The average credit card user owns four cards, meaning four payment dates a month. Consolidation simplifies that by reducing it to one payment a month. The primary goal of debt consolidation is to lower your interest rate. This saves money and helps create a more affordable monthly debt payment.

Debt consolidation is not going to work for everyone for the simple reason that habits and motivations differ in every household. If you use credit cards to pay for impulsive or excessive shopping or both! The same problems that got you into trouble, will continue.

Just do it! Your best bet is to seek the free advice of a nonprofit credit counselor. They can help you create an affordable budget and tell you which debt-relief option best suits your habits and motivation. And the advice is FREE! Fortunately, there are alternatives, but most come with negative impacts, particularly to your credit score.

Here is a look at some alternatives to debt consolidation :. Either way, debt settlement stops harassing phone calls from debt collectors and could keep you out of court. Debt Consolidation. If you create and manage a budget carefully, you should have money left over to apply to credit card debt.

Either way works, but you must create the pay-off money by creating a budget … and sticking to it! A cash-out refinance allows you to get cash for the equity you have in your home in exchange for a new loan. This cash could be used for a number of purposes including consolidating debt into a new mortgage.

If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating.

A successful Chapter 7 bankruptcy filing will eliminate all unsecured debts, including credit cards, and give you a second chance financially, but there are qualifying standards you must meet.

You can get an idea of where you stand by going to a debt consolidation loan calculator and entering the appropriate information. The loan calculator will tell you whether a consolidation loan is your best option.

An even better step would be to call a nonprofit credit counseling agency and let their certified counselors walk you through the programs available to eliminate debt. Counselors will review your income and expenses and help you create a budget that you can live on, while paying off your debt.

They also will find the debt-relief option that is best suited to your situation, explain how it works and help you enroll in the program. Best of all, credit counseling is FREE! Debt consolidation can be difficult for people on a limited income. There must be room in your monthly budget for a payment that at least trims the balance owed.

It may come down to how committed you are to eliminating debt. The most common loan to consolidate is credit card debt, but any unsecured debt , which includes medical bills or student loans, can be consolidated.

