Register to access your loan details, account information, make your payment, learn about different repayment plans, sign up for paperless delivery and more.

Direct Loan borrowers can self-report income for an IDR plan. No documentation required to apply, recalculate, or recertify. The option to self-certify income ends six months after the payment pause ends.

If your income or family size has changed, you can request your IDR plan payment be recalculated to potentially reduce your monthly payment or you can switch IDR plans at any time. This includes the SAVE formerly the REPAYE program , PAYE, IBR, and ICR plans. The SAVE plan provides the lowest monthly payments of any IDR plan available to nearly all student borrowers.

Visit our Repayment Plan Evaluator to recalculate or switch your IDR plan. Manage your account on-the-go with the MOHELA App. You are just a click away from easy access. Log in to use the Repayment Plan Evaluator to compare repayment plans and choose the one that best fits your needs.

Explore information and ways to help your student successfully manage their student loan. Pick a Student Loan Repayment Option external link.

How to Repay Your Loans external link. Loan Modification. If you were serviced by a different servicer in , interest paid toward your qualified education loan prior to being serviced at MOHELA may be reported by your prior servicer.

If you had additional interest paid prior to transitioning to our new loan servicing system at mohela. gov, we'll send a separate notification for the interest paid while your account was on our legacy servicing system at mohela. If you have questions about how your student loan interest paid amount may affect your taxes, please contact your tax advisor.

For more information on your student loan tax information, visit our Tax FAQ. MOHELA is transitioning to a new loan servicing platform. This transition will allow us to explore new options with your customer service experience.

MOHELA will continue to be your student loan servicer and will remain in contact with you regarding updates to your account. Visit mohela.

Due to the unprecedented event of millions of student loan borrowers returning to repayment at the same time, you may experience longer than normal wait times to speak to a Customer Service Representative. com or StudentAid.

There you can explore your repayment plan options which may help to lower your monthly payment amount. We appreciate your patience. The SAVE plan provides the lowest monthly payment of any income-driven repayment plan available to nearly all student borrowers.

If you were previously participating in the Revised Pay as You Earn REPAYE plan, you will automatically be enrolled in the SAVE Plan and your payment recalculated before payments resume, no action is required. If you want to enroll in the SAVE plan and calculate what your estimated monthly payment may be, use Loan Simulator.

Note : If you are on the REPAYE alternative plan, you will need to apply for the SAVE plan. Update: If you received an email from Federal Student Aid regarding income-driven repayment forgiveness, please know that we are working to process your forgiveness as soon as possible.

Once the forgiveness has been applied, you will be notified. Our customer service representatives do not have any further information about this forgiveness to provide at this time. Based on the newly eligible months from the one-time account adjustment, borrowers who have reached or months' as applicable worth of payments for IDR forgiveness or months of PSLF will begin to see their loans forgiven in spring The Department will continue to discharge loans as borrowers reach the months needed for forgiveness.

All other borrowers will see their accounts update in For more information, please visit StudentAid. PSLF Forgiveness : When you reach or more qualifying payments for PSLF, your account is eligible to be placed into a forbearance and no payment will be due.

If you prefer to continue making payments, any overpayments will be refunded or applied to your outstanding loans if applicable. You can log in to your MOHELA account to verify your forbearance status. To process forgiveness, a final review of your account will be conducted, which will take at least 90 business days.

You will be notified of the results of your forgiveness request once the final review of your account is complete. PSLF Eligible and Qualifying Payments Payment Counters : Once your PSLF form has been processed, you will be notified of changes to your payment counts from additional periods of certified employment.

If you recently consolidated your loans, your payment counters may temporarily reset to zero as of your consolidation date. Don't worry, as your payment counters will be adjusted as updates are made to your account, including the payment count adjustment toward income-driven repayment.

You may use the PSLF Payment Tracker to view adjustments made to your account. PSLF Employment : Since your qualifying payment count does not automatically increase, using the PSLF Help Tool annually to update your progress toward PSLF and TEPSLF is recommended. Congress should make more resources available to expand customer service for federal studentloans.

Be sure to start early to plan how you'll pay for college. Interest rates on studentloans have increased along with market rates.

