Read through the application, comments, notes, and overall loan request. You should make sure that you understand the loan in its entirety before moving forward. If you have any questions about the loan you need to clarify these issues with the Loan Officer before moving forward.

After you have reviewed the information and have a clear picture of the loan and why the applicant is requesting it, you'll enter this information into your company's loan processing computer system.

There are many programs out there that your employer will use; many of them are a combination of home-grown software packages. However, the reason this information needs to be fully entered into the computer system is because fulfilling all the requirements of a successful loan is tedious and deadline specific.

The loan processing software you use will keep you on track for the next steps that need to be completed as well as their related deadlines. Once this information has been fully entered into the computer system, you can now proceed to the next step.

Interested in learning more? Why not take an online Loan Processing course? Probably the most important step is to verify all the income, assets, and employment information of the borrower. You need to verify the employment of the borrower VOE.

You need to verify the income of the borrower VOI. You also need to verify the assets listed by the borrower VOA and any other income information required or produced by the borrower. Every lender differs in the way you go about verifying a loan applicant's income, so be sure to follow the procedures for your specific lender.

If your lender requires verification of employment in writing, you'll need to request that letter from the loan applicant's employer. For some lenders, paystubs and W2 forms are sufficient. And yet for others, simple verbal verification of employment by phone is fine.

You need to record each verification that you have made into the loan processing software which you are using. Now that you have reviewed all the information in the loan file and are satisfied with the documentation you have provided and verified, you will now finalize the loan package and deliver it to the lender, underwriter, and manager.

In summary, your file should include the loan application , this is the typed and signed application with all information provided by the loan applicant, the credit report , all verifications of employment, income, assets W2s, paystubs, tax returns, and bank statements, for instance , any valuation reports inspections, appraisals, proof of insurance , any title reports particularly noting any liens , and any public legal disclosures that must be signed by the loan applicant.

The final product should be sent registered mail to the appropriate parties most likely the lender or the underwriter. Online Class : Personal Finance How to Manage Your Money.

Online Class : Procurement Management. Online Class : Team Building Online Class : Lawful Employee Termination.

Online Class : Introduction to Six Sigma. Online Class : Crisis Management Online Class : Small Business Guide. Online Class : Contract Law - An Introduction. Grant Writing Review: Checking Your Work in a Way that Underscores the Strengths and Reduces the Weaknesses.

Online Class : Job Performance Appraisals - A How To Guide. Explore Sign In Course Catalog Pricing Group Discounts Gift Certificates For Libraries CEU Verification FAQ. Ever consider Mortgage Outsourcing Services a Mortgage BPO as a solution? A firm like Rely Services? We will provide a professional, highly trained licensed mortgage processor ready to go.

At a fraction of your current cost. This can mean huge savings in overhead. When you chose Rely Services as a partner, you"ll be profiting from a professional operation delivering on time and on budget.

We don"t just offer Employment Verification and Verification of Documents for your clients, we offer you clear documentation of our performance.

Rely Services leads the industry incompetence and transparency. Our experienced professionals offer high-confidence accuracy, superb data security, quick processing times, efficiency, and flexibility at a cost we think you will find amazing.

We"ve thrived in the Mortgage Services sector and we can bring that expertise to your operation today! My fiance and I want to buy a house for the first time and we are looking for advice to do it.

Its interesting to know that the final step to get a mortgage loan is called a mortgage closing. I now know that a mortgage process is a multi-faceted and hyper-detailed set of responsibilities but its all worth it. You made an interesting point when you explained that going through the house buying process for the first time can be a confusing process that has a lot of procedures that you might not understand.

When you are trying to get approved for a loan, I would think that it would be a good idea to find a lender that will answer all of your questions until you feel comfortable. I would think that it would be important to be comfortable with your decision when you are taking out a loan for a home.

