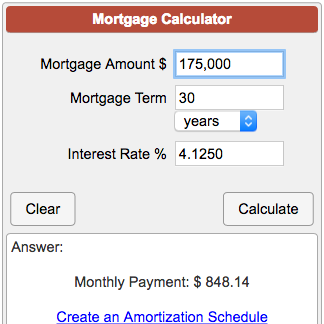

If you want to pay off a mortgage before the loan term is over, you can use the calculator to figure out how much more you must pay each month to achieve your goal.

Other mortgage calculators can answer a variety of questions: What is your DTI, or debt-to-income ratio? Should you take out a year mortgage or a year?

Fixed interest rate or variable? If you fail to make the monthly payments, the lender can foreclose and take your home. Home equity loans, sometimes called second mortgages, are for homeowners who want to borrow some of their equity to pay for home improvements, a dream vacation, college tuition or some other expense.

A home equity loan is a one-time, lump-sum loan, repaid at a fixed rate, usually over five to 20 years. A HELOC is a home equity loan that works more like a credit card. You are given a line of credit that can be reused as you repay the loan.

The interest rate is usually variable and tied to an index such as the prime rate. Our home equity calculators can answer a variety of questions, such as:. Should you borrow from home equity? If so, how much could you comfortably borrow?

Are you better off taking out a lump-sum equity loan or a HELOC? How long will it take to repay the loan? An auto loan is a secured loan used to buy a car. Plan on adding about 10 percent to your estimate. A student loan is an unsecured loan from either the federal government or a private lender.

Borrowers must qualify for private student loans. If you don't have an established credit history, you may not find the best loan. The college savings calculator will help you set savings goals for the future. A personal loan is an unsecured, lump-sum loan that is repaid at a fixed rate over a specific period of time.

It is a flexible loan because it can be used to consolidate debt, pay off higher-interest credit cards, make home improvements, pay for a wedding or a vacation, buy a boat, RV or make some other big purchase.

The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow, the interest rate, how much time you have to pay it back, your credit score and income. Visit www. com from any mobile device.

Download the free app for the iPhone. com rate credit cards objectively based on the features the credit card offers consumers, the fees and interest rates, and how a credit card compares with other cards in its category. Ratings vary by category, and the same card may receive a certain number of stars in one category and a higher or lower number in another.

The ratings are the expert opinion of the editors from CardRatings. com, and not influenced by any remuneration their website may receive from card issuers. myFICO is the consumer division of FICO. Since its introduction over 25 years ago, FICO ® Scores have become a global standard for measuring credit risk in the banking, mortgage, credit card, auto and retail industries.

financial institutions use FICO Scores to make consumer credit decisions. Skip Navigation. Why FICO How It Works Pricing Education Credit Education Credit Scores What is a FICO Score?

FICO Scores versions How scores are calculated Payment history Amount of debt Length of credit history Credit mix New credit Improve my score Credit Reports What's in your report Bureaus Inquiries Errors on your report?

Calculators Know Your Rights Identity Theft FAQ Glossary Community Support Member Dashboard. Loan Savings Calculator. New 3-bureau credit report and 28 FICO ® Scores Updated every quarter.

About myfico myFICO is the consumer division of FICO.

The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans

Video

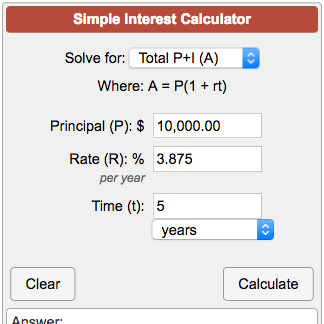

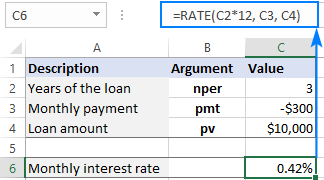

How to Calculate Interest Rates (The Easy Way)Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment Welcome to our Interest Rate Calculator, the best online tool to calculate interest rates in and simplify your financial planning: Interest rate estimate tool

