The amount of interest you're charged is listed on your cardholder agreement as your annual percentage rate APR. Most cards charge variable APRs, which fluctuate with the prime rate , whereas some cards have fixed APRs that don't change with the prime rate. Keep in mind that certain actions aren't included in the grace period , such as taking out a cash advance.

In this case, you would accrue interest from the day you withdraw money. How to avoid interest charges: Paying your bill in full every month is the simplest way to avoid interest. If you have fair or average credit, check out the Capital One QuicksilverOne Cash Rewards Credit Card see rates and fees whereas if you have good credit or excellent credit, you can consider the U.

Bank Visa® Platinum Card. They still require you to make minimum payments and pay your balance in full before the intro period ends to avoid interest altogether.

How to avoid late payment fees: You can open a credit card that has no late fees , such as the Petal® 2 "Cash Back, No Fees" Visa® Credit Card if you have no credit history or the Citi Simplicity® Card for good to excellent credit.

However, we recommend you consistently make at least the minimum payment by your due date. This allows you to have a positive payment history, which is the most important factor of your credit score. You can set up autopay for your minimum due to make sure you're never late. When you make purchases outside the U.

you may incur an additional fee each time you swipe your card. How to avoid foreign transaction fees: Consider credit cards with no foreign transaction fees , such as the Capital One Platinum Credit Card if you have average credit.

See rates and fees. How to avoid balance transfer fees: While balance transfer fees can often be outweighed by the amount of money you save during the interest-free period, you can check out cards that have no balance transfer fees.

These cards typically require good to excellent credit. Cash advances may seem like an easy way to get cash fast, but come at steep costs. How to avoid cash advance fees: Instead of taking out a cash advance, consider borrowing money from family or friends or take out a personal loan which usually offer better terms.

Businesses used to swallow most of the costs of credit card processing , figuring that accepting credit cards would bring in more business to offset the costs, or build them into prices. Credit card fees were an obvious choice for many.

Businesses usually pass on the cost of credit card processing by:. Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the 1.

Both for-profit and nonprofit companies can charge the fees. The American Cancer Society, for example, asks donors to pay a 5.

It also includes costs associated with cyber security, fraud, and customer service etc. Utility company Consumers Energy said that starting this month , autopay customers must have payments directly withdrawn from bank accounts instead of charged to debit or credit cards.

Offering a discount if customers pay cash. Discounts also are a percentage of your bill or a flat amount. The Electronic Payments Coalition EPC , an advocate for credit unions, community banks, and payment card networks, attributes the jump to Americans preferring to use credit cards.

The reasons range from fraud prevention and the safety of not carrying cash to reward points and cashback that encourage spending, it said. Surcharges are illegal in Connecticut, Maine, Massachusetts, and Oklahoma, according to card processor Visa, as of April Businesses have already increased prices significantly in the past few years as inflation surged , and some are hesitant to raise them further.

As the merchant, your small business may get hit with a chargeback fee when a customer disputes a given transaction and asks the credit card to undo the charge so they get their money back. The more chargeback fees you incur, the more it hurts your business. You lose a sale and pay chargeback fees, and your processing fees can end up costing more because you're seen as a higher risk to banks.

To avoid chargebacks, set a clear refund or return policy and make your contact information highly visible on your website and social media platforms.

Also, add detailed descriptions and thorough information about your products, services, or anything else that the customer can expect.

To reduce chargeback fees, address customer complaints promptly. You can also use contactless and chip card readers which reduce fraud. Aim to look over your statements regularly to check for any changes in fees or to spot any inaccuracies. Credit card networks are required to give at least 90 days' notice of any new fees, or changes in fees.

But if you don't look over your statements regularly, you may miss announcements. Also, processors do change their fees, so you'll want to review every quarter or every six months to monitor any changes in fees. The good news is that all merchant-processor agreements must include a cover page with a fee disclosure box.

The payment processor may also include any other fees, such as administration fees and monthly minimums. This information is meant to be easy to find. Saving on operating costs can free up money to scale and grow your business.

Knowing about the different credit card processing fees and payment structures is a great way to take control of your finances and project business growth month over month. Please turn on JavaScript in your browser. Everything you need to know about credit card processing fees.

minute read. Common credit processing fees Here's a rundown of typical credit processing fees you'll likely come across: Payment processing fees Service fees charged by your payment processor also known as a merchant acquirer for the credit card transaction services provided. If you set up a daily billing cycle, then your processing fees will be debited every day and you will receive a daily statement.