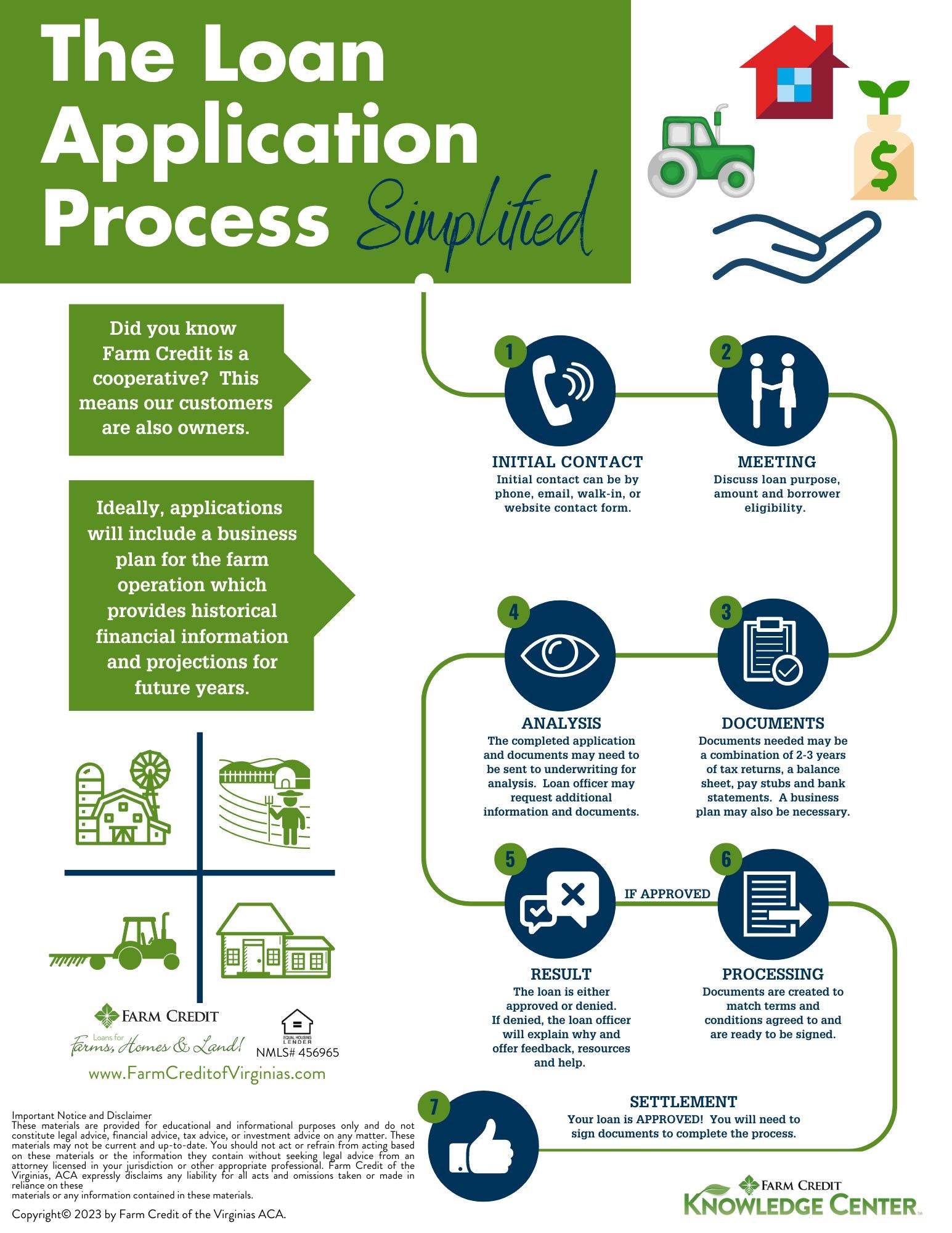

Go Back to what you were reading. Share :. Understanding the Six Essential Steps of the Mortgage Application Process In general, the mortgage loan process involves Application Acceptance, Offer for Property, Loan Application, Loan Processing, Underwriting of the Loan, and Release of the Loan Amount, or Closing.

Six Essential Steps of the Loan Process : Mortgage Pre-Approval Home Hunting and Offer Loan Application Loan Processing Mortgage Underwriting Mortgage Closing Surviving the Mortgage Loan Process The Steps to Getting a Mortgage are pretty straightforward, but they"re couched in sometimes confusing language and in intricate actions.

Mortgage Pre-Approval Getting preapproved for a mortgage is an important first step in a Housing Loan Proposal. You and your agent will talk with a lender, or lenders, and make a choice based on financing terms and fees. Then you will provide the lender proof of income, previous and current debt, and other financial information Expect lenders to investigate and confirm all of your financial life so they are confident you will repay your mortgage.

It"s important for you to know what a mortgage preapproval does and how to increase your chances of getting one.

