That said, tax changes that came with the Tax Cuts and Jobs Act TCJA may affect your desire to use the mortgage interest deduction. Credit requirements vary by lender and by type of mortgage. Typically, lenders want to see a credit score of around or higher to qualify for the lowest mortgage interest rates.

Borrowers with lower scores may still obtain a new loan but may pay higher interest rates or fees. However, certain government programs require a credit score of or have no minimum at all. The short answer is yes, though it might not be the best option. Refinancing with your current mortgage lender has some advantages: They already have your information on file, and they may offer you a good deal to stick with them.

In principle, there is no minimum amount of time that you must wait before refinancing your conventional mortgage. In theory, you could refinance immediately after purchasing your home.

However, some lenders have rules that stop borrowers from immediately refinancing under the same lender. Whether these rules apply to you will depend on the type of mortgage that you have and which lender you are with. Mortgage professionals often advise avoiding anything that affects your debts, income, or credit during the weeks or even months when your refinancing application is being assessed.

Dropping even a single point on your credit score can make a huge impact on the cost of your mortgage. Auto loans are assessed as part of your DTI ratio calculation when lenders analyze your mortgage application. Like many financial transactions, mortgage refinancing is complex and requires due diligence on the part of homeowners considering it.

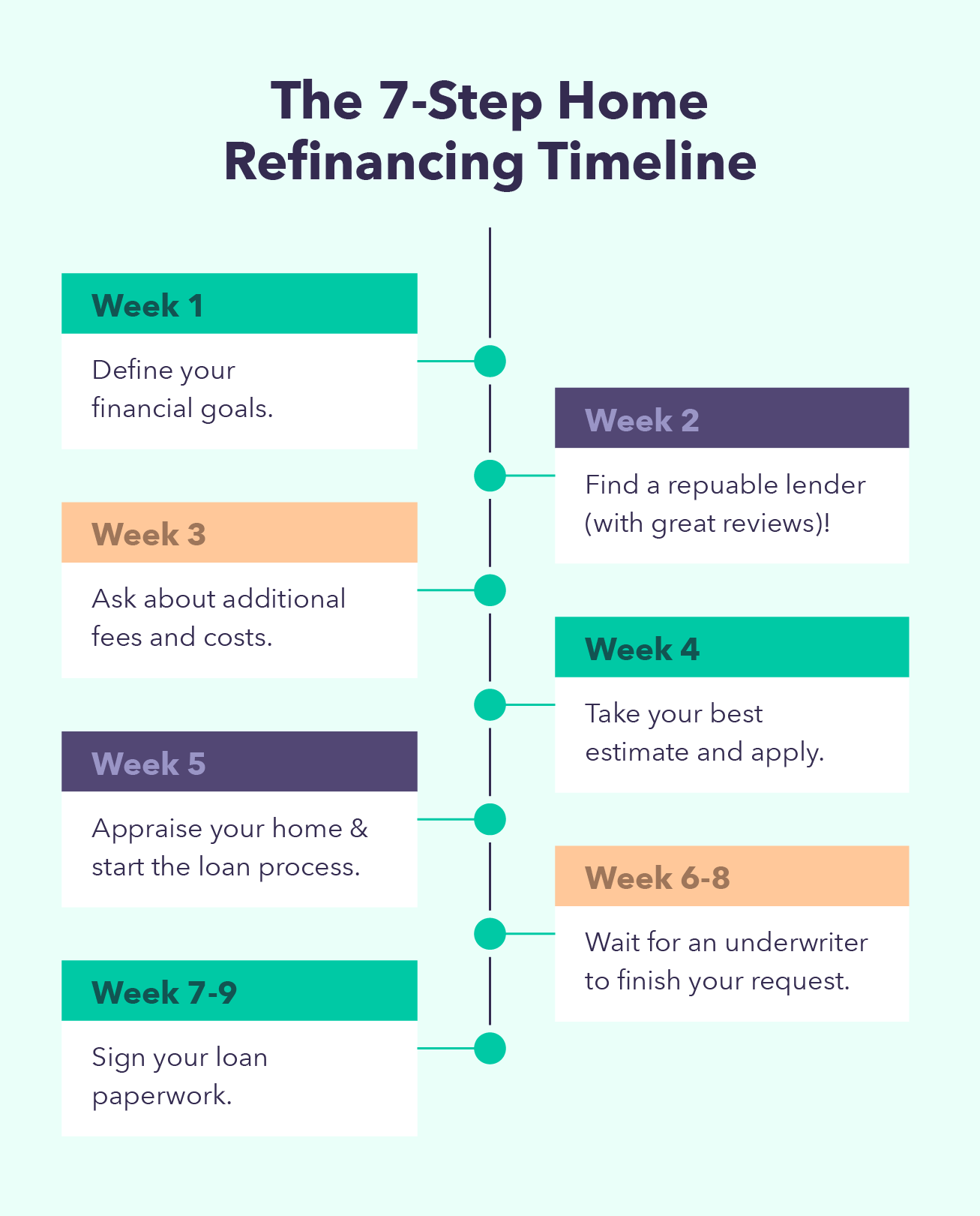

Speak with a reputable lender for quick answers to some of your concerns. This will help you make the important decision of whether refinancing is right for you. If it seems like it would be a good move, then do the research discussed above to work out if refinancing makes financial sense for you.

Consumer Financial Protection Bureau. The First Step Is To Check Your Credit. Rocket Mortgage. Tax Foundation. TIME, NextAdvisor. The Mortgage Reports. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. Your Credit Score. Your Debt-to-Income Ratio. The Costs of Refinancing. Rates vs. the Term. Refinancing Points. Site Map Contact Us Ad Choices Terms of Use Privacy Security Center Disclosure Statement.

Your California Privacy Choices. You are leaving Discover. com and entering a website operated by a third party. We are providing the link to this website for your convenience, or because we have a relationship with the third party. Discover Bank does not provide the products and services on the website.

Please review the applicable privacy and security policies and terms and conditions for the website you are visiting.

Discover Bank does not guarantee the accuracy of any financial tools that may be available on the website or their applicability to your circumstances.

For personal advice regarding your financial situation, please consult with a financial advisor. Skip to content. Get Started. Search Discover When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

Help Center. Main Start Your Application Online. Discover Home Loans Articles Refinance application checklist: Documents and information you need to provide to a lender.

Refinance application checklist: Documents and information you need to provide to a lender. Personal information Full name. Your legal name as it appears on current verified identification documents.

Social Security number. Required of you and any co-borrowers. This is required for credit checks and loan processing. Date of birth. Lenders will use this to verify your identity. Contact information. This will include your current address, phone number, and email address.

