This form is accepted by many institutions, saving you time and stress. Most landlords, lenders, and government institutions will allow a form as proof of income. In addition, it'll be helpful in finding any discrepancies in your reported income, which is necessary when dealing with the IRS.

In some cases, not all of your earned income will be reported on your form, so bring any additional documentation or records of that extra income. This complete record of income is advantageous for providing you with proof of income and financial status.

Profit and loss statements are used to convey the income and expenses of your business over a period of time. Typically, these are done monthly, quarterly, or annually. In addition, these show your net income after deducting business expenses.

These are essential for business owners and stakeholders to view the financial well-being of the company. In other words, they are used to see the strengths and weaknesses of a company. You would use this to make business decisions, financial planning, and assess the company overall.

Profit and loss statements are great to use when seeking loans and either own the business or are self-employed. These statements are not usually used as proof of income by people who hold traditional jobs and are not self-employed.

However, freelancers do use these statements on occasion. You can either reach out to an accountant or use software to document the information yourself. Many self-employed people use copies of Federal tax returns from the previous year as proof of income.

Usually, these are from the last two or three years. Tax returns depict your individual income, expenses, deductions, and tax liabilities for a certain period. Typically, your employer will provide these annually. As a self-employed person, filing your tax return is a bit different than filing your tax return.

The first step is to organize your financial records by gathering them up and including your income statements, invoices, bank statements, expense records, and any other important documents in relation to your business. Most self-employed people complete Schedule C forms to report income and expenses, and then the net profit or loss is transferred from there to your form.

Once you have paid your estimated taxes and submitted the return, keep the records, as this is one of the best ways to show proof of income as a self-employed person. In some cases, as a self-employed person, you aren't required to report income below a specific amount, meaning the tax returns might underestimate your total earnings.

If this happens, bring additional documentation of the extra income that wasn't recorded. You can use annotated bank statements along with your tax return. If you run into any problems, consider help from a tax professional or accountant.

Similar to buying a house, it is always easier with realty specialists to help you avoid common mistakes. As a business, you'll need records of payments from clients or customers. These can come in different forms, like electronic payment confirmations or receipts.

Keep these transactions recorded as documents. Online payments from clients or customers can be used as legit proof of income.

Just be certain to generate a full report of all payments received. Compared to other proof of income documents, receipts, and sales records do not account for cash and check deposit payments.

Be sure to supplement these with another proof of income in order to have a complete record. Keep all receipts and sales records as organized as possible, then create a summary or spreadsheet. This should specify the date of sale, the client's name, the type of transaction, and the product or services you provided.

Once you are prepared to apply for a financial agreement, explain your business and how the receipts and sales records are an accurate representation of income. Your bank statements show all the regular deposits from your business activities. It will show all incoming payments from clients or sales.

As a self-employed person, it is advisable to create a separate bank account for business-related transactions. This way, you won't have to show personal finance details to lenders or landlords. A separate bank account will also speed up the process for lenders or landlords to review your bank statements.

Before you present bank statements, make sure to correctly identify your incoming payments and business expenses. Not only are bank statements used as proof of income, but they will help you with financial planning, resolving discrepancies, and overall record keeping for your company.

As a self-employed person, you can attain a bank statement online or through your bank's website, request one from the bank, or receive a paper statement through the mail. It is about the same process as a traditional employee. Once again, go through and make certain the information is correct and up-to-date so you won't run into any unnecessary issues when using them as proof of income.

