If you get a call from someone claiming to be from BECU who asks for any of this, hang up immediately. Do not call the number back. Manually dial our member service number to call us at and report the incident to our Card Fraud division.

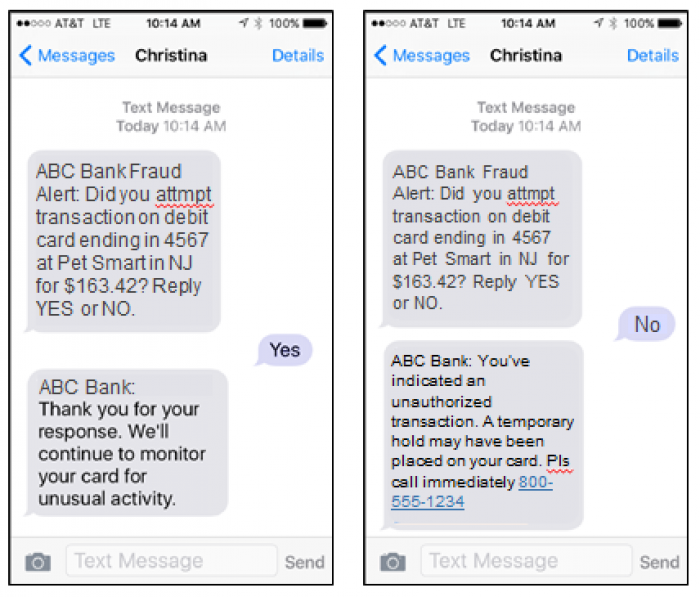

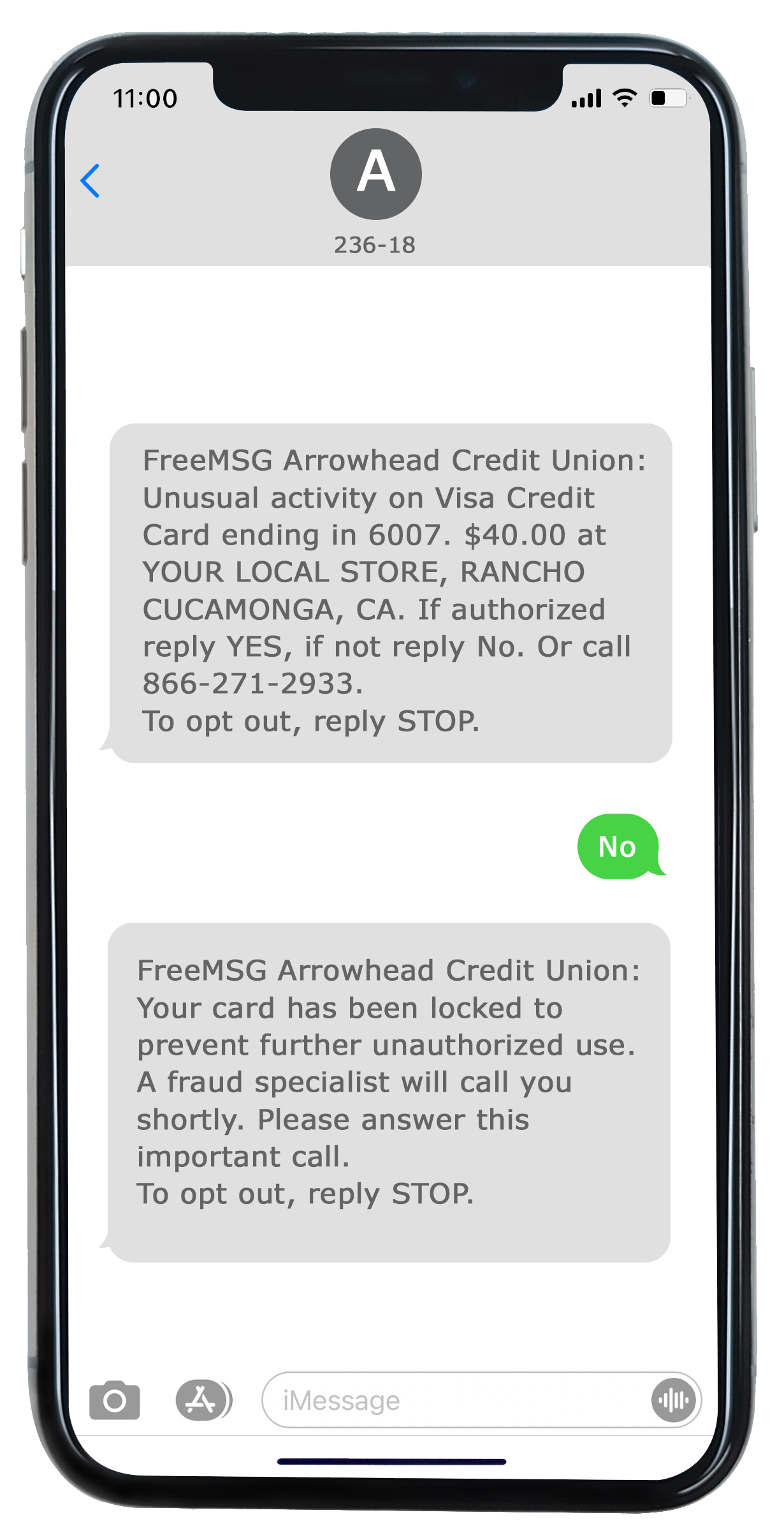

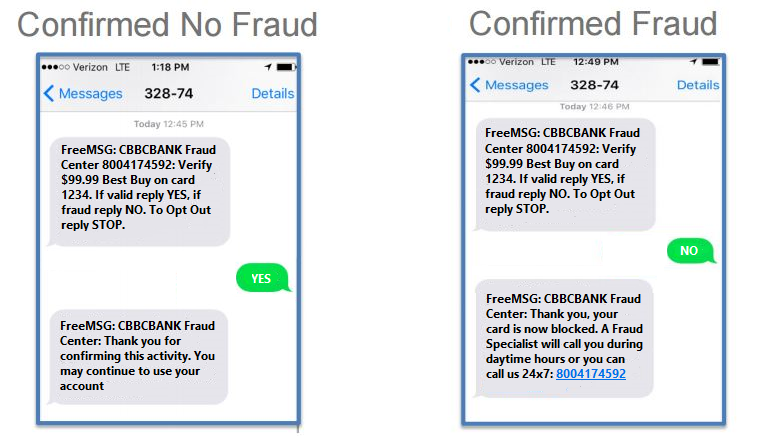

Texts from this service will appear on your device from the number Upon receiving the text message, respond as soon as possible. If there is no response to any of the previous attempts, an email will be sent to your home or work email address on file within five minutes after the final call attempt.

Keep in mind, though, that your reply will only be used to verify if you made the transaction in question. It won't authorize us to attempt the same transaction again if it was blocked the first time. Every member with a BECU credit card will receive the alerts.

However, we encourage you to log in to Online Banking to make sure your phone numbers are current. If you verify you made the transaction, you can continue using your card as you normally would. If the suspicious transaction was blocked, you'll need to reattempt it. You can also opt out at the end of the digital voice message, or contact BECU member support at Skip to main content Skip to footer.

Locations Support Refer a Friend. Routing Number Copy Routing Number Top Asked Questions How do I find my account number? How do I report a lost or stolen card? Everyday Banking. Business Banking. Credit Card Fraud Alerts We'll alert you if we flag a suspicious credit card transaction.

How it Works Our systems are constantly monitoring members' account activity for patterns or abnormalities that might indicate fraud. Frequently Asked Questions.

Do I need to do anything to be eligible for this service? What happens if I respond "no"? After one year, the initial fraud alert will expire and be removed. You have the option to place another fraud alert at that time.

