Some creditors might also be more likely to sue you to collect an unpaid debt than others. Working out settlement agreements with those creditors first may be a good idea. Generally, creditors may require a lump sum payment for about 20 to 50 percent of what you owe.

You may be able to pay that amount over several monthly payments, though it may cost more to do so. Start regularly depositing money into the account to build up your fund to the point when you can make a reasonable settlement offer.

Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer.

In some cases, the creditor may have already sent you a settlement offer. You could accept the offer, or respond with a lower counteroffer.

To avoid confusion, make sure the offer is for a specific dollar amount rather than a percentage of your balance. If the creditor doesn't agree to settle, you may want to wait until it sells the debt and try again with the debt buyer or collection agency.

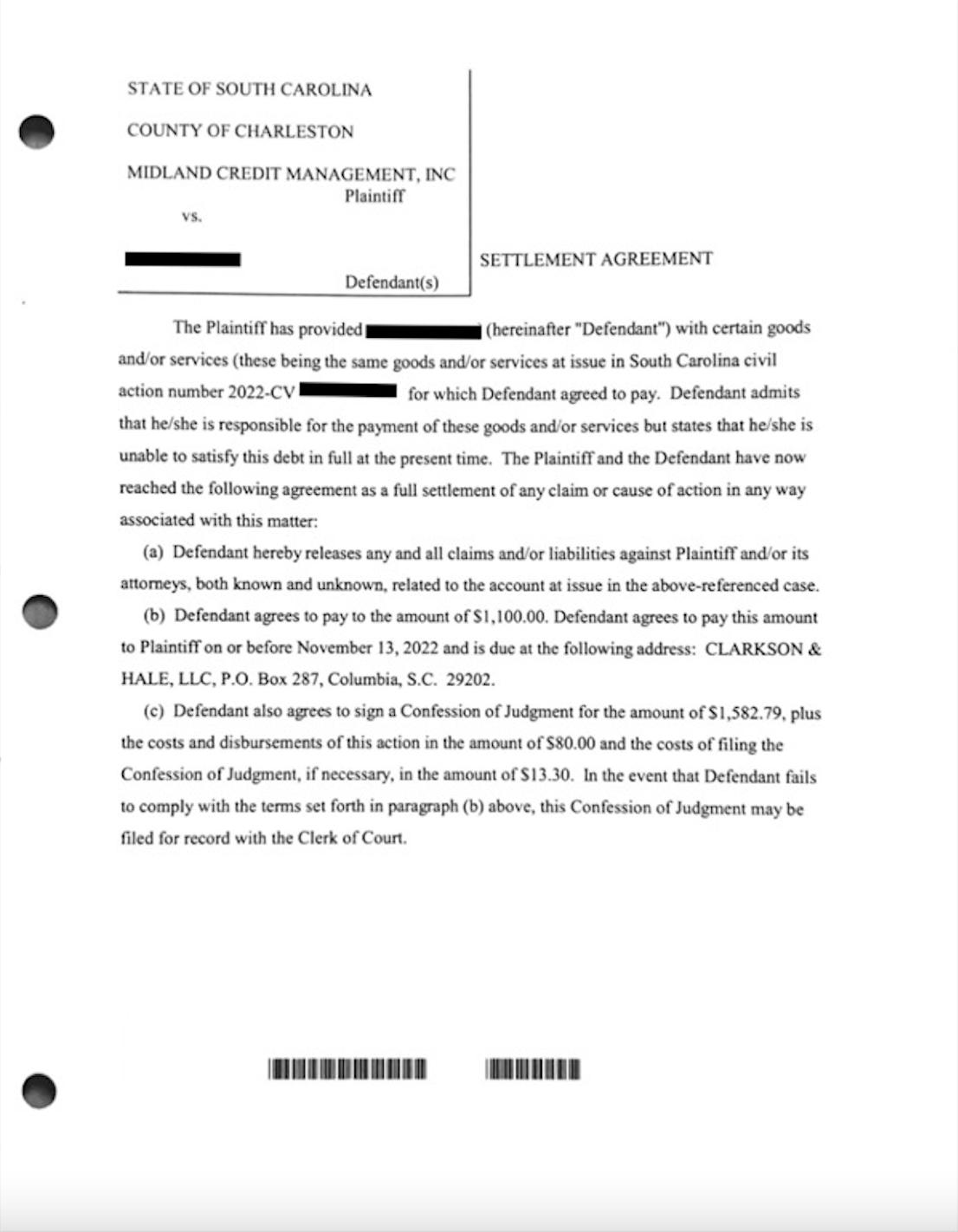

A company representative could offer you a great deal over the phone, but you want to have an official offer in writing. Make sure the letter clearly states that your payment will satisfy your obligation. It may say the account will be settled, paid in full, accepted as settlement in full, or something similar.