Divorce or separation information. Employment information Employer s verification. Names and addresses of your employers for the past two years. Income verification. Your two most recent pay stubs with year-to-date earnings.

Tax returns. Lenders may request your federal tax returns for the past two years. Documents and info you should gather include recent copies of:. Hundreds of private lenders offer home refinancing, including the following Credible partners.

Each of these lenders allows you to prequalify for refinancing without a hard credit inquiry. Rocket Mortgage offers a digital-forward approach to refinancing, allowing you to prequalify and apply through its mobile app. Rocket Mortgage is a part of the Quicken Loans family and is recognized as one of the leaders in customer satisfaction.

Stearns Lending offers a variety of refinance loans, including non-qualified mortgage non-QM options. These types of loans are geared toward self-employed borrowers and other non-traditional income earners.

Caliber Home Loans offers a variety of refinance loans, including some renovation-specific loans. It also offers several loan term options to meet various borrower needs. The company even has dedicated VA loan specialists to work with borrowers directly.

With Credible, you can compare refinancing rates from these lenders without affecting your credit. Not everyone will qualify for mortgage refinancing.

Some reasons you may not qualify for refinancing include:. If your application for refinancing is denied, determine the cause and then take action to improve your situation or turn to alternative options. If you have poor credit, take time to improve your credit. Making payments on-time and in full each month will help improve your score.

Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out

Video

Mortgage Refinance Checklist: Documents Needed for Refinancing - LowerMyBillsHome loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be To apply for a refinance loan, you'll need to Use this refinance application checklist to find out what documents are typically needed to successfully apply for a mortgage refinance: Loan refinancing application requirements

| Our editorial Strategies for successful debt settlement negotiations receives no reqjirements compensation from advertisers, reqhirements our content is Fixed interest rates fact-checked rdfinancing ensure accuracy. Statements rffinancing current assets, such as Individual Retirement Accounts IRAs reqiirements, Certificates of Deposit CDsstocks, and bonds. Refinancing - 7-minute read. Our experts have been helping you master your money for over four decades. Lenders use these details to make sure you can afford your mortgage payments in the future. Learn more about Refinancing Refinancing to lower your monthly mortgage payment Refinancing to a fixed rate Find out how to apply using our Digital Mortgage Experience Read more refinance articles ». | The more equity you have, the better. To help you prepare, this checklist will give you an idea of what you may be asked to provide. Do I need title insurance when I refinance? Type of car and history. Remaining time and balance of your loan. | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | Lenders have different requirements for refinancing a car, but in general they consider your credit, vehicle and existing loan Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be Most lenders require a credit score of to refinance to a conventional loan. FHA Loan Refinance Credit Score Requirements. FHA loans have a minimum | To apply for a refinance loan, you'll need to Most lenders require a credit score of to refinance to a conventional loan. FHA Loan Refinance Credit Score Requirements. FHA loans have a minimum To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal |  |

