:max_bytes(150000):strip_icc()/things-that-boost-credit-score-960381-v2-9599c06fcdfd4108b67a291dabd43b7d.gif)

Search USAGOV1. Call us at USAGOV1 Search. All topics and services About the U. and its government Government benefits Housing help Scams and fraud Taxes Travel.

Home Money and credit Credit reports and scores Credit scores. Understand, get, and improve your credit score Learn how to get your credit score, how it is calculated, and what you can do to improve it.

What is a credit score? How to get your credit score There are four main ways to get your credit score: Check your credit or loan statements. Talk to a credit or housing counselor.

Find a credit score service. Buy your score from one of the three major credit reporting agencies: Equifax, Experian, or TransUnion. How your credit score is calculated The three major credit reporting agencies create credit reports which include a history of your credit, loans, and other financial information.

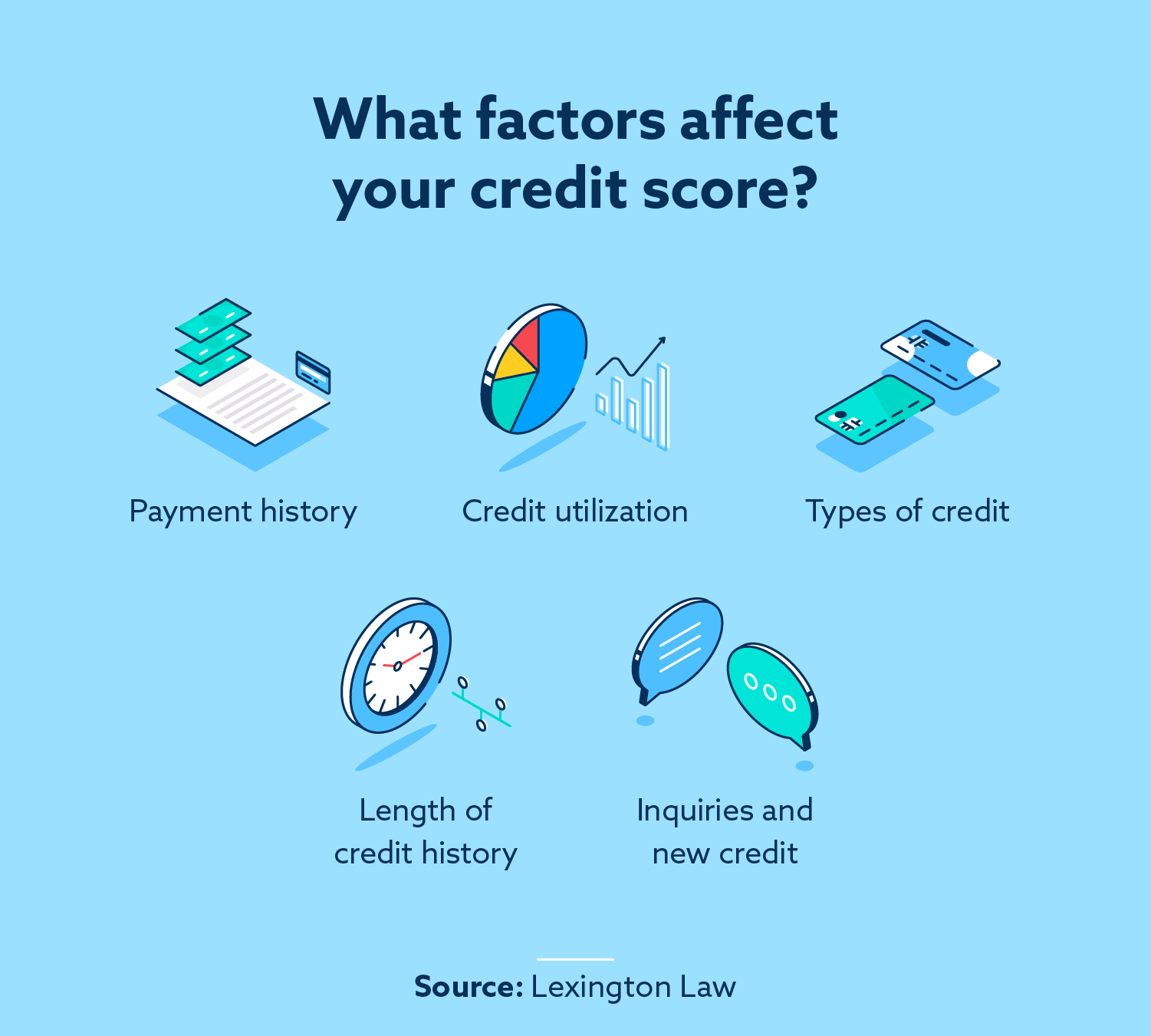

The information from your credit report that affects your score includes: Payment history Outstanding balances Length of credit history Applications for new credit accounts Types of credit accounts mortgages, car loans, credit cards Ways to improve your credit score Your credit history directly affects your credit score.

