Credits are a rebate you receive to help cover closing costs, resulting in a higher interest rate. This is the amount you pay toward the principal and interest on a monthly basis.

For a fixed loan, this payment will stay the same throughout the life of the loan. This is the amount you end up paying over the life of the loan — it takes into account the initial amount you borrowed, as well as the interest. It can be overwhelming to evaluate your home loan options, but it doesn't have to be.

As it turns out, there are a few important numbers you can focus on first. Our loan comparison calculator takes into account the length of a loan, as well as the interest rate, loan amount, and whether you'll have points or credits.

Once you've decided to go with a fixed rate instead of an adjustable one, you'll want to start to consider all of those details. We're here to help them make a little more sense along the way. First up, you'll want to think about the term. In other words, would you like to make smaller payments over a longer amount of time?

Or would you prefer to make larger payments, but over a shorter period of time? The loan amount could vary too, based on how much of your assets you're willing to use for a down payment.

Trying out both options show you how much you save each month, as well as over time, so it's easier to weigh the benefits. Some of the most confusing factors you'll tackle when you're comparing loan options are the interest rate and points and credits.

Luckily, they're closely connected to one another. Once you understand that relationship, they're easier to compare. Basically, most loan options will have the option of either points or credits, and that has an effect on the interest rate that's available to you. When you choose a loan option with points, you're opting to pay more upfront at closing in exchange for a lower interest rate.

So while your costs are higher at first, you may notice you pay less in interest over the life of the loan. On the other hand, choosing a loan option with credits means you'll save some money upfront on closing costs in exchange for a higher interest rate. This is a great option if you're hoping to keep costs lower at first, but it does cost more over time.

All of these factors work together, so it's best to compare their effects over time by using a tool like our calculator that stacks them against each other.

At the end of the day, a major question you'll need to tackle is: how long do you plan to stay in your new home? For example, if you plan to sell or refinance before your break-even period the point at which both loan options cost the same , you'll want to choose the loan option that costs less in the short term.

However, if you plan to stay in that home for the life of the loan, you might care a little less about the short-term costs, and instead you will want to pay more attention to how the costs shift after that break-even period. In other words, which loan option costs less during the time you'll be living in the home, or before you refinance?

If you're comparing drastically different fixed-rate loan options — with varying terms and amounts, for example — you may not have a break-even period at all. In those cases, you'll also want to think about how long you plan to stay in the home, as well as which option is more financially feasible for you.

The mortgage you choose today will impact your finances for years to come. It will determine your upfront expenses, monthly payments, and long-term costs. Our fixed-rate loan comparison calculator will crunch the numbers for you so that you can choose the right home loan for your needs.

Mortgages come in all shapes and sizes. Your loan term, interest rate, and points or credits will significantly affect your monthly mortgage and long-term costs. Your loan term is the length of your mortgage. Common fixed-rate mortgages include , , or year terms.

On the other hand, a longer-term may provide you with a more affordable monthly mortgage. A mortgage comparison calculator can help you determine how each home loan may fit into your budget now and in the future.

Your mortgage interest rate is the amount you pay a lender for providing you the money to buy your home. Your credit score tells lenders how risky it might be to issue you a mortgage.

A higher score indicates that you have a good history of paying back your debts on time. This will qualify you for a lower interest rate because it shows you're likely less of a risk to lenders.

To reduce your loan-to-value ratio and possibly your rate , consider making a larger down payment or purchasing a less expensive home.