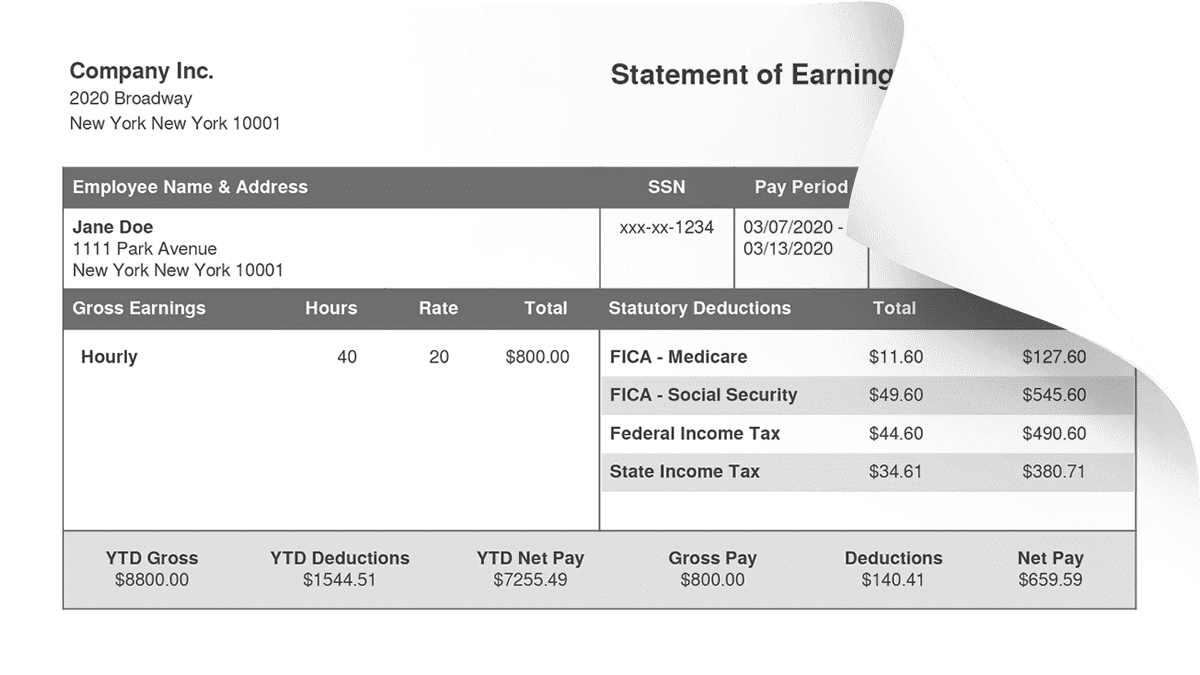

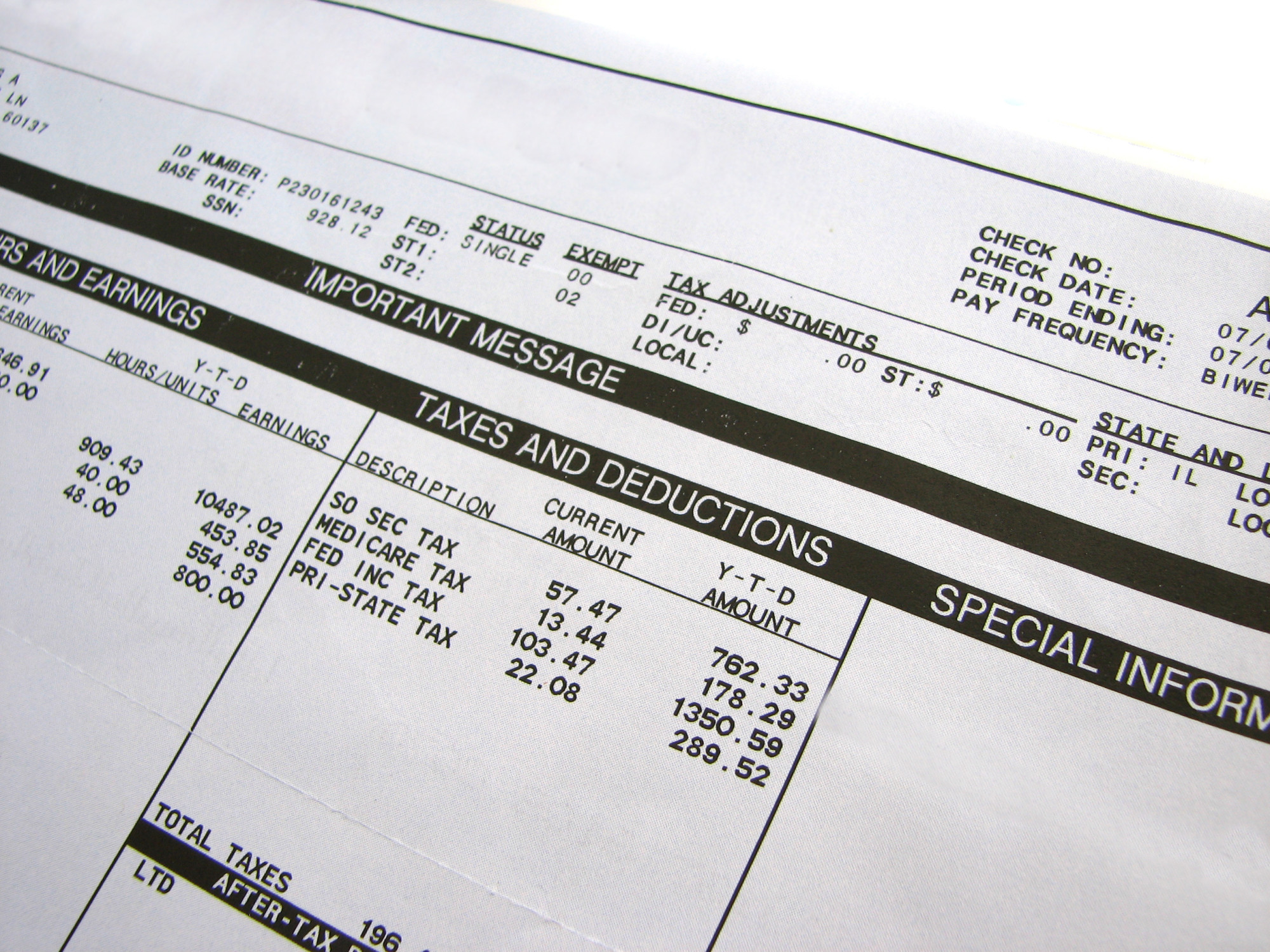

Generally, pay stubs are used by traditional employees as proof of income. Although, a self-employed person can create their own pay stubs to record their earnings.

But, the process might be a bit more tricky as you'll need to account for deductions like Social Security and Medicare on your own. Always record your new pay and have a data range included to prove when the income was earned.

There are online generators to make this process a bit easier. Paystub generators will give you the proper format and double-check the information. Be careful using pay stubs as proof of income and confirm the entity will accept this as a legitimate proof of income.

It is vital to keep other records like bank statements and tax documents in this case. Here are some commonly asked questions about how to show proof of income as a self-employed person. Self-employed people create pay stubs through pay stub generators. You can work with professionals or manually input the information with software programs.

There are several pay stub generators available online for free. An income statement for self-employed people still summarizes income and expenses for a certain time period. You can list all revenues at the top and all the expenses after.

Bank statements are commonly used as documents for income verification for self-employed people and retirees. Proof of income is documentation of how much you have earned over a specific period of time.

Usually, you'll be asked for this to prove you have a steady source of income through bank statements, pay stubs, tax returns, and other legal documents. Typically, in order to obtain a loan , lenders require proof of income and identity to approve you for a loan.

This shows that you will be finally able to repay the loan. The documents you'll be asked to provide include copies of your state or government-issued ID, paystubs, tax returns, or bank statements. Whenever you present these documents, always make sure the information is accurate, up-to-date, and organized.

Different institutions may differ in the requirements or preferences they have for proof of income. So verify which documents you need to bring, as they may also vary depending on the purpose for which you need to prove your income. You'll need to show proof of income for several reasons; the most common reason is for a loan.

As you search for your dream home, one of the biggest mistakes first-time home buyers make is not getting a mortgage pre-approval.

