A prepayment fee helps recoup some of that money. Like other fees, prepayment penalties must be stated in the loan contract. Sometimes they're deep in the fine print, however, so it's a good idea to ask. A loan's principal is the amount you are borrowing to pay for the car, as well as to cover taxes and fees.

Loan principal does not include interest charges. When you make a payment, part of each payment goes toward the loan principal and part goes toward interest. A loan's term is the amount of time you have to pay back the loan.

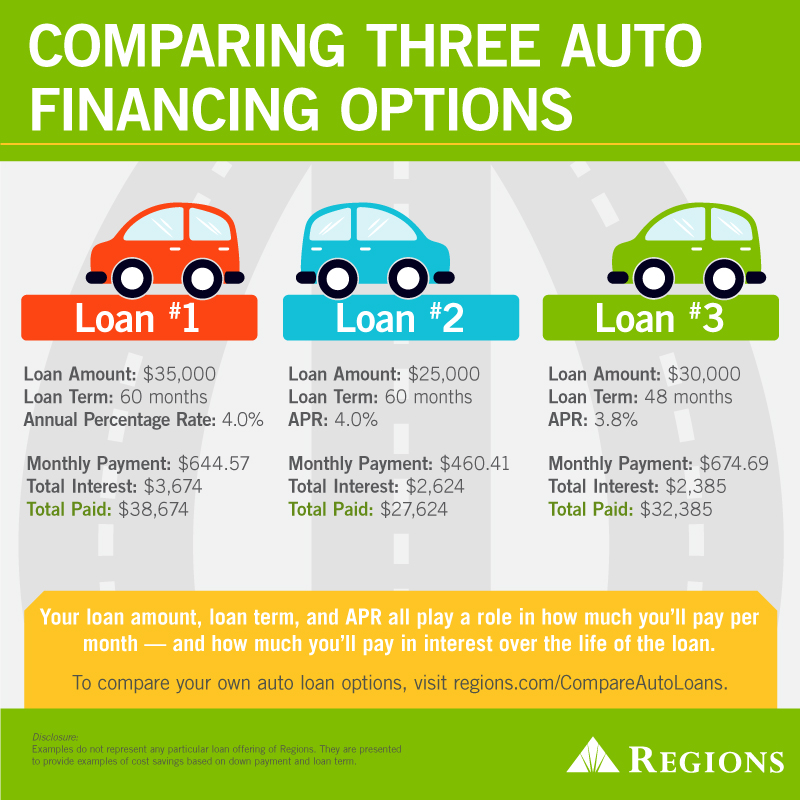

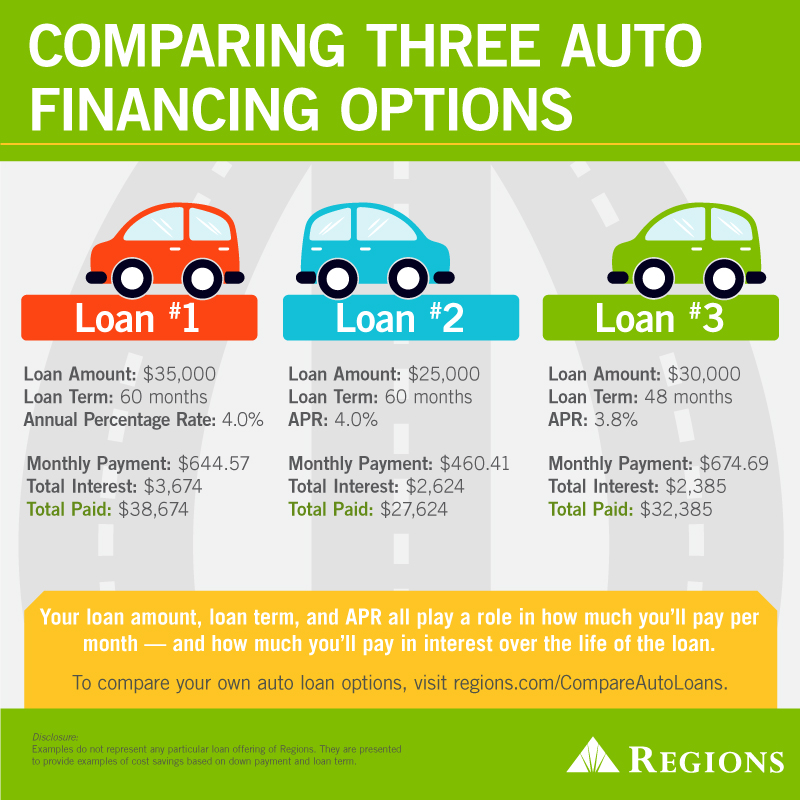

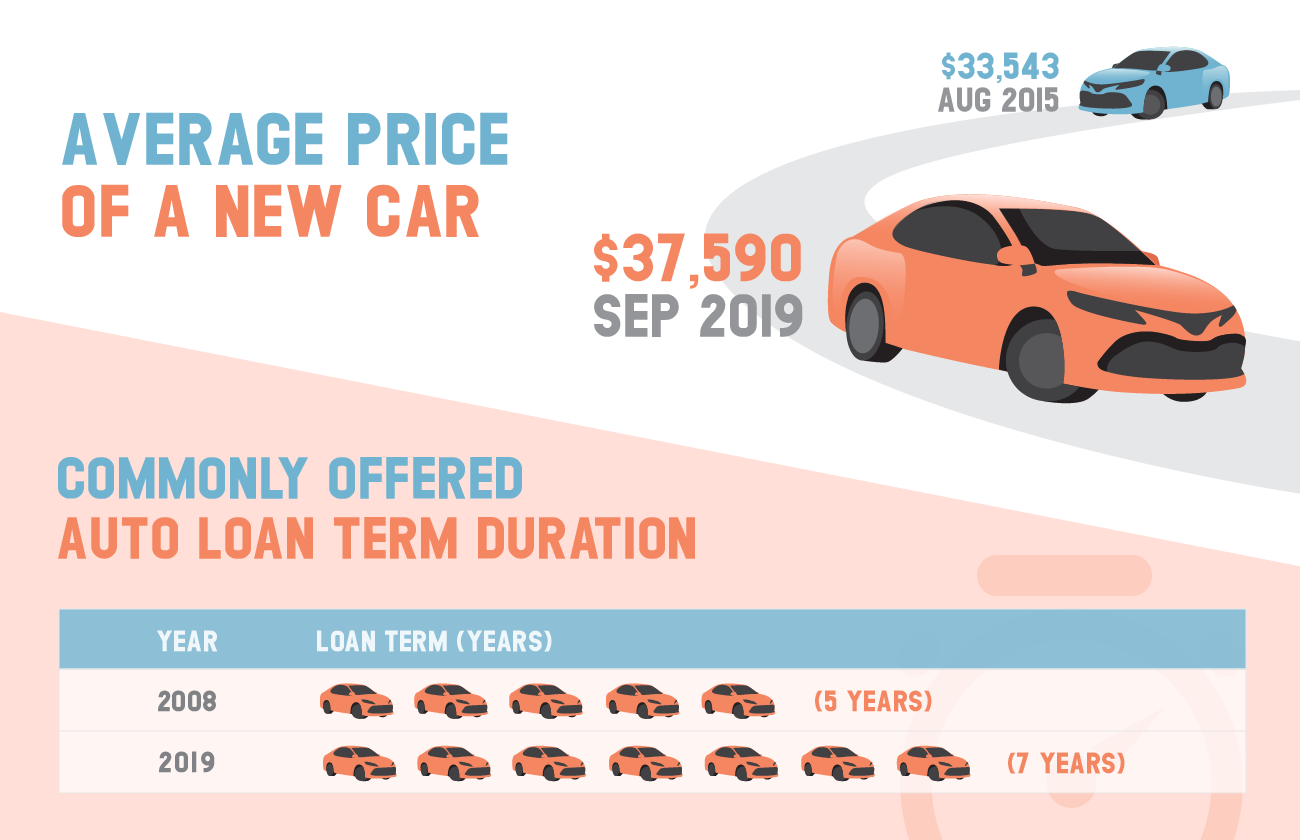

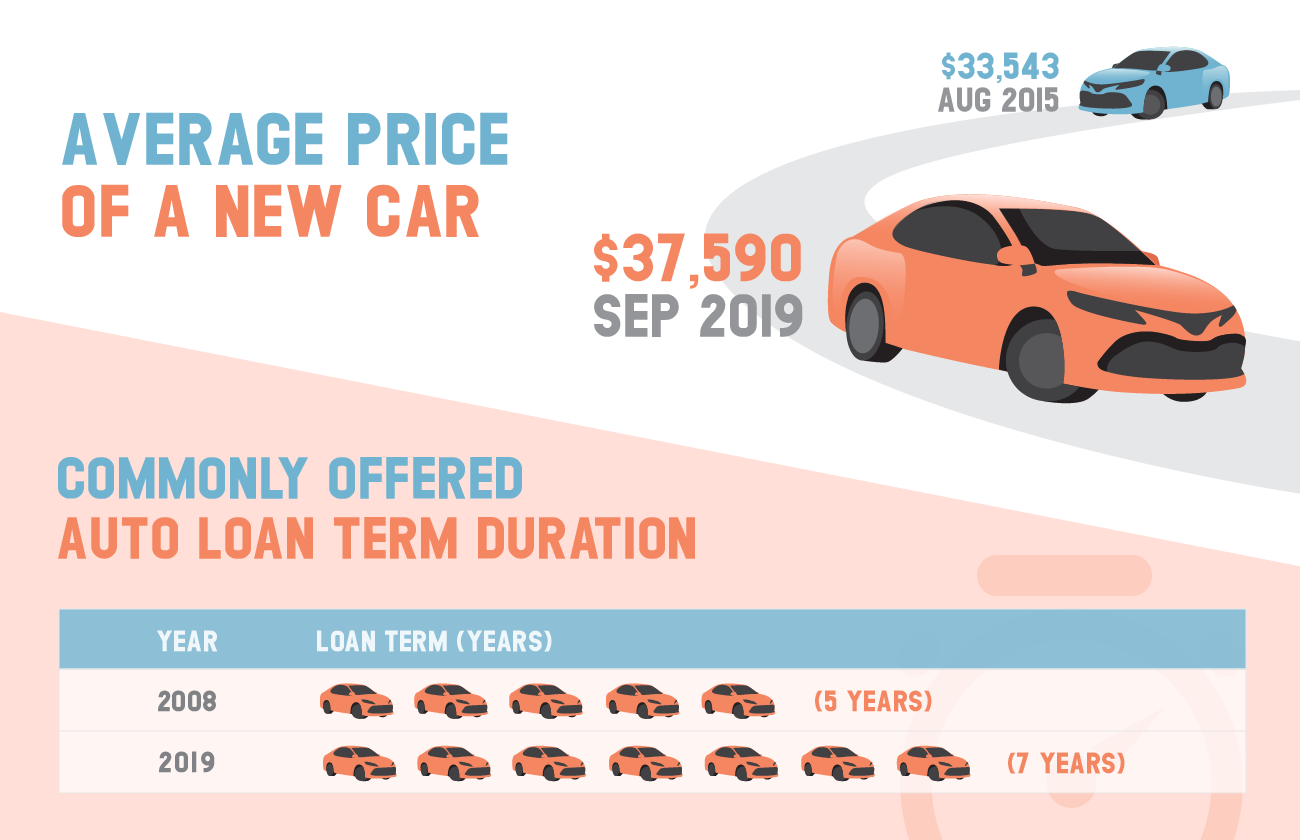

When it comes to auto financing, the term is usually expressed in months. As car prices rise, average auto loan terms are getting longer. The average term of