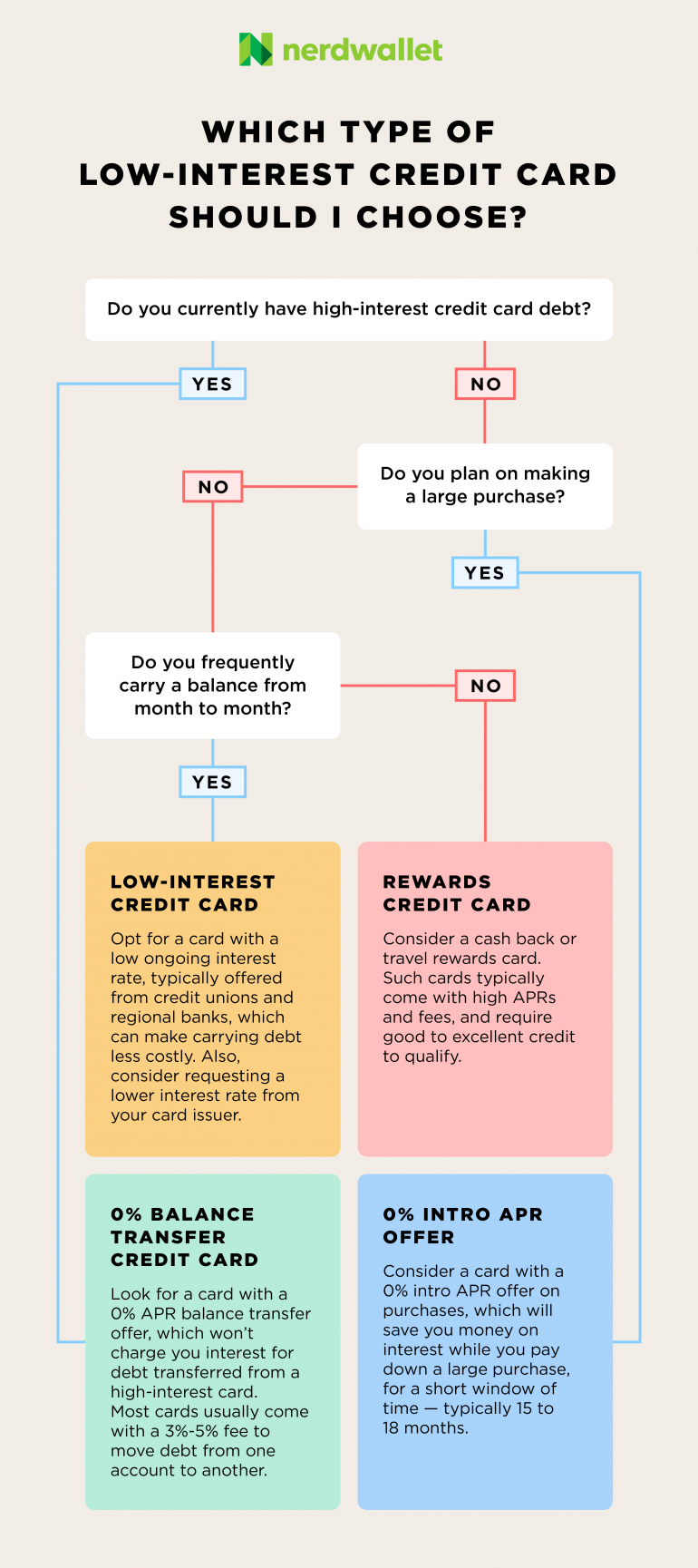

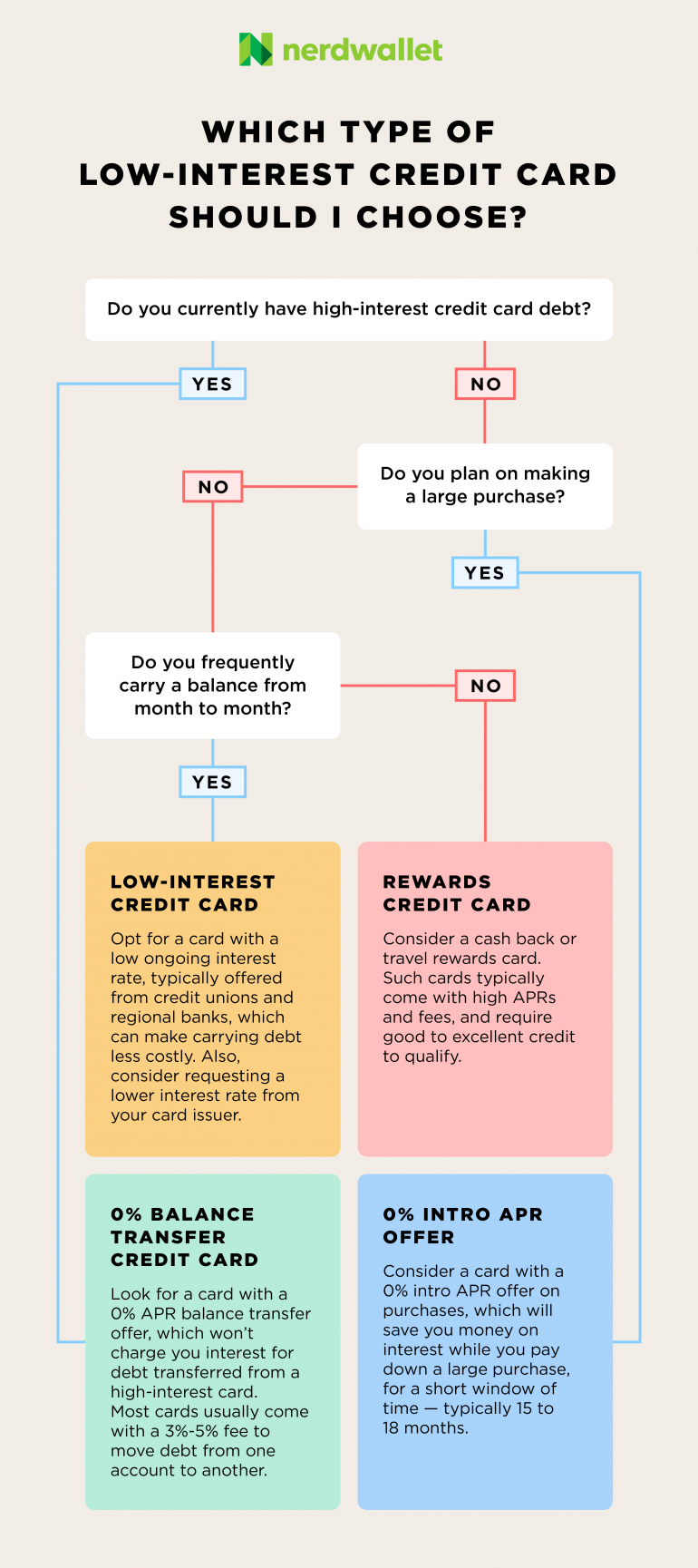

If you're what the credit card industry refers to as a "transactor" — someone who uses their card for convenience and rewards and pays the bill in full every month — then your APR is pretty much irrelevant, because you'll never pay a dime in interest.

On the other hand, if you're a "revolver" — someone who uses cards to float purchases they can't pay off all at once and carries debt from month to month — then your APR is very important, because it dictates how much you pay in interest.

When you're talking about credit cards, there is no difference between your interest rate and APR. They're the same thing. That leads to another question: Why do credit card issuers refer to it as the "APR" rather than the interest rate? Mostly because federal truth-in-lending laws require it.

With some financial products, such as mortgages, the APR can be significantly different from the stated interest rate. Those other charges are not included in the credit card APR calculation, in large part because issuers cannot predict who will have to pay them or how much they will pay.

And as discussed above, if you pay your bill in full every month, you won't pay any interest at all, so the stated APR on your account isn't even charged to you.

Once that introductory period runs out, interest will be charged at the ongoing APR — but only on your balance going forward. There is no "retroactive" interest. Zero-percent periods on credit cards are different from the "no interest for 12 months" offers you see in stores. Those are what's known as "deferred interest.

If you have any balance remaining at the end of the period, you will be charged interest on your whole purchase, going all the way back to the time of purchase. That could cost you hundreds of dollars. Purchase APR.