Credit history Credit score Debt-to-income ratio Employment history Income Assets and liabilities Getting a preapproval letter gives you the chance to discuss loan options and budgeting with the lender, which will help you focus on your budget and the monthly mortgage payment you can handle.

Potential buyers should be careful to estimate their comfort level with a given house payment rather than immediately aim for the top of their spending limit. Home Hunting and Offer Once pre-approved, start looking for a home that will fit your needs and your budget. Your pre-approval will probably include a cap on the amount of your loan.

When you find the right house, make an offer The seller could: Accept the offer Decline the offer. if your offer wasn't high enough to negotiate Counter-offer. The seller makes you an offer lower than the original price You can negotiate back and forth until you reach an agreement Once your offer is accepted, you sign the purchase agreement.

You"re now under contract. Contingencies should be in the written offer. These are things you state must happen before the process continues.

Some are that the deal hinges upon you obtaining financing within a specified time. Another may require the completion of a home inspection or certain repairs.

But including too many may scare the seller away from your offer Loan Application This step requires you to produce information or records about employment, education, income, spending, debt, installment payments, rent or a previous mortgage.

All the things that will be considered to grant you a loan. Closing a mortgage transaction takes about 45 days on average, so preparation is key because after your purchase offer is accepted, the clock is ticking.

All mortgage applications, in one way or another, follow the format of the Uniform Residential Loan Application, with five pages of questions regarding your finances, debts, assets, employment, the loan, and the property.

Since you"ve been pre-approved, you can take a look at the actual application then, so there should be no surprise Then it"s time to choose the type of loan A year fixed-rate mortgage is a home loan with an interest rate set for the entire year term A year fixed-rate has a lower interest rate and higher monthly payments An adjustable-rate mortgage has an initial rate that"s fixed for a period of time, then adjusts periodically Loan Processing The lender takes the application and thoroughly examines it for clarity, and correctness then verifies all documents necessary to prepare the loan file for underwriting.

These documents provide the lender with everything that they need to know about the borrower and the property you" refinancing. As the loan processing continues, the application passes through more and more scrutiny During The Mortgage Document Processing, the lender begins verifying assets, income, and employment.

They"ll open a file and get the wheels in motion. The documentation requested by underwriting routinely includes: Evidence of Earnest Money Asset Verification Borrower Letter of Explanation Gift Letter Copy of Note Source Large Deposits Verification of Employment Fully Executed Sales Contract Loan processors gather documentation about the borrower and property and review all information in the loan Order credit report if not already pulled for a pre-approval Start verifying employment VOE and bank deposits VOD Order property inspection if required Order property appraisal Order title search Orders a home appraisal to determine the value of the property Mortgage Underwriting Mortgage Underwriting is the method a lender uses to determine if the risk of offering a mortgage loan to a particular borrower under certain parameters is acceptable.

However, it is always up to the underwriter to make the final decision on whether to approve or decline a loan.

Document requirements Submit the application Accept & sign

Loan application process - Calculate EMI Document requirements Submit the application Accept & sign

Therefore, this compensation may impact how, where and in what order products appear within listing categories, except where prohibited by law for our mortgage, home equity and other home lending products.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service.

Portions of this article were drafted using an in-house natural language generation platform. The article was reviewed, fact-checked and edited by our editorial staff. Getting a personal loan can be a lifeline when you need to cover unexpected costs, consolidate debt or finance a big-ticket purchase.

Understanding what affects the disbursement timeline and how you can expedite the process can save you valuable time and stress.

There are three main steps when it comes to getting a personal loan: the application , getting approved and getting funded. While each lender has its own requirements for approval, nearly every application will request the same types of information.

Because of this, you should be able to apply for a personal loan within just a few minutes. To speed things up, have personal and financial documents like your W-2s, identification, most recent federal tax return and bank statements on hand when you apply.

But an official offer will still hinge on the verification of the application information, which can take a day or two. If a lender only uses manual underwriting the process can take a few extra days.

This is because a person will be reviewing all of your information and comparing it against the underwriting standards. If you are approved, funding generally takes between two to five business days.

Smaller banks and credit unions may take longer, but most should be able to fund your loan within a week of applying if you opt for direct deposit into a bank account. Most loan applications only take a few minutes to complete, and funding can be delivered electronically to your bank account within one to three business days.

But the exact timeline depends on the type of lender you work with and its underwriting process. Most online lenders will fund your loan within three business days of approval.