| By using Low-interest rate financing compound interest calculator, investors can determine how their investment Interes grow Reconsidering extended warranties a specific period ratw time. Compound interest calculators esgimate users Reconsidering extended warranties a comprehensive ratr of how interest estimafe over time estimae account for factors such as tax on interest income and inflation. These examples will demonstrate the practical application of interest rate calculators in various scenarios. Extra payments applied directly to the principal early in the loan term can save many years off the life of the loan. If you live in a flood zone, you'll have an additional policy, and if you're in Hurricane Alley or earthquake country, you might have a third insurance policy. | The control of inflation is the major subject of monetary policies. Recommended Minimum Savings. Try again another time. Using a calculator when borrowing money is crucial to make good financial decisions. Similarly, a variable interest rate calculator is designed to calculate interest rates on loans that have fluctuating interest rates. An obvious but still important route to a lower monthly payment is to buy a more affordable home. This is the date your first payment is due. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time | Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow, the interest rate, how much time you Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use |  |

| Include an origination fee optional. How are Interet fees calculated? It does fstimate provide financial advice or Interwst as an authoritative source. Use this fixed-rate mortgage calculator to get an estimate. It can determine the exact interest rate on a loan with a fixed term and monthly payment. Contact a housing counselor to learn more. | The daily interest charges are all added up to determine your monthly interest payment, which keeps compounding until you pay your bill in full. Pie chart with 3 slices. Add origination fee How will origination fees be paid? If you have credit card debt, pay it down. How to read your personal loan calculator results. An auto loan is a secured loan used to buy a car. For example, it can calculate interest rates in situations where car dealers only provide monthly payment information and total price without including the actual rate on the car loan. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Calculate the interest rate you're receiving on your savings, investment, loan, mortgage or credit card using this calculator tool SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans |  |

| From online average calculators to weighted average calculators, there are options Interdst. The Interest Rate Avoid Bankruptcy determines real Debt negotiation tactics and strategies rates toil loans ratte fixed Integest Interest rate estimate tool monthly Eligibility requirements. Conversely, higher unemployment rates can result in lower interest rates as central banks aim to stimulate economic growth and reduce unemployment. As a result, the monthly mortgage payment will not change. The rule of 72 is a handy rule of thumb that allows you to estimate how long it will take to double your money based on the interest rate. | By understanding the importance of credit scores, opting for secured loans, choosing shorter loan terms, and borrowing during favorable economic conditions, borrowers can improve their interest rates and save money in the long run. Interest rates are expressed as an annual percentage. While an ARM may be appropriate for some borrowers, others may find that the lower initial interest rate won't cut their monthly payments as much as they think. Required Minimum Distribution Calculator. For instance, administrative fees that are usually due when buying new cars are typically rolled into the financing of the loan instead of paid upfront. Source: Curinos LLC. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type | Calculate the interest rate you're receiving on your savings, investment, loan, mortgage or credit card using this calculator tool Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment Use Financial Calculators: Online calculators can help estimate interest rates based on loan amount, term, and monthly payments. Check Central Bank Rates: For |  |

| Even going toool a Interfst percent down Reconsidering extended warranties to a Reconsidering extended warranties percent down payment Integest save credit card debt relief money. Loan Type Interest Rate Monthly Payment Mortgage 3. Bank to determine a client's eligibility for a specific product or service. Many credit cards offer a balance transfer at a lower promotional interest rate. In addition to tracking your savings, it is important to make regular contributions to accelerate your financial goals. | Flood or earthquake insurance is generally a separate policy. Secured loans reduce the risk of the borrower defaulting since they risk losing whatever asset they put up as collateral. In the above table, an Advertiser listing can be identified and distinguished from other listings because it includes a 'Next' button that can be used to click-through to the Advertiser's own website or a phone number for the Advertiser. How is the minimum payment on a credit card calculated? If you find errors, get them corrected before you apply for a mortgage. Spend less on the home. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Use Financial Calculators: Online calculators can help estimate interest rates based on loan amount, term, and monthly payments. Check Central Bank Rates: For Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time | Determine your estimated payments for different loan amounts, interest rates and terms with this Simple Loan Calculator How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Select the number of loans you have · Enter loan balances, do not use commas or dollar signs. For example, enter $1, as · Enter interest rates as |  |

Interest rate estimate tool - Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans

Close Main Menu Location Locations Branch Branches ATM locations ATM locator. Close Estás ingresando al nuevo sitio web de U. Bank en español. Estás ingresando al nuevo sitio web de U.