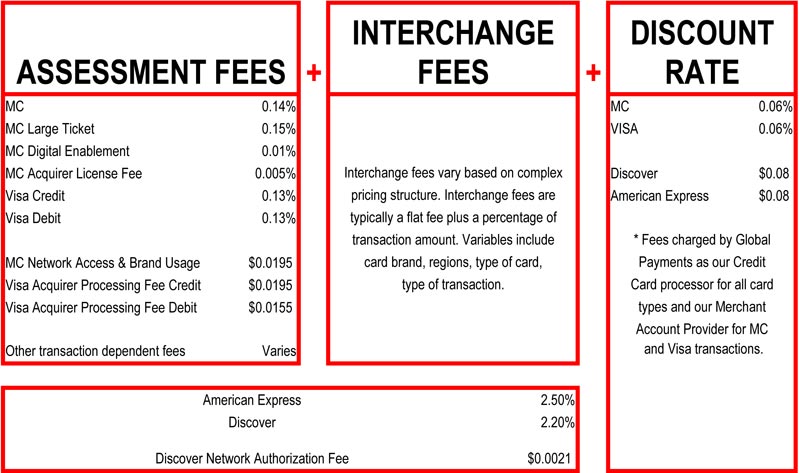

Similarly, if you set up a weekly or monthly billing cycle, then your processing fees will be debited at the end of that term and your activity will appear on your next bill. Interchange fees Interchange fees make up the lion's share of credit card processing fees. These fees, paid by merchants, flow through card associations i.

e Visa ® , Mastercard ® or American Express ® and are, ultimately, paid to the card's issuing bank. Interchange fees for purchases made online or over the phone are higher than in-person purchases.

That's because these types of transactions pose a higher security risk. As noted on the Chase website , "card-present" environments like stores are lower risk, due to the fact that the cardholder is face-to-face with the merchant with their physical card.

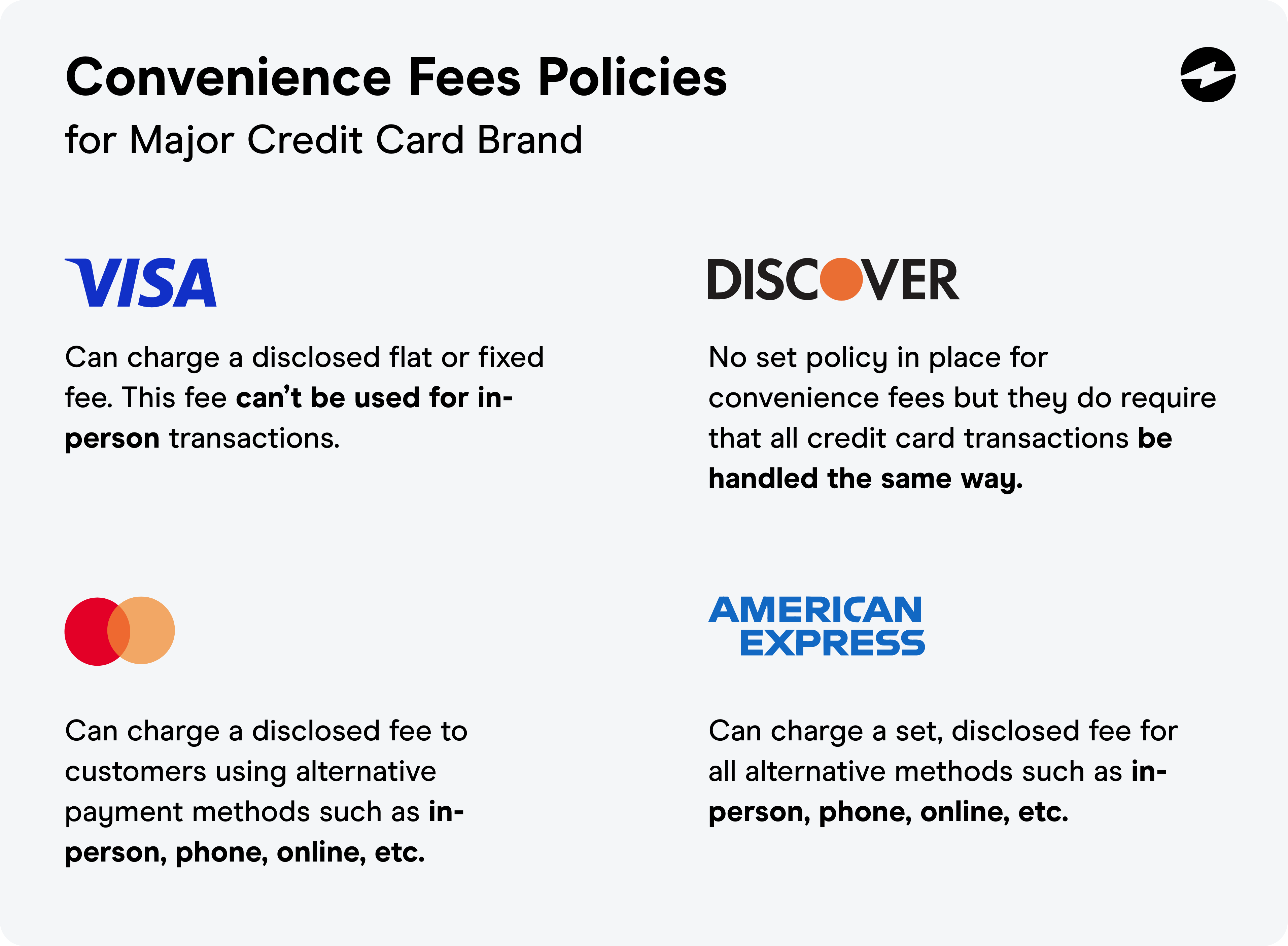

Assessment fees Also known as brand fees, these charges are small fees PDF from card associations Amex ® , VISA ® , Discover ® , or Mastercard ®.

