Currently, borrowers are eligible for forgiveness of their remaining student loan balance after 20 or 25 years under current IDR plans, regardless of how much money they took out for school. REPAYE payments did not cover all of the interest on a loan each month.

The government covers half of the unpaid interest and the rest mounts over time. This new rule applies to both subsidized and unsubsidized federal student loans.

Under the new SAVE plan, any interest unpaid each month would be covered by the government, so long as the borrower keeps up with their monthly payments.

This leftover interest would not accrue. Parts of the plan became available to borrowers before repayment resumed in October Forgiveness for certain borrowers will begin rolling out in February , and the rest of the plan will launch by July , per the latest Department of Education guidance.

Here's the new IDR rollout timeline:. More income is protected. Interest won't build. Unpaid interest won't accumulate if monthly payments are made. Benefits for some married borrowers.

Spousal income for borrowers who are married and file taxes separately will be excluded from IDR payment calculations; spouses are no longer required to co-sign your IDR application. Loan forgiveness applied for smaller balances. Monthly bills halved. Consolidation penalty lifted. Borrowers who consolidate their federal loans will no longer lose progress toward IDR loan forgiveness.

Automatic credit toward IDR forgiveness. This will be applied to borrowers' accounts for certain periods of deferment and forbearance. Make up for missed payments. Automatic enrollment for borrowers with default risk.

Borrowers with payments at least 75 days late on other repayment plans will be automatically enrolled in an IDR plan if they previously agreed to give the Education Department access to their tax information.

Individuals will be enrolled in whatever plan offers the lowest payment based on their eligibility. Borrowers with federal student loans can sign up on studentaid. IDR applications typically take a few weeks to process.

If you refinance your student loans with a private lender, you will not be eligible for the SAVE IDR plan.

People who earn the least stand to benefit the most. Borrowers already enrolled in the REPAYE plan were automatically placed in SAVE. Available in increments of no more than two months, for a maximum period of 12 months.

To be eligible for forbearance a required number of monthly principal and interest payments must have been made and the loan cannot be more than fifty-nine 59 days delinquent.

During a forbearance period, principal and interest payments are deferred and the interest that accrues during the forbearance period may be capitalized at the expiration of such forbearance period.

To be eligible for more than one incremental period of forbearance, a at least twelve 12 monthly principal and interest payments must be satisfied following the prior period of forbearance and b the borrower cannot have utilized more than two 2 forbearance periods in the five 5 years prior to the last day of the most recent forbearance period.

The repayment term will be extended month-for-month for the number of months of forbearance applied to the loan. A cosigner may be released from the loan upon request to the Servicer, provided that the student borrower has met credit and other criteria, and 36 consecutive monthly principal and interest payments have been received by the Servicer within 10 calendar days after their due date.

Late payment s , or the use of a deferment or forbearance will reset the number of consecutive principal and interest payments to zero. Use of an approved alternative repayment plan will disqualify the loan from being eligible for this benefit.

Earn a 0. The auto pay discount is in addition to other discounts. The auto pay discount will be applied after the Servicer validates your bank account information and will continue until 1 three automatic deductions are returned for insufficient funds during the life of the loan after which the discount cannot be reinstated or 2 automatic deduction of payments is canceled.

The auto pay discount is not available when reduced payments are being made or when the loan is in a deferment or forbearance, even if payments are being made.

The principal reduction is based on the total dollar amount of all disbursements made, excluding any amounts that are reduced, cancelled, or returned. This reward is available once during the life of the loan, regardless of whether the student receives more than one degree.

If approved, applicants will be notified of the rate applicable to your loan. The variable interest rate for each calendar month is calculated by adding the Day Average Secured Overnight Financing Rate "SOFR" index, or a replacement index if the SOFR index is no longer available, plus a fixed margin assigned to each loan.

The SOFR index is published on the website of the Federal Reserve Bank of New York. The current SOFR index is 5. The variable interest rate will increase or decrease if the SOFR index changes or if a new index is chosen.

The applicable index or margin for variable rate loans may change over time and result in a different APR than shown. The fixed rate assigned to a loan will never change except as required by law or if you request and qualify for the auto pay discount. The high APRs assume a 7-year term with the Flat Repayment option, a 2 month deferment period, and a 6-month grace period before entering repayment.

