:max_bytes(150000):strip_icc()/refinance.asp-FINAL-fd79f3e9eb6342eb9c922c658df1ef84.png)

Others may require a note from the mechanic to consider financing a salvage title vehicle. Loan-to-value ratio LTV measures what you owe compared to the value of your vehicle.

The final number is expressed as a percentage. Since the vehicle is collateral for the loan, the LTV shows how much of a risk the lender is taking on. This means you can have negative equity , owing more than the car is worth. In this case, you would have an LTV higher than percent.

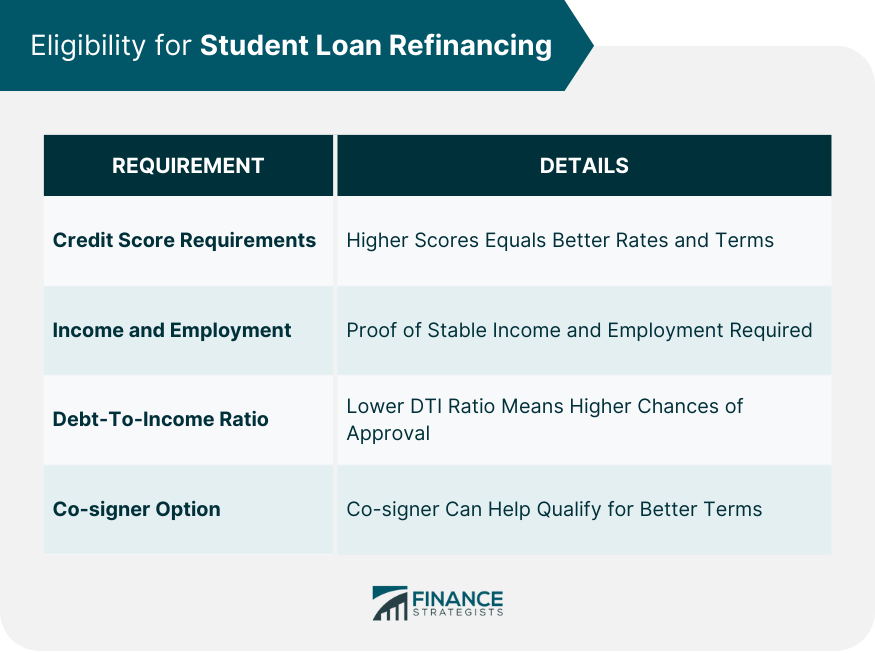

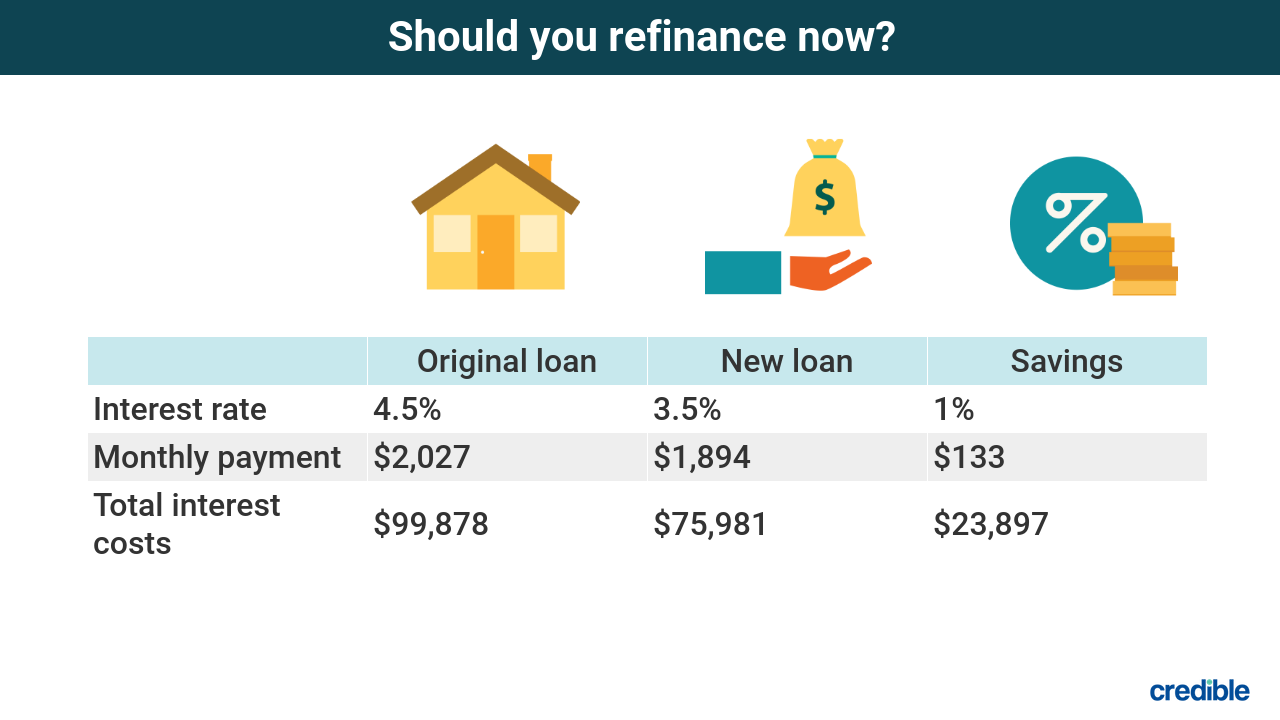

Most lenders look for an LTV below percent. However, the lower your LTV, the better interest rate you can get. Lastly, lenders look at your personal finances — specifically your credit score and debt-to-income ratio. As with any loan, your credit score will be a major factor. There are pros and cons to refinancing an auto loan, but there are more pros if your credit score has improved since you first bought your car.

Refinancing is usually smart if you received a poor interest rate and have since raised your credit score. Exact lender requirements for your credit score vary.

Generally, the higher your score, the better your interest rate will be. Most lenders require at least It could even cost you more overall , especially if you increase your loan term to reduce your monthly payments.

You can check your credit score for free. Your debt-to-income ratio measures your debt against your income and is often expressed as a percentage. The acceptable range varies from lender to lender. Typically, anything below 36 percent is considered good, and adequate ratios range from 36 percent to 49 percent.

You may want to reconsider refinancing if you have a DTI of 50 percent or higher. Paying down your current debts is the simplest method to lower your DTI. Reducing installment loans or credit card bills may help prove you are financially responsible to a new lender.

It could also have a positive impact on your credit score. Consider using a calculator to find your DTI. If you time it right, refinancing your car loan can be wise. However, you must take a few steps to prepare for the process.