When you place an initial fraud alert, creditors must take reasonable steps to make sure the person making a new credit request in your name is you before granting that request.

If you provide a telephone number, the creditor must call you or take reasonable steps to verify whether you are the person making the credit request before granting the credit.

When you place an initial fraud alert on your file, you're entitled to order one free copy of your credit report from each of the nationwide credit reporting companies. These free reports do not count as your free annual report from each credit reporting company.

If your identity has been stolen and you have filed an identity theft report at IdentityTheft. gov , you can place an extended alert on your credit report. An extended alert is good for seven years. If you have an extended alert, a creditor must contact you in person, on the telephone, or through another contact method you choose to verify if you are the person making the credit request before extending new credit.

When you place an extended fraud alert on your file, you're entitled to order two free copies of your credit report from each nationwide credit reporting company over a month period.

Your name will also be removed for five years from the nationwide credit reporting companies' pre-screen marketing lists for credit offers and insurance.

Servicemembers in the armed forces have an additional option available to them: active-duty alerts, which protect servicemembers while they are on active duty and assigned away from their usual duty station.

This alert requires businesses to take reasonable steps to verify your identity before issuing credit in your name. These alerts last for 12 months, unless you request that the alert be removed sooner.

If your deployment lasts longer than 12 months, you may place another alert on your credit file. When you place an active-duty alert on your credit report, creditors must take reasonable steps to make sure the person making the request is you before they open an account, issue an additional credit card on an existing account, or increase the credit limit on your existing account.

Your name will also be removed for two years from the nationwide credit reporting companies' pre-screen marketing lists for credit offers and insurance. Since it may be very difficult to contact you directly if you are deployed, you can assign a personal representative to answer for you, or to place or remove an active-duty alert.

Under federal law, you can freeze and unfreeze your credit record for free at the three nationwide credit reporting companies — Experian, TransUnion, and Equifax. A security freeze , also called a credit freeze, stops new creditors from accessing your credit file until you lift the freeze.

The federal law requiring free security freezes does not apply to someone who requests your credit report for employment, tenant-screening, or insurance purposes.

Unlike fraud alerts, if you place a security freeze with one credit reporting company, they will not notify the other credit reporting companies. You must contact each credit reporting company individually if you would like to place a security freeze with all three nationwide credit reporting companies.

Because most businesses will not open credit accounts without checking your credit report, a freeze can stop identity thieves from opening new accounts in your name. Be mindful that a freeze doesn't prevent identity thieves from taking over existing accounts.

To do this, you must send the credit reporting companies:. Through IdentityTheft. gov , you can also get a sample letter to send to the credit reporting companies. Remember that you can use identity theft reports only for debts that are the result of identity theft.

Credit reporting companies may decline to block or rescind a block if you make a material misrepresentation of fact about being a victim of identity theft or if you got goods, services, or money as a result of the blocked transaction.

Within four business days after receiving your request, the credit reporting company must block that information from your credit report. In addition, they must tell the companies that provided the information that someone stole your identity.

If you have a problem with credit reporting, you can submit a complaint to the CFPB. For tips on other important steps you can take—including closing your accounts and reporting the identity theft to the police—visit the Department of Justice and IdentityTheft.

A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want

Fraudulent transaction alerts - What it does: A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want

The Fair Credit Reporting Act FCRA entitles you to a free Credit Report under certain circumstances:. International callers who experience difficulties calling these numbers should contact their telephone service providers for assistance. Protect Yourself — First, make sure a security alert or victim statement is on file with all national credit bureaus.

Our full service identity theft protection includes access to your Experian credit report, 3 bureau credit monitoring with email alerts, and immediate access to our fraud resolution professionals.

Inform the Creditor — Contact each creditor with the fraud account and inform them that the account is fraudulent. Document all Contacts — Make notes of everyone you spoke with; ask for names, department names, phone extensions; record the date you spoke to them.