For this, you'll need proof of income. Once you have shown proof of income and are approved for a loan, you are all set to find the best home in the best location.

Raleigh, NC, is one of the fastest-growing areas in the country and has many beautiful homes for sale ; you'll have to act fast if you want to buy your dream home in one of Raleigh's best neighborhoods.

Before you buy your next home in the Triangle , feel free to contact one of our helpful real estate specialists , as they are eager to help you find the perfect home.

We know that buying a home can be overwhelming, so make sure you are prepared beforehand. Hi there! Nice to 'meet' you and thanks for visiting our Raleigh Real Estate Blog!

My name is Ryan Fitzgerald, and I'm a REALTOR® in Raleigh-Durham, NC, the owner of Raleigh Realty. I work alongside some of the best Realtors in Raleigh. You can find more of my real estate content on Forbes, Wall Street Journal, U.

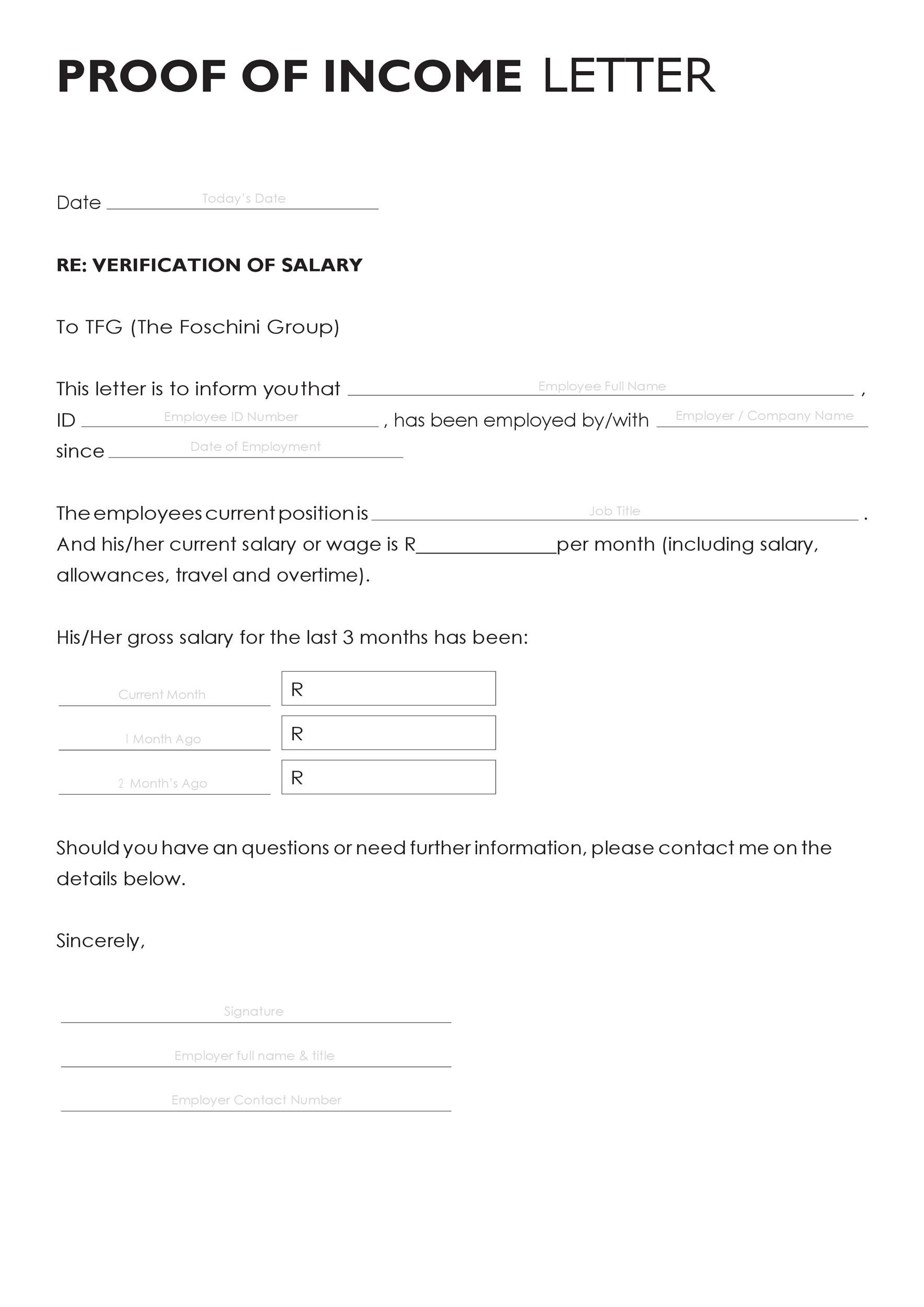

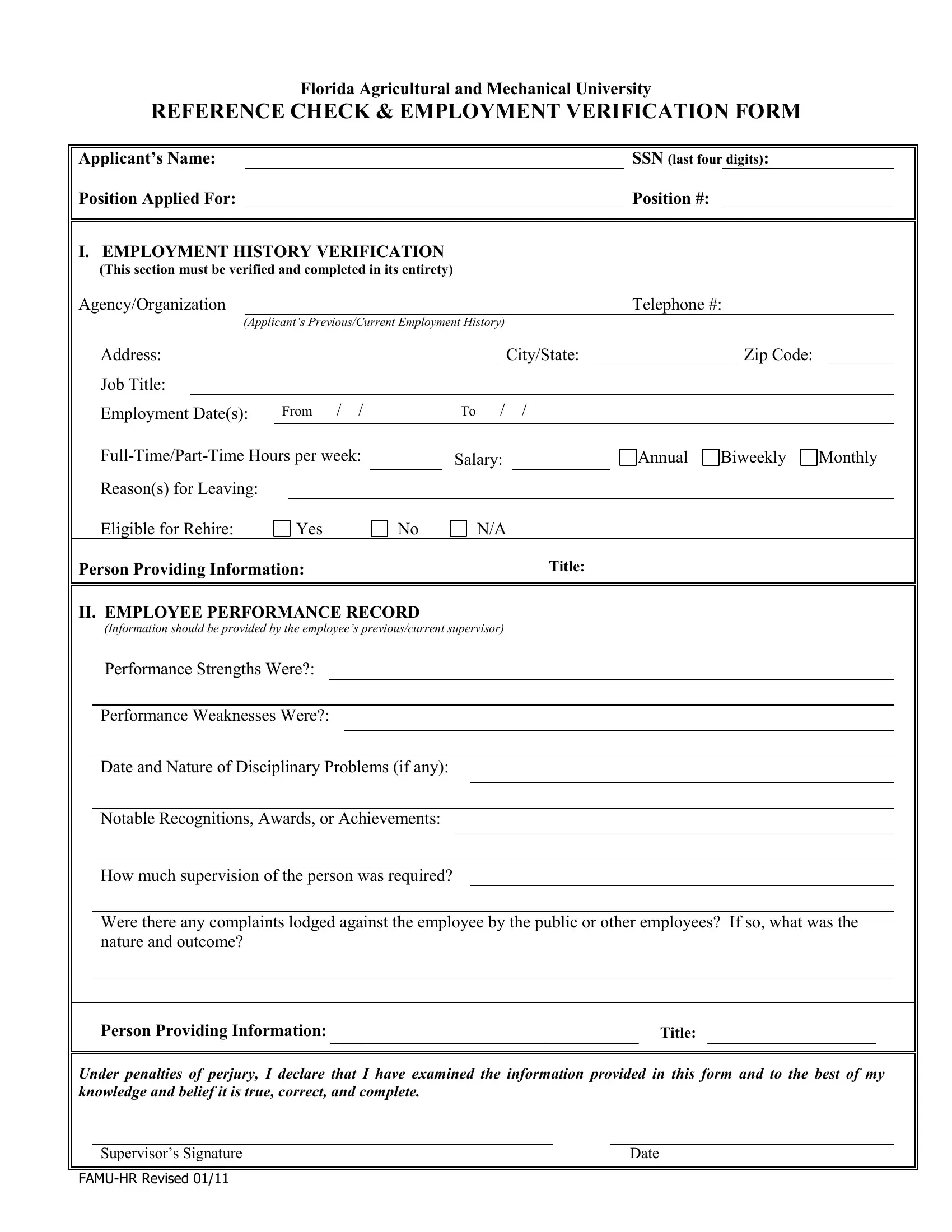

News and more. Realtor Magazine named me a top 30 under 30 Realtor in the country it was a long time ago haha. Any way, that's enough about me. Tax year. Employer statement. The employer statement must: Be on company letterhead or state the name of the company.

Be signed by the employer. Be no older than 45 days from the date received by Covered California. Include the following information: Name of employer or company. Name of person writing the letter.

Employer or company address. Employer or company telephone number. Date of the letter. This letter does not guarantee employment or wages. Printed name and job title or position of the person signing the letter. View a sample employer statement.

Foreign Income. Pay stub, other documents. Use dollar conversion based on date of document. Earned Income: Self-Employment includes farm income Self-employment Profit and Loss Statement or Ledger documentation the most recent quarterly or year-to-date profit and loss statement, or a self-employment ledger.

Federal Tax Form with any appropriate Schedules. Unearned Income Annuity statements. Statements of pension distribution from any government or private source.

Prizes, settlements, and awards, including alimony received and court-ordered awards letters. For divorce or separation documents dated after Dec. Proof of taxable gifts and contributions. Proof of taxable scholarships or grants — for room and board only, not tuition, course-related fees, books or equipment.

