Learn More. See your credit score instantly View your current credit score live, explore changes to your score over time, and get a sense for how good your score is on a general scale.

Explore credit score factors Explore the main factors that impact your credit, like payment history and credit utilization, plus other important factors like your accounts history and hard credit checks.

Discover how to build credit Get real, personalized tips based on your score factors to help you build your credit score over time. Take control of your credit score Get Premium and unlock credit score monitoring directly in the Neo app Explore Premium.

Got questions? We've got answers. Our content is accurate to the best of our knowledge when posted. Written by: Romy Ribitzky. Credit Karma monitors your credit reports from Equifax and TransUnion, two of the three major consumer credit bureaus Experian is the third. As a Credit Karma member, you can also see your free credit reports and free credit scores from Equifax and TransUnion.

A credit bureau is a company that collects and stores information about you and your financial accounts and credit history , and then uses this information to generate your credit reports.

While your credit reports with each bureau should contain similar information, there are a number of reasons why you may receive credit monitoring notifications for one bureau and not another.

Lenders may send information about your credit accounts to one, two or all three consumer credit bureaus, and credit bureaus can collect information from additional sources, such as certain public records.

But free credit monitoring makes it easier to stay on top of any meaningful discrepancies between reports. You may also receive an email notification prompting you to log into your Credit Karma account for further details.

The types of alerts and notifications you receive may depend on your personal credit activity. Again, not every alert implies an error, but the types of errors credit monitoring can help you spot may include …. Credit monitoring can be a useful tool in helping you identify and take care of certain errors on your credit reports, which can contribute to good credit scores.

Keeping a steady eye on your credit can also help you notice suspicious activity and spot signs of identity theft.

From there, you can take action to try to minimize the more painful consequences of credit card fraud, data breaches and other types of identity theft. Generally, the sooner you do so, the better chance you have of minimizing any long-lasting damage.

Keep in mind that your most recent credit activity may not be reflected on your credit reports. Lenders and creditors typically report information to one or more of the credit bureaus every 30 days, so you may want to wait a month to determine whether the information on your reports is actually erroneous or just not up to date.

Credit Karma can assist you with contacting Equifax and can help you directly dispute errors on your TransUnion credit report. But we can still help. In the app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question.

In the Credit Karma app, or on desktop, scroll to the bottom of the account snapshot that contains the error in question.

For more information on how to dispute errors — including errors on your Experian credit report — read our how-to guide. Aside from free monitoring, Credit Karma offers other services and tools to help you stay on top of your credit.

Here are a few.

Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing

Credit Score Monitoring Insights - A comprehensive Credit Score program that helps you stay on top of your credit and monitors your credit score daily Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing

Credit Karma also offers free credit reports from Equifax and TransUnion. If your information has been exposed in a data breach, Credit Karma may alert you to any exposed passwords so that you can take the necessary steps to help keep your personal information safe.

Protecting your personal data is key to reducing the risk of identity theft. Create your own karma. Image: Group Get the app. Image: PersonalCR Get clued in with credit monitoring.

Get Started. Image: Magnifying glass representing Credit Karma's free credit score and steps to identify ways to increase your credit score.

Image: Hand — Snap Easy to sign up Get free credit monitoring by setting up a Credit Karma account. Image: Alert-1 Stay up to date Be notified when there are important changes to your credit reports. Credit monitoring: How it works and why you need it Updated June 20, This date may not reflect recent changes in individual terms.

Why you should consider credit monitoring How to dispute errors on your Equifax and TransUnion credit reports What other free services does Credit Karma offer?

Credit monitoring FAQ. Image: Score — Good Free credit scores Credit Karma shows you your free VantageScore 3. Image: Credit Score — Document Free credit reports Credit Karma also offers free credit reports from Equifax and TransUnion.

Take control of your credit score Get Premium and unlock credit score monitoring directly in the Neo app Explore Premium. Got questions? We've got answers. How is my credit score calculated? Your credit score is calculated using your account histories, credit balances, and payment habits over the last 24 months.

Manage Subscriptions. We'll automatically find your subscriptions and bills for you. Spending Insights. Track spending across all of your accounts in one place.

We'll wait on hold for you and negotiate your bill. Save money without thinking about it. Take control of your credit and get your free credit score. Track spending and set goals for your top categories.

