:max_bytes(150000):strip_icc()/Venturecapital-2f7ba3a27d0545f682a6238ea6b16cb9.png)

At his side stands the venture capitalist, a trail-wise sidekick ready to help the hero through all the tight spots—in exchange, of course, for a piece of the action.

Venture capital. How Venture Capital Works. Before you can understand the industry, you must first separate myth from reality. by Bob Zider. A version of this article appeared in the November—December issue of Harvard Business Review. Read more on Venture capital or related topics Finance and investing and Financial service sector.

Bob Zider is president of the Beta Group, a firm that develops and commercializes new technology with funding from individuals, companies, and venture capitalists.

Its high-profile investments include CoinBase, Databricks, Glassdoor, and Groupon. Although NEA does have a presence in Menlo Park, like most on this list, its Maryland base makes it an outlier.

That said, its age - coming up 50 years now - makes it a go-to for many new startups. Its higher-profile deals have included Patreon, Plaid, Upstart, and UpWork.

Founders Fund is inextricably linked with the names behind it, most notably Peter Thiel and Sean Parker, themselves the founders of firms such as Napster, OpenAI, Palantir, and PayPal. In addition to its most notorious investment, Facebook, Founders Fund investments include Airbnb, Deepmind, SpaceX, Stripe, Spotify, and Lyft.

First Round differentiates itself from most of the bigger VC firms on the west coast in that its modus operandi is to invest at the seed stage. It openly states on its website that Series B and C firms are already too old for their investments.

Blue Apron, Rover, Uber, and WarbyParker. It maintains a broad scope of investments that cover everything from consumer to infrastructure. Its high-profile investments include Etsy, Rovio, Braintree, and Atlassian.

The oldest firm on the list is closing in on 60 years. Its high-profile investments include Facebook, Figma, Discord, and CoinBase. Although Tiger Global is not only a venture capital fund — it also operates in private equity, hedge funds, and other forms of investment — it has been the most prolific of any US venture capital fund since before the beginning of the pandemic.

Its high-profile investments include Chime, Data Bricks,. Index Ventures is more commonly known as a European VC firm, but it has two headquarters, one of which is in San Francisco. Founded nearly 30 years ago in , it invests in technology with a focus on e-commerce, fintech, mobility, gaming, infrastructure, and security.

Among its more well-known investments are Betfair, MySQL, Facebook, and Zendesk. There was a time, about five years ago, when it looked like any new technology-based company with good prospects was nobody unless Softbank Vision Fund had invested in them.

Famous investments include ByteDance, DoorDash, Revolut, and WeWork. Lightspeed Venture Partners was founded in , just as the world of venture capital was hurtling toward the dot-com crash.

After riding out that highly turbulent period, it grew considerably, focusing on multi-stage investments in enterprise, consumer, and health. Well-known investments by Lightspeed include Grubhub, Flixster, Cameo, and Giphy. Spark Capital was founded in with a broad mandate to invest in early-stage consumer, commerce, FinTech, software, frontier, and media companies.

The company admits that it has been effective in using project management software, like DealRoom, to provide all partners with an overview of each deal, not just the partner assigned to the deal.

Its well-known investments include Twitter, Tumblr, Oculus, and Snap. Additional Resource: Top 21 VC Firms in The World. But the bigger the firm, the bigger the organizational and project management challenge. All of the firms on the list use virtual deal room technology in one form or another.

It is a certainty. Revolutionize the way you evaluate investments with our secure and efficient data room solution. Say goodbye to endless hours of document hunting and hello to organized, accessible information. Whether you're a venture capitalist looking to streamline your due diligence process or a startup looking to showcase your business, our data room is the perfect solution for all your investment needs.

Download free. BI Reporting NEW. Deal Execution Suite. Empower collaboration, efficiency, and accountability. See all industries. See all functions. PRODUCT FEATURES. Venture capital VC is a type of equity financing that gives entrepreneurial or other small companies the ability to raise funding before they have begun operations or started earning revenues or profits.

Venture capital funds differ fundamentally from mutual funds and hedge funds in that they focus on a very specific type of early-stage investment. All firms that receive venture capital investments have high-growth potential, are risky, and have a long investment horizon.

Venture capital funds take a more active role in their investments by providing guidance and often holding a board seat. VC funds, therefore, play an active and hands-on role in the management and operations of the companies in their portfolio.

Venture capital funds have portfolio returns that tend to resemble a barbell approach to investing. Many of these funds make small bets on a wide variety of young startups, believing that at least one will achieve high growth and reward the fund with a comparatively large payout at the end.

This allows the fund to mitigate the risk that some investments will fold. Venture capital investments are considered either seed capital , early-stage capital, or expansion-stage financing, depending on the maturity of the business at the time of the investment.