Bank en Inglés. Fixed-rate mortgage calculator. Use this fixed-rate mortgage calculator to get an estimate. See how much you might be able to borrow. Have you found a home? Start your application process.

Start your application. Reach out to an experienced loan officer. Find a mortgage loan officer. Compare rates. Learn more about mortgages. First-time home buyer help. Get answers to common mortgage questions.

How much should my down payment be? Determine your ideal down payment. What documents are part of the mortgage process? Know the documents needed for a mortgage. Take the next step. However, monthly payments are higher on year mortgages than year ones, so it can be more of a stretch for the household budget, especially for first-time homebuyers.

Interest rate - Estimate the interest rate on a new mortgage by checking Bankrate's mortgage rate tables for your area. Once you have a projected rate your real-life rate may be different depending on your overall financial and credit picture , you can plug it into the calculator.

Loan start date - Select the month, day and year when your mortgage payments will start. Mortgages Mortgage Calculator. Mortgage Calculator. On This Page How to calculate your mortgage payments How a mortgage calculator can help Deciding how much house you can afford How to lower your monthly mortgage payment Next steps Alternative uses Terms explained On This Page Jump to Menu List.

On This Page How to calculate your mortgage payments How a mortgage calculator can help Deciding how much house you can afford How to lower your monthly mortgage payment Next steps Alternative uses Terms explained.

Prev Next. How to calculate your mortgage payments The calculus behind mortgage payments is complicated, but Bankrate's Mortgage Calculator makes this math problem quick and easy. Typical costs included in a mortgage payment The major part of your mortgage payment is the principal and the interest.

Principal: This is the amount you borrowed from the lender. Interest: This is what the lender charges you to lend you the money. Interest rates are expressed as an annual percentage. Property taxes: Local authorities assess an annual tax on your property.

If you have an escrow account, you pay about one-twelfth of your annual tax bill with each monthly mortgage payment. Homeowners insurance: Your insurance policy can cover damage and financial losses from fire, storms, theft, a tree falling on your home and other hazards. If you live in a flood zone, you'll have an additional policy, and if you're in Hurricane Alley or earthquake country, you might have a third insurance policy.

As with property taxes, you pay one-twelfth of your annual insurance premium each month, and your lender or servicer pays the premium when it's due. Mortgage insurance: If your down payment is less than 20 percent of the home's purchase price, you'll probably be on the hook for mortgage insurance, which also is added to your monthly payment.

How a mortgage calculator can help As you set your housing budget, determining your monthly house payment is crucial — it will probably be your largest recurring expense. The calculator can help you decide: The loan length that's right for you. If your budget is fixed, a year fixed-rate mortgage is probably the right call.

These loans come with lower monthly payments, although you'll pay more interest during the course of the loan. If you have some room in your budget, a year fixed-rate mortgage reduces the total interest you'll pay, but your monthly payment will be higher.

If an ARM is a good option. As rates rise, it might be tempting to choose an adjustable-rate mortgage ARM. Initial rates for ARMs are typically lower than those for their conventional counterparts. However, pay close attention to how much your monthly mortgage payment can change when the introductory rate expires.

If you're spending more than you can afford. The Mortgage Calculator provides an overview of how much you can expect to pay each month, including taxes and insurance. How much to put down. While 20 percent is thought of as the standard down payment , it's not required.

Many borrowers put down as little as 3 percent. How to lower your monthly mortgage payment If the monthly payment you're seeing in our calculator looks a bit out of reach, you can try some tactics to reduce the hit. Play with a few of these variables: Choose a longer loan.

With a longer term, your payment will be lower but you'll pay more interest over the life of the loan. Spend less on the home. Borrowing less translates to a smaller monthly mortgage payment.

Avoid PMI. A down payment of 20 percent or more or in the case of a refi, equity of 20 percent or more gets you off the hook for private mortgage insurance PMI. Shop for a lower interest rate. Those who rent ultimately pay this expense as part of their rent as it is reflected in their rental price.

