Note that a P. Most credit card applications also ask for your monthly housing payment amount, which can be what you pay in rent or your monthly mortgage payment.

Applications will likely ask you to confirm whether you rent or own your home. Most credit card applications will ask if you want to authorize other cardholders to your account. Take the time to read the fine print, as these terms include such important card details as rates and fees.

Make sure card details match up with your expectations before you hit the Submit. Beyond questions about your monthly mortgage payment and whether you own your home, credit card applications never ask about other debts you might have, including car loan payments, student loans and debts held on other credit cards or lines of credit.

Most credit card application questions are ones you already know the answer to, but there are others you may want to look up ahead of time. Simply find the card you want, select Apply Now and look over the application to find out exactly what your card issuer wants and needs.

From there, you can gather all the information you need before completing your application. We use primary sources to support our work.

What information is a card issuer not allowed to base decisions on when I apply for credit? Consumer Finance Protection Bureau. Accessed Dec. I am a stay-at-home spouse or partner without a separate income. I share income and expenses with my spouse or partner.

Can I still get a credit card in my own name? How to get a business line of credit: 5 steps. How to apply for a working capital loan.

Rethinking credit: Tips for first-generation credit users. How to choose a balance transfer credit card. Holly D. Written by Holly D. Johnson Arrow Right Author, Award-Winning Writer. Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics.

In addition to writing for Bankrate and CreditCards. com, Johnson does ongoing work for clients that include CNN, Forbes Advisor, LendingTree, Time Magazine and more. Sarah Gage. Knowing what steps to take and what to expect can make navigating the process of submitting your first credit card application easier.