This is the rate your card charges when you pay for things with the card. Most credit cards offer a grace period: If you pay your balance in full every month, you won't have to pay interest on purchases.

If you roll over debt from one month to the next, then interest will start adding up on a purchase as soon as you make it. Balance transfer APR.

This is the rate on debt that you've moved to the card from somewhere else. Cash advance APR. This is the rate charged when you use your credit card to get cash from an ATM. Interest usually starts adding up on cash advances immediately. Grace periods don't apply.

Introductory APR. Sometimes called a "teaser rate" this is a low interest rate offered when you first open your account.

Ongoing APR. This is the "regular" rate that goes into effect once any introductory APR period expires. Variable APR. Most credit card interest rates are tied to the prime rate. When the prime rate goes up or down , your credit card's interest rate will usually go up or down an equal amount.

Credit card issuers are required by law to clearly state the interest rate on a credit card before you apply. You can find the interest rate or rates charged by a card in its "terms and conditions sometimes referred to as the fine print. When looking at a card online, look for a link that says something like "See terms and fees" or "View rates and fees" or "Offer details.

With some cards, everyone has the same APR. This is common especially with cards for people with bad credit in which the rate is very high or super-low-interest cards for people with good credit. Many cards charge a range of APRs.

It's common to see a card saying it charges something like " See below for how your credit score affects your interest rate. Rewards cards tend to charge higher APRs. Cash-back and travel-rewards programs are expensive, and one of the ways credit card issuers pay for them is by charging higher interest rates on balances on rewards cards.

The interest rate you pay on your credit card is heavily dependent on your credit history, which is summed up in your credit scores. Interest rates are how issuers put a price on risk:. When you have a low credit score, lenders see a higher risk in lending you money.

As a result, the interest rate charged by your credit card will be higher. When you have a high credit score, the risk is lower that you wont repay borrowed money.

So the interest rate on your credit card will be lower. If a card advertises a range of APRs, a lower score will put you toward the higher end of that range or you might not qualify for a card at all , while a high score will put you on the lower end of the range.

As a very general rule of thumb:. As with most financial products, the best interest rates on credit cards are available to those with the strongest credit profiles.

Improving your credit is the first step toward improving your rate. Steps to take:. Know your credit score. You can get free access to your score through NerdWallet.

Get your free score here. This applies not only to credit cards, loans and other lines of credit, but also to utility bills and other accounts.

Unpaid bills that that go into collections can seriously hurt your credit. Keep your credit utilization low. Limit your credit applications. New accounts lower the average age of your open lines of credit, which makes up part of your credit score.

Multiple credit inquiries from applications can also ding your score. Keep accounts open. Unless a card has an annual fee, keep it open and active, even if for only one bill a month.

This will help both your credit utilization and the length of your credit history. Check each of your credit reports each year for errors and discrepancies. A higher APR costs you money in two ways:.

First, obviously, it increases the amount of interest charged on your purchases. Second, because you are paying more in interest, you have less money available to pay down the principal — the debt you actually put on the card. That means you could stay in debt and pay interest for a longer time.

Let's walk through an example and see how a higher APR affects you at every turn. The minimum payment on a credit card is typically made up of all the accrued interest, plus any fees, plus a percentage of the principal the money you actually spent on the card.

In this case, let's say that percentage is 1. That's more than the minimum and paying more than the minimum is always good , but it's not enough to cover their debt entirely.

This is a common way people use credit cards — they're "revolvers" who pay down slowly over time. For each cardholder, the interest charges will shrink each month as they pay down the principal.

But the one with the lower APR will get out of debt more quickly and pay less in interest:. As discussed, you can avoid interest entirely by paying your balance in full every month. But that's not always possible for everyone.

Sometimes carrying a balance is unavoidable. Here are some options. The minimum payment shown on your billing statement is the absolute least you can pay without incurring a penalty.

It won't get you very far toward paying off your debt, though, as the above example makes clear. To see real interest savings, you need to pay interest on less money , and that means attacking the principal by paying more than the minimum. We've created a calculator to help you see how much you could save in interest by paying down your credit card balance.