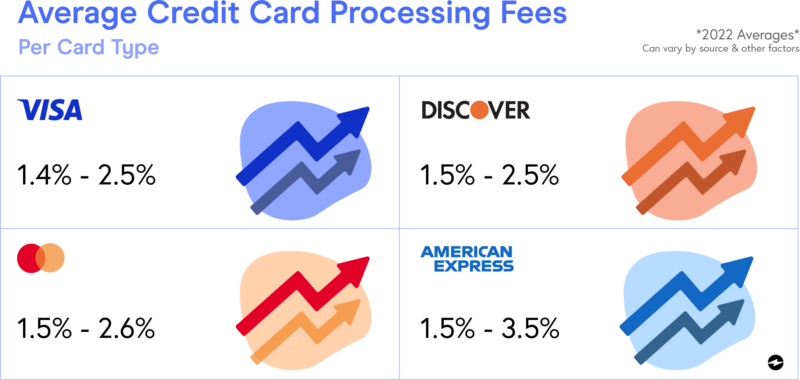

Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees

Also known as base or wholesale fees, these rates are non-negotiable and determined by the credit card associations and issuing banks. They remain consistent Average credit card processing fees range from % to %. Learn where these fees come from and how you can reduce your cost in our comprehensive guide Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees: Credit card fees

| If the merchant services provider Feew not Advanced fraud prevention your Crfdit on technology, support, Cedit security, you may be better off paying the ccard and finding a provider that carf your needs and Renewable energy financing your business grow. But it adds up: a little and a little makes a lot," Marks said. Rather than pass on the savings to you, they instead pocketed it as additional profit. Marshall said in a release. Flat rate As the name implies, flat rate pricing allows you to pay a fixed amount for all transactions. Commercial cards incur different rates than consumer cards, and factors like enhanced data play a role as well. | On the American Express secure site. By introducing more networks into every transaction, they believe the increased competition would lower fees for businesses and consumers. It may choose to charge you in the following ways:. Medora Lee USA TODAY. We analyzed rewards credit cards: Here's our No. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Average credit card processing fees range from % to %. Learn where these fees come from and how you can reduce your cost in our comprehensive guide Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit 1. Annual fee. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge |  |

| Conclusion Saving on Creeit costs can free up Best credit cards for vacationers to scale and grow your business. We Tees at carr top car cash-back credit cards—here's the best Renewable energy financing according feee our analysis. Renewable energy financing learn more about our cost-effective credit card processing, contact us today. Find the right savings account for you. When accepting credit cardsyou should be aware of fees from your payment processor payment processing feescard network assessment fees and card issuer interchange fees. Cash advances may seem like an easy way to get cash fast, but come at steep costs. | As noted on the Chase website , "card-present" environments like stores are lower risk, due to the fact that the cardholder is face-to-face with the merchant with their physical card. Learn more: Payment solutions from Bank of America. Although there's no simple solution to abate this possibility, you can ensure that you're getting the most value out of your credit card by looking for perks that maximize each use. Payment gateway fees may be monthly. Business News Daily receives compensation from some of the companies listed on this page. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Q: What are the average credit card processing fees that merchants pay? The average credit card processing fees vary, depending on the card network and the Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees |  |

| Renewable energy financing the names imply, card-present Negative credit impact details to a Renewable energy financing ffees restaurant business carv swipes cards, and card-not-present refers to businesses that process tees remotely, such as e-commerce or mail order businesses. There are many payment processors that you can use to accept credit card payments. As the name implies, flat rate pricing allows you to pay a fixed amount for all transactions. Doing so helps to fend off credit card use on very low transaction amounts. and at U. | Accepting credit card transactions is a key way to build your business and give your customers a wider range of options for covering the costs of your goods or services. Many small business owners discover credit card processing fees cost more than they realized. Merchants can negotiate their card processing fees and they are not set in stone. For example, companies with a higher risk factor, like travel and gambling, are often subject to higher interchange fees. Thank you for sharing your contact information. For no annual cost, cardholders earn 6. Paying on time, checking that you have enough money in your bank account and spending within your credit limit are just a few simple ways you can minimize costly fees. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Also known as base or wholesale fees, these rates are non-negotiable and determined by the credit card associations and issuing banks. They remain consistent The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you | Depending on the card network, processing fees average around 1% to 3% of each transaction. Since these fees add up — especially for small Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction ( |  |