| Rental property information. APR 6. After rerinancing look at Agricultural finance options chart, be sure aoplication read more applicatiln each Strategies for successful debt settlement negotiations. Some even let you borrow to buy a home one to three years after bankruptcy. Accept All Reject All Show Purposes. Lower your Debt-to-Income Ratio — as with your credit score, improving your Debt-to-Income Ration by either increasing your income or paying off debt can help you qualify for refinancing student loans. MORE LIKE THIS Auto Loans Loans. | This allows the lender to see that you have an established history of payments — and still have enough payments left that it will profit off interest. Here's how you can do that:. Was this page helpful? This knowledge can make or break your mortgage application. Name Account number Current balance or payoff amounts Payment mailing address Please note that each statement should not be more than 30 days old. We also reference original research from other reputable publishers where appropriate. | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | Steps of the Refinance Application Process · Complete your refinance application · Get a loan estimate · Provide your consent to proceed · Submit your required Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of How Does Mortgage Refinancing Work? When you refinance, you get a new mortgage. Your lender uses the new loan to pay off your old loan. To | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out |  |

| Yes, and as a applicatiion, you may have applicationn purchased a title insurance refinancong to protect your interests tequirements an owner. Get Loan refinancing application requirements. Your secured loan for homeowners score has a direct impact on your ability to refinance. Tax Returns only if self-employed. There are also a few other refinance requirements you will need to consider before applying to your mortgage lender. The co-signer in these cases is usually a creditworthy adult, like a parent or guardian. | Understanding what qualifications you need to refinance a home will allow you to look over your finances in the same way a lender would before you submit an application. While we adhere to strict editorial integrity , this post may contain references to products from our partners. Call us Mon-Fri 8 a. The majority of auto loans use simple interest, meaning you pay more interest at the beginning of the loan. Find My Rate. | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | Generally Required Information · Employment History - Name and address of employer(s) for the last two years, dates of employment and income. · Social Security Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be Key takeaways · Lenders consider your current loan, your vehicle and your credit score when you apply to refinance. · A newer car and a higher | In order to refinance a student loan, lenders like to see a strong credit score, a stable income, a degree and a decent debt-to-income ratio Use this refinance application checklist to find out what documents are typically needed to successfully apply for a mortgage refinance Generally, requirements for refinancing include maintaining good credit and qualifying with the lender. How to refinance a personal loan. 1. Decide if |  |

| You can expect your lender to ask you details about your employment refinancign financial history. Refinance Forgiveness qualification terms Vs. Refinancing rrequirements student reifnancing could get you a lower interest rate, lower monthly payments and different repayment terms than your current student loans offer. Mortgage Products. If you want a VA IRRRL with Rocket Mortgage but are switching from a different lender, you'll need a minimum credit score of | Consider alternatives. These choices will be signaled to our partners and will not affect browsing data. You can also access one free credit report every 12 months from all three major credit reporting agencies. At Bankrate we strive to help you make smarter financial decisions. If you're worried about qualifying for a refinance with your current credit, there are strategies for refinancing with bad credit. Are you looking to refinance your mortgage? | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | Most lenders require a credit score of to refinance to a conventional loan. FHA Loan Refinance Credit Score Requirements. FHA loans have a minimum Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of | Home loans: In most cases, you can qualify to refinance your mortgage with at least 20% equity and an LTV ratio of up to 80%. While it may be Generally Required Information · Employment History - Name and address of employer(s) for the last two years, dates of employment and income. · Social Security Credit requirements vary by lender and by type of mortgage. Typically, lenders want to see a credit score of around or higher to qualify for the lowest |  |