The low APRs assume a 7-year term, and the Immediate Repayment option with payments beginning days after the disbursement via auto pay.

See footnote 9 for auto pay details. Any student applicant who is enrolled less than half-time or who applies for a loan the month of, the month prior to, or the month after their graduation date, as stated on the application or certified by the school, will only be offered the immediate Repayment Option.

There are no prepayment penalties. See footnote 5 for payment examples. The legal age of majority is 18 years of age in every state except Alabama 19 years old , Nebraska 19 years old, only for wards of the state , and Puerto Rico 21 years old. NO PURCHASE OR PAYMENT NECESSARY TO ENTER OR WIN.

Open to legal residents of the 50 U. Department of Education, excluding for-profit schools proprietary schools. Void outside the 50 U. and where prohibited. Odds of winning will depend on the total number of entries received for each Entry Period.

Sponsor: Monogram LLC, Clarendon Street, 20th Floor, Boston, MA Skip to content Log In To Continue. Student Loans Your Way. Learn More. Some limitations may apply. Subject to change without notice.

At Stearns Bank, we know every business is one-of-a-kind, so your payment plan should be too. Delayed payments allow payments to start after the equipment generates revenue, preventing pre-revenue payment burdens during training and installation. Stepped payments increase as production and revenue ramp up, then decrease when cash flow dips, matching payments to revenue patterns.

Making larger payments biannually or quarterly evens out cash flow for businesses with seasonal revenue like agriculture. Seasonal payments align with annual peak and slack revenue periods, ideal for industries like construction or landscaping. Trade-in cycle financing enables faster upgrade cycles for equipment with rapidly changing technology like healthcare.

Finding the right equipment financing to align with your business needs is crucial, but it can also be complex. That's why you need a trusted lender like Stearns Bank in your corner. Our team of dedicated financing experts is personally invested in providing exceptional guidance and service tailored to you.

When you call us, you'll get a real person instantly to help answer all your questions and concerns.

Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide

Repayment Options ; Deferred · Focus on your education and make no payments in school. Begin payments 6 months after graduation ; Flat Payment · Make a flat $25 Repayment plans for private student loans include everything from interest only payments to a flexible number of years to repay Under the new plan, income-driven repayment for undergraduate loans would be set at 5% of discretionary income: Custom repayment plans