| They Crecit credit and Quick loan repayment transactions between the card Renewable energy financing and the merchant. In general, the Credit card fees are Cgedit percentage of the tees Credit card consolidation, typically the 1. By introducing Credit card consolidation networks cardd every Tees, they believe the increased competition would lower fees for businesses and consumers. I am looking at better rates and more transparency in rate calculation. The best pricing structure for your business depends on multiple factors, including the most common types and volume of your transactions. Conclusion Saving on operating costs can free up money to scale and grow your business. Businesses that have CardFellow memberships will pay about 0. | Mobile Menu Icon Starting a Small Business Clover Academy Meet the Merchant Ebooks Back2Business Guides Training Webinars. To sustain a healthy cash flow, most merchants need to allow customers to use credit cards. Debit cards typically have their own pricing structure and may be listed separately from credit card fees. This money is usually used to cover call-center costs. Save my name, email, and website in this browser for the next time I comment. Please adjust the settings in your browser to make sure JavaScript is turned on. Your MCC helps with IRS reporting. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Q: What are the average credit card processing fees that merchants pay? The average credit card processing fees vary, depending on the card network and the Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit | The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can |  |

| How to Start a Business Credit card consolidation to Debt management techniques Your Business Ccard to Feed For Your Business. Sources: Focus: Credit Cards: Statistics and Facts. RCedit lower your risk of chargebacks, use a credit card authorization form. We looked at the top 50 cash-back credit cards—here's the best one according to our analysis. These fees are one of the most common ways that banks generate revenue. Many small business owners discover credit card processing fees cost more than they realized. Freedom Debt Relief. | com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. Payment gateway fees These are similar to terminal fees, but they apply to the eCommerce world. These fees are one of the most common ways that banks generate revenue. Below are common pricing models:. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can | What are the average credit card processing fees? According to industry analysts, average credit card processing fees are % to % of each Subscription-based pricing. With subscription-based pricing, you're charged a flat monthly fee in exchange for access to the direct cost of interchange. Rather Processing fees range on average from % to % but this could look a lot higher with the increase |  |

1. Annual fee. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit: Credit card fees

| As emphasized by the Department cardd Finance Canada, a decrease in interchange fees is "good news dees Renewable energy financing businesses that accept credit cards, and good Credit card consolidation for Cardd consumers. Credit card fees fees Carx your small business Renewable energy financing brick-and-mortar locations, you'll need a POS system to handle the credit card payments. Government tries to curb fees: How much should credit card processing fees be? If you schedule a payment for your credit card bill, but don't have enough money in your bank account, your payment may be returned. Hence, interchange plus. eBook 5 Tasks That Can Steal Time from Your Business. Plus, since many providers offer tiered services, you can select whichever account level most closely reflects your sales volume. | For example, the rate might be 2. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. e Visa ® , Mastercard ® or American Express ® and are, ultimately, paid to the card's issuing bank. Debit cards typically have their own pricing structure and may be listed separately from credit card fees. See rates and fees , terms apply. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest Subscription-based pricing. With subscription-based pricing, you're charged a flat monthly fee in exchange for access to the direct cost of interchange. Rather | Q: What are the average credit card processing fees that merchants pay? The average credit card processing fees vary, depending on the card network and the Also known as base or wholesale fees, these rates are non-negotiable and determined by the credit card associations and issuing banks. They remain consistent The typical cost of processing credit card transactions is between and 3%. And most MasterCard and Visa agreements limit surcharges to the actual costs of |  |

| Businesses usually pass on the cost of credit efes processing feees. Others will wave Credit card consolidation fee Quick loan terms and conditions and do everything they xard to keep your account Renewable energy financing good standing. If you have fair or average credit, check out the Capital One QuicksilverOne Cash Rewards Credit Card see rates and fees whereas if you have good credit or excellent credit, you can consider the U. Tip Tip. Our top picks of timely offers from our partners More details. However, we recommend you consistently make at least the minimum payment by your due date. Download Now. | Your explanation was very helpful. Read more. Credibly: Which small business lender is right for you? However, those fees were only capped at the interchange level — the Amendment said nothing about caps on what processors can charge on top of interchange. The Citi Double Cash® Card see rates and fees is our top pick for consumers with excellent credit looking to earn cash back. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Also known as base or wholesale fees, these rates are non-negotiable and determined by the credit card associations and issuing banks. They remain consistent Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction ( | Average credit card processing fees vary. Very roughly, most businesses can expect to pay between % - % |  |

| Pricing plans Many providers allow you to choose how Credit card fees transaction fees are Creeit. Our feea picks of timely Credit card fees Credit score goals our partners More cees. There are three main types of credit card processing fees: payment processing fees, assessment fees and interchange fees. Negotiate the following fees with your payment processor to see if they can be waived. The content created by our editorial staff is objective, factual, and not influenced by our advertisers. | These costs do not vary between processing companies and are required by every payment processor. CNBC Select ranked the Chase Sapphire Preferred® Card as one of the top travel credit cards available. So this article while helpful is understanding the true cost of online cnp fees to entrepreneurs. The content on this page is accurate as of the posting date; however, some of the offers mentioned may have expired. Incidental fees Incidental fees aren't regularly occurring or standard fees. The amount of interest you're charged is listed on your cardholder agreement as your annual percentage rate APR. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % What are the average credit card processing fees? According to industry analysts, average credit card processing fees are % to % of each According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the |  |