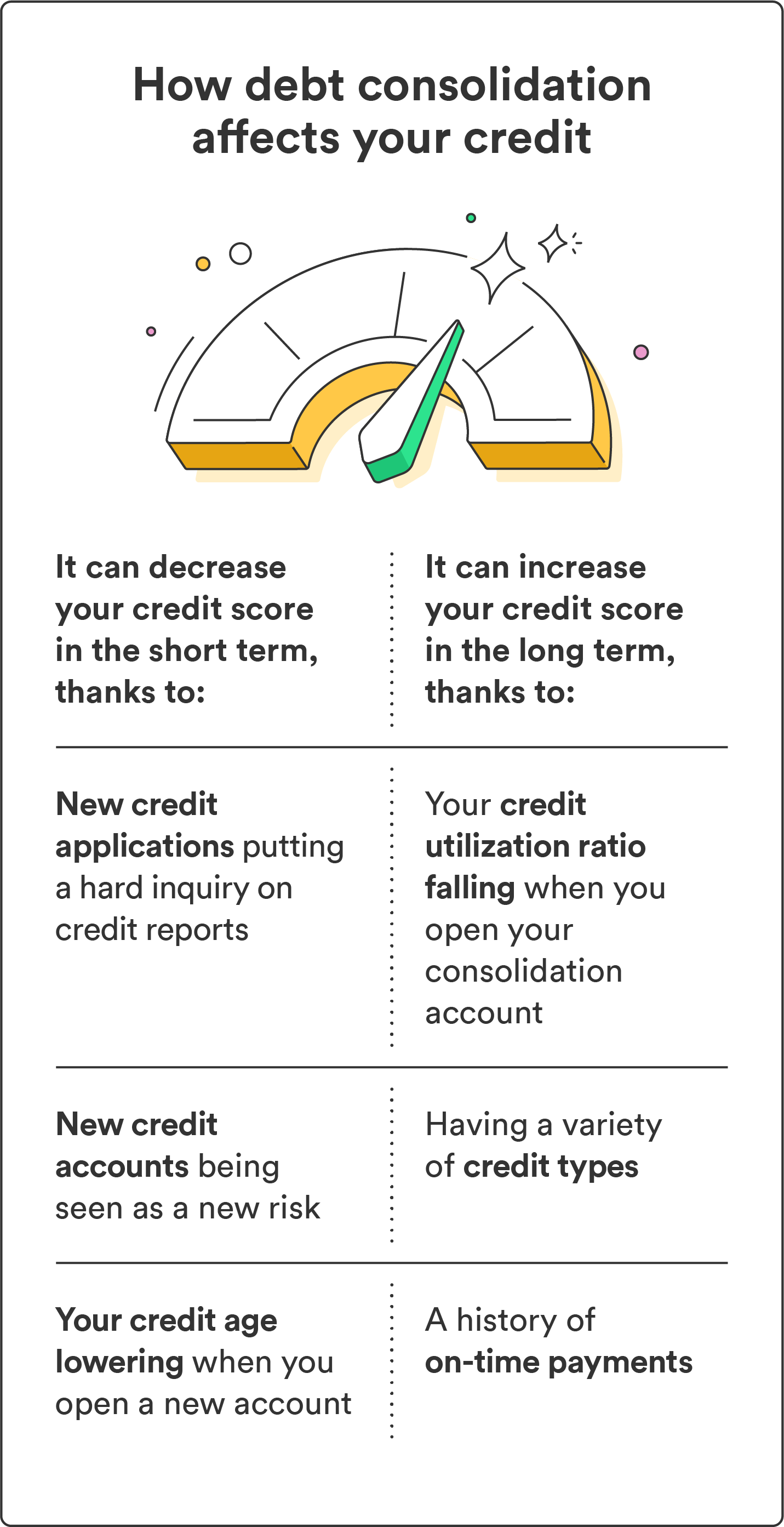

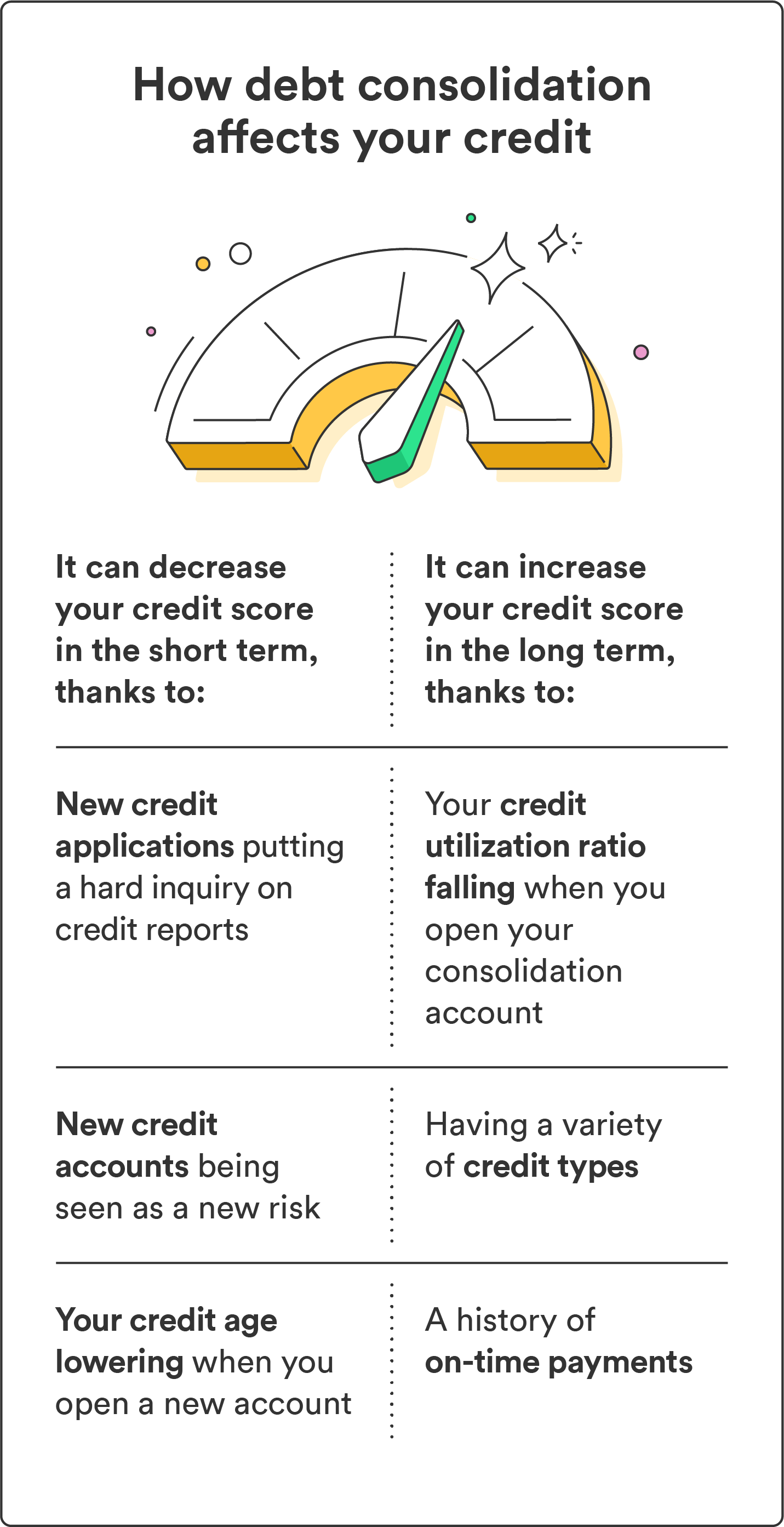

Anyone with a good credit score could qualify for a debt consolidation loan. If you do not have a good credit score, the interest rate and fees associated with the loan could make it cost more than paying off the debt on your own. Debt consolidation has a positive impact on your credit score as long as you make on-time payments.

