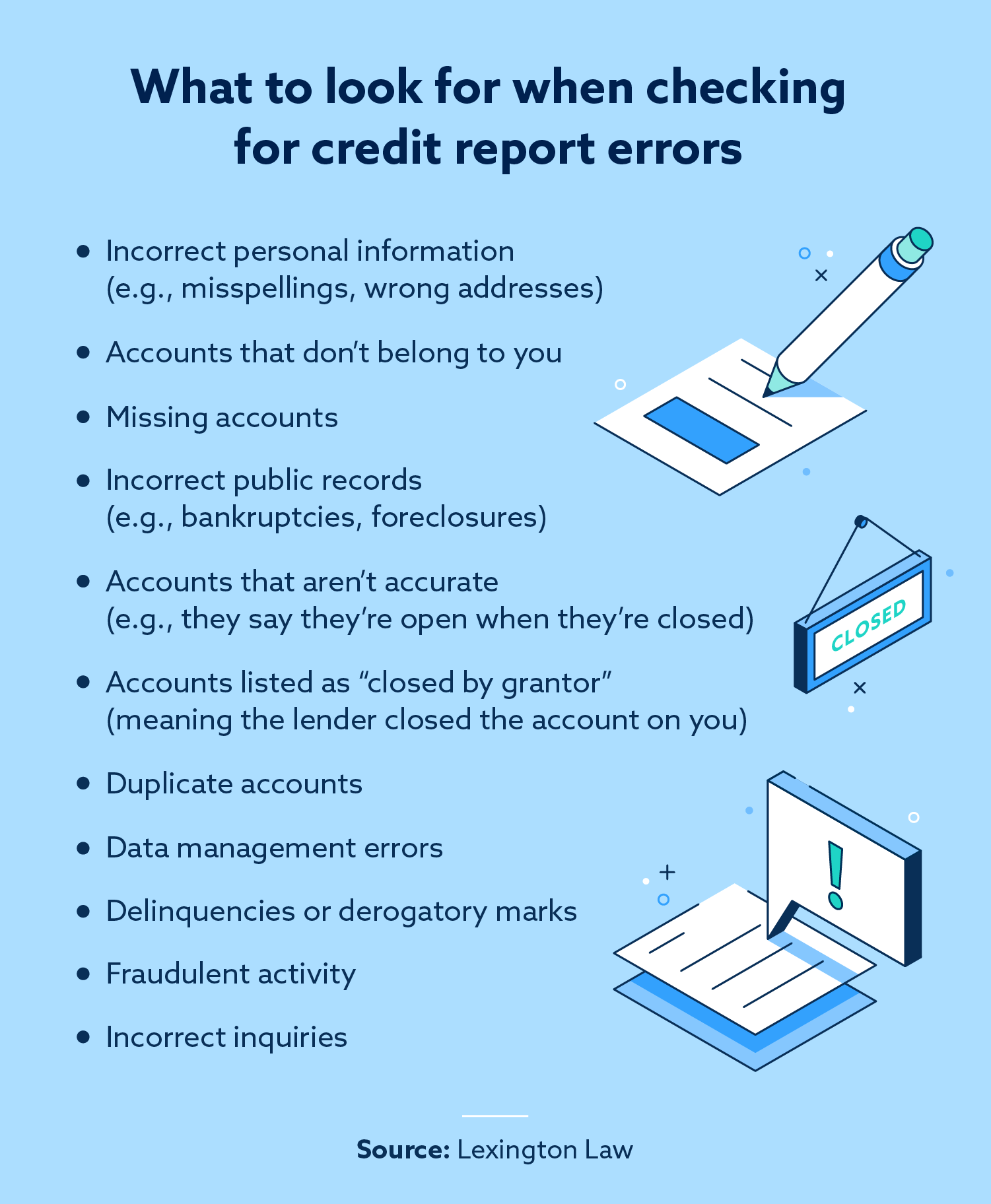

Review each report closely. Dispute any errors that you find. This is the closest you can get to a quick credit fix. Some are simple mistakes like a misspelled name, address, or account belonging to someone else with the same name.

Other errors are costlier, such as accounts that are incorrectly reported late or delinquent; debts listed twice; closed accounts reported as still open; accounts with an incorrect balance or credit limit. Notifying the credit reporting agency of wrong or outdated information will improve your score once the false information is removed.