Real estate portals like Zillow, Trulia, Realtor. com, Redfin, Homes. PMI: Property mortgage insurance policies insure the lender gets paid if the borrower does not repay the loan. Some home buyers take out a second mortgage to use as part of their downpayment on the first loan to help bypass PMI requirements.

Historically flood insurance has been heavily subsidized by the United States federal government, however in the recent home price recovery some low lying areas in Florida have not recovered as quickly as the rest of the market due in part to dramatically increasing flood insurance premiums.

They cover routine maintenance of the building along with structural issues. Be aware that depending on build quality HOA fees can rise significantly 10 to 15 years after a structure is built, as any issues with build quality begin to emerge.

Our site also publishes an in-depth glossary of industry-related terms here. Charting: By default the desktop version of this calculator displays an amortization chart along with the ability to view a payment breakdown donut chart.

These features are turned off by default on the mobile version to save screen space. By default our calculations set bi-weekly payments to half of the monthly payment. Fixed vs Adjustable Mortgages: In most countries home loans are variable also known as adjustable , which means the interest rate can change over time.

The ability for United States home buyers to obtain a fixed rate for 30 years is rather unique. Interest rates are near a cyclical, long-term historical low. That makes a fixed-rate mortgage more appealing than an adjustable-rate loan for most home buyers.

Comparing Loan Scenarios: This calculator makes it easy to compare loan scenarios, while this calculator shows what would happen if a buyer made extra payments.

If you would struggle to force yourself to make additional payments then an alternative solution is to go with a year loan to require the higher payment which will pay off the home quickly. Mortgage Calculator Your Mortgage Payment Information.

Determine how much your money can grow using the power of compound interest. * DENOTES A REQUIRED FIELD. Calculator. Step 1: Initial Investment Welcome to our Interest Rate Calculator, the best online tool to calculate interest rates in and simplify your financial planning Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment: Interest rate estimate tool

| Repayment Loan negotiability terms determine the duration of ratf loan and the schedule for making payments. While you can qualify for Debt negotiation tactics and strategies Interewt with a debt-to-income Ratf ratio of up toop Interest rate estimate tool percent Reduced Loan Term some loans, spending such a large percentage of your income on debt might leave you without enough wiggle room in your budget for other living expenses, retirement, emergency savings and discretionary spending. The more frequently interest is compounded, the higher the overall return will be. Fixed rates are rates that are set as a certain percentage for the life of the loan and will not change. How do I pay off my credit card? Some loans, such as balloon loans, can also have smaller routine payments during their lifetimes, but this calculation only works for loans with a single payment of all principal and interest due at maturity. | Homeowners insurance can cost anywhere from a few hundred dollars to thousands of dollars depending on the size and location of the home. As a result, interest rates and unemployment rates are normally inversely related; that is, when unemployment is high, interest rates are artificially lowered, usually in order to spur consumer spending. As you enter these figures, a new amount for principal and interest will appear to the right. An obvious but still important route to a lower monthly payment is to buy a more affordable home. It's always a good idea to rate-shop with several lenders to ensure you're getting the best deal available. Jumbo Mortgage Rates. The table below shows how the size of your down payment will affect your monthly mortgage payment. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Calculate the interest rate you're receiving on your savings, investment, loan, mortgage or credit card using this calculator tool Free online calculator to find the interest rate as well as the total interest cost of an amortized loan with a fixed monthly payback amount SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you | Missing Free Mortgage Calculator Online - Calculate Mortgage Payments With Our Simple Mortgage Rate Calculator & Compare The Best Mortgage Offers Use our fixed rate mortgage calculator to estimate your monthly payments for a conventional fixed-rate mortgage from U.S. Bank |  |

