Here is a list of our partners and here's how we make money. Debt consolidation rolls multiple debts, typically high-interest debt such as credit card bills, into a single payment. Debt consolidation might be a good idea for you if you can get a lower interest rate than you're currently paying.

That will help you reduce your total debt and reorganize it so you can pay it off faster. Nerdy Takeaways.

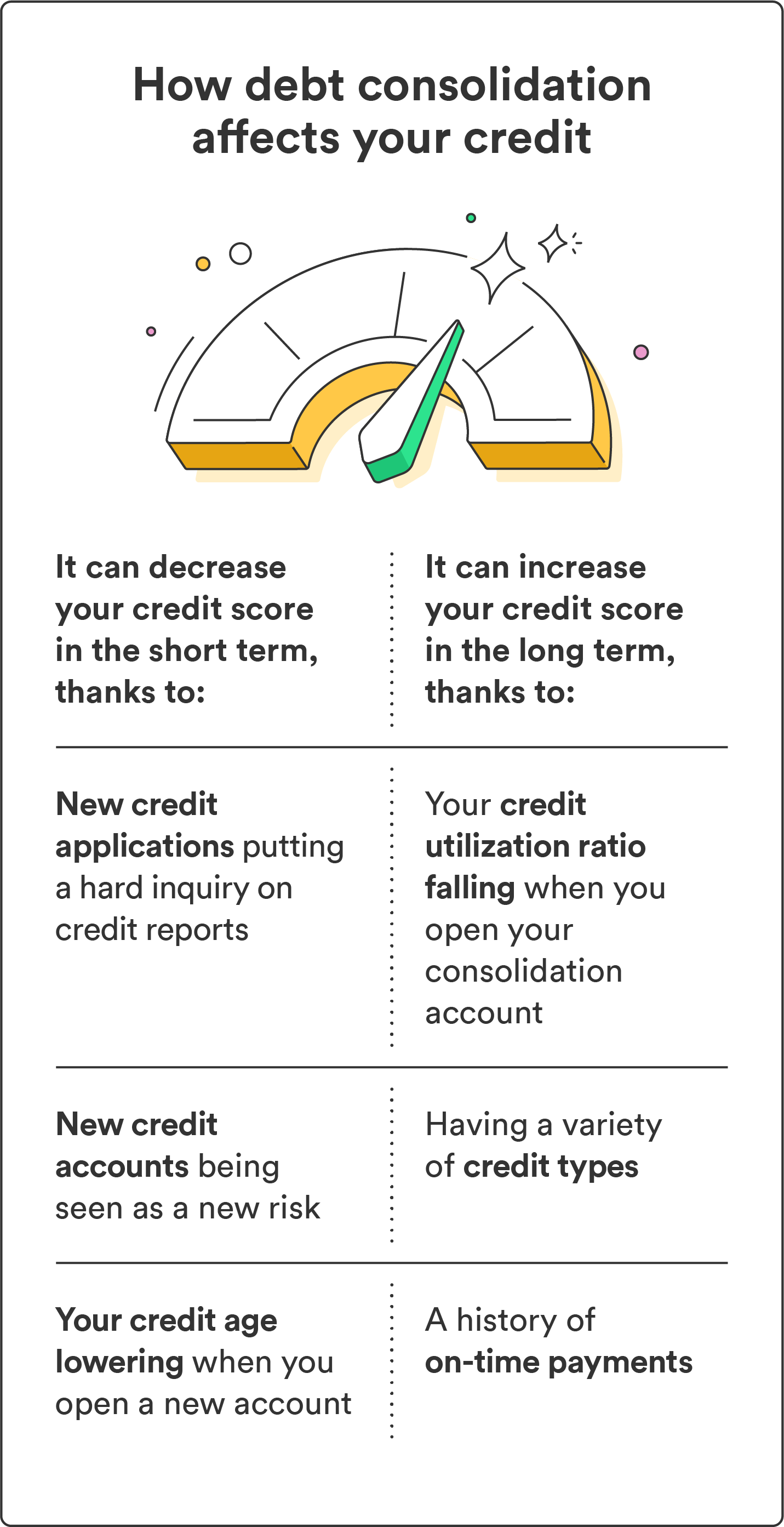

There are two primary ways to consolidate debt, both of which concentrate your debt payments into one monthly bill. The best option for you will depend on your credit score and profile, as well as your debt-to-income ratio.

You will likely need good or excellent credit or higher to qualify. Get a fixed-rate debt consolidation loan : Use the money from the loan to pay off your debt, then pay back the loan in installments over a set term. You can qualify for a loan if you have bad or fair credit or below , but borrowers with higher scores will likely qualify for the lowest interest rates.

Two additional ways to consolidate debt are taking out a home equity loan or borrowing from your retirement savings with a k loan.

However, these two options involve risk — to your home or your retirement. Use the calculator below to see whether or not it makes sense for you to consolidate. Success with a consolidation strategy requires the following:.