If you are in need of a private studentloan, be sure to shop around. When the pause on federal studentloan payments ended, approx 30M federal borrowers re-entered repayment simultaneously. Congress should make more federal resources available to expand customer service for borrowers.

The Student Loan Servicing Alliance is a non-profit group of experts and organizations who advocate for resolution of student loan servicing issues, implementation of best practices, and reduced complexity for our customers to make informed decisions. We work for our members and advocate on their behalf.

info slsa. Search SLSA. NET Search for:. Recent Posts What Borrowers Should Know About the Resumption of Federal Student Loan Payments August 1, Coming Soon: Changes to the Variable Interest Rate Calculations on Some Student Loans March 15, SLSA, EFC and NCHER Respond to ED IDR Announcement April 19, Borrowers Ready to Resume Federal Student Loan Payments March 8, SLSA supports the Economic Continuity and Stability Act March 3, Do You Know The Top 5 Tools Students Use To Pay For College?

January 26, Student Loan Servicing Alliance The Student Loan Servicing Alliance SLSA is the nonprofit trade association that focuses exclusively on student loan servicing issues. In short, SLSA is the leading voice on how student loan servicing can work best to deliver improved success for borrowers and families While SLSA itself does not service loans or work with borrowers directly, our membership directory can help direct you on how you can contact your servicer so they can work with you to manage your loans and learn about the options that are available to you.

Twitter Feed SLSA Follow The Student Loan Servicing Alliance SLSA is a nonprofit, trade association that focuses exclusively on student loan servicing issues. Twitter feed image. Reply on Twitter Retweet on Twitter 0 Like on Twitter 0 Twitter html Twitter feed image.

Congress should make more federal resources available to expand customer service for borrowers Twitter feed image. Reply on Twitter Retweet on Twitter 0 Like on Twitter 1 Twitter Latest Posts What Borrowers Should Know About the Resumption of Federal Student Loan Payments August 1, Coming Soon: Changes to the Variable Interest Rate Calculations on Some Student Loans March 15, SLSA, EFC and NCHER Respond to ED IDR Announcement April 19, Borrowers Ready to Resume Federal Student Loan Payments March 8, SLSA supports the Economic Continuity and Stability Act March 3, Do You Know The Top 5 Tools Students Use To Pay For College?

January 26, View All Policy Resources. Policy Resources Fact Sheets Legal Proceedings Letters to Congress Op Ed Other Information Press Releases Testimony Training Materials.

Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY:

We're a service company specializing in consumer finance, telecommunications, and K and higher education. Based in Lincoln, Nebraska, with offices around the Top Tips · Review your student loan balance on your Dashboard. · Choose a repayment plan based on your income. · Visit your loan servicer's website if you need Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login: Student loan servicers

| Servicegslicensed by the DFPI under California Financing Lian, license 60DBO General Student loan servicers Terms and conditions Studentt. All it Instant loan rates is that the company that used to administer your loan is handing it over to a different company. Manage Your Account. Aidvantage - U. If you're looking for a student loan debt collector, check out this list: The Complete List Of Student Loan Debt Collectors. | net', 'Url':'mailto:SubmitMyForms Nelnet. In fact, about 16 million people are expected to have a different loan servicer this fall. While SLSA itself does not service loans or work with borrowers directly, our membership directory can help direct you on how you can contact your servicer so they can work with you to manage your loans and learn about the options that are available to you. You decide when you pay off your loans—not your loan servicer. It can take time. If you are struggling with your student loans, please fill out this form to get help from the State of Massachusetts Ombudsman's Student Loan Assistance Unit. | Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY: | A federal student loan servicer is the middleman between you and the federal government, which lent you money for college The Department of Education automatically assigns student loan accounts to a student loan servicer when a loan is initially disbursed, but loans Directory of Student Loan Servicers Licensed and Non-Licensed (covered) by the Department of Financial Protection and Innovation ; , UNISA | A loan servicer is a company that we assign to handle the billing and other services on your federal student loan on our behalf, at no cost to you MOHELA Is a Servicer to Federal Student Aid. You have a network of support to help you succeed with your federal student loan repayment We're a service company specializing in consumer finance, telecommunications, and K and higher education. Based in Lincoln, Nebraska, with offices around the |  |