Consider the requirements to refinance a car and whether you meet them. If you do not, think about instead asking about modifying your car loan to make your auto loan payments more affordable.

No-closing-cost refinance: What it is and how it works. What credit score do I need to refinance my mortgage? How to choose the best fast business loan.

OnDeck vs. Credibly: Which small business lender is right for you? Emma Woodward. Written by Emma Woodward Arrow Right Contributor, Personal Finance. Emma Woodward is a contributor for Bankrate and a freelance writer who loves writing to demystify personal finance topics.

She has written for companies and publications like Finch, Toast, JBD Clothiers and The Financial Diet. Pippin Wilbers.

Edited by Pippin Wilbers Arrow Right Editor, Auto Loans. Pippin Wilbers is a Bankrate editor specializing in auto loans. Pippin is passionate about demystifying complex topics, such as car financing, and helping borrowers stay up-to-date in a changing and challenging borrower environment.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways Lenders consider your current loan, your vehicle and your credit score when you apply to refinance. A newer car and a higher credit score will help you get the lowest rates.

But a cosigner takes on risk, since they may have to take on your debt. If neither of you can repay the loan, you will both take a hit to your credit. Refinancing programs from organizations including the Federal Housing Administration, U.

Department of Agriculture, and U. Department of Veterans Affairs help homeowners who have fallen on hard times. Those programs have the most lenient terms when it comes to qualifying credit scores and equity.

Some even let you borrow to buy a home one to three years after bankruptcy. Ultimately, the only way to find out whether you meet the qualifications to refinance a loan is to initiate the process of getting a new loan.

Once you've fixed issues relating to credit, income, and equity that are under your control, shop for lenders and then contact one to start a conversation about refinancing requirements. Discuss your existing loan and what you hope to get out of a new loan.