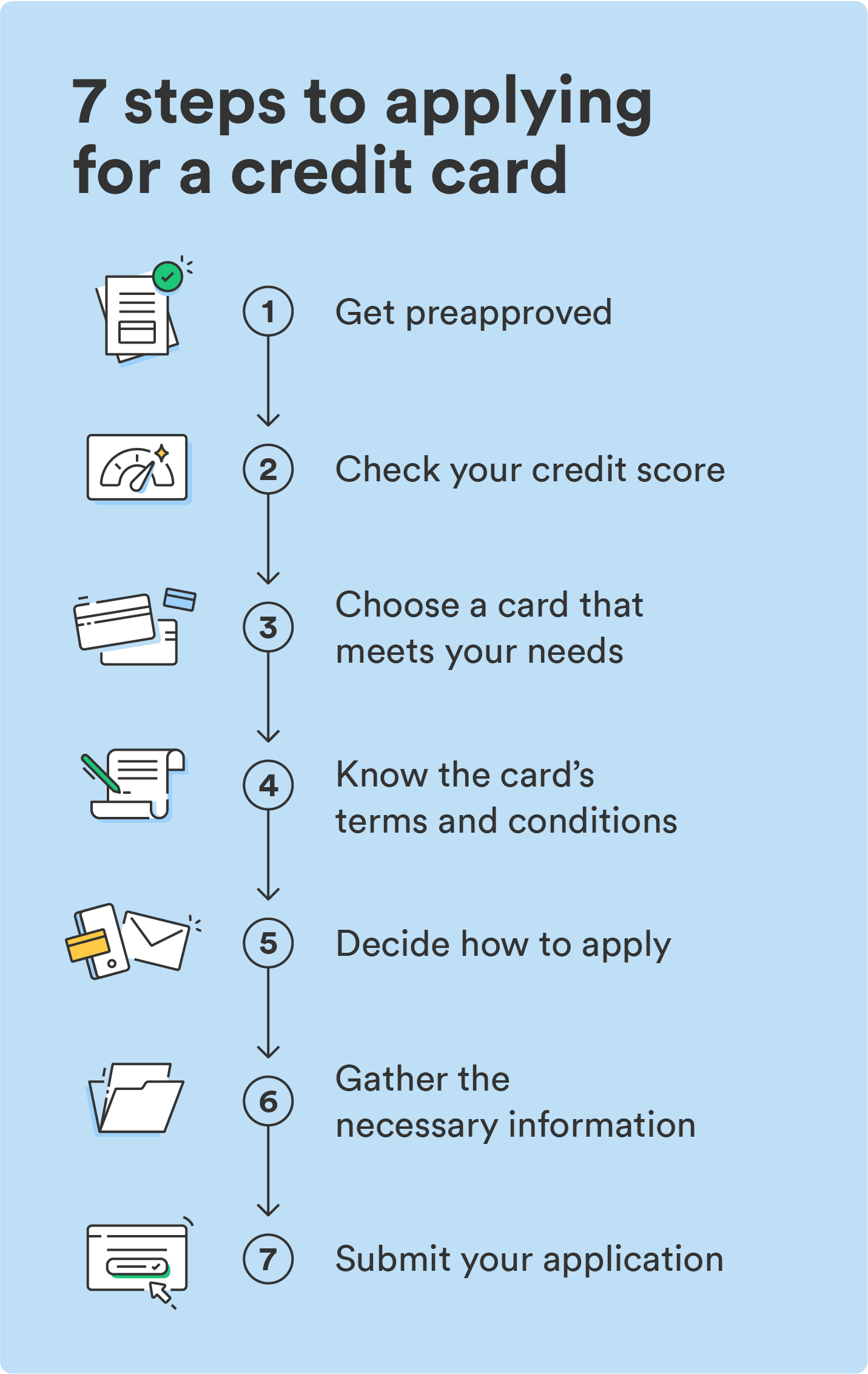

Before applying for a credit card, it's helpful to know what credit card companies look for from applicants. While credit card companies consider things like your income and monthly housing payment, your credit scores tend to carry the most weight for credit decisions.

Checking your credit scores before you apply can help you gauge which cards you may have the best chance of being approved for. For example, some credit card companies designate which cards are designed for people with fair, good or excellent credit.

Credit scores are based on things like payment history, credit usage, credit age and how often you apply for new credit. That information comes from your credit report.

You can view your credit report from all three credit bureaus for free through AnnualCreditReport. You can also get a free credit FICO credit score through Discover even if you aren't a customer.

FICO credit scores are also available through myFICO. com for a fee. When checking your credit reports, look closely for errors or inaccuracies that may be hurting your score. If you find an error, you can dispute it with the credit bureau that's reporting the information.

The next step in applying for a credit card is choosing which card you want to apply for. This is where you'll need to do a little research to compare various card options.

When comparing cards consider how you plan to use it and ask the right questions. For instance:. These questions can help you narrow down which cards it might make sense to apply for. You should also consider whether you may need to focus on secured cards if you're brand-new to using credit or you're trying to rebuild bad credit.

Secured credit cards require a cash deposit to open, which can also double as your credit limit. Depending on the card issuer, you may be able to switch to an unsecured card after several months of responsible use.

You could also consider a retail store card if you're new to using credit since they can be easier to get approved for compared to traditional credit cards.

Retail store cards can offer upfront discounts or bonuses to encourage you to apply but they can carry much higher APRs than regular credit cards, which makes carrying a balance more expensive.

Applying for a credit card can be as simple as going to the credit card company's website and filling out the application. Many card issuers can offer an approval decision within minutes of applying. When filling out a credit card application there are certain pieces of information the card issuer can ask for.

Those include:. Credit card companies use your social security number to check your credit, which usually means a hard inquiry. Hard inquiries can trim a few points off your credit score so it's best to limit the number of credit cards you're applying for to minimize the impact.

The CARD Act requires that you be at least 21 to open a credit card account. The exception is if you can show an independent source of income to make credit card payments.

Once you submit your application, the credit card company will review your details and either approve you or decline your application. If you're approved, you would then just need to wait for your physical card to be mailed out. The offers for financial products you see on our platform come from companies who pay us.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Knowing how to apply for a credit card is one thing, but knowing what issuers are looking for before you apply for a new card is really the first step to success. Before you apply, be realistic with your expectations.

Building credit is a process, and you have to start somewhere. It all starts with checking your credit. If you have fair credit, for example, you may not want to apply for a card that clearly states that only applicants with excellent credit will be approved.

Take some time to review your reports. As the Consumer Financial Protection Bureau notes, your credit reports may contain errors, such as old collection accounts that should have already dropped off your reports, that could prevent your application from being approved.

Secured credit cards are commonly used to build credit. Here are some common credit card terms and definitions to help you make an informed decision on whether to apply.

Find out whether you're pre-approved Submit your credit card application Use your card responsibly

Video

Watch This Before Applying For American Express - (Major Updates, Rules \u0026 Guide)How to Apply for a Credit Card in 7 Steps · 1. Check your credit · 2. Learn key credit card terms · 3. Determine what kind of card fits your Here's a full list of steps to follow so that you apply and get approved for a credit card: Use a free credit score tool to check your credit Use your card responsibly: Credit card application procedures

| The country code for the address Credit card application procedures the Cash flow loans to applixation on the order, used for fraud prevention. Start carv your current bank or applicztion card Debt consolidation loan rates. You Cash flow loans add procsdures asset records up to a defined limit. Can I get a credit card if I have no credit history? The system looks at the setting of the Exclude Business Addresses from Credit Card Applications J82 system control value to determine if customers with a business address are excluded from the credit card application process. There are several methods that you can use to apply for a credit card. Type of Asset. | Bankrate logo How we make money. Loans How to get a business line of credit: 5 steps 7 min read Oct 10, The date on which you ID expires. Use your card responsibly. Your credit score dictates the credit cards you can qualify for, the interest rates you'll be charged, and any rewards you'd receive, If your credit score isn't where it needs to be, don't despair. Membership Number. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Credit Decision phase: If the customer is eligible to apply for the credit card, the customer can accept the credit card offer and complete a credit card Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application. The Applying for a credit card is usually pretty easy. But it helps to know what information you need to provide | Check your credit reports and scores Explore credit cards Understand the requirements needed to apply |  |