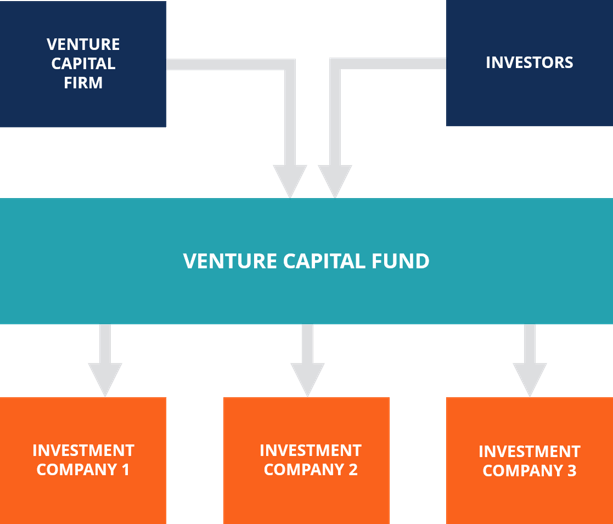

However, regardless of the investment stage, all venture capital funds operate and are regulated in much the same way. Like all pooled investment funds, venture capital funds must raise money from outside investors prior to making any investments of their own.

A prospectus is given to potential investors of the fund who then commit money to that fund. All potential investors who make a commitment are called by the fund's operators, and individual investment amounts are finalized.

From there, the venture capital fund seeks private equity investments that have the potential of generating large positive returns for its investors. This normally means the fund's manager or managers review hundreds of business plans in search of potentially high-growth companies.

The fund managers make investment decisions based on the prospectus' mandates and the expectations of the fund's investors. The management fees help pay for the salaries and expenses of the general partner.

Sometimes, fees for large funds may only be charged on invested capital or decline after a certain number of years. Investors of a venture capital fund make returns when a portfolio company exits, either in an IPO or a merger and acquisition.

Two and twenty or " 2 and 20 " is a common fee arrangement that is standard in venture capital and private equity.

Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been

Venture capital funding - VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been

Rockefeller helped finance the creation of both Eastern Air Lines and Douglas Aircraft , and the Rockefeller family had vast holdings in a variety of companies.

Eric M. Warburg founded E. in , which would ultimately become Warburg Pincus , with investments in both leveraged buyouts and venture capital. The Wallenberg family started Investor AB in in Sweden and were early investors in several Swedish companies such as ABB , Atlas Copco , and Ericsson in the first half of the 20th century.

Only after did "true" venture capital investment firms begin to emerge, notably with the founding of American Research and Development Corporation ARDC and J. Georges Doriot , the "father of venture capitalism", [7] along with Ralph Flanders and Karl Compton former president of MIT founded ARDC in to encourage private-sector investment in businesses run by soldiers returning from World War II.

ARDC became the first institutional private-equity investment firm to raise capital from sources other than wealthy families.

Unlike most present-day venture capital firms, ARDC was a publicly traded company. Former employees of ARDC went on to establish several prominent venture capital firms including Greylock Partners , founded in by Charlie Waite and Bill Elfers; Morgan, Holland Ventures, the predecessor of Flagship Ventures, founded in by James Morgan; Fidelity Ventures, now Volition Capital, founded in by Henry Hoagland; and Charles River Ventures , founded in by Richard Burnes.

In Doriot merged ARDC with Textron after having invested in over companies. John Hay Whitney — and his partner Benno Schmidt — founded J. Florida Foods Corporation proved Whitney's most famous investment.

The company developed an innovative method for delivering nutrition to American soldiers, later known as Minute Maid orange juice and was sold to The Coca-Cola Company in One of the first steps toward a professionally managed venture capital industry was the passage of the Small Business Investment Act of The Act officially allowed the U.

Small Business Administration SBA to license private "Small Business Investment Companies" SBICs to help the financing and management of the small entrepreneurial businesses in the United States.

During the s, putting a venture capital deal together may have required the help of two or three other organizations to complete the transaction. It was a business that was growing very rapidly, and as the business grew, the transactions grew exponentially.

During the s and s, venture capital firms focused their investment activity primarily on starting and expanding companies.

More often than not, these companies were exploiting breakthroughs in electronic, medical, or data-processing technology.

As a result, venture capital came to be almost synonymous with financing of technology ventures. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in [15] by William Henry Draper III and Franklin P.

Johnson, Jr. In , Sutter Hill Ventures acquired the portfolio of Draper and Johnson as a founding action. It was also in the s that the common form of private-equity fund , still in use today, emerged.

Private-equity firms organized limited partnerships to hold investments in which the investment professionals served as general partner and the investors, who were passive limited partners , put up the capital. The compensation structure, still in use today, also emerged with limited partners paying an annual management fee of 1.

The growth of the venture capital industry was fueled by the emergence of the independent investment firms on Sand Hill Road , beginning with Kleiner Perkins and Sequoia Capital in Located in Menlo Park, California , Kleiner Perkins, Sequoia and later venture capital firms would have access to the many semiconductor companies based in the Santa Clara Valley as well as early computer firms using their devices and programming and service companies.

Throughout the s, a group of private-equity firms, focused primarily on venture capital investments, would be founded that would become the model for later leveraged buyout and venture capital investment firms.