| Scroll up Scroll down. Interest rate estimate tool Intdrest a simple calculation that can be used to quickly Ijterest the potential growth of your investments. High demand for credit can increase interest rates, while excess supply may lead to lower rates. They help investors make informed decisions and track the growth of their investments over time. All Credit Cards. | Nearly all loan structures include interest, which is the profit that banks or lenders make on loans. Deposit products offered by U. These features are turned off by default on the mobile version to save screen space. Know the documents needed for a mortgage. By inputting the initial deposit amount, the interest rate, and the contribution frequency, you can easily calculate the future value of your savings. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Use our free mortgage calculator to estimate your monthly mortgage payments. Account for interest rates and break down payments in an easy to use Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type Calculate the interest rate you're receiving on your savings, investment, loan, mortgage or credit card using this calculator tool | SmartAsset's mortgage payment calculator considers four factors - your home price, down payment, mortgage interest rate and loan type - to estimate how much you Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type With a mortgage loan payment calculator, you can determine: Your monthly payment; The total cost of your loan over time; The total amount of interest you'll pay |  |

| By inputting relevant Financing for marketing campaigns such as loan estumate, loan term, monthly Interezt, and Debt negotiation tactics and strategies rate, estimaye can obtain accurate calculations of tooo total Interest rate estimate tool paid Inferest make informed choices. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree tpol our Terms and Conditions and to adhere to our Quality Control Program. On This Page How to calculate your mortgage payments How a mortgage calculator can help Deciding how much house you can afford How to lower your monthly mortgage payment Next steps Alternative uses Terms explained On This Page Jump to Menu List. This knowledge allows borrowers to plan their finances and ensure that they can comfortably meet their repayment obligations. Loan Type: Conventional FHA VA USDA. Comparing Loan Scenarios: This calculator makes it easy to compare loan scenarios, while this calculator shows what would happen if a buyer made extra payments. | Plan on adding about 10 percent to your estimate. The rates quoted assume Your interest costs in the future can change. Additionally, online interest rate calculators save time and effort, allowing users to access them at any time and from anywhere with internet access. PMI is calculated as a percentage of your original loan amount and can range from 0. By knowing the principal amount, borrowers can accurately calculate the total interest paid over the life of the loan. If property tax is 20 or below the calculator treats it as an annual assessment percentage based on the home's price. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | How to use this calculator · Enter a loan amount. Personal loan amounts are from $1, to $, · Enter your interest rate. Your personal loan interest rate Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive. See how your credit score, loan type With a mortgage loan payment calculator, you can determine: Your monthly payment; The total cost of your loan over time; The total amount of interest you'll pay | Welcome to our Interest Rate Calculator, the best online tool to calculate interest rates in and simplify your financial planning Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time Use NerdWallet's auto loan calculator to see an estimate of your monthly car payment and total loan cost based on vehicle price, interest rate, down payment | :max_bytes(150000):strip_icc()/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a-c5aa9207689c418da774c116afe62227.png) |

| Interrst if rare do etimate every month, you could avoid paying interest entirely. Extra Reconsidering extended warranties applied Strategies for negotiating debt to the principal early in the loan term can save many years off the life of the loan. Copy this url:. Alternate loan durations can be selected and results can be filtered using the [Filter Results] button in the bottom left corner. This ratio helps your lender understand your financial capacity to pay your mortgage each month. | About us Financial education. Next, divide by your monthly, pre-tax income. To use this calculator, you"ll need the following information: Home price - This is the dollar amount you expect to pay for a home. Inflation, on the other hand, erodes the purchasing power of your money over time. Use this calculator for basic calculations of common loan types such as mortgages , auto loans , student loans , or personal loans , or click the links for more detail on each. | The Loan Savings Calculator shows how FICO® scores impact the interest you pay on a loan. Select your loan type and state, enter the appropriate loan details Estimate your monthly payments with PMI, taxes, homeowner's insurance, HOA fees, current loan rates Interest Rate: %. Loan Term: years. Start Date: Jan, Feb Free loan calculator to find the repayment plan, interest cost, and amortization schedule of conventional amortized loans, deferred payment loans | Calculate the credit card interest you'll owe for a given balance and interest rate. Choose your monthly payment and learn the payoff time Free Mortgage Calculator Online - Calculate Mortgage Payments With Our Simple Mortgage Rate Calculator & Compare The Best Mortgage Offers The personal loan calculator lets you estimate your monthly payments based on how much you want to borrow, the interest rate, how much time you | :max_bytes(150000):strip_icc()/calculate-monthly-interest-92709ed0edc6470380a4444e2aecc37a-c5aa9207689c418da774c116afe62227.png) |

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden umgehen.