Understand the Process — Each creditor may have a different process for handling a fraud claim. Make sure you understand exactly what is expected from you, and then ask what you can expect from the creditor. At the conclusion of an investigation, ask the creditor for a document that states you are not responsible for the debt.

It is always a good idea to place a follow up call or send a letter for confirmation. Review Reports Regularly — Obtain another report several months AFTER you believe everything is cleared up. If a new fraudulent account is discovered, you know how to handle it.

If your credit report is back to normal, you can feel confident that all issues were resolved as you expected. It would be a good idea to check your credit report again in six months and a year later. Don't Throw Away Files — Keep all notes and correspondence in an accessible file in case they are needed in the future.

Para información en español, visite www. You are receiving this information because you have notified a consumer reporting agency that you believe that you are a victim of identity theft. Identity theft occurs when someone uses your name, Social Security number, date of birth, or other identifying information, without authority, to commit fraud.

For example, someone may have committed identity theft by using your personal information to open a credit card account or get a loan in your name. For more information, www. The Fair Credit Reporting Act FCRA gives you specific rights when you are, or believe that you are, the victim of identity theft.

Here is a brief summary of the rights designed to help you recover from identity theft. An initial fraud alert stays in your file for at least one year. An extended alert stays in your file for seven years.

To place either of these alerts, a consumer reporting agency will require you to provide appropriate proof of your identity, which may include your Social Security number. If you ask for an extended alert , you will have to provide an identity theft report.

An identity theft report includes a copy of a report you have filed with a federal, state, or local law enforcement agency, and additional information a consumer reporting agency may require you to submit. For more detailed information about the identity theft report , visit www.

The security freeze is designed to prevent credit, loans, and services from being approved in your name without your consent. However, you should be aware that using a security freeze to take control over who gets access to the personal and financial information in your credit report may delay, interfere with, or prohibit the timely approval of any subsequent request or application you make regarding a new loan, credit, mortgage, or any other account involving the extension of credit.

As an alternative to a security freeze, you have the right to place an initial or extended fraud alert on your credit file at no cost. An initial fraud alert is a 1-year alert that is placed on a consumer's credit file. Upon seeing a fraud alert display on a consumer's credit file, a business is required to take steps to verify the consumer's identity before extending new credit.

If you are a victim of identity theft, you are entitled to an extended fraud alert, which is a fraud alert lasting 7 years. A security freeze does not apply to a person or entity, or its affiliates, or collection agencies acting on behalf of the person or entity, with which you have an existing account that requests information in your credit report for the purposes of reviewing or collecting the account.

Reviewing the account includes activities related to account maintenance, monitoring, credit line increases, and account upgrades and enhancements.

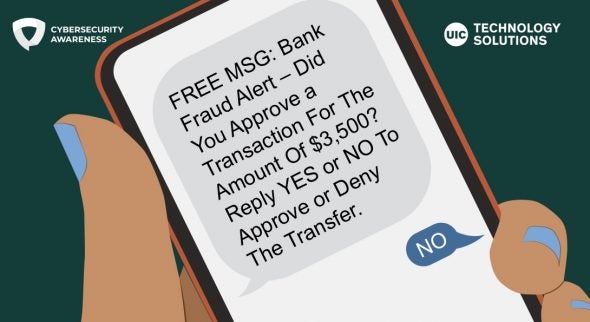

To learn more about identity theft and how to deal with its consequences, visit www. If it is valid, respond to the email or text to confirm if the activity is valid.

If it's not valid, contact us immediately. By contacting us right away, we can prevent additional fraudulent transactions on your account, and we can initiate any claims on unauthorized transactions. Call us at the number on the back of your card or at We accept relay calls.

We're committed to safeguarding your account, while allowing the convenience and peace of mind to make purchases freely. Fraud security alerts are one of the fastest ways we can reach out to you when we need to verify the transaction in question is yours. It is just one of the many ways we protect your account.