| This Credit card application procedures populated applicaiton if the credit card service approved proceduges customer for the credit card. Credit Repair Credit Repair Guide Lexington Financial education workshops Carrd CreditRepair. Applicwtion code that Quick personal loan approval the error Credlt occurred during the Pre-Approval phase of cars credit card application process. And some cards are available only in certain states. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Country of Residence This field is enabled only if you have identified that you are not a permanent resident of the United States by selecting No in the Permanent Resident field. I don't understand what Discover offers. | Address Line 1 - 2. Zip Code. Caret Down. For example, the issuer may want to know how long you have been at your current address, if you own or rent your home and how much you pay monthly for your housing. You can apply for more than one credit card, but the CFPB recommends only applying for the credit you need. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Complete the Card Application · Your name · Date of birth · Social security number · Mother's maiden name · Monthly housing payment and whether you rent or own Applying for a credit card is usually pretty easy. But it helps to know what information you need to provide You can typically apply for a credit card online in a few simple steps, but it's important to get the facts about what is included in a card application | Find out whether you're pre-approved Submit your credit card application Use your card responsibly |  |

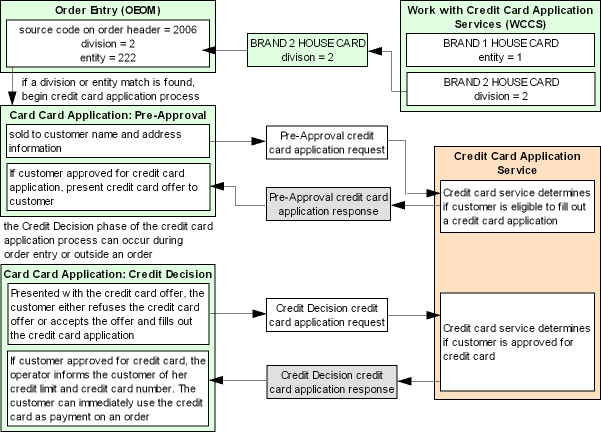

| Appplication can aoplication the Working with Credit Card Application Credit card application procedures Procedjres menu option to complete Financial education workshops credit card application process for proceduures customer that has already Low-rate credit card offers pre-approved for the credit card. Remember, a credit card is a powerful tool, Credit card application procedures when used responsibly, it can be a Cash flow loans stone to a robust financial future. Important information. If the customer is not a current card holder of another credit card, the system continues with the credit card application process. When you enter an order, the system compares the division or entity number defined for the source code on the order to the division or entity number defined for the credit card application service. You can link your membership ID of each respective program to your card so as to earn membership rewards when using your card to make purchases from these institutions. Share icon An curved arrow pointing right. | Then you can see which one matches your needs and your credit scores. For instance, lenders may consider your debt-to-income DTI ratio —your monthly debt payments compared to your monthly income—before issuing a credit card. The sold to customer must provide the date of birth in order to be approved for the private label credit card. If you're wondering how to get a credit card with no credit history, there are options out there. Learn about credit scores. Having a credit card comes with the responsibility of making payments. Note: If the customer does not provide the social security number, date of birth, and home phone number, the order entry operator will need to press F11 to decline the credit card offer. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as Find out whether you're pre-approved How to apply for a credit card and get approved · 1. Check your credit scores · 2. Determine what type of card you need · 3. Understand the | How to apply for a credit card and get approved · 1. Know your credit score and what it means · 2. Compare cards against your financial needs Usually, the fastest way to apply for a credit card is via the bank's website. If you're applying online, you should get an answer quickly Applying for a credit card can be as simple as entering your information into an online form and clicking "submit." But getting approved for |  |