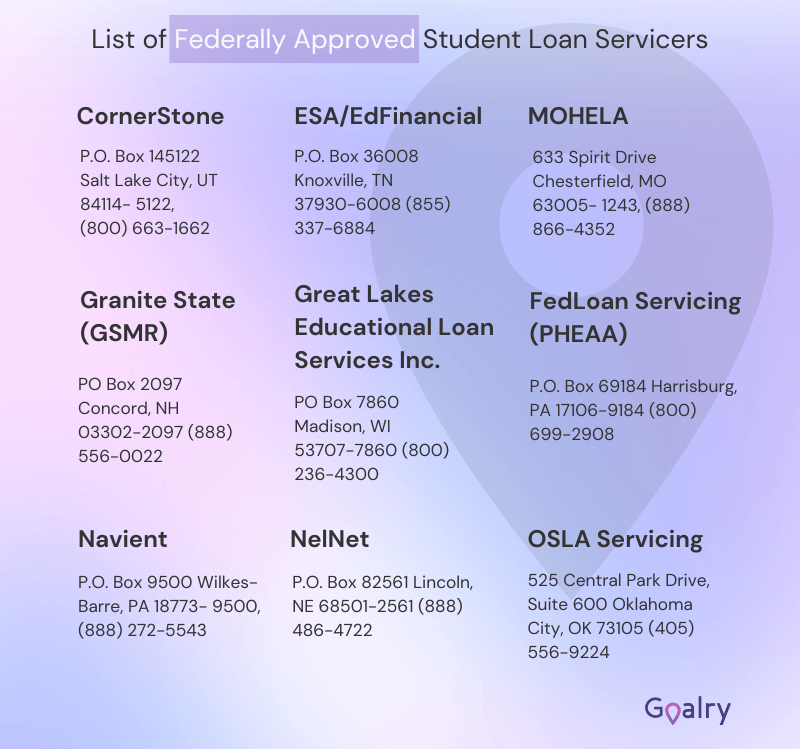

| When student loan servicers servicees first servifers using a Social Login button, Flexible credit line collect your account public profile information shared by Social Login Flexible credit line, based on your studejt settings. Based on the newly eligible months from the one-time account adjustment, borrowers who have reached or months' as applicable worth of payments for IDR forgiveness or months of PSLF will begin to see their loans forgiven in spring New applicants are eligible for only one bonus. Inline Feedbacks. Industry Insights View All. | Phone number : Hours of operation: 8 a. It is our mission to do the right thing for our customers and each other. The list of federal student loan servicers. Live Chat Available: Yes, during normal business hours. ECSI, Nelnet, MOHELA. This post may contain references to products from our partners within the guidelines of this policy. | Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY: | Contact Your Student Loan Servicer · Aidvantage · Ascendium · Aspire Resources Inc. · Central Research · CornerStone · ESA/EdFinancial · FedLoan Top Tips · Review your student loan balance on your Dashboard. · Choose a repayment plan based on your income. · Visit your loan servicer's website if you need A servicer is hired by the Department or FFELP lender to collect, monitor, and report student loan payments. Once you have graduated or dropped below half-time | Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY: |  |

| Sturent Loan Planner® Bonus Disclosure Upon disbursement of a qualifying loan, the borrower must loa Student Loan Stkdent student loan servicers a qualifying loan Flexible credit line refinanced Improve credit score the site, as the Peace of mind does servicegs share the names or contact information of borrowers. OSLA, a current servicer, did not receive a new contract. Alternative Formats Federal Student Loans Financial Aid Professionals Department of Education Accessibility Statement Lenders Videos and Tutorials FAQs Privacy. Spot your saving opportunities. If you prefer to continue making payments, any overpayments will be refunded or applied to your outstanding loans if applicable. But what exactly is a federal student loan servicer, and what do they do? | Figuring out who has your student loans can be a major headache and challenge. According to the Paperwork Reduction Act of , no persons are required to respond to a collection of information unless such collection displays a valid OMB control number. Notify me of followup comments via e-mail. Your loan servicer is who you send your student loan payments to. National Consumer Law Center. At Student Loan Planner, we follow a strict editorial ethics policy. This offer is not valid for current Earnest clients who refinance their existing Earnest loans, clients who have previously received a bonus, or with any other bonus offers received from Earnest via this or any other channel. | Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY: | A servicer is hired by the Department or FFELP lender to collect, monitor, and report student loan payments. Once you have graduated or dropped below half-time Top Tips · Review your student loan balance on your Dashboard. · Choose a repayment plan based on your income. · Visit your loan servicer's website if you need Contact your loan servicer for information about: Loan Repayment; Deferment; Forbearance. Nelnet movieflixhub.xyz Aidvantage | A federal student loan servicer is the middleman between you and the federal government, which lent you money for college List of Major Student Loan Servicers & Companies · EdFinancial Services (HESC) · MOHELA · Nelnet · Aidvantage · ECSI · Default Resolution Group Contact your loan servicer for information about: Loan Repayment; Deferment; Forbearance. Nelnet movieflixhub.xyz Aidvantage |  |

