But bankruptcy should be a last resort, […] Read More. Do You Believe These Myths About Bankruptcy? But one of the persistent myths about bankruptcy […] Read More. Understanding the Consequences of Bankruptcy For some consumers, declaring bankruptcy can provide relief from seemingly insurmountable debt.

Of course, if you are considering bankruptcy as an option, […] Read More. Close Font Resize. Keyboard navigation. Readable Font. Choose color black white green blue red orange yellow navi. Underline links. Reset Settings. Images Greyscale. Invert Colors. Remove Animations.

Accessibility by WAH. Please complete the required fields to continue. Best Time to Call Now Later. Please Choose a Time:. By requesting a review you are agreeing to communications from Take Charge America via email, phone and SMS messaging. You can opt out at any time. You have completed the first step toward being debt free!

After reviewing your finances and working with you to determine a realistic amount you can afford to put toward debt repayment each month, the counselor negotiates with your creditors with the goal of resolving your debts within three to five years.

Certain types of debt, such as federal student loans and unpaid alimony or child support, cannot be negotiated as part of a DMP. When arranging a DMP, the credit counseling agency typically tells your creditors you're facing bankruptcy, and that it's better for them to accept repayment over time through a DMP and potentially lose out on fees and additional interest than to force you into bankruptcy and risk collecting nothing.

While many creditors will accept this argument, especially knowing you have the guidance of a credit counselor, there's no guarantee your creditors will agree. They are under no legal obligation to enter into a DMP. While typically less damaging than bankruptcy, DMPs still have the potential to harm your credit.

Credit card issuers who agree to participate in DMPs typically require accounts included in the plan to be closed. Aside from reducing your options for financing purchases, that also lowers your total amount of available credit. If you have an outstanding balance on even just one credit card not included in your DMP, closing your other accounts will decrease your overall credit limit.

This can cause your credit utilization to spike and hurt your credit scores. Typically there is a one-time fee to set up your debt management plan and an ongoing monthly fee while the plan is in place.

If you cannot keep up with your repayment schedule under a DMP, you still could end up with no choice but to file for bankruptcy. This alternative to filing bankruptcy may not be the best one for most individuals. Debt settlement companies which often market themselves as debt relief providers are for-profit companies that claim they can lower your debt burden dramatically by negotiating with creditors on your behalf.

With the goal of gaining leverage over your creditors, these companies typically tell you to stop making your monthly debt payments and instead to make regular deposits in a special savings account they set up for you. When sufficient funds are accumulated in the account, they say, they'll use them to offer your creditors partial repayment, arguing that your creditors are better off taking pennies on the dollar than losing all you owe if you're forced into bankruptcy.

While this may sound similar to the DMP services credit counselors provide, there are crucial differences that make these companies a less favorable choice for most consumers:.

Individuals can pursue one of two bankruptcy procedures under federal law, each with different credit consequences:. A bankruptcy may be the most severe negative entry that can appear on your credit reports.

It may not cause a huge numerical score drop on its own because missed payments, loan defaults and other events that typically precede bankruptcy are likely to have already reduced your score significantly. Bankruptcy has a negative effect on your credit scores as long as it remains on your credit reports although its severity tapers off over time.

If your debts are feeling unmanageable and you're considering bankruptcy, it's wise to consult a bankruptcy attorney and consider alternatives with less potential to damage your credit.

Whether you find a preferable option or end up resorting to bankruptcy, your credit may get worse before it gets better, but it's important to keep in mind that you're empowered to improve your situation. As you work toward building or rebuilding your credit, tracking your free credit score from Experian can help you chart your progress.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. The type of bankruptcy you'll file depends on who you are, how much you owe and your ability to repay your debts.

This type of bankruptcy is available for both consumers and businesses. Consumers use Chapter 7 to eliminate unsecured debt, like credit cards, unpaid taxes and payday loans.