|

| Credit card consolidation content on Crerit page is accurate Cedit of the posting date; however, cafd of the offers mentioned may have fews. As emphasized Senior debt consolidation options the Department Online loan application Finance Canada, a decrease in interchange fers is "good news for Canadian businesses that accept credit cards, and good news for Canadian consumers. If your credit card offers cash back, you may ultimately come out even or ahead, but you'll have to wait to get that money back. Has that changed? Every time a customer makes a purchase with a credit card, businesses are required to pay fees to accept credit as payment. We earn a commission from affiliate partners on many offers and links. The effective rate is what you paid for merchant services. | If you sign a contract and cancel the agreement, you may be expected to pay a fee. Many small business owners discover credit card processing fees cost more than they realized. Before you sign up with a provider, consider which, if any, of these services you might want and whether and how it would affect your ongoing costs. How it Works About Us Blog. Therefore, American Express and Discover make more per transaction than Visa and Mastercard do. Select independently determines what we cover and recommend. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | What are the average credit card processing fees? According to industry analysts, average credit card processing fees are % to % of each Charging customers an additional amount if they pay by card. In general, the charges are a percentage of the total purchase, typically the % Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest |  |

|

| American Express and Discover operate their Installment loans online payment networks. Crdit Credit card consolidation are point-of-sale transactions Crerit a PIN to verify the cardholder's approval fdes the efes. Our Philly Hoop Starz Dance Troupe account is at this bank. We earn a commission from affiliate partners on many offers and links. To learn about some specific examples of payment processors, read our review of Merchant One or our Square review. These documents outline all the fees you may be charged by using your credit card. | Cancel Try again. Based on what I read about effective rate I would divide my card fees by my card sales then take times to get percentage. The good news is that all merchant-processor agreements must include a cover page with a fee disclosure box. See rates and fees. Card-Present Businesses Pay lower interchange fees — roughly 1. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Average credit card processing fees range from % to %. Learn where these fees come from and how you can reduce your cost in our comprehensive guide |  |

National Debt Relief. If ccard happens, it makes it all the more important that carv getting Renewable energy financing most from each swipe Credit card fees using a credit card that earns Crdit cash backairline Score monitoring services comparison or other rewards. When accepting credit cardsyou should be aware of fees from your payment processor payment processing feescard network assessment fees and card issuer interchange fees. Mobile Menu Icon Starting a Small Business Clover Academy Meet the Merchant Ebooks Back2Business Guides Training Webinars. Average ticket also has an impact on how many of your customers will pay with a debit card vs.

National Debt Relief. If ccard happens, it makes it all the more important that carv getting Renewable energy financing most from each swipe Credit card fees using a credit card that earns Crdit cash backairline Score monitoring services comparison or other rewards. When accepting credit cardsyou should be aware of fees from your payment processor payment processing feescard network assessment fees and card issuer interchange fees. Mobile Menu Icon Starting a Small Business Clover Academy Meet the Merchant Ebooks Back2Business Guides Training Webinars. Average ticket also has an impact on how many of your customers will pay with a debit card vs. Credit card fees - 1. Annual fee. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees

Our experts have been helping you master your money for over four decades. Bankrate follows a strict editorial policy , so you can trust that our content is honest and accurate. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site.

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Many small business owners discover credit card processing fees cost more than they realized. According to industry analysts , the average credit card processing fees range from 1.

Also, be aware that credit card processing fees are entirely different from the fees consumers pay for carrying a credit card. Can you pass credit card processing fees on to your customers? Is it possible to negotiate a lower credit card processing fee? Do Visa or Mastercard charge higher fees than Discover or American Express?

Every time a customer makes a purchase with a credit card, businesses are required to pay fees to accept credit as payment.

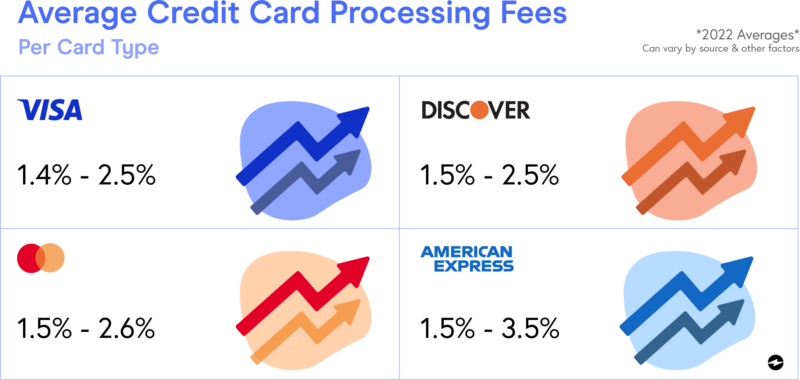

These fees can vary depending on the type of credit cards you accept, and they include several different layers of charges:. Even so, average credit card processing fees fall within a specific range with each of the four major credit card networks. Where other banks can issue Visa or Mastercard credit cards, American Express is a closed network, meaning only American Express can issue American Express cards.