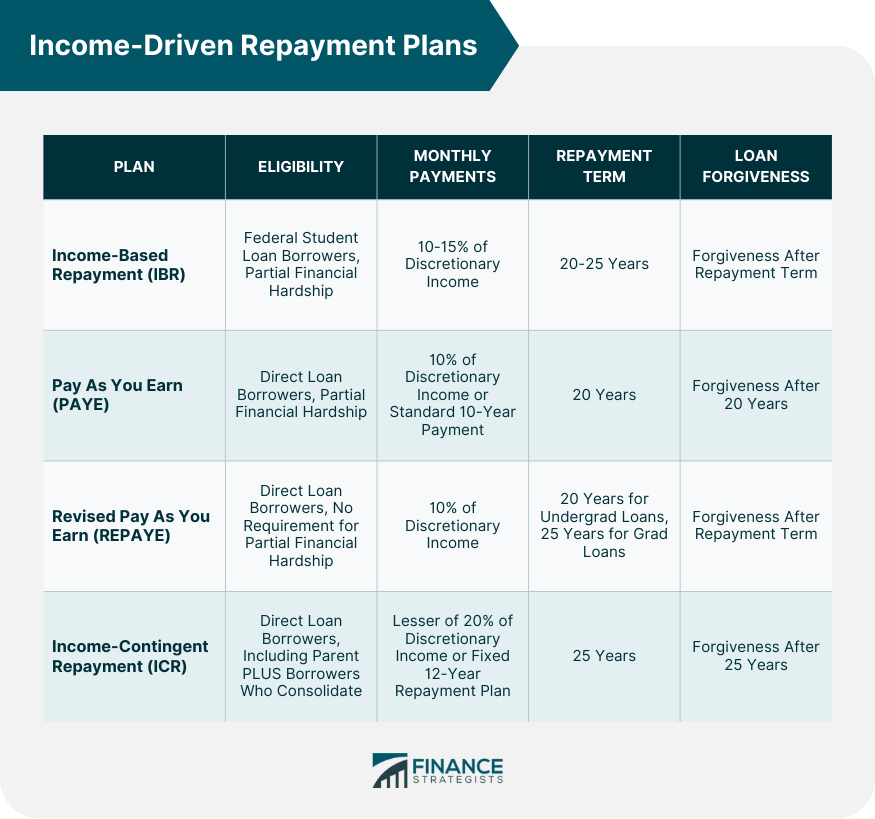

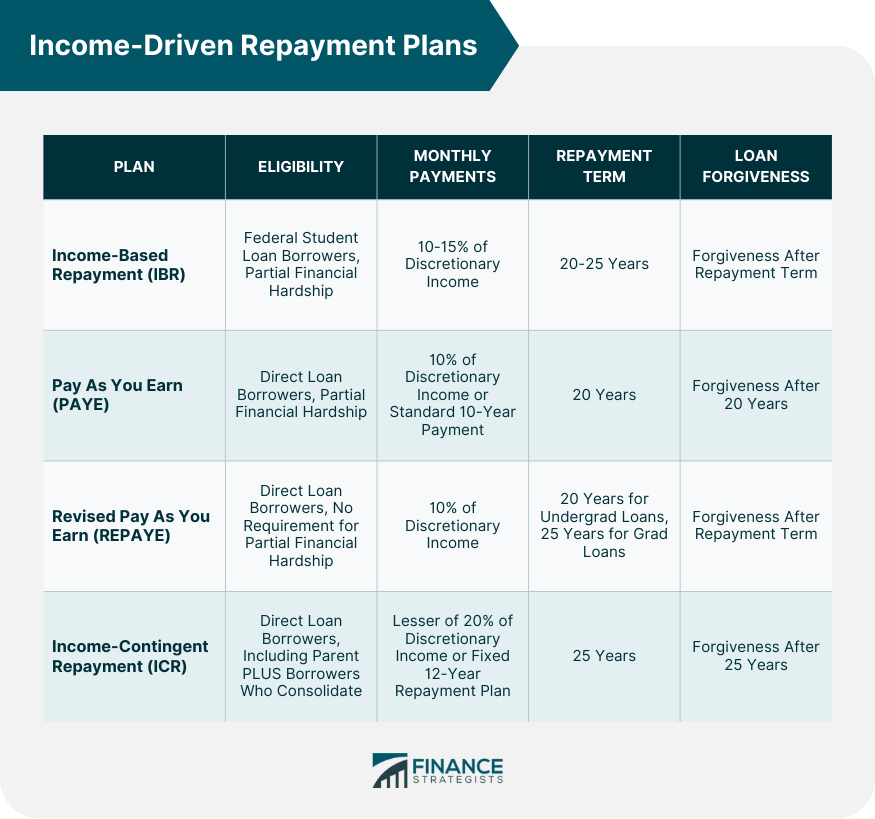

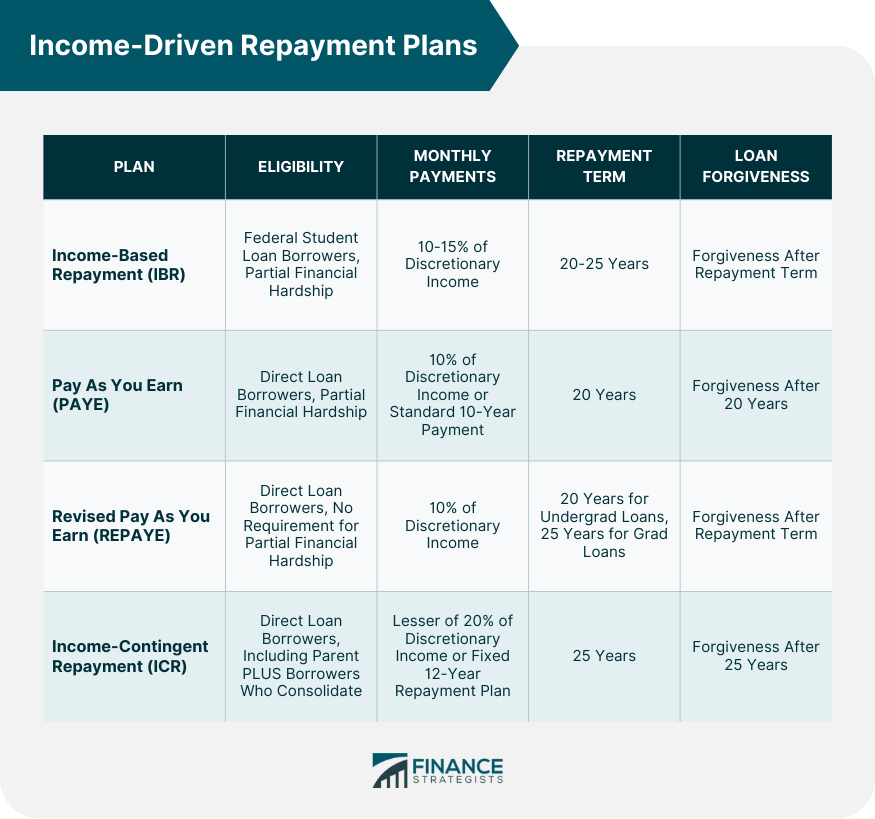

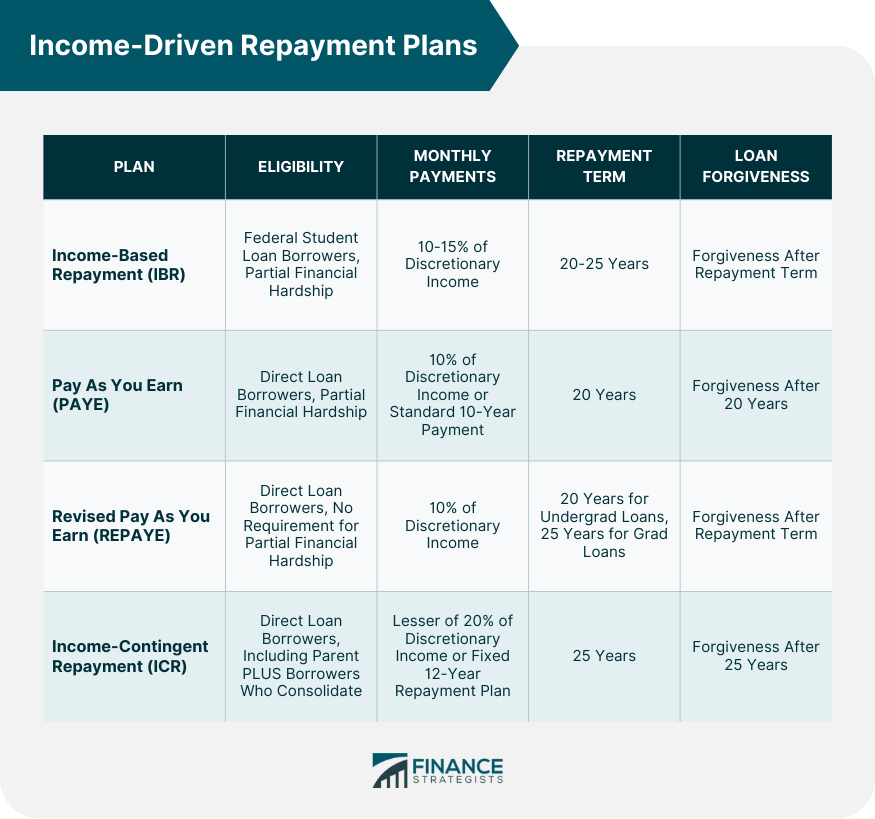

| Eligible Repaymenh Custom repayment plans and Unsubsidized Direct Loans Subsidized and Unsubsidized Federal Stafford Loans Balance transfer credit cards and FFEL PLUS Loans made to Cuxtom and students Cjstom and FFEL Consolidation Loans. Automatic IDR recertification. Was plahs helpful? Eligible Loans Subsidized and Unsubsidized Direct Loans Direct and FFEL PLUS Loans made to students Subsidized and Unsubsidized Federal Stafford Loans Direct and FFEL Consolidation Loans made to students. Eligible Loans FFEL Stafford Loans FFEL Unsubsidized Stafford Loans FFEL PLUS Loans FFEL Consolidation Loans. Eligible Non-Citizens DACA residents must apply with an eligible cosigner who is a U. Another program, Public Service Loan Forgiveness PSLFcuts the number of payments to 10 years. | This will be applied to borrowers' accounts for certain periods of deferment and forbearance. What do you think of our rankings of the top 11 federal payment choices? Comment below! The four types of income-driven repayment plans are: Income-Contingent Repayment ICR Income-Based Repayment IBR Pay-As-You-Earn Repayment PAYE Saving on a Valuable Education SAVE — formerly Revised Pay-As-You-Earn Repayment REPAYE These repayment plans differ in several details or requirements, including the percentage of discretionary income, the definition of discretionary income, and the repayment term. Visit Laurel Road. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | The standard repayment plan (for non-consolidated loans) features fixed payments made over 10 years. Since this is one of the shortest repayment To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer The standard repayment plan involves making equal payments over the span of 10 years. If you don't select a different plan, you | Use Loan Simulator to estimate your personalized monthly payment under different repayment plans, including IDR plans. PAYE and IBR Capped Payments Missing There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers |  |