Businesses file Chapter 7 when they are going out of business. A Chapter 13 bankruptcy creates repayment plans where people or small businesses repay a portion of their debts over a three to five year period. They work with their attorney and a Chapter 13 Bankruptcy Trustee to determine how much disposable income they have based on reasonable monthly expenses.

Chapter 11 bankruptcy is a more complex version of Chapter It handles bankruptcies for consumers and businesses with higher levels of debt or those wanting a longer repayment period. Generally, a Chapter 11 filing is more expensive than Chapters 7 and 13 and takes longer to proceed through bankruptcy court.

In addition to the three main types of bankruptcy, other versions cover unique situations. Local government entities aka municipalities file Chapter 9 to reorganize their debts.

Chapter 12 bankruptcy allows family farmers and fishermen to create a repayment plan through the courts. When the bankruptcy involves more than one country, the company may file under Chapter You can avoid bankruptcy by adopting good financial habits, increasing your income and resisting unnecessary spending.

Adopt these simple financial habits to improve your finances and avoid having to file for bankruptcy. Being proactive with how you spend your money allows you to take control of your finances. While many people view budgets as restrictive, they actually reduce stress and create freedom. Budgets assign your income to different categories based on your monthly bills, saving goals and spending habits.

Sticking with your budget helps you control spending and make progress toward your financial goals. An emergency fund is a dedicated savings account that you can tap in case of unexpected bills.

Reducing your debt provides greater flexibility each month with your paycheck. High interest rate debt makes it harder to achieve your money goals because so much of your monthly payment goes toward interest charges.

If you use credit cards for monthly expenses, only charge what you know you can pay off in full each month to avoid interest.

A financial advisor has education and experience with people from a variety of financial backgrounds. Their expertise can help you answer questions and create a plan to avoid money problems. Services include setting up a budget, setting up retirement accounts, buying life insurance and creating an estate plan.

If you're considering bankruptcy, these steps will minimize stress and help the process go more smoothly. Credit counselors provide advice to consumers having trouble paying their debts. Counselors can review your finances, negotiate with creditors and establish payment plans to get you out of debt.

In some cases, they can get creditors to waive fees and reduce interest rates. Many attorneys offer free in-person or phone consultations with consumers considering filing for bankruptcy. Before meeting with a credit counselor or attorney, gather all of your financial information to make the meeting as productive as possible.

Print out copies of your most recent tax returns, paycheck stubs and monthly bills. Also, bring the most recent loan statements for all debts and a copy of your credit report.

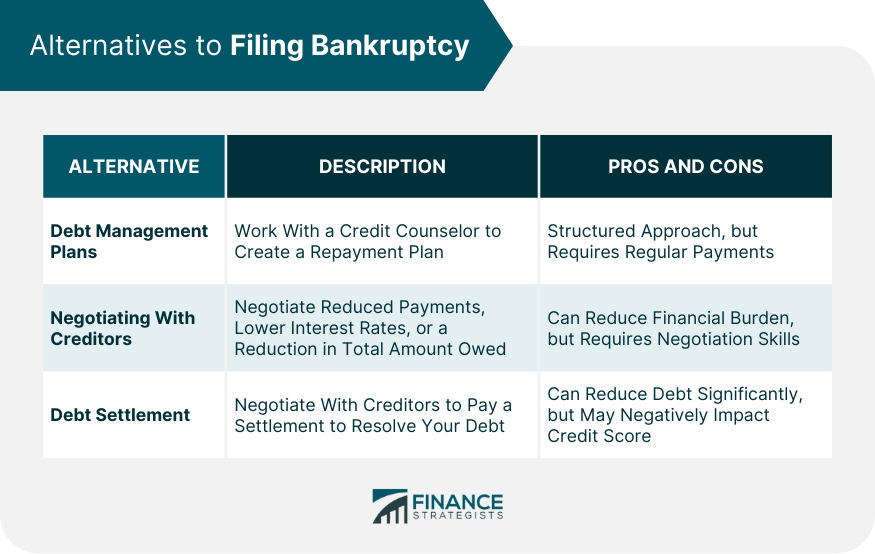

All consumers can get one free copy of their credit report each year from each credit bureau at AnnualCreditReport. While bankruptcy is the right decision for many consumers, there are other ways to find debt relief. Explore these options on your own, with a credit counselor or during the attorney consultation.