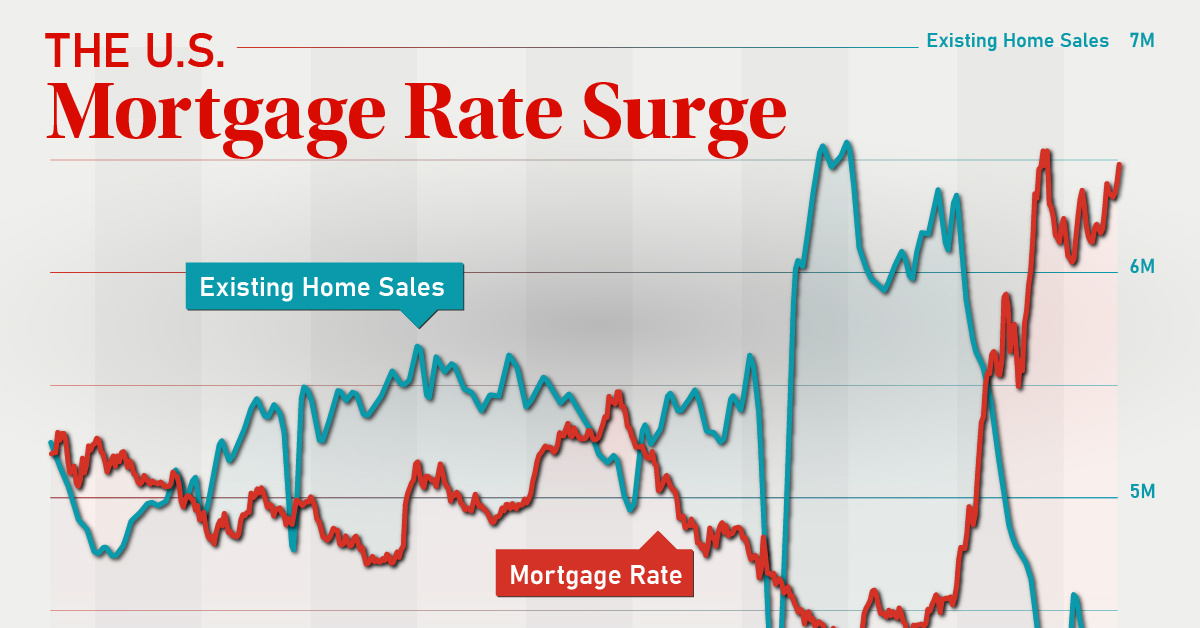

Economic factors, such as U. economic growth, monetary policy, the bond market, housing market conditions, and inflation can all affect rates.

Learn more about how the economy impacts rates here. A calculator simplifies the process and shows you what each home loan will cost you upfront, every month, and over time. This helps you see how a particular mortgage would fit into your financial picture at different points.

The sum you borrow to cover the sale price of your new home is different from the lifetime cost of your mortgage. That's because your lifetime loan amount includes the principal the amount to cover the home purchase , interest what you pay the lender , and points or credits which help you save money at closing or in interest.

A loan comparison calculator considers all of these expenses and can help you understand your total cost to become a homeowner. This is important because it can help you determine which loan makes the most sense based on your plans.

In this case, you should select the best option for your financial situation. However, having a visual that shares how different mortgages affect your short- and long-term costs can help you narrow down the right option.

Disclaimer: This home affordability calculator is made for illustrative purposes only. Accuracy is not guaranteed. Current mortgage rates. Rates on some of the most popular types of mortgages ticked up slightly as of Feb.

The average rate on a year fixed mortgage rose to 6. The year rate has held steady in the upper-6 percent range since December, after the Federal Reserve opted not to hike rates and instead pointed to cuts.

The central bank again held rates steady at its Jan. While the Fed doesn't directly set mortgage rates, its monetary policies do influence their direction.

Fixed mortgage rates move with the year Treasury yield, while adjustable-rate loans more closely follow the Fed. Mortgage rates spiked after the January employment [report] showed strength in the headline number of jobs created. For the coming week, I think rates will stay in their current range.

Mortgage rates will be flat this week after rising at the end of last week due to the much stronger-than-expected jobs report. With no market-moving data and just a slew of Fed speak, there is little to make rates move in any direction this week.

Next week will be a different story with CPI, PPI and Retail sales reporting for the month of January! Associate Professor of Finance and Dale Carnegie Trainer, Middle Tennessee State University , Murfreesboro , TN. Until that time, I predict that rates will remain in the current range.