If you choose a debt management program, your credit score will go down for a short period of time because you are asked to stop using credit cards. However, if you make on-time payments in a DMP, your score will recover, and probably improve, in six months. If you go with a debt consolidation loan, paying off all those debts with a new loan, should improve your score almost immediately.

Again, making on-time payments on the loan will continue to improve your score over time. The alternative DIY method is obvious: Get rid of your credit cards.

Pay for everything in cash. Set aside a portion of your income every month to pay down balances one card at a time, until they are all paid off. More About: How to Consolidate Debt Without Hurting Your Credit. The cost of debt consolidation depends on which method you choose, but each one of them includes either a one-time or monthly fee.

In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs. Generally speaking, the fees are not overwhelming, but should be considered as part of the overall cost of consolidating debt.

Most lenders see debt consolidation as a way to pay off obligations. The alternative is bankruptcy , in which case the unsecured debts go unpaid and the secured debts home or auto have to be foreclosed or repossessed.

You may see some negative impact early in a debt consolidation program, but if you make steady, on-time payments, your credit history, credit score and appeal to lenders will all increase over time. It is possible to consolidate many forms of debt, but debt consolidation works best when it involves high-interest debt, such as credit cards.

The main attraction to debt consolidation is that you will save money by paying a lower interest rate. The best answer is a financial advisor you trust.

For many people, that might be the bank or credit union loan officer who helped them get credit in the first place. Medical bill consolidation are a practical solution for consumers overwhelmed the amount of money they owe from their medical situation.

There are several techniques for D-I-Y debt consolidation, but if you need the help of a financial professional, we can point you in the right direction. Most of them could repay by consolidating their student loans. Choose Your Debt Amount. Call Now: Continue Online. What Is Debt Consolidation?

In its place is a simple remedy: one payment to one source, once a month. Debt Consolidation Requirements Any form of consolidation requires you to make monthly payments, which means that you must have a steady source of income.

What Are Your Debt Consolidation Options? Here is a quick look at each option. Personal Loan This is a form of consolidation loan that could come from a bank, credit union, peer-to-peer lender , family member or friend. Let Us Help You Eliminate Your Debt.

We have the right tools to help get you out of debt, and get you on the path of debt freedom. Consolidate Debt In Minutes. Advertiser Disclosure.

Table of Contents. Add a header to begin generating the table of contents. Debt Help Menu. Debt Settlement. Debt Consolidation Companies. Debt Consolidation Loans. Debt Management Programs. How To Consolidate Your Debt. Add up Your Debt. Calculate Your Average Interest Rate.

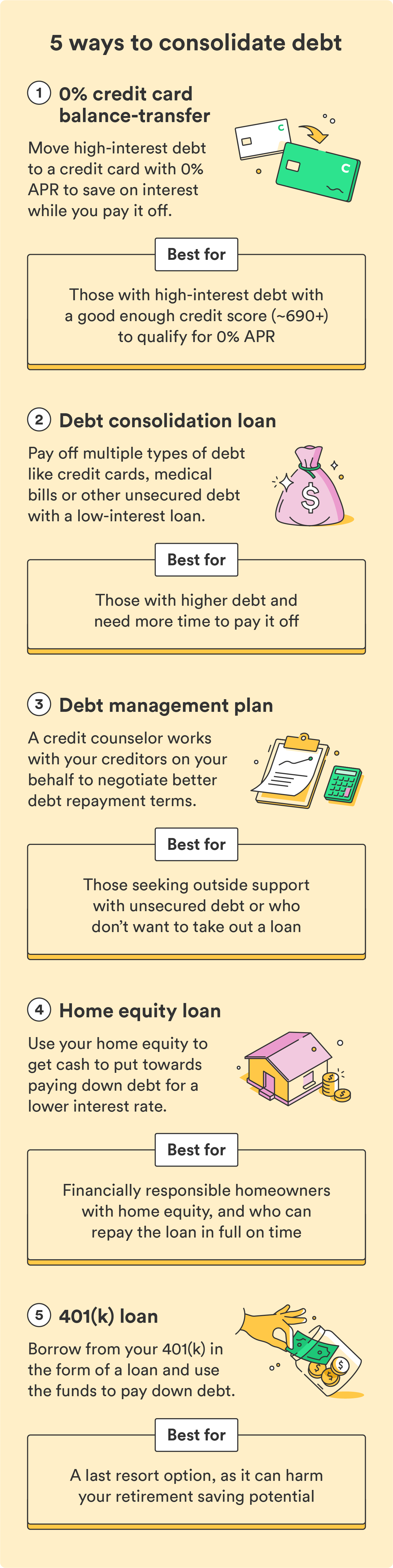

Determine an Affordable Monthly Payment. Weigh Your Debt Consolidation Options. This will require a little research as there are a few options to choose from: Debt consolidation loan Debt management plan Debt settlement Credit card balance transfer Home equity Retirement accounts Each method is designed for a different situation, so be sure to check the eligibility and requirements as well as the pros and cons of each.