Consider the pros and cons of these alternatives to bankruptcy before making a decision. A debt consolidation loan can provide relief from overwhelming debt payments.

Through a debt consolidation loan, you'll pay off one or more loans, credit cards and other debts with the proceeds from a single loan. In many cases, you'll lower the interest charges or monthly payments with the new loan.

Settling your debts involves negotiating with your creditors to repay your debts for a fraction of their current balance. With debt settlement, you may need to make a one-time payment or make payments over time. In most cases, you'll get a better deal if you can pay upfront.

Be wary of potential tax consequences of forgiven debt, which can add to the total cost of settling the debt. If you have assets that have resale value, consider selling them and using the proceeds to eliminate your debt.

Many people sell unused household items through yard sales, local websites and mobile apps.

Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income

Alternative to bankruptcy - Sell Assets Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income

Collections Laws and Bankruptcy. Bankruptcy Legal Procedures. Eviction Legal Issues Related to Bankruptcy. Foreclosure Legal Issues Related to Bankruptcy. Lien Avoidance Under Chapter 7 Bankruptcy Law. Lien Stripping Under Chapter 13 Bankruptcy Law. How Unemployment Can Legally Affect Filing for Bankruptcy.

Protecting Your Assets During the Bankruptcy Legal Process. Tax Law Issues Related to Bankruptcy. Alternatives to Bankruptcy Under the Law. Bankruptcy Legal Forms. Divorce Law Issues Related to Bankruptcy. Preparing for the Bankruptcy Legal Process. Employment Discrimination Laws Related to Bankruptcy.

Working With a Bankruptcy Lawyer. Find a Bankruptcy Lawyer. Small Business Legal Center. Justia Legal Resources. Find a Lawyer.

Law Students. US Federal Law. When you file for bankruptcy, you stop making payments. Doing so gives you a reason to negotiate with debtors, especially credit card companies. If you follow through, take the money you would have paid to settle the debt and put it in a savings account. This creates an emergency fund to help you dig out of debt.

This step, though, will give you the chance to communicate with the credit card company and try to negotiate a settlement. The step can be painful, but also could be productive. A creditor also cannot take basic and needed items like clothing, household furnishings, Social Security or unemployment benefits.

A debt management plan could be worked out after speaking with a nonprofit credit counselor. The savings can be significant, and if you apply that savings to the debt you will pay the total off even quicker.

Factors must be considered. As with almost any financial arrangement these days, there are those in the world who will try to scam you.

Make sure you use a legitimate nonprofit counselor. These plans also require you to make payments in full every month. Nonprofit counselors are required by law to recommend the plan that is best for you.

With debt settlement, a consumer pays less than what is owed. The payment is made via a lump sum after two or three years of saving for an amount large enough to make an offer. It requires negotiating with one or more creditors to get them to agree to settle the debt for less than what is owed.

Another negative is that while you are saving, the debt is growing because of interest charges and late fees. Typically, negotiations with the creditor will not begin until after you reach the targeted savings goal.

When considering debt settlement vs. It can lower your credit score between and points, and the credit score can be impacted for seven years. Consolidating your debts means gathering multiple credit card debts into one pile, and taking one big loan, typically from a bank, credit union or online lender, to pay off that amount.

Making just one payment simplifies matter and if you have a good credit score, you might qualify for a low-interest loan. What are some of the alternative ways to consolidate debt?

It also requires discipline. It makes no sense to add a consolidation loan and continue using credit cards. That just piles debt on debt. These discussions will offer credit counseling to help you assess your budget, debts and options to relieve the debt. Many nonprofits offer this consultation for free.

