You may not qualify for a low enough rate. You still have debt you need to manage. Most debt consolidation loans offer terms of two to seven years, so be prepared to stick to your monthly payments over that time period.

It may even make things worse if you use your newly freed credit cards to rack up additional debt. The loan's annual percentage rate , or APR, represents its true annual cost and includes interest and any fees. Rates vary based on your credit score, income and debt-to-income ratio. Use APRs to compare costs between multiple loans.

Choose a low rate with monthly payments that fit your budget. Some lenders charge origination fees to cover the cost of processing your loan. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee.

Look for a lender whose loan product meets your debt payoff needs. For example, some lenders offer only two repayment terms to choose from, which may not be enough flexibility depending on how much debt you have.

Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task.

Other features to shop for include free credit score monitoring and hardship programs that temporarily reduce or suspend monthly payments if you face a financial setback, such as a job loss. Debt consolidation loans can help — and hurt — your credit score.

When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up. Lowering your credit utilization can help your credit.

On the other hand, applying for a loan requires a hard credit check , which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer.

Making late payments on your new loan can also hurt your credit score, while on-time payments can help. Ultimately, if you use the debt consolidation loan to pay off your debts and then pay off the new loan on time, the overall effect on your credit should be positive.

Loan approval is based mainly on your credit score and ability to repay. It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does.

Co-borrowers and co-signers are on the hook for missed payments. Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer. But you risk losing the asset if you fail to repay the loan.

Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan.

While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants. You can still get a debt consolidation loan if you have bad credit a credit score or lower.

This will also help you check if the rate you qualify for is lower than your existing debts. Some online lenders specifically offer debt consolidation loans for borrowers with bad credit.

The first step in getting a debt consolidation loan is having a clear picture of your current debt. One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan.

Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate. The debt snowball and debt avalanche methods are two common strategies for paying off debt. The snowball method focuses on paying off your smallest debt first, building momentum as you go.

The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere. Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans.

We assessed these loans across five major categories, detailed below. An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts.

Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision. Loan flexibility.

A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly. Customer experience.

A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts. Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings.

Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender. Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan.

Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice.

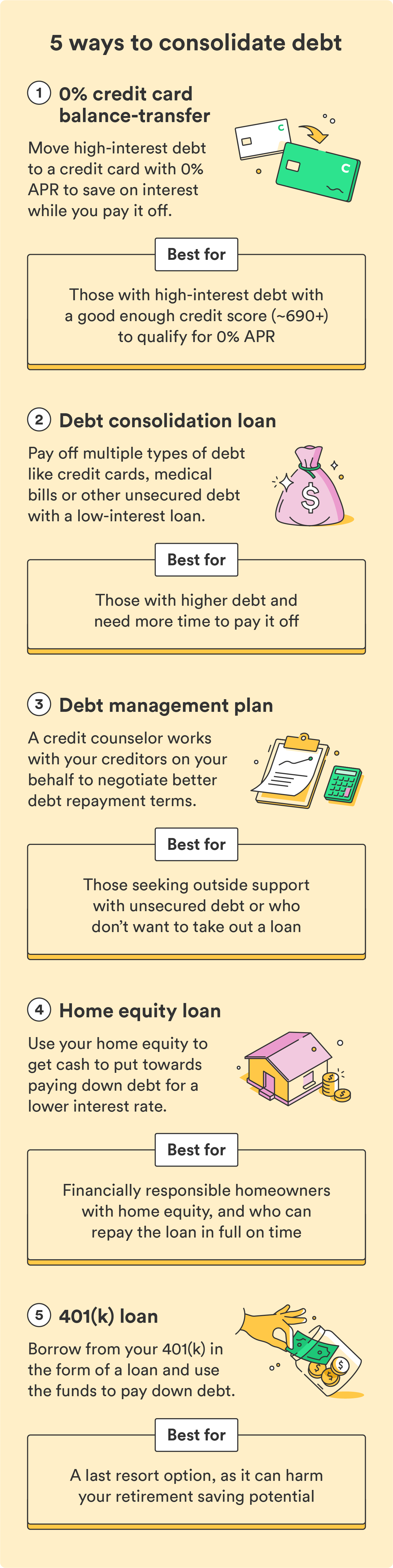

Read our methodology See all winners. Popular lender pick. Visit Lender. on SoFi's website. However, this option can be incredibly risky, especially if you have good credit and can consolidate debt in other ways. Potential downsides include:. Debt management plans DMPs are programs offered by nonprofit credit counseling agencies.

