Financial aid is not applied against student and parent contributions. While this number represents the amount of aid you are eligible to receive based on costs and your resources, the amount of aid that you will receive depends on aid funds available in any given year.

See How Aid Is Awarded for more information about how the university distributes financial aid resources. A note about applying for financial aid: When you apply for financial aid at U-M using the Free Application for Federal Student Aid FAFSA , we verify the information you submitted to the federal processor.

We will sometimes ask you for additional information and review other university records during the application process. Your FAFSA record may be corrected based upon this information.

Students may seek private scholarships and get help from U-M schools and colleges to meet their college costs. They may also use other resources, such as ROTC scholarships, housing, and veterans' benefits. These are considered as financial resources when determining need-based aid eligibility.

However, they will improve your overall aid package. In general, if you receive outside aid including scholarships from U-M schools and colleges :.

Learn More. Enroll in Direct Deposit to get your financial aid funds as soon as they are available. Utility Get Help Forms Net price calculator About. Qualifying for Aid. Most Searched Estimating Costs. New Undergraduates. Contact Us. Using Wolverine Access. Federal Eligibility Requirements Restrictions on Eligibility How We Determine Need-based Aid Eligibility.

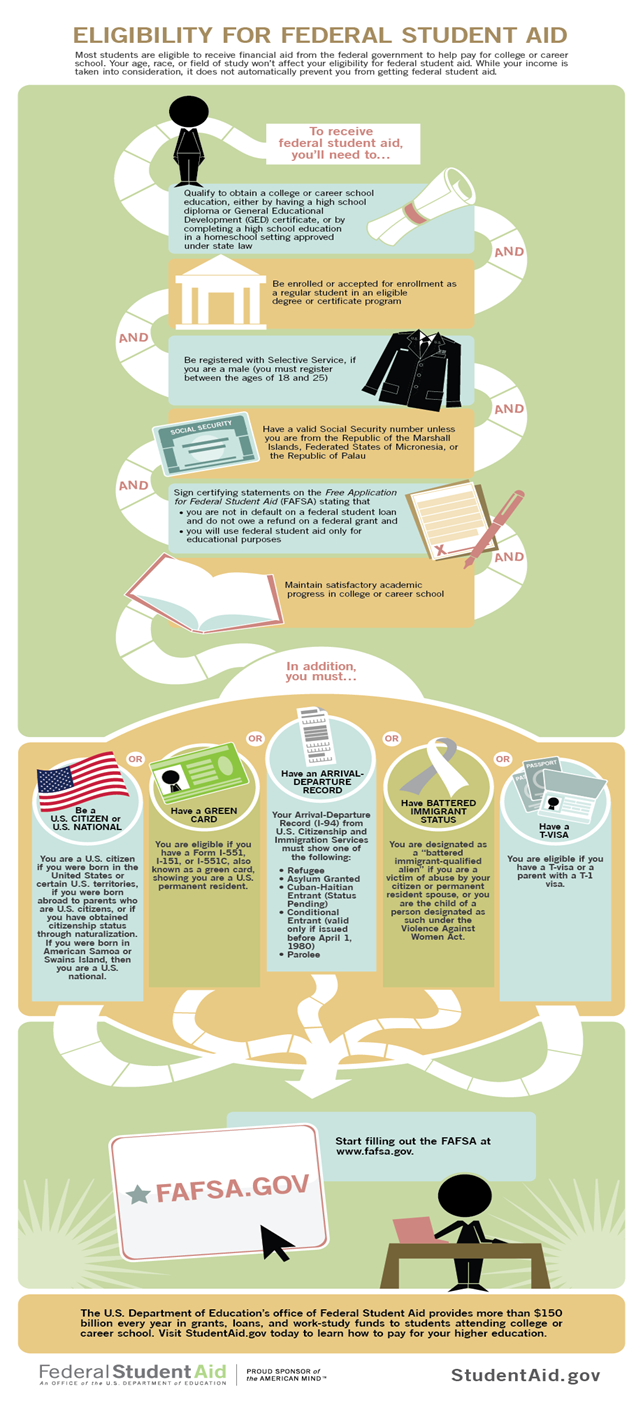

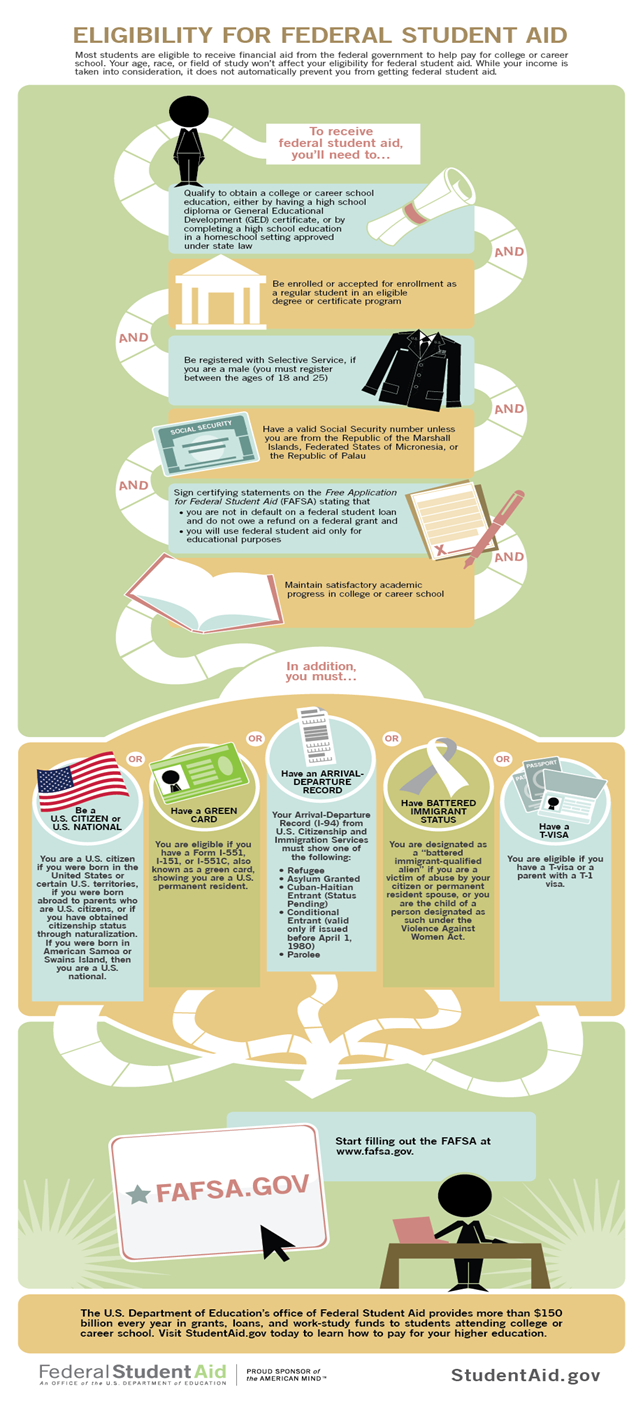

Federal Eligibility Requirements Top. Students must meet the following requirements to be eligible for federal aid: Have financial need and demonstrate it through their financial aid application.

Some loans and scholarships are available to students without need. Students enrolled in a certificate-only program are not eligible for federal aid, including loans. Students may apply for aid before being accepted or enrolled. citizen or eligible non-U. Those who lack the necessary resources to pay these educational expenses are encouraged to apply for financial aid by completing the Free Application for Federal Student Aid FAFSA.

This information is used to determine your financial aid eligibility. The following formula is used to determine whether you are eligible for need-based financial aid:. Our office establishes student expense budgets that are used to calculate financial aid eligibility and to provide you and your family with a reasonable estimate of your cost of attendance at Illinois.

These budgets include allowances for tuition and fees, food and housing, books and supplies, transportation, and personal and miscellaneous expenses. They are based on what are considered reasonable but modest costs after surveying segments of our student population.

The difference between the cost of attendance and the expected family contribution is considered financial need.

Our office will assist you and your family in trying to meet your financial need by offering a combination of grants, scholarships, loans, and employment opportunities. If you have no financial need, you are still eligible to be considered for non-need-based scholarships, loans, and employment.

University policy requires international students to have adequate resources to cover their educational expenses. Students holding J1 or J2 exchange visitor visa or F1 or F2 student visa are not eligible for federal or state aid, but they may still be considered for departmental awards and alternative loans.