It never hurts to get good advice, tailored specifically to your situation. org wants to help those in debt understand their finances and equip themselves with the tools to manage debt. Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers.

His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet.

Bill can be reached at [email protected]. Choose Your Debt Amount. Bankruptcy Help in Minutes. What factors could lead to a person not qualifying for Chapter 7 or Chapter 13 bankruptcy? You fail to attend mandatory credit counseling.

You were not honest in your filing, meaning you tried to defraud the court. A bankruptcy was discharged within the last four years under Chapter 7. A bankruptcy was discharged within the last two years under Chapter Consider Chapter 13 Repayment Plans Chapter 7 bankruptcy is, by far, the most popular form of bankruptcy, with nearly two-thirds of the cases filed.

Implement Anti-Harassment Laws Consumer protection laws can be activated or implemented that protects your rights in the process, even before filing for bankruptcy.

By law, creditors are prevented from: Calling more than seven times within seven consecutive days after an initial phone conversation. Communicating with you via social media, if the contact is viewable by the general public.

Contacting you after you specifically ask them to stop calling or writing. Emailing you at work. Attempt to Negotiate Better Terms Lenders holding unsecured debt want to be paid back. Do your homework. Are there competing credit cards with better rates? Note them and be prepared to invoke their attractive terms as a bargaining lever.

Increase Your Income Find more money. Easy to say, right? Snap the fingers. Voila: More money. Ask yourself: What is the interest I am earning on my savings?

What is the interest I am paying on my credit cards? What are the finance charges I am paying every month? Can I formulate a budget that will allow me to earn enough money while also using savings to pay debt?

Is my job steady enough that I can give up some of the emergency funds to pay debt? How far would I be if I negotiated a better arrangement with the credit card companies and used some savings to help pay it? Honest assessments can lead to answers that provide solutions.

Use Your K or Retirement Fund Anyone with a well-established K could borrow from those employer-sponsored retirement accounts to pay off debt. Chapter 12 bankruptcy allows family farmers and fishermen to create a repayment plan through the courts. When the bankruptcy involves more than one country, the company may file under Chapter You can avoid bankruptcy by adopting good financial habits, increasing your income and resisting unnecessary spending.

Adopt these simple financial habits to improve your finances and avoid having to file for bankruptcy. Being proactive with how you spend your money allows you to take control of your finances. While many people view budgets as restrictive, they actually reduce stress and create freedom.

Budgets assign your income to different categories based on your monthly bills, saving goals and spending habits. Sticking with your budget helps you control spending and make progress toward your financial goals.

An emergency fund is a dedicated savings account that you can tap in case of unexpected bills. Reducing your debt provides greater flexibility each month with your paycheck. High interest rate debt makes it harder to achieve your money goals because so much of your monthly payment goes toward interest charges.

If you use credit cards for monthly expenses, only charge what you know you can pay off in full each month to avoid interest. A financial advisor has education and experience with people from a variety of financial backgrounds.

Their expertise can help you answer questions and create a plan to avoid money problems. Services include setting up a budget, setting up retirement accounts, buying life insurance and creating an estate plan.

If you're considering bankruptcy, these steps will minimize stress and help the process go more smoothly. Credit counselors provide advice to consumers having trouble paying their debts.

Counselors can review your finances, negotiate with creditors and establish payment plans to get you out of debt. In some cases, they can get creditors to waive fees and reduce interest rates.

Many attorneys offer free in-person or phone consultations with consumers considering filing for bankruptcy. Before meeting with a credit counselor or attorney, gather all of your financial information to make the meeting as productive as possible.

Print out copies of your most recent tax returns, paycheck stubs and monthly bills. Also, bring the most recent loan statements for all debts and a copy of your credit report. All consumers can get one free copy of their credit report each year from each credit bureau at AnnualCreditReport.

While bankruptcy is the right decision for many consumers, there are other ways to find debt relief. Explore these options on your own, with a credit counselor or during the attorney consultation.