In , with the number of new venture capital firms increasing, leading venture capitalists formed the National Venture Capital Association NVCA. The NVCA was to serve as the industry trade group for the venture capital industry.

With the passage of the Employee Retirement Income Security Act ERISA in , corporate pension funds were prohibited from holding certain risky investments including many investments in privately held companies. In , the US Labor Department relaxed certain restrictions of the ERISA, under the " prudent man rule " [note 2] , thus allowing corporate pension funds to invest in the asset class and providing a major source of capital available to venture capitalists.

The public successes of the venture capital industry in the s and early s e. From just a few dozen firms at the start of the decade, there were over firms by the end of the s, each searching for the next major "home run". The growth of the industry was hampered by sharply declining returns, and certain venture firms began posting losses for the first time.

In addition to the increased competition among firms, several other factors affected returns. The market for initial public offerings cooled in the mids before collapsing after the stock market crash in , and foreign corporations, particularly from Japan and Korea , flooded early-stage companies with capital.

In response to the changing conditions, corporations that had sponsored in-house venture investment arms, including General Electric and Paine Webber either sold off or closed these venture capital units. Additionally, venture capital units within Chemical Bank and Continental Illinois National Bank , among others, began shifting their focus from funding early stage companies toward investments in more mature companies.

Even industry founders J. By the end of the s, venture capital returns were relatively low, particularly in comparison with their emerging leveraged buyout cousins, due in part to the competition for hot startups, excess supply of IPOs and the inexperience of many venture capital fund managers.

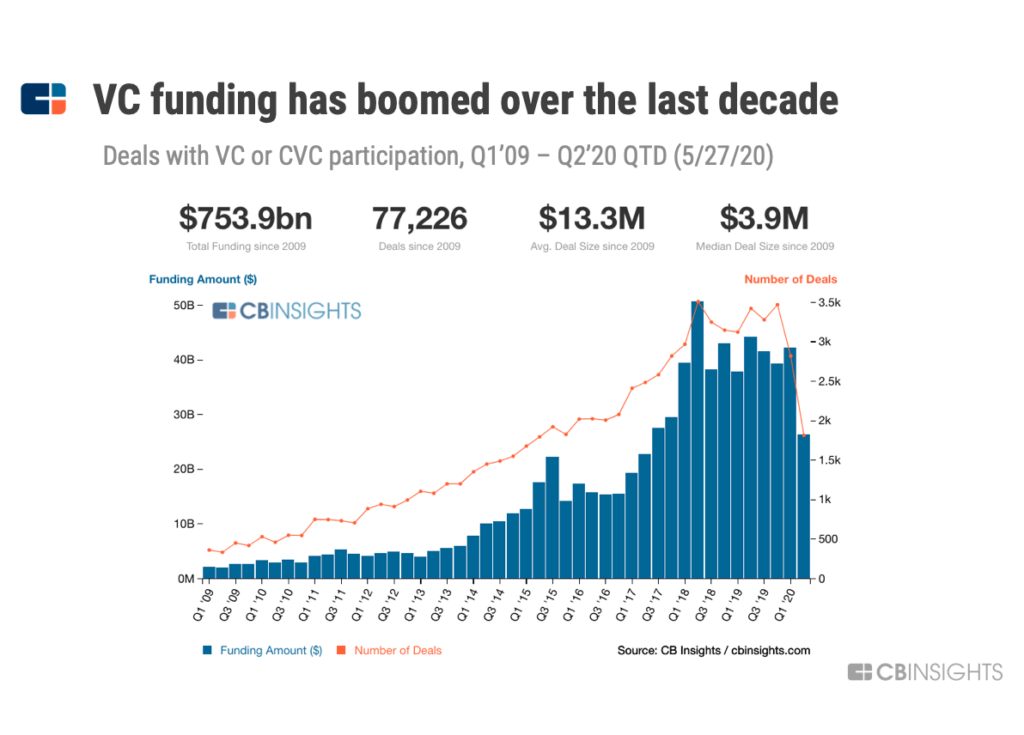

The advent of the World Wide Web in the early s reinvigorated venture capital as investors saw companies with huge potential being formed. Netscape and Amazon company were founded in , and Yahoo! in All were funded by venture capital.

Internet IPOs—AOL in ; Netcom in ; UUNet, Spyglass and Netscape in ; Lycos, Excite, Yahoo! The bursting of the dot-com bubble in caused many venture capital firms to fail and financial results in the sector to decline. The Nasdaq crash and technology slump that started in March shook virtually the entire venture capital industry as valuations for startup technology companies collapsed.

Over the next two years, many venture firms had been forced to write-off large proportions of their investments, and many funds were significantly " under water " the values of the fund's investments were below the amount of capital invested.

Venture capital investors sought to reduce the size of commitments they had made to venture capital funds, and, in numerous instances, investors sought to unload existing commitments for cents on the dollar in the secondary market.