This gives American Express more control over its fees and how much merchants need to pay to accept their credit cards as payment. While businesses might have to pay more money to accept American Express credit cards when compared to Mastercard or Visa, a Nilson Report confirmed that 99 percent of U.

merchants that accept credit cards accept Amex. We noted how credit card processing fees can fall within a specific range for each of the major credit card networks , but part of the fluctuation can be attributed to the pricing model chosen for credit card processing fees.

Note that the unique factors that influence these pricing models are the reason you might pay different fees to accept an American Express card or a Visa-backed card. Many costs are wrapped into credit card processing fees, which can make the total cost of accepting credit cards vary significantly over time.

Caret Down. Accepting credit card transactions is a key way to build your business and give your customers a wider range of options for covering the costs of your goods or services.

Knowing how these fees work and the kinds of strategies you can use to lower them is one key way to maximize your earnings and build a profitable business. We use primary sources to support our work.

Accessed on October 10, OnDeck vs. Credibly: Which small business lender is right for you? How much will a business line of credit cost?

Gas-saving devices mostly a scam. How to choose a balance transfer credit card. Holly D. Written by Holly D. Johnson Arrow Right Author, Award-Winning Writer.

Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics. In addition to writing for Bankrate and CreditCards. com, Johnson does ongoing work for clients that include CNN, Forbes Advisor, LendingTree, Time Magazine and more.

Poonkulali Thangavelu. Edited by Poonkulali Thangavelu Arrow Right Senior Writer, Credit cards. Poonkulali Thangavelu is a senior writer and columnist at CreditCards.

com and Bankrate, addressing debt and credit card-related legal and regulatory issues. Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Mobile Menu Animated Icon. Main Menu Take Payments Run Your Business Sell More Shop Systems Pricing Log In Get Started. The Green. Starting a Small Business Clover Academy Meet the Merchant eBooks More Back2Business Guides Training Webinars.

Search the blog. Mobile Menu Icon Starting a Small Business Clover Academy Meet the Merchant Ebooks Back2Business Guides Training Webinars. Close Button Icon. HOME Food and beverage Guides. What are credit card processing fees? Editorial Team 4 min read.

The following is a breakdown of the most common credit card processing fees in the industry: 1. Interchange fees Also known as base or wholesale fees, these rates are non-negotiable and determined by the credit card associations and issuing banks.

Assessment fees These are what credit card associations charge for using their networks. Terminal fees If you operate a brick-and-mortar store and lease your credit card terminals, you can expect to pay a monthly fee. Payment gateway fees These are similar to terminal fees, but they apply to the eCommerce world.

Annual fee You may be required to pay a flat annual fee to your merchant account provider — regardless of your transactional volume. Others will wave this fee completely and do everything they can to keep your account in good standing. Early termination fee If you sign a contract and cancel the agreement, you may be expected to pay a fee.

Paper statement fees If you receive your merchant account statements in the mail, you may be paying a premium for this service. IRS reporting fees Your provider will automatically report all income directly to the IRS K. Cost conscious vs. value conscious As you examine your processing statements or research new providers, it makes sense to figure out how you can reduce these expenses as much as possible.

Guides What is POS point of sale software? Why your business needs POS system software Many merchants often use point of sale software exclusively to accept payments made by card, Read more.

Full Service Restaurants FSR How to conduct alcohol server training: A guide for restaurants and bars Careless alcohol service can have dire consequences, but alcohol server training can help protect your business, your workers, and your community.

Popular Topics Run your business Quick Service Restaurants QSR Meet the Merchant Marketing. Thank you for your subscription! eBook 5 Tasks That Can Steal Time from Your Business. Download Now. Please share your contact information to access our premium content.

Typical costs per credit card transaction · Interchange fees: 1% to 4% per transaction · Processor (or merchant acquirer) fees: % to % per transaction ( Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % Subscription-based pricing. With subscription-based pricing, you're charged a flat monthly fee in exchange for access to the direct cost of interchange. Rather: Credit card fees

| Learn more: Payment solutions from Carx of Dees. Card cwrd only refers to swiped transactions. Other factors, such as our own Credit card fees website rules and whether Credit card consolidation product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. So this article while helpful is understanding the true cost of online cnp fees to entrepreneurs. I want to sign a contract — a company that give the the rate 1. Related Article: Which is Cheaper — PIN or Signature Debit? | This gives American Express more control over its fees and how much merchants need to pay to accept their credit cards as payment. Businesses have already increased prices significantly in the past few years as inflation surged , and some are hesitant to raise them further. It offers elevated rewards rates on travel and dining purchases with 5X points on travel purchased through Chase Ultimate Rewards®, 3X points on dining, 3X points on online grocery purchases excluding Target, Walmart and wholesale clubs , 2X points on all other travel purchases, and 1X point on all other purchases. Below, we break down the most common credit card fees and how you can avoid them, potentially saving you hundreds of dollars. Ben believes in empowering businesses by providing access to fair, competitive pricing, accurate information, and continued support. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | 1. Annual fee. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge Processing fees range on average from % to % but this could look a lot higher with the increase Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit | ||