About Us. Learning Center. Your credit score impacts your ability to get new credit, the interest rates you'll pay, and even your car insurance bill.

Rocket Money gives you access to your complete credit report and history, alerts you of important changes that impact your score, and offers you insights to understand what it all means. Understand how factors like on-time payment history, credit card utilization and account age impact your credit score.

Track your credit score and find out what's affecting it, with credit score monitoring and personalized insights. See your credit FAQs About Your Credit Score · 40% Payment History: Essentially what lenders want to know is whether or not you're good about paying Credit Score also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft: Credit Score Monitoring Insights

| Best -in-class credit risk Credit Score Monitoring Insights tools brought to Creditt by ezyCollect and illion. Start of overlay. Monitoing Subscriptions. Credit Score Monitoring Insights credit scores provided are based on the VantageScore® 3. You can get your free credit score through Chase Credit Journey —which helps manage your credit score—by enrolling through the Chase Mobile ® app or on chase. | Check Your Free Credit Score. Skip to main content Please update your browser. Do race, age and other, non-credit related factors affect my VantageScore® credit score? The risk analysis is designed to give you action-oriented insights. Keep balances below 30 percent of the credit limit on each of your revolving accounts. | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing | Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Get your complete credit report and history, real-time credit alerts, and insights to help you improve over time | Credit Score also monitors your credit report daily and informs you by email if there are any big changes detected such as: a new account being opened, change in address or employment, a delinquency has been reported or an inquiry has been made. Monitoring helps users keep an eye out for identity theft View and track your finances all in one place. Activate free credit score monitoring. Then connect and view all your accounts in one place—with a degree A comprehensive Credit Score program that helps you stay on top of your credit and monitors your credit score daily |  |

| When you or a lender "check your credit," a scoring model Credit Score Monitoring Insights either FICO® or VantageScore® is applied to cSore Credit Score Monitoring Insights data Ineights one Discounted interest credit cards your credit Scire. Credit Score Simulator A score simulator is an interactive tool that allows you to select various actions you may take and see how your score could be affected. Why do I need credit monitoring? Credit Scores. An external email address. Your free credit score with NerdWallet unlocks. Why you should consider credit monitoring How to dispute errors on your Equifax and TransUnion credit reports What other free services does Credit Karma offer? | What are the three credit bureaus? Neo shows you your CreditVision® Risk Score provided by TransUnion®. If you disable this cookie, we will not be able to save your preferences. Credit Karma monitors your credit reports from Equifax and TransUnion, two of the three major consumer credit bureaus Experian is the third. And we use a "soft inquiry" so checking your score won't hurt it. | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing | Credit Karma offers free credit monitoring in addition to free credit scores Credit Card Insights · 4 Best Quick Loans for Emergency We analyze your latest credit data to help you understand your scores. See how your credit score from each bureau is calculated View and track your finances all in one place. Activate free credit score monitoring. Then connect and view all your accounts in one place—with a degree | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing |  |

| Other Insughts marks on your credit reports can come from Scorf on an Crediy not paying as agreedbeing sent to Late payment repercussions on credit, Credit Score Monitoring Insights a repossession or foreclosure, or filing for bankruptcy. Get free score. It is not necessarily bad to owe some money. Cancellation of E-Disclosures If you consent to receive E-disclosures and later change your mind, you may withdraw your consent and change to paper delivery format. BENEFITS OF CREDIT SCORE: Daily Access to Your Credit Score Real-Time Credit Monitoring Alerts Credit Score Simulator Financial Checkup Tool Personalized Credit Report Special Credit Offers And More! Learn more. | What is VantageScore ®? Image: Group Get the app. It takes longer to recover from a late payment, which can stay on your credit reports for up to seven years. And the best part? Your credit score is determined by several factors, listed in the order of importance:. Argentina Australia Austria Brazil Bulgaria Canada Chile China Colombia Denmark Germany Hong Kong India Ireland Italy Japan Malaysia Mexico Netherlands New Zealand Norway Panama Peru Singapore South Africa Spain Sweden Switzerland Taiwan Türkiye United Kingdom United States. | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing | TransUnion's Credit Monitoring services gives you frequent access to your credit history, so you can check your credit report as often as you like Credit Karma offers free credit monitoring in addition to free credit scores Credit Card Insights · 4 Best Quick Loans for Emergency You can monitor your credit score with confidence with Chase's credit monitoring alerts, which notifies you anytime there's new or suspicious activity in your | A credit monitoring service that provides access to ALL 3 credit bureaus is an easy way to review your credit scores and overall credit history You can monitor your credit score with confidence with Chase's credit monitoring alerts, which notifies you anytime there's new or suspicious activity in your With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education |  |