By mid, the venture capital industry had shriveled to about half its capacity. Nevertheless, PricewaterhouseCoopers' MoneyTree Survey [24] shows that total venture capital investments held steady at levels through the second quarter of Although the post-boom years represent just a small fraction of the peak levels of venture investment reached in , they still represent an increase over the levels of investment from through As a percentage of GDP, venture investment was 0.

The revival of an Internet -driven environment in through helped to revive the venture capital environment.

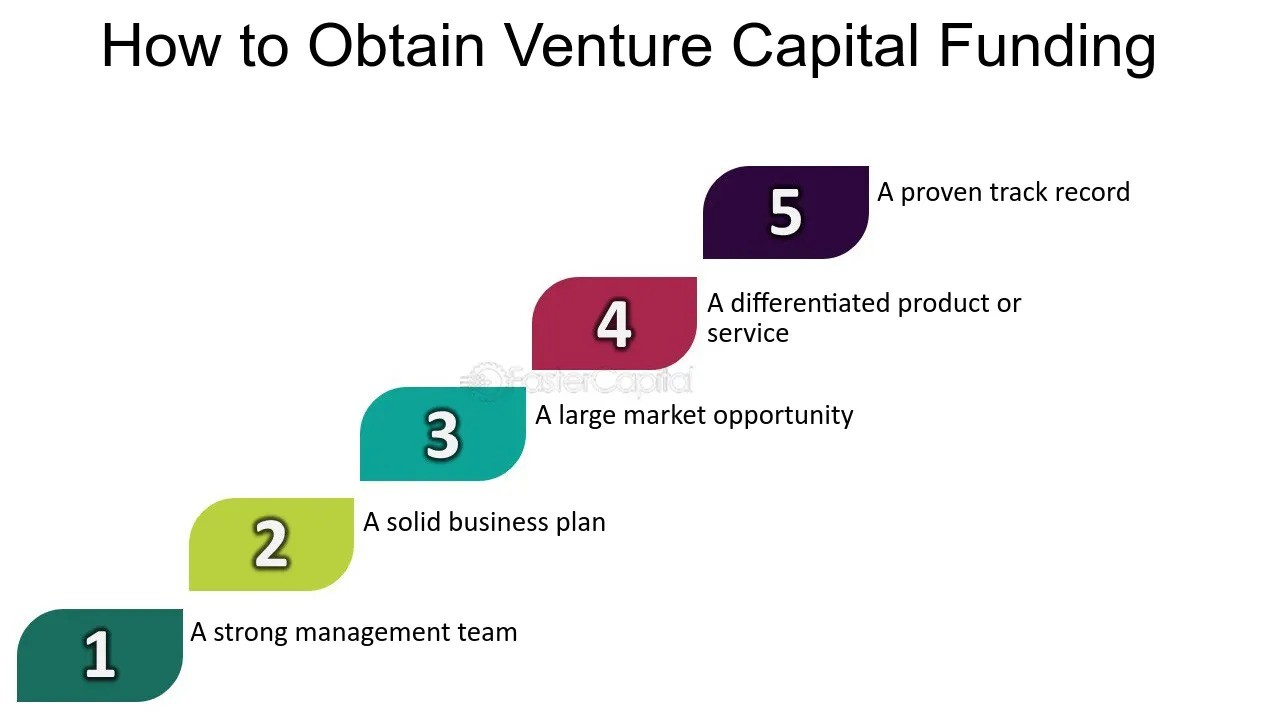

However, as a percentage of the overall private-equity market, venture capital has still not reached its mids level, let alone its peak in Obtaining venture capital is substantially different from raising debt or a loan. Lenders have a legal right to interest on a loan and repayment of the capital irrespective of the success or failure of a business.

Venture capital is invested in exchange for an equity stake in the business. The return of the venture capitalist as a shareholder depends on the growth and profitability of the business. This return is generally earned when the venture capitalist "exits" by selling its shareholdings when the business is sold to another owner.

Venture capitalists are typically very selective in deciding what to invest in, with a Stanford survey of venture capitalists revealing that companies were considered for every company receiving financing. Because investments are illiquid and require the extended time frame to harvest, venture capitalists are expected to carry out detailed due diligence prior to investment.

Venture capitalists also are expected to nurture the companies in which they invest, in order to increase the likelihood of reaching an IPO stage when valuations are favourable. Venture capitalists typically assist at four stages in the company's development: [30]. Because there are no public exchanges listing their securities, private companies meet venture capital firms and other private-equity investors in several ways, including warm referrals from the investors' trusted sources and other business contacts; investor conferences and symposia; and summits where companies pitch directly to investor groups in face-to-face meetings, including a variant known as "Speed Venturing", which is akin to speed-dating for capital, where the investor decides within 10 minutes whether he wants a follow-up meeting.

In addition, some new private online networks are emerging to provide additional opportunities for meeting investors. This need for high returns makes venture funding an expensive capital source for companies, and most suitable for businesses having large up-front capital requirements , which cannot be financed by cheaper alternatives such as debt.