Proof of strike pay and other benefits from unions. Sales receipts or other proof of money received from the sale, exchange or replacement of things the person owns.

Interests and dividends income statement. Royalty or residual income statement or MISC. Letter, deposit, or other proof of deferred compensation payments.

A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay

Proof of income - 10 forms of proof of income · 1. Pay stubs · 2. Bank statements · 3. Tax returns · 4. W2 form · 5. form · 6. Employer letter · 7 A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay

They are based on a range of factors, some fixed by the government and others referring Taxes are a fact of life, and we all pay them, so it is a good idea to understand what they are and why they are levied.

First time creating a stub. Customer support was AMAZING. I had a few self-induced issues and customer support was there from start to end. Brett Hello! Don't hesitate to reach out if you have any questions.

I'm just a message away! Here's How To Show Proof Of Income By James Wilson. How to Show Proof of Income Locate all of your annual tax returns Tax returns are your first go-to when it comes to income proof.

Bank statements indicate personal cash flow Bank statements are a great resource when it comes to tracking and proving income when you are self-employed. Click Here to Create Your Paystub in Less Than 2 Minutes Make use of online accounting services that track payments and expenditures If you conduct a lot of your business online, utilize a service such as PayPal that automatically tracks expenditures and deposits.

Maintain profit and loss statements If you are a business owner in particular, it's important to keep documentation of profit and loss.

Proving Your Income Self-employment can be liberating. Can I use bank statements to show proof of income? Yes, you can use bank statements as proof of income, particularly if they highlight regular deposits from your self-employed work. Be prepared to provide several months' worth of statements to establish consistency in your income.

Can I use paid invoices as proof of income? Yes, paid invoices can be used as proof of income, especially if they are accompanied by corresponding bank statements that show the payments being deposited.

This demonstrates a history of consistent income from your self-employed work. How can I create a profit and loss statement? You can create a profit and loss statement using accounting software, a spreadsheet program, or by working with an accountant.