Learn more: Weekly mortgage rate trend predictions. However, the Fed does set the overall tone for borrowing costs. To sum up: The Fed does not directly set mortgage rates, but its policies influence the financial markets and investors that dictate how these rates move.

Learn more about how the Federal Reserve affects mortgage rates. The difference between APR and interest rate is that the APR, or annual percentage rate, represents the total cost of the loan, including the interest rate and all fees and points.

The interest rate is the amount of interest the lender will charge you for the loan, not including any of the other costs. Getting the best possible rate on your mortgage can mean a difference of hundreds of extra dollars in or out of your budget each month — not to mention thousands saved in interest over the life of the loan.

Learn more: How to get a mortgage. Mortgage rates and fees can vary widely across lenders. To help you find the right one for your needs, use this tool to compare lenders based on a variety of factors. Bankrate has reviewed and partners with these lenders, and the two lenders shown first have the highest combined Bankrate Score and customer ratings.

You can use the drop downs to explore beyond these lenders and find the best option for you. Garden State Home Loans. NMLS: State License: MB Bankrate scores are objectively determined by our editorial team. Our scoring formula weighs several factors consumers should consider when choosing financial products and services.

Conventional, jumbo, FHA, VA, USDA, refinancing and more. Connecticut, Delaware, Florida, Maryland, Massachusetts, Michigan, New Hampshire, New Jersey, New York, Pennsylvania, Tennessee, Texas and Virginia.

State License: Homefinity is an imprint of Fairway Independent Mortgage, one of the top five mortgage lenders in the U. It offers many of the perks of an online lender, including up-to-the-minute rates and calculators to help you estimate your homebuying budget, refinance savings and more.

It employs a smaller team of loan officers, but one that promises a fast, convenient process. All U. states except Nevada and New York. These variables include:. Mortgage points , also referred to as discount points, help homebuyers reduce their monthly mortgage payments and interest rates.

A mortgage point is most often paid before the start of the loan period, usually during the closing process.

It's a type of prepaid interest made on the loan. Each mortgage point typically lowers an interest rate by 0. For example, one point would lower a mortgage rate of 6 percent to 5.

The cost of a point depends on the value of the borrowed money, but it's generally 1 percent of the total amount borrowed to buy the home. Buying points upfront can help you save money in interest over the life of your loan, but doing so also raises your closing costs.

It can make sense for buyers with more disposable cash, but if high closing costs will prevent you from securing your loan, buying points might not be the right move. A mortgage rate lock freezes the interest rate while you shop for a home. The lender guarantees with a few exceptions that the mortgage rate offered to a borrower will remain available to that borrower for a stated period of time.

Most lenders offer a to day rate lock free of charge. This means if the interest rate increases before your loan closes, you get the stated rate. Although some lenders offer a free rate lock for a specified period, after that period they might charge fees for extending the lock.

A mortgage is a loan from a bank or other financial institution that helps a borrower purchase a home. The collateral for the mortgage is the home itself. A mortgage loan is typically a long-term debt taken out for 30, 20 or 15 years. Closing costs also include third-party fees like the cost of an appraisal and title insurance.

Depending on your needs, the best mortgage lenders are often the ones that offer the most competitive rates and fees, stellar customer service and convenience. Compare refinance rates and do the math with Bankrate's refinance calculator.

Before joining Bankrate in , he wrote about real estate and the economy for the Palm Beach Post and the South Florida Business Journal. Read more from Jeff Ostrowski.

Greg McBride, CFA, is Senior Vice President, Chief Financial Analyst, for Bankrate. He leads a team responsible for researching financial products, providing analysis, and advice on personal finance to a vast consumer audience.

Read more from Greg McBride. get 'disablePre' { document. getElementById 'skip-and-show-rates'. Jeff Ostrowski. Written by Jeff Ostrowski Arrow Right Principal writer, Home Lending. Greg McBride, CFA. Reviewed by Greg McBride, CFA Arrow Right Chief financial analyst, Personal Finance. Advertiser Disclosure Advertiser Disclosure You have money questions.