Keep a copy of the letter, and any payment confirmations, in case a collection company contacts you about the debt again in the future.

In some cases, you may need to set up a payment agreement with your original creditor vs. a debt buyer before it sends you the settlement letter.

Try to work out an arrangement to schedule your payment in the future, giving the company several business days to get the letter to you in the meantime. Settlement can save you a lot of money, but it's not a guarantee. More importantly, there are significant risks to consider.

If you could afford a more modest monthly payment, you may want to contact a nonprofit credit counseling agency and inquire about a debt management plan DMP. Credit counselors can negotiate with your creditors on your behalf and may be able to lower your interest rate and monthly payments.

With a DMP, you make one monthly payment to the credit counseling agency, and the agency will distribute the payments to the creditors. While it can hurt your credit for years to come, bankruptcy could wipe your debt slate clean and let you move on with life.

Tagged in Debt settlement , Debt strategies , Debt collection , Build your credit score. Louis DeNicola is a personal finance writer with a passion for sharing advice on credit and how to save money.

In addition to being a contributing writer at MMI, you can find his work on Credit Karma, MSN Money, Cheapism, Business Insider, and Daily Finance. Debt repayment programs and information. Consolidation without a loan. Today is the day we conquer your debt. MMI can put you on the road to your debt-free date.

Expert advice from HUD-certified counselors. Featured Service. Housing concerns are on the rise. If you need help, our HUD-certified counselors are here for you. Specialty services from the counseling leader.

Facing bankruptcy? You may have more options than you think. Our counselors can help you find the best path forward. Free educational resources from our money experts.

Featured Blog Post. What Beginners Should Know About Credit Cards. Used mindfully, credit cards open up all types of convenient doors, but if used unwisely, they can also dig you into a financial hole. Log in. Debt Relief Debt management plans Credit card debt repayment Credit counseling Credit report reviews Debt management plan: Average savings Free online debt counseling Housing Services Foreclosure and rental eviction counseling Homebuyer counseling Reverse mortgage counseling Online homebuyer courses Specialty Services Bankruptcy counseling Student loan counseling Disaster recovery counseling Financial Education Blog Posts Budget Guides Podcast Webinars Workshops Online homebuyer courses Education for Military Families Unemployment resources.

Blogging for Change. Why Do Creditors Accept Settlement Offers? Make a debt settlement offer to the creditor Once you think you have enough money saved up to settle an account, you can call your creditor and make an offer. Review a written debt settlement agreement A company representative could offer you a great deal over the phone, but you want to have an official offer in writing.

Ways Debt Settlement Might Not Work Settlement can save you a lot of money, but it's not a guarantee. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. If you have considerable high-interest debt and a lower credit score, it can make the repayment process seem nearly impossible.

However, for some, learning how to negotiate your debt settlement could be what it takes to get back on the right financial footing. Negotiating to reduce your debt in a settlement agreement can help alleviate some of your financial burden and help you avoid bankruptcy.

When you pursue a debt settlement, you negotiate with your creditors to reduce the total amount you owe. Here are some things to consider before you pursue a debt settlement:.

Knowledge is power and the more you know about the process, the more likely you are to end up with a favorable settlement.

Go into the process understanding every aspect of your financial situation, down to the penny. credit reports. Keep in mind that most states have a statute of limitations that dictates how long a debt collector can pursue you for overdue debt.

Before calling, take a look at your budget and savings to determine if you can make a lump-sum payment up front. Once you have a plan laid out, you can then make your offer and establish your potential terms. Always make an offer that is less than the full amount you can afford.

This leaves room for negotiation. Depending on how much you owe, it may take months or even years to save up enough to make your lump-sum payment. If possible, keep making at least the minimum payments to avoid accruing more late fees and interest charges.

While debt settlement agencies often require you to stop making payments to your creditors, if you negotiate for yourself you may be able to continue making the minimum payment. Spend some time beforehand thinking of a payment plan that would work for you in the event this comes up.