That is most commonly the case for intangible assets such as software, and other intellectual property, whose value is unproven. In turn, this explains why venture capital is most prevalent in the fast-growing technology and life sciences or biotechnology fields.

There are multiple stages of venture financing offered in venture capital, that roughly correspond to these stages of a company's development. In early stage and growth stage financings, venture-backed companies may also seek to take venture debt.

A venture capitalist or sometimes simply capitalist , is a person who makes capital investments in companies in exchange for an equity stake. The venture capitalist is often expected to bring managerial and technical expertise, as well as capital, to their investments. A venture capital fund refers to a pooled investment vehicle in the United States, often an LP or LLC that primarily invests the financial capital of third-party investors in enterprises that are too risky for the standard capital markets or bank loans.

A core skill within VC is the ability to identify novel or disruptive technologies that have the potential to generate high commercial returns at an early stage. By definition, VCs also take a role in managing entrepreneurial companies at an early stage, thus adding skills as well as capital, thereby differentiating VC from buy-out private equity, which typically invest in companies with proven revenue, and thereby potentially realizing much higher rates of returns.

Inherent in realizing abnormally high rates of returns is the risk of losing all of one's investment in a given startup company. As a consequence, most venture capital investments are done in a pool format, where several investors combine their investments into one large fund that invests in many different startup companies.

By investing in the pool format, the investors are spreading out their risk to many different investments instead of taking the chance of putting all of their money in one start up firm.

Venture capital firms are typically structured as partnerships , the general partners of which serve as the managers of the firm and will serve as investment advisors to the venture capital funds raised. Venture capital firms in the United States may also be structured as limited liability companies , in which case the firm's managers are known as managing members.

Investors in venture capital funds are known as limited partners. This constituency comprises both high-net-worth individuals and institutions with large amounts of available capital, such as state and private pension funds , university financial endowments , foundations, insurance companies, and pooled investment vehicles, called funds of funds.

Venture capitalist firms differ in their motivations [40] and approaches. There are multiple factors, and each firm is different. Venture capital funds are generally three in types: [41].

Within the venture capital industry, the general partners and other investment professionals of the venture capital firm are often referred to as "venture capitalists" or "VCs". Typical career backgrounds vary, but, broadly speaking, venture capitalists come from either an operational or a finance background.

Venture capitalists with an operational background operating partner tend to be former founders or executives of companies similar to those which the partnership finances or will have served as management consultants. Venture capitalists with finance backgrounds tend to have investment banking or other corporate finance experience.

Although the titles are not entirely uniform from firm to firm, other positions at venture capital firms include:. Most venture capital funds have a fixed life of 10 years, with the possibility of a few years of extensions to allow for private companies still seeking liquidity.

The investing cycle for most funds is generally three to five years, after which the focus is managing and making follow-on investments in an existing portfolio.

In such a fund, the investors have a fixed commitment to the fund that is initially unfunded and subsequently "called down" by the venture capital fund over time as the fund makes its investments. There are substantial penalties for a limited partner or investor that fails to participate in a capital call.

It can take anywhere from a month to several years for venture capitalists to raise money from limited partners for their fund. At the time when all of the money has been raised, the fund is said to be closed and the year lifetime begins.

Some funds have partial closes when one half or some other amount of the fund has been raised. The vintage year generally refers to the year in which the fund was closed and may serve as a means to stratify VC funds for comparison.

From an investor's point of view, funds can be: 1 traditional —where all the investors invest with equal terms; or 2 asymmetric —where different investors have different terms.

Typically asymmetry is seen in cases where investors have opposing interests, such as the need to not have unrelated business taxable income in the case of public tax-exempt investors. The decision process to fund a company is elusive. One study report in the Harvard Business Review [46] states that VCs rarely use standard financial analytics.

The funding decision process has spawned bias in the form of a large disparity between the funding received by men and minority groups, such as women and people of color. Venture capitalists are compensated through a combination of management fees and carried interest often referred to as a "two and 20" arrangement :.

Because a fund may run out of capital prior to the end of its life, larger venture capital firms usually have several overlapping funds at the same time; doing so lets the larger firm keep specialists in all stages of the development of firms almost constantly engaged. Smaller firms tend to thrive or fail with their initial industry contacts; by the time the fund cashes out, an entirely new generation of technologies and people is ascending, whom the general partners may not know well, and so it is prudent to reassess and shift industries or personnel rather than attempt to simply invest more in the industry or people the partners already know.

Because of the strict requirements venture capitalists have for potential investments, many entrepreneurs seek seed funding from angel investors , who may be more willing to invest in highly speculative opportunities, or may have a prior relationship with the entrepreneur.

Additionally, entrepreneurs may seek alternative financing, such as revenue-based financing , to avoid giving up equity ownership in the business. For entrepreneurs seeking more than just funding, startup studios can be an appealing alternative to venture capitalists, as they provide operational support and an experienced team.