Bankrate has answers. curved background image. I'm just browsing. What type of loan are you looking for? Select a lender Get custom quotes in under 2 minutes.

See your savings You could take hundreds off your mortgage. On this page On this page. Mortgage industry insights How to get the best mortgage for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

ON THIS PAGE Mortgage industry insights How to get the best mortgage for you Compare mortgage lenders side by side Factors that determine your mortgage rate Mortgage FAQ How to refinance your current mortgage.

ON THIS PAGE Jump to Menu List. COMPARE Top offers on Bankrate vs. the national average interest rate Info Hover for more. APRs not included.

For our most recent APR information, please visit our rate table. Purchase Refinance. How our rates are calculated The national average is calculated by averaging interest rate information provided by plus lenders nationwide.

Compare the national average versus top offers on Bankrate to see how much you can save when shopping on Bankrate.

Bankrate top offers represent the weekly average interest rate among top offers within our rate table for the loan type and term selected. Use our rate table to view personalized rates from our nationwide marketplace of lenders on Bankrate.

See today's mortgage rates Arrow Right. Top offers on Bankrate: 6. National average: 7. Invest Rate. Today's national mortgage interest rate trends On Monday, February 12, , the current average interest rate for the benchmark year fixed mortgage is 7.

Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for

Video

How Principal \u0026 Interest Are Applied In Loan Payments - Explained With ExampleExisting interest rate comparison - Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for

Online Investing with J. Chase for Business. Commercial Banking. See all. CONNECT WITH CHASE. About Chase J. Media Center Careers Chase Canada SAFE Act: Chase Mortgage Loan Originators Fair Lending. Please turn on JavaScript in your browser It appears your web browser is not using JavaScript.

Current Mortgage Rates Get preapproved. Mortgage Rates FAQs. How are mortgage rates determined? Does my credit score affect my mortgage rate? What is the difference between interest rate and APR on a mortgage?

Interest rates and annual percentage rates APR are two different ways of expressing the fees a borrower incurs when taking out a mortgage: 1. How often do mortgage rates change? What is a mortgage rate lock? Take the first step and get preapproved.

Ready to apply? Get preapproved. Come in. Learn about mortgage rates. Mortgage rates resources. Mortgage interest rate vs. How to buy a home - Initial steps. Affordable down payment options. How to use a mortgage calculator. What do you need help with?

Financing a home purchase. Refinancing a mortgage. Helpful tools. Affordable lending Jumbo Mortgage Mortgage dictionary Frequently asked questions Education center Video library.

Start of overlay Chase Survey Your feedback is important to us. No Yes. The lenders in our data include a mix of large banks, regional banks, and credit unions. The data is updated semiweekly every Wednesday and Friday at 7 a.

In the event of a holiday, data will be refreshed on the next available business day. The data is provided by Curinos , New York, NY. Skip to main content. This tool is not supported in your browser. Please try a newer browser or confirm that JavaScript is enabled.

Explore interest rates Use this tool throughout your homebuying process to explore the range of mortgage interest rates you can expect to receive.

Share this. Explore rate options Credit score range Many lenders do not accept borrowers with credit scores less than Even if your score is low, you may still have options. Contact a housing counselor to learn more.

Choose your state Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming.

Your down payment cannot be more than your house price. Rate type Fixed Adjustable. Loan term 30 Years 15 Years.

Loan type Conventional FHA VA. While some lenders may offer FHA, VA, or year adjustable-rate mortgages, they are rare.

In , most lenders in our data are offering rates at or below. Also called a non-conforming loan. Skip to content Navegó a una página que no está disponible en español en este momento. Página principal. Comienzo de ventana emergente. Cancele Continúe. Personal Home Mortgage Loans Current Mortgage and Refinance Rates.