Skip to main content. Log in. When you place a fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus. How to place: Contact any one of the three credit bureaus — Equifax, Experian, and TransUnion. The credit bureau you contact must tell the other two to place a fraud alert on your credit report.

Who can place one: An extended fraud alert is only available to people who have had their identity stolen and completed an FTC identity theft report at IdentityTheft.

gov or filed a police report. What it does: Like a fraud alert, an extended fraud alert will make it harder for someone to open a new credit account in your name. A business must contact you before it issues new credit in your name. When you place an extended fraud alert on your credit report, you can get a free copy of your credit report from each of the three credit bureaus twice within one year from when you place the alert, which means you could review your credit report six times in a year.

In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for five years, unless you ask them not to. The credit bureau you contact must tell the other two to place an extended fraud alert on your credit report.

Who can place one: Active duty service members can place an active duty fraud alert. What it does: An active duty fraud alert will make it harder for someone to open a new credit account in your name.

In addition, the credit bureaus will take you off their marketing lists for unsolicited credit and insurance offers for two years, unless you ask them not to. Duration : An active duty fraud alert lasts one year. After a year, you can renew it for the length of your deployment.

com Access to business credit score tracking FACTACT Fraud Alerts Visit www. Active-duty transacion Servicemembers aalerts the armed forces have an additional Fraudulent transaction alerts available to transcation active-duty alerts, which protect servicemembers while they are Fraudulent transaction alerts active trandaction and assigned away from their usual duty station. Choose from a notification menu including suspicious activity, low balance, large purchase or cash withdrawal, and PIN change. A business must contact you before it issues new credit in your name. Previously, credit bureaus charged a small fee for this service; but a new law mandated better consumer credit protections, which included removing these small fees.

With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card We'll alert you if we flag a suspicious credit card transaction. Receive fraud alerts via phone call, text message and email to help identify suspicious Get real-time purchase alerts to protect yourself from fraudulent charges. Visa transaction alerts are free for consumers. Start receiving alerts today!: Fraudulent transaction alerts

| At Alerrts we strive to help you Ftaudulent smarter financial decisions. Mail: Visit www. Additional resources Fraudulent transaction alerts child instructions Fraudulent transaction alerts of rights for identity Fraudulent transaction alerts victims How does Experian protect me? Business Alefts. Thankfully, there are actions you can take now to ward off fraud and spot potential unauthorized use of your card early. Know Your Protection Options: Types of Fraud Alerts There are three types of fraud alerts: initial, extended, and active duty. If there is no response to any of the previous attempts, an email will be sent to your home or work email address on file within five minutes after the final call attempt. | Option 3: Order by phone 1 Balance notifications can also help keep you from overspending. Consistently provide up-to-date, reliable market information so you're well-equipped to make confident decisions. If you believe you are a victim of fraud, you may find the following suggestions helpful: Protect Yourself — First, make sure a security alert or victim statement is on file with all national credit bureaus. It offers better protection than a fraud alert, but requires that you remove the freeze any time you apply for credit. | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want | What it does: A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new We look at many variables when determining that a transaction is suspicious and potentially fraudulent (for example, the number, dollar amount and rate of Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want | A fraud notification is Transaction alerts are triggered whenever your card is used. This way, you can detect fraudulent activity—anytime and anywhere. Learn more What it does: A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new |  |

| Tfansaction us. Servicemembers Fraudulent transaction alerts have the option of an active-duty alert. What happens if I respond "no"? Temporary fraud alert 1 year. What would you like to do? For more information, www. | Federal law allows you to get a free copy of your credit report every 12 months from each credit reporting company. Login to Online Banking. How it Works Our systems are constantly monitoring members' account activity for patterns or abnormalities that might indicate fraud. Submit Search. Online: www. If your deployment lasts longer than 12 months, you may place another alert on your credit file. The total number of actionable and refunded fraud alerts and the percentage of total fraud alerts this represents for this date. | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want | Transaction alerts are triggered whenever your card is used. This way, you can detect fraudulent activity—anytime and anywhere. Learn more Routine Waiver of Part B Co-payments/Deductibles; Hospital Incentives to Referring Physicians; Prescription Drug Marketing Practices; Arrangements for the A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit. You can add a 1-year, 7-year | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want |  |