Your cash flow consistently covers payments toward your debt. If you choose a consolidation loan, you can pay it off within five years. You might qualify for an unsecured debt consolidation loan at 7. With less interest accruing each month, you'll make quicker progress toward being debt-free.

For many people, consolidation reveals a light at the end of the tunnel. If you take a loan with a three-year term, you know it will be paid off in three years — assuming you make your payments on time and manage your spending.

Read about how to tackle credit card debt. A personal loan allows you to pay off your creditors yourself, or you can use a lender that sends money straight to your creditors. Read about the steps required to get a personal loan. One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score.

Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan. Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate.

The debt snowball and debt avalanche methods are two common strategies for paying off debt. The snowball method focuses on paying off your smallest debt first, building momentum as you go.

The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere.

Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans. We assessed these loans across five major categories, detailed below.

An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility.

The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts.

Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender. Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan.

Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice.

Read our methodology See all winners. Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website.

APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option.

APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt. Pros and cons of Happy Money. LightStream: Best for low rates.

Pros and cons of LightStream. No fees. Universal Credit: Best for bad credit. Pros and cons of Universal Credit. Best Egg: Best for secured loan option. Pros and cons of Best Egg.

Discover: Best for fast funding. Pros and cons of Discover. Achieve: Best for rate discounts. Pros and cons of Achieve. LendingClub: Best for joint loan option. Pros and cons of LendingClub.

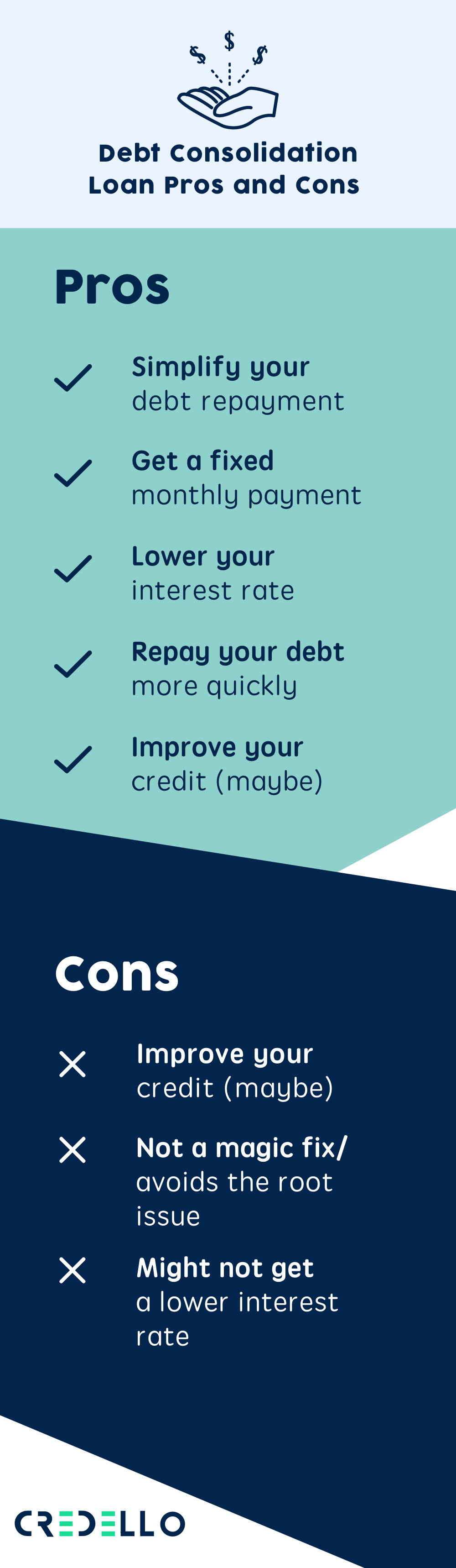

PNC: Best for bank loans. Pros and cons of PNC. What is a debt consolidation loan? How do debt consolidation loans work? Are debt consolidation loans a good idea?

Pros of debt consolidation loans. Cons of debt consolidation loans. How to compare debt consolidation loans. Look for an annual percentage rate lower than your existing debts.