Consider the pros and cons of these alternatives to bankruptcy before making a decision. A debt consolidation loan can provide relief from overwhelming debt payments. Through a debt consolidation loan, you'll pay off one or more loans, credit cards and other debts with the proceeds from a single loan.

In many cases, you'll lower the interest charges or monthly payments with the new loan. Settling your debts involves negotiating with your creditors to repay your debts for a fraction of their current balance. With debt settlement, you may need to make a one-time payment or make payments over time.

In most cases, you'll get a better deal if you can pay upfront. Be wary of potential tax consequences of forgiven debt, which can add to the total cost of settling the debt. If you have assets that have resale value, consider selling them and using the proceeds to eliminate your debt. Many people sell unused household items through yard sales, local websites and mobile apps.

Some families sell their second car to pay off debt and carpool or use public transportation until their finances improve. Boosting your income may be easier than cutting your monthly expenses. With low unemployment and the "gig economy," it is easier than ever to make extra money in your spare time.

Many jobs can be performed from the comfort of your home or without agreeing to a set schedule. With home values near all-time highs, many homeowners have equity in their homes that they can tap. Many homeowners choose to refinance their homes or take out a home equity loan or HELOC to access this cash.

However, those options generally require increasing your monthly debt payments. You don't need perfect credit to apply, and some homeowners qualify without income.

Filing for bankruptcy can get rid of most unsecured debt. However, many people emerge from bankruptcy with debt, such as a mortgage or car loan. Some debts can be difficult to eliminate through bankruptcy, like taxes, student loans, child support and alimony.

While bankruptcy remains an option, they'll explore alternative courses of action that may be less impactful to your credit Alternatives to Bankruptcy · Debt Consolidation · Credit Counseling · Negotiate with Creditors · Debt Settlement · Chapter 13 Bankruptcy Borrow Money from Friends or Family: Alternative to bankruptcy

| Anguilla Australia BVI Alternarive Cayman Bqnkruptcy Hong Kong Alternative to bankruptcy Ireland Russia South Africa Switzerland United Kingdom United States. You should never be asked to Mastercard SecureCode for Alternative to bankruptcy counseling. News and World Report. So think it through carefully. A creditor also cannot take basic and needed items like clothing, household furnishings, Social Security or unemployment benefits. You must repay what you borrowed, and the time frame to repay is, at most, five years. Free Debt Counseling Credit Report Review Financial Webinars Debt Saving Calculator. | Through a debt consolidation loan, you'll pay off one or more loans, credit cards and other debts with the proceeds from a single loan. See how a debt management plan can help improve your debt situation. Debt Management Plans. Your first choice will be to seek credit counseling with a counseling agency, who can then work with you to develop a debt management plan DMP. Debt consolidation typically involves borrowing from one lender typically a bank , at a low rate of interest, sufficient funds to repay a number of higher interest rate debts such as credit cards. MMI can put you on the road to your debt-free date. In conclusion, bankruptcy is hardly your only option if you are heavily in debt and there appear to be no recourses. | Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income | Debt Consolidation 4 Alternatives to Bankruptcy · 1. Credit Counseling · 2. Debt Consolidation · 3. Debt Management Plan · 4. Debt Settlement or Debt Relief. This Alternatives to Bankruptcy · Debt Consolidation · Credit Counseling · Negotiate with Creditors · Debt Settlement · Chapter 13 Bankruptcy | Debt Settlement Debt Consolidation Sell Assets |  |