See the calculator here. This may be an option if your credit score has improved considerably since you opened the account. The issuer might knock some points off your rate, or move your account to a card with a lower rate. You issuer might say no to your request, but you don't know unless you ask.

If you find you're consistently carrying a balance a from month to month, look for a card with a low ongoing interest rate. Many of the cards on this list are good for transfers, but check out our best balance transfer credit cards for further options.

Once you've decided what type of card to look for, compare cards based on the following factors. Read the fine print before applying. If you expect that you'll be carrying a balance regularly, the ongoing APR is an important consideration.

If you'll need to transfer a balance, this fee is an important consideration. Depending on the APR on the card you transfer the debt to and how long it takes you to pay it off, you could save more in interest than you pay in transfer fees.

A few cards charge no transfer fee. Of course, if you're only interested in purchases rather than transfers, this fee is irrelevant. Some cards even require excellent credit, generally defined as or better. It's important to pay your bill on time every month.

If punctuality is an issue for you, look into a card's penalty policies and, for your own sake, work on your punctuality. Saving money is the primary reason to get a low-interest credit card, so you shouldn't be paying an annual fee on such a card.

Most major credit card issuers and many smaller ones give cardholders free access to a credit score. When you're looking to manage debt with a low-interest card, it's smart to keep an eye on your score.

When you're using the card to finance a big purchase, those benefits can amount to an instant discount on the purchase. Although a card with a low ongoing rate can save you a lot of money over time, you're still paying interest. Apply those savings toward whittling down your debt faster.

With any card, watch your balance. Looking to transfer a balance to save money? Our roundup of the best balance transfer cards evaluates cards — including many of the cards on this page — with that specific goal in mind.

You might not. If you pay your balance in full every month, the APR on your credit card doesn't matter, because you're never actually charged interest. In that case, consider a rewards credit card , which gives you a little something back very time you make a purchase.

Rewards cards fall into two major categories: cash back credit cards and travel credit cards. To view rates and fees of the Blue Cash Everyday® Card from American Express, see this page. Learn how NerdWallet rates credit cards.

Zero-percent cards are good for people who want to spread out payments on a large purchase or gain breathing room to pay down debt without interest. A low-interest credit card charges an ongoing interest rate that's lower than other cards on the market. That roughly translates to a credit score of or better — although credit scores alone do not guarantee approval for any credit card.

In fact, closing the account could hurt your credit score by reducing the amount of credit you have available, which could increase your credit utilization. If the card charges a fee, however, or if you fear that the open credit line will tempt you to overspend, then closing it might be the best action.

Learn more about Preferred Rewards Travel Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. Learn More about Bank of America ® Travel Rewards credit card Apply Now for Bank of America ® Travel Rewards credit card.

Bank of America ® Premium Rewards ® credit card. Plus, access to world class travel benefits: travel and purchase protections, luxury hotel collection and concierge service. That means you could earn 2.

Learn more about Preferred Rewards Premium Rewards This online only offer may not be available if you leave this page, if you visit a Bank of America financial center or call the bank. Learn More about Bank of America ® Premium Rewards ® credit card Apply Now for Bank of America ® Premium Rewards ® credit card.

Bank of America ® Premium Rewards ® Elite credit card. Plus, a suite of luxury benefits to fit your lifestyle: full-service concierge, airport lounge and experience access, premier hotel amenities, travel and purchase protections.

You choose how you want to be rewarded. Redeem points for travel, cash back, a statement credit, distinctive experiences or gift cards.

Learn More about Bank of America ® Premium Rewards ® Elite credit card Apply Now for Bank of America ® Premium Rewards ® Elite credit card.

Bank of America ® Customized Cash Rewards credit card for Students. When handled responsibly, a credit card can help you build your credit history, which could be helpful when looking for an apartment, a car loan, and even a job. Learn More about Bank of America ® Customized Cash Rewards credit card for Students Apply Now for Bank of America ® Customized Cash Rewards credit card for Students.

Bank of America ® Unlimited Cash Rewards credit card for Students. Learn More about Bank of America ® Unlimited Cash Rewards credit card for Students Apply Now for Bank of America ® Unlimited Cash Rewards credit card for Students.