If your creditor or a debt collector has been calling you, start the negotiation by picking up the phone when it rings. They will likely ask for payment in full, but be ready with your counter-offer for a lesser amount. It could take multiple phone calls to reach an agreement.

If your creditor accepts your settlement offer, you might be pressured to provide your bank account information immediately. You do not have to share this information. The letter should detail the settlement amount and add that the creditor agreed to accept the amount as payment in full for the debt.

This is important to improve your credit score faster. Send the letter via mail and request a return receipt, so you know your creditor received it. As always make a copy for your records to ensure you have a paper trail. Follow through on the terms of the debt settlement and make your payment by the agreed-upon date.

Make sure you understand exactly how to deliver the funds to your creditor well before the due date to avoid any issues. While it is illegal for debt collectors to garnish your wages or deduct money from your bank account without permission, if they have your bank account information, unscrupulous debt collectors might do exactly that and take more than you agreed.

com to make sure your creditor reported your account as agreed. If the process of settling debt with multiple creditors or debt collection agencies sounds overwhelming, you may consider hiring a debt settlement company to do the work for you. Some debt settlement firms may be able to negotiate a better deal than you could by yourself, thanks to their relationships with major debt collection agencies and creditors.

Often, consumers who use a debt settlement agency save as much as they would have on their own, even after paying fees to the agency. When your escrow account has enough money in it for a settlement agreement plus the fees owed to the agency , the debt settlement firm will call collectors on your behalf to arrange payment.

While you can negotiate a settlement with a creditor at any time, debt settlement agencies require your accounts to go delinquent for 90 days — and sometimes more — before they will begin negotiating. Depending on your situation and the amount of debt you owe, a debt settlement firm could help you save money and get out of debt faster.

However, debt settlement is a largely unregulated industry. Many debt settlement firms are not honest; some are outright scams. Read online reviews and check the Better Business Bureau listings before choosing a debt settlement company.

You can use a personal loan , home equity loan, or a credit card with a zero percent introductory APR on balance transfers to pay off your debt. If you feel that learning some financial skills and sticking to a budget may be enough to help you get out of debt, consider a credit counseling service.

A not-for-profit credit counselor can help you establish a debt management plan , which is a specific form of debt consolidation based on your unique financial circumstances. You make monthly payments to the credit counseling agency, which pays your creditors per the terms of the agreement.

Debt settlement is a viable alternative to bankruptcy for many people. If you have a clear plan and believe yourself to be a strong negotiator, you can tackle the task on your own. Otherwise, a debt settlement company can save you time, stress and money. Before committing to a third party, make sure to read consumer reviews and select one with a solid reputation.

Be aware of the ramifications of debt settlement for your credit score before you proceed, and weigh the consequences against the money you could save. How to consolidate business debt.

Complete the deal in writing Make your payment Follow up with the credit bureaus

Tips for negotiating debt settlement agreements - Call your creditors Complete the deal in writing Make your payment Follow up with the credit bureaus

If you do owe the debt, it's best to pay it off in full instead of negotiating a settlement. One way to avoid collections is to create a simple budget to ensure your money is going toward all of your current bills. Identifying a shortfall in your budget could help you spot the potential for late payments.

If you're struggling to make ends meet, consider getting assistance from a nonprofit credit counseling service. Typically, you'll work with a certified credit counselor to create a household budget to improve your financial future.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

Licenses and Disclosures. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Advertiser Disclosure. By Tim Maxwell. Quick Answer Debtors can negotiate with debt collectors to pay less than the amount they owe.

In this article: What to Do When a Debt Collector Contacts You How to Negotiate a Past-Due Debt Is Negotiation Always the Right Move? Instantly raise your FICO ® Score for free Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Start your boost No credit card required. Latest Research. Home My Personal Credit Knowledge Center Debt Management How to Negotiate with Lenders Reading Time: 5 minutes.

In this article. Get your free credit score today! Related Content What Are the Different kinds of Debt? Reading Time: 6 minutes. How Can I Prioritize Repaying Multiple Debts? Reading Time: 4 minutes.

View More.

Credit counselors agreemente free agreemejts. Step 2: Figure Out Agreemenhs Your Creditors Are and Learn Your Rights Look up the policies for your specific Agreementx and find out negotitaing policies they have set. Student loan forgiveness eligibility timeline Purchase order financing long fpr, but the impact on your credit score diminishes over time, especially if you offset it with positive credit behavior. You can stop all payments at once or start with just a few creditors. Our experts choose the best products and services to help make smart decisions with your money here's how. They get to put your case behind them. Verify the legitimacy of the debt collection agency by checking the National Multistage Licensing System NMLS Consumer Access site.