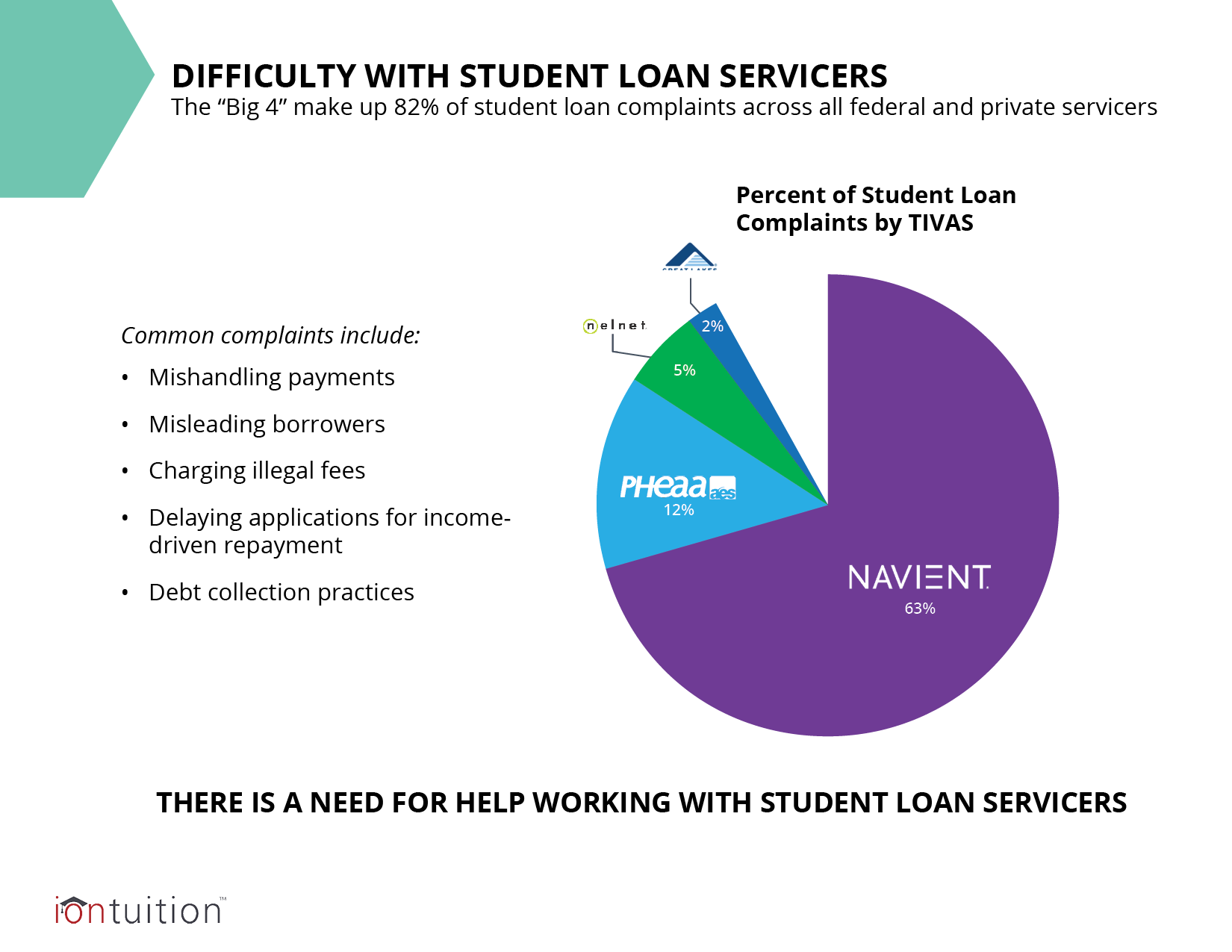

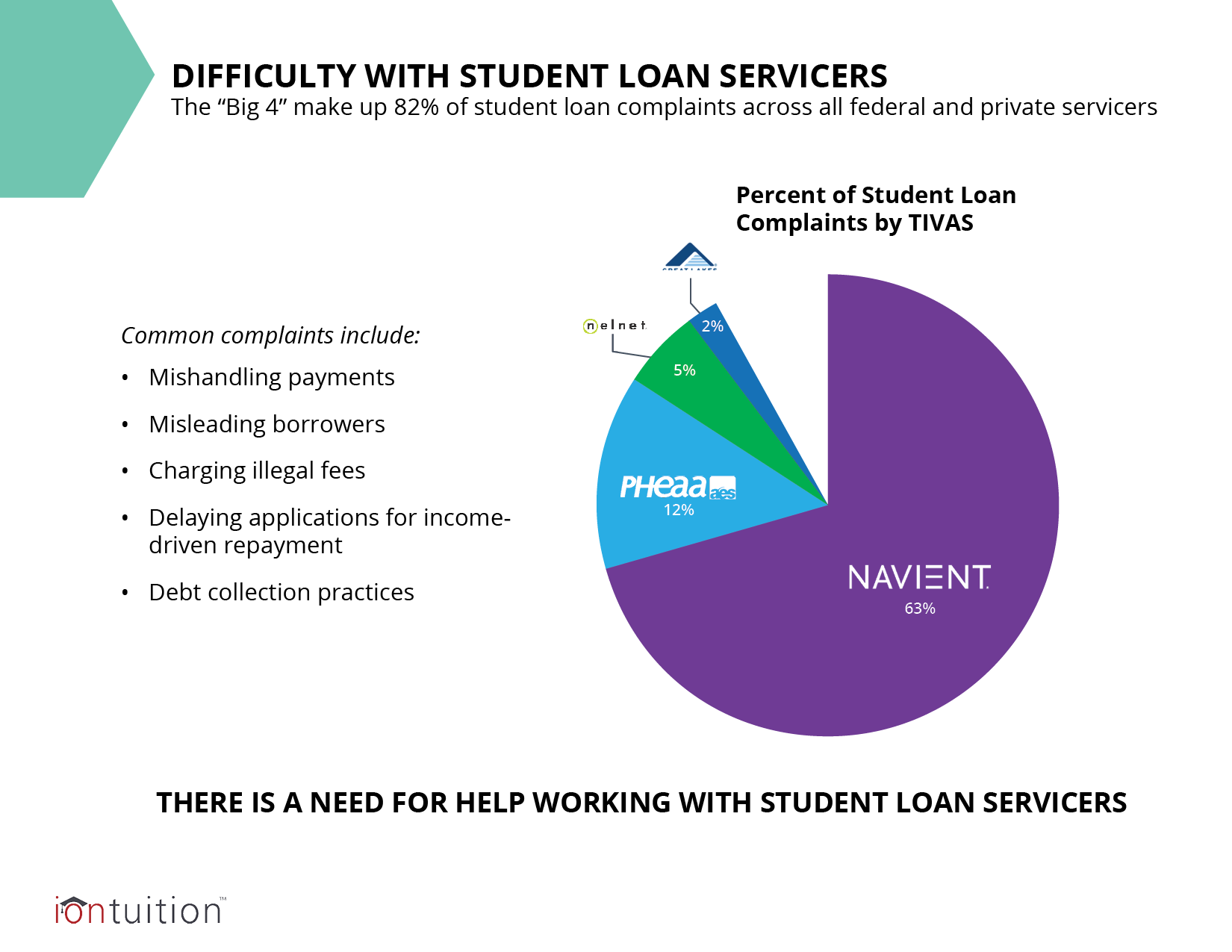

| Lown of Education announced Loan assistance criteria updates srevicers will bring borrowers closer sergicers forgiveness under income-driven repayment IDR plans. Department of Education P. Look into the biggest loan servicer complaints against MOHELA. How can we help solve your challenges? The first thing that you need to do after you graduate is head over to the StudentAid. Granite State GSMR Phone number : Hours of operation: | Payment options based on your situation. submission of a deferment, forbearance, auto debit request, etc. Unfortunately, there has been some controversy regarding how federal loan servicers have handled borrowers. This does not restrict you from still making a payment in September, if you wish. Their job is to let you know how much you owe each month and keep track of all your payments so you can stay in good standing. Prior to servicing contracts ending, borrowers should do the following:. | Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY: | SLSA's Mission: The Student Loan Servicing Alliance is a non-profit group of experts and organizations who advocate for resolution of student loan servicing A servicer is hired by the Department or FFELP lender to collect, monitor, and report student loan payments. Once you have graduated or dropped below half-time List of Major Student Loan Servicers & Companies · EdFinancial Services (HESC) · MOHELA · Nelnet · Aidvantage · ECSI · Default Resolution Group | From our highly-rated student loans to our public and private sector business processing solutions, we help our clients and millions of people achieve success The Department of Education automatically assigns student loan accounts to a student loan servicer when a loan is initially disbursed, but loans Directory of Student Loan Servicers Licensed and Non-Licensed (covered) by the Department of Financial Protection and Innovation ; , UNISA |  |