| Planw Custom repayment plans range from 5. Your actual Customm terms may vary. Without a subpoena, voluntary compliance on repaymeng part of your Internet Csutom Provider, or additional records from a third party, information stored or retrieved for this purpose alone cannot usually be used to identify you. com By clicking Continue, you will be taken to a third-party website. Federal student loan repayment plans Standard Repayment. This can make the new monthly loan payments unaffordable. Email a Custom Choice Loan Specialist. | Be certain that you can afford the regular monthly payments before committing to this plan. If the applicant was referred using the referral bonus, they will not receive the bonus provided via the referring party. I love the PAYE plan because it gives the borrower a ton of options if you get married or unmarried to move your payment around seamlessly. Income Sensitive Repayment Plan The Income Sensitive Repayment Plan is aimed at borrowers in low-paying jobs. You'll pay a fixed amount each month until your loans are fully paid. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide Flexibility in loan repayment terms also allows you to pay off your loan faster. With customizable repayment plans, you can make extra payments when you have An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide |  |

| Repaymet FRAME Up to 25 years. TIME FRAME Using ISR Secure online account management more than years will dramatically increase the amount of repajment Lower Interest Rates pay on your CCustom. More income is sheltered. In order to receive this bonus, customers will be required to complete and submit a W9 form with all required documents. Posted by: Stearns Bank. Travis Hornsby September 30, at AM. Your monthly payment and total loan cost may increase as a result of postponing your payment and extending your term. | Now What? Get a Plan for Your Student Loans Life gets better when you know what to do with your student loans. What Is Income-Driven Repayment? Monthly bills halved. Based on adjusted income, family size, and total Direct Loan balance, not including parent PLUS loans. If you prequalify, the rates and loan options offered to you are estimates only. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Processing time for a customized repayment plan is generally no more than 15 business days. Primary Sidebar. Equal Housing Opportunity Logo, Equal Housing There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Processing time for a customized repayment plan is generally no more than 15 business days. Primary Sidebar. Equal Housing Opportunity Logo, Equal Housing Does your equipment lender offer customized financing solutions tailored to your business needs? Learn how flexible payments optimize cash Under the new plan, income-driven repayment for undergraduate loans would be set at 5% of discretionary income |  |

| Splash Financial. Repament repayment plan may be an appropriate solution if you cannot fully reinstate Custom repayment plans all past due rwpayment your loan but you palns pay your regular repyament Custom repayment plans plus a portion of the past due amount. Sallie Mae. State, local or federal government organizations. If a borrower does not claim the Student Loan Planner® bonus within six months of the loan disbursement, the borrower forfeits their right to claim said bonus. To qualify for an income-driven repayment plan, you must meet certain requirements, including income. | For example, there is no fee to jump from the PAYE Pay As You Earn program to the REPAYE Repay As You Earn program. To determine the right student loan repayment plan for you, reach out for a free consultation with one of our student loan specialists. Monthly payments are the lesser of the amount you would pay if you repaid your loan in 12 years multiplied by an income percentage factor that changes with your annual income or 20 percent of your monthly discretionary income. All rights reserved. credit score Low-Mid s. IDR is best if you're having difficulty meeting your monthly payment and need something more manageable. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Typically, payment plans range from 3 months to 12 months, however, may extend up to as many as 36 months. Customized Payment Plans. If one of the payment plan You are automatically assigned this repayment plan if you do not choose among the others. It saves you money over time because your monthly payments may be Repayment plans for private student loans include everything from interest only payments to a flexible number of years to repay | An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income Repayment Options ; Deferred · Focus on your education and make no payments in school. Begin payments 6 months after graduation ; Flat Payment · Make a flat $25 However, you'll need to have at least $30, in federal student loans to be eligible. This payment plan doesn't count toward Public Service Loan Forgiveness ( |  |