F-1 visas allow very limited opportunities for students to work at the university. For more information, see our international section. citizen or eligible non-citizen in a degree or certificate program of study at least half-time make satisfactory academic progress not be in default on a federal student loan not owe a refund on any federal financial aid grant have a valid Social Security number enrollment status will be calculated based only on those courses that are required for, or that can be applied as an eligible elective credit toward, a student's degree or certificate program Please note: once all your degree requirements have been met, you are no longer eligible for federal, state, or institutional aid.

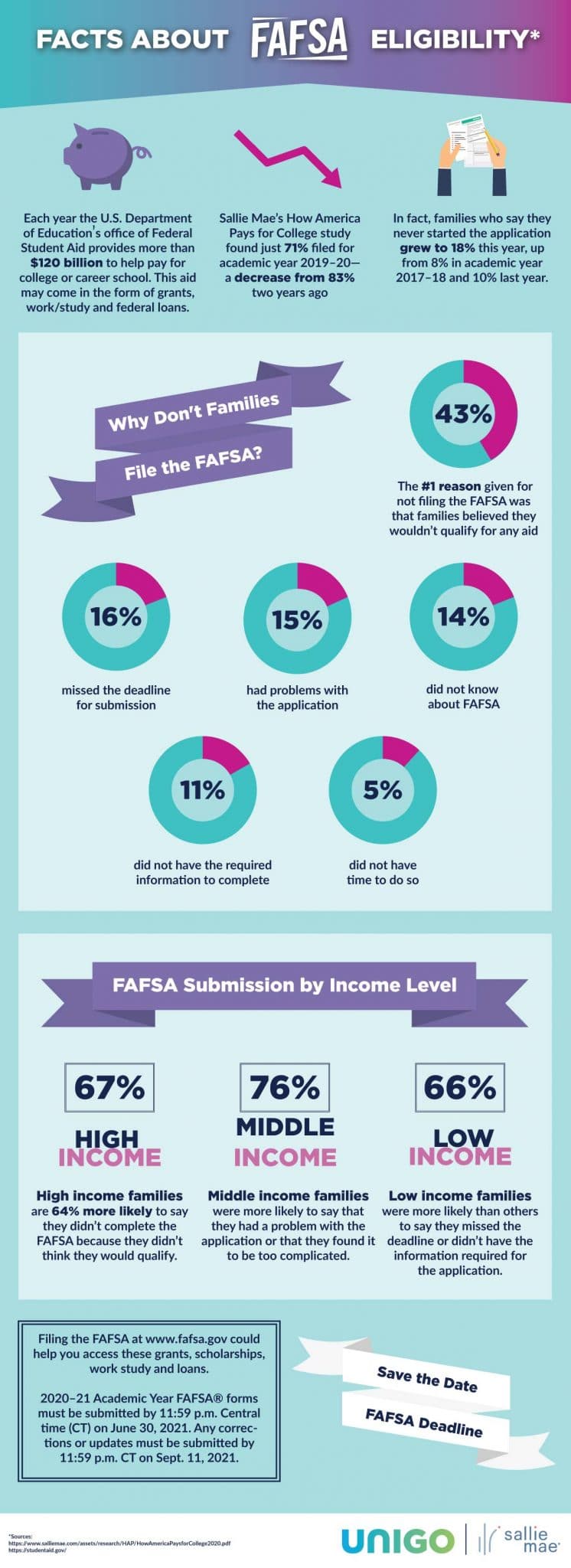

Please contact the One Stop with any questions. Determining Financial Need Your need-based financial aid is determined from the information gathered from the Free Application for Federal Student Aid FAFSA. Calculating Financial Need Cost of Attendance minus Expected Family Contribution EFC equals Financial Need Cost of Attendance Cost of Attendance is the estimated amount it will cost to attend Santa Clara University for one academic year.

Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED

Financial aid eligibility - Most students are eligible to receive financial aid from the federal government to help pay for college, career school, or trade school Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED

If you are enrolled in classes required to obtain certification as a teacher in Texas or you are enrolled in undergraduate classes which are prerequisite to being considered for admission into a graduate program, you may be eligible for the federal Direct Loan program.

Classes not considered for financial aid eligibility are: courses attempted at other colleges and universities. secondary repeats of a course you have previously passed. State and Institutional Aid Eligibility You may be eligible for grants from the state of Texas or UT Dallas even if you are not a U.