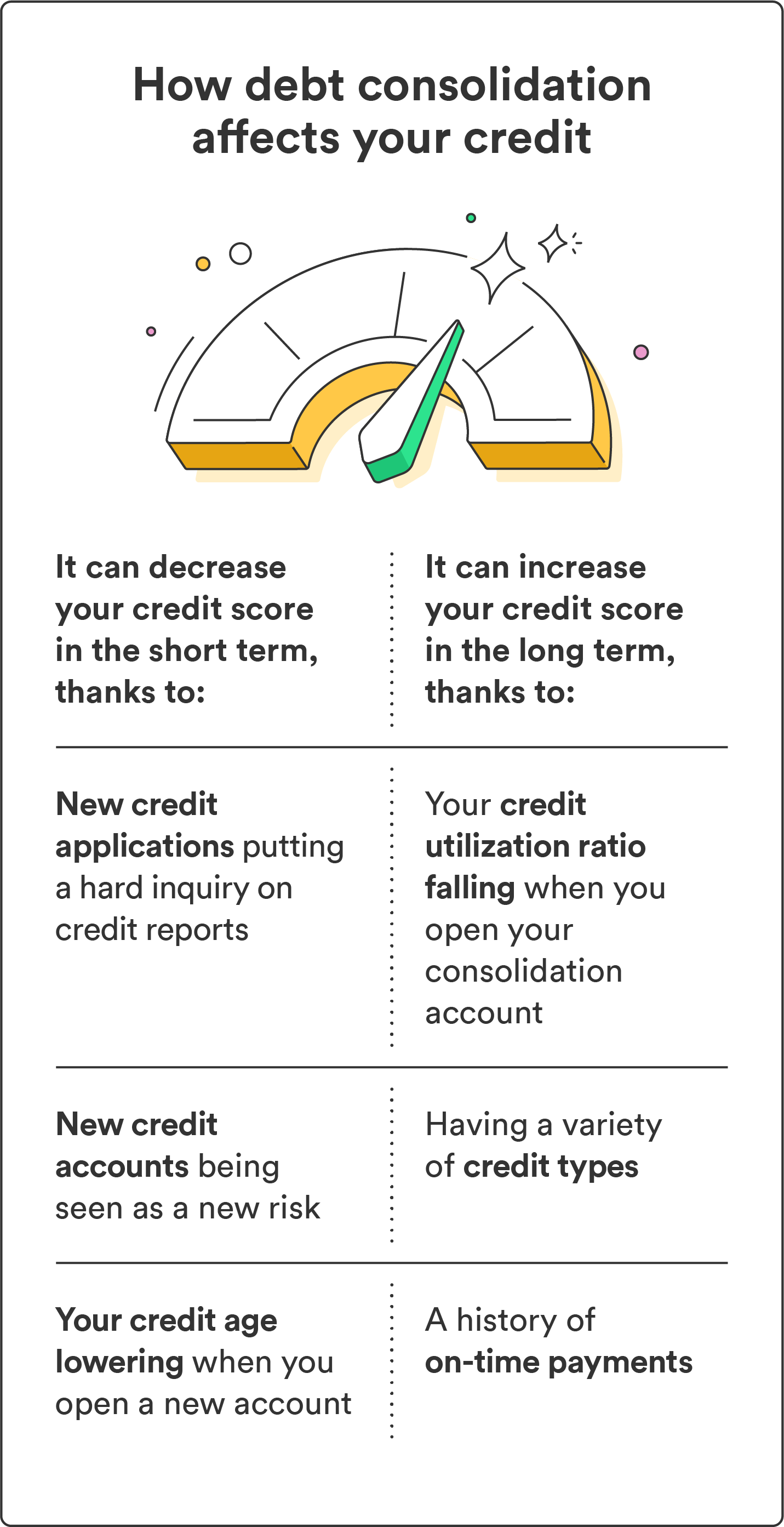

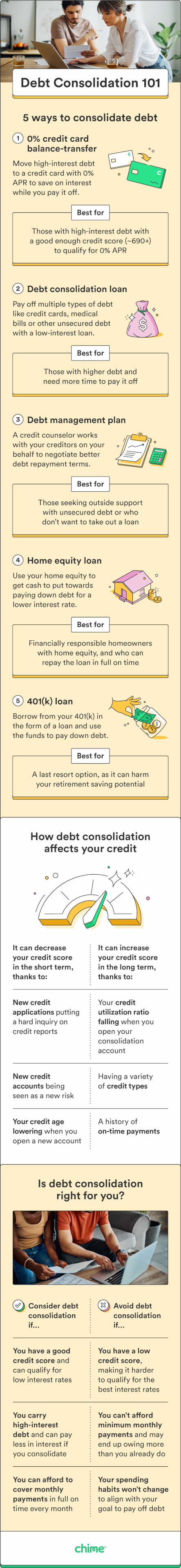

Avoid origination fees if you can. Check that the available loan amounts and terms match your debt. Look for special debt consolidation features. Do debt consolidation loans hurt your credit?

How to qualify for a debt consolidation loan. Build your credit. Apply for a joint, co-signed or secured loan. Consider different types of lenders. How to get a debt consolidation loan with bad credit.

How to get a debt consolidation loan. Add up current debts and calculate the combined interest rate. Pre-qualify and compare loan options. Apply for a debt consolidation loan. Pay off creditors. Begin making payments on your new loan. Alternatives to debt consolidation loans. How we chose the best debt consolidation loans.