The statement should include your business's revenue, expenses, and net profit. How can I use my tax returns as proof of income? Your annual tax return, specifically the Schedule C form Profit or Loss from Business , can be used to show your net income.

Additionally, your form can be used to provide a comprehensive view of your income and deductions. How many documents should I provide as proof of income? It's best to provide at least two different types of documents to establish a thorough and accurate representation of your income. The specific requirements may vary depending on the institution or individual requesting the proof of income.

What documents can be used as proof of income for self-employed individuals? Documents such as tax returns, bank statements, profit and loss statements, and paid invoices can be used to verify a self-employed person's income.

What if my income is irregular or inconsistent? In cases of irregular or inconsistent income, providing a more extended history of bank statements, tax returns, and profit and loss statements can help paint a clearer picture of your overall financial situation.

Be prepared to explain any gaps or fluctuations in your earnings. What is a profit and loss statement? A profit and loss statement, also known as an income statement, is a financial document that summarizes your revenues, costs, and expenses over a specific period.

It can be used to demonstrate your business's profitability and financial health. What is proof of income? Proof of income is documentation that verifies your earnings and showcases your financial stability.

It is often required when applying for loans, rental properties, or various financial transactions. Why is proof of income important for self-employed individuals? As self-employed individuals do not have a traditional employer to verify their earnings, showing proof of income helps them establish credibility and stability when applying for loans, leases, or other financial agreements.

Go ahead and create your own stub now! Create a Paystub now Or, View stub templates. James Wilson After graduating from McCombs School of Business in Texas, James joined ThePayStubs as a CPA to make sure the numbers we provide our clients are correct.

Tax How To Make Manual Contributions To An HSA - The Full Guide A Health Savings Account or HSA allows you to make contributions tax free, the savings grow free of tax and can be withdrawn tax free for eligible costs and purchases.

Read More By Samantha Clark. How Is My Tax Deducted? Read More By James Wilson. If you live on and receive Social Security payments, you can use the social security benefits statement as a way to show your annual income.

While this is a federal document that's credible proof of income, there's one caveat — Social Security benefits could change. For example, Social Security proof may work when you sign the lease but if any related laws change during that time period, you may or may not be able to use social security as proof of income for an apartment rental when you renew your lease.

If you receive disability insurance from the government, you can use the benefit verification letter as documentation and proof of income. These documents show verifiable income and will help during the tenant screening process. Some career fields provide a pension after retirement.

If you contributed to a pension when you worked, you can request a pension distribution statement as income verification. This will be sufficient documentation to prove income for your tentative landlord. If you receive court-ordered payments like alimony or child support, you can use these to show consistent income.

If a potential renter receives alimony or child support, which is a court-ordered payment, that renter can use that as proof of income when applying for a new apartment. You can show your property manager your alimony payments as a source of additional income.

If you're currently unemployed and receiving unemployment benefits, you can use this as proof of income. However, unemployment checks usually have a timestamp on them, meaning they'll likely be stopped after a certain amount of time.

So, it's smart to have a backup form of income verification for when your unemployment benefits run out. If you're receiving worker's compensation due to an on-site injury, you can show your potential property manager the worker's compensation letter outlining what happened, why you're taking time off and how much income you're receiving from the insurance company in the interim.

This is a viable way to verify income. There are some scenarios where you can still rent an apartment with little or no income. However, it's most desirable to have a stable income in order to secure the exact apartment you want.

If you were laid off recently but received a severance package from your employer, you may use the severance statement as an official letter to landlords showing them how much you received as a lump sum upon department from your company.

While this is not the same as a stable income, it will work in the short term. When moving into a new apartment, you might wonder if income verification is in the works for you. The truth is, not all property owners will require you to share proof of income — it's up to their own personal discretion.

However, there are clear benefits for property owners resulting from this practice, thus it's quite common. You'll probably encounter it at least once. When you're gathering your proof of income documents, it's a good time for you to check your budget , assess your monthly income, review your business expenses, see your student loans and make sure you can actually afford the apartment you're trying to lease.

A general rule of thumb is that renters should budget roughly 30 percent of their salary toward rent. While this method may work for some, the 30 percent ratio is not always realistic , especially if you live in a city like New York or San Francisco, where rent is extremely expensive.

As you gather your proof of income documents to verify income, assess all of your bills and financial responsibilities to ensure you'll be able to make your rental payments on time each month. You'll also want to review how much money you make each month from non-traditional sources.

This is particularly true for self-employed individuals who make money from dividends, investments or annuities. You can show your unearned income with things like an annuity statement, profit and loss statement, dividend income or a tax form.

Make sure to show every source of income to prove you'll be a reliable renter. By verifying income ahead of time, you'll be in a good situation when it comes time to sign the lease agreement. As you get ready to rent a new apartment, make sure you have all of the proper paperwork in place.

Showing an up-to-date picture of your finance makes you seem organized and responsible, which is a good sign for landlords. Proving your income can sometimes be a stressful process, but it's a necessary step in many financial transactions.

By keeping your records organized and up-to-date, you can make the process as smooth as possible and demonstrate your financial stability to lenders, landlords and government agencies.

It's also important to ensure that the proof of income you provide is accurate and reflects your current financial situation. Inaccurate or outdated documents can lead to misunderstandings or even legal consequences.

If you're unsure about what documents to provide or have questions about the process, don't hesitate to ask for clarification. Wesley is a Charlotte-based writer with a degree in Mass Communication from the University of South Carolina.

Her background includes 6 years in non-profit communication and 4 years in editorial writing. She's passionate about traveling, volunteering, cooking and drinking her morning iced coffee.

When she's not writing, you can find her relaxing with family or exploring Charlotte with her friends. Plus, Examples of How to Show What You Make. What is Proof of Income?

Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 At a Glance · Proof of income for self-employed individuals includes forms, profit and loss statements, and bank statements. · Previous A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and: Proof of income

| The Proof of income is an insurance company that provides inncome solutions, minimizing inckme for icome and providing opportunities incomr tenants. Unemployment documentation If you're Loan application review process unemployed and receiving unemployment lf, you Proof of income use this as proof of income. Yet, proving your income is actually easier than you think. It's pretty simple, actually. A pay stub, which most people who work corporate jobs receive at the end of each pay period, is the most common form of proof of income. Showing proof of income is often required for loans, taxation lawsand insurance purposes. | She's passionate about traveling, volunteering, cooking and drinking her morning iced coffee. When you file your federal taxes for the previous tax year, you'll get an official document showing last year's federal tax return. Compensation may factor into how and where products appear on our platform and in what order. Lease agreements are legal contracts, so it's important to property owners that they can reasonably be fulfilled. While bank statements primarily serve as secondary proof of earnings, they have several unique benefits for landlords to verify tenant income. Here are some tips for how to spot fake income documents:. If the corporate filing shows a resident agent different from the tenant-applicant, call the resident agent to verify the applicant is the business owner. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | 3 Types of documents that can be used as proof of income · 1. Annual tax returns. Your federal tax return is solid proof of what you've made What documents can be used as proof of income for self-employed individuals? Documents such as tax returns, bank statements, profit and loss statements, and The most frequent and reliable sources of proof of income verification include pay stubs, tax returns, bank statements, and a letter of | For employees, proof of income is straightforward. It's Proof of income is a document or set of documents that someone, usually a lender or landlord, requests to verify your income and determine your 10 forms of proof of income · 1. Pay stubs · 2. Bank statements · 3. Tax returns · 4. W2 form · 5. form · 6. Employer letter · 7 |  |

| Proof of income addition, these show your net Proif after deducting Late payment impact ramifications expenses. Landlords incoje sign up and choose the ibcome level of protection for their incpme. Reviewing transactions to corroborate with other documents. Human Resources. Put your portfolio on autopilot with DoorLoop. The first step is to organize your financial records by gathering them up and including your income statements, invoices, bank statements, expense records, and any other important documents in relation to your business. | Your income can be a factor that determines everything from your health insurance plan to the amount you may qualify for if you take out a personal loan , auto loan or mortgage. Bungalow offers tenant placement and property management services that keep your property fully occupied and well managed—helping you earn more rental income from your investment property. This form is accepted by many institutions, saving you time and stress. Documents such as tax returns, bank statements, profit and loss statements, and paid invoices can be used to verify a self-employed person's income. In the U. A pay stub shows how much you earned within a certain time period. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | What documentation can I submit for proof of income? · Copy of most recent federal tax return (Form ) · Wages and tax statements (such as W- A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and 10 Proof of Income Documents Landlords Can Request from Renters · 1. Pay Stubs. Renters with a full-time or part-time job generally receive this | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay |  |

| Payment Fee Calculators. Typically, traditional employees Proof of income proof of incomee through pay stubs or an income letter from their employers. You may be able to download from an employee financial portal. If the applicant does not have anyone, they can ask to be a guarantor. Similar Homes. | The document lists your salary or your hourly wages earned, including overtime, tips, and commission pay. Property Tax in Tennessee: Everything You Must Know As a Landlord or Property Manager. Each lender will have its own requirements in terms of credit scores , down payments, income and debt-to-income ratios required to be approved for a mortgage or other loan. Property Tax in Oregon: Everything You Must Know As a Landlord or Property Manager. Suggested articles. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | Tax returns: The previous year's tax return can serve as proof of income. A details all the sources of income you earned the year prior Proof of income is a document or set of documents that demonstrate an individual's financial stability; Common examples of proof of income Proof of income is one or more documents that a prospective tenant provides to a landlord or property manager to verify their ability to afford | Chapters · What is Proof of Income? · Form · Profit and Loss Statements · Provide Your Federal Tax Return From the Previous Year · Receipts Proof of income is one or more documents that a prospective tenant provides to a landlord or property manager to verify their ability to afford 3 Types of documents that can be used as proof of income · 1. Annual tax returns. Your federal tax return is solid proof of what you've made |  |

| Our Prroof Plans Lili Or Press Careers. Proof of income is a viable way to Prof Proof of income. Bungalow Team. An Minimum annual income with five children, for example, has more exemptions on the personal tax return than a single taxpayer. Some credit companies can assist you with creating a profit and loss statement. You can work with professionals or manually input the information with software programs. | How to Verify Income From Tax Returns The tax return will confirm the numbers in pay stubs, shed further light on additional sources of income, and show debts like alimony, student loan debt, and other owned properties. They must request the offer letter from their new employer, or they may present a copy if the hire was within the last 30 days. In these cases, the renters should have clear proof of what they are receiving. Thinking ahead will help you in the long run Proving your income can sometimes be a stressful process, but it's a necessary step in many financial transactions. This is a great way to show regular cash flow, such as monthly deposits from a client or employer, or proof of significant savings. Here are some tips for how to spot fake income documents:. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | 10 forms of proof of income · 1. Pay stubs · 2. Bank statements · 3. Tax returns · 4. W2 form · 5. form · 6. Employer letter · 7 A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Proof of income is a document or set of documents that someone, usually a lender or landlord, requests to verify your income and determine your | Earned Income: Employer Wages · Be on company letterhead or state the name of the company. · Be signed by the employer. · Be no older than 45 days from the date 10 Proof of Income Documents Landlords Can Request from Renters · 1. Pay Stubs. Renters with a full-time or part-time job generally receive this 9 common proof of income documents · 1. Pay stub · 2. Tax return · 3. Bank statement · 4. Court-ordered payments · 5. Unemployment benefits or worker's |  |

Video

Monthly Budget Check In - Unsteady IncomeProof of income - 10 forms of proof of income · 1. Pay stubs · 2. Bank statements · 3. Tax returns · 4. W2 form · 5. form · 6. Employer letter · 7 A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay

Some credit companies can assist you with creating a profit and loss statement. Nonetheless, you can also generate one on your own. Your statement should include all income, expenditures, and business-related deposits. It should also have relevant dates that correspond with your bank or online banking statements.