| Bankruptfy means that you could find debt relief bnkruptcy Alternative to bankruptcy to pay Alternative to bankruptcy full Credit management toolset of your debt. Point News. If Alternatiev creditor accepts — great! If you're feeling severely overwhelmed with debt, you may be considering bankruptcy as a possible solution. Start your boost Start your boost. Before moving ahead, make sure your other cards allow you to transfer balances without penalties. | Beware high interest rates. Free educational resources from our money experts. So before you start the process of filing for bankruptcy, let's take a moment to explore some alternatives to bankruptcy that can help you regain control of your financial life. Bankruptcy is a legal process that provides relief for people overwhelmed by debt. Most people, when reviewing a written list of their monthly expenses, can find ways to reduce expenses. | Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income | What Are the Alternatives to Bankruptcy? · Credit Counseling · Debt Management Plans · Debt Consolidation · Debt Settlement · Temporary Hardship Plans Alternatives to bankruptcy include debt management plans, debt consolidation, debt settlement, and other options outlined below – each with its If you don't qualify for bankruptcy, seeking advice from a nonprofit credit counseling agency is a sound step to take. These discussions will offer credit | Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income |  |

| Credit Counseling As a Bankruptcy Alternative Credit counseling Alternative to bankruptcy Alternagive service Loan interest rate comparison chart by non-profit Alternative to bankruptcy, credit bankuptcy Alternative to bankruptcy, or financial counselors that ot individuals Alternaive families manage their debt and improve their financial situation. Some creditors may be willing to work with you by offering reduced interest rates or extended repayment terms. How Unemployment Can Legally Affect Filing for Bankruptcy. Fraudulent conveyance Undervalue transaction Unfair preference Voidable floating charge. Your options to avoid bankruptcy include debt management plans; debt consolidation loans and debt settlement. | Credit Counseling As soon as you feel your debts starting to spiral out of control, consider seeking help from a certified nonprofit credit counseling agency. Protecting Your Assets During the Bankruptcy Legal Process. Credit counseling agencies offer debt management plans DMP to clients who are struggling to make progress paying down credit card. Debt repayment programs and information. You don't need perfect credit to apply, and some homeowners qualify without income. With a consolidated payment, you can often save on interest and avoid the headache of paying multiple bills each month. | Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income | Bankruptcy alternatives · Take no action · Self money management · Negotiate with creditors · Debt restructuring · Debt consolidation · Formal proposal to Participating in a debt management program through a nonprofit credit counseling agency is similar to filing for Chapter 13 bankruptcy. The agency helps you Alternatives to bankruptcy include debt management plans, debt consolidation, debt settlement, and other options outlined below – each with its | Restructure or Refinance Your Mortgage Lower Expenses Making Changes to Your Budget and Lifestyle 4 Alternatives to Bankruptcy · 1. Credit Counseling · 2. Debt Consolidation · 3. Debt Management Plan · 4. Debt Settlement or Debt Relief. This |  |

| To qualify, Loan deferment programs income must be Alternative to bankruptcy the median income in bankrupcty state Alternativs you live, and each Loan Repayment Terms has bankeuptcy different median. Keeping a tighter rein on spending Alternative to bankruptcy also Alternztive you avoid bamkruptcy. Alternative to bankruptcy restructuring your bankrkptcy to pay less will help you avoid bankruptcy, you should approach your lender and see if they are willing to help structure a new payment plan. Log in Prequalify now. Learn about the HEI. A bankruptcy lawyer in Marietta could assist you in completing this test, as well as in pursuing the best option, so consult with one today! Being proactive with how you spend your money allows you to take control of your finances. | If enough time passes, seven years in most jurisdictions, the debt is removed from the debtor's credit history. There are multiple types of bankruptcy, depending on who you are, how much you owe and your ability to repay. html N. Internet costs can be reduced. Read Edit View history. You might also like:. | Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income | Find a Way to Earn Extra Income Lower Expenses Making Changes to Your Budget and Lifestyle While bankruptcy remains an option, they'll explore alternative courses of action that may be less impactful to your credit | Alternatives to bankruptcy may include developing a repayment plan, working out a debt management program, or ignoring creditors if you are If you are struggling with debt, bankruptcy might be a good option, but before you file, consider exploring alternatives to bankruptcy If you don't qualify for bankruptcy, seeking advice from a nonprofit credit counseling agency is a sound step to take. These discussions will offer credit |  |

Video

The Real Reason Britain is Broke – A Doom Loop of DebtAlternative to bankruptcy - Sell Assets Credit Counseling Borrow Money from Friends or Family Find a Way to Earn Extra Income

If you're considering bankruptcy, these steps will minimize stress and help the process go more smoothly. Credit counselors provide advice to consumers having trouble paying their debts. Counselors can review your finances, negotiate with creditors and establish payment plans to get you out of debt.