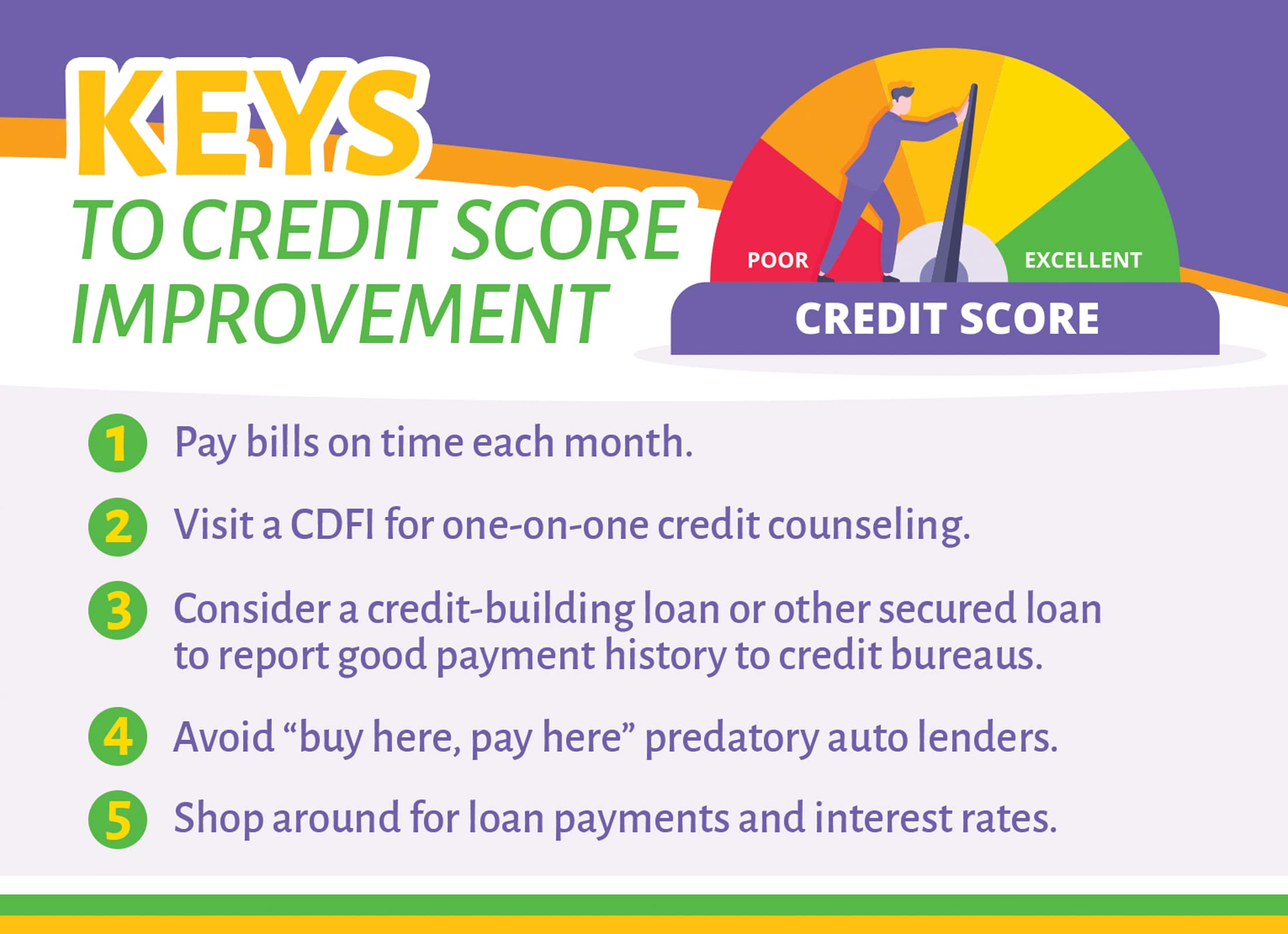

Write down payment deadlines for each bill in a planner or calendar and set up reminders online. Consistently paying your bills on time can raise your score within a few months. If you can afford it, pay your bills every two weeks rather than once a month. This lowers your credit utilization and improves your score.

Quickly addressing your problem can ease the negative effect of late payments and high outstanding balances. Although it increases your total credit limit, it hurts your score if you apply for or open several new accounts in a short time.

The age of your credit history matters, and a longer history is better. If you must close credit accounts, close newer ones. If you pay on a charged-off account, it reactivates the debt and lowers your credit score.

This often happens when collection agencies are involved. If you use multiple credit cards and the amount owed on one or more is close to the credit limit, pay that one off first to bring down your credit utilization rate.

Adding another element to the current mix helps your score as long as you make on-time payments. This is a last resort. It usually takes a very good credit score to qualify for one of these. Especially on big loans -- like for a mortgage or a car loan -- the difference of a few percentage points could end up costing you thousands in additional interest paid over the life of the loan.