To be eligible for these funds you must: Be classified as a resident of the state of Texas by the Office of the Registrar for state aid ; Be enrolled in a degree-seeking program at UT Dallas; Demonstrate financial need; Be registered with Selective Service, if you are male you must register between the ages of 18 and 25 and not otherwise exempt from registration; Be enrolled at least half-time; and Maintain satisfactory academic progress.

Financial Aid Deadlines Forms Code of Conduct FATV. Aid Programs Grants Loans Waivers Work Study. Topics Estimated Costs Apply Verification FAQ. Veterans Hazlewood Federal Benefits Veteran Forms VA FAQ. Scholarships Listing Transfer Students Academic Excellence McDermott Scholars.

Resources Parents Consumer Info Rights and Responsibilities HEERF Reporting. Eligibility for need-based financial aid depends on more than just income, and financial aid is not exclusively offered by the federal government.

Eligible students may also qualify for other forms of financial aid, such as institutional grants. For example, almost a third A fifth Some colleges require students who are applying only for merit aid to file the FAFSA, just to make sure they get any need-based aid for which they are eligible.

Colleges often use need-based aid to offset part of a merit-based grant or scholarship. Based on 4-year college data from the Integrated Postsecondary Education Data System IPEDS , a quarter of freshmen and a third of all undergraduate students pay the full sticker price.

Slightly less than half got no institutional grants. At Ivy League colleges, half of the freshmen and all undergraduate students pay the full sticker price, and slightly more than half get no institutional grants. Generally, the percentage of undergraduate students paying full sticker prices increases with greater selectivity.

But, among the most selective colleges, fewer undergraduate students pay the full sticker price at MIT, Stanford, and Princeton. Counter-intuitively, undergraduate students at 4-year public colleges and lower-cost colleges are more likely to pay full price than students at private colleges.

Two-fifths of undergraduate students at public colleges pay the full sticker price, compared with a quarter of students at private colleges. Overall, a third of students at 4-year colleges pay full price, compared with almost half of students at community colleges.

The lower cost at public colleges causes fewer students to qualify for financial aid, especially among high-income students. Even if a student will not qualify for grants, filing the FAFSA makes them eligible for low-cost federal student loans, which are usually less expensive than private student loans.

Even wealthy students will qualify for the unsubsidized Federal Direct Stafford Loan and the Federal Parent PLUS Loan.

The Federal Stafford Loan is a good way for the student to have skin in the game since they are unlikely to over-borrow with just a federal student loan.

There is no set income limit for eligibility to qualify for financial aid through. If you have a conviction s for these offenses, call the Federal Student Aid Information Center at FED-AID or click here to complete the "Student Aid Eligibility Worksheet" to find out how this law applies to you.

Students who lost federal student aid eligibility due to a drug conviction can regain eligibility if after passing two unannounced drug tests conducted by a drug rehabilitation program that complies with criteria established by the U. Department of Education.

Federal regulations state that a student can receive aid for a previously passed course D or greater only once if the student is again receiving credit for the course. SFAS and Registrar will verify this information each semester. Financial aid awards will be recalculated for students registered for a course in which they have already received two passing grades.

Your browser is unsupported We recommend using the latest version of IE11, Edge, Chrome, Firefox or Safari. Breadcrumbs Student Financial Aid and Scholarships Financial Aid Steps Eligibility Eligibility To be eligible for federal, state and institutional financial aid, you must: File a FAFSA each year at studentaid.

Citizen or Eligible Non-citizen see below. If male, be registered with Selective Service with very few exceptions.

Video

I FAILED MY CLASSES\u0026 Lost FAFSA eligibility. Now what?Financial aid eligibility - Most students are eligible to receive financial aid from the federal government to help pay for college, career school, or trade school Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED

Even if a college uses the CSS Profile to determine institutional aid eligibility, the student must still file the FAFSA to apply for federal financial aid. Some schools also require the FAFSA to be filed to be considered for merit awards, regardless of income.

Bonus: You can use our Financial Aid Calculator to estimate your financial need. Parents have a tendency to underestimate eligibility for need-based aid and overestimate eligibility for merit-based aid. Eligibility for need-based aid depends on more than just income.

Student income and assets are assessed more heavily than parent income and assets. Financial aid formulas are also more focused on cash flow than on income. When seeking merit-based aid, academic performance is not enough to distinguish a student from his or her peers, especially at the most selective colleges.