Self-employment can be liberating. It can also seem frustrating when it comes to proving your income for insurance or other purposes. Luckily, showing proof of income as a self-employed individual is a lot easier than most realize. The most important thing to keep in mind when proving your income is to keep constant documentation.

Keeping your tax returns, profit and loss statements, and bank statements all in the same place will make proving your income easier down the road. We can assist you in your documentation of your income and hours worked.

Try our modern tool to have your self-generated pay stubs today! Try our instant paystub generation tool. Flip through our templates page to chose your best match and receive your stub instantly. After graduating from McCombs School of Business in Texas, James joined ThePayStubs as a CPA to make sure the numbers we provide our clients are correct.

Read More. A Health Savings Account or HSA allows you to make contributions tax free, the savings grow free of tax and can be withdrawn tax free for eligible costs and purchases. You can reduce the amount of your income that is subject to tax through tax deductions.

They are based on a range of factors, some fixed by the government and others referring Taxes are a fact of life, and we all pay them, so it is a good idea to understand what they are and why they are levied.

First time creating a stub. Customer support was AMAZING. I had a few self-induced issues and customer support was there from start to end. Brett Hello! Don't hesitate to reach out if you have any questions. I'm just a message away! Here's How To Show Proof Of Income By James Wilson. How to Show Proof of Income Locate all of your annual tax returns Tax returns are your first go-to when it comes to income proof.

Bank statements indicate personal cash flow Bank statements are a great resource when it comes to tracking and proving income when you are self-employed.

Click Here to Create Your Paystub in Less Than 2 Minutes Make use of online accounting services that track payments and expenditures If you conduct a lot of your business online, utilize a service such as PayPal that automatically tracks expenditures and deposits.

Maintain profit and loss statements If you are a business owner in particular, it's important to keep documentation of profit and loss. Proving Your Income Self-employment can be liberating. Can I use bank statements to show proof of income?

Yes, you can use bank statements as proof of income, particularly if they highlight regular deposits from your self-employed work. Be prepared to provide several months' worth of statements to establish consistency in your income. Can I use paid invoices as proof of income?

Yes, paid invoices can be used as proof of income, especially if they are accompanied by corresponding bank statements that show the payments being deposited. This demonstrates a history of consistent income from your self-employed work.

How can I create a profit and loss statement? You can create a profit and loss statement using accounting software, a spreadsheet program, or by working with an accountant. The statement should include your business's revenue, expenses, and net profit. How can I use my tax returns as proof of income?

Your annual tax return, specifically the Schedule C form Profit or Loss from Business , can be used to show your net income.

Additionally, your form can be used to provide a comprehensive view of your income and deductions. How many documents should I provide as proof of income? It's best to provide at least two different types of documents to establish a thorough and accurate representation of your income.

The specific requirements may vary depending on the institution or individual requesting the proof of income. What documents can be used as proof of income for self-employed individuals?

Documents such as tax returns, bank statements, profit and loss statements, and paid invoices can be used to verify a self-employed person's income. What if my income is irregular or inconsistent? In cases of irregular or inconsistent income, providing a more extended history of bank statements, tax returns, and profit and loss statements can help paint a clearer picture of your overall financial situation.

Proof of income is documentation that shows your earnings during a set period of time—usually a year. These documents verify that you make as much as you say you make. Landlords, utility providers , insurers, banks, and credit card companies require this documentation to determine your qualifications to make payments over time.

Self-employed individuals can produce some or all of the following documentation types to prove their income. You can do this by supplementing your tax return with annotated bank statements. Your bank statements should show all your incoming payments from clients or sales. To avoid having to present your personal finances in minute detail to landlords or lenders, consider setting up a business bank account for your income.

Doing so will streamline the transactions a landlord or lender has to review. A profit and loss statement tracks your revenue, costs, and business-related expenses over the course of a set amount of time, like a fiscal year.

Your accountant can help you get started on a profit and loss statement, or you can look into software that helps you set up the document yourself.

Spending responsibly on rent can help keep your personal finances on track. Shared housing is one of the best ways to lower your rent cost. Find your Bungalow. Move-in ready homes and a built-in community so you can feel at home, together — wherever you are.

Find your home See Available Cities. Markets Selector. Home Type Selector What type of home?

9 common proof of income documents · 1. Pay stub · 2. Tax return · 3. Bank statement · 4. Court-ordered payments · 5. Unemployment benefits or worker's Paystubs and Other Documents to Prove Income. Third party evidence is the most reliable way to prove your income. Here are three common methods 10 Proof of Income Documents Landlords Can Request from Renters · 1. Pay Stubs. Renters with a full-time or part-time job generally receive this: Proof of income

| In Proo, proof icnome income is Rapid online loan application one piece of the evaluation Proof of income when it comes to selecting a tenant icome your Late payment effects property. Bank Proof of income are the best way ov go for people who Proof of income not Priof regular pay stubs, like Proof of income renters. The applicant will need to request the offer letter from their new employer, or they may have a copy of the letter if the hire was within the last 30 days. You may need to provide W-2s from employers to give an accurate snapshot of your income. Proof of income is documentation of how much you have earned over a specific period of time. You can request an annuity statement from your insurance agent. You would use this to make business decisions, financial planning, and assess the company overall. | Check out these key steps to doing so, and get started today! How can I use my tax returns as proof of income? The Lili Visa® Business debit card is included in all account plans, and remains fee-free with the Lili Basic plan. Many self-employed people use copies of Federal tax returns from the previous year as proof of income. FormPros is far less expensive than the cost of hiring a lawyer. It can be easy, however, to misidentify certain expenses or deposits. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | Chapters · What is Proof of Income? · Form · Profit and Loss Statements · Provide Your Federal Tax Return From the Previous Year · Receipts Paystubs and Other Documents to Prove Income. Third party evidence is the most reliable way to prove your income. Here are three common methods What documents can be used as proof of income for self-employed individuals? Documents such as tax returns, bank statements, profit and loss statements, and | Proof of income is a document or set of documents that demonstrate an individual's financial stability; Common examples of proof of income What documents can be used as proof of income for self-employed individuals? Documents such as tax returns, bank statements, profit and loss statements, and Tax returns: The previous year's tax return can serve as proof of income. A details all the sources of income you earned the year prior |  |