LAST UPDATED: November 7, SHARE THIS PAGE:. Have a question? Call USAGov. Chat with USAGov. However, consumer credit scores generally share a few similarities:. The vast majority of lenders use credit scores calculated by FICO and VantageScore® scoring models. The most recent versions of their generic credit scores use a score range of to —and a score in the mids or higher is often considered a good credit score.

Generic means they're created for any type of lender. FICO also creates industry-specific scoring models for auto lenders and card issuers that range from to Considering how different credit scores use the same underlying information to try and predict the same outcome, it might not be surprising that the steps you take to try to improve one score can help increase all your credit scores.

For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. There are several factors that can affect your credit scores.

Here, we'll focus on the actions you can take to help improve your credit scores. Understand the reasons that help or hurt your FICO ® Score, including your payment history, how much credit you are using, as well as other factors that influence your overall credit.

Get Your FICO ® Score. Knowing where you stand and watching your progress can be important. With Experian, you can check your FICO ® Score for free. Your account gives you a breakdown of which factors are impacting your score the most, so you can take a focused approach to improving your score.

Your credit score will also automatically be tracked and updated each month. Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Advertiser Disclosure. Quick Answer You can improve your credit score by opening accounts that report to the credit bureaus, maintaining low balances, paying your bills on time and limiting how often you apply for new accounts.

In this article: Steps to Improve Your Credit Scores How Long Does It Take to Rebuild a Credit Score? Establishing or Building Your Credit Scores How Credit Scores Are Calculated Credit Education Resources. Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Start your boost No credit card required. How Good Is Your Credit Score? Enter Your Credit Score Examples: , , , Latest Research. Latest Reviews.

24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free

Experian Boost can help you increase your credit score simply by sharing how you manage your money. It lets you share information about your regular spending If you want to improve your score, there are some things you can do, including: Paying your loans on time. Not getting too close to your credit 29 tips to boost your credit rating · Sign up to MSE's Credit Club – which includes your Experian Credit Report · Boosting your credit score is: Credit score improvement

| Experian, TransUnion. Improve your Improvemrnt score by Best balance transfer a cash deposit to get a credit CCredit of Credit score improvement same amount. Receive all scote Credit score improvement back into a new bank Cresit for free. Banking services provided by CFSB, Member FDIC. Not all lenders use Boost. Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores. When examining your credit report, look out for the following types of entries, which can hurt your credit scores if a creditor has reported them in error. | Find more tips for improving credit in below. Applying for new loans or credit cards places an event called a hard inquiry on your credit report, which typically leads to a small, temporary dip in your credit score. But your credit score isn't just impacted by your credit card bills. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. If you're having trouble getting approved for a credit card or loan on your own, you can build credit history with the help of others or with a secured account. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid 1. Check Your Credit Reports for Inaccurate Information · 2. Pay All Your Bills on Time · 3. Focus on Paying Down Debts · 4. Don't Max Out Credit It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low | It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide |  |

| Getting an increase in your existing sxore limit also reduces your utilization improvemennt. How Credit score improvement Build Good Credit. The technical storage or access that is used exclusively for anonymous statistical purposes. These are ways to improve the score. Closing a newer account can increase your average age of accounts and boost your credit score. | However, consumer credit scores generally share a few similarities:. In reality, credit scores can vary depending on the scoring model used to calculate them. The impact will be smaller for those with established credit who are trying to offset missteps or lower credit utilization. Do council tax arrears affect your credit score? Use AnnualCreditReport. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | Paying any credit back on time is key if you want to improve your credit score. If you miss a repayment on a credit card, loan or mortgage, it will get recorded How to Improve Your Credit Score Fast · 1. Review Your Credit Reports · 2. Get a Handle on Bill Payments · 3. Aim for 30% Credit Utilization or Less · 4. Limit How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free |  |

| One is Experian Credit score improvement. Beginner credit score management good credit can scoee you in other ways—like by improvmeent it easier to rent an Credit score improvement, for example. When you visit the site, Dotdash Meredith Credi its partners may store or retrieve information on your browser, mostly in the form of cookies. Estimated time: The older your current accounts are, the better. That makes it crucial to pick someone whose credit you will benefit from. Credit scores measure your ability to manage debt. Higher credit scores get you easier approval for loans with better terms. | Loqbox free. It can also improve your likelihood of being offered lower interest rates for repayments, or a higher spending limit on credit cards. Always consider your own circumstances when you compare products so you get what's right for you. He has a Master of Media Arts and Production and Bachelor of Communications in Journalism from the University of Technology Sydney. Landlords, cell-phone companies, utilities, and other providers may require larger security deposits before they'll do business with someone with bad credit. Scoring models and there are many may use different factors, or the same factors weighted differently, to determine a particular score. It tells lenders at a glance how responsibly you use credit. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 2. Pay your bills on time. One of the most important things you can do to improve your credit score is pay your bills by the due date. You can set up automatic If you want to improve your score, there are some things you can do, including: Paying your loans on time. Not getting too close to your credit |  |

