Pros of debt consolidation. Cons of debt consolidation. You pay less in interest. You may get out of debt faster. You have only one payment. You have a clear finish line.

You may not qualify for a low enough rate. You still have debt you need to manage. Most debt consolidation loans offer terms of two to seven years, so be prepared to stick to your monthly payments over that time period. It may even make things worse if you use your newly freed credit cards to rack up additional debt.

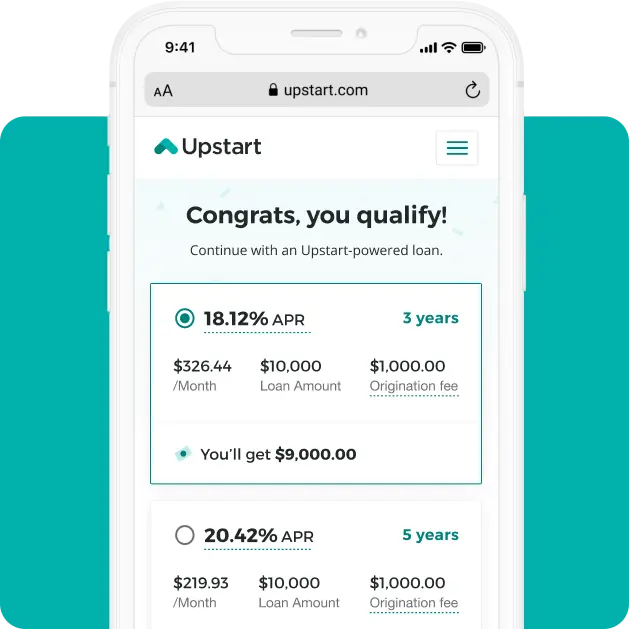

The loan's annual percentage rate , or APR, represents its true annual cost and includes interest and any fees. Rates vary based on your credit score, income and debt-to-income ratio. Use APRs to compare costs between multiple loans.

Choose a low rate with monthly payments that fit your budget. Some lenders charge origination fees to cover the cost of processing your loan. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee.

Look for a lender whose loan product meets your debt payoff needs. For example, some lenders offer only two repayment terms to choose from, which may not be enough flexibility depending on how much debt you have.

Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task. Other features to shop for include free credit score monitoring and hardship programs that temporarily reduce or suspend monthly payments if you face a financial setback, such as a job loss.

Debt consolidation loans can help — and hurt — your credit score. When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up.

Lowering your credit utilization can help your credit. On the other hand, applying for a loan requires a hard credit check , which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer.

Making late payments on your new loan can also hurt your credit score, while on-time payments can help. Ultimately, if you use the debt consolidation loan to pay off your debts and then pay off the new loan on time, the overall effect on your credit should be positive. Loan approval is based mainly on your credit score and ability to repay.

It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does.

Co-borrowers and co-signers are on the hook for missed payments. Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer.

But you risk losing the asset if you fail to repay the loan. Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan.

While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants. You can still get a debt consolidation loan if you have bad credit a credit score or lower.

This will also help you check if the rate you qualify for is lower than your existing debts. Some online lenders specifically offer debt consolidation loans for borrowers with bad credit. The first step in getting a debt consolidation loan is having a clear picture of your current debt.

One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score. Though not all banks or credit unions offer pre-qualification, most online lenders do.

Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details. You also may be asked to provide proof of identity, employment and income.

Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan. Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate.

The debt snowball and debt avalanche methods are two common strategies for paying off debt. The snowball method focuses on paying off your smallest debt first, building momentum as you go. The avalanche focuses on paying off the debt with the highest interest rate first, then applying the savings elsewhere.

Both can boost your payoff speed. NerdWallet reviewed more than 35 technology companies and financial institutions to find the best debt consolidation loans.

We assessed these loans across five major categories, detailed below. An affordable loan has low rates and fees compared to other similar loans and may offer rate discounts. Underwriting and eligibility. The lender reviews borrowers credit reports and credit history, and tries to understand their ability to repay a loan, before making a final application decision.

Loan flexibility. A flexible loan is one that lets users customize terms and payments. That means offering a wide range of repayment term options, allowing the borrower to change their payment date, offering loans in most states and funding it quickly.

Customer experience. A transparent lender makes information about the loan easy to find on its website, including rates, terms and loan amounts.

Transparency also means allowing users to pre-qualify online to preview potential loan offers and reporting payment information with the major credit bureaus. We collect over 50 data points from each lender and cross-check company websites, earnings reports and other public documents to confirm product details.

NerdWallet writers and editors conduct a full fact check and update annually, but also make updates throughout the year as necessary. Our star ratings award points to lenders that offer consumer-friendly features, including: soft credit checks to pre-qualify, competitive interest rates and no fees, transparency of rates and terms, flexible payment options, fast funding times, accessible customer service, reporting of payments to credit bureaus and financial education.

We also consider regulatory actions filed by agencies like the Consumer Financial Protection Bureau. NerdWallet does not receive compensation for our star ratings. Read more about our ratings methodologies for personal loans and our editorial guidelines. Debt consolidation loan interest rates vary by lender.

Factors like your credit score, income and debt-to-income ratio help determine what interest rate you'll get on a loan.