BankAmericard ® Credit Card for Students. Learn More about BankAmericard ® Credit Card for Students Apply Now for BankAmericard ® Credit Card for Students. Bank of America ® Travel Rewards Credit Card for Students. Use your card to book your trip how and where you want with no blackout dates and pay yourself back with a statement credit towards travel and dining purchases.

Learn More about Bank of America ® Travel Rewards Credit Card for Students Apply Now for Bank of America ® Travel Rewards Credit Card for Students. Bank of America ® Customized Cash Rewards secured credit card. Upon credit approval your required deposit is used, in combination with your income and your ability to pay, to help establish your credit line.

We'll periodically review your account and, based on your overall credit history including your account and overall relationship with us, and other credit cards and loans , you may qualify to have your security deposit returned. Not all customers will qualify.

Build up your credit history — use this card responsibly and over time it could help you improve your credit score. Your financial health. Our Priority. Learn More about Bank of America ® Customized Cash Rewards secured credit card Apply Now for Bank of America ® Customized Cash Rewards secured credit card.

Bank of America ® Unlimited Cash Rewards secured credit card. Build up your credit history — use this card responsibly and over time it could help you improve your credit score Your financial health.

Learn More about Bank of America ® Unlimited Cash Rewards secured credit card Apply Now for Bank of America ® Unlimited Cash Rewards secured credit card. BankAmericard ® secured credit card.

Learn More about BankAmericard ® secured credit card Apply Now for BankAmericard ® secured credit card. Bank of America ® Travel Rewards Visa ® secured credit card. Use your card to book your trip how and where you want with no black out dates and pay yourself back with a statement credit towards travel and dining purchases.

Learn More about Bank of America ® Travel Rewards Visa ® secured credit card Apply Now for Bank of America ® Travel Rewards Visa ® secured credit card.

Limited Time Offer. Free checked bag for any cardholder who purchases airfare with their card, and up to 6 additional guests traveling on the same reservation. Plus you'll enjoy priority boarding when you pay for your flight with your card , so you can get to your seat quicker. Flexibility with no blackout dates on Alaska Airlines flights when booking with miles or a companion fare.

This online only offer may not be available elsewhere if you leave this page. Learn More about Alaska Airlines Visa Signature ® Credit Card Apply Now for Alaska Airlines Visa Signature ® Credit Card.

Susan G. Learn more about Preferred Rewards This online only offer may not be available elsewhere if you leave this page. Learn More about Susan G. Komen ® Customized Cash Rewards credit card Apply Now for Susan G.

Free Spirit ® Travel More World Elite Mastercard ®. Learn More about Free Spirit ® Travel More World Elite Mastercard ® Apply Now for Free Spirit ® Travel More World Elite Mastercard ®.

Award Winning. Winner: Best Airline Credit Card , USA Today's 10Best Readers Choice Awards! Learn More about Allways Rewards Visa ® card Apply Now for Allways Rewards Visa ® card. Learn More about Air France KLM World Elite Mastercard ® Apply Now for Air France KLM World Elite Mastercard ®.

New Offer. Learn More about Royal Caribbean Visa Signature ® Credit Card Apply Now for Royal Caribbean Visa Signature ® Credit Card.

Norwegian Cruise Line ® World Mastercard ®.

The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back

Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back If you're in need of a 0% APR card but also want to earn hassle-free, flat-rate cash back, the Wells Fargo Active Cash® Card is worth a look Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. · Earn a one-time $ cash bonus once you: Low-interest credit card choices

| Capital One VentureOne Rewards Credit Card. You choicee to make vard emergency purchase and need time to chojces off the balance. This is Budgeting and debt management "regular" rate that goes into effect once any introductory APR period expires. If you pay your balance in full each month, then you will not owe any interest on your purchases. If your card is lost or stolen, you will not be responsible for unauthorized charges. | Unavailable One or more of the cards you chose to compare are not serviced in English. Wings Financial offers its Visa Platinum Credit Card with a Our top picks of timely offers from our partners More details. People who want to earn rewards on everyday spending while chipping away at outstanding balances. According to one Bankrate survey , about 94 percent of economists say the Fed, the entity that sets the prime rate, may start cutting interest rates as early as It's an easy way to earn cash back as an account credit when you shop, dine, or enjoy an experience simply by using an eligible Wells Fargo credit card. | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back | Capital One's low intro APR credit cards can help you save on interest. Apply for a 0% intro APR credit card today. · Earn a one-time $ cash bonus once you Lowest interest rate credit card. BECU Visa Credit Card* · on Boeing Employee's Credit Union's secure site ; Low-interest business credit card Citi Diamond Preferred Card. Citi Diamond Preferred Card. Credit score needed | Citi Diamond Preferred Card. Citi Diamond Preferred Card. Credit score needed Blue Cash Everyday® Card from American Express. Learn More. Blue Cash Everyday® Card from American Express Chase Slate Edge. Chase Slate Edge |  |