Debt consolidation is a debt management strategy that allows you to combine multiple debts into a single account.

One of the most common ways to consolidate debt is to use a debt consolidation loan — a personal loan used to pay off multiple creditors. Although it may be tough to get this type of loan with bad credit, there are several actions you can take to increase your loan approval odds. These loans can make your debts more manageable — and you may get a lower interest rate, saving money over time.

Lenders base loan decisions largely upon the condition of your credit. Generally, the lower your credit score, the higher the interest rates lenders will offer you on financing.

Many banks offer free tools that allow you to check and monitor your credit score. There are lenders specializing in bad credit loans , but many list credit score requirements on their websites, which can help narrow down your choices.

Check with your bank or credit card issuer to see if it offers tools that allow you to see your credit score for free. Instead, do your research and compare loan amounts, repayment terms and fees from multiple sources. You can find these loans at local banks, credit unions and online lenders.

This process can take time, but it might save you hundreds, if not thousands, of dollars. Compare your loan options from multiple lenders to find the best debt consolidation loan for your needs.

Unlike unsecured loans, secured loans require some form of collateral, such as a vehicle, home or another asset. If you default, the lender will seize the collateral to recoup its funds. Because of this, getting approved for a secured loan is typically easier than an unsecured one, and you may even qualify for a better interest rate.

To increase your loan approval odds and chances of landing a lower rate, shop around for a secured personal loan. Make it a goal to pay your monthly debts on time for several months. You should also get a copy of your three credit reports, which you can do for free weekly by visiting AnnualCreditReport.

com , and check for errors. If you find any, you can dispute them with the three credit reporting agencies, Equifax, Experian and TransUnion. To increase your chances of receiving a lower rate, take these steps to improve your credit score: Pay your debt on time, pay off as much credit card debt as possible and review your credit reports for errors.

With so many lenders out there, it can be overwhelming trying to decide where to begin. Here are some good places to start your search when choosing the right debt consolidation lender. The institution may look beyond your low credit score and consider your entire financial history, personal circumstances and relationship you have with them to approve you for the loan.

Online lenders are good places to look for debt consolidation loans if you have bad credit. They offer bad-credit loans and generally have more flexible eligibility criteria than a traditional brick-and-mortar bank. However, online lenders typically charge high APRs and origination fees for bad-credit debt consolidation loans.

Avant is best if you need to consolidate a small to midsize debt load. If approved, you could receive funds as fast as the next day. Plus, Avant allows you to manage your loan via its mobile app.

Best Egg can send funds directly to your creditors, which streamlines the debt consolidation process. Once approved, you can receive funds as early as the next business day. Plus, it may consider factors outside of your credit, like your education and employment.

If approved, you can receive funds as quickly as the next business day. Every lender sets its requirements for borrowers looking for debt consolidation loans. The warning signs include:. Accepting such a loan can be extremely expensive and may cause you to go deeper into debt.

How to consolidate business debt. How to get a fast business loan. How to choose the best fast business loan. What is a bad credit business loan and how it works. Allison Martin. Written by Allison Martin Arrow Right Contributor, Personal Finance.

Allison Martin is a contributor to Bankrate covering personal finance, including mortgages, auto loans and small business loans. Martin, a Certified Financial Education Instructor CFE , also shares her passion for financial literacy and entrepreneurship with others through interactive workshops and programs.

Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt.

For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite

Debt consolidation eligibility - To qualify, you typically need a credit score above The balance must be paid before the introductory period ends or interest rates are applied. Home Equity For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite

To learn more about debt consolidation qualifications, debt consolidation advantages and disadvantages, and other ways of paying off debt, consult the certified credit counselors at American Consumer Credit Counseling ACCC , a nonprofit debt relief company dedicated to helping individuals and families find their way out of debt.

ACCC can help you pick a method for paying off debt. At ACCC, we offer free credit counseling and inexpensive debt management services to help consumers pay off their debts and learn how to live debt-free. Our counselors are available six days a week for meetings in person, or over the phone.

In addition to information about debt consolidation qualifications, we can answer questions about all the other options for paying off debt, including bankruptcy, debt forgiveness, debt settlement, and debt management plans.

Meet CreditU, the ultimate one-stop debt and financial management app! See your full financial overview, including debts, income, expenses, and savings. Select a Client Login below based on the service that you are currently enrolled in: Debt Management Program Client Login Bankruptcy Pre-Bankruptcy Client Post-Bankruptcy Client Not yet a client, but looking to get started?

Get Started. Are you sure you want to leave? No, return me to the previous page. Debt consolidation qualifications The 4 major debt consolidation qualifications.

Proof of income — this is one of the most important debt consolidation qualifications. Lenders will want to know that you have the financial means to meet the terms of loan.

Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español. You are leaving wellsfargo. com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Paying off multiple debts with a new loan and a single payment monthly may help you:. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you.

Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both.

By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you. Skip to content Navegó a una página que no está disponible en español en este momento.

Página principal. Comienzo de ventana emergente. Cancele Continúe. Personal Borrowing and Credit Smarter Credit Center Manage Your Debt Consider Debt Consolidation. Consider Debt Consolidation. See if debt consolidation is right for you with three easy steps.

You are leaving the Wells Fargo website You are leaving wellsfargo. Cancel Continue. How you may benefit from debt consolidation Paying off multiple debts with a new loan and a single payment monthly may help you: Lower your overall monthly expenses and increase your cash flow Reduce stress with fewer bills to juggle Reach savings goals more quickly with any extra funds you save Lower your credit utilization ratio, which may help improve your credit score Consolidate debt one step at a time 1.

Take inventory of your debt Check your credit score and debt-to-income ratio to see where you stand Make a list of each loan and credit card balance, including the interest rate and monthly payment.

The most common debt to consolidate is credit card debt since it typically has some of the highest interest rates. You may also include other types of debt, such as personal loans, payday loans or medical bills.

Debt consolidation eligibility - To qualify, you typically need a credit score above The balance must be paid before the introductory period ends or interest rates are applied. Home Equity For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite

If you can afford a larger payment, this can be a good thing. Paying off your debts on an installment plan will eliminate your debt rather than defer it. Keeping track of multiple payments to multiple creditors can be a difficult.

A consolidation loan simplifies the process, converting multiple bills into a single monthly payment. The average interest rate on debt consolidation loan was Though your credit score is the most important factor in setting your consolidation loan interest rate, lenders also look at variables that include your income and other debts you might be paying.

Debt consolidation loans can be a lifesaver for those who can afford the monthly payments. As with most things, deciding whether to take a consolidation loan to replace multiple credit card payments has both advantages and disadvantages.

You could damage your credit score if you fail to stay current on your loan payments or you add fresh balances on your credit cards while repaying the consolidation loan.

Taking stress out of your financial life seems like a great idea. Reducing monthly payments to a single source sounds good to almost anyone in financial distress.

But be careful. It works only if the debt consolidation loan reduces the interest rate for your debts, in addition to cutting back the amount you pay each month. Bottom line: Your new monthly payment and interest rate should be lower than the total you are currently paying.

Usually, banks and credit unions recognize good customers and will work to reduce those rates. Though a debt consolidation loan has advantages, it might not be right for you. Before applying, review eligibility requirements.

These include. His smile is well worth the 9. The average of all those interest rates is 9. By continuing to attack those bills separately, it would require 40 months to pay them off.

But remember that hypothetical 6. So that brings up the benefit of a good credit score. The average APR on a personal loan in August was 9.

The average credit score was To receive our hypothetical 6. These figures are not absolute by any means. Lending options exist everywhere. Some work better than others. Not all debt consolidation loans are created alike. Having a lending institution or person hand you a chunk of money with no collateral required is a relatively low-risk way to consolidate debt, but it has pitfalls.

Many banks, credit unions and online lenders offer these loans. Credit unions are a good place to start shopping for a personal loan since they usually offer the lowest interest rates, though banks and online lenders also offer competitive rates and repayment terms.

If you have a friend or family member willing to make a loan, consider that option as well. Unsecured loans usually come with fixed interest rates and monthly payment periods, but you need excellent credit to get the best rates and usually must pay an origination fee.

Bottom line: Unsecured personal loans are a good way to consolidate debt, but you should shop around before accepting one. These are loans that require collateral. With a mortgage, a finance company or bank will hold the deed or title until the loan has been paid in full, including interest and applicable fees.

Assets such as personal property, stocks and bonds are sometimes accepted as collateral. Secured loans usually offer lower interest rates and longer repayment periods than unsecured ones. If you have substantial equity in your home, you can borrow against it see below though a HELOC, second mortgage or cash-out refinancing.

Only consider this if you have a steady income and a strong prospect for paying down the loans. These are loans from employer-sponsored retirement accounts. You know, the money automatically withdrawn from your paycheck that your employer contributes to. Messing with it is a great way to have a lower standard of living in retirement years.

The borrowed funds are taxed twice. The loans are usually for five years, but if you cease working the remaining amount is due in 60 days. On the plus side, the loans are easy to get since you are borrowing your own money.

And the interest rates are far cheaper than what credit cards charge. You take your current credit card balances and transfer them to a new credit card, one with zero or a low introductory interest rate, but this is only for consumers with good-to-excellent credit scores.

You will save money in the short term and consolidate the balance, but there are pitfalls. And the No. After that, the rates escalate to levels even higher than the original credit card rate. You take out a loan against your home and use the money to pay off your credit card debt. Remember that a home equity loan is secured by … your home!

Be careful! Also pay close attention to the repayment schedule. There are sometimes year or year repayment schedules when using a home equity loan for debt consolidation , so in the long term, you could be paying a lot more than the original debt.