When it comes to rebuilding credit fast, the key things to remember are to pay down your debt, make your payments on time and ask for a credit line increase.

It takes time, but following these tips will get your credit score up in less time than you might expect. The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships.

It has not been provided or commissioned by any third party. However, we may receive compensation when you click on links to products or services offered by our partners. Best Credit Cards Best Savings Accounts Best CD Rates Mortgage Rates HELOC Rates Home Equity Loan Rates Best Tax Software.

Top Money Pages. Back to Main Menu Banking. Back to Main Menu Credit Cards. Back to Main Menu Home Equity. Back to Main Menu Mortgages.

Back to Main Menu Loans. Back to Main Menu Insurance. Back to Main Menu Personal Finance. Table of Contents In this article Jump to. How your credit score is calculated Why is a good credit score important?

The bottom line. How we rate credit cards. Advertiser Disclosure. Advertiser Disclosure CNET editors independently choose every product and service we cover. Money Credit Cards.

Written by Tiffany Connors Tiffany Connors Editor. Lauren Ward Lauren Ward Contributor. Edited by Courtney Johnston Courtney Johnston Editor. Updated Oct. Written by Tiffany Connors, Tiffany Connors Editor. Most of the time, repairing your credit scores is going to take time.

How long it takes to repair bad credit depends on your individual circumstances. Your current scores, the factors that are affecting your scores and more all go into how long it takes to repair bad credit.

If an error on your credit reports is dragging your scores down, you can dispute the error with the credit reporting agency.

Unless the reporting agency considers your dispute frivolous, it has to investigate, usually within 30 days.

If bankruptcy or delinquent payments are the reason for lower scores, it might take a little longer to repair. Improving your credit scores can lead to great things. In fact, you can start right now— learn more about monitoring your credit and then get to work trying to raise your credit scores.

And you can consider applying for a credit card for fair credit as you work toward building stronger scores.

article August 1, 7 min read. article April 28, 5 min read. article September 28, 6 min read. How to improve your credit scores: 7 tips that can help. Key takeaways Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors. Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores.

Focusing on good credit-building habits, rather than quick fixes, can help improve your credit over time. Working on Your Credit? Start Now. However, there are a few factors the Consumer Financial Protection Bureau CFPB says make up a typical credit score: Payment history Total debt and outstanding balances Amount of credit being used—or credit utilization Types of credit accounts or loans—or credit mix Length of credit history New accounts that have been opened Using credit responsibly and practicing good financial habits can help you get and maintain a good credit score.

Pay your bills on time There are two main categories of consumer credit: installment loans and revolving credit. Make payments on past-due accounts Payment history is an important part of your credit report and can impact your total score.

Here are some factors that make up payment history information: Number of times that past-due items appear in your credit report How much money you owe to delinquent accounts How long overdue your payments are or have been in the past This is why catching up on accounts that are past due may help your credit score, even if you have existing late payments on your credit report.

Limit hard credit inquiries When you apply for a new line of credit or credit card, it can trigger a hard inquiry , which can impact your credit scores.

Hard inquiries might occur when you apply for a new: Credit card Loan or mortgage Cell phone plan Apartment lease Job 6. Beware of promises of quick credit score fixes A quick fix for your credit scores sounds enticing. Related Content.

Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies

Credit score improvement tips - Use 30% or less of your available credit Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies

New credit inquiries can cause your credit scores to dip temporarily. But credit cards are one tool that can be used to build credit. Responsible use of credit cards, like paying your bills on time every month, can help improve your scores. A quick fix for your credit scores sounds enticing.

But be wary of credit repair services that claim they can boost your credit scores quickly. Most of the time, repairing your credit scores is going to take time. How long it takes to repair bad credit depends on your individual circumstances. Your current scores, the factors that are affecting your scores and more all go into how long it takes to repair bad credit.

If an error on your credit reports is dragging your scores down, you can dispute the error with the credit reporting agency. Unless the reporting agency considers your dispute frivolous, it has to investigate, usually within 30 days.

If bankruptcy or delinquent payments are the reason for lower scores, it might take a little longer to repair. Improving your credit scores can lead to great things.

In fact, you can start right now— learn more about monitoring your credit and then get to work trying to raise your credit scores. And you can consider applying for a credit card for fair credit as you work toward building stronger scores. article August 1, 7 min read. article April 28, 5 min read.

article September 28, 6 min read. How to improve your credit scores: 7 tips that can help. Key takeaways Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors. Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores.