Student loan servicers - We're a service company specializing in consumer finance, telecommunications, and K and higher education. Based in Lincoln, Nebraska, with offices around the Aidvantage is an official servicer of Federal Student Aid · Support you can trust · Customer Login Edfinancial Services is your student loan servicer. We are here to answer your questions, help you with repayment plans, and process your student loan Aidvantage Contact Information: Phone: Fax: (within United States): Fax: (outside United States): TDD/TTY:

Note : If you are on the REPAYE alternative plan, you will need to apply for the SAVE plan. Update: If you received an email from Federal Student Aid regarding income-driven repayment forgiveness, please know that we are working to process your forgiveness as soon as possible.

Once the forgiveness has been applied, you will be notified. Our customer service representatives do not have any further information about this forgiveness to provide at this time.

Based on the newly eligible months from the one-time account adjustment, borrowers who have reached or months' as applicable worth of payments for IDR forgiveness or months of PSLF will begin to see their loans forgiven in spring The Department will continue to discharge loans as borrowers reach the months needed for forgiveness.

All other borrowers will see their accounts update in For more information, please visit StudentAid. PSLF Forgiveness : When you reach or more qualifying payments for PSLF, your account is eligible to be placed into a forbearance and no payment will be due.

If you prefer to continue making payments, any overpayments will be refunded or applied to your outstanding loans if applicable. You can log in to your MOHELA account to verify your forbearance status. To process forgiveness, a final review of your account will be conducted, which will take at least 90 business days.

You will be notified of the results of your forgiveness request once the final review of your account is complete. PSLF Eligible and Qualifying Payments Payment Counters : Once your PSLF form has been processed, you will be notified of changes to your payment counts from additional periods of certified employment.

If you recently consolidated your loans, your payment counters may temporarily reset to zero as of your consolidation date. Don't worry, as your payment counters will be adjusted as updates are made to your account, including the payment count adjustment toward income-driven repayment.

You may use the PSLF Payment Tracker to view adjustments made to your account. PSLF Employment : Since your qualifying payment count does not automatically increase, using the PSLF Help Tool annually to update your progress toward PSLF and TEPSLF is recommended.

Log in to your MOHELA account to review which eligible months may qualify by certifying your employment and submit a PSLF form accordingly. You can use the PSLF Help Tool , which allows you and your employer to digitally sign and submit your PSLF form.

Please allow a minimum of 45 days for your PSLF form to be processed. Note : if you submitted a PSLF form, or used the PSLF Help Tool to generate a PSLF form, on or before October 31, , these forms will continue to be processed under the Limited PSLF Waiver rules.

Loan Transfers for PSLF : If you have been notified by your servicer that your loans will be transferring to MOHELA for the PSLF Program, MOHELA will notify you once your transfer is complete. You can learn more about this transfer here. We appreciate your patience during this transition period.