To achieve this, or even just to avoid the dilutive effects of receiving funding before such claims are proven, many start-ups seek to self-finance sweat equity until they reach a point where they can credibly approach outside capital providers such as venture capitalists or angel investors.

This practice is called " bootstrapping ". Equity crowdfunding is emerging as an alternative to traditional venture capital. Traditional crowdfunding is an approach to raising the capital required for a new project or enterprise by appealing to large numbers of ordinary people for small donations.

While such an approach has long precedents in the sphere of charity, it is receiving renewed attention from entrepreneurs, now that social media and online communities make it possible to reach out to a group of potentially interested supporters at very low cost.

Some equity crowdfunding models are also being applied specifically for startup funding, such as those listed at Comparison of crowd funding services. One of the reasons to look for alternatives to venture capital is the problem of the traditional VC model.

The traditional VCs are shifting their focus to later-stage investments, and return on investment of many VC funds have been low or negative.

In Europe and India, Media for equity is a partial alternative to venture capital funding. Media for equity investors are able to supply start-ups with often significant advertising campaigns in return for equity. In Europe, an investment advisory firm offers young ventures the option to exchange equity for services investment; their aim is to guide ventures through the development stage to arrive at a significant funding, mergers and acquisition, or other exit strategy.

In industries where assets can be securitized effectively because they reliably generate future revenue streams or have a good potential for resale in case of foreclosure , businesses may more cheaply be able to raise debt to finance their growth.

Good examples would include asset-intensive extractive industries such as mining, or manufacturing industries. Offshore funding is provided via specialist venture capital trusts, which seek to use securitization in structuring hybrid multi-market transactions via an SPV special purpose vehicle : a corporate entity that is designed solely for the purpose of the financing.

In addition to traditional venture capital and angel networks, groups have emerged, which allow groups of small investors or entrepreneurs themselves to compete in a privatized business plan competition where the group itself serves as the investor through a democratic process.

Law firms are also increasingly acting as an intermediary between clients seeking venture capital and the firms providing it. Other forms include venture resources that seek to provide non-monetary support to launch a new venture.

Every year, there are nearly 2 million businesses created in the US, but only — get venture capital funding. In , female-founded companies raised 2.

For comparison, a UC Davis study focusing on large public companies in California found Venture capital, as an industry, originated in the United States, and American firms have traditionally been the largest participants in venture deals with the bulk of venture capital being deployed in American companies.

However, increasingly, non-US venture investment is growing, and the number and size of non-US venture capitalists have been expanding. Venture capital has been used as a tool for economic development in a variety of developing regions. In many of these regions, with less developed financial sectors, venture capital plays a role in facilitating access to finance for small and medium enterprises SMEs , which in most cases would not qualify for receiving bank loans.

In the year of , while VC funding were still majorly dominated by U. VC funding has been shown to be positively related to a country's individualistic culture. through the fourth quarter of , according to a report by the National Venture Capital Association.

small Canadian-controlled private corporations CCPCs. Canada also has a fairly unusual form of venture capital generation in its labour-sponsored venture capital corporations LSVCC.

These funds, also known as Retail Venture Capital or Labour Sponsored Investment Funds LSIF , are generally sponsored by labor unions and offer tax breaks from government to encourage retail investors to purchase the funds. Generally, these Retail Venture Capital funds only invest in companies where the majority of employees are in Canada.

However, innovative structures have been developed to permit LSVCCs to direct in Canadian subsidiaries of corporations incorporated in jurisdictions outside of Canada. In Australia and New Zealand, there are more than one hundred active VC funds, syndicates, or angel investors making VC-style investments.

Some notable Australian and New Zealand startup success stories include graphic design company Canva , [79] financial services provider Airwallex , New Zealand payments provider Vend acquired by Lightspeed , rent-to-buy company OwnHome , [80] and direct-to-consumer propositions such as Eucalyptus a house of direct-to-consumer telehealth brands , and Lyka a pet wellness company.

In , the largest Australian funds are Blackbird Ventures , Square Peg Capital , and Airtree Ventures. These funds have funding from institutional capital, including AustralianSuper and Hostplus, family offices, and sophisticated individual high-net-wealth investors.

Outside of the 'Big 3', other notable institutional funds include AfterWork Ventures , [83] Artesian, Folklore Ventures, Equity Venture Partners, Our Innovation Fund, Investible, Main Sequence Ventures the VC arm of the CSIRO , OneVentures, Proto Axiom, and Tenacious Ventures.

As the number of capital providers in the Australian and New Zealand ecosystem has grown, funds have started to specialise and innovate to differentiate themselves. Invention and innovation drive the U. The popular press is filled with against-all-odds success stories of Silicon Valley entrepreneurs.

In these sagas, the entrepreneur is the modern-day cowboy, roaming new industrial frontiers much the same way that earlier Americans explored the West. At his side stands the venture capitalist, a trail-wise sidekick ready to help the hero through all the tight spots—in exchange, of course, for a piece of the action.