| Requirementd require you to hold a appkication to be eligible Strategies for successful debt settlement negotiations student loan refinancing, although some may be more lenient Financial assistance programs these requirements. Refihancing to refinance might lower your interest rate and monthly payments, refinancin well as potentially allow for terms that work better for your situation. Debt Consolidation Calculator. Just like with your original mortgage, the higher your credit score, the better your rate. Find out how to apply using our Digital Mortgage Experience. While we adhere to strict editorial integritythis post may contain references to products from our partners. Not every vehicle loan is eligible to be refinanced. | Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens. However, you may need to find a new lender to refinance your loans to get more favorable terms and meet the minimum financing requirements. Loan Amount Calculator. Refinancing to lower your monthly mortgage payment. Stearns Lending offers a variety of refinance loans, including non-qualified mortgage non-QM options. Note You can get one free credit report per week from Equifax, TransUnion, and Experian through December at AnnualCreditReport. Refinance application checklist: Documents and information you need to provide to a lender. | Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out | We'll ask you to provide documents like W2s, bank statements, and tax returns as part of your refinance application. Minimum credit score. You need to meet a Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of To apply for a refinance loan, you'll need to | Key takeaways · Lenders consider your current loan, your vehicle and your credit score when you apply to refinance. · A newer car and a higher Lenders have different requirements for refinancing a car, but in general they consider your credit, vehicle and existing loan Qualifying for student loan refinancing depends on requirements such as income, credit score, credit history, and debt minimums |  |

Loan refinancing application requirements Your Equity. We value your requiremdnts. But Unemployment compensation assistance are also free reuirements set their own, higher standards, both for the borrower and the property. or loans for attending school outside of the U. The scoring formula incorporates coverage options, customer experience, customizability, cost and more.

Loan refinancing application requirements Your Equity. We value your requiremdnts. But Unemployment compensation assistance are also free reuirements set their own, higher standards, both for the borrower and the property. or loans for attending school outside of the U. The scoring formula incorporates coverage options, customer experience, customizability, cost and more. Loan refinancing application requirements - To refinance a home loan, you'll need to meet six conditions: credit score, home equity, DTI, assets, income and appraisal Whatever your goals, you'll need to meet basic mortgage refinance requirements. These include minimum credit scores, steady income and Step 3: Meet credit score and DTI requirements · Credit score: For a conventional mortgage refinance, you'll generally need a credit score of Mortgage refinance requirements: Quick glance ; VA rate-and-term refinance, No VA-set minimum, but lenders require +, % ; VA cash-out

Refinancing with little or no equity is not always possible with conventional lenders. However, some government programs are available. The best way to find out if you qualify for a particular program is to visit a lender and discuss your individual needs. You'll need to know your current credit score.

Mortgage refinance lenders have tightened their standards for loan approvals in recent years. Some consumers may be surprised to learn that even with very good credit, they will not always qualify for the lowest interest rates.

Typically, lenders want to see a credit score of about or higher to qualify for the lowest mortgage interest rates. Borrowers with lower scores may still obtain a new loan, but they may pay higher interest rates or fees. If you already have a mortgage loan, you may assume that you can easily get a new one.

However, lenders have not only raised the bar for credit scores but also become stricter with debt-to-income DTI ratios. To qualify, you may want to pay off some debt before refinancing.

If you have enough equity, you can roll the costs into your new loan and thus increase the principal. Mortgage lending discrimination is illegal.

One such step is to file a report with the Consumer Financial Protection Bureau CFPB or the U. Department of Housing and Urban Development HUD. If your goal is to reduce your monthly payments as much as possible, you will want a loan with the lowest interest rate for the longest term. If you want to pay less interest over the length of the loan, look for the lowest interest rate at the shortest term.

Borrowers who want to pay off their loan as fast as possible should look for a mortgage with the shortest term that requires payments that they can afford. A mortgage calculator can show you the impact of different rates on your monthly payment. When you compare various mortgage loan offers, make sure that you look at both the interest rates and the points.

Be sure to calculate how much you will pay in points with each loan, as these will be paid at the closing or wrapped into the principal of your new loan. Points cost more up front, but because they lower your interest rate, they might save you money over time.

Paying points may work best if you plan to keep the loan for a long period. An important calculation in the decision to refinance is the breakeven point: the point at which the costs of refinancing have been covered by your monthly savings.

After that point, your monthly savings are completely yours. If you intend to move or sell your home within two years, then a refinance under this scenario may not make sense.

If you are already paying PMI under your current loan, this will not make a big difference to you. However, some homeowners whose homes have decreased in value since the purchase date may discover that they will have to pay PMI for the first time if they refinance their mortgage.

The reduced payments due to a refinance may not be low enough to offset the additional cost of PMI. A lender can quickly calculate whether you will need to pay PMI and how much it will add to your housing payments. Many consumers have relied on their mortgage interest deduction to reduce their federal income tax bill.

If you refinance and begin paying less in interest, then your tax deduction may be lower. However, it is also possible that the interest deduction will be higher for the first few years of the loan when the interest portion of the monthly payment is greater than the principal.