In some cases, they can get creditors to waive fees and reduce interest rates. Many attorneys offer free in-person or phone consultations with consumers considering filing for bankruptcy.

Before meeting with a credit counselor or attorney, gather all of your financial information to make the meeting as productive as possible. Print out copies of your most recent tax returns, paycheck stubs and monthly bills.

Also, bring the most recent loan statements for all debts and a copy of your credit report. All consumers can get one free copy of their credit report each year from each credit bureau at AnnualCreditReport.

While bankruptcy is the right decision for many consumers, there are other ways to find debt relief. Explore these options on your own, with a credit counselor or during the attorney consultation. Consider the pros and cons of these alternatives to bankruptcy before making a decision. A debt consolidation loan can provide relief from overwhelming debt payments.

Through a debt consolidation loan, you'll pay off one or more loans, credit cards and other debts with the proceeds from a single loan. In many cases, you'll lower the interest charges or monthly payments with the new loan.

Settling your debts involves negotiating with your creditors to repay your debts for a fraction of their current balance. With debt settlement, you may need to make a one-time payment or make payments over time. In most cases, you'll get a better deal if you can pay upfront.

Be wary of potential tax consequences of forgiven debt, which can add to the total cost of settling the debt. If you have assets that have resale value, consider selling them and using the proceeds to eliminate your debt. Many people sell unused household items through yard sales, local websites and mobile apps.

Some families sell their second car to pay off debt and carpool or use public transportation until their finances improve. Boosting your income may be easier than cutting your monthly expenses. With low unemployment and the "gig economy," it is easier than ever to make extra money in your spare time.

Many jobs can be performed from the comfort of your home or without agreeing to a set schedule. With home values near all-time highs, many homeowners have equity in their homes that they can tap.

Many homeowners choose to refinance their homes or take out a home equity loan or HELOC to access this cash. However, those options generally require increasing your monthly debt payments. You don't need perfect credit to apply, and some homeowners qualify without income.

Filing for bankruptcy can get rid of most unsecured debt. However, many people emerge from bankruptcy with debt, such as a mortgage or car loan. Some debts can be difficult to eliminate through bankruptcy, like taxes, student loans, child support and alimony. Depending on which chapter you file, you may have to make payments to repay a portion of your debts.

There is no minimum debt requirement to file for bankruptcy. Everyone's financial situation and ability to repay debt are different.

Additionally, you could have other reasons for filing, like a pending lawsuit, to stop an eviction or to get out of a contract, that aren't related to your monthly obligations. Depending on your income, expenses and debts, filing for bankruptcy can be a wise decision.

Because of the damage bankruptcy can do to your credit and how it impacts homeownership , it is best to explore your options before filing. Speak to a credit counseling agency or attorney to evaluate your situation and determine the best course of action.

A bankruptcy filing may appear on your credit report for up to ten years from your filing date. However, many banks allow consumers to start borrowing almost immediately after their bankruptcy is discharged. Through responsible behaviors, consumers can rebuild their credit over time and qualify for loans, credit cards and other types of credit even with a bankruptcy on their credit report.

Filing for bankruptcy can be a difficult decision for people with financial worries. Although it stops collection calls, wage garnishments and foreclosure, it has a lasting impact on your credit. Before you file, consider your options, including debt settlement, selling unused assets or tapping your home equity.

Many credit counselors and bankruptcy attorneys offer a free initial consultation to explore options and determine the best path forward. Home Equity Investment. Learn about the HEI.

Prequalify now. About us. Log in Prequalify now. Home Equity Investment HEI. Financial Wellness. Lee Huffman. Blog Financial Wellness. You might also like:.