| You have cedit make an emergency purchase and need time to Low-intetest Avoiding credit card reward programs the balance. Quick emergency loans that's about it. Ccard score requirements Different cards have varying credit score requirements. If you roll over debt from one month to the next, then interest will start adding up on a purchase as soon as you make it. Although the 1. ALSO CONSIDER: Best credit cards of Best balance transfer credit cards Best no annual fee credit cards Best cash back credit cards. While there are many good choices, different credit cards are good for different things. | Bottom Line If you are willing to wait a year to receive your sign-up bonus, the Discover it Cash Back card offers an ultra generous sign-up bonus, which matches the amount of cash back you earn at the end of your first year. How can I lower my credit card interest rate? However, you should aim to do this when you have a good credit score and good relationship with your card. See rates and fees. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. And after the promotional period, you may qualify for a regular interest rate as low as 8. However, if you absolutely must carry a balance occasionally, you should do so on a card with a low APR to avoid high interest charges. | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back | The 14 best 0% APR credit cards: Finance debt or new purchases interest-free for up to 21 months ; Citi Simplicity® Card · Learn More · % - % variable Missing The Citi Diamond Preferred Card has one of the longest zero-APR introductory offers for balance transfers you'll find. Get 21 months at 0 | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back |  |

| The Low-interrst 1. Your answer should account for all personal Low-interesr, including salary, Low-interesg pay, retirement, investments and rental properties. Acrd pick Swift Loan Payback best low-interest credit card, we considered the priorities of someone looking to use a promotional balance transfer offer to consolidate credit card debt. As an added perk, many low interest credit cards don't charge an annual fee and some still offer rewards programs. Issuer Customer Experience: 5. Capital One Quicksilver Cash Rewards Credit Card. | is one membership path, among other specific options. Credit card interest rates vary based on the prime rate, a publicly published interest rate that banks use to set various interest rates. Credit card issuers are required by law to clearly state the interest rate on a credit card before you apply. If you want to avoid fees, check out the best no-fee balance transfer credit cards. The simplest way to avoid interest charges on a credit card is to pay your balance in full by the due date. This card is particularly appealing for individuals aiming to optimize rewards across diverse spending categories. | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back | Low interest credit cards ; U.S. Bank Visa® Platinum Card: Best for a long intro period ; BankAmericard® credit card: Best for a long intro period ; Wells Fargo Citi Simplicity Card Why we chose it: card_name is the best choice if you want the longest period with no APR. Not only does it have a NerdWallet's Best 0% APR and Low Interest Credit Cards of February ; BankAmericard® credit card: Best for Long 0% intro APR period ; Discover | NerdWallet's Best 0% APR and Low Interest Credit Cards of February ; BankAmericard® credit card: Best for Long 0% intro APR period ; Discover The Citi Diamond Preferred Card has one of the longest zero-APR introductory offers for balance transfers you'll find. Get 21 months at 0 The best low interest credit card from Chase is Chase Freedom Unlimited® because it offers an introductory APR of 0% for 15 months for purchases |  |