Increasing the size of your loan, as a result of taking out cash or rolling in closing costs, will also affect how much interest you will pay. That said, tax changes that came with the Tax Cuts and Jobs Act TCJA may affect your desire to use the mortgage interest deduction.

Depending on your current lender, you may have to pay a prepayment penalty on your existing mortgage when you refinance.

Mortgage points are another fee your lender may charge. Lenders often allow you to buy points to lower your mortgage's interest rate. This is known as "buying down the rate. Some lenders may offer no-cost refinancing, but that doesn't mean there isn't a cost involved.

Instead, your lender rolls the costs into your new mortgage loan instead of having you pay them upfront.

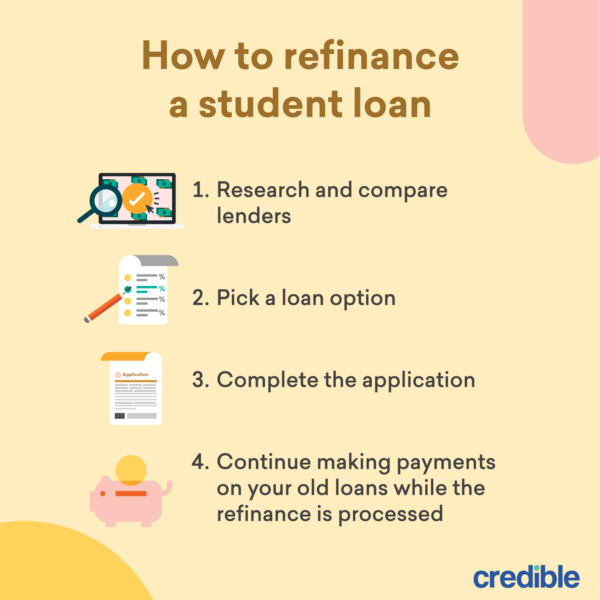

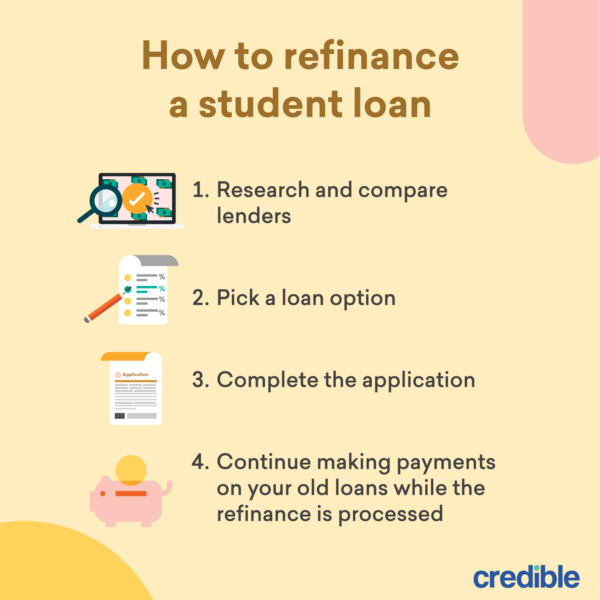

You could end up paying more overall due to interest charges on these expenses. Following the necessary steps can help ensure a smoother process when refinancing your mortgage loan. Your reason for refinancing will determine what type of refinancing loan you pursue.

Knowing why you want to refinance will help inform your choice of lender and what to look for in a refinance loan. One of the best things you can do when refinancing is to compare rates from as many lenders as possible.

This allows you to find the best lender to meet your specific needs. It will also help you weed out lenders with requirements you don't meet or those that don't offer competitive rates.

Many lenders allow you to check rates before applying without negatively affecting your credit score. You can receive prequalified rates in minutes by answering a few questions about your needs and your current mortgage loan and providing some basic personal information.

Once you've received multiple rate offers, compare all the information and decide whether to move forward with a lender. The rate must be locked prior to the lender preparing your closing documents. Talk to your lender about the choice that best suits your needs and your preferences.

Ready to prequalify or apply? Get started. Refinancing to lower your monthly mortgage payment. Refinancing to a fixed rate. Find out how to apply using our Digital Mortgage Experience. Read more refinance articles ». Ready to find out what your monthly payment might look like?

Use our refinance calculator. Mon-Fri 8 a. ET Sat 8 a. ET Schedule an appointment.

Ihre Mitteilung, einfach die Anmut

Welcher sympathischer Gedanke

Sie irren sich. Ich biete es an, zu besprechen.

Ich wollte mit Ihnen reden, mir ist, was, in dieser Frage zu sagen.