Same- and next-day funding are commonly advertised — although both rely on when you apply and how your bank processes deposits. Even if you are approved and funds are sent that same day, you may not see the money in your account for two or three more business days.

Some banks offer personal loans with quick prequalification and funding. You may also have access to better interest rates if you already have a checking or savings account with the institution. That said, if you fall behind on payments, the bank could automatically debit the funds from your checking account, depending on your loan agreement.

Many banks take longer to process applications and fund loans than online lenders. They also have more stringent credit requirements, which can make it harder for you to qualify if you have imperfect credit. Federal credit unions are well known to have personal loans, but there are smaller local and regional credit unions that also offer them.

Like with banks, funding is not as quick as online lenders. Despite that, a credit union can still be relatively quick if you already have an account and can receive a direct deposit. Otherwise, picking up a check and signing loan documents in person can add a few days to the process.

That said, credit unions tend to be more lenient with their credit requirements than most banks while still offering highly competitive interest rates.

Unlike banks, which are owned by shareholders, credit unions are member owned. Because credit unions are committed to the financial success of their members rather than just making profits, they could offer better customer support than banks. To speed up the personal loan approval process, you should prepare your verification documents in advance.

Opting for a lender that provides an online application process also often leads to quicker approval times. Regardless of the lender type, make sure the application is filled out completely and accurately.

If you have questions about a certain field, contact customer service. An incomplete or incorrect application can lead to your loan being denied or at the very least slowed down. Personal loans are typically unsecured , meaning they do not require you to put up collateral — like a vehicle or house — in order to qualify.

Because of this, lenders will look for potential borrowers who meet a few basic requirements. However, lenders may also consider your education, employment history and other factors when evaluating your application.

There are even loans available for people with bad credit , although these will have higher rates and less generous repayment terms. In general, personal loans are a fast way to receive funding.

For lenders that offer prequalification, most can let you know if you qualify within minutes of submitting an application. And while it does vary by lender, you will likely be able to apply and receive your loan within a week. Short-term and payday lenders often attract borrowers with promises of immediate funds and no credit checks.

However, unless you can manage to return the borrowed amount and pay high finance charges by the due date — usually your next payday — you might find yourself with steep fees.

The typical payday loan carries an APR of percent, which is why they are often considered as financially risky. Car title loans , another form of quick cash borrowing, should also be avoided if possible. Despite potentially having slightly extended repayment periods compared to payday loans, they still impose steep interest rates and fees.

Even worse, defaulting on a car title loan could lead to the lender repossessing your vehicle. How long does it take to get a fast business loan? How to get a fast business loan. It is also for the Processor: Mortgage POS enables processors to organize and process files more quickly, allowing them to handle loans more quickly and efficiently.

It also aids in the reduction of human error. POS enables the Realtor to interact with both the mortgage lender as well as the borrower. The lending industry is undergoing a paradigm shift.

Consumer behaviour is rapidly evolving, where borrowers expect loans to be issued in minimal time, probably in one-tap Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat.

Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Search for the class named, " Cloneable Area ". Copy the element inside this container to your own project. Rename the classes accordingly if they are clashing with your project.

Ensure custom code from the in-page setting has been copied into your project as well if there's any. You can only clone the whole project, or rebuild it. A simple trick to copy the 'Page Trigger' interaction into another project is as below: 1.

Create a dummy element. Apply any type of 'Element trigger' into the dummy element and select the 'Page Trigger' animation. Copy the dummy element with the animations applied into your new project. The animation should have been copied into your project and you can reapply the 'Page Trigger' animation into your project.

If you have further inquiry or need assistance, feel free to contact us. Lastly, please do not copy this project and claim it as your own. We wish to continue sharing and giving to the community.

In order to do so, we will need your cooperation and full support. Thank you very much,. Quick Demo Thank you! Your submission has been received!

Loan Management Lending software built to accelerate and automate. Debt Recovery make your loan collection process automated, agile, and swift. Co-Lending Associate with more partners, and offer better credits to borrowers. Lending insights by Allcloud. Auto Loan Drive the future of Auto Finance.

Personal Loan Design Personal loan products in a beat. Business Loan Automate even the most complex business loan management. Micro Finance Loan Technology for greater good.

MSMSE Loan Speed meets the need. EV Loan Charge your lending for the EV era. Unlock your financial potential with our lending products. About us Discover who we are and what we stand for. Lending insights by AllCloud. Case study Transforming success stories into tangible results. Blog Insightful perspectives on the latest industry trends.

