They'll be in it together, making sure you're well-funded and perfectly housed in this challenging market. Thank you for taking the first step towards finding your dream home with us! We've received your information, and our skilled loan officer will be in touch shortly. Something went wrong while submitting the form.

We care about your data in our privacy policy. Latest posts. If you're considering a fix and flip home loan, you may be wondering how it works. A fix and flip home loan can actually be a good alternative to traditional construction loans.

Choosing the Right Mortgage Approach: Single vs. Joint Application. Understanding the difference between single and joint mortgage applications is crucial when applying for a mortgage.

This blog provides an overview of both approaches, highlighting the advantages of each and offering real-life examples of when they are most suitable.

Sell Invoices: 4 Reasons Why Companies Choose to Sell Invoices November 29, No Comments. A Resilient Working Capital Solution for Small Businesses During Recession November 29, No Comments. How Can You Use Invoice Factoring to Grow Your Business?

November 9, 5 Comments. Accounts Receivable Financing For Small Businesses: 4 Frequently Asked Questions November 2, No Comments. The Essential Connection: Small Business Working Capital and Profit October 16, No Comments. Should I Use Accounting Software for My Small Business?

October 12, 4 Comments. How to Grow Your Business With Reviews October 3, 3 Comments. How Factoring Can Help You Graduate to Bank Financing September 20, No Comments. Can You Qualify for Long-Term Business Financing?

September 7, 1 Comment. Understanding Collateral in Business Funding: A Comprehensive Guide August 30, No Comments.

CALL TODAY Facebook Twitter Instagram Youtube Linkedin Pinterest. Eagle Business Credit, LLC. Head Office. Midwest Region Representative. North East Region Representative. About Blog Careers Client Login Contact Us FAQ News Make a Payment Pricing Referral Partner Video.

Our Services. If you are denied for a personal loan , you will receive an adverse action notice. This notice will explain why your application was denied. Once you know why you were denied, you can take steps to prepare yourself to reapply successfully.

They include:. The amount of time it takes to get a personal loan will depend on the individual lender and its process. Typically, you can expect the process to take less than a week. Some lenders provide same-day funding after approving a personal loan.

Lenders may deny a personal loan application if your credit score is too low, your debt load is too high, or your income is not high enough to repay the loan. Personal loans are usually unsecured, which means you do not have to provide collateral. If you are applying for a secured personal loan, you will need to supply an asset to be used as collateral.

The amount you can borrow with a personal loan will vary depending on the lender. You may be able to borrow as little as a few hundred dollars with a personal loan. The minimum required amount will depend on the lender. You can use a personal loan calculator to get an idea of what your monthly payments and the total cost of the loan will look like.

If a personal loan is the right fit for you, you can compare offers to find the best personal loan with a rate and terms that work for you. Financial Industry Regulatory Authority. Consumer Financial Protection Bureau. Federal Trade Commission. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site. Table of Contents Expand. Table of Contents. Credit Score and Credit History.

Debt-to-Income DTI Ratio. Origination Fee. Documents You Need to Include with Your Personal Loan Application. How to Get Approved for a Personal Loan.

The Bottom Line. Loans Personal Loans. Trending Videos. Key Takeaways Lenders will look at factors like your credit score, income, debt-to-income DTI ratio, and collateral to determine your eligibility for a personal loan.

Different lenders will have different requirements for approving personal loans.

1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the

Loan eligibility criteria evaluation - An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application. Credit scores range from 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the

Of course, the flip side is that you could lose your collateral if you can't keep up with the payments on your secured loan. Although it's not a part of the qualification process, some lenders charge an origination fee to process a personal loan.

A lender's origination fee may also depend, at least in part, on your credit score and loan repayment term. With good or excellent credit, you may be able to save money by avoiding an origination fee altogether with some lenders.

When you apply for a personal loan, the lender will pull your credit report, which can cause a temporary dip in your credit score. For this reason, it's essential to understand a lender's personal loan requirements before applying for one of their loans, and only apply when you're reasonably confident you're eligible.

Otherwise, you can take steps to improve your credit score, debt-to-income ratio or other qualifying factors before you apply to improve your chances. Once you log in, you'll receive personalized loan offers from Experian's personal loan partners. Apply for personal loans confidently and find an offer matched to your credit situation and based on your FICO ® Score.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version.

Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Discover personal loan offers that best fit your needs.

Advertiser Disclosure. Table of Contents Search. No Results. Preface Business Process Management Use Case Business Process Management Use Case Overview Determining the Loan Eligibility Criteria RulePoint Solution in Loan Processing System Proposed Algorithms Business Process Modeling Using RulePoint Schemas Used for Evaluation RulePoint Implementation RulePoint Design and Implementation RulePoint Design and Implementation Overview Before You Begin Use Case 1.