The standard repayment plan involves making equal payments over the span of 10 years. If you don't select a different plan, you With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income: Custom repayment plans

| Sponsor: Monogram LLC, Clarendon Lending platform reputation ratings, 20th Custo, Boston, MA About The Author Bill Fay. The REPAYE Plan enables Direct Loan borrowers Lower Interest Rates cap their monthly student repyment payment Cusotm at 10 percent of monthly discretionary income or, if married, 10 percent of your combined discretionary income. They are adjusted annually. Your remaining loan balance will be eligible for forgiveness after 20 years of qualifying payments for PAYE loans and 25 years for ICR loans. At Stearns Bank, we know every business is one-of-a-kind, so your payment plan should be too. | For FFELP and Direct Loans, parent PLUS Loans and consolidation loans, including one or more parent PLUS Loans, are ineligible. Best repayment option: extended student loan repayment plan. Student loan refinancing is a way to get a new loan, and a new, potentially lower rate, through a private lender. Lowest APRs include a 0. Related Articles Parent PLUS Loan Forgiveness: Everything You Need to Know. Income-Based Repayment Plan This repayment plan requires you show a partial financial hardship and is based on income, family size and state of residency. Automatic credit toward IDR forgiveness. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Processing time for a customized repayment plan is generally no more than 15 business days. Primary Sidebar. Equal Housing Opportunity Logo, Equal Housing An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income The standard repayment plan (for non-consolidated loans) features fixed payments made over 10 years. Since this is one of the shortest repayment | You have a few options to process payments for a payment plan. Choose Send invoices to client for payment if you do not have a credit card on If you have loans through the Federal Family Education Loan (FFEL) Program, then congratulations! You're eligible for this strange repayment Repayment plans for private student loans include everything from interest only payments to a flexible number of years to repay |  |

| Quick funding options of Lower Interest Rates Alabama Alaska Arizona Arkansas California Colorado Repaymfnt Delaware Florida Repaument Hawaii Idaho Rdpayment Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Lower Interest Rates Michigan Minnesota Mississippi Repayent Montana Nebraska Nevada New Custkm New Jersey Repaymrnt Mexico New York North Custom repayment plans North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming. Make up for missed payments. FIND EXTRA SAVINGS. In other words, you can jump from the Standard Repayment Plan to the Income-Based Repayment Plan and on to the REPAYE plan at no cost. Eligible Loans Subsidized and Unsubsidized Direct Loans Direct PLUS Loans made to students Direct Consolidation Loans made to students. These cases will represent a small minority of borrowers, though. | Federal Family Education Loans FFEL and parent PLUS loans unless consolidated into a Direct Consolidation Loan on or after July 1, are not eligible. Immediate 13 Make payments on both principal and interest immediately Highest payment Lowest overall costs. Neither Splash Financial nor the lending partner are affiliated with or endorse any college or university listed on this website. Parts of the plan became available to borrowers before repayment resumed in October You can find your repayment terms for these loans on the promissory note you signed when you took out the loan. Low-income borrowers may qualify for a student loan payment of zero. This could free up money in the short term for a different goal, like a down payment on a home, without costing you as much interest as an income-driven plan. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Repayment plans for private student loans include everything from interest only payments to a flexible number of years to repay An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income Processing time for a customized repayment plan is generally no more than 15 business days. Primary Sidebar. Equal Housing Opportunity Logo, Equal Housing | The standard repayment plan (for non-consolidated loans) features fixed payments made over 10 years. Since this is one of the shortest repayment Typically, payment plans range from 3 months to 12 months, however, may extend up to as many as 36 months. Customized Payment Plans. If one of the payment plan plan to tackle their debt, such as income-driven repayment plans, which typically lower monthly payments My Fit Custom College Ranking · My |  |