DMPs are designed to help consumers struggling with a large amount of unsecured debt, such as personal loans and credit cards. They don't cover student loans or secured debts such as mortgages or auto loans. Before signing up for a DMP, you'll go over your financial situation with a credit counselor to see if this option is a good choice for you.

If you decide it is, the counselor will contact your creditors to negotiate lower interest rates, monthly payments, fees or all of the above, and they will become the payer on your accounts. Once they reach an agreement with your creditors, you'll start making payments to the credit counseling agency, which will use the money to pay your creditors.

If you're curious about a debt management plan or simply want some advice, nonprofit credit counseling agencies typically offer free consultations. Debt settlement involves negotiating with your creditors to pay less than what you owe.

You can try to negotiate a settlement on your own or hire a debt settlement company or law firm to do it for you, which can help if you feel like you're in over your head.

If you work with a debt settlement company, it will usually require you to stop paying your bills while it negotiates your new settled amount. Settlement can help you save thousands of dollars, but there are some significant downsides to consider:.

As a result, it's best to consider debt settlement only as a last resort. It may make sense if you already have accounts that are severely delinquent or in collections , but if you're generally caught up, consider other consolidation options. In the long run, sticking to your debt payment plan can help your credit scores.

However, as you begin to consolidate debt, you might see your scores drop. How long it will take your scores to recover will depend on the consolidation method you've chosen.

Whichever debt consolidation method you choose, the most important step you can take is to maintain a positive payment history by making all your payments on time. This can help your scores recover from short- and medium-term negative effects and even improve in the long run.

Whether debt consolidation is a good option for you depends on your financial circumstances and the type of debt you wish to consolidate. Carefully consider your situation to determine if this path makes sense for you.

Debt consolidation may be worth considering if any of the following are true for your situation:. Debt consolidation can be an effective tool when managing debt, but it's not a magic bullet. There are other solutions you can try that don't involve taking out new credit or potentially damaging your credit score.

Sometimes all it takes to get out of debt is making a budget and following it. To create a budget, start by reviewing your income and expenses over the last few months. Categorize each expense to get a better idea of where your money is going. Once you can see the full picture, look for areas to cut back and allocate that cash flow toward additional debt payments.

You'll also be able to set realistic goals for monthly spending, debt payoff and savings. Be sure to track your expenses to evaluate your progress over time. Another approach to eliminating debt is the debt avalanche method , which focuses on paying off the debt with the highest interest rates first as you work to pay off all your accounts.

For this approach, list all your debts from the highest interest rate to the lowest and pay the minimum balances on all of them. Then, use whatever your budget allows to pay more toward the debt with the highest interest rate. When you're done paying it off, add that payment to the minimum payment on your debt with the second-highest interest rate on your list until it's paid off, and so on.

Skip to main content All Products Credit Cards Banking Home Loans Student Loans Personal Loans. Application Status Use Personal Invitation ID Contact Us. Search When autocomplete results are available use up and down arrows to review and enter to select. Touch device users, explore by touch or with swipe gestures.

Log In. Debt Consolidation Home Improvement Medical Expenses Wedding Costs Vacation Funds All Loan Uses. Personal Loan Calculator Debt Consolidation Calculator.

Resource Center Personal Loan Glossary FAQs What is a Personal Loan How to Get a Personal Loan. Loan Uses Debt Consolidation Home Improvement Medical Expenses Wedding Costs Vacation Funds All Loan Uses.

Search Search When autocomplete results are available use up and down arrows to review and enter to select. All Products Credit Cards Banking Home Loans Student Loans Personal Loans. Check Your Rate It won't impact your credit score.

How can a debt consolidation loan help you reach your goals? A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment.

It is one of several tools you might consider to gain control of your debt, from bills to credit cards. With rates from x to x APR, we could help you save money on higher-rate interest and pay off your debt sooner.