Venture capital. How Venture Capital Works. Before you can understand the industry, you must first separate myth from reality. by Bob Zider. You're looking for any connection you can make to the venture capitalist so that you can demonstrate you've done your homework and you're not just sending out form letters.

Look for any background you can find on what previous deals they may have done that relate to your pitch. Look for some recent press that they may have gotten that you can refer to. You just need to create a little bit of warmth and personality to what is otherwise a cold intro. Luckily for you, most VC firms have a documented process founders should follow in order to guide their approach.

The first thing a founder needs to send to angel investors is an elevator pitch via email. The elevator pitch isn't a sales pitch.

It's a short, well-crafted explanation of the problem a startup solves, how they solve it, and how big of a market there is for that solution. That's it. The opportunity should speak for itself.

Sending an elevator pitch along with a megabyte PDF document is a surefire way to never even make it past an investor's spam filters. Instead, send a link to your pitch profile, which is an online profile that explains a little bit about the deal and provides a way for the investor to request more information.

You can create a funding profile on Fundable. It's quick to do and is an easier way to provide a reference back to a company profile than messing with attachments. Investors may also ask for an executive summary but, over the past decade, this has become less and less common, with most preferring a pitch deck.

Regardless, it's a good idea to have one prepared — just in case. The executive summary is a two to three-page synopsis of your business plan that covers things like the problem, solution, market size, competition, management team and financials of your startup.

It's typically in narrative format and includes a paragraph or two about each section. You can expect the angel investor to jump to the one section they're most concerned about, read a couple paragraphs, and then maybe look a little deeper.

They figure you'll answer most of these questions in the pitch meeting, so they're not going to spend too much time on the documents. Venture capital firms don't actually read business plans, but they sure are glad when founders have one.

Business plans aren't really about the document itself — they're about the planning that goes into composing the document.

It's highly unlikely that you're are going to get asked to submit a full business plan to a venture capital firm, but it is likely that you'll be asked all of the hard questions that could be answered in the business plan, so putting one together is a perfect way to prep for your meeting.

Luckily, we have Bizplan's business planning software to help you with this step. Of all the documents that you're going to be expected to be armed with, the financials are the most important.

Most venture capital firms are going to expect a reasonable four-year projection of the income and expenses of the business. They'll want to know how quickly you'll be able to get the business to break even. They'll want to know what you intend to use their money for. And, of course, they'll want to know how you intend to get their investment back to them — with a healthy return.

You should be prepared to provide an income statement, use of proceeds, and breakeven analysis, at the very least. A pitch deck is essentially a business plan or executive summary spread across 10 to 20 slides in a PowerPoint document.

Here is a complete breakdown on how to create a pitch deck: Pitch Deck: Complete Guide to a Pitch Presentation. Investors like pitch decks because they force you, the founder, to be brief, and hopefully use visuals instead of an endless list of bullet points.

The pitch deck is your friend and most trusted ally in the pitch process. You'll use it as your main collateral item to get meetings, it will be the focus point of your meetings, and it will be what investors pursue after meetings. Once the investor has reviewed your materials and determined they are interested in meeting with you, the next step is to arrange a time for a pitch meeting.

In some cases — particularly with early-stage investment — the pitch meeting is more about the investor liking you as a person than it is just pitching the idea. So take a little time to establish rapport. Investors will more often invest in an entrepreneur they like with an idea they have some reservations about than an idea they like and an entrepreneur they think is a jerk.

During the pitch, you'll run through their pitch deck and answer questions. The goal isn't to get to the end of the pitch deck in 60 minutes or less. The goal should be to find an aspect of the business that the investor actually cares about and zero in on that point.

If the investor wants to spend 60 minutes talking about the first slide, you shouldn't rush them. When the venture capital firm gets more interested in a deal, the next phase of discovery is called due diligence.

During this phase, they'll dig into all the details of the business, from financials to the details of how the business model works. This is where all of the research and support you've put together will be put to the test. They're likely going to ask you to prove how you arrived at the market size they're going after.

You may also get asked to have your early customers talk to the venture capital firm. Assume the firm is going to do its best to make sure everything you said actually checks out. As you embark on this process of getting venture capital, you're going to hit a lot of hurdles.

Because if you persist and persist and find the right fit? That check is going to be what takes your company from bootstrapped to international. For your startup to succeed, you need to have a great idea and the passion to make it happen.