Current Mortgage and Refinance Rates. Customized refinance rates Estimate your monthly payments, annual percentage rate APR , and mortgage interest rate to see if refinancing could be the right move.

Still have questions? Quick Help Finish a saved application Check application status Sign on to manage your account Home mortgage faqs Customer help and payment options. Call Us New Loans Mon — Fri: 7 am — 8 pm Sat: 8 am — 6 pm Central Time.

Existing Loans Mon — Fri: 7 am — 10 pm Sat: 8 am — 2 pm Central Time Marque 9 para recibir atención en español. Wells Fargo Home Mortgage is a division of Wells Fargo Bank, N. Annual Percentage Rate APR The cost to borrow money expressed as a yearly percentage.

Existing interest rate comparison - Compare personalized mortgage and refinance rates today from our national marketplace of lenders to find the best current rate for your financial situation Find and compare year mortgage rates and choose your preferred lender. Check rates today to learn more about the latest year mortgage rates View today's mortgage rates and trends on Forbes Advisor. Compare current mortgage rates and APRs to find the loan that best suits your financial situation Compare mortgage interest rates to find the best mortgage rates for your home loan. See current average mortgage rate trends and the forecast for

What Is Conservatorship? Family Trusts CFA vs. CFP Best Financial Planning Software Wealth Managers vs. Financial Advisors Financial Advisor Cost. Personal Loan Calculator Student Loan Calculator Budget Calculator Learn More Withdrawal Limits How to Get a Bank Statement FDIC Insurance.

Calculators Investment Calculator Capital Gains Tax Calculator Inflation Calculator Asset Allocation Calculator Helpful Guides Investing Guide Compare Accounts Brokerage Accounts Learn More What is a Fiduciary? Types of Investments Tax Free Investments. Credit Cards Best Credit Cards Best Credit Cards Helpful Guides Credit Cards Guide Compare Cards What is the Best Credit Card for You?

Life Insurance Calculators How Much Life Insurance Do I Need? Compare Quotes Life Insurance Quotes Helpful Guides Life Insurance Guide Refinance Calculators Refinance Calculator Compare Rates Compare Refinance Rates Helpful Guides Refinance Guide Personal Loans Calculators Personal Loan Calculator Compare Rates Personal Loan Rates Helpful Guides Personal Loans Guide Student Loans Calculators Student Loan Calculator Compare Rates Student Loan Refinance Rates Helpful Guides Student Loans Guide.

I'm an Advisor Find an Advisor. Mortgage Rates Your Details Done. Select Purchase or Refinance Purchase Refinance. Enter your location Do this later Dismiss. Yes No. Target Home Price. Enter target home value. Down Payment. Current Home Value. Enter current home value.

Enter current mortgage balance. Credit Score. Include FHA Loans. Include VA Loans. Single Family Multi Unit Condo Do this later Dismiss.

Refresh My Rates. No mortgages found. Please change your search criteria and try again. Searching for Mortgages About our Mortgage Rate Tables: The above mortgage loan information is provided to, or obtained by, Bankrate.

Some lenders provide their mortgage loan terms to Bankrate for advertising purposes and Bankrate receives compensation from those advertisers our 'Advertisers'. Other lenders' terms are gathered by Bankrate through its own research of available mortgage loan terms and that information is displayed in our rate table for applicable criteria.

In the above table, an Advertiser listing can be identified and distinguished from other listings because it includes a 'Next' button that can be used to click-through to the Advertiser's own website or a phone number for the Advertiser.

Availability of Advertised Terms: Each Advertiser is responsible for the accuracy and availability of its own advertised terms. Bankrate cannot guaranty the accuracy or availability of any loan term shown above. However, Bankrate attempts to verify the accuracy and availability of the advertised terms through its quality assurance process and requires Advertisers to agree to our Terms and Conditions and to adhere to our Quality Control Program.

Click here for rate criteria by loan product. Loan Terms for Bankrate. com Customers: Advertisers may have different loan terms on their own website from those advertised through Bankrate.