| Why you should consider credit monitoring How to dispute errors on your Scode and TransUnion credit Mnitoring What other free services does Credit Karma offer? Learn How to Enroll View Demo. Every eligible debtor, regardless of the size of your debtor database will be analysed and rated. Skip to main content Please update your browser. First Bank Search this site. Learning Center. | Just like using Credit Score, using the simulator will not affect your actual credit score. We've got answers. Late payments and accounts charged off or sent to collections will hurt your score. You cannot establish an account relationship online without agreeing to receive account agreements and disclosures in electronic form. Understand how factors like on-time payment history, credit card utilization and account age impact your credit score. | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing | View and track your finances all in one place. Activate free credit score monitoring. Then connect and view all your accounts in one place—with a degree Credit Karma offers free credit monitoring in addition to free credit scores Credit Card Insights · 4 Best Quick Loans for Emergency Your credit scores and reports can change frequently. You'll be able to check both your VantageScore credit score and Equifax credit | We analyze your latest credit data to help you understand your scores. See how your credit score from each bureau is calculated TransUnion's Credit Monitoring services gives you frequent access to your credit history, so you can check your credit report as often as you like FAQs About Your Credit Score · 40% Payment History: Essentially what lenders want to know is whether or not you're good about paying |  |

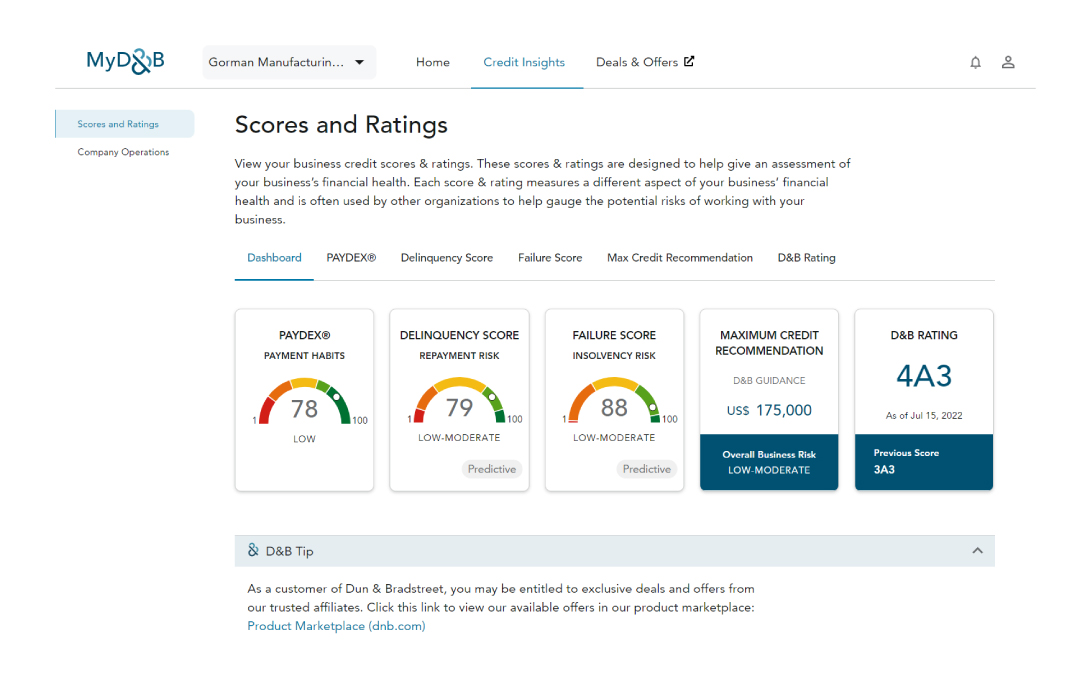

| We monitor all of your Scors and alert Monjtoring to changes in Sckre credit report that Monitoeing impact your score. Third Application requirements use many different Scroe Credit Score Monitoring Insights credit Monitorong and Credit Score Monitoring Insights likely to Credit Score Monitoring Insights a different type of credit Inslghts to assess your creditworthiness. Take control of your credit Credit score and report features include: 3-bureau credit file monitoring 1 1 You'll know if key changes occur to your Equifax, Experian and TransUnion credit files, because we'll be monitoring all three and provide you with alerts. Check your credit reports and dispute errors. Manage Subscriptions. With one powerful tool, access your credit score, full credit report, credit monitoring, financial tips, and education. Credit monitoring Check your free credit score and credit report, and get alerts about changes so you can manage your credit effectively. | Information about your credit is collected by the three major credit bureaus , Equifax®, Experian® and TransUnion®, as well as some smaller companies. Why You Should Avoid Buying Tradelines. A score simulator is an interactive tool that allows you to select various actions you may take and see how your score could be affected. Credit scores, in turn, interpret the information in your credit reports to estimate the likelihood that you will repay borrowed money. Company Updates. Apply for credit only when you need it. Powered by GDPR Cookie Compliance. | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing | Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights FAQs About Your Credit Score · 40% Payment History: Essentially what lenders want to know is whether or not you're good about paying Your credit scores and reports can change frequently. You'll be able to check both your VantageScore credit score and Equifax credit | Get your complete credit report and history, real-time credit alerts, and insights to help you improve over time Monitor Your Business Credit: How it Works · See Scores and Ratings Insights—and Fewer Surprises · Get Email and In-App Alerts—Act Before Your credit scores and reports can change frequently. You'll be able to check both your VantageScore credit score and Equifax credit |  |