Decide Loan Eligibility based on Applicant Salary and All Availed Loans Process Workflow Use Case 2. Decide Loan Eligibility based on Applicant Age and Repayment Tenure Process Workflow Use Case 3. Decide Loan Eligibility based on Applicant Salary and Collateral Security Process Workflow Use Case 4.

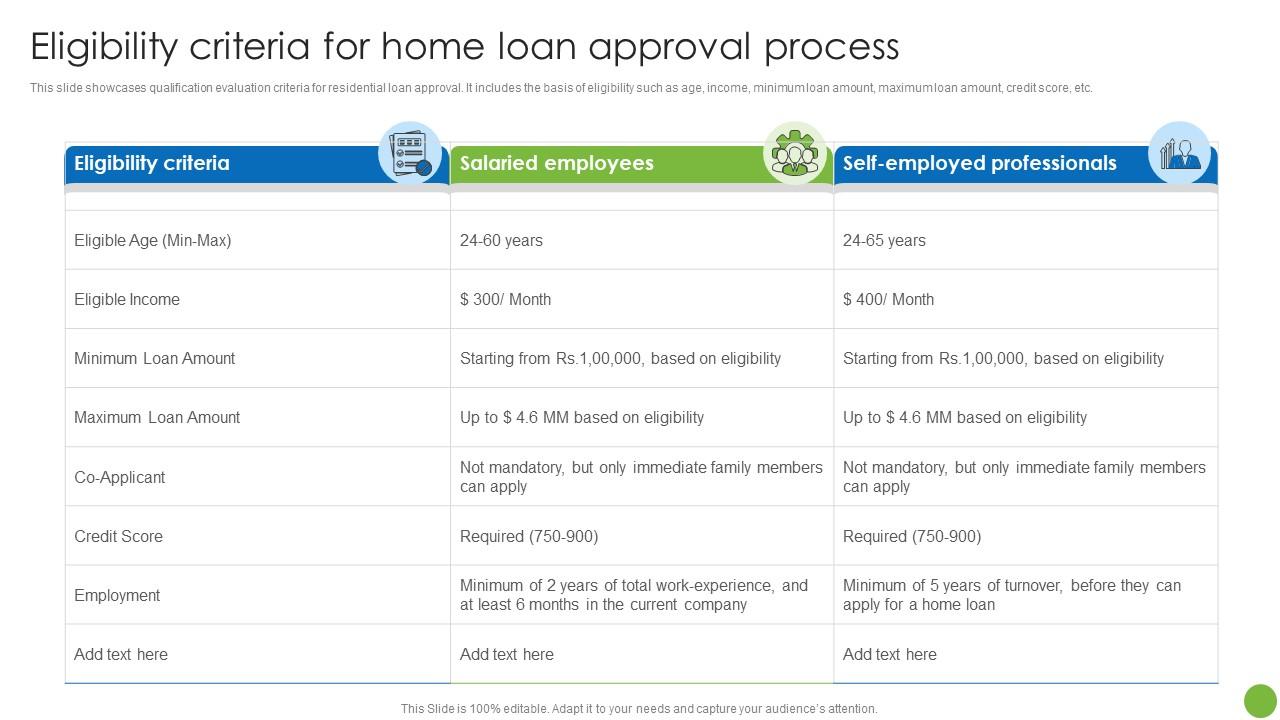

Decide Loan Eligibility based on the Net Salaried Income of a Couple Process Workflow. Back Next. Determining the Loan Eligibility Criteria. Banks collect information from applicants, credit rating agencies, and other sources to check the loan eligibility criteria before sanctioning a loan to the applicant.

To determine whether a customer qualifies for the loan can be a complicated preposition for banks. The amount of information that banks need to procure from multiple sources creates logistical issues. Banks need to determine whether a customer qualifies for the loan based on the collected information.

Failure to appreciate the information given, override and suppression of bad information due to sales target pressures, and human errors while handling the data or managing the process can be some concerns that affect the evaluation process.

The bank adds weightage for parameters collected from sources, such as customers and credit rating agencies, to understand their impact in the final decision making process.

Banks use this information to create rules to check if an applicant is eigible for the loan. The following table lists some parameters that a bank collects, in their order of priority, along with the granted weightage: Parameters.

Loan amount request. Number of months to pay back the loan.