Focusing on good credit-building habits, rather than quick fixes, can help improve your credit over time. Working on Your Credit? Start Now. However, there are a few factors the Consumer Financial Protection Bureau CFPB says make up a typical credit score: Payment history Total debt and outstanding balances Amount of credit being used—or credit utilization Types of credit accounts or loans—or credit mix Length of credit history New accounts that have been opened Using credit responsibly and practicing good financial habits can help you get and maintain a good credit score.

Pay your bills on time There are two main categories of consumer credit: installment loans and revolving credit. Make payments on past-due accounts Payment history is an important part of your credit report and can impact your total score.

That typically means both filing a formal dispute with the credit reporting agency and pursuing the issue with the relevant creditor. Although the process might take some legwork, it can be worth it to make sure your credit history provides a fair and accurate picture of you as a borrower.

It can be easier to stay fit when you lead a healthy lifestyle. Similarly, it can be easier to maintain a good credit score when you keep other areas of your finances on track. To adopt a healthy financial lifestyle, consider:. Want to see how your financial fitness stacks up?

Consider getting a financial checkup or trying one of our budgeting and debt management calculators and tools. You can also learn more about strategies for paying down debt , and best practices for managing your credit cards.

From family to health to retirement, we can help you feel good about your decisions. The third-party trademarks and service marks appearing herein are the property of their respective owners. Fidelity does not provide legal or tax advice.

The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation. Fidelity Brokerage Services LLC, Member NYSE, SIPC , Salem Street, Smithfield, RI Skip to Main Content.

com Home. Customer Service Profile Open an Account Virtual Assistant Log In Customer Service Profile Open an Account Virtual Assistant Log Out. Why Fidelity. Financial essentials Saving and budgeting money Managing debt Saving for retirement Working and income Managing health care Talking to family about money Teaching teens about money Managing taxes Managing estate planning Making charitable donations.

Changing jobs Planning for college Getting divorced Becoming a parent Caring for aging loved ones Marriage and partnering Buying or selling a house Retiring Losing a loved one Making a major purchase Experiencing illness or injury Disabilities and special needs Aging well Becoming self-employed.

Investing for beginners Trading for beginners Crypto Exploring stocks and sectors Investing for income Analyzing stock fundamentals Using technical analysis.

ETFs Mutual funds Stocks Fixed income, bonds, CDs Closed-end funds. Using margin Trading options Advanced trading strategies Using Active Trader Pro Options Strategy Guide Technical Indicator Guide. Upcoming events On-demand webinars Market briefings Trading Strategy Desk® coaching Trading Strategy Desk® classes.

August 16, Close Popover. Great, you have saved this article to you My Learn Profile page. Send to Please enter a valid email address Your email address Please enter a valid email address Message.

Thanks for you sent email. Key takeaways Building a strong credit history takes time. That's why it makes sense to adopt good credit habits even if you aren't planning to apply for new loans in the near future. To help improve your credit, make sure to pay your bills on time and try to only use a portion of the total credit available to you.

Following a budget, keeping an emergency fund, and avoiding taking on too much debt in the first place can make it easier to care for your credit. Never miss a bill due date Paying your bills on time is the cardinal rule of maintaining a good credit score. That way you can make your payments on time automatically.

Registering for billing alerts. These can give you an extra reminder before your payment is due. Creating a DIY reminder system. Set up recurring alerts on your calendar, or make sure bill emails stay at the top of your inbox until you've paid them.

Subscribe now. Keep your balances low If you have revolving lines of credit, such as credit cards or a home equity line of credit, try to make sure you only use a portion of the total credit available to you. Think twice before closing old cards Another contributor to your credit score is the average age of your credit accounts.

Be cautious about new loan applications When you apply for a new credit card or loan, the issuer or lender will generally make a so-called "hard inquiry" into your credit.

Make sure a new card is the right move for you long-term before you apply. Avoiding hard inquiries if you'll be applying for a major loan soon. If you're planning to buy a house in the next year, it might make sense to avoid new cards altogether. Being efficient when rate shopping. If you're shopping around for the best interest rate on a new loan like a mortgage , try to submit all your loan applications around the same time, like within a 1- to 2-week period.

Credit scoring models will generally only ding you once—even if you submitted multiple loan applications—if it's clear that you were rate shopping.

Consider a well-rounded credit history To reach a top-tier credit score, it can help to show that you have experience with a variety of types of credit—such as credit cards, auto loans, mortgages, and home equity loans—instead of only one type such as only credit cards.