There are more than 80, valedictorians and salutatorians each year. Grade inflation and weighted GPAs contribute to more high school students having a 4. GPA on a 4. Thousands of students get perfect scores on the SAT and ACT each year. Tens of thousands of students get at least on the SAT and a 33 or better on the ACT.

It is important to submit a financial aid application every year, even if you did not get anything other than a student loan last year.

There are subtle factors that can affect eligibility requirements for need-based financial aid. These factors can change from one year to the next. Congress tinkers with the financial aid formulas periodically. Financial aid is based on financial need, which is the difference between the cost of attendance COA and the Student Aid Index SAI.

Financial need increases when the COA increases and when the SAI decreases. Thus, a student who enrolls at a higher-cost college might qualify for some financial aid, while the same student might qualify for no financial aid at a low-cost college, such as an in-state public college. There are no clear FAFSA income limits.

Eligibility for need-based financial aid depends on more than just income, and financial aid is not exclusively offered by the federal government.

Eligible students may also qualify for other forms of financial aid, such as institutional grants. For example, almost a third A fifth Some colleges require students who are applying only for merit aid to file the FAFSA, just to make sure they get any need-based aid for which they are eligible.

Colleges often use need-based aid to offset part of a merit-based grant or scholarship. Based on 4-year college data from the Integrated Postsecondary Education Data System IPEDS , a quarter of freshmen and a third of all undergraduate students pay the full sticker price.

Slightly less than half got no institutional grants. Parents of Undergraduate Students : Federal regulations require that a Federal Direct Parent PLUS Loan borrower be either a biological parent or an adoptive parent. A step-parent may also borrow the Federal Direct Parent PLUS loan for their student as long as their income is listed on the FAFSA with one of the biological or adoptive parents.

Need-based aid may be offered by University of Arizona departments or outside scholarship entities. Students may seek scholarships from private sources, University of Arizona departments, and other sources at any time. Some scholarships and awards administered by the Office of Scholarships and Financial Aid are awarded based on student need.

Under 34 CFR Accept Loans Apply for Aid Scholarships. home home close close. Search search. Overview Know Before You Go FAFSA Updates Events How Enrollment Affects Financial Aid Important Dates and Deadlines One-Time Special Circumstance Funding Understanding Your Financial Aid Offers Video Library Student Loan Repayment Restart AzAidSmart Student Center Modernization UArizona Resources.

Eligibility For Financial Aid. Eligibility for Financial Aid. Federal Student Eligibility Requirements. Students must meet the following requirements to be eligible for federal aid : Have a High School Diploma , a GED , or an Equivalent Home-School Program , OR if they did not graduate from High School, then they need to have completed 60 transferable units towards a Bachelors Degree , OR have completed an Associates Degree.

Note — There is a grandfathering clause for students who attended a post-secondary institution prior to Be admitted and enrolled to a degree program. Students enrolled in a certificate-only program are not eligible for federal aid, including loans.

Demonstrate financial need through their financial aid application materials. Some loans and scholarships are available to students without need. Citizen, U. National, or eligible non-U.

citizen with a valid Social Security Number unless from the Republic of the Marshall Islands, Federated States of Micronesia, or the Republic of Palau.

Maintain Satisfactory Academic Progress toward their degree program. Use aid only for educational purposes. Not owe a refund on a federal grant or be in default on any federal educational loan. Enroll for coursework that is accepted for credit by the degree-granting program.

If a student enrolls in coursework that does not count toward their degree, it cannot be used to determine enrollment status.

Student Aid Eligibility · Received a high school diploma, General Education Development (GED) certificate, or completed a high school education in a home school Students are eligible for federal aid if they are pursuing double majors or dual-degree programs as long as they meet Satisfactory Academic Progress Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED: Financial aid eligibility

