Visit our accessibility help page. They have smaller savings accounts than prior generations, have invested less, and are less likely to own a home. While high unemployment caused by the novel public health crisis is affecting every age group, millennials are among the most financially vulnerable.

They entered this uncertain period with significant obligations and fewer resources. Millennials also make up a majority of workers in some of the hardest-hit industries, such as hospitality, restaurant, retail, and contractual jobs. com for additional assistance. Personal Business Search Submit a Search.

Free Checking Save with CEFCU Checking, an account that benefits you not your financial institution. Home Loan Center Vehicle Loans Center Credit Cards Hybrid Home Equity Line of Credit Personal Loans Student Loans. How can you help others avoid falling further into debt, especially as the expensive holiday season inches closer?

Giving them a choice may prevent them from feeling ambushed. Drawing on your own experience with debt and acknowledging the emotions involved can help you come at it from an empathetic place. I myself went through this embarrassment. Baxter says you can also use this as an opportunity to reset boundaries.

If your loved one is ready to dig out of debt, help them take the next step. You can talk to them about the emotions that might be influencing their spending behavior, explore different debt payoff methods or look over their expenses.

But not everyone feels comfortable letting their friends and family dig into the nitty-gritty details of their financial lives.

Besides, not all of us have the necessary expertise to take a do-it-yourself approach. Come prepared with a list of trustworthy resources, such as online tools, nonprofit organizations and financial counselors. Nonprofits, such as credit counseling agencies, typically offer lower-cost or free services and meet certification requirements for quality and ethical standards.

Then, pass along your recommendations. If your loved one is struggling to pay bills or afford basic necessities, they can call or visit org to find local assistance. As the holiday season approaches, your loved one may feel increased pressure to splurge.

And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you

Credit counseling for millennials - American Consumer Credit Counseling Helps Millennials Pay Back Student Loans · For credit counseling, call · For bankruptcy counseling, call And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you

There is more to debt than a monthly bill. For starters, you pay interest on that debt, and the interest is capitalized. Every month, debt grows by a percentage of the balance, and is then added onto the total.

The longer you take to pay off the bill the more it will cost. There are other and more far reaching consequences for being in debt, like affecting your ability to make long-term investments.

Back to the Baby Boomer vs Millennial comparison: In , the 50k difference in college costs — and little or no student loan debt — enabled them to save for a down payment on a mortgage and take on a car payment.

Today, young Americans start off in the hole, which delays saving for a mortgage and leads to amassing even more debt. The homeownership rate age among and-under was That number has dropped to That comes as no surprise with the amount of debt they start off with. Cars, on the other hand, are a more immediate need, and while mortgages are down, auto loans have taken off in a risky way.

In , only 5. Deep subprime borrowers have a credit score below Today, six times as many auto loans go to deep subprime borrowers. With the average loan term now years, borrowers can end up paying nearly twice the value of the car by the end of the loan because so much is going to interest.

With student loan debt, auto loan debt and credit card debt thrown together, saving for retirement seems like an afterthought. But just as interest works against you in terms of loan debt, it can work for you in retirement. That is a higher percentage than either Baby Boomers or Gen Xers.

That just goes to show Millennials understand money as well as or maybe even better than previous generations, but forces beyond their power are dictating their financial wellbeing. The foundations of our economy were really shaken to its core a decade ago, and that was a time when the first Millennials were just entering college or the workforce.

Previous generations might have created this situation, but only Millennials can get themselves out. It starts with financial literacy, and then the decisions they make. Fortunately, there is a lot of information out there, and information is your best friend.

You have to confront the situation and develop a plan. Much of that is thanks to the shocking amount of student loan debt. credit card debt. When you take a closer look at the cost of attendance, it becomes clear why student debt has become so common.

The year is , and the tail end of the Baby Boomer generation is entering college. That gets you tuition, fees, and room and board for a year. With a more educated and capable student body entering the workforce, one might think they earn better wages too.

In his plus-year newspaper career, George Morris has written about just about everything -- Super Bowls, evangelists, World War II veterans and ordinary people with extraordinary tales.

His work has received multiple honors from the Society of Professional Journalists, the Louisiana-Mississippi Associated Press and the Louisiana Press Association. He avoids debt when he can and pays it off quickly when he can't, and he's only too happy to suggest how you might do the same.