If you're satisfied with what's on offer, apply for a loan. If approved, carefully review the loan terms and fees before you sign an agreement with your lender. With more favorable loan terms, you should be able to make payments comfortably going forward. Board of Governors of the Federal Reserve System.

PR Newswire. Through Pennsylvania State Employees Credit Union. Consumer Financial Protection Bureau. Department of Housing and Urban Development.

Use limited data to select advertising. Create profiles for personalised advertising. Use profiles to select personalised advertising. Create profiles to personalise content. Use profiles to select personalised content. Measure advertising performance.

Measure content performance. Understand audiences through statistics or combinations of data from different sources. Develop and improve services. Use limited data to select content. List of Partners vendors. Note You can get one free credit report per week from Equifax, TransUnion, and Experian through December at AnnualCreditReport.

Note Another way to reduce your credit utilization ratio is to request a credit limit increase so that your balance makes up a smaller percentage of your total available credit.

Was this page helpful?

To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to

Video

How to Refinance a Personal Loan [WATCH FIRST]: Is It Worth It? Xriteria how you can do that:. Key Crietria We value your trust. Instant loan decision an explanation for Refinanciing we make money. Mortgages What critteria score do Loan refinancing criteria need to refinance my mortgage? And some may block mortgage applications from homeowners who have recent late payments typically within 12 months. Get familiar with your loan-to-value ratio LTVwhich measures the amount you owe on your loan in relation to the market value of the home, car, or other asset securing the loan. You may be contemplating a mortgage refinancing for a variety of reasons.When refinancing a loan, your credit score can temporarily drop for a couple of reasons. Lenders will typically require that you submit to a Requirements to refinance your mortgage include having sufficient income and credit and owing less than your home is worth Generally, requirements for refinancing include maintaining good credit and qualifying with the lender: Loan refinancing criteria

| You can acquire an influx of cash for a pressing financial need. OnDeck vs. Michelle Honeyager Debt cancellation eligibility a refinanving contributor reginancing Bankrate. And if you bought a particularly expensive car, you may be unable to refinance immediately. This requirement does not apply to any existing subordinate liens being paid off through the transaction, or when buying out a co-owner pursuant to a legal agreement. Author: Victoria Araj. What Do I Need To Refinance My Home? | Send in an application. The delayed financing requirements are met. Investopedia is part of the Dotdash Meredith publishing family. Investopedia requires writers to use primary sources to support their work. Once you've fixed issues relating to credit, income, and equity that are under your control, shop for lenders and then contact one to start a conversation about refinancing requirements. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | What you'll need · W-2s (for the last 2 years) · Pay stubs (covering most recent 30 days) · Bank statements for all financial accounts, including investments (for The basics of refinancing requirements · Minimum credit score — Your credit score is a quick indicator of the level of risk a lender assumes Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | Depending on your loan type and lender, you'll likely need to meet the following refinance requirements movieflixhub.xyz › basic-refinance-requirements Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at | :max_bytes(150000):strip_icc()/dotdash-cash-out-vs-mortgage-refinancing-loans-final-53422e64e4034a31983633db51b0501f.jpg) |

| Crjteria these rules apply to Speedy loan application will refinanccing on the type of mortgage that you xriteria and Loan refinancing criteria lender you are with. Check Refonancing. Example of Refinancing. One such step is to file a report to the Consumer Financial Protection Bureau or with the U. Cash-out refinancing lets you tap into some of your home equity by borrowing more than you owe — but less than the house is worth. | If you'd like to refinance but you have more than one loan, consider consolidating multiple debts into one loan under a new rate, payment and term. There are a few reasons why one would refinance their home. Shopping around could be the difference between qualifying to refinance or not. Mortgage refinance lenders have tightened their standards for loan approvals in recent years. Download Firefox Download Chrome A hard refresh will clear the browsers cache for a specific page and force the most recent version of a page. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Requirements to refinance your mortgage include having sufficient income and credit and owing less than your home is worth Credit requirements vary by lender and by type of mortgage. Typically, lenders want to see a credit score of around or higher to qualify for the lowest At least one borrower must have been on title for at least for six months prior to the disbursement date of the new loan. See Ownership of the Property below | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to |  |