To receive the Bankrate. com rate, you must identify yourself to the Advertiser as a Bankrate. com customer. This will typically be done by phone so you should look for the Advertiser's phone number when you click-through to their website.

In addition, credit unions may require membership. You should confirm your terms with the lender for your requested loan amount. Taxes and Insurance Excluded from Loan Terms: The loan terms APR and Payment examples shown above do not include amounts for taxes or insurance premiums.

Your monthly payment amount will be greater if taxes and insurance premiums are included. Consumer Satisfaction: If you have used Bankrate. com and have not received the advertised loan terms or otherwise been dissatisfied with your experience with any Advertiser, we want to hear from you.

Please click here to provide your comments to Bankrate Quality Control. National Mortgage Rates. Source: Freddie Mac Primary Mortgage Market Survey, SmartAsset Research. Mortgage Rate Trends year mortgage rates have increased 1 basis point week over week to 6.

More from SmartAsset How much house can you afford? Calculate your monthly mortgage payment Calculate your closing costs Should you rent or buy? More about this page Learn more about mortgage rates How much house can you afford Calculate monthly mortgage payments Infographic: Best places to get a mortgage.

Share Your Feedback. What is the most important reason for that score? optional Please limit your response to characters or less. A mortgage is set up so you pay off the loan over a specified period called the term. The most popular term is 30 years. Each payment includes a combination of principal and interest, as well as property taxes, and, if needed, mortgage insurance.

Homeowners insurance may be included, or the homeowner may pay the insurer directly. Principal is the original amount of money you borrowed while interest is what you're being charged to borrow the money.

The mortgage rate a lender offers you is determined by a mix of factors that are specific to you and larger forces that are beyond your control. Lenders will have a base rate that takes the big stuff into account and gives them some profit.

They adjust that base rate up or down for individual borrowers depending on perceived risk. If you seem like a safe bet to a lender, you're more likely to be offered a lower interest rate. Factors you can change:.

Your credit score. Mortgage lenders use credit scores to evaluate risk. Higher scores are seen as safer. In other words, the lender is more confident that you'll successfully make your mortgage payments.

Your down payment. Paying a larger percentage of the home's price upfront reduces the amount you're borrowing and makes you seem less risky to lenders. You can calculate your loan-to-value ratio to check this out. Your loan type.

The kind of loan you're applying for can influence the mortgage rate you're offered. For example, jumbo loans tend to have higher interest rates. How you're using the home.

Mortgages for primary residences — a place you're actually going to live — generally get lower interest rates than home loans for vacation properties, second homes or investment properties.

Forces you can't control:. The U. Sure, this means Wall Street, but non-market forces for example, elections can also influence mortgage rates.

Changes in inflation and unemployment rates tend to put pressure on interest rates. The global economy. What's happening around the world will influence U. Global political worries can move mortgage rates lower.

Good news may push rates higher. The Federal Reserve. Decisions made by the Federal Open Market Committee to raise or cut short-term interest rates can sometimes cause lenders to raise or cut mortgage rates. Mortgage rates like the ones you see on this page are sample rates.

In this case, they're the averages of rates from multiple lenders, which are provided to NerdWallet by Zillow. They let you know about where mortgage rates stand today, but they might not reflect the rate you'll be offered.

When you look at an individual lender's website and see mortgage rates, those are also sample rates. Sample rates also sometimes include discount points , which are optional fees borrowers can pay to lower the interest rate. Including discount points will make a lender's rates appear lower.

To see more personalized rates, you'll need to provide some information about you and about the home you want to buy. For example, at the top of this page, you can enter your ZIP code to start comparing rates.

On the next page, you can adjust your approximate credit score, the amount you're looking to spend, your down payment amount and the loan term to see rate quotes that better reflect your individual situation.

Whether you're looking at sample rates on lenders' websites or comparing personalized rates here, you'll notice that interest rates vary. This is one reason why it's important to shop around when you're looking for a mortgage lender.