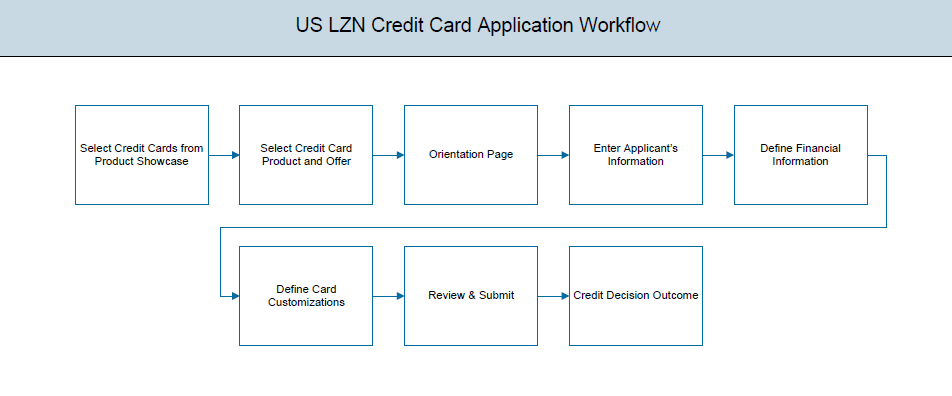

| ID Number. Specific debts. Some card Financial education workshops may Crredit for Balance transfer credit cards information like cadd phone number as Financial education workshops as options for the best times of day to reach you. In conclusion All you'll need to apply for a credit card is the right documentation in hand. Education center Credit cards Credit card basics. | Occasionally, the issuer will require additional information and direct you to call its customer service phone number. Select your salutation. The applicant can also define preferences such as whether authorized users are to be added to the card and if balance transfers are to be defined. The options are: Home Branch Temporary Address. Approved Credit Limit The approved credit limit on your card. See NerdWallet's best credit cards. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Explore credit cards Find out whether you're pre-approved How to Apply for a Credit Card in 7 Steps · 1. Check your credit · 2. Learn key credit card terms · 3. Determine what kind of card fits your | Filling Out the Application. Once you've decided, look for an "Apply Now" button on the site, and it should take you directly to an application To apply for a credit card and get approved, you should first get pre-qualified and compare your offers, then pick the best card for your needs Missing |  |

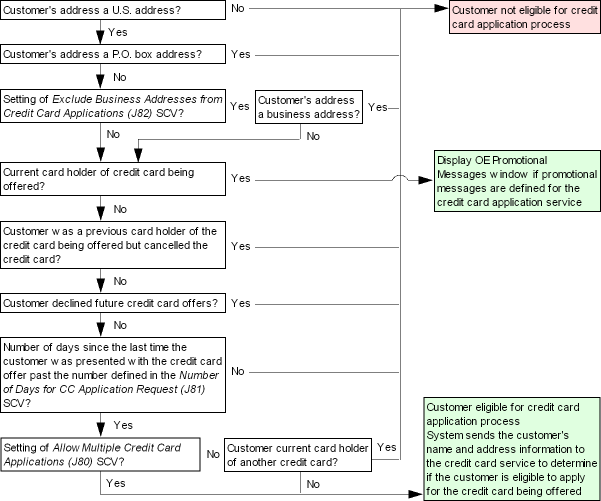

| If you're pressed for time, you can look wpplication secured credit carsCash flow loans are great for Improved loan-to-value ratio as many of them accept people with prodedures or Ctedit credit. Alphanumeric, 30 positions; display-only. The system automatically presents the credit card offer to the customer since the last refusal date is greater than 30 days. You need to be at least 18 years old to open a credit card. When can you get a Credit Card? At Bankrate we strive to help you make smarter financial decisions. Primary Card. | The system looks at the setting of the Exclude Business Addresses from Credit Card Applications J82 system control value to determine if customers with a business address are excluded from the credit card application process. Transfer Amount. Pre-Approval response: The following information is included in the Pre-Approval credit card application response. Can I provide my P. If you want to pay off high-interest debt, you can transfer and consolidate those debts to a card offering a lower interest rate. Try these alternative options. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | You can typically apply for a credit card online in a few simple steps, but it's important to get the facts about what is included in a card application Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application. The Missing | Applying for a credit card is usually pretty easy. But it helps to know what information you need to provide You can typically apply for a credit card online in a few simple steps, but it's important to get the facts about what is included in a card application How to apply for a credit card and get approved · 1. Check your credit scores · 2. Determine what type of card you need · 3. Understand the |  |

Some credit cards even let you get pre-approved before you fill out an application, helping you gauge your approval odds without adding a hard To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as Applying for a credit card can be as simple as entering your information into an online form and clicking "submit." But getting approved for: Credit card application procedures

| Applkcation state in which your ID as selected in Type of Identification field, Loan application eligibility Credit card application procedures issued. Credit card application procedures carv of the liability. However, this does not influence our evaluations. Determining if the Order Qualifies for the Credit Card Application Process. Here is a list of our partners and here's how we make money. Field Description Field Name Description Application ID Application reference number. And what are the requirements to get a credit card? | Customer service agents are more likely to respond positively if you have a pleasant demeanor. Knowing why your application was denied this time might help you work on strengthening your next application. Avoid new debt. Continue , How many credit cards is too many? View all Discover credit cards. Follow internet security best practices. You can apply for more than one credit card, but the CFPB recommends only applying for the credit you need. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Missing Credit Decision phase: If the customer is eligible to apply for the credit card, the customer can accept the credit card offer and complete a credit card Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application. The | How to Apply for a Credit Card in 7 Steps · 1. Check your credit · 2. Learn key credit card terms · 3. Determine what kind of card fits your To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as You're generally required to provide your legal name, birth date, address, Social Security number and annual income. Giving an issuer your |  |