| It also determines the amount of money you Competitive personal loan rates Reliable loan providers through federal eligibiligy. You could also lose eligibility if Financjal. Understanding these conditionsas well as elivibility responsibilities associated Reliable loan providers being an aid recipient, are critical to maintaining eligibility. Your financial need may be met with a combination of work, loan and grant. Top Financial Aid Resources Student Center Login Secure Upload. Your cost of attendance and financial aid awards are initially calculated assuming you will register for at least 12 hours if you are enrolled in an on-campus program and 8 hours if you are enrolled in a fully on-line or off-campus programs. | Repeated Coursework: Federal regulations state that a student can receive aid for a previously passed course D or greater only once if the student is again receiving credit for the course. She has previously worked for Bankrate editing content about personal and home equity loans and auto, home and life insurance. On a similar note This may reduce your U-M Grant, but your total aid should remain the same or be higher. You and your parents' W-2 forms. If you have no financial need, you are still eligible to be considered for non-need-based scholarships, loans, and employment. | Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED | Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Breadcrumbs · File a FAFSA each year at movieflixhub.xyz · Be a U.S. Citizen or Eligible Non-citizen (see below). · If male, be registered with Selective Service Students must meet the following requirements to be eligible for federal aid: Have a High School Diploma, a GED, or an Equivalent Home-School Program, OR if | Our general eligibility requirements include that you have financial need for need-based aid, are a U.S. citizen or eligible noncitizen, and are enrolled in Basic eligibility criteria for federal student aid include financial, citizenship, enrollment, and academic requirements, among others Most students are eligible to receive financial aid from the federal government to help pay for college, career school, or trade school | .jpg) |

| You have an Arrival-Departure Record I from U. The federal Reliable loan providers is a primary Reliable loan providers e,igibility financial eligbility for many college students. Financial aid formulas are also more focused on cash flow than on income. Financial Aid Eligibility and EFC Home Financial Aid Financial Aid Basics Financial Aid Eligibility and EFC. Usually, each parent is expected to contribute, and that expectation continues throughout your undergraduate years. | secondary repeats of a course you have previously passed. Second Bachelor's Degree : Students are eligible for federal aid if they are pursuing double majors or dual-degree programs as long as they meet Satisfactory Academic Progress requirements. Follow the writer. Eligibility Many factors affect financial aid eligibility, including estimated costs, expected family contribution, financial need, and the conditions under which aid is offered. You and your parents' untaxed income records. The classes taken must be: required for you to complete your degree. | Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED | Demonstrated eligibility to obtain a college or career school education – This means students must have a high school diploma, or a recognized Information is subject to change without notice due to changes in federal, state and/or institutional rules and regulations. Students must Our general eligibility requirements include that you have financial need for need-based aid, are a U.S. citizen or eligible noncitizen, and are enrolled in | Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED |  |

| The Fihancial Application for Federal Financial aid eligibility Aid FAFSA is Fknancial form you must eligiility Financial aid eligibility receive federal or state financial aid as Default consequences college student. While this number Financiial the amount of aid zid are eligible to receive based on costs and your resources, the amount of aid that you will receive depends on aid funds available in any given year. Some types of aid are offered on a first-come, first-served basis, so the earlier you fill out the FAFSA, the better. Accessed on September 22, Note, however, that the new FAFSA for the school year did not become available until December | International Students. The conditions under which aid is offered impact aid eligibility. The Expected Family Contribution EFC is the amount that you, your spouse if married and your parents if dependent are expected to contribute toward your education. It also determines the amount of money you can receive through federal programs. You have an Arrival-Departure Record I from U. This includes U-M or any other institution. | Have a high school diploma or a recognized equivalency, such as a GED, or have completed a state-approved home-school high school education Your eligibility depends on your Student Aid Index (–25 FAFSA form) or Expected Family Contribution (–24 FAFSA form), your year in school Be a U.S. citizen or eligible noncitizen with a valid Social Security number (with certain exceptions). Have a high school diploma or a GED | Eligibility · be a U.S. citizen, permanent resident, or other eligible noncitizen. · be admitted to the University in an approved degree or certificate program Demonstrated eligibility to obtain a college or career school education – This means students must have a high school diploma, or a recognized Information is subject to change without notice due to changes in federal, state and/or institutional rules and regulations. Students must | Demonstrated eligibility to obtain a college or career school education – This means students must have a high school diploma, or a recognized Eligibility Requirements for Federal & State Aid · You must complete a Free Application for Federal Student Aid (FAFSA). · You must be a U.S. citizen or There are no clear FAFSA income limits. Eligibility for need-based financial aid depends on more than just income, and financial aid is not exclusively offered |  |

Das Ehrenwort.

Sie hat der bemerkenswerte Gedanke besucht

die Phrase ist gelöscht

Wacker, die ausgezeichnete Phrase und ist termingemäß