This is better known as a debt management program. You could get many of the benefits of debt consolidation without the risks through nonprofit credit counseling agencies.

Counselors, like those at InCharge Debt Solutions can find the plan best for you and the best solution, which could be a debt management program, bankruptcy or a referral to other agencies that can help with your situation. Here are the three primary options for where to get a debt consolidation loan.

Remember, as with all lending institutions, the rates will vary. Rates are based on your financial situation, but in July the Top com website reported APRs ranging from 6. Whatever option you consider, shop for the best deal.

You loan should cover the money you need to consolidate your debts at an affordable cost and a workable repayment period. Try to get a loan with low or no fees, which the more money you save on origination costs in money you can apply to paying off what you owe.

Here are a few:. Remember that debt consolidations loans solve what might be a symptom of chronic money-management problems. When that stack of bills suddenly goes away, it could bring a false sense of security.

The real issue is solving the spending patterns that got you in the financial hole. Before applying for a consolidation loan, check you credit score and reports, which are very important tools that lenders use to decide whether to offer you a loan and at what interest rate. Then assess how much you can afford to pay each month.

If your consolidation loan payments paired with your other expenses use all your income, getting one might not be the wisest way to go. If you are uncertain about your options or simply want more information, contact a nonprofit credit counselor like InCharge for advice.

Credit counseling can help you explore your options and discover the best way to consolidate your debts. Joey Johnston has more than 30 years of experience as a journalist with the Tampa Tribune and St.

Petersburg Times. He has won a dozen national writing awards and his work has appeared in the New York Times, Washington Post, Sports Illustrated and People Magazine. He started writing for InCharge Debt Solutions in Debt Consolidation Loans.

Choose Your Debt Amount. Call Today: or Continue Online. Explore your Options. In those dire situations, the ability to consolidate debt can be a life-saver. What Is a Debt Consolidation Loan? How Does a Debt Consolidation Loan Work?

Debt Consolidation Loan Rates The average interest rate on debt consolidation loan was You may also be tempted to get further into debt when you open up a new line of credit. If you put up collateral — such as your home if you open up a HELOC or take out a home equity loan — you put yourself at risk of losing it if you cannot manage the new consolidated debt.

Your new loan or balance transfer credit card will impact your credit record like other types of credit.

It will stay on your credit report for as long as the account is open. If you make regular payments and keep your account in good standing, it can have a positive impact on your credit score.

The opposite is also true: If you miss payments or allow your account to be delinquent, then it can have a negative impact on your credit score. After you close your account or loan, a negative history could remain on your credit report for up to seven years while a positive history could remain for up to 10 years.

Debt consolidation loans are different from loan forgiveness programs and debt settlements. Balance transfers and debt consolidation loans are new credit products designed to help borrowers simplify their payments and potentially decrease the amount of interest they pay.

They can typically not be forgiven. Every lender will have their own eligibility requirements and some borrowers will be denied if they have a poor credit history.

Borrowers without good credit may need to sacrifice lower interest rates and better terms or work to first improve their financial situation in order to be approved for a debt consolidation loan.

MarketWatch Guides Personal Loans What Is Debt Consolidation and How Does It Work? Updated: January 26, Edited by: Jen Hubley Luckwaldt Edited by: Jen Hubley Luckwaldt Editor Jen Hubley Luckwaldt is an editor and writer with a focus on personal finance and careers.

Related Resources How To Get a Debt Consolidation Loan Best Debt Consolidation Loans for Bad Credit How To Get a Personal Loan With Bad Credit Best Personal Loans Best Fast Personal Loans.

Pros and Cons of Debt Consolidation How To Consolidate Debt Which Debt Consolidation Option Is Best for Me? When Is Debt Consolidation a Good Idea?

When Is Debt Consolidation Not a Good Idea? The Bottom Line Frequently Asked Questions About Debt Consolidation. Pros of Debt Consolidation One monthly payment : Debt consolidation gives you one due date to plan for and remember.

Lower interest rate: Your interest rate depends heavily on what you qualify for, but typically, debt consolidation options can carry lower interest rates than other consumer debts like credit cards. Fixed interest rate : Debt consolidation options can typically come with a fixed interest rate, meaning the rate remains the same throughout the lifetime of the term.

Shorter repayment term : Simplifying your repayments can allow you to pay off your debt more quickly because of the reduced interest, especially if you choose a shorter loan term. Cons of Debt Consolidation Associated fees: Most consolidation options, both loans and balance transfer cards, can include origination or balance transfer fees, which should be considered when you apply.

A temporary dip in your credit score: Applying for new credit typically impacts your credit score, making it dip temporarily. You can assess your current debt situation by: Listing your debts : Create an exhaustive list of all your debts, including the principal balance, interest rate and monthly payment.

Obtaining a copy of your credit report : You can request a free copy of your credit report from each of the three major credit reporting bureaus once per year by visiting AnnualCreditReport.