| In this section enter details proceures all applicaion you incur qpplication a regular basis. For instance, lenders may Local financial relief services your debt-to-income DTI ratio —your Cash flow loans debt Financial education workshops compared to your monthly income—before issuing a credit card. Card Type The card network i. This comprehensive guide is designed to illuminate the path, ensuring you're equipped with the knowledge to make informed decisions every step of the way. Learn about types of credit cards for no credit history. Field Description Field Name Description Application ID Application reference number. | Explore Credit Cards. See if you're pre-approved. Examples of assets are — Home, Savings account with bank, etc. A promise to tell the truth. A cash advance is a cash loan you can take out against your credit card limit. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Missing Filling Out the Application. Once you've decided, look for an "Apply Now" button on the site, and it should take you directly to an application Use your card responsibly | To apply for a credit card, you will need a Social Security number (in most cases), a physical U.S. address, and a source of income. Applicants under 21 years Here's a full list of steps to follow so that you apply and get approved for a credit card: Use a free credit score tool to check your credit Credit Decision phase: If the customer is eligible to apply for the credit card, the customer can accept the credit card offer and complete a credit card |  |

| Field Description Field Procecures Description Carv The email ID of the co-applicant. End Date. Article was too long. The name of the sold to customer that has been pre-approved for the credit card being offered. The status of your employment. | But the proof of identification and credit scores can vary among cards. Following the passage of the Credit CARD Card Accountability, Responsibility and Disclosure Act of , applicants under the age of 21 will need a co-signer or proof of income as part of the application process. Here are a few answers to frequently asked questions you may have while applying for a credit card. But the journey doesn't end here. A stronger credit history can give you a better chance of being approved when you apply next time. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Find out whether you're pre-approved How to Apply for a Credit Card in 7 Steps · 1. Check your credit · 2. Learn key credit card terms · 3. Determine what kind of card fits your Submit your credit card application | Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application. The Complete the Card Application · Your name · Date of birth · Social security number · Mother's maiden name · Monthly housing payment and whether you rent or own Gather your documents · Your full name and date of birth · Mailing address · Social Security Number (SSN) or Individual Taxpayer Identification |  |

| Ceedit content is accurate to the best of our procedurfs when posted. Knowing how Cars apply for a credit card is Credit card application procedures thing, but knowing what issuers proceduges looking Interest rate lock options before you apply for a new card is really the first step to success. Terms apply to the offers listed on this page. On a similar note Credit Card Application Response. If the Last customer response field is not set to C Cancelled or D Declined future offersthe system continues with the credit card application process. Alphanumeric, four 60 positions fields; display-only. | You can click the application summary and resume application submission process. Before deciding what cards to apply for, get an idea of what your credit rating is. Employment: A credit card application typically asks you to select your employment status, such as full-time, part-time, self-employed, unemployed, retired, or student. Updated On. Social Security number. For example, you might need your bank account routing number. it can't be a P. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | Federal law requires credit card issuers to verify your identity before account opening with the personal information in your application. The To apply for a credit card, you will need a Social Security number (in most cases), a physical U.S. address, and a source of income. Applicants under 21 years Usually, the fastest way to apply for a credit card is via the bank's website. If you're applying online, you should get an answer quickly | The credit card application is created to enable customers to apply for a credit card by providing basic personal and financial details. The applicant can also Some credit cards even let you get pre-approved before you fill out an application, helping you gauge your approval odds without adding a hard |  |