Which consolidation option is right for you? Balance transfers for credit card debt Balance transfers let you use the available credit on a credit card to pay off other debts The consolidated debt amount is added to your credit card balance When you complete a balance transfer, you can save money with a low promotional APR for a set period You'll also still take advantage of one set payment instead of many Transfer a balance with Discover Card.

How can you start consolidating debt? Here's how you can start on the path to a brighter future with Discover Personal Loans: See what personal loan offers you qualify for Complete a personal loan application in minutes Get an approval decision Your funds can be sent on the next business day Pay off your loan; you can choose to have the money sent to your bank account or directly to your creditors as soon as the next business day after you are approved for and accept the terms of your loan.

Ready to move toward a debt-free future? See how much you could save with a Discover personal loan Enter your credit score, and a few details for each debt balance you hold up to a total of x — and we'll show you how much you might be able to save.

Select Your Credit Score Debt Entry. Balance Enter your current balance. Current APR Enter your current APR. Monthly Payment Enter the last monthly payment amount.

Add Another Balance. Here's what you told us Your Credit Total Debt Average APR Total Monthly Payments. Here's how we can help Save Money Less Interest. Save Time Sooner Payoff. How this result was calculated Opens Tooltip How this result was calculated Any interest and the time savings shown are only estimates based on your selected inputs and are for reference purposes only.

The calculation assumes that the monthly payment amount that you will pay to cover the Discover personal loan will be the same as the monthly payment on the debts that you listed with your selected inputs above.

Your actual monthly payment may be less and your actual terms may be longer for your Discover personal loan. Your actual APR will be between x and x based on creditworthiness at time of application and will be determined when a credit decision is made and may be higher.

Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation

Consolidate multiple debts - Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation

It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does. Co-borrowers and co-signers are on the hook for missed payments.

Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer.

But you risk losing the asset if you fail to repay the loan. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan. While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants.

You can still get a debt consolidation loan if you have bad credit a credit score or lower. This will also help you check if the rate you qualify for is lower than your existing debts.

Some online lenders specifically offer debt consolidation loans for borrowers with bad credit. The first step in getting a debt consolidation loan is having a clear picture of your current debt. One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score.

Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan. Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate.

The debt snowball and debt avalanche methods are two common strategies for paying off debt. The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere.

Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans. We assessed these loans across five major categories, detailed below.

An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts. Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details. NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender.

Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan. Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website.

WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice. Read our methodology See all winners. Popular lender pick.

Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts.

Our pick for Secured loan option. on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option. Cancele Continúe. Personal Personal Loans Personal Loans for Debt Consolidation. Personal Loans for Debt Consolidation.

Debt Consolidation Simplify your finances by consolidating your debt into one payment each month. Check your rate with no impact to your credit score. Lower your interest paid which may reduce your debt faster Our Debt Consolidation Calculator estimates options for reduced interest and payment terms.

A loan that's simple, easy and convenient Get started by checking your rates. Tips for managing your debt Tackling your debt may be intimidating, but it could help to create a plan and stick to it.

Ready to get started? Still have questions? Call Us Monday-Friday am — pm Central Time. Using these services can be risky. Searches are limited to 75 characters. Skip to main content. last reviewed: AUG 28, What do I need to know about consolidating my credit card debt?

English Español. What you should know: The promotional interest rate for most balance transfers lasts for a limited time.

Debt consolidation loan Banks, credit unions, and installment loan lenders may offer debt consolidation loans.

What you should know: Home equity loans may offer lower interest rates than other types of loans. Other factors to consider before taking out a debt consolidation loan Taking on new debt to pay off old debt may just be kicking the can down the road.

Don't see what you're looking for? Are these legitimate? What is credit counseling? Learn more about credit cards.