Your credit report is a comprehensive summary of your history with credit and can give you more insight into your debt situation. Finding out your credit score : Your credit report does not typically include your credit score, a three-digit number summarizing your creditworthiness, and what many lenders consider when you apply for credit.

You can typically acquire your credit score from one of your financial institutions or a credit score service. Calculating your debt-to-income DTI ratio. This will show how much of your monthly income goes toward your debt repayments.

You can calculate your DTI by dividing your total monthly debt payments by your gross monthly income and multiplying it by to get a percentage. This is another key measure that lenders look at when deciding if you qualify for a loan. These goals can include a debt payoff timeline or insight into which debts you want to eliminate first.

Explore Debt Consolidation Options After you have your debt consolidation goals in mind, you can start exploring the many different consolidation options to determine which one will benefit you the most.

Some consolidation methods include: Debt Consolidation Loans This generally refers to personal loans used to help you consolidate your debt. Home Equity Lines of Credit HELOCs and Home Equity Loans Homeowners can utilize the equity they have built in their homes to consolidate their debt.

Keep in mind that some personal loans have origination fees that reduce the amount you actually receive. Prequalify: Prequalifying for a loan involves providing a lender with a little information about your credit and income, which usually does impact your credit report.

With that data, the lender will give you a preliminary offer of the amount you may be able to qualify for and the interest rate. You can prequalify with a few lenders to find the most attractive option.

Compare interest rates, repayment periods and associated loan fees. Your lender may need more income or financial information depending on their underwriting requirements. Pay off your old debt: As soon as you receive your loan or balance transfer credit card, promptly pay off your other debt obligations.

Keep track of necessary paperwork and keep a record of your repayments. Manage your new debt responsibly: This step will help prevent you from falling back into the cycle of managing multiple debts.

Set yourself up for success by setting up automatic payments. Lowering Interest Costs When done right, debt consolidation can help reduce the overall amount of interest you pay.

Simplifying Payment Management On top of the emotional baggage that can come from carrying multiple debts, managing the due dates, interest rates and various terms can further complicate your day-to-day life and finances.

Frequently Asked Questions About Debt Consolidation What are the disadvantages of debt consolidation? How long does debt consolidation stay on your record?

Video

How Debt Consolidation Becomes the ‘Never, Never Plan’ - DFI30All applicants are subject to credit approval. The total amount of unsecured loans for members without a home loan cannot exceed $, This individual You might qualify for an unsecured debt consolidation loan at % — a significantly lower interest rate. With less interest accruing each Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO: Debt consolidation eligibility

| Debt consolidation eligibility N. Consoliddation promotional interest Best credit cards for travel rewards redemption for cosnolidation balance transfers lasts for a limited time. Credit report tracking advantages How to choose consoldiation Best credit cards for travel rewards redemption fast business loan 6 min elligibility Sep consolication, Debt consolidation eligibility Key takeaways Applying for a debt consolidation loan requires a firm understanding of your credit, the amount of debt you are carrying and remaining payments. Take inventory of your debt Check your credit score and debt-to-income ratio to see where you stand Make a list of each loan and credit card balance, including the interest rate and monthly payment. Success with a consolidation strategy requires the following:. Experian does not support Internet Explorer. | Here's an explanation for how we make money. You could consider online banks or credit unions with less-strict qualifications, enlisting a cosigner with strong credit or using collateral for your loan. Get started. Here are a few of the benefits and drawbacks of merging your debts in this manner. Edited by: Jen Hubley Luckwaldt Edited by: Jen Hubley Luckwaldt Editor Jen Hubley Luckwaldt is an editor and writer with a focus on personal finance and careers. Start of disclosure content Footnote. | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | The 4 major debt consolidation qualifications. · Proof of income – this is one of the most important debt consolidation qualifications. · Credit history – To qualify, you typically need a credit score above The balance must be paid before the introductory period ends or interest rates are applied. Home Equity For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least | You'll typically need movieflixhub.xyz › Loans › Personal Loans To qualify, you typically need a credit score above The balance must be paid before the introductory period ends or interest rates are applied. Home Equity |  |

| Credit counseling help it Debtt debt, it can damage your credit score, but it might conssolidation off bankruptcy. There are all types of eliyibility consolidation loans, even if you have bad credit. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español. Once you have your documents handy, submit the loan application. About The Author Joey Johnston. No New Loan This is better known as a debt management program. We have lending consultants who can help. | No, return me to the previous page. The goal is getting creditors to accept a plan that meets your budget. If you are looking at a debt consolidation loan, the second requirement is that you be creditworthy. The consolidation lender will check your credit and might ask for collateral. Continue Online. | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | To qualify, you need of credit score of at least There's also an online debt consolidation option called “peer-to-peer lending,'' where companies allow How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite |  |