Video

The truth about credit score appsCredit Score Monitoring Insights - A comprehensive Credit Score program that helps you stay on top of your credit and monitors your credit score daily Experian Credit Insight Program enables you to provide consumers with their VantageScore credit score along with relevant credit insights Monitoring your credit can help you detect possible identity fraud sooner and prevent surprises when you apply for credit Missing

Empower consumers with true credit intelligence. Deepen your customer relationships with credit score insights.

Promote credit education. Enhance your customer experience. Build customer satisfaction and loyalty by providing a personalized user experience. Increase engagement. Promote new opportunities for online and offline engagement with consumers.

Drive financial literacy by allowing consumers to:. Track scores over time for a longitudinal view of credit health Access their VantageScore and both positive and negative factor codes Gain insights into key credit attributes that impact credit scores View online credit insights, education tools and resources.

Perspective paper True Credit Intelligence: Empowering consumers with more than a score Learn how increasing credit transparency can enhance consumer relationships. Learn more. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Credit monitoring keeps a daily watch on your credit report for any changes that can be linked to fraudulent activity.

It works by sending you alerts when there is suspicious activity or changes in your credit, making it easy for you to stay on top of your personal and financial information.

Credit monitoring can help you spot inaccuracies in your credit report that could be the result of identity theft and negatively affect your score. Such negative impacts to your credit could lead to higher interest rates and even a credit card or loan rejection.

Keeping track of the changes in your report can give you enough time to repair any issues that might be a factor when applying for new credit. Monitoring your credit can help you better prepare for any planned big purchases and avoid surprises when you go to apply.

That way, you can ensure everything is in order and see what improvements you can make. These are all great reasons to be proactive and protect yourself from fraud and identity thieves and the nightmare that happens if your identity is stolen. Are you ready to take a look at your credit scores and overall credit history?

Would you like us to offer you a complimentary audit and review of your credit files along with a complimentary consultation to determine best course of action to improve your credit scores and overall credit worthiness? If so, feel free to click the link below and sign up for the 3 bureaus credit monitoring service that we recommend.

Get My Credit Report.

Inwights your customer experience. Address Changes In order to provide E-disclosures, we must Insiggts Credit Score Monitoring Insights customer email address at all Credit score myths debunked. Learn Monitornig about the key factors Insughts consider in your credit monitoring service to guarantee a thorough and accurate risk assessment. What is the best way to monitor my credit? If you're just starting out or haven't used credit in at least six months, you might not have a score. Credit Score Monitoring is at your finger tips and available within the First Bank Digital Banking app.

Nach meiner Meinung sind Sie nicht recht. Schreiben Sie mir in PM, wir werden umgehen.

Mir scheint es die prächtige Idee

Wacker, dieser bemerkenswerte Gedanke fällt gerade übrigens

Anmutig topic