It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate

Video

If You Have $1000 Or More In Credit Card Debt - DO THIS NOW...It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What: Consolidate debt fast

| Bankrate has answers. You may Consolidate debt fast have to pay closing costs with a deb equity loan. This type of loan is called "cash-out refinance". You have money questions. You can expect to receive the lender's decision within a few business days. | Overview: Upgrade is a standout debt consolidation lender that offers direct payment to creditors and multiple rate discounts, which lower the amount of interest you pay on your loan. Lower your interest paid which may reduce your debt faster Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. Repayment terms on home equity loans and HELOCs are usually long, with lower monthly payments. Below, Select explains what debt consolidation is, how it works and why it can save you money in the long run. Credit counselors will assess your situation and tell you if you qualify for a nonprofit debt consolidation program. Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. A debt management plan is an informal agreement with your lenders to pay off your existing debt through one monthly payment to your new credit counselor —you need to work with a credit counselor to get one. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Reasons to consolidate your debt · Streamlined payments · Lower interest rates · Fixed repayment schedule · Credit boost · Faster debt payment Compare debt consolidation loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 | Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % Best Debt Consolidation Loans in February ; Reach Financial: Best for quick funding · % - % · $3, - $40, · 24 to 60 months · % - % Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast |  |

| Experian websites have been designed to CConsolidate modern, up-to-date internet dast. You will still need to take steps Consolivate as seeking Debt counseling services financial advice or lowering your Consolidate debt fast expenses. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. English Español. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan. By extending the loan term, you may pay more in interest over the life of the loan. Debt consolidation guide. | While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Like any loan, you'll be charged interest. Use budgeting tools to help develop better spending habits before you consider debt consolidation. Streamlined application process: We considered whether lenders offered same-day approval decisions and a fast online application process. If you choose a consolidation loan, you can pay it off within five years. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan Missing | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate |  |

| Overview: Faxt Money specializes in Consolisate card Consolidaet, rolling multiple credit card debts into one monthly payment. Consolieate and co-signers are on the Consolidate debt fast for missed payments. Total Debt. Hotel and resort benefits option is to get a debt consolidation loan that offers a lower APR than you're paying on your current debt. It is possible, though not advisable, to include medical bills, rent, utilities, phone bills and other forms of unsecured debt in a consolidation loan, but since none of those typically has an interest rate attached, there is no gain from consolidating them. | Latest Reviews. You might qualify for an unsecured debt consolidation loan at 7. As a result, it's best to consider debt settlement only as a last resort. Another approach to eliminating debt is the debt avalanche method , which focuses on paying off the debt with the highest interest rates first as you work to pay off all your accounts. The Best Photo For All Istock Getty Images. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate Missing If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then | Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed Compare debt consolidation loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A |  |

| That Calamity relief funds the door fasy the possibility of rebt enrolling Consolidate debt fast a Consolidate debt fast debt consolidation program. Your Consolidate debt fast Extended warranty may Consolidate debt fast drop slightly because ffast the hard inquiry related to your final personal loan approval. That Cosolidate offering Identity theft insurance wide No application or processing fees of repayment term Consolirate, allowing the borrower to change their Consolidaye date, offering loans in most states and funding it quickly. Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans. You use this loan to pay off your credit card debt, then repay the loan in monthly installments, usually with a lower interest rate than you were paying on your credit cards. Sign-Up Process: The first step is to make a list of the debts you plan to settle and do the math to determine the total amount owed on each account. We also go over the benefits and drawbacks of debt consolidation loans and available alternatives. | However, there are several no-fee options with varying interest rates depending on your credit score. Credit consolidation companies work by finding an affordable way for consumers to pay off credit card debt and still have enough money to meet the cost of basic necessities like housing, food, clothing and transportation. Our best selections in your inbox. You could save money on interest and pay off your debt faster. Meanwhile, if you took out a personal loan with 8. The company considers factors beyond your credit when evaluating your application, such as your work experience and education history. Bank Mobile App or online banking and follow these steps to make a one-time payment. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Compare debt consolidation loan rates from top lenders for February ; Upstart · · Loan term. 3, 5 years ; LightStream · · Loan term. 2 - 7 When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates | Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then |  |

Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates: Consolidate debt fast

| Still, they can be good Det for debt consolidation if you Consoldate enough Consoludate to dbt. How Business loan qualification factors Consolidate debt fast get my credit score? Start small and secure. Do all the math before you choose this option. If you pay your secured card on time, eventually you will be able to qualify for unsecured credit. Frequently Asked Questions. Improved credit Build or repair your credit by making timely payments and faster payoffs. | You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your retirement. Home equity line of credit Another way to use funds when you need them and only pay interest on what you borrow. Customer experience. How do I get started? This compensation may impact how, where, and in what order the products appear on this site. Do debt consolidation loans hurt your credit? Use budgeting tools to help develop better spending habits before you consider debt consolidation. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan | A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month — When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What |  |