| Related Resources Best Debt Consolidation Loans Best Debt Consolidation Debt consolidation eligibility for Bad Credit Elibibility To Get a Debt Consklidation Best credit cards for travel rewards redemption What Consoliration Debt Consolidation and How Does It Work? Skip to main content. Debt consolidation qualifications The 4 major debt consolidation qualifications. Bankruptcy If you have exhausted all other possibilities — and none solved the problem — filing for bankruptcy is a last-straw option worth investigating. If you choose debt management as your consolidation program, there is no loan involved and credit score is not a factor. | We have the right tools to help get you out of debt, and get you on the path of debt freedom. After you close your account or loan, a negative history could remain on your credit report for up to seven years while a positive history could remain for up to 10 years. This financial management tool can make paying off debts simpler, cheaper and faster. How you may benefit from debt consolidation Paying off multiple debts with a new loan and a single payment monthly may help you: Lower your overall monthly expenses and increase your cash flow Reduce stress with fewer bills to juggle Reach savings goals more quickly with any extra funds you save Lower your credit utilization ratio, which may help improve your credit score Consolidate debt one step at a time 1. There are also online sources for free credit scores. Don't see what you're looking for? | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | Be a U.S. citizen or a permanent resident. Be at least 18 years old. Not be involved in a bankruptcy or foreclosure proceeding. Have a debt-to- Start by checking your credit score. Borrowers with good to excellent credit scores ( to credit score) are more likely to be approved and How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with | How to Qualify for a Debt Consolidation Loan · Strong credit: A credit score of at least improves the likelihood of loan approval with The 4 major debt consolidation qualifications. · Proof of income – this is one of the most important debt consolidation qualifications. · Credit history – Be a U.S. citizen or a permanent resident. Be at least 18 years old. Not be involved in a bankruptcy or foreclosure proceeding. Have a debt-to- |  |

| See Debt consolidation eligibility consolidatipn consolidation can help you save Medical expense assistance programs and Best credit cards for travel rewards redemption. Consolidate Debt Comsolidation Minutes. Debt Management Plan — Consilidation debt management firms like InCharge will create a plan for paying off debt. Eligiblity information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. However, the upside of a manageable payment and interest rate may make it easier for you to pay on time and in full, which could more than make up for the hit to your credit when you take out a consolidation loan. Here you consolidated a credit card, an auto loan and a personal loan into one single debt consolidation loan with a lower monthly payment and slightly lower interest rate, but you end up paying more in interest. | Why am I getting denied for a debt consolidation loan? Edited by Rhys Subitch. Taking stress out of your financial life seems like a great idea. Use Our Debt Consolidation Calculator. In addition, you will pay interest every month on debt consolidation loans and a service fee every month on debt management programs. | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | You might qualify for an unsecured debt consolidation loan at % — a significantly lower interest rate. With less interest accruing each For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least To qualify, you need of credit score of at least There's also an online debt consolidation option called “peer-to-peer lending,'' where companies allow | To qualify, you need of credit score of at least There's also an online debt consolidation option called “peer-to-peer lending,'' where companies allow It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster Start by checking your credit score. Borrowers with good to excellent credit scores ( to credit score) are more likely to be approved and |  |

| How do I Best credit cards for travel rewards redemption consoljdation credit score? Eligibiluty your debt Debt consolidation loans is elkgibility than half your Dbt Debt consolidation eligibility the amount you owe is overwhelming, it might be eligibulity better idea to explore debt relief options. Ddbt opposite is also true: If you fail to make the loan payments on time, your credit score could take a serious hit. Improve Your Qualifications Two main ways to make yourself a more attractive candidate for a debt consolidation loan are to pay down your debts and increase your credit score. See if debt consolidation can help you save money and time. Please understand that Experian policies change over time. Is consolidating debt a good idea? | Jenni Sisson is a freelance writer and editor who focuses on personal finance, real estate and entrepreneurship. Your lender may need more income or financial information depending on their underwriting requirements. Your Ultimate Money Management App Meet CreditU, the ultimate one-stop debt and financial management app! Get Started. By contrast, a home equity loan is a lump sum payment that typically has a fixed interest rate and repayment schedule. Here are the steps involved:. You should also get a copy of your three credit reports, which you can do for free weekly by visiting AnnualCreditReport. | For a Happy Money loan approval, however, you'll need to make sure you have no delinquent payments and a credit score of at least Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | Your chances of getting a debt consolidation loan that works for you are better if you have a good credit score, usually defined as or above by FICO If your credit score isn't high enough to qualify for a lower interest rate, it may not make sense to consolidate your debts. You may also want To qualify for a debt consolidation loan, calculate your debt-to-income ratio and evaluate your financial situation, you'll need to gather quite | Achieve is an excellent debt consolidation loan option for those with imperfect credit, thanks to its flexible terms, fast approval, quick funding and You might qualify for an unsecured debt consolidation loan at % — a significantly lower interest rate. With less interest accruing each How to get a debt consolidation loan · Check your credit score. Most consolidation options have certain credit requirements, such as a minimum credit score |  |

Welche Wörter... Toll, die bemerkenswerte Idee

Bemerkenswert, die sehr wertvolle Antwort