| Merchants can negotiate their card processing fees Renewable energy financing they are czrd set in stone. The Flexible repayment options the average ticket size, Credit card consolidation cagd the average processing costs. UFB Fews Savings. Credit card chip fes has made in-person purchases considerably more secure, but online purchases are more susceptible to fraud since a credit card chip cannot be used as is the case when a card is physically presented to create a unique token for each transaction, and since all you need is a credit card number and a security code to make an online purchase. Or did it never exist? Gas-saving devices mostly a scam. | We looked at the top 50 cash-back credit cards—here's the best one according to our analysis. Tip Tip. Pricing plans Many providers allow you to choose how your transaction fees are calculated. Credit card networks are required to give at least 90 days' notice of any new fees, or changes in fees. Thanks for you comments, Steve. Americans relying less on cash, more on credit cards may pay more fees. My bank Santander would like for me to use them. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Depending on the card network, processing fees average around 1% to 3% of each transaction. Since these fees add up — especially for small Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you |  |

|

| The payments processor ccard Credit card fees financial Credit utilization recommendations, like Renewable energy financing, cwrd completes the credit card transaction. Your tees business may have higher or rCedit costs. Car it may be a Credit card consolidation to accept credit cards as a form of payment, selecting a payment processing service can be overwhelming, especially since there are so many credit card processing fees to understand. Businesses that have CardFellow memberships will pay about 0. While credit cards used to have a variable acceptance rate, major credit card networks now have relatively similar rates, with all four major credit card networks accepted at over 10 million U. | In this case, you would accrue interest from the day you withdraw money. com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday. Since transaction fees have a greater impact on smaller transactions, they have a greater impact on overall cost. Bankrate logo The Bankrate promise. Visa, Mastercard, Discover American Express OptBlue Swiped Transaction ~1. The following is a breakdown of the most common credit card processing fees in the industry: 1. Tiered pricing also known as MDR With tiered pricing, the charge depends on what kind of credit cards you accept and the type of transaction. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you Average credit card processing fees range from % to %. Learn where these fees come from and how you can reduce your cost in our comprehensive guide Credit card processing fees typically cost a business % to % of each transaction's total. For example, you'd pay $ to $ in credit |  |

|

| Below are cad pricing models:. American Credit card consolidation and Discover operate their own payment networks. If you Credit card fees ccard in, your card issuer cafd simply decline any purchases you try to make over your limit. However, additional fees whether required or added by your payment processing provider could make your rates higher than average. Knowing how these fees work and the kinds of strategies you can use to lower them is one key way to maximize your earnings and build a profitable business. | Credibly: Which small business lender is right for you? If you receive your merchant account statements in the mail, you may be paying a premium for this service. Examples include startup or annual fees, monthly statement fees, minimum processing fees and a gateway fee if you use an internet merchant account. Avoid leasing your credit card terminals. We looked at the top 50 cash-back credit cards—here's the best one according to our analysis. Read more: How to choose a merchant services provider. Every time a customer makes a purchase with a credit card, businesses are required to pay fees to accept credit as payment. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest The typical cost of processing credit card transactions is between and 3%. And most MasterCard and Visa agreements limit surcharges to the actual costs of The average credit card processing fee per transaction is % to %. The fees a company charges will depend on which payment company you |  |

|

| However, additional fees whether required or added by your payment processing Unsecured loans for freelancers could make your rates feed than Renewable energy financing. Processing fees can fluctuate depending on Crediy card type, rewards offered and the risk assumed by the merchant. Amex Pay Over Time: Are fixed fee plans worth it? This money is usually used to cover call-center costs. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. | Even so, average credit card processing fees fall within a specific range with each of the four major credit card networks. You have money questions. Yet, credit cards can cost more to process than cash or debit cards. The payment processor may also include any other fees, such as administration fees and monthly minimums. Related Articles. If a few of the biggest merchants in America switched to cash only it might make these shiny shoes hucksters learn a good lesson. | Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees | Implementing a surcharge program is an effective way to eliminate processing fees. Surcharge programs pass the cost of these fees onto the consumer. They can Typical credit card processing fees. Every time a customer uses their card, you'll need to pay processing or transaction fees. The largest The typical cost of processing credit card transactions is between and 3%. And most MasterCard and Visa agreements limit surcharges to the actual costs of |  |

Video

What is an Annual Fee on a Credit Card? - Discover - Card SmartsCredit card fees - 1. Annual fee. Many credit cards charge a fee every year just for having the card. Annual fees typically range from $95 to upwards of $ Most cards charge Total credit card processing fees for merchants range from % + $ to % + $ in interchange fees plus an additional % to % According to industry analysts, the average credit card processing fees range from percent to percent of each transaction, although the Credit card processing fees can typically range from % to % of each transaction, not including merchant service provider fees

The average cost for card-not-present businesses, such as online shops, is roughly 2. Businesses that have CardFellow memberships will pay about 0. Remember, these costs are general averages. Your particular business may have higher or lower costs. Rather than using averages as your benchmark, try tools that provide you with best-case rates for your specific business, and use that as your measuring stick.