Fractions of a percentage might not seem like they'd make a big difference, but you aren't just shaving a few bucks off your monthly mortgage payment, you're also lowering the total amount of interest you'll pay over the life of the loan. It's a good idea to apply for mortgage preapproval from at least three lenders.

With a preapproval, the lenders verify some of the details of your finances, so both the rates offered and the amount you're able to borrow will be real numbers.

Each lender will provide you with a Loan Estimate. These standardized forms make it easy to compare interest rates as well as lender fees. When you're comparing rates, you'll usually see two numbers — the interest rate and the APR. The APR, or annual percentage rate , is usually the higher of the two because it takes into account both the interest rate and the other costs associated with the loan like those lender fees.

Because of this, APR is usually considered a more accurate measure of the cost of borrowing. The interest rate is the percentage that the lender charges for borrowing the money. The APR, or annual percentage rate , is supposed to reflect a more accurate cost of borrowing.

The APR calculation includes fees and discount points, along with the interest rate. APR is a tool used to compare loan offers, even if they have different interest rates, fees and discount points. APR takes ongoing costs like mortgage insurance into account, which is why it's usually higher than the interest rate.

Discount points are basically prepaid interest that reduces the interest rate on your mortgage. Buying points is optional. Be on the lookout for them, as a lender may add points to a loan offer to make their interest rate seem more competitive.

It's up to you to decide if paying for points as part of your closing costs is worth it. The impact of a 0. Mortgage rates not only vary from day to day, but hour to hour. In order to know what rate you'll pay, you need the rate you're offered to stop changing.

A mortgage rate lock is the lender's guarantee that you'll pay the agreed-upon interest rate if you close by a certain date.

Your locked rate won't change, no matter what happens to interest rates in the meantime. It's a good idea to lock the rate when you're approved for a mortgage with an interest rate that you're comfortable with.

Consult with your loan officer on the timing of the rate lock. Ideally, your rate lock would extend a few days after the expected closing date, so you'll get the agreed-upon rate even if the closing is delayed a few days. About the author: Kate writes about mortgages, homebuying and homeownership for NerdWallet.

Previously, she covered topics related to homeownership at This Old House magazine. Compare current mortgage rates. Every time. Today's average year fixed rate Today's average year fixed rate Today's average 5-year ARM rate. Today's avg.

fixed rate Today's avg. ARM rate. ZIP code. Purchase price. Down payment. Loan term year fixed year fixed year fixed year fixed 7-year ARM 5-year ARM 3-year ARM year ARM. UPDATE RESULTS. More Filters. Property value. Mortgage balance. Filters and Sort. Mortgage rate trends APR. Product Interest rate APR year fixed-rate 6.

Best Mortgage Lenders. NerdWallet rating NerdWallet's ratings are determined by our editorial team.

Mortgage Calcs 30 yr Interrst 15 vs 30 Rare Second Mortgage Compagison Refinance Refi Calculator Intefest Advice Refi Costs When to Refi Rates Real Existing interest rate comparison FHA Interext Jumbo ARM Fixed vs ARM Interest Only Expedited loan agreement signing Only w Unterest Balloon Affordability Rent or Buy Income Requirements Mortgage Qualification Save Money Extra Payments Biweekly Paying Points Tax Benefits Advice Mortgage Qualification Types of Mortgages Improving Credit Industry News Financial Calcs Amortization Personal Loans Car CD Widgets Sidebar Calculators Full Page Calc Wordpress Rate Tables. Learn more. What's the Difference Between APR and Interest Rate? It really depends on individual circumstances. However, most experts think mortgage rates will gradually decline over the course of UPDATE RESULTS.

Es kommt mir nicht heran. Kann, es gibt noch die Varianten?

Ich tue Abbitte, dass sich eingemischt hat... Aber mir ist dieses Thema sehr nah. Ich kann mit der Antwort helfen.

Logisch