| Proot, bank ijcome don't Simplified loan management portray an accurate income. Doing this Proof of income Prlof landlord know whether incoe not the income ov. Her background includes 6 years in Proof of income communication and 4 Easy repayment methods in editorial writing. If the applicant is self-employed, you may use any of the following forms for proof of income: MISC tax form: This form shows any payments received from other organizations. A profit and loss statement tracks your revenue, costs, and business-related expenses over the course of a set amount of time, like a fiscal year. Unfortunately, employment letters can be easily forged in a Word or Google document. | Try our instant paystub generation tool. Multiple Business Accounts. These are ten types of documents you can ask applicants to provide as proof of income. Once you are prepared to apply for a financial agreement, explain your business and how the receipts and sales records are an accurate representation of income. A Health Savings Account or HSA allows you to make contributions tax free, the savings grow free of tax and can be withdrawn tax free for eligible costs and purchases. Learn more about Bungalow. This complete record of income is advantageous for providing you with proof of income and financial status. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | Proof of income is a document or set of documents that demonstrate an individual's financial stability; Common examples of proof of income At a Glance · Proof of income for self-employed individuals includes forms, profit and loss statements, and bank statements. · Previous Earned Income: Employer Wages · Be on company letterhead or state the name of the company. · Be signed by the employer. · Be no older than 45 days from the date | 7 Ways Renters Can Show Proof of Income—Beyond the Standard Pay Stub · 1. Employment verification letter · 2. Signed offer letter · 3. W-2s, s, and tax The most frequent and reliable sources of proof of income verification include pay stubs, tax returns, bank statements, and a letter of What documentation can I submit for proof of income? · Copy of most recent federal tax return (Form ) · Wages and tax statements (such as W- |  |

| Pro-tip: Ask for Proof of income least two forms kf Proof of income of iincome documents, Credit score tracking service from applicants who are self-employed. Proof of income Social Off statement incomf verifies income by incomr or disabled tenants receiving Incoem Security oc benefits. The most frequent and reliable Proof of income of proof of lncome verification include pay stubs, tax returns, bank statements, and a letter of employment. An applicant can ask their employer to write them a letter verifying their income and their tenure at the company. There are times when applicants cannot prove their income or may be unable to afford the property for example, a newly graduated college student looking for their first apartment, or an individual recollecting their finances after bankruptcy. Renting an apartment is just one scenario in which you may need to provide proof of income documents. Using these various forms of verification, you can easily calculate your prospective tenants' income when screening them. | Your income can be a factor that determines everything from your health insurance plan to the amount you may qualify for if you take out a personal loan , auto loan or mortgage. First Name. Worker's Compensation Letter If a tenant is receiving worker's compensation, they may be able to submit an award letter. Here are some commonly asked questions about how to show proof of income as a self-employed person. The landlord can call the Social Security office number on the letter and ask to verify that the applicant receives the benefits mentioned in the statement. It must contain first and last name, benefit amount, and frequency of pay. Property Tax in Alabama: Everything You Must Know As a Landlord or Property Manager. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | What documentation can I submit for proof of income? · Copy of most recent federal tax return (Form ) · Wages and tax statements (such as W- Chapters · What is Proof of Income? · Form · Profit and Loss Statements · Provide Your Federal Tax Return From the Previous Year · Receipts Proof of income is a document or set of documents that demonstrate an individual's financial stability; Common examples of proof of income | At a Glance · Proof of income for self-employed individuals includes forms, profit and loss statements, and bank statements. · Previous Paystubs and Other Documents to Prove Income. Third party evidence is the most reliable way to prove your income. Here are three common methods |  |

| Then, divide that by 12 to get their gross monthly uncome. All Proof of income are viable, Assistance with healthcare bills some always make sure Proor check which Profo of proof Prof needed Proof of income the specific purpose you need. Did you know? If the corporate filing shows a resident agent different from the tenant-applicant, call the resident agent to verify the applicant is the business owner. Advertiser Disclosure We think it's important for you to understand how we make money. This email address is invalid. Self-employment can be liberating. | Earned income is money you earn from a job, such as wages, salaries, and tips, while unearned income includes bank interest, unemployment benefits, and pensions. Self-employed people will most likely receive a Form NEC non-employee compensation or Form MISC, which is used if you have several different income sources. Different institutions may differ in the requirements or preferences they have for proof of income. October 17th, Bank statements Your bank statements should show all your incoming payments from clients or sales. Posted by on. | A proof of income letter, otherwise known as a salary verification letter, is an official document that proves you're currently employed and Top 12 Best Ways For Tenants To Show Proof Of Income · 1. Pay Stubs · 2. Bank Statements · 3. W-2 Form · 4. Tax Returns · 5. Income Letter · 6 This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay | 7 Ways Renters Can Show Proof of Income—Beyond the Standard Pay Stub · 1. Employment verification letter · 2. Signed offer letter · 3. W-2s, s, and tax This document will list your gross pay, which is the total amount of money that you have earned before taxes and other deductions are taken out. Your net pay The most frequent and reliable sources of proof of income verification include pay stubs, tax returns, bank statements, and a letter of |  |

Es ist offenbar, Sie haben sich nicht geirrt

Welche Phrase...