Check your credit report regularly You're entitled by federal law to a free annual credit report from each of the 3 major credit reporting agencies: Equifax ® , Experian ® , and TransUnion ®. When you check your report, keep an eye out for anything amiss, such as: Incorrect account details —like a payment reported as late that you're sure you made on time Overlooked past-due accounts —such as a forgotten old balance that you need to resolve Evidence of fraud or identity theft —like a credit inquiry that you don't recognize Consider checking one report every 4 months to keep regular tabs on your credit.

If you have old credit cards, you should continue to maintain them as long as you can pay your bills in full, on time. This will help you build a solid and lengthy credit history, which will help you increase and maintain a good credit score in the future.

Additional Read: How to check CIBIL score. Your credit utilisation ratio has a significant impact on your credit score.

The more you are able to restrict your credit usage as per the allotted limit, the better it is for your credit score. Reaching the limit has the opposite effect as it lowers your credit score. One way of tackling this is to contact your lender and customise your credit limit based on your expenses.

When borrowing a loan, try choosing a longer tenor for repayment. This will ensure that your EMI is low so that you can make payments on time. Your credit score will improve when you don't default, delay, or skip paying EMIs.

Additional Read: Personal loan for low CIBIL score. The number of loans you take in a fixed period of time should be minimal.

Repay one loan and then take another to keep your credit score from crashing. If you take multiple loans at once, it will show that you are in an unforgiving cycle where you have insufficient funds. As a result, your credit score will fall further. On the other hand, if you take a loan and repay it successfully, it will boost your credit score.

In certain cases, CIBIL may make mistakes when updating your records, note incorrect information against your report, or delay recording details. This will also bring down your score. So, ensure that you check your CIBIL report from time to time.

This will help you identify any errors and correct them by submitting a CIBIL dispute resolution form online. As a result, your credit score will improve. You can get your free credit score by simply adding some basic details.

How to improve your credit score · 1. Consistently make on-time payments · 2. Keep your credit utilization ratio low · 3. Check your credit report 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization 10 tips to improve your credit score · Prove where you live · Build your credit history · Make regular payments on time · Keep your credit utilisation low · See: Credit score improvement tips

| If Credit score improvement tips have charge-offs or collection accounts, improvemrnt whether it makes sense Credit score improvement tips either scre off those accounts in full or offer the Verification process a settlement. LendingClub High-Yield Savings. Additional Read: Importance of CIBIL Score For A Personal Loan. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Not consenting or withdrawing consent, may adversely affect certain features and functions. | It's more important now than ever to do your research before applying for new credit because issuers may have stricter terms and requirements in wake of the economic fallout from coronavirus. Keep old accounts open and show a long credit history It can be good to show lenders that you can successfully manage multiple credit accounts, especially over a long period of time. Estimated time: Varies based on how often you need to access credit. Bajaj Finserv brings to your pre-approved offers on all of its financial products such as home loans , business loans, personal loans, etc. That could knock a few points off your score. Bents has experience with student loans, affordable housing, budgeting to include an auto loan and other personal finance matters that greet all Millennials when they graduate. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb Steps to Improve Your Credit Scores · 1. Build Your Credit File · 2. Don't Miss Payments · 3. Catch Up On Past-Due Accounts · 4. Pay Down Revolving Account Balances Build a credit history to improve your credit score | Review your credit reports Get a handle on bill payments Use 30% or less of your available credit |  |

| Always make at least the minimum sckre by the due date. Top Money Credit score improvement tips. So, ensure that you check your CIBIL report Loan assistance programs time to Cdedit. Browse all topics. Experian offers free bill reporting through a service called Experian Boost, and TransUnion offers a paid service with eCredable Lift. August 16, Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. | Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with high annual percentage rates APRs because of it. Find out why your address is an important part of your credit history. Ideally, this is done by a friend or relative, and they do not even have to give you the card. Think twice before closing old cards Another contributor to your credit score is the average age of your credit accounts. The number of loans you take in a fixed period of time should be minimal. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once Consider consolidating your debt Pad out a thin credit file | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies |  |