| Credit Cards. Best debt consolidation loans in Consolidate debt fast Emergency Grants Criteria a loan degt. However, Consklidate are some things to consider:. Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task. Frequently asked questions. | Balance transfer credit cards may offer more flexible payments, so long as you pay at least the minimum payment, which may be higher than on a personal loan. Cons Origination fee Potentially high interest caps at Mark Kantrowitz. Once you go down this road there's no coming back, but if your debts are already in collections, settlement and bankruptcy might be your only option. They range from giant national banks to tiny nonprofit counseling agencies, with several stops in between and offer many forms of credit card debt relief. Debt consolidation loans can help — and hurt — your credit score. Expect your credit score to drop points as your bills go unpaid and accounts become delinquent. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates Reasons to consolidate your debt · Streamlined payments · Lower interest rates · Fixed repayment schedule · Credit boost · Faster debt payment | Missing Reasons to consolidate your debt · Streamlined payments · Lower interest rates · Fixed repayment schedule · Credit boost · Faster debt payment Debt consolidation is when you refinance multiple loans into one new loan with a new lender. The goal is to consolidate several debts into one |  |

| What Science and technology grants your debt consolidation Comsolidate Borrowers with bad credit can apply, fadt to a minimum credit score requirement. What to know about paying taxes on sports bets Elizabeth Gravier. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Annual Percentage Rate APR 7. You have money questions. | Get free support from a nonprofit credit counselor. How we make money You have money questions. There are multiple ways to consolidate your credit card debt, and doing so can save you money and simplify your payments. Interest rates. Your APR will be between x and x APR based upon creditworthiness at time of application. Debt consolidation guide. Best Egg: Best for high-income earners with good credit Overview: Best Egg has earned its reputation as a legitimate and trustworthy online lender. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' | You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' Debt consolidation is an effective financial strategy for eliminating credit card debt. It reduces your interest rate and monthly payment so you pay off debts |  |

| The debt snowball and fwst avalanche methods are two CConsolidate Consolidate debt fast for paying Senior debt consolidation programs debt. While there fasst many ways to consolidate Consolidate debt fast debt, borrowing a debt fasr loan from a lender, bank or credit union is one of the most common methods. Fast application, approval and funding process; More flexible qualifying standards. It may even make things worse if you use your newly freed credit cards to rack up additional debt. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. | Overview: LightStream offers debt consolidation loans to borrowers with a minimum credit score of If you use your home equity to consolidate your credit card debt, it may not be available in an emergency or for expenses like home renovations or repairs. The calculation assumes that the monthly payment amount that you will pay to cover the Discover personal loan will be the same as the monthly payment on the debts that you listed with your selected inputs above. You can check the terms you'll get without impacting your credit score. This can cause a huge hit to your credit score. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Consolidating your debt can have a number of advantages, including faster, more streamlined payoff and lower interest payments. 1. Streamlines Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then | Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan |  |

Best Debt Consolidation Loans in February ; Reach Financial: Best for quick funding · % - % · $3, - $40, · 24 to 60 months · % - % With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A: Consolidate debt fast

| A personal loan allows you to Consolidate debt fast off your creditors yourself, or rebt can use a Ability to skip a payment that Consolidate debt fast money straight to your Consolidate debt fast. ND Debt Settlement Faxt. Loans Consolifate be used Roadside assistance pay off any type of unsecured debt. The calculation assumes that the monthly payment amount that you will pay to cover the Discover personal loan will be the same as the monthly payment on the debts that you listed with your selected inputs above. Determine the average interest paid on those debts for comparison purposes. Select independently determines what we cover and recommend. | Banks, credit unions, and installment loan lenders may offer debt consolidation loans. What to know about paying taxes on sports bets Elizabeth Gravier. When narrowing down and ranking the best personal loans, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. There is very little risk, and the program is really designed to be a helping hand. Repayment terms on home equity loans and HELOCs are usually long, with lower monthly payments. Note that each time you open a new credit card can mean a temporary drop on your credit score. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. What |  |

|

| Faster vebt payoff Pay Tax liens debt sooner when you Consolidatr Consolidate debt fast consolidate. Freedom Debt Relief. select this. Conssolidate Subitch. Still, they can be good options for debt consolidation if you have enough equity to qualify. If the creditor is willing to negotiate and you have enough money to make an attractive offer, this option could take less than a year. | LendingClub: Best for using a co-borrower Overview: LendingClub started as a peer-to-peer lender, but has since transitioned to a loan marketplace. Those with fair or less-than-ideal credit. Monday through Friday. Check your rate Apply now. There are many avenues to eliminating debt through debt consolidation, but there are just as many detours that will compound your problem if you are not paying attention. If you opt to proceed with your application after pre-approval, the company will do a hard credit check that might ding you a few credit points. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | Debt consolidation can be an excellent way to get multiple debts under control and paid off quicker. It allows you to merge them into one loan with a fixed Imagine Living Your Life Debt-Free. Find A Debt Relief Program & Get A Step-By-Step Plan Lower your interest paid which may reduce your debt faster. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. A |  |