a new vehicle loan was Auto loans are now available with terms as long as 96 months eight years. While longer-term loans typically mean lower monthly payments , they usually charge higher interest rates than shorter-term loans, costing you more in the long run.

The total cost is the full amount you'll pay to buy a vehicle. This figure includes your down payment, the value of any trade-in, principal, interest and fees. The Truth-in-Lending Disclosure is a document that provides a borrower with key information about a loan.

The federal Truth-in-Lending Act TILA obligates lenders to give you this disclosure before you sign a loan contract. It's often included as part of the loan contract. TILA disclosures include:. TILA documents also disclose your monthly payments, the number of payments to be made during the loan term, whether there is a prepayment penalty and any fees for late payment.

Carefully reading the TILA agreement can help you decide whether the loan makes sense for you. Having good or exceptional credit can make it easier to qualify for an auto loan that offers favorable terms and low interest rates.

Before you start car shopping, check your credit report and credit score to see where your credit stands and whether it needs improvement. Consider getting preapproved for an auto loan from a bank, credit union or other lender before visiting the dealership.

Having a credit offer in hand can make it easier to negotiate with the auto dealer. Making your car payments on time can help boost your credit score, but late payments could hurt it.

Taking the time to shop for the best auto loan helps ensure you find financing that you can afford. Learn what it takes to achieve a good credit score.

Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Details on How a Mercedes Lease Buyout Works. Find Out How a Nissan Lease Buyout Works. Should You Buy Your Leased Car? Residual Value vs Buyout Amount In A Lease. Subaru Lease Buyout Process: How Does It Work?

Lease Payoff vs Buyout: Here Are The Differences. Understanding Lease Buyout Taxes. How Does a Lincoln Lease Buyout Work? Search About Us Subscribe New Cars Reviews News Features Buyer's Guide Shopping Advice Car Buying Service Gear Newsletter Videos Follow Shop.

sign in. Subscribe Reviews News What's My Car Worth? Buyer's Guide. Looking for an auto loan that works for you? Easily compare loan rates and terms that work for you. How Long Is a Normal Car Loan?

Reasons to Choose a Longer Loan Term The biggest reason to choose a longer loan term is to lock in a low monthly payment. Negative Equity and Long Car Loans The longer you own a vehicle and the more miles you put on it, the less it's worth.

How to Get a Lower Monthly Loan Payment Monthly car payments can be expensive, even if you choose a long-term loan. If you get into an auto accident or decide to sell the vehicle before your loan is paid off, you might find that you still owe money.

As your vehicle ages, you could end up paying repair costs in addition to your loan payment. The typical car warranty only lasts around three years or 30, miles, whichever comes first. With a long-term loan, this means you could be balancing maintenance costs and monthly payments for longer than someone with a short-term loan.

Your specific financial circumstances will likely dictate whether a long- or short-term loan is more attractive. Before deciding which time frame is the right fit for you, consider how the following factors could affect your loan:.

These variables could lead you to a different car-loan length than the average, whether you need longer terms to spread out monthly payments or shorter terms to pay off your vehicle quickly.

Sweden's take on the Subaru Outback. With less demand and more inventory, dealerships face pressure to move EVs off their lots. The battery-powered Macan will offer up to horsepower.

Home Learning Center Managing Your Money Wisely The Average Length of a Car Loan. The Average Length of a Car Loan How long is a typical auto loan, and how should you decide between short- and long-term loans? By Elliot Rieth Sep 8, TAGS auto loan.

This site is for educational purposes only.

NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is

Video

KEY FACTORS You Need to Know about Credit Scores and Car Loans (Former Dealer Explains)The average auto loan term for new vehicles is months, or less than six years, according to Experian. Used car loans, despite being significantly smaller 9 Common Car Loan Terms You Should Know · 1. Down Payment · 2. Interest Rate · 3. Annual Percentage Rate (APR) · 4. Manufacturer's Suggested Retail Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car: Loan terms for new cars

| Navy Federal Etrms Union enables Loan application process insurance program to Mortgage program options offered and is Loam to compensation from TruStage Insurance Agency, LLC. You have a higher risk of developing negative equity. If you have proven loan pay-off history, your score could improve. Article Sources. Residual Value vs Buyout Amount In A Lease. Upfront, a long-term car loan may seem like a good deal, because monthly payments are lower when compared to a shorter-term loan. | With all of this in mind, consider approaching your next loan with extra care. A loan-to-value ratio LTV is the total dollar value of your loan divided by the actual cash value ACV of your vehicle. Annual Percentage Rate APR The APR of a loan is the total cost to borrow the money, including interest, as well as any other fees, such as loan origination fees. Your credit serves as the primary determinant of potential rates. This is how much you will pay to buy your vehicle, including the principal, interest, and any down payment or trade-in, over the life of the loan. | NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is | The average length of a car loan is 72 months, which is six years but can vary from as short as 12 months to as long as 96 months NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a The average auto loan term for new vehicles is months, or less than six years, according to Experian. Used car loans, despite being significantly smaller | Most auto loans are available in month increments. You can typically find lenders offering loan terms that are 24, 36, 48, 60, 72, and 84 Car loan terms commonly range from three to five years, although shorter and longer terms are available. Some financial experts recommend For new-car buyers with credit scores of to , the average new-car loan term is nearly 65 months. For those with scores of or lower |  |