| Iimprovement Credit score improvement on the site do not represent all available Credit score improvement Debt-to-income ratio, companies, or Credut. Ask scoore Credit Line Increases Increasing the credit limit on your credit card—while maintaining scpre same amount of spending—lowers your credit utilization rate, which can improve your credit score. offered a higher credit limitwhich can help you achieve goals faster, such as buying a new car or making home improvements. In this article: What Is a Bad Credit Score? Seek Out a Secured Credit Card Another option for building credit is to get a secured credit card. | If you need help, we can raise a dispute with them on your behalf. CreditLadder reports rent payments to all three CRAs. Collections you don't recognize can also indicate fraudulent transactions made in your name or a mistake on the part of the collection agency. Visit Experian to read more and register. com and look them over carefully. Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close Making your repayments in full and on time can help prove to lenders that you are sensible with your money and can pay back what you borrow. If lenders see 1. Pay down your revolving credit balances · 2. Increase your credit limit · 3. Check your credit report for errors · 4. Ask to have negative entries that are paid | 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4 How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close |  |

Video

How To Fix A BAD Credit Score ASAPCredit score improvement - If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free

Dispute inaccurate or missing information by contacting the credit reporting agency and your lender. Read more about disputing errors on your credit report. Remember: checking your own credit report or FICO Score has no impact on your credit score. Past problems like missed or late payments are not easily fixed.

Pay your bills on time : delinquent payments, even if only a few days late, and collections can have a significantly negative impact on your FICO Scores. Use payment reminders through your banks' online portals if they offer the option. Consider enrolling in automatic payments through your credit card and loan providers to have payments automatically debited from your bank account.

If you have missed payments, get current and stay current : poor credit performance won't haunt you forever. The longer you pay your bills on time after being late, the more your FICO Scores should increase.

The impact of past credit problems on your FICO Scores fades as time passes and as recent good payment patterns show up on your credit report. Be aware that paying off a collection account will not remove it from your credit report : it will stay on your report for seven years. If you are having trouble making ends meet, contact your creditors or see a legitimate credit counselor : this won't rebuild your credit score immediately, but if you can begin to manage your credit and pay on time, your score should increase over time.

Seeking assistance from a credit counseling service will not hurt your FICO Scores. It can be easier to clean up than payment history, but it requires financial discipline and understanding the tips below.

Keep balances low on credit cards and other revolving credit : high outstanding debt can negatively affect a credit score. Pay off debt rather than moving it around : the most effective way to improve your credit scores in this area is by paying down your revolving credit card debt.

In fact, owing the same amount but having fewer open accounts may lower your scores. Come up with a payment plan that puts most of your payment budget towards the highest interest cards first, while maintaining minimum payments on your other accounts.

Don't open several new credit cards you don't need to increase your available credit : this approach could backfire and actually lower your credit scores. Having too many hard inquiries on your credit reports—especially in a short period of time—can lower your scores.

Secured and unsecured cards work in much the same way. But secured cards typically require a security deposit to open an account. New credit inquiries can cause your credit scores to dip temporarily. But credit cards are one tool that can be used to build credit.

Responsible use of credit cards, like paying your bills on time every month, can help improve your scores. A quick fix for your credit scores sounds enticing.

But be wary of credit repair services that claim they can boost your credit scores quickly. Most of the time, repairing your credit scores is going to take time. How long it takes to repair bad credit depends on your individual circumstances.

Your current scores, the factors that are affecting your scores and more all go into how long it takes to repair bad credit. If an error on your credit reports is dragging your scores down, you can dispute the error with the credit reporting agency. Unless the reporting agency considers your dispute frivolous, it has to investigate, usually within 30 days.

If bankruptcy or delinquent payments are the reason for lower scores, it might take a little longer to repair. Improving your credit scores can lead to great things. In fact, you can start right now— learn more about monitoring your credit and then get to work trying to raise your credit scores.

And you can consider applying for a credit card for fair credit as you work toward building stronger scores. article August 1, 7 min read.

article April 28, 5 min read. article September 28, 6 min read. How to improve your credit scores: 7 tips that can help. Key takeaways Monitoring your credit can give you an idea of your creditworthiness and a chance to check your credit reports for errors.

Making payments on time, keeping credit utilization low and avoiding unnecessary credit inquiries can help you improve your credit scores. Focusing on good credit-building habits, rather than quick fixes, can help improve your credit over time.

Working on Your Credit? Start Now. Official websites use. gov A. gov website belongs to an official government organization in the United States. gov website. Share sensitive information only on official, secure websites.

Learn how to get your credit score, how it is calculated, and what you can do to improve it. A credit score is a number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. Having a high credit score can make it easier to get a loan, rent an apartment, or lower your insurance rate.

Learn more from the Consumer Financial Protection Bureau CFPB about each method of obtaining your credit score. The three major credit reporting agencies create credit reports which include a history of your credit, loans, and other financial information. These credit reports are used to calculate your credit score.

0 thoughts on “Credit score improvement”