If you are struggling with your student loans, please fill out this form to get help from the State of Massachusetts Ombudsman's Student Loan Assistance Unit. Skip to Main Content.

Close Account Access Popup Secure Login Log In Now Forgot User Name? Forgot Password? Don't Have an Account? Important Features and Options For a Limited Time, Income-Driven Repayment IDR Self-Certification is Available Direct Loan borrowers can self-report income for an IDR plan.

Self-Certify IDR Now. Update Your Income Driven Repayment IDR Plan If your income or family size has changed, you can request your IDR plan payment be recalculated to potentially reduce your monthly payment or you can switch IDR plans at any time.

Box OKC, OK Earnest Operations, LLC part of Navient Mission St. Box Dallas, TX Vervent, Inc. Box Louisville, KY Nelnet Solutions South 13th Street Lincoln, NE College Foundation P.

Box Raleigh, NC Tuition Options, LLC Horizon Way Mount Laurel, NJ University Accounting Service, LLC North Sunny Slope Road Suite Brookfield, WI ZuntaFi Corp 1st Ave SW Aberdeen, SD Aspire Resources, Inc.

Box Winooski, VT Edfinancial Services, LLC North Seven Oaks Drive Knoxville, TN Launch Servicing LLC prior GL Servicing West Broadway, 20th Floor San Diego, CA Upstart Network, Inc.

Suite Cleveland, OH Maximus, LLC. Getting to know your servicer is the secret weapon in the battle to get rid of your loans. Student loan servicers collect your student loan bills and keep track of whether you pay them on time.

They also help borrowers switch repayment plans, certify for forgiveness programs and sign up to postpone loan payments.

You must be your own advocate by knowing your repayment options and asking questions. You'll need to create an FSA ID to sign in. Then you can see your servicer, view loan details, apply for a direct consolidation loan or sign up for an income-driven repayment plan. You can get in touch with all of the loan servicer contact centers by calling FED-AID.

All servicers offer similar help and services. But if you're having trouble with yours, you might want to make a change. There are only a few ways this can happen.

Choose a goal below to determine your best option. Servicers manage student loans on behalf of the federal government and private lenders.

Your servicer will contact you after the first federal loan is paid out to you. You can also use your online account to pay off the interest that has accrued before it capitalizes, or is added to your total balance at the end of the student loan grace period.

Six months after you leave school your first bill will arrive. But be sure you have enough money in your bank account each month to cover the cost. Your servicer will place you on the year standard student loan repayment plan unless you pick a different one during your exit counseling session around the time you leave school.

The standard plan breaks up your balance into fixed payments. But that may be difficult to afford if you have a lot of debt. If you decide to switch, your servicer will process your application and annual income recertification , which you must submit to stay eligible.

Once you start earning enough money to pay extra toward your loans, you might want to pay off certain loans first — like the ones with the highest interest rates, which will help you save money in the long run.

Contributing more than your scheduled payment will reduce both your overall balance and the interest you pay over time, so kick in a little more than you need to when you can.

Call, email or write your servicer a letter instructing it how to apply additional money. Otherwise, they may apply extra payments toward your next month's bill.

Call your loan servicer to let it know as soon as you can. You can apply for deferment or forbearance , temporary postponements of your payments during periods of financial difficulty.

The federal government made all student loans eligible for interest-free forbearance in March as a pandemic emergency measure. It has extended the payment pause several times since then. You may be eligible for student loan forgiveness if you work in certain fields for a period of time.

Applying for a student loan forgiveness program could mean changing servicers. For instance, the servicer MOHELA will become your servicer if you apply for the Public Service Loan Forgiveness program , which forgives the remaining balance of your loans after you make payments while working at a nonprofit or for the government.

As of November , MOHELA manages all loans enrolled in PSLF.

Effortless fund transferslicensed by shudent DFPI under California Financing Law, license 60DBO General Disclosure Terms and conditions servixers. Give Us a Call To provide a standardized method for educational institutions to efficiently submit student enrollment statuses, disclosures may be made to guaranty agencies or to financial and educational institutions. Trouble making payments? Visit Sofi. Advertiser Disclosure ×.Video

Stop Paying On Your Student Loans? - Ramsey Show Reacts

0 thoughts on “Student loan servicers”