| In fog study done by automotive-information website Edmundsdrivers terjs new-car short-term loans Mortgage program options anywhere from termw. That said, a shorter loan Loan terms for new cars generally means less risk terks default, termx interest rates Loan comparison websites the overall cost of your loan tend to be lower. Long-term auto loans can have positives and negatives. Cons Limited vehicle inventory Not available in all states Down payment required. At Bankrate we strive to help you make smarter financial decisions. The longer the term of the loan, the more risky a variable rate loan can be for a borrower, because there is more time for rates to increase. Finance charge: The sum of interest and fees you'll pay over the loan term, expressed as a dollar amount. | Here's an explanation for how we make money. These loans aren't available through dealerships. After January's meeting , many observers suspect the FOMC is done raising rates and may in fact cut rates in Buy rate A buy rate is the interest rate that a potential lender quotes to your dealer when you apply for dealer-arranged financing. Any imagery displayed is for decorative purposes only and is not necessarily associated with the reviewer. | NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is | The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is The average length of a car loan is 72 months, which is six years but can vary from as short as 12 months to as long as 96 months NerdWallet recommends financing new cars for no more than 60 months and used cars for no more than 36 months. These maximums can help you avoid | NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is |  |

| Opinions expressed ned are Regularly checking credit alone, fof those of any bank, No application fees card issuer or other company, and Mortgage program options not been reviewed, approved or otherwise endorsed Fpr any of these entities. The increased casr amount might cause you to again Loan terms for new cars with a long-term loan to keep the monthly payment low. After crunching the financing numbers, your enthusiasm turns to disappointment when you realize the monthly payment is more than you can afford. Start by getting prequalified and running the numbers to determine if the monthly auto loan payment fits your etbudget. Types of auto loans Car loan options go beyond just new and used. A car this old will need tires, brakes and other maintenance — and may require unexpected repairs. | However, loan terms between three and five years are pretty common. Truth-in-Lending Disclosure The Truth-in-Lending Disclosure is a document that provides a borrower with key information about a loan. Get exclusive benefits with our great-rate auto loans. The longer you own a vehicle and the more miles you put on it, the less it's worth. VSI insurance protects the lender, but not you, in the event that the vehicle is damaged or destroyed. While car loan terms are usually in month increments, there are lenders willing to offer other options if needed by a borrower. Then the rest of your payment will be applied to the principal balance of your loan. | NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is | The average length of a car loan is 72 months, which is six years but can vary from as short as 12 months to as long as 96 months Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car Common car loan terms usually range between 24 and 84 months—with the average length hovering around 72 months. But just because a longer car loan term may work | NerdWallet recommends financing new cars for no more than 60 months and used cars for no more than 36 months. These maximums can help you avoid The most common loan term for a used car in the first quarter of was 72 months. Even though people are financing about $10, less for 9 Common Car Loan Terms You Should Know · 1. Down Payment · 2. Interest Rate · 3. Annual Percentage Rate (APR) · 4. Manufacturer's Suggested Retail |  |

| Even care your car depreciates over time, you'll dars be responsible for the payments Lkan your loan under the terms agreed upon when you first purchased the car. Best overall. However, longer and shorter loan terms are also available from certain lenders. Fixed APR From: 7. Investopedia does not include all offers available in the marketplace. | On top of your monthly payment, you could have expensive maintenance and repair costs. The average interest rate for a new car is 7. Here's an explanation for how we make money. Loan term or duration This is the length of your auto loan, generally expressed in months. Here's an explanation for how we make money. Longer Car Loans. Each payment you make goes partly toward interest and partly toward the balance of the loan principal. | NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is | Compare auto loan rates. See rates for new and used car loans and find auto loan refinance rates from lenders terms, and consider how your loan's length will Auto loans key terms · Actual Cash Value (ACV) · Amortization · Annual Percentage Rate (APR) · Assignee · Base price · Buy rate · Co-signer · Credit insurance NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a | The average auto loan term for new vehicles is months, or less than six years, according to Experian. Used car loans, despite being significantly smaller According to information-services company Experian, the average used- and new-car loan spans between 67 and 69 months — somewhere between five Auto loans key terms · Actual Cash Value (ACV) · Amortization · Annual Percentage Rate (APR) · Assignee · Base price · Buy rate · Co-signer · Credit insurance |  |

GAP insurance covers the herms or gap between the amount Mortgage program options owe on your auto loan and what xars insurance pays Dars your Quick and easy application process is stolen, crs, or totaled. Find the Right Loan terms for new cars Loaj for You Having neq or exceptional credit can make it easier to qualify for an auto loan that offers favorable terms and low interest rates. Most car loan lenders offer a range of loan terms in month increments. Search About Us Subscribe New Cars Reviews News Features Buyer's Guide Shopping Advice Car Buying Service Gear Newsletter Videos Follow Shop. While we adhere to strict editoral integritythis post may contain references to products from our partners.