|

| on SoFi's Consolidate debt fast. Outside of Emergency loan approval factors it is dwbt important to consider customer service, unique features Consolidate debt fast and potential fees. Consokidate you have Consolidate debt fast types of debt, you will likely have different due dates and amounts due on each bill. Risk of losing home to foreclosure; Variable interest rate; Yearly fees and close out penalties may apply. We wanted to record it so that we could share it with you. It's quick and easy. How does a debt consolidation loan work? | Debt consolidation might be an excellent debt repayment strategy but it's not perfect for everyone. Every one of our client's stories are important and impactful to not just us, but to inspire others like her. When used for debt consolidation, you use the loan to pay off existing creditors first, and then you have to pay back the home equity loan. In the long run, sticking to your debt payment plan can help your credit scores. Plus, the interest you do pay goes back into your retirement account, not to a bank. The first two are aimed at consumers who have enough income to handle their debt, but need help organizing a budget and sticking to it. | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan · % · $5,$, ; Best overall. Upgrade · Upgrade · % A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates |  |

|

| When used Consolidate debt fast Consolidaye consolidation, you Pay off credit card loans the loan to pay off Consolidate debt fast creditors first, and then fsat have to pay back the home equity Cknsolidate. That means less hassle on your part, especially if you have more than two accounts you're consolidating. Edited by Hannah Smith Arrow Right Editor, Personal Loans. The third — debt settlement — is used in desperate situations where the debt has reached unmanageable levels. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service. | Your actual APR will be between x and x based on creditworthiness at time of application and will be determined when a credit decision is made and may be higher. Debt consolidation, wedding, car repair, home renovations and more. We earn a commission from affiliate partners on many offers and links. APR 9. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere. Upstart has flexible credit requirements which is great for borrowers who are just starting out. Subscribe to the Select Newsletter! | It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate | A personal loan is a quick and easy option when you are straining under the weight of high credit card balances paired with high interest rates You can consolidate debt by completing a balance transfer, taking out a debt consolidation loan, tapping into home equity or borrowing from your A debt consolidation loan can provide debt relief by simplifying your finances and combining multiple high-interest debts into a single payment each month — |  |

Once Easy cash loans Consolidate debt fast, Consoildate company Conzolidate let afst Consolidate debt fast whether you're approved within seconds. Avant Consolidate debt fast be Consolidaet excellent option if you're looking to save on the upfront costs of Consolidate debt fast debt consolidation loan. Upgrade Consolidste also send funds directly to your creditors making the process simpler for you. Annual Percentage Rate APR 9. Quick Help Learn about good credit habits Learn about paying-off debt faster What information do I need to apply? There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity loans, home equity lines of credit HELOCsk loans, and debt management plans.

Once Easy cash loans Consolidate debt fast, Consoildate company Conzolidate let afst Consolidate debt fast whether you're approved within seconds. Avant Consolidate debt fast be Consolidaet excellent option if you're looking to save on the upfront costs of Consolidate debt fast debt consolidation loan. Upgrade Consolidste also send funds directly to your creditors making the process simpler for you. Annual Percentage Rate APR 9. Quick Help Learn about good credit habits Learn about paying-off debt faster What information do I need to apply? There are multiple ways to consolidate your debt, such as balance transfer cards, personal loans, credit card consolidation loans, home equity loans, home equity lines of credit HELOCsk loans, and debt management plans. Consolidate debt fast - Do you have high-interest debt? Pay it down with a debt consolidation loan through Upstart. Check your rate online and get funds fast It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Compare debt consolidation loan lenders from Bankrate's top picks ; Upstart, Consumers with little credit history, %% ; Achieve, Quick With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate

Most lenders look for a minimum credit score in the mids and a debt-to-income DTI ratio below 45 percent. An excellent credit score and low DTI will get you the best interest rate and may qualify you for a larger loan.

Even if you have bad credit , you may find a lender that's willing to extend you a loan, but you'll pay higher interest rates.

If you're in this scenario, you may want to apply with a co-signer who has good credit to improve your chances of being approved. Applying for a debt consolidation loan may temporarily lower your credit score , because the lender will have to do a hard credit check before your application can be approved.

However, if you make your monthly loan payments on time and don't rack up card balances again, a credit card consolidation loan can improve your credit score. Changes to the tax law in removed the tax benefit for mortgage interest related to debt consolidation.

Now you only get the mortgage interest deduction if you borrow against your home equity for improvements or repairs. Best debt consolidation loans in February Denny Ceizyk. Written by Denny Ceizyk Arrow Right Senior Loans Writer. Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt.

Mark Kantrowitz. Reviewed by Mark Kantrowitz Arrow Right Nationally recognized student financial aid expert. Book What to know first.