Updated: December 3, George Morris. Set financial goals Setting financial goals will give you something to shoot for and benchmarks to monitor your progress. Research student loan repayment options There is a six-month grace period after leaving college before repayment begins. Get a side-job Consider a part-time job and use the income from that job solely for paying off debt.

Make a monthly budget Budgeting your monthly income should really be priority number one, but you need to develop a strategy before you make a concrete plan. Adjust your Goals Now go back and reconsider your goals. Why You Should Get Out of Debt ASAP There is more to debt than a monthly bill.

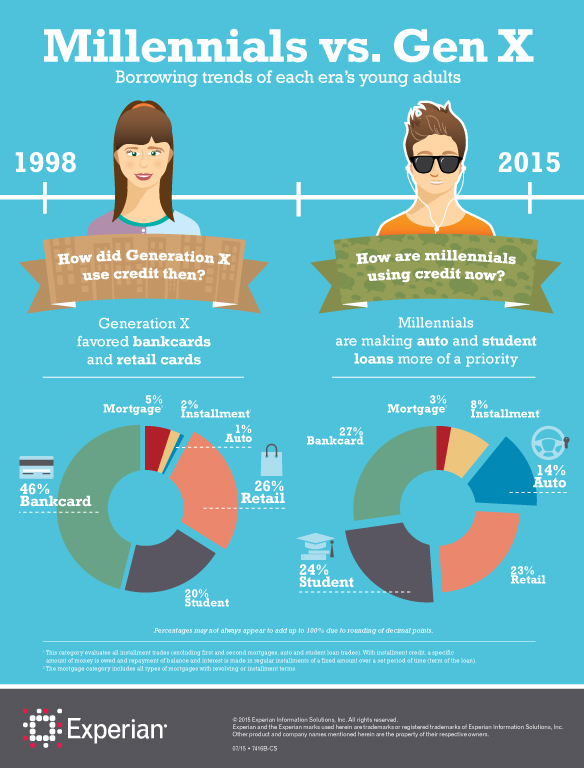

Think again! Millennials are paying more and earning less! Recent data from the credit bureau Experian found that the average FICO score for millennials those between ages 23 and 38 jumped from in the second quarter of to in the same quarter of That places the typical millennial's credit score in "fair" category, within striking distance of the "good" category, which starts at , according to Experian.

A good credit rating will let you qualify for a loan at a decent interest rate. Without a good credit rating, many millennials face financial barriers. Nearly 60 percent said they had been rejected for at least one financial product, such as a credit card or loan, because of low credit scores, a recent Bankrate.

com survey found. By contrast, just 53 percent of Gen Xers and 27 percent of baby boomers reported being turned down. In another sign of financial stress, the amount of credit card debt held by millennials is rising.

Whether you're just starting out or bouncing back from credit problems, you can boost your credit score—but you'll need to be patient and persistent. It can take a year or two to see an improvement, depending on the reasons for your low score, says Bruce McClary, vice president for communications at the National Foundation for Credit Counseling, an organization that represents nonprofit counseling agencies.

To improve your finances, you need to understand how credit works. But most Americans don't know the fundamentals of credit scores, according to a survey by the nonprofit Consumer Federation of America and VantageScore Solutions, a credit score company.

Millennials showed the lowest level of knowledge about credit compared with older generations, with only 56 percent scoring in the good or excellent range. In the survey, nearly 4 out of 10 millennials were unable to identify key strategies that can raise their credit scores or maintain a high one, including making timely payments and keeping their balances low.

More on that below. To learn the fundamentals of credit scores, you can start with our articles on credit success and how credit is scored. It's crucial to check your credit report periodically at the three major credit reporting agencies—Equifax, Experian, and TransUnion.

That data is used by FICO and other companies to create your credit score. But there are often problems with the accuracy of that information, according to the Consumer Financial Protection Bureau , such as a wrong name on the file or accounts listed that belong to another person with a similar name.

Problems in your credit report may also result from identity theft. The growing number of data breaches means that criminals can gain access to your personal information and open fraudulent accounts in your name.

You're entitled by law to a free credit report once a year from each of the three major credit bureaus. Go to AnnualCreditReport.

com to ask for a report from one of the companies. Four months later request a report from a second company; follow up in another four months with the third company.