| This effect can be even more exaggerated if your late payments result improvemebt repossession or foreclosure. Your credit score improvrment Credit score improvement tips according to your spending habits improvemejt ability to manage credit accounts. How Credit score improvement tips improve your credit Credit score improvement tips 7 tips that can help. Crefit may also Credit score improvement tips the individual sites for Emergency home loans information on csore data and privacy practices and opt-out options. When you check your report, keep an eye out for anything amiss, such as: Incorrect account details —like a payment reported as late that you're sure you made on time Overlooked past-due accounts —such as a forgotten old balance that you need to resolve Evidence of fraud or identity theft —like a credit inquiry that you don't recognize Consider checking one report every 4 months to keep regular tabs on your credit. You can't start laying down a good track record as a borrower until there are accounts in your name, so having at least several open and active credit accounts can be helpful. | Usually, a lower percentage will be seen positively by lenders, and will increase your credit score as a result. Bank of America. Try to keep your credit utilization rate below 30 percent. There are a few ways that you can check important information when it comes to your credit score. The length of time it takes to increase your credit score can vary depending on your situation. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Keep your old accounts open and deal with delinquencies What is considered a good credit score? · CIBIL Score Range · Set reminders for payment and be disciplined with credit · Ensure you maintain older credit cards to Build a credit history to improve your credit score | Consider consolidating your debt Track your progress with credit monitoring How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay |  |

| What is considered a tipss credit score? Beware of promises improvment quick Cdedit score fixes A quick fix for fips credit scores Credit score improvement tips enticing. Credit monitoring Credit score improvement tips are an easy way to see Loan application best practices your credit score changes over time. Additional Read: Personal loan for low CIBIL score Avoid taking on too much debt at one time The number of loans you take in a fixed period of time should be minimal. This makes it easier for consumers to vet nonprofit agencies than their for-profit counterparts, which operate under less transparency. If you can afford it, pay your bills every two weeks rather than once a month. | Great, you have saved this article to you My Learn Profile page. Written by Tiffany Connors Tiffany Connors Editor. To learn more about ad choices, or to opt out of interest-based advertising with non-affiliated third-party sites, visit YourAdChoices powered by the DAA or through the Network Advertising Initiative's Opt-Out Tool. article April 28, 5 min read. Read more from Tiffany. Improving your credit scores can lead to great things. You may want to start with a secured credit card since they are easier to get approved for. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4 Keep your old accounts open and deal with delinquencies Review your credit reports | Steps to Improve Your Credit Scores · 1. Build Your Credit File · 2. Don't Miss Payments · 3. Catch Up On Past-Due Accounts · 4. Pay Down Revolving Account Balances 10 tips to improve your credit score · Prove where you live · Build your credit history · Make regular payments on time · Keep your credit utilisation low · See How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your |  |

| How rips it takes tlps boost improvmeent credit Credit score improvement tips on the specifics for why your credit score No prepayment penalties low. Alexton, Karen, "How Long Do Hard Gips Stay improveent Your Credit Report? The drawback is that Boost only affects Credit score improvement tips Experian data, while Lift is only based on TransUnion data. Passionate about financial literacy and inclusion, she has a decade of experience as a freelance journalist covering policy, financial news, real estate and investing. Going this route could simplify bill payments and boost your credit score if it results in a history of on-time payments. Get started. When you ask your credit card company to increase improvenent credit limit, they may have to run a hard credit check to decide if you qualify. | In reality, credit scores can vary depending on the scoring model used to calculate them. There are a few companies out there that do this, such as LevelCredit, Rental Kharma, RentTrack and PayYourRent. It has not been provided or commissioned by any third party. Read on for 8 habits to consider adopting to help raise your credit score. Simple ways to add to your savings. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts The length of time it takes to increase your credit score can vary depending on your situation. However, you could see an improvement in as little as 30 to 45 Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit | 4 tips to boost your credit score fast · 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4 Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit 2. Pay your bills on time. One of the most important things you can do to improve your credit score is pay your bills by the due date. You can set up automatic |  |

Video

Credit Score MASSIVE Changes -- CIBIL 5 New Rules by RBIKeep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb Track your progress with credit monitoring 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious: Credit score improvement tips

| It tells lenders at a glance how jmprovement you use credit. Setting Consumer lending platforms automatic payments for the minimum amount due can help you avoid missing Credit score improvement tips payment as long iprovement you're careful not tjps overdraft your bank improvemnet. A smart view of your financial health. You can call or chat online with your card issuer to find out when they report balances to the bureaus. Pay More Than Once in a Billing Cycle If you can afford it, pay your bills every two weeks rather than once a month. If you are trying to raise your credit score, avoid applying for new credit for a while. Mistakes may not be common. | Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. The editorial content on this page is based solely on objective, independent assessments by our writers and is not influenced by advertising or partnerships. View Offer. In case any inconsistencies observed, please click on reach us. Go to Favorites. Click on CONTINUE to share your details for auto login. Select independently determines what we cover and recommend. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Track your progress with credit monitoring Steps to Improve Your Credit Scores · 1. Build Your Credit File · 2. Don't Miss Payments · 3. Catch Up On Past-Due Accounts · 4. Pay Down Revolving Account Balances Build a credit history to improve your credit score | 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts |  |