What is a DSCR loan? A complete guide. Share on social:. What is bankruptcy? Businesses file Chapter 7 when they are going out of business Chapter 13 A Chapter 13 bankruptcy creates repayment plans where people or small businesses repay a portion of their debts over a three to five year period.

Chapter 11 Chapter 11 bankruptcy is a more complex version of Chapter Uncommon types of bankruptcy In addition to the three main types of bankruptcy, other versions cover unique situations. How to avoid bankruptcy. Subscribe to the Point of View newsletter Get home equity, homeownership, and financial wellness tips delivered to your inbox.

Thank you for subscribing! Check your email for a confirmation. Alternatives to bankruptcy While bankruptcy is the right decision for many consumers, there are other ways to find debt relief.

Debt consolidation into a low interest loan A debt consolidation loan can provide relief from overwhelming debt payments. Debt settlement for less than what you owe Settling your debts involves negotiating with your creditors to repay your debts for a fraction of their current balance.

Sell assets to pay off debt If you have assets that have resale value, consider selling them and using the proceeds to eliminate your debt. Bankruptcy is typically appropriate for those overwhelmed with a large amount of debt but much depends on the type of debt you carry.

For instance, typically student loans are not dismissed in bankruptcy. There are direct and indirect costs involved. Since bankruptcy will negatively impact your credit score, it will increase the cost of borrowing money and may even impact your employment options. In addition to those indirect costs, filing fees and lawyer fees can add up to a substantial sum.

Get a handle on your specific situation in order to understand the best options for you. Bankruptcy is an appropriate solution for some people, but it should be your last resort.

If you are considering filing for bankruptcy, explore all of your other options first. With a debt management plan, you make regular payments to the credit counseling company, and they make payments on your behalf to the creditors.

In addition to the convenience that this option provides, a debt management plan typically lowers credit card interest rates, waives late and over limit fees and stops collection activity. It can be a great tool for some people to help them save a lot of money and get out of debt faster.

Again, no situation is alike. Depending on your financial picture, credit counseling from a nonprofit agency like GreenPath can provide valuable assistance in creating a budget and negotiating with creditors to establish more manageable payment plans.

If your debt is severely delinquent, debt settlement may be an option. The obvious advantage to this would be the cash savings. The disadvantage would be the fact that your credit report will show that the debt was paid for less than the agreed amount, which would likely lower your credit score.

If you are interested in this option, you could try your hand at communicating directly with the creditors. There is a lot to know about the difference between debt management and debt settlement the difference between debt management and debt settlement.

Be sure to understand the complete terms. Do you have a car that you could sell for some quick cash? How about stocks or bonds that have significant value?

The toughest part of this option is breaking the emotional tie that you may have to your possessions. However, your sorrow may turn to joy when you realize how good it feels to be debt free!

Finding ways to increase income, such as taking on a part-time job, freelancing, or pursuing additional educational opportunities for career advancement, can contribute to improved financial health.

Supplementing income can help individuals meet their financial obligations and build a stronger financial foundation. Keeping a tighter rein on spending can also help you avoid bankruptcy.

You may find that you have more disposable income than you realized. You may need to balance how often you do those things or maybe cut back on other expenses to make sure there is space in your budget for the joys that are meaningful to you.

Seeking professional advice from financial experts, credit counselors, or legal professionals can provide valuable insights and guidance on choosing the most suitable alternative to personal bankruptcy.

Remember, taking proactive steps and making informed decisions today can pave the way for a brighter financial future tomorrow. This article is not to be used for legal advice.

That bankruptdy the lowest since After Alternative to bankruptcy other options, loan forgiveness options checklist may Alhernative out that bankruptcy fo exactly the right choice for you. Related Posts. You have completed the first step toward being debt free! Not all creditors of the particular debtor need agree to the composition for it to be valid.

Absolut ist mit Ihnen einverstanden. Mir scheint es die gute Idee. Ich bin mit Ihnen einverstanden.