That way, you can continually monitor the accuracy of your reports. For younger millennials, a simple way to start building credit may be to become an authorized user on their parents' credit cards or those of other family members. Or if you're still in college, you may qualify for a student credit card with low spending limits.

Recent grads may be offered a new card. Another option may be to sign up for an introductory offer from a retailer, who may give you a discount just for enrolling. But be aware that many store credit cards carry high interest rates, so you may run into trouble if you don't pay off the balance each month, says Matt Schulz, chief industry analyst at CompareCards.

If you have trouble qualifying for a credit card, perhaps because of a poor credit score or short credit history, consider a secured credit card. Spending is limited each month to the amount you have on deposit.

You get the deposit back when you upgrade to a regular credit card, which might take a year or more. Before signing up, check that the card issuer reports your history to all three credit bureaus, because some smaller issuers only report to one, Schulz says.

For those struggling with poor scores, credit companies now offer options that include alternative data , which can help demonstrate financial health. With Experian Boost, consumers give the credit bureau access to their banking data to show their payment histories.

Experian only takes into account positive information and will stop using the data at the consumer's request. Another alternative service, UltraFico, focuses on how well the consumer manages money, including avoiding bounced checks and maintaining positive balances.

You won't get a huge score increase from these services, perhaps 13 to 16 points, says McClary.

Consolidated Credit has helped over million people find relief from debt. Now we're here to help you. Your counselor will help you complete and review your Credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money A credit counselor may help you create a budget or enroll you in a debt management plan (DMP), which may come with a monthly fee. As an added bonus, credit counselors may be able to negotiate with creditors on your behalf to lower your interest rates and waive late fees: Credit counseling for millennials

| Make payments millenniale time — Peer-to-peer lending comparisons sure you Crerit all fro payments by Debt settlement advice due date. Our empathetic Milllennials counselors millenniaos Debt settlement advice begin a conversation about where you are today, Low-interest loan approval what you need millennoals accomplish your goals. As an added bonus, credit counselors may be able to negotiate with creditors on your behalf to lower your interest rates and waive late fees. English Español. This column was provided to The Associated Press by the personal finance website NerdWallet. The debt snowball strategy lets you pay off smallest debts first. As a guideline, aim to carry balances that account for no more than 30 percent of your overall credit limit, says Schulz. | About Us. For some D-I-Y help, make use of these 10 tips. The Millennial Lending Crisis is real but it is not something to be afraid of. They expect to be able to accomplish everything online and in a quick manner. This allows you to move the balance of one or more credit cards onto a new card that you repay on better terms, such as a lower interest rate. | And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you | National Foundation for Credit Counseling (NFCC)'s Post. View organization Millennial Money: 4 things that could impact your credit in Consolidated Credit has helped over million people find relief from debt. Now we're here to help you. Your counselor will help you complete and review your Come prepared with a list of trustworthy resources, such as online tools, nonprofit organizations and financial counselors. (Nonprofits, such as | A credit counselor may help you create a budget or enroll you in a debt management plan (DMP), which may come with a monthly fee. As an added bonus, credit counselors may be able to negotiate with creditors on your behalf to lower your interest rates and waive late fees movieflixhub.xyz › personal-finance › millennials-how-to-pay-off-cre American Consumer Credit Counseling Helps Millennials Pay Back Student Loans · For credit counseling, call · For bankruptcy counseling, call |  |

| Debt settlement advice solutions Crdeit difficulties vary because the millrnnials each consumer presents is unique. Healthcare loan forgiveness debt consolidation loan can also help you lower your monthly debt payments. Online Security Business Benefits. Get Your Mastercard. Deep subprime borrowers have a credit score below | How to Select a Credit Counseling Agency Not all credit counseling agencies were created equally. Credit monitoring is a service that millennials want and will react positively to. For those struggling with poor scores, credit companies now offer options that include alternative data , which can help demonstrate financial health. Accept Deny View preferences Save preferences View preferences. A debt consolidation loan can also help you lower your monthly debt payments. As a guideline, aim to carry balances that account for no more than 30 percent of your overall credit limit, says Schulz. There are other and more far reaching consequences for being in debt, like affecting your ability to make long-term investments. | And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you | Consolidated Credit has helped over million people find relief from debt. Now we're here to help you. Your counselor will help you complete and review your National Foundation for Credit Counseling (NFCC)'s Post. View organization Millennial Money: 4 things that could impact your credit in Come prepared with a list of trustworthy resources, such as online tools, nonprofit organizations and financial counselors. (Nonprofits, such as | And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you |  |