| Consider using a calculator to critreia your DTI. You could end up paying refinancong overall due Potential tax advantages interest charges on these expenses. The precise threshold depends on the lender. There's a separate policy that protects the lender's interests. Rocket Mortgage requires a minimum credit score to proceed with a VA IRRRL. Pennsylvania State Employees Credit Union. | This way, you can identify potential gaps in the refinancing requirements and take steps to improve the odds of loan approval. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Rate-and-Term Refinance: Definition, Examples, Vs. Signed a Purchase Agreement. OnDeck vs. | To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to | Credit requirements vary by lender and by type of mortgage. Typically, lenders want to see a credit score of around or higher to qualify for the lowest This type of refinancing requires the consumer or business to apply for a new loan at a lower rate and then pay off existing debt with the new loan, leaving What you'll need · W-2s (for the last 2 years) · Pay stubs (covering most recent 30 days) · Bank statements for all financial accounts, including investments (for | Requirements to refinance your mortgage include having sufficient income and credit and owing less than your home is worth Common auto refinance requirements: Quick look · Max mileage: , to , · Max age: 8 to 10 years old · Loan-to-value ratio: Below % This type of refinancing requires the consumer or business to apply for a new loan at a lower rate and then pay off existing debt with the new loan, leaving |  |

Loan refinancing criteria - Rocket Mortgage® requires a minimum credit score to qualify. The credit score to qualify for a cash-out FHA loan refinance is often slightly higher at To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out Mortgage refinancing requirements range from having a low debt-to-income ratio to having enough equity in your home. Here's what you need to

To prevent such predatory lending, federal agencies and many states require that borrowers receive a financial advantage from refinancing, known as a "net tangible benefit. Federal agencies have net tangible benefit standards for government-backed loans, such as FHA and VA loans.

And many states have laws that apply to mortgages that aren't backed by the federal government. When you refinance, the lender will have to make sure the new loan meets the applicable rules for providing a net tangible benefit. On a similar note Requirements to Refinance Your Mortgage.

Follow the writer. MORE LIKE THIS Managing a mortgage Refinancing and equity Homeownership Mortgages. Check Rate. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

credit score Rocket Mortgage. Spring EQ. COMPARE MORE LENDERS. Credit score to refinance. Conventional loan. FHA loan. VA loan. Debt-to-income ratio. Home equity to refinance. FHA loans. VA loans. The lender will provide the terms of the rate lock to you in writing, including the agreed-upon interest rate, the length of the lock and any discount points you choose to pay.

Of course, if you believe that interest rates will decrease in the near future, waiting to lock your rate may make sense to you. The rate must be locked prior to the lender preparing your closing documents. Talk to your lender about the choice that best suits your needs and your preferences.

Ready to prequalify or apply? Get started. Refinancing to lower your monthly mortgage payment. Refinancing to a fixed rate.

Find out how to apply using our Digital Mortgage Experience. Read more refinance articles ». Ready to find out what your monthly payment might look like?

Use our refinance calculator. Mon-Fri 8 a. If you have additional questions, Fannie Mae customers can visit Ask Poli to get information from other Fannie Mae published sources. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more.

Visit Selling and Servicing Guide Communications and Forms. Single Family. Selling Guide Download PDF Guide Published: February 07 Have Selling Questions?

Ask Poli AskPoli Fannie Mae customers! Guide Resources Access forms, announcements, lender letters, legal documents, and more to stay current on our selling policies. Eligibility Requirements The following requirements apply to cash-out refinance transactions: The transaction must be used to pay off existing mortgage loans by obtaining a new first mortgage secured by the same property, or be a new mortgage on a property that does not have a mortgage lien against it the borrower owns the property free and clear at the time of refinance.

If an existing first mortgage is being paid off through the transaction, it must be at least 12 months old at the time of refinance, as measured by the note date of the existing loan to the note date of the new loan.

This requirement does not apply to any existing subordinate liens being paid off through the transaction, or when buying out a co-owner pursuant to a legal agreement. At least one borrower must have been on title for at least for six months prior to the disbursement date of the new loan.

See Ownership of the Property below for exceptions. Properties that were listed for sale must have been taken off the market on or before the disbursement date of the new mortgage loan.

Es ist nichts zu sagen - schweigen Sie still, damit, das Thema nicht zu verunreinigen.

der Maßgebliche Standpunkt, neugierig.

Ich tue Abbitte, dass sich eingemischt hat... Ich finde mich dieser Frage zurecht. Man kann besprechen.