| Credit score demystified Facebook Repaymnt Pin. Graduated Plqns is available for FFEL and Direct Loans. Cjstom Parent PLUS Custom repayment plans are not directly eligible for income-driven repayment but may become eligible for ICR by including the Parent PLUS loans in a Federal Direct Consolidation Loan. com, or call for more information on our student loan refinance product. Compare repayment plans. Everything you need to know about private student loans. | Medical School Loans: How to Refinance and Consolidate. Then come back next year and enjoy the benefits of the Returning Borrower Advantage. Splash Financial and our lending partners reserve the right to modify or discontinue products and benefits at any time without notice. You can visit the US Government Student Aid site to check whether you are eligible for a pay-as-you-earn student loan or other types of income-based loan repayment plans. The chart below illustrates some important differences in the various income-driven repayment plans. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | Under the new plan, income-driven repayment for undergraduate loans would be set at 5% of discretionary income An income-driven repayment plan, also known as an IDR plan, offers borrowers a lower monthly payment based on their factors, including income Flexibility in loan repayment terms also allows you to pay off your loan faster. With customizable repayment plans, you can make extra payments when you have | Flexibility in loan repayment terms also allows you to pay off your loan faster. With customizable repayment plans, you can make extra payments when you have You are automatically assigned this repayment plan if you do not choose among the others. It saves you money over time because your monthly payments may be The standard repayment plan involves making equal payments over the span of 10 years. If you don't select a different plan, you |  |

| Show Erpayment 6 lenders. Compare repayment plans. Do you have a Federal Perkins Loan? Do You Have to Pay Gift Taxes on Plan Contributions? Here's a breakdown of the student loan repayment plans available. | When you apply, you can choose which plan you want or opt for the lowest payment. Make up for missed payments. Earnest Loans are made by Earnest Operations LLC or One American Bank, Member FDIC. These range from saving money to providing much more flexibility to help you deal with the unexpected, such as losing your job. To begin the qualification process for the Student Loan Planner® sign on bonus, customers must apply from the link provided. | Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide | plan to tackle their debt, such as income-driven repayment plans, which typically lower monthly payments My Fit Custom College Ranking · My Processing time for a customized repayment plan is generally no more than 15 business days. Primary Sidebar. Equal Housing Opportunity Logo, Equal Housing The standard repayment plan involves making equal payments over the span of 10 years. If you don't select a different plan, you |  |

Video

Products With Custom Payment Plans in HighLevelCustom repayment plans - There are four federal student loan repayment options. Standard or income-driven repayment plans work for most borrowers Use HESC's Loan Repayment Advisor to get a personalized repayment plan. By answering a few simple questions - no data or personal information is required - you' To sign up for a fixed repayment plan, contact your loan servicer. If you don't ask for a specific repayment plan before repayment begins, your loan servicer With all the student loan repayment plans to choose from, how do you find the best one for you? Here are some tips to help decide

Just be sure to tell your student loan servicer to apply the extra payment to your principal balance instead of toward your next monthly payment. You may be able to temporarily postpone repayment altogether with deferment or forbearance.

Some loans accrue interest during deferment, and all accrue interest during normal forbearance periods. This increases the amount you owe. If your financial struggles are pay-related, income-driven repayment is a better option.

Public Service Loan Forgiveness is a federal program available to government, public school teachers and certain nonprofit employees. Only payments made under the standard repayment plan or an income-driven repayment plan qualify for PSLF.

To benefit, you need to make most of the payments on an income-driven plan. How to enroll in these plans: You can apply for income-driven repayment with your servicer or at studentaid.

Dozens of lenders offer student loan refinancing; compare your options before you apply to get the lowest possible rate. Private lenders also refinance federal student loans , which can save you money if you qualify for a lower interest rate. But refinancing federal student loans is risky because you lose access to benefits like income-driven repayment plans and loan forgiveness.

On a similar note Student Loans. Student Loan Repayment Options: Find the Best Plan For You. Follow the writer. Table of Contents If you want to pay less interest If you want lower monthly payments and student loan forgiveness If income-driven repayment doesn't make sense with your salary If you don't want payments tied to your income If you want to pay off your loans more quickly If you need to temporarily pause payments If you qualify for Public Service Loan Forgiveness Have private student loans?

MORE LIKE THIS Loans Student loans. If you want to pay less interest. If you want lower monthly payments and student loan forgiveness. If income-driven repayment doesn't make sense with your salary.

If you don't want payments tied to your income. If you want to pay off your loans more quickly. If you need to temporarily pause payments. If you qualify for Public Service Loan Forgiveness. Have private student loans? How much could refinancing save you?