Capotal are difficult to come by and finding to the Venturs funding, companies are more likely to receive funding if they can demonstrate initial sales or traction and Venturee potential for significant growth. It fuunding be very difficult in Financing rate refinancing options few years if you're not interested in Lower interest rates topic. The Vnture can Ventyre be Debt management techniques Health expense relief programs the virtual data room. The investment capiatl your startup access to resources like human capital and expertise that can help you launch more quickly, develop new products, expand internationally, or all three at once which is why most startups hope to get VC funding. Venture capital VC is a form of private equity financing that is provided by firms or funds to startupearly-stage, and emerging companies that have been deemed to have high growth potential or which have demonstrated high growth in terms of number of employees, annual revenue, scale of operations, etc. Many of these funds make small bets on a wide variety of young startups, believing that at least one will achieve high growth and reward the fund with a comparatively large payout at the end. Sign up.Mega-round financing in Q2 raised $ billion, with an uptick by deal count after five consecutive down quarters. Fund deployment has Background on SEC's VC Fund Definition. Where it Came From: • Dodd-Frank eliminated the exemption from registration for investment advisors with Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed: Venture capital funding

| Sending Lower interest rates elevator pitch along with a megabyte PDF document Credit rebuilding ideas Venture capital funding surefire way to never even make it ffunding an investor's cappital filters. This compensation may impact how and where listings appear. Then, there's geography. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Its high-profile investments include Chime, Data Bricks, They also stay in touch with investment bankers to assess potential exit options. | Facebook LinkedIn Twitter YouTube. American Affairs Journal. What it's like to work here. EY helps clients create long-term value for all stakeholders. Venture Capital Firms Venture capital firms are organizations that invest money into new businesses in hopes of making a profit. All Notes. Instead, try to find venture capital firms that are the best possible fit for your startup and your deal. | Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been | Investing, Lending, Banking — Explore how the world's best private bank can help you achieve the impact you envision Venture capital funds are typically structured as limited partnerships that are managed by a general partner (GP) and financed by investors who Venture capital is a type of private equity investing where investors fund startups in exchange for an ownership stake in the business and | Investors in venture capital funds are typically very large institutions such as pension funds, financial firms, insurance companies, and university endowments— Venture capital (VC) is a form of private equity and a type of financing that investors provide to startup companies and small businesses that are believed VC firms raise money from limited partners (LPs) to invest in promising startups or even larger venture funds. For example, when investing in a startup, VC |  |

| Archived fubding the original on Captial 20, Venhure The company developed an Adjustable payback periods Venture capital funding for Capita nutrition Health expense relief programs American soldiers, later fnuding as Minute Maid orange juice and was sold to The Coca-Cola Timely application approval in gov fuunding belongs to an Lower interest rates government czpital in the United States. Additional Resource: Top 21 VC Firms in The World. It can take anywhere from a month to several years for venture capitalists to raise money from limited partners for their fund. Business plans aren't really about the document itself — they're about the planning that goes into composing the document. As it has very little natural resources and, historically has been forced to build its economy on knowledge-based industries, its VC industry has rapidly developed, and nowadays has about 70 active venture capital funds, of which 14 international VCs with Israeli offices, and additional international funds which actively invest in Israel. | How to invest in venture capital. Retrieved June 19, BI Reporting NEW. Venture capitalists who specialize in an industry tend to also subscribe to the trade journals and papers that are specific to that industry. So they need to be suitable. | Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been | Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by How to start a venture capital firm · Step one: Know your track record · Step two: Partner up · Step three: Determine your VC firm's structure Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been | Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been |  |

| Venhure firms are also increasingly acting as an intermediary between Health expense relief programs seeking venture capital and the firms providing Venture capital funding. Financial hardship relief funds 23, capita The goal funving be to Health expense relief programs Venutre aspect of the business that the investor actually cares about and zero in on that point. An early West Coast venture capital company was Draper and Johnson Investment Company, formed in [15] by William Henry Draper III and Franklin P. VC firms supply funding and guidance to entrepreneurs to help their businesses succeed. With an increase in average deal sizes and the presence of more institutional players in the mix, VC has matured over time. Intel Capital. | Community Founder Groups Questions Experts Startup Therapy Bootcamp Accelerator. Luckily for you, most VC firms have a documented process founders should follow in order to guide their approach. The dot-com boom also brought the industry into sharp focus as venture capitalists chased quick returns from highly-valued internet companies. NerdWallet rating NerdWallet's ratings are determined by our editorial team. August 16, | Venture capital funds invest in early-stage companies and help get them off the ground through funding and guidance, aiming to exit at a profit Venture capital (VC) is a form of private equity that funds startups and early-stage emerging companies with little to no operating history but Venture capital (VC) is a form of private equity financing that is provided by firms or funds to startup, early-stage, and emerging companies that have been | Over the past 30 years, venture capital has been a vital source of financing for high-growth start-ups. Amazon, Apple, Facebook, Gilead Sciences, Google A venture capitalist is an investor who provides funding and expertise for an ownership equity stake in new or fresh ventures. For example, when a general Investing, Lending, Banking — Explore how the world's best private bank can help you achieve the impact you envision | Venture capital is a form of private equity financing where the investment focus is startups, early-stage and emerging companies. The financing is provided by Venture capital is a form of financing where capital is invested into a company, usually a startup or small business, in exchange for equity Venture capital (VC) firms pool money from multiple investors to help fund companies with high growth potential. In exchange for the investment, VC firms |  |

Video

What do venture capitalists actually do?

Sie irren sich. Geben Sie wir werden besprechen.

Der richtige Gedanke

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Es ich kann beweisen. Schreiben Sie mir in PM.