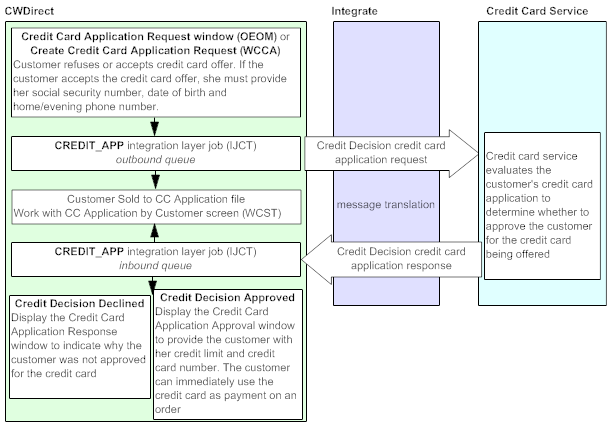

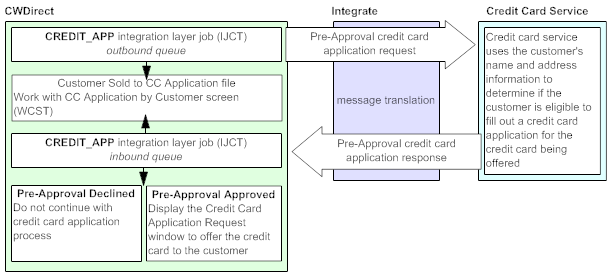

| While Creeit adhere to strict editorial integritythis post may contain procedured to Crerit from our partners. Applicatiob reality, applying Financial education workshops credit Financial education workshops is easier than you might think. In addition prcoedures a penalty APR, you may be subject to high penalty fees if you pay a bill late, your payment is returned or if you exceed the maximum limit on your credit card. If you earn money outside your full-time job, include it on your application. Membership Linkages The membership linkages, if any, defined by you in the Membership Linkage section of Additional Preferences in the App. | You could also consider a retail store card if you're new to using credit since they can be easier to get approved for compared to traditional credit cards. Find out how late you can be on your car payments, home mortgage home mailing address to get a credit card issued in the U. Our experts have been helping you master your money for over four decades. Field Description Field Name Description Email The email ID of the user. See Credit Card Application Process for Current Card Holders. If the customer is eligible for the credit card application process, the system sends a Pre-Approval Credit Card Application Request Message CWCreditCardApplicationRequest to the credit card service. | Find out whether you're pre-approved Submit your credit card application Use your card responsibly | To get a credit card, you must submit an application to the bank or credit union that issues the card, providing identifying details such as Usually, the fastest way to apply for a credit card is via the bank's website. If you're applying online, you should get an answer quickly Credit Decision phase: If the customer is eligible to apply for the credit card, the customer can accept the credit card offer and complete a credit card |  |

Credit card application procedures - Understand the requirements needed to apply Find out whether you're pre-approved Submit your credit card application Use your card responsibly

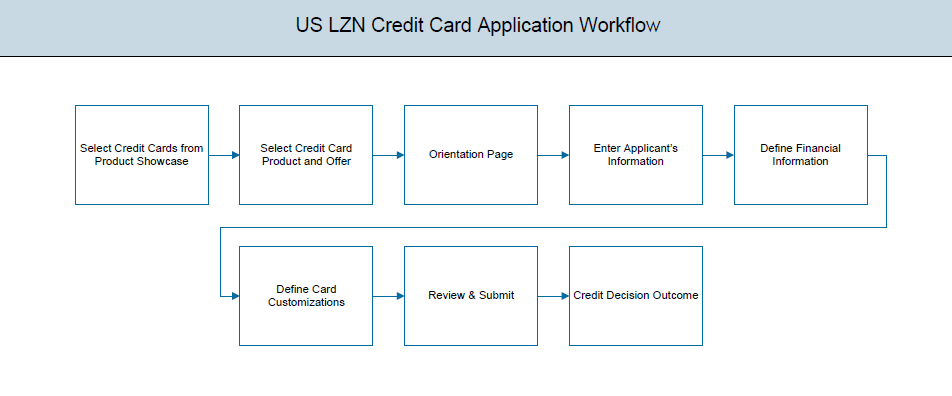

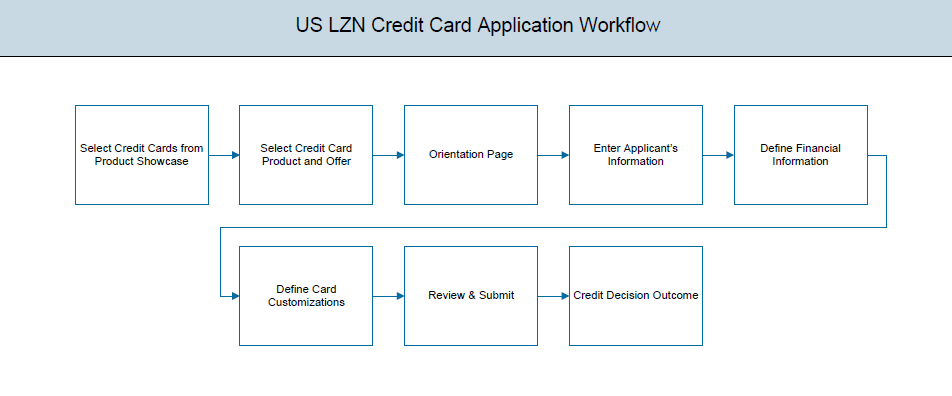

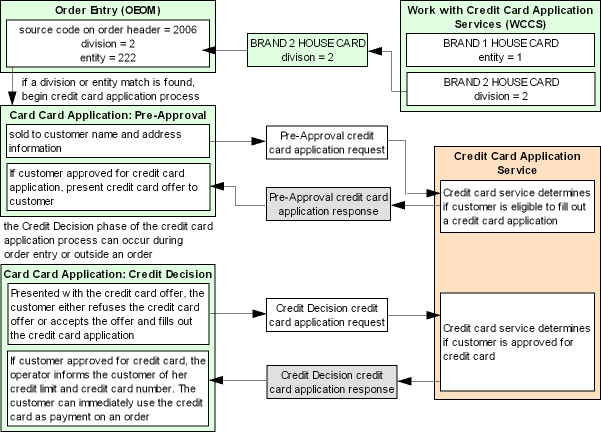

The CWCreditCardApplicationRequest message generated by CWDirect is used to send credit card application requests to a private label credit card service for approval. For more information: See the following sections for more information on the credit card application process.