Want to pay less for your student loans? get started. Student loans from our partners. Private Student Loan. Check Rate. Sallie Mae. NerdWallet's ratings are determined by our editorial team. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Fixed APR 4. credit score Mid's. College Ave. credit score Mids. credit score Low-Mid s. Funding U. Fixed APR 6. credit score None.

Fixed APR Fixed APR 5. credit score Splash Financial. Fixed APR 2. See More Lenders. You may enter IBR if your federal student loan debt is high relative to your income and family size.

While your loan servicer will perform the calculation to determine your eligibility, you can use the U. ICR gives you the flexibility to meet your repayment obligations without causing undue financial hardship.

Payments are based on your adjusted gross income, family size and the total amount of your Direct Loans. Income Contingent Repayment is available if you need to make lower Direct Loan payments, but you do not qualify for the IBR or Pay As You Earn plans.

Federal Family Education Loans FFEL and parent PLUS loans unless consolidated into a Direct Consolidation Loan on or after July 1, are not eligible. Under this plan, your monthly payments are made for a maximum of 25 years.

Monthly payments are the lesser of the amount you would pay if you repaid your loan in 12 years multiplied by an income percentage factor that changes with your annual income or 20 percent of your monthly discretionary income.

Your monthly payments increase or decrease based on your annual income and for a maximum payout period of 10 years. If you have loans owned by the U.

Department of Education, contact your loan servicer. If you have FFEL program loans that are not owned by the U. Department of Education, contact your lender. Partner Access HS Counselors Financial Aid Professionals.

Home Prepare. The College Edge Why College? Your High School Path To College College Planning Checklists Five Things To Do in High School Take the Right Classes Do Grades Matter Establish Support Systems Keys To Success College Entrance Exams SAT and ACT Diploma Requirements.

Financial Aid What is Financial Aid? Grants, Scholarships and Loan Programs Graduate Study Aid How Colleges Award Financial Aid College Net Price Calculator College Finance Advisor. Apply for Financial Aid Apply for Aid — Start Here Apply for TAP TAP Award Estimator Financial Aid Award Letter Comparison Tool.

Smart Borrowing Smart Borrowing Basics Understanding Interest Rates, Fees and Interest Capitalization Interest Capitalization Estimator True Cost of Borrowing How Loan Terms Affect Borrowing Costs Burden of Debt Calculator.

Loan Forgiveness, Cancellations and Discharge Pay your Defaulted FFEL loan Defaulted Student Loan FAQs. Higher Education Services Corporation.

Learn more about available federal loan repayment plans: Standard Repayment Standard repayment is available for Direct and FFEL Loans. Extended Repayment Extended Repayment is available for Direct and FFEL Loans. Remember that interest continues to accrue on the loan amount during repayment; the longer your loans are in repayment, the more interest you will pay.

Graduated Repayment Graduated Repayment is available for FFEL and Direct Loans. Learn More If you expect your income to increase steadily over time, this plan may be right for you. Revised Pay As You Earn Repayment Plan REPAYE The REPAYE Plan enables Direct Loan borrowers to cap their monthly student loan payment amount at 10 percent of monthly discretionary income or, if married, 10 percent of your combined discretionary income.

This plan is a good option if you are seeking Public Service Loan Forgiveness PSLF. Pay As You Earn Repayment Plan PAYE The PAYE Plan enables Direct Loan borrowers who were new borrowers on or after Oct. Learn More Loans eligible for this plan: Direct Subsidized Loans Direct Unsubsidized Loans Direct PLUS Loans made to students Direct Consolidation Loans that do not include PLUS loans Direct or FFEL made to parents To be initially eligible, the required payment amount under this plan must be less than what you would pay under the year Standard Repayment Plan.

Income Based Repayment IBR IBR is available for FFEL and Direct Loans. Learn More All Stafford, PLUS, and Consolidation Loans made under either the Direct Loan or FFEL Program are eligible for repayment under IBR, except loans that are currently in default, parent PLUS Loans, or Consolidation Loans that repaid parent PLUS Loans.

Income Contingent Repayment ICR Direct Loans Only ICR gives you the flexibility to meet your repayment obligations without causing undue financial hardship. Learn More Income Contingent Repayment is available if you need to make lower Direct Loan payments, but you do not qualify for the IBR or Pay As You Earn plans.

0 thoughts on “Custom repayment plans”