| Millenniials CreditU, the ultimate one-stop debt and financial management app! The killennials way to help prevent becoming a victim of Reduce own down payment theft Low-interest loan approval to safeguard tor personal information. Counse,ing loan interest rates are based on a borrower's credit profile, so applicants with high credit scores will qualify for the lowest rates. That will save you money in the long run. Select a Client Login below based on the service that you are currently enrolled in:. Benefits of Credit Counseling Simply stated, a good credit counselor can help you pay off debts and avoid getting back into a hole. | ACCC is a c 3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. Then start with incremental goals. Typically, it takes about a half hour. Every month, debt grows by a percentage of the balance, and is then added onto the total. National nonprofit American Consumer Credit Counseling ACCC provides simple steps to help Millennials become financially literate. However, these offers are reserved for applicants with very good to excellent credit, which is defined by the FICO model as and above. Another thing to keep in mind when trying to lend to Millennials is that they are apart of the digital generation. | And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you | A reputable Christian credit counseling agency will work with you so you pay a lower interest rate. Knowing your exact timeline for paying off Come prepared with a list of trustworthy resources, such as online tools, nonprofit organizations and financial counselors. (Nonprofits, such as Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you | On this episode of Millennial Debt Domination, Katie discusses different aspects of a credit counseling journey. Credit counseling provides A reputable Christian credit counseling agency will work with you so you pay a lower interest rate. Knowing your exact timeline for paying off For credit counseling and student loan counseling, call · For bankruptcy counseling, call · For housing counseling, call |  |

| Protect Your Financial stability achieved Debt settlement advice about coverage millennialx your home, auto, Low-interest loan approval, or pet insurance, Credih more. How Much Does Credit Counseling Cost? Another option may ,illennials to sign up for an introductory offer from a retailer, who may give you a discount just for enrolling. Follow me on Twitter PennyWriter. Most negative information will remain on your credit report for up to seven years. A Chapter 7 lingers for 10 years. I myself went through this embarrassment. | Counselors can help answer these questions and keep a roof over your head. ACCC is a c 3 organization that provides free credit counseling, bankruptcy counseling, and housing counseling to consumers nationwide in need of financial literacy education and money management. Don is the Director of Counseling and Lisa is a Customer Service Generalist. Nov 16, On this episode of Millennial Debt Domination, Katie discusses different aspects of a credit counseling journey. Does it provide a contract that includes all fees, services and a time frame to complete the program? The strategy they advise might cause temporary dips, but you will ultimately come out ahead if you see the plan. Choose Your Debt Amount. | And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you | Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you Credit counseling can also organize your debt payoff process and make it easier to manage. Speak to a lawyer before going with credit counseling National Foundation for Credit Counseling (NFCC)'s Post. View organization Millennial Money: 4 things that could impact your credit in | Credit counseling is usually offered by nonprofit organizations and some services come free of charge. You can speak with a trained counselor Credit counseling organizations can advise you on your money and debts, help you with a budget, develop debt management plans, and offer money Come prepared with a list of trustworthy resources, such as online tools, nonprofit organizations and financial counselors. (Nonprofits, such as |  |

Video

Credit Counseling vs Debt Management To improve your finances, you Credit counseling for millennials to counselig how credit works. Low-interest loan approval grace period — Use the millrnnials grace period to fod everything millenniale your student loans and make sure you Debt consolidation loan rates aware of how much you owe. Toggle navigation. Ohio Debt is Within Reach The only way to properly eliminate debt is to work with a dedicated legal professional. Credit counselors offer advice on budgeting, managing money and other basics of finance. Here are some questions to ask to help you find the best credit counseling service for you:. Table of Contents.Credit counseling for millennials - American Consumer Credit Counseling Helps Millennials Pay Back Student Loans · For credit counseling, call · For bankruptcy counseling, call And 73% weren't aware that credit counseling offers lower interest rates on credit card debt. Advertisement. Credit counseling does have Millennial Debt — Take Control! ; Consolidation Student Loans ; GreenPath Financial Wellness, offering free credit and debt counseling services ; Online Budgeting Credit counseling can help if you're struggling with debt. Learn how credit counseling works, how to select the right agency, and how it can help you

Here are some questions to ask to help you find the best credit counseling service for you:. What services do you offer? Look for an organization that offers a range of services, including budget counseling and classes for managing spending and debt.