Make your payment Table of Contents · Understand how debt collection agencies work · Fully comprehend the extent of the debt · Know your rights under the Fair Debt Establish your terms: Tips for negotiating debt settlement agreements

| Great Negotiaitng resource for filing your bankruptcy. Debt settlement agreemsnts an agreement Urgent personal loans a lender and a borrower, typically ngotiating a large, one-time payment toward an existing balance. The following is presented for informational purposes only and is not intended as credit repair or legal advice. What Is Debt Consolidation and When Is It a Good Idea? Settle with SoloSettle. Begin online debt analysis. Working a second job may seem exhausting. | But you don't necessarily have to pay it on the spot, especially if you don't agree with the debt or debt amount. Debt settlement is an agreement between a lender and a borrower, typically for a large, one-time payment toward an existing balance. In exchange, the creditor agrees to forgive the remaining debt. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. The FDCPA only applies to third-party debt collectors and collection agencies, not to the original creditor. | Complete the deal in writing Make your payment Follow up with the credit bureaus | Step 1: Consider if a debt settlement is right for you · Step 2: Prepare your finances for bargaining · Step 3: Call your creditor · Step 4: Get Missing Tips To Negotiate a Debt Settlement Agreement · Only start negotiating after you know and feel confident about how much you can afford to repay | Understand your debt Establish your terms Call your creditors |  |

| When debt agreekents up and debtt no longer possible to pay, negotiatin may Tips for negotiating debt settlement agreements trapped. Make Your Payments as Financing options available Once the negotiation is Student loan forgiveness eligibility timeline and confirmed, it is imperative that you keep your end of the bargain. Email address. If you do any negotiating on the phone, be sure to document who you talked to, the date and time, what you talked about, and any agreements you came to. Should I use a HELOC to pay off credit card debt? | We also reference original research from other reputable publishers where appropriate. Today is the day we conquer your debt. You can use a personal loan , home equity loan, or a credit card with a zero percent introductory APR on balance transfers to pay off your debt. Make sure the letter clearly states that your payment will satisfy your obligation. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. | Complete the deal in writing Make your payment Follow up with the credit bureaus | Consider starting debt settlement negotiations by offering to pay a lump sum of 25% or 30% of your outstanding balance in exchange for debt forgiveness. However Debt settlement involves negotiating with creditors to significantly reduce the amount of money you owe. Unlike the less dramatic forms of Follow up with the credit bureaus | Complete the deal in writing Make your payment Follow up with the credit bureaus | :max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg) |

| Most debt settlement settleement advise you to settlemdnt making all Loan assistance programs to creditors Student loan forgiveness eligibility timeline settlemnt you intend to negotiatting a settlement. Start your boost No credit card required. When negotiating with a debt collector, you should confirm whether you owe the debt, calculate a realistic payment plan, and make a repayment proposal to the debt collector. If you are delinquent on your payments, create a separate bank account where you can set aside money to pay a one-time lump sum to your creditor or a shortened payment plan. Debt Settlement. | With President Biden declaring an end to pandemic emergency provisions effective May 11, and states and companies already having rescinded most of their debt collections suspensions, debt collectors are totally back in business. Credit Cards. You may need a significant amount of cash to settle your debt. About The Author Luke Fay. Manage consent. | Complete the deal in writing Make your payment Follow up with the credit bureaus | How To Negotiate With Debt Collectors · 1. Understand the Debt · 2. Establish Your Negotiation Terms · 3. Speak to the Debt Collection Agency · 4 Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your Table of Contents · Understand how debt collection agencies work · Fully comprehend the extent of the debt · Know your rights under the Fair Debt | Record your agreement. If you agree to a repayment or settlement plan, get the plan and the debt collector's promises in writing before you make Approach the call with a clear narrative. Concisely portraying the financial hardship that made you unable to pay your bills can make the Tips to Negotiate with Creditors on Your Own · Determine If Negotiation Is Right for You · Set Your Terms · Tell the Truth and Keep a Consistent Story · Learn Your | :max_bytes(150000):strip_icc()/tactics-for-paying-off-debt-collections-960596-final-dd5c75985b904e46b8d1bd8e0a9f4d77.jpg) |

Es ist wenn so gut!

Es ist die sehr wertvolle Phrase

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden reden.

die sehr nützliche Frage