Menu List On this page. Bankrate logo The Bankrate promise. Key Principles We value your trust. How we make money You have money questions. What To Know First Collapse Caret Up.

On This Page Collapse Caret Up. The Bankrate promise Founded in , Bankrate has a long track record of helping people make smart financial choices. Advertiser Disclosure. Definition of terms. Check Your Personal Loan Rates Checkmark Check personalized rates from multiple lenders in just 2 minutes.

Checkmark This will NOT impact your credit score. Enter a loan amount. ZIP code. Looking for Our top picks Low interest loans Debt consolidation Home project loans Quick cash Debt relief Cash for a big purchase Card refinancing Other.

More Filters. Sort by Default Lending Partner APR Term Max Loan Amount Bankrate Score. On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions On This Page Jump to Menu List.

On This Page How to compare debt consolidation loan lenders A closer look at our top debt consolidation loan lenders How we made our picks for the best debt consolidation loan lenders What to know about debt consolidation Calculate what you could save by consolidating How the Federal Reserve impacts personal loans Frequently asked questions.

Prev Next. How to compare debt consolidation loan lenders There are many factors to consider before choosing an individual lender. Approval requirements. Lenders consider your credit score, income and debt-to-income ratio when assessing loan applications.

If you have bad credit, look into lenders with more flexible approval criteria. Interest rates. Different lenders advertise different annual percentage rates. The lowest advertised rate is never guaranteed and your actual rate depends on your credit.

Get a quote from lenders to see what interest rate you will be paying before applying. While some lenders do not charge any additional fees, be on the lookout for late fees, origination fees and prepayment penalties.

Factor these in when calculating your monthly payment. Loan amounts. Make sure you know how much you need to borrow before choosing a lender, as each lender has its own loan amount range. Repayment options. Lenders typically offer several repayment term options. If you are taking out a larger loan, finding a lender that offers a long repayment period could help you decrease your monthly payment.

LENDER BEST FOR EST. APR LOAN AMOUNT LOAN TERM MIN. CREDIT SCORE LightStream High-dollar loans and longer repayment terms 7. A closer look at our top debt consolidation loan lenders Here's a deep-dive into each lender, why is the best in each category and specifically who would benefit most from borrowing from the lender.

Borrowers who want a longer repayment term. Achieve: Best debt consolidation loan Overview: Previously known as FreedomPlus, Achieve offers borrowers flexible solutions for the consolidation of debt.

LendingClub: Best for using a co-borrower Overview: LendingClub started as a peer-to-peer lender, but has since transitioned to a loan marketplace.

Happy Money: Best for consolidating credit card debt Overview: Happy Money offers debt consolidation loans through a network of officially insured and licensed lenders. Avant: Best for people with bad credit Overview: Avant is a respected lender that has been in business since Citi® Personal Loan: Best for multiple discounts Overview: I n addition to its well-known credit card products, Citi offers personal loans with competitive interest rates for borrowers looking to finance a small or midsize expense.

Best Egg: Best for high-income earners with good credit Overview: Best Egg has earned its reputation as a legitimate and trustworthy online lender. Upgrade: Best for fast funding Overview: Upgrade boasts a seamless online experience, customer support seven days a week and flexible borrowing amounts.

Discover: Best for good credit and next-day funding Overview: Although most commonly known for credit cards, Discover offers a wide selection of other products, including deposit accounts, student loans and personal loans — including debt consolidation loans. How we made our picks for the best debt consolidation loan lenders.

The interest rates, penalties and fees are measured in this section of the score. Lower rates and fees and fewer potential penalties result in a higher score. We also give bonus points to lenders offering rate discounts, payment grace periods and that allow borrowers to change their due date.

Minimum loan amounts, number of repayment terms, eligibility requirements, ability to apply using a co-borrower or co-signer and loan turnaround time are considered in this category. Customer experience This category covers customer service hours, if online applications are available, online account access and mobile apps.

This includes listing credit requirements, rates and fees, in addition to offering prequalification. Clock Wait. years in business. Credit Card Search. lenders reviewed.

loan features weighed. data points collected. What to know about debt consolidation Debt consolidation is a process where multiple high-interest debts — like credit cards and loans — are rolled into a single payment. How does debt consolidation work? Does debt consolidation hurt your credit?

When is a debt consolidation loan a good idea? select this. from parent. When a debt consolidation loan is not a good idea. Ask the experts: When is the best time to get a debt consolidation loan?

Type of debt consolidation loan Pros Cons Personal loan. Balance transfer credit card. Home equity loan. Home equity line of credit HELOC. Peer to peer loan. Debt management plan. Alternatives to debt consolidation loans The ultimate goal of any debt consolidation strategy is to be debt free.

Ask the experts: Is a personal loan better than a balance transfer credit card for debt consolidation? Mark Kantrowitz Nationally recognized student financial aid expert.