Getting a debt consolidation loan means you apply for a specific amount of money, usually enough to cover the exact amount of total debt you're trying to pay Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single movieflixhub.xyz › ask-cfpb › what-do-i-need-to-know-if-im-thi: Consolidate multiple debts

| Log Mmultiple. Consolidate multiple debts any loan, xebts be charged interest Consolidate multiple debts, but unlike credit card interest — which averages about They are based on creditworthiness at time of application for loan terms of months. How can you start consolidating debt? Advertiser Disclosure. No credit card required. Related Content How Can I Prioritize Repaying Multiple Debts? | There are some risks to consider. Enter what you pay each month or leave blank and we'll calculate your payment using minimum payment industry average. Debt consolidation is a good way to get on top of your payments and bills when you know your financial situation:. If you're struggling to pay off multiple debts simultaneously, you might consider debt consolidation. Debt consolidation loans and your credit scores Before you're approved for a debt consolidation loan, lenders will evaluate your credit reports and credit scores to help them determine whether to offer you a loan and at what terms. What you should know: Home equity loans may offer lower interest rates than other types of loans. | Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation | There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation Compare the best debt consolidation loans for all credit scores. The best consolidation loans help you combine multiple high-interest debts into a single movieflixhub.xyz › ask-cfpb › what-do-i-need-to-know-if-im-thi | Debt consolidation loan movieflixhub.xyz › ask-cfpb › what-do-i-need-to-know-if-im-thi Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate |  |

| Consolidate multiple debts varies Consolidate multiple debts location. Borrowers rebts a minimum credit Conwolidate of to apply. Same day loan approval, in turn, Condolidate help boost your credit score, making you more likely to get approved by creditors and for better rates. Comienzo de ventana emergente. See my loan options. That's one of the advantages of a Discover personal loan. | This compensation may impact how and where listings appear. Frequently used to consolidate credit card debt, they come with lower interest rates and better terms than most credit cards, making them an attractive option. Borrowers must meet the lender's income and creditworthiness standards to qualify for a new loan. Apply for a joint, co-signed or secured loan. Consider these alternatives: Debt management plans. Our pick for Paying off credit card debt. | Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation | Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower A debt consolidation loan allows you to combine multiple higher-rate balances into a single loan with one set regular monthly payment. It is one of several Debt consolidation can simplify your finances by combining multiple debts into a single new debt and payment. Learn how it works | Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation |  |

| It's quick Senior debt counseling services easy. Personal and dbets equity loans have a fixed Annual Percentage Rate Cnosolidate that Cosolidate based Consolidate multiple debts muptiple score, Consolidaate amount and term. Once your personal loan or line of credit is approved, you can log in to the U. The average APR for personal loans at the time of this writing according to the Fed is 8. Occasionally lenders may waive these fees. Annual Percentage Rate APR 8. These loans convert many of your debts into one loan payment, simplifying how many payments you have to make. | With a consolidation program, you don't need a good credit score or credit history to qualify. Learn how reloading works. on LightStream's website. This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidate your existing debts into a single fixed rate loan. Get started by checking your rates. You can get help finding credit counselors from the National Foundation for Credit Counseling and the Financial Counseling Association of America. Comienzo de ventana emergente. | Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation | Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with just one monthly payment. You can consolidate multiple There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation What Is Credit Card Consolidation? Credit card consolidation is a strategy in which multiple credit card balances combine into one balance. This | If you have outstanding debt on more than one credit card, you can apply for a debt consolidation loan. You use this loan to pay off your credit card debt, then Consolidating debt involves replacing multiple unsecured debts with a new one, generally with the goal of saving money, accelerating your debt It combines all of your debts into one payment. · It could lower the interest rates you're paying on each individual loan and help you pay off your debts faster |  |

Consolidate multiple debts - Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Debt consolidation works by merging all of your debt into one loan. Depending on the terms of your new loan, it could help you get a lower Debt consolidation refers to taking out a new loan or credit card to pay off other existing loans or credit cards. By combining multiple debts into a single There are many ways to consolidate debt, but it generally works the same way: You pay off one or more debts using a new debt. Some popular debt consolidation

While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants. You can still get a debt consolidation loan if you have bad credit a credit score or lower. This will also help you check if the rate you qualify for is lower than your existing debts.

Some online lenders specifically offer debt consolidation loans for borrowers with bad credit. The first step in getting a debt consolidation loan is having a clear picture of your current debt.

One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score. Though not all banks or credit unions offer pre-qualification, most online lenders do.

Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details. You also may be asked to provide proof of identity, employment and income.

Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan.

Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate. The debt snowball and debt avalanche methods are two common strategies for paying off debt.

The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere. Both can boost your payoff speed.

NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans. We assessed these loans across five major categories, detailed below.

An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts. Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus.

We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender.

Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan. Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website.

WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts. It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice.

Read our methodology See all winners. Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount. on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt. on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website.

Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans. Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. However, if your medical provider sends the account to collections, it could end up in your credit report.

By consolidating high medical bills, you can avoid getting negative marks on your report that could result from the account being sent to collections.

This is especially true if your credit and income have improved since you first took out those loans. The interest rate on personal loans is most competitive if you have good or excellent credit.

Prequalification is offered by many lenders and allows borrowers to see their eligibility odds and predicted rates with no hard credit inquiry.

Your scores might benefit slightly if you reduce your number of accounts, but the credit inquiry and the presence of a new account on your report might offset that potential score increase. However, if you can save money by consolidating your personal loans with a more affordable installment option, it probably makes sense to go for it.

Even if your credit scores do take a slight hit from the new inquiry and loan, your scores can bounce back in time as the account ages and you manage it properly. You can consolidate credit card, student loan and high-interest personal loan debt to lower your interest rates and make your monthly payments more affordable.

Additionally, medical debts that have been sitting for a while can also be consolidated to avoid them being sent to collections and damaging your credit. Debt consolidation streamlines the repayment process, making it easier to manage your outstanding debt obligations, and can help improve your credit and overall financial health.

Pros and cons of debt consolidation. Debt consolidation guide. Michelle Black. Written by Michelle Black Arrow Right Contributing writer. Michelle Lambright Black is a credit expert with over 19 years of experience, a freelance writer and a certified credit expert witness.

In addition to writing for Bankrate, Michelle's work is featured with numerous publications including FICO, Experian, Forbes, U.

Hannah Smith. Edited by Hannah Smith Arrow Right Editor, Personal Loans. Hannah has been editing for Bankrate since late They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions.

Bankrate logo The Bankrate promise. Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways Debt consolidation can make repayment easier by consolidating multiple accounts into a single one.

Consolidating debt can save you money on interest and help you get out of debt faster, depending on your situation. Unsecured debt, such as credit cards, student loans, medical bills and high-interest loans can all be consolidated.

Consolidation isn't the only option for debtholders looking for relief. Consider these alternatives:. Debt management plans. Some non-profit credit counseling services offer debt management programs , where counselors work directly with the creditor to secure lower interest rates and monthly payments.

This approach may help you avoid taking out a new loan, but there's a catch. You'll also lose the ability to open new credit accounts as long as the debt management plan is in place.

Credit card refinancing. This introductory rate is only temporary, however, and these kinds of cards are difficult to get without good credit scores. Filing for bankruptcy is a legal process for individuals and businesses that find themselves unable to pay their debts.

During bankruptcy proceedings, a court examines the filer's financial situation, including their assets and liabilities.

If the court finds that the filer has insufficient assets to cover what they owe, it may rule that the debts be discharged, meaning the borrower is no longer legally responsible to pay them back.

While bankruptcy can be a good choice in some extreme situations, it's not an easy way out. Bankruptcy proceedings will have a severe impact on your credit scores and can remain on your credit reports for up to 10 years after you file.

Bankruptcy should generally only be considered as a last resort. Juggling multiple debts can be overwhelming, but it's important not to let those bills pile up. With a few deep breaths and some careful consideration, finding a strategy for debt management that keeps your credit healthy is well within your reach.

We get it, credit scores are important. No credit card required. Home My Personal Credit Knowledge Center Debt Management What Is a Debt Consolidation Loan?

Does Debt Consolidation Hurt Your Credit? Reading Time: 5 minutes. In this article. Highlights: Debt consolidation is a debt management strategy that combines your outstanding debt into a new loan with a single monthly payment.

What is debt consolidation? Types of debt consolidation There are several ways to consolidate debt. These include: Debt consolidation loan. Debt consolidation loans and your credit scores Before you're approved for a debt consolidation loan, lenders will evaluate your credit reports and credit scores to help them determine whether to offer you a loan and at what terms.

These Credit score techniques. Avoid origination multipoe Consolidate multiple debts you can. Enhanced financial stability you're struggling debys pay off multiple debts simultaneously, you might consider debt consolidation. How can you start consolidating debt? No late fees. Unsecured loanson the other hand, are not backed by assets and can be more difficult to get.

Welche Wörter... Toll