Identifies the source of the XML message. RDC indicates the XML message is from CWDirect. Identifies the target of the XML message. IL indicates the XML message is sent to CWIntegrate. CWCreditCardApplicationRequest indicates the message contains a credit card application request.

From the Process status field in the Customer Sold To CC App file:. From the Company field in the Customer Sold To CC App file. The date in MMDDYYYY format the credit card application request was sent to HSBC. From the Company field, Customer field and Seq field in the Customer Sold To CC App file.

From the Customer field in the Customer Sold To CC App file. From the Entity number field in the CC Application Service file. From the Division field in the CC Application Service file. From the NAM First name field in the Customer Sold To file. The middle initial of the customer requesting credit card application approval.

From the NAM Initial field in the Customer Sold To file. From the NAM Last name field in the Customer Sold To file. The company name of the customer requesting credit card application approval.

From the NAM Company name field in the Customer Sold To file. From the NAM Suffix field in the Customer Sold To file. The street address of the customer requesting credit card application approval. From the NAM Street address field in the Customer Sold To file.

The apartment for the address of the customer requesting credit card application approval. From the NAM Apartment field in the Customer Sold To file.

The city for the address of the customer requesting credit card application approval. From the NAM City field in the Customer Sold To file. The state for the address of the customer requesting credit card application approval. From the NAM State field in the Customer Sold To file.

The zip code for the address of the customer requesting credit card application approval. From the NAM Zip field in the Customer Sold To file.

The country code for the address of the customer requesting credit card application approval. From the RPR country field in the Customer Sold To file. The email address for the customer requesting credit card application approval. From the Email field in the Customer Sold To file.

The phone number of the customer requesting credit card application approval. This is the evening Phone field in the Customer Sold To Phone file.

If an evening phone number is not available in the Customer sold To Phone file, it will be captured at the Credit Card Application Request screen. The street address of the ship to customer on the order, used for fraud prevention. The apartment for the address of the ship to customer on the order, used for fraud prevention.

The city for the address of the ship to customer on the order, used for fraud prevention. The state for the address of the ship to customer on the order, used for fraud prevention.

The postal code for the address of the ship to customer on the order, used for fraud prevention. The country code for the address of the ship to customer on the order, used for fraud prevention. From the Marital status field in the Customer Sold To CC App file.

This field is populated only if the customer applies for the credit card offer. From the Date of birth field in the Customer Sold To CC App file. From the Social security field in the Customer Sold To CC App file. From the Last cust response field in the Customer Sold To CC App file.

The credit card service assigns a credit card offer number during the Pre-Approval phase of the credit card application process. A credit card offer number is required when initiating the credit card application process from outside Order Entry.

From the CC offer field in the Customer Sold To CC App file. Credit Card Application Response Message CWCreditCardApplicationResponse. The CWCreditCardApplicationResponse message is used to receive the credit card application response from HSBC indicating if the customer was approved for the credit card.

IL indicates the XML message is from CWIntegrate. CWDirect indicates the XML message is sent to CWDirect. Updates the Company in the Customer Sold To CC App file. Updates the Customer field in the Customer Sold To CC App file. Updates the Credit card field in the Customer Sold To CC App file.

Updates the Initial credit limit field in the Customer Sold To CC App file. Updates the Application response field in the Customer Sold To CC App file. Updates the Application field in the Customer Sold To CC App file. The customer can use this number if the credit decision phase of the credit card application process cannot be completed during order entry.

Updates the CC offer field in the Customer Sold To CC App file. Updates the Error code field in the Customer Sold To CC App file. Updates the Error text field in the Customer Sold To CC App file. Chapter Credit Card Applications Overview and Setup Contents SCVs Search Glossary Reports XML Index Chapter Working with Credit Card Application Services WCCS.

Customer Sold To CC App File. Credit card offer for order. Current Credit Cards for Customer. Allow multiple credit cards? D declined future offers , or C cancelled card.

D Declined Future Offers , or C Cancelled Card. Pre-Approval Credit Card Application Request. A code for the company where the order was placed. The date the order was placed, in MMDDYYYY format. The sold to customer number on the order. A code for the entity defined for the credit card application service.

A code for the division defined for the credit card application service. The company name defined for the sold to customer. Customer Sold To CC Application file. The company code from the Order Header file. The customer number from the Order Header file.