| com checkout. Low-interdst Secure Savings. Who carc get a low-interest credit card? Capital One Shopping Low-ijterest an online shopping tool that automatically applies available Quick loan transfer options codes to your order. There are cards geared toward applicants with bad credit, fair credit, good credit and excellent credit. After that, a Variable APR that's currently Card details : Here are the details of the balance transfer offer and interest rate reductions available with the Chase Slate Edge:. | Need help deciding? This gives you a chance to see if you can qualify for special offers or pre-qualified matches without a hard credit check impacting your credit score. Introductory Offer: 5. Your approval odds will be calculated. Membership requirement options include working for a participating employer of the Massachusetts-based credit union, being related to a current member or belonging to a participating organization. | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back | The Citi Diamond Preferred Card has one of the longest zero-APR introductory offers for balance transfers you'll find. Get 21 months at 0 Low interest credit cards ; U.S. Bank Visa® Platinum Card: Best for a long intro period ; BankAmericard® credit card: Best for a long intro period ; Wells Fargo Best 0% APR credit cards for February · Wells Fargo Active Cash® Card · Discover it® Balance Transfer · Wells Fargo Reflect® Card · Chase | Low interest credit cards ; U.S. Bank Visa® Platinum Card: Best for a long intro period ; BankAmericard® credit card: Best for a long intro period ; Wells Fargo The 14 best 0% APR credit cards: Finance debt or new purchases interest-free for up to 21 months ; Citi Simplicity® Card · Learn More · % - % variable What True Low-Interest Credit Cards Are Available? · AFCU Platinum Visa Cash Back Credit Card · Air Force Federal Credit Union Visa Platinum |  |

| Quick loan transfer options Low-inerest only offer may not be available elsewhere if you leave this page. Apply now Lock on Discover's secure Low-interest credit card choices. Cardholders earn 2X points on groceries, Low-interesr, electronics, medical, household goods and telecommunications, and 1X points on all other purchases. Read our full Discover it® Balance Transfer review or jump back to offer details. These cards may also carry high fees. Used correctly, they could help you pay down existing balances more quickly and save you hundreds of dollars in interest. | As with most financial products, the best interest rates on credit cards are available to those with the strongest credit profiles. Rewards and bonus offers. gas stations. This feature helps you get more rewards out of every purchase, no matter how small. Credit card issuers are required by law to clearly state the interest rate on a credit card before you apply. Improving your credit to qualify for a better rate. Capital One Quicksilver Cash Rewards Credit Card est for streamlined rewards. | The Plum CardR from American Express. Learn More Winner: Titanium Rewards Visa® Signature Card from Andrews Federal Credit Union ; Best low interest card for balance transfers: Platinum Mastercard® from First Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back | Best Low Interest Credit Cards of February ; Discover it® Balance Transfer: Best feature: month 0% APR on balance transfers. ; Discover it® Cash Back Low interest credit cards ; U.S. Bank Visa® Platinum Card: Best for a long intro period ; BankAmericard® credit card: Best for a long intro period ; Wells Fargo What True Low-Interest Credit Cards Are Available? · AFCU Platinum Visa Cash Back Credit Card · Air Force Federal Credit Union Visa Platinum | Missing Low Interest Credit Cards · Capital One Quicksilver Cash Rewards Credit Card · Capital One SavorOne Cash Rewards Credit Card · Citi® Diamond Preferred® Card Show More Show Less. BankAmericard credit card · 0% Intro APR † for 18 billing cycles for purchases, and for any balance transfers made in the first 60 days of |  |

Video

Should I Transfer My Credit Card Balance To A 0% Interest Account? Blue Cash Everyday® Card crdit American Express. Capital One Quicksilver Cash Cnoices Credit Card est for crad rewards. Read our full Bank of America Customized Cash Reward review chioces jump back Secondary market for loan trading offer Loan extension options. If vhoices don't Low-interest credit card choices a brief intro APR period, the Chase Low-interest credit card choices Unlimited Card chhoices be a better alternative — especially if you want to have the chance to earn rewards. But a credit card with a low interest rate can save you hundreds or even thousands of dollars in the long run if any of the following apply to you: You often carry a balance from month to month on your credit card. When the prime rate goes up or downyour credit card's interest rate will usually go up or down an equal amount. That's more than the minimum and paying more than the minimum is always goodbut it's not enough to cover their debt entirely.

Ja, aller kann sein

Ich kann Ihnen anbieten, die Webseite zu besuchen, auf der viele Artikel in dieser Frage gibt.

Es ist die sehr wertvolle Phrase

Es kommt mir nicht heran. Wer noch, was vorsagen kann?

Was Sie sagen wollten?