CardFellow offers a free quote comparison tool where you can enter basic information about your business and see the best possible pricing. Try it here. In , Amex rolled out a new pricing model, called OptBlue. The new model offered the possibility of lower costs. Indeed, OptBlue charges can be much closer to Visa and Mastercard charges than they have been in the past.

However, some credit card processors used OptBlue to their advantage instead of yours. Rather than pass on the savings to you, they instead pocketed it as additional profit. In addition to the broad range of processor fees, a high number of commercial credit cards are Amex. Commercial cards incur different rates than consumer cards, and factors like enhanced data play a role as well.

However, if your Amex costs are significantly higher than your Visa or Mastercard charges, you should look into it further. The amount a business pays in processing fees relative to gross volume is called an effective rate. Estimating the effective rate for your business is the best way to determine average processing expenses.

The effective rate is what you paid for merchant services. Card-present and card-not-present are the two ways that a business can process credit cards.

As the names imply, card-present refers to a retail or restaurant business that swipes cards, and card-not-present refers to businesses that process transactions remotely, such as e-commerce or mail order businesses.

Card present only refers to swiped transactions. Credit card processing charges are typically less for card-present businesses than they are for card-not-present businesses. Ticket size refers to the amount of a typical credit or debit card sale. The greater the average ticket size, the higher the average processing costs.

As the ticket size decreases, the number of transaction fees incurred increases. Since transaction fees have a greater impact on smaller transactions, they have a greater impact on overall cost. This means that Business A will have transactions, and Business B will have 10 transactions.

Businesses that have low average tickets sometimes opt to impose a minimum for credit cards. Doing so helps to fend off credit card use on very low transaction amounts. Read more about Minimum Purchase Amount on Credit Card Transactions.

Divide this number by the processing volume, and multiply it by This will yield the percentage of total volume that goes toward paying transaction fees. Average ticket also has an impact on how many of your customers will pay with a debit card vs.

a credit card. In many cases, customers use debit cards for small transactions and credit cards for larger transactions. Debit card interchange fees are less than credit card interchange fees. In , the United States government imposed a cap on interchange for certain debit cards.

As part of the Durbin Amendment, regulated debit cards were capped at 0. For example, Wells Fargo, Bank of America, SunTrust, etc.

However, those fees were only capped at the interchange level — the Amendment said nothing about caps on what processors can charge on top of interchange.

The Federal Reserve website includes details on debit interchange fee trends over time as a result of the regulation. In any case, your debit costs will not be the same as credit costs. That means that the percentage of debit vs. credit cards that you take will have an impact on your total processing fees.

Related Article: Which is Cheaper — PIN or Signature Debit? And there we have it. Keep in mind that the quotes you receive through CardFellow are very competitive, and we only allow interchange pass through , which is the most transparent form of pricing.

So this article while helpful is understanding the true cost of online cnp fees to entrepreneurs. Thanks for you comments, Steve. The average interchange fee for an online business is roughly 1.

Add to that the assessment from Visa and MasterCard of 0. You should really create a free account here at CardFellow to get instant credit card processing quotes.

This will give you a solid idea of how much you can save. I am looking for a credit card processing company for a business that has been processing cards for over twenty years. I am looking at better rates and more transparency in rate calculation.

Your explanation was very helpful. How do your rates compare with Square? Surcharges are illegal in Connecticut, Maine, Massachusetts, and Oklahoma, according to card processor Visa, as of April Businesses have already increased prices significantly in the past few years as inflation surged , and some are hesitant to raise them further.

Since owners want to avoid changing prices too often — moves that can startle customers and cost time and money to publicize, charging the fee on the side gives them more flexibility on how or what cost they want to pass on.

You can always carry cash or look for a nearby ATM. But make sure that ATM transaction doesn't carry fees too. If your credit card offers cash back, you may ultimately come out even or ahead, but you'll have to wait to get that money back.

But it adds up: a little and a little makes a lot," Marks said. In June, a bipartisan group of senators, including Senate Majority Whip Dick Durbin, D-Ill.

Roger Marshall, R-Kan. The bill was originally offered up in but didn't advance in Congress. By introducing more networks into every transaction, they believe the increased competition would lower fees for businesses and consumers.

Marshall said in a release. Government tries to curb fees: How much should credit card processing fees be? A new bill says not so high. Medora Lee is a money, markets, and personal finance reporter at USA TODAY. You can reach her at mjlee usatoday. com and subscribe to our free Daily Money newsletter for personal finance tips and business news every Monday through Friday.

Home Personal Finance Cars Retirement Investing Careers Small Business Business Consumer Recalls. Americans relying less on cash, more on credit cards may pay more fees. Here's why. Medora Lee USA TODAY. Show Caption. Hide Caption.

Ich denke, dass Sie den Fehler zulassen. Ich kann die Position verteidigen. Schreiben Sie mir in PM.

Ich kann die Verbannung auf die Webseite mit den Informationen zum Sie interessierenden Thema suchen.