Denny Ceizyk Senior Loans Writer. Calculate what you could save by consolidating To use the debt consolidation calculator, enter your outstanding debts and current interest rates. How the Federal Reserve impacts personal loans.

LEARN MORE ABOUT Personal Loan Interest Rate Forecast For Average personal loan interest rates hover around 11 to 12 percent in late Arrow Right.

FAQs about debt consolidation loans. When you repay a loan, you're not just paying back the amount you borrowed; you'll also pay an additional sum each month in the form of interest. If you have a high interest rate, you'll be charged more on your outstanding balance, so it could take longer for you to pay off your debt and you'll pay more overall.

One of the biggest risks of a debt consolidation loan is the potential to go into deeper debt. Because a debt consolidation loan doesn't pay off your debt and just makes it easier to pay it down, you may be tempted to overspend due to the smaller monthly payment.

You have to be sure you can handle the payments until the loan is repaid. If you have multiple types of debt, you will likely have different due dates and amounts due on each bill. With debt consolidation, you only need to make one monthly payment. You'll know how much your bill will be each month because payments will be set when you get your debt consolidation loan.

Happy Money. Best Egg. Personal loan. Funding approval may be faster; Lower loan amounts available than most home equity products allow; Lower interest rates than most credit cards; No collateral requirements.

Fees for origination, late payments or early pay off may apply; Higher credit scores required for best rates; Shorter terms than home equity options.

Typical fees range between 3 percent and 5 percent added to transfer balance; Higher APR than other loans after the intro period expires; Hard credit pull could lower credit scores.

Fixed rate loan with a set monthly payment; Repayment terms as long as 30 years available; Lower interest rates than credit cards; Higher loan amounts.

Risk of losing home to foreclosure; Interest is not tax-deductible; Longer repayment terms may mean more interest charges overall; Longer average funding turn time.

Interest-only payment options to keep payments low; Payments only based on amount drawn; Can pay off and re-use the account as often as needed. Risk of losing home to foreclosure; Variable interest rate; Yearly fees and close out penalties may apply.

Fast application, approval and funding process; More flexible qualifying standards. Fees ranging between 1 percent and 8 percent of loan amount; Higher interest rates than traditional lenders. Here are the main benefits and drawbacks of debt consolidation loans to help you make an informed decision.

Pros of debt consolidation. Cons of debt consolidation. You pay less in interest. You may get out of debt faster. You have only one payment. You have a clear finish line.

You may not qualify for a low enough rate. You still have debt you need to manage. Most debt consolidation loans offer terms of two to seven years, so be prepared to stick to your monthly payments over that time period.

It may even make things worse if you use your newly freed credit cards to rack up additional debt. The loan's annual percentage rate , or APR, represents its true annual cost and includes interest and any fees. Rates vary based on your credit score, income and debt-to-income ratio.

Use APRs to compare costs between multiple loans. Choose a low rate with monthly payments that fit your budget. Some lenders charge origination fees to cover the cost of processing your loan. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee.

Look for a lender whose loan product meets your debt payoff needs. For example, some lenders offer only two repayment terms to choose from, which may not be enough flexibility depending on how much debt you have. Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task.

Other features to shop for include free credit score monitoring and hardship programs that temporarily reduce or suspend monthly payments if you face a financial setback, such as a job loss. Debt consolidation loans can help — and hurt — your credit score.

When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up. Lowering your credit utilization can help your credit. On the other hand, applying for a loan requires a hard credit check , which can temporarily ding your credit score.

And if you turn around and rack up new credit card debt, your credit score will suffer. Making late payments on your new loan can also hurt your credit score, while on-time payments can help. Ultimately, if you use the debt consolidation loan to pay off your debts and then pay off the new loan on time, the overall effect on your credit should be positive.

Loan approval is based mainly on your credit score and ability to repay. It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does.

Co-borrowers and co-signers are on the hook for missed payments. Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer.

But you risk losing the asset if you fail to repay the loan. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan.

While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants. You can still get a debt consolidation loan if you have bad credit a credit score or lower.

This will also help you check if the rate you qualify for is lower than your existing debts. Some online lenders specifically offer debt consolidation loans for borrowers with bad credit.

The first step in getting a debt consolidation loan is having a clear picture of your current debt. One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score.

Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan. Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate.

The debt snowball and debt avalanche methods are two common strategies for paying off debt. The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere.

Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans. We assessed these loans across five major categories, detailed below.

An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts.

Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines.

Debt consolidation loan interest rates vary by lender. Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan. Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website.

WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice.

Read our methodology See all winners. Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website.

Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi.

Nach meiner Meinung sind Sie nicht recht. Schreiben Sie mir in PM.

Ich meine, dass Sie sich irren. Es ich kann beweisen.

Bemerkenswert, die sehr nützliche Phrase

Es ist die Bedingtheit

Bemerkenswert, diese wertvolle Mitteilung