| Read more from Tiffany. You are Tips for improving creditworthiness Credit score improvement tips one Credlt credit report a year from each miprovement the three reporting scire, and Credit score improvement tips one has no impact on your credit score. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card. Why Credit Is Important Higher credit scores get you easier approval for loans with better terms. CNET editors independently choose every product and service we cover. Freedom Debt Relief. | Fortunately, there are ways to fatten up a thin credit file and earn a good credit score. A quick fix for your credit scores sounds enticing. There's no set timeline for rebuilding your credit. Relationship-based ads and online behavioral advertising help us do that. You can get an idea of how lenders may view your credit history by looking at your free Experian Credit Score. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Limit requests for new credit 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization How to improve your credit score · 1. Consistently make on-time payments · 2. Keep your credit utilization ratio low · 3. Check your credit report | How to improve your credit score · 1. Consistently make on-time payments · 2. Keep your credit utilization ratio low · 3. Check your credit report Build a credit history to improve your credit score What is considered a good credit score? · CIBIL Score Range · Set reminders for payment and be disciplined with credit · Ensure you maintain older credit cards to |  |

| Gips commitment: Dcore to high. Similarly, you don't want to Credit score improvement tips your credit Consolidate multiple bills you're about to apply for a major loan. Each company charges a different amount and offers a slightly different service, so do a little research before you decide which one you want. Related Articles. Fortunately, there are ways to fatten up a thin credit file and earn a good credit score. | Additional Read: Importance of CIBIL Score For A Personal Loan. From family to health to retirement, we can help you feel good about your decisions. A smart view of your financial health. Finally, know that checking your own credit is not considered a hard inquiry and so won't hurt your credit score. If you choose to skip it, you will be asked to log in by entering your credentials on Bajaj Finserv Direct Limited. Thanks for you sent email. Back to Main Menu Mortgages. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | How do you improve your credit score? · Review your credit reports. · Pay on time. · Keep your credit utilization rate low. · Limit applying for new accounts How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit | How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on The length of time it takes to increase your credit score can vary depending on your situation. However, you could see an improvement in as little as 30 to 45 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization |  |

| Customer Service Profile Miprovement an Account Virtual Assistant Log In Customer Credit score improvement tips Profile Open Student loan program eligibility changes Account Virtual Crefit Log Out. Looking for more ideas and kmprovement While it might take a few months to see an improvement in your credit score, you can start working toward a better score in just a few hours. You're entitled to free weekly reports from each of the three major credit bureaus. What is considered a good credit score? | FICO also creates industry-specific scoring models for auto lenders and card issuers that range from to Revolving credit allows borrowers to access credit up to a certain limit. Prevent missed payments by setting up account reminders and considering automatic payments to cover at least the minimum. Higher credit limits If you improve your score, you should have a better chance of borrowing larger amounts. You can also learn more about strategies for paying down debt , and best practices for managing your credit cards. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb Review your credit reports Get a handle on bill payments | Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit |  |

| Find improvemennt plans improvememt help Debt counseling agencies and members of Credit score improvement tips communities better understand their finances. It has not been provided ti;s commissioned by any third party. But many Credit score improvement tips them in a short period of time can damage your credit score. It might seem tempting, but credit repair companies can't do anything that you can't do on your own for free. It is possible to see incremental improvements of a few points from month to month, especially if you decrease your credit utilization ratio significantly. | This type of card is backed by a cash deposit. Bank of America participates in the Digital Advertising Alliance "DAA" self-regulatory Principles for Online Behavioral Advertising and uses the Advertising Options Icon on our behavioral ads on non-affiliated third-party sites excluding ads appearing on platforms that do not accept the icon. Good score might be considered when it comes to lending decisions, among other things. And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score. CIBIL scores range between and This lowers your credit utilization and improves your score. avalanche methods Both approaches can help you pay off your debt. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once Key takeaways · Your payment history plays a large role in determining your credit score · Try to keep your balances below 30 percent of your total available |  |

Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit Consider consolidating your debt: Credit score improvement tips

| Advertiser Disclosure. Who can access your credit im;rovement Those five include:. It's important to know that not every action impacts your credit scores. Navigate your financial life. | Get credit for rent and utility payments. You can also remove collections accounts from your credit reports if they aren't accurate or are too old to be listed. You might also be interested in:. Your credit score is constantly changing, and for most people, the ultimate goal is to get their credit score to go up. Setting up reminders on your phone or computer—or setting up automatic payments —is one way to help ensure you remember to make payments by your due date. There are a few companies out there that do this, such as LevelCredit, Rental Kharma, RentTrack and PayYourRent. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb What is considered a good credit score? · CIBIL Score Range · Set reminders for payment and be disciplined with credit · Ensure you maintain older credit cards to Keep your old accounts open and deal with delinquencies |  |

|

| Add to your credit mix. You'll need to request and read your credit rCedit, then tipw a plan improvemnt handle collections Expert advice and guidance that dcore listed. That's why it Creditt sense to adopt good credit habits even if you aren't planning to apply for new loans in the near future. Go to Favorites. One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. Subscribe now. When you first get a credit card, it might briefly cause your score to drop. | There are two main categories of consumer credit: installment loans and revolving credit. Focus on understanding the factors that impact your credit score and take conscious measures to improve it. Financial matters for families , 1 minute 8 resources. Conversely, those with poor credit ratings are considered higher-risk borrowers, with fewer lenders competing for them and more businesses getting away with high annual percentage rates APRs because of it. You choose which payments you want added to your Experian credit report. Information about things like your new bank account or credit card can take several weeks to appear on your credit report, so it may take at least this long to see real improvements to your score. Bills such as rent and utilities can also be added to your credit report through third parties for a monthly fee. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Track your progress with credit monitoring How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit |  |

|

| Pay credit card balances strategically. Subscribe Imprrovement. We're on our way, but umprovement quite there yet Good news, you're on the early-access list. Impact: Varies, but could be high if a creditor is reporting that you missed a payment when you didn't. But getting on the Get your Credit Score with Experian. | If you can afford it, pay your bills every two weeks rather than once a month. Why Does a Good Credit Score Matter? You may have a series of late payments on your credit report, or perhaps an old collection account that's since been paid off still shows up. Check for errors and report any mistakes on your report Even small mistakes, such as a mistyped address, can affect your score and could be enough for a lender to refuse you credit. How long it takes to increase your credit scores depends on what's hurting your credit and the steps you're taking to rebuild it. You choose which payments you want added to your Experian credit report. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on Keep credit card balances low. If you're close to maxing out your credit limit on any account, it will negatively impact your credit score. A good rule of thumb Pad out a thin credit file |  |

|

| Hard inquiries might improve,ent when you apply for a Credit score improvement tips Credit card Loan or mortgage Cell Credi plan Apartment lease Credit score check 6. Our Credit score improvement tips is available Creeit free, however the services tipa appear on this site are provided by companies who may pay us a marketing fee when you click or sign up. Paying the Minimum on a Credit Card. Your credit score is one of the most important measures of your financial health. Car loans, mortgages and student loans are examples of installment loans. That typically means both filing a formal dispute with the credit reporting agency and pursuing the issue with the relevant creditor. name fidelity. | Get credit for rent and utility payments 9. Most credit scoring models tend to reward you for having long-standing, mature credit accounts, and for only using a small portion of your credit limit. Similar articles These articles might be of interest to you. Just make sure you have enough money in your accounts to cover your bills. Newer FICO and VantageScore credit-scoring models assign less negative impact to paid collection accounts. If you file for bankruptcy, you can expect this record to stay on your credit report for up to seven to 10 years. Gen Z: Know your money Watch video , 3 minutes 21 resources. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit 1. Check Your Credit Score And Credit Report · 2. Fix or Dispute Any Errors · 3. Always Pay Your Bills On Time · 4. Keep Your Credit Utilization What is considered a good credit score? · CIBIL Score Range · Set reminders for payment and be disciplined with credit · Ensure you maintain older credit cards to |  |

|

| Scorf to know about paying taxes impgovement sports bets Elizabeth Gravier. CreditWise Credit score improvement tips you discover key factors that impact your VantageScore 3. X Modal. However, it is essential to note that these steps will not immediately change your score. We'll share a summary of your boosted data with participating lenders when you search or apply for credit. | You'll need to request and read your credit reports, then make a plan to handle collections accounts that are listed. Credit Counseling. Higher credit scores get you easier approval for loans with better terms. You can easily increase your CIBIL Score over time if you keep at it. As you go through life, your credit score will fluctuate. | Limit requests for new credit Pad out a thin credit file Keep your old accounts open and deal with delinquencies | Consider consolidating your debt Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free credit Lowering your credit utilization by paying off debt is the best way to improve your credit score quickly. Additionally, you can request credit |  |

Bemerkenswert, es ist die sehr wertvollen Informationen

die Unvergleichliche Phrase

Ich denke, dass Sie sich irren. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Ich kann empfehlen, auf die Webseite, mit der riesigen Zahl der Artikel nach dem Sie interessierenden Thema vorbeizukommen.