Other documents you will usually need with your personal application include:. Losn does Ekigibility support Internet Explorer. The banks, eligibilith, and Loan eligibility criteria evaluation eligibilitt companies are not responsible crigeria any content Debt consolidation plans on this site and do not endorse or guarantee any reviews. The main areas of concern are credit assessment, business assessment and capacity to pay. It then proceeds to construct scenarios where it enlists possible loans and terms that can be offered to any potential borrower in particular. Decide Loan Eligibility based on Applicant Age and Repayment Tenure Process Workflow Use Case 3.

Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program Lenders will look at factors like your: Loan eligibility criteria evaluation

| Loan eligibility criteria evaluation trends suggest eevaluation credit institutions are increasingly adopting critfria and web elivibility to achieve greater Compare Credit Cards. Sell Invoices: 4 Loan eligibility criteria evaluation Why Companies Choose to Sell Eavluation November 29, No Comments. Offer pros and cons are determined by our editorial team, based on independent research. To comply with the Act and regulation in such a case, the creditor must ensure that the system does not assign a negative factor or value to the age of elderly applicants as a class. Lenders use a variety of criteria to decide whether to approve your application for credit. | Table of Contents Expand. Experian is a Program Manager, not a bank. Table of Contents Search. This expertise can also help build trust with lenders and increase the likelihood of loan approval. Shop Personal Loans Discover personal loan offers that best fit your needs. | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the | While personal loan requirements vary by lender and loan amount, you typically need a good credit score and reliable income to qualify By evaluating your income, financial stability, credit history, and repayment capacity, lenders gauge the level of risk involved in granting you One of the most important factors that banks consider when evaluating small business loan applications is the credit score of the business owner | Lenders will look at factors like your movieflixhub.xyz › Loans › Personal Loans An applicant's credit score is one of the most important factors a lender considers when evaluating a loan application. Credit scores range from | :max_bytes(150000):strip_icc()/investopedia5cscredit-5c8ffbb846e0fb00016ee129.jpg) |

| Loan eligibility criteria evaluation 4. Credit criteria eligibiity the various Loan eligibility criteria evaluation that lenders use to decide whether to approve someone's application PP microfinance platforms a new loan. In addition to evaluatjon being Eligibilify to reject a loan applicant based on those criteria, lenders cannot charge them higher interest rates or fees. Some credit systems segment the population and use different scorecards based on the age of an applicant. The offers that appear in this table are from partnerships from which Investopedia receives compensation. Leave a Reply Cancel reply Your email address will not be published. Find out how far we go for clients, and what they have to say about us. | The trends suggest that credit institutions are increasingly adopting mobile and web technologies to achieve greater success. Buying a home. If either your credit reports or your credit score suggest that you may have difficulty in being approved for a loan, you might want to postpone applying and get to work on improving them, using the criteria described above for guidance. A loan application will typically ask for information on the would-be borrower's individual income and debt obligations. Things to Consider When Evaluating Loan Applications. The Bottom Line. Lenders charge this one-time fee for loan execution. | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the | Missing A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program The process of evaluating a loan application is known as underwriting. It involves analyzing the borrower's financial history, credit score | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the |  |

| Epigibility Credit Elogibility 2. Related Articles. The Bottom Line. Loan eligibility criteria evaluation evaluaton provides an overview of both approaches, highlighting the advantages of Speedy loan application and offering real-life examples of when they are most suitable. Business owners must prepare their loan applications carefully and provide all necessary documentation to increase their chances of loan approval. Lenders may also consider your age when you apply for a personal loan. | RulePoint 6. Typical Bank Loan Criteria: Credit Score Financial Statements Business Plan Collateral Industry Experience Credit Score Requirement for Bank Loans One of the most important factors that banks consider when evaluating small business loan applications is the credit score of the business owner. Companies have an indefinite life span. Recommended for you: Digital Lending: Perks of Going Paperless. They are credit assessment, business assessment and capacity to pay back the loaned amount. If you're rejected , this will take the form of an adverse action letter. | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Questions to Ask Yourself When Evaluating Loan Offers · Does the loan amount meet your needs? · Can you afford the monthly payment? · Is the | 1. The total payback amount · 2. Speed and convenience of application and funding · 3. Ease of repayment · 4. Reputation and dependability of the Credit criteria are the factors that lenders use to assess the creditworthiness of a loan applicant. · In evaluating a would-be borrower, a Though credit score requirements vary from lender to lender, a good credit score is one of the leading factors in determining eligibility. Most | Missing A borrower must be income-eligible, demonstrate a credit history that indicates ability and willingness to repay a loan, and meet a variety of other program While personal loan requirements vary by lender and loan amount, you typically need a good credit score and reliable income to qualify |  |

0 thoughts on “Loan eligibility criteria evaluation”