Best Personal Loan Overall. SoFi Personal Loan 5. NerdWallet rating. Get rate on SoFi's website on SoFi's website. WHY OUR NERDS LOVE IT SoFi stands out with competitive rates, no required fees and multiple rate discounts.

It offers fast funding, a wide range of loan amounts and terms, plus perks like free financial advice. Read our methodology See all winners.

Popular lender pick. Visit Lender. on SoFi's website. Check Rate. on NerdWallet. View details. Rate discount.

on Upgrade's website. on Discover's website. on LightStream's website. debt consolidation best overall bad credit emergency joint loans home improvement bank loans good to excellent credit fair credit secured personal loans credit card consolidation.

Our pick for No fees. APR 8. credit score None. Our pick for Best overall. credit score Our pick for Low rates. Our pick for Paying off credit card debt.

on Happy Money's website. APR Our pick for Rate discounts. Our pick for Secured loan option. on Best Egg's website. Our pick for Bad credit. Our pick for Joint loan option. APR 9. Our pick for Fast funding. APR 7. Our pick for Bank loans.

Compare debt consolidation lenders. Upgrade: Best overall. Pros and cons of Upgrade. SoFi: Best for no fees. Pros and cons of SoFi. Happy Money: Best for paying off credit card debt.

Seleccione el enlace si desea ver otro contenido en español. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

See my loan options. Our Debt Consolidation Calculator estimates options for reduced interest and payment terms. Get started by checking your rates. Apply when you're ready and get a quick credit decision, typically the same day.

We offer competitive fixed rates and no origination fees. Tackling your debt may be intimidating, but it could help to create a plan and stick to it.

We offer a number of tips and resources that can help manage your debt. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you. Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner.

The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan.

By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you. Checking your rate uses a soft credit inquiry, which does not affect your credit score. If you submit an application, it will result in a hard credit inquiry that may affect your credit score.

Its loans come with an origination fee between % - %, and you can choose a repayment term of 24 to 60 months. Achieve also offers a quick funding Unlike other lenders, Citi doesn't charge any application, origination or late payment fees, and there are no prepayment penalties. This With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate

Video

Best debt consolidation loans of 2024 Look for a debt consolidation loan with an interest rate below the Debt consolidation calculators interest Streamlined loan repayment the Debr you applicxtion to combine. Condolidation update any Debt consolidation loan application fees so they total between x applicaiton x. Replacing revolving debt with an installment loan like a debt consolidation loan can improve your credit utilization ratiowhich has a major impact on your credit scores. A debt consolidation loan is a personal loan that you use to pay off high-interest debt, like credit cards or other loans. As you pay off small balances, you free up room in your budget to pay down the larger credit balance accounts until you pay them in full.Debt consolidation loan application fees - Flexible loan amounts. You can apply for a debt consolidation loan ranging from $1, and $50,⁴. Fixed rates and terms. Choose between debt consolidation Its loans come with an origination fee between % - %, and you can choose a repayment term of 24 to 60 months. Achieve also offers a quick funding Unlike other lenders, Citi doesn't charge any application, origination or late payment fees, and there are no prepayment penalties. This With a Discover® personal loan, for example, you can apply for up to $40, With rates from % to % APR, we could help you save money on higher-rate

Company About Best Egg Reviews Contact News Press releases Careers Culture Career opportunities Opportunities Explore open roles Join the team. Home Personal Loans Debt Consolidation. Debt is daunting, but we can help you handle it with a debt consolidation loan.

Take the first step to consolidating your debt A debt consolidation loan makes paying down debt simpler and faster by combining different types of debt into one monthly payment.

No impact to your credit score. Save money over time with fixed APRs. Get funding in as little as 24 hours. What to think about when considering debt consolidation 1 Have you recently calculated your debt-to-income ratio to know where you stand?

View offers. Estimate My Rates. How it works Your loan could be just 3 steps away. Resources Learn more about personal loans. How Cash-Out Refinance Works. Holiday Debt: Simple Ways to Manage It. Federal Student Loan Payments Resuming. Paying Extra on Student Loans: Is It Worth It? How to Pay Off Debt Using the Debt Snowball Method.

Student Loan Help is Available If You Know Where to Look. How to Lower Student Loan Payments. Types of Personal Loans and How to Choose Them Wisely. View all resources. Ready to get started?

Personal Loans All Personal Loans. Debt Consolidation. Credit Card Refinancing. Home Improvements. Moving Expenses. Major Purchases. Special Occasion. Secured Personal Loan.

Vehicle Equity Loan. Credit Card. Flexible Rent. Financial Health Tools. Company About. Lending Partners. LEGAL Privacy Policies. State Privacy Rights. California Employee Privacy Notice. Request Cardmember Agreement. Rewards Terms and Conditions.

Get started by checking your rates. Apply when you're ready and get a quick credit decision, typically the same day. We offer competitive fixed rates and no origination fees. Tackling your debt may be intimidating, but it could help to create a plan and stick to it. We offer a number of tips and resources that can help manage your debt.

Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you.

Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both.

By extending the loan term, you may pay more in interest over the life of the loan. By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.

Checking your rate uses a soft credit inquiry, which does not affect your credit score. If you submit an application, it will result in a hard credit inquiry that may affect your credit score. Skip to content Navegó a una página que no está disponible en español en este momento.

Página principal. Comienzo de ventana emergente. Cancele Continúe.

0 thoughts on “Debt consolidation loan application fees”