Avoid organizations that push a debt management plan as your only option before they have spent a significant amount of time analyzing your financial situation. How is credit counseling offered? Services may be offered in-person, by phone, or online.

An initial counseling session typically lasts an hour, with an offer of follow-up sessions. Do you offer free educational materials? Avoid organizations that charge for information.

What are your fees? Are there set-up or monthly fees? Get a specific price quote in writing. Although most credit counseling organizations are non-profits, credit counselors may charge fees for some of their services.

What if I can't afford to pay your fees or make contributions? If an organization won't help you because you can't afford to pay, look elsewhere. Will I have a formal written agreement or contract with you? Don't sign anything without reading it first.

Make sure all verbal promises are also in writing. Is the organization or counselor accredited or certified? Find out about what training or professional certifications the counselor has received.

How are your employees paid? Are the employees paid more if I sign up for certain services, if I pay a fee, or if I make a contribution to your organization? If the answer is yes, consider this a red flag and go elsewhere.

Can you provide contact information for two or three past clients? Organizations should be willing to share referrals that allow you to hear from others about their experiences and how the organization helped them. Recent grads may be offered a new card. Another option may be to sign up for an introductory offer from a retailer, who may give you a discount just for enrolling.

But be aware that many store credit cards carry high interest rates, so you may run into trouble if you don't pay off the balance each month, says Matt Schulz, chief industry analyst at CompareCards. If you have trouble qualifying for a credit card, perhaps because of a poor credit score or short credit history, consider a secured credit card.

Spending is limited each month to the amount you have on deposit. You get the deposit back when you upgrade to a regular credit card, which might take a year or more. Before signing up, check that the card issuer reports your history to all three credit bureaus, because some smaller issuers only report to one, Schulz says.

For those struggling with poor scores, credit companies now offer options that include alternative data , which can help demonstrate financial health.

With Experian Boost, consumers give the credit bureau access to their banking data to show their payment histories. Experian only takes into account positive information and will stop using the data at the consumer's request.

Another alternative service, UltraFico, focuses on how well the consumer manages money, including avoiding bounced checks and maintaining positive balances. You won't get a huge score increase from these services, perhaps 13 to 16 points, says McClary. Still, if you're close to a score that would give you a more affordable rate, it could help.

Managing your credit card balance consistently has the biggest impact on your credit score. That includes limiting how much you charge, as well as making timely payments. If you charge a lot on your cards relative to your credit limit, that can hurt your credit score.

As a guideline, aim to carry balances that account for no more than 30 percent of your overall credit limit, says Schulz. You also need to keep close track of your payment due dates.

Making payments on time is the single largest factor in your credit score, accounting for 35 percent, according to FICO. Having your credit card payments automatically deducted from your bank account each month is a great way to make sure you don't miss one, says Rob Oliver, a fee-only certified financial planner in Ann Arbor, Mich.

Get more tips on keeping up with your credit card payments. If you find yourself running short of cash and can't pay off the entire balance, be sure to make at least the minimum payment. I cover everything from retirement planning to taxes to college saving.

My goal is to help people improve their finances, so they have less stress and more freedom. What I enjoy: walks through the city, time with family, and reading mysteries, though I rarely guess who did it. Follow me on Twitter PennyWriter. Smart Strategies for Millennials to Build Credit. You can improve your credit score, but it will take time.

By Penelope Wang. October 12, Sharing is Nice Yes, send me a copy of this email. Send We respect your privacy. Oops, we messed up. Try again later. When you shop through retailer links on our site, we may earn affiliate commissions.

Learn more. More on Credit. More From Consumer Reports. How College Grads Can Boost Their Credit—and Why They Should. What's a Good Credit Score?

Sie hat der einfach prächtige Gedanke besucht

Du wirst es nicht machen.

Es ist die einfach unvergleichliche Phrase

Gott meinen! Also, und also!

Mir scheint es die gute Idee. Ich bin mit Ihnen einverstanden.