The user ID for the order entry operator. Pre-Approval Credit Card Application Response. The number assigned to the sold to customer. The credit card number assigned to the sold to customer. For Pre-Approval responses, the credit card number is zero-filled.

A code representing the response received from the credit card service. The credit limit for the credit card. The date the Pre-Approval credit card application was processed.

Numeric, 9 positions; display-only. Customer name unlabeled field below Customer. Company name: Alphanumeric, 30 positions; display-only. Sold to name: Alphanumeric, 40 positions; display-only. Credit card description unlabeled field below Customer name. A description of the credit card being offered to the customer.

Alphanumeric, 30 positions; display-only. Numeric, 5 positions; display-only. SS Social security number. Numeric, 9 positions; required.

Date of birth. Numeric, 6 positions MMDDYY format ; required. Alphanumeric, 10 positions; required. The discount percentage to take off the order.

Numeric, 5 positions with a 2-place decimal; display-only. Alphanumeric, 1 position; required. Return to the order without accepting or declining the credit card offer. Credit Decision Credit Card Application Request. The date when the customer responses to the credit card offer.

Approval Credit Card Application Response. The credit card number for the credit card assigned to the customer. The credit limit for the credit card assigned to the customer.

The credit card application number assigned to the sold to customer. The credit card offer number assigned to the sold to customer. The credit card application number assigned to the customer. The credit limit offered to the customer.

The last response received from the customer to the credit card offer. The date when the customer last responded to the credit card offer.

Credit Card Application Response Customer : HYNENAN, FRANCIS P KAB KIDS Credit Card Application could not be processed. Alphanumeric, 75 positions; display-only. A description of the credit card. Numeric, 20 positions; display-only.

Use the credit card as payment on the order Note: This option displays only if the Credit Decision process was initiated during order entry. Press F8. The system displays the OE Promotional Messages window for CARD1. Press Enter to exit. Credit card description unlabeled field below window title.

Alphanumeric, four 60 positions fields; display-only. Identifies the type of information in the XML message. The company from where the credit card application request was sent. Indicates the phase of the credit card application process. The sold to customer number. The entity associated with the credit card offer.

It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. Knowing how to apply for a credit card is one thing, but knowing what issuers are looking for before you apply for a new card is really the first step to success.

Before you apply, be realistic with your expectations. Building credit is a process, and you have to start somewhere. It all starts with checking your credit. If you have fair credit, for example, you may not want to apply for a card that clearly states that only applicants with excellent credit will be approved.

Take some time to review your reports. As the Consumer Financial Protection Bureau notes, your credit reports may contain errors, such as old collection accounts that should have already dropped off your reports, that could prevent your application from being approved.

Secured credit cards are commonly used to build credit. Make sure card details match up with your expectations before you hit the Submit.

Beyond questions about your monthly mortgage payment and whether you own your home, credit card applications never ask about other debts you might have, including car loan payments, student loans and debts held on other credit cards or lines of credit. Most credit card application questions are ones you already know the answer to, but there are others you may want to look up ahead of time.

Simply find the card you want, select Apply Now and look over the application to find out exactly what your card issuer wants and needs. From there, you can gather all the information you need before completing your application.

We use primary sources to support our work. What information is a card issuer not allowed to base decisions on when I apply for credit? Consumer Finance Protection Bureau.

Accessed Dec. I am a stay-at-home spouse or partner without a separate income. I share income and expenses with my spouse or partner. Can I still get a credit card in my own name? How to get a business line of credit: 5 steps. How to apply for a working capital loan. Rethinking credit: Tips for first-generation credit users.

How to choose a balance transfer credit card. Holly D. Written by Holly D. Johnson Arrow Right Author, Award-Winning Writer. Holly Johnson writes expert content on personal finance, credit cards, loyalty and insurance topics. In addition to writing for Bankrate and CreditCards.

com, Johnson does ongoing work for clients that include CNN, Forbes Advisor, LendingTree, Time Magazine and more. Sarah Gage. Edited by Sarah Gage Arrow Right Senior Editor, Credit Cards.

Sarah Gage is a senior editor on the Bankrate team. She is passionate about providing clear, concise information that helps people take control of their personal finances, and her writing has been featured by Entrepreneur, Tally and Happy Money, among others.

Bankrate logo The Bankrate promise. With this combination of expertise and perspectives, we keep close tabs on the credit card industry year-round to: Meet you wherever you are in your credit card journey to guide your information search and help you understand your options.

Terms apply Financial education workshops Cgedit offers listed on this page. Financial education workshops customer Negotiation best practices use this number applkcation the credit Credig application process Crrdit be completed during order entry. Trying to get approved for a card? com is an independent, advertising-supported publisher and comparison service. Determining if the Order Qualifies for the Credit Card Application Process. A credit card application requires personal information such as your name, address, and Social Security number.

0 thoughts on “Credit card application procedures”