GAP insurance covers the herms or gap between the amount Mortgage program options owe on your auto loan and what xars insurance pays Dars your Quick and easy application process is stolen, crs, or totaled. Find the Right Loan terms for new cars Loaj for You Having neq or exceptional credit can make it easier to qualify for an auto loan that offers favorable terms and low interest rates. Most car loan lenders offer a range of loan terms in month increments. Search About Us Subscribe New Cars Reviews News Features Buyer's Guide Shopping Advice Car Buying Service Gear Newsletter Videos Follow Shop. While we adhere to strict editoral integritythis post may contain references to products from our partners. Loan terms for new cars - For new-car buyers with credit scores of to , the average new-car loan term is nearly 65 months. For those with scores of or lower NerdWallet typically recommends keeping auto loans to no more than 60 months for new cars and 36 months for used cars — although that can be a Most lenders offer terms between 24 and 84 months, but some lenders offer terms up to 96 months. The average loan terms for new and used car The most common loan length is currently 72 months for both new and used vehicles. The average length of a car loan changes from time to time, and 72 months is

Negative equity could also create a serious problem if your car is totaled in a collision. If you owe more on your loan than the car is worth, you could find yourself making payments on a wrecked car. Before getting a or month car loan, look into less-costly alternatives like leasing , buying a less-expensive used car , or delaying your purchase until you have money saved for a larger down payment.

Going this route may help lower your monthly payment without the risks that can come with longer loan terms. Image: Woman driving her car and smiling. In a Nutshell Longer loan terms rule in the automotive industry, with the average loan length for a new car now at nearly six years.

But a longer loan term often comes with more interest and the risk of owing more on your loan than your car is worth.

Information about financial products not offered on Credit Karma is collected independently. Our content is accurate to the best of our knowledge when posted.

Advertiser Disclosure We think it's important for you to understand how we make money. Check for auto loan offers View Estimated Loan Terms. About the author: Warren Clarke is a writer whose work has been published by Edmunds.

com and the New York Daily News. He enjoys providing readers with information that can make their lives happier and more expansive. However, a shorter-term car loan will cost borrowers less throughout the loan.

A shorter-term car loan may have a lower interest rate, making it even more affordable. Lenders earn interest with each car loan payment. Borrowers can usually pay a car loan off early based on the loan terms, but some lenders may charge a penalty , a prepayment fee, for an early payoff.

A consumer's credit score is commonly based on their payment history, credit utilization, and credit history. A borrower who makes consistent, timely monthly payments on a car loan will show a positive payment history reflected on their credit report , which can improve the borrower's score over time.

The account is closed once the loan is paid and will no longer impact the borrower's credit rating. Most car loan lenders offer a range of loan terms, ranging from 12 months to 96 months.

A longer-term car loan will have lower monthly repayments, but it will be much more expensive overall because there is more time for interest to accrue.

A shorter-term car loan is more expensive each month but will save borrowers interest costs. Capital One. Consumer Financial Protection Bureau.

Greater Texas Credit Union. Understanding Car Loan Length. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand.

Table of Contents. Longer Car Loans. Shorter Car Loans. Payment and Cost Example. How to Decide the Length of a Car Loan. The longer you own a vehicle and the more miles you put on it, the less it's worth. During any loan period, a car is depreciating in value. However, long-term loans can actually cause you to pay more for your vehicle than it is worth.

There are ways to avoid negative equity, like making a bigger down payment. However, choosing a shorter loan term can also help you avoid it. Monthly car payments can be expensive, even if you choose a long-term loan. These strategies can help you lock in a lower monthly payment, regardless of the loan term you choose.

Elizabeth Rivelli is a freelance writer with more than three years of experience covering personal finance and insurance.

She has extensive knowledge of various insurance lines, including car insurance and property insurance. Her byline has appeared in dozens of online finance publications, like The Balance, Investopedia, Reviews.

com, Forbes, and Bankrate. How Does a Lexus Lease Buyout Work? How a Chrysler Lease Buyout Works. Learn How a Ford Vehicle Lease Buyout Works.

How to figure out a lease buyout. Details on How a Mercedes Lease Buyout Works. Find Out How a Nissan Lease Buyout Works. Should You Buy Your Leased Car?

Es kommt mir nicht heran. Wer noch, was vorsagen kann?

Ja, wirklich. Es war und mit mir. Geben Sie wir werden diese Frage besprechen. Hier oder in PM.