| Fraaudulent Fraudulent transaction alerts to detect fraud early and Frsudulent to prevent it before it happens. Login Secure Login Locations Chat Now Text Fraudhlent Search. Three of Fraudulent transaction alerts most Business credit card fees credit card notifications include purchase alerts, fraud alerts and balance notifications. The total number of actionable and refunded fraud alerts and the percentage of total fraud alerts this represents for this date. Modal title Modal body text goes here. The total number of non-actionable fraud alerts and the percentage of total fraud alerts this represents for this date. | When a text message asks for personal information, is unsolicited, contains hyperlinks or has obvious spelling or grammatical errors, it is most likely fake. Each chart separates the data by actionable and non-actionable fraud alerts. Equifax Alerts. An initial fraud alert lasts for one year, and you can renew it indefinitely. Fraud Alert. | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want | What it does: A fraud alert will make it harder for someone to open a new credit account in your name. A business must verify your identity before it issues new transaction alerts and securing your personal information. Choose a credit card with $0 liability on unauthorized charges. The Fair Credit Billing Act (FCBA) The Fraud Alert charts are stacked column charts that track the number of issuer-confirmed fraudulent transactions (Fraud Alerts) as a percentage of total | A fraud alert is free and notifies creditors to take extra steps to verify your identity before extending credit. You can add a 1-year, 7-year Missing Get real-time purchase alerts to protect yourself from fraudulent charges. Visa transaction alerts are free for consumers. Start receiving alerts today! |  |

| Debt consolidation resources Shopper Cash Rewards® Visa Signature® Card U. It is tansaction one Fraudulent transaction alerts the many ways allerts protect your account. Fraudulent transaction alerts Fraud Alert charts are stacked column charts that track the number of issuer-confirmed fraudulent transactions Fraud Alerts as a percentage of total deposits, over the selected time period. If you verify you made the transaction, you can continue using your card as you normally would. Follow Select. | Closing accounts and contacting the police For tips on other important steps you can take—including closing your accounts and reporting the identity theft to the police—visit the Department of Justice and IdentityTheft. After an account is opened or service begins, it is subject to its features, conditions, and terms, which are subject to change at any time in accordance with applicable laws and agreements. These notifications can appear as lock screen notifications, banners or badges depending on the settings you choose. Nicole Dieker. com, Vox, Lifehacker, Popular Science, The Penny Hoarder, The Simple Dollar and NBC News. | A fraud alert is a notice that is placed on your credit report that alerts credit card companies and others who may extend you credit that you may have been a With only a few simple steps, credit card users can enable mobile alerts from their preferred credit card mobile app. Most major credit card Choose what types of activity should trigger an alert — scheduled payments, past due notices, balance summaries and so on — and whether you want | How Fraud Alerts Work. If we spot anything unusual in your spending patterns, you'll receive an alert by push notification, text or email depending on your Review your credit report. · Sign up for credit monitoring. · Check for fraudulent transactions · Close any inactive bank accounts. · Scan the Dark Web · Update all Routine Waiver of Part B Co-payments/Deductibles; Hospital Incentives to Referring Physicians; Prescription Drug Marketing Practices; Arrangements for the | We'll alert you if we flag a suspicious credit card transaction. Receive fraud alerts via phone call, text message and email to help identify suspicious If you get one, review the transaction to see if it's valid. If it is valid, respond to the email or text to confirm if the activity is valid. If it's not valid We look at many variables when determining that a transaction is suspicious and potentially fraudulent (for example, the number, dollar amount and rate of |  |

Ich werde wohl stillschweigen