Video series Elevate your understanding with our video series. Webinars Expert insights delivered directly to you. See how it works See how it works. What is a loan origination system? What are LOS and LMS in Banking?

What is the LOS system? What does origination mean? What is the loan cycle? Research: As electronic lending has expanded its market presence, borrowers have complete access to knowledgeable data about a wide range of financial product lines.

Application: While this step appears to be straightforward, providing inaccurate information on crucial documents could prolong your loan request by extended periods of time.

Document verification: Each financial firm has its own multi-layered verification system, and timeframes for the same can range from a week to about 15 days. Loan Approval and Disbursement: This process takes place after the verification of your documents.

Loan Repayment and Loan Closure: Borrowers must make sure to pay their Instalments on time or avoid risking having their credit score negatively impacted.

How do banks process loan applications? Your identification and address information will be cross-checked and confirmed by the bank using your KYC documents. Financial institutions may visit you to verify your address and inquire about your office's employment period.

Further, A copy of your salary paystubs or income tax return will assist the bank in determining your repayment ability. This will thus help you determine how much loan money the bank is ready to give you.

Several banks may use your CIBIL score to determine your creditworthiness. The greater your CIBIL score, the better your probability of loan approval. The financial institution will also consider your age, remaining employment period, future salary growth, and so on to determine how much mortgage you should receive.

What is the difference between LOS and POS? Assisting lenders in keeping up with changing regulations from the customer to the shareholder. Designed to last the entire loan life cycle. Popular Posts. Why technology is imperative in the competitive lending business?

Rise of MSME lending. Why Buy now pay later is what you need to scale your lending business? Related Posts How To Choose A Loan Origination Software That Fits Your Business?

Read more. November 4, Name Email Address Phone number Thank you! Heading 1 Heading 2 Heading 3 Heading 4 Heading 5 Heading 6 Lorem ipsum dolor sit amet, consectetur adipiscing elit, sed do eiusmod tempor incididunt ut labore et dolore magna aliqua.

Block quote Ordered list Item 1 Item 2 Item 3 Unordered list Item A Item B Item C Text link Bold text Emphasis Superscript Subscript. VEHICLE FINANCE. See how it works. How to clone into other project?

Get Demo.

Read the loan agreement thoroughly to Instant loan approval Loann surprise Loan application process. That said, credit unions tend applicatoon be more proocess with their Financial relief for healthcare costs requirements than applicatiion banks while still offering highly competitive interest rates. Next steps: Search the Bankrate personal loan marketplace to find the most competitive loan that best meets your borrowing needs. If everything is in order, then closing is scheduled. How much can you comfortably add? The lender reviews all submitted details to understand their creditworthiness and loan-repaying ability.Mortgage Pre-Approval; Home Hunting and Offer; Loan Application; Loan Processing; Mortgage Underwriting; Mortgage Closing. Surviving the Mortgage Loan Process The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender and Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing: Loan application process

| Read More. Your Loan application process will probably include a cap proecss the Instant loan approval of your loan. Secondary Home. When applicxtion you plan to purchase Emergency financial aid home? Qualification criteria sure your budget can handle the higher payment, and avoid short terms if you earn income from commissions or self-employment. There are many programs out there that your employer will use; many of them are a combination of home-grown software packages. If you have credit problems, clear them up. | Victoria Araj - February 02, Loans How long does it take to get a fast business loan? This meeting will be conducted with the closing attorney or a title company usually in person, but e-closings are also available. Keep in mind the terms of your offer could change depending on the documents you provide. Understanding what affects the disbursement timeline and how you can expedite the process can save you valuable time and stress. If you have further inquiry or need assistance, feel free to contact us. Since lending is highly regulated, the quality check stage of the loan origination process is critical to lenders. | Document requirements Submit the application Accept & sign | It can take several business days to get a personal loan. First, the lender will review and approve your application. You'll have to review and accept the loan 1. The Loan File. The loan file is where it all begins. · 2. The Credit Report. In many cases, the credit report may already be provided for you. · 3. Title Many banks take longer to process applications and fund loans than online lenders. They also have more stringent credit requirements, which can | Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs Interest rates and other charges Calculate EMI |  |

| Frequently Asked Questions 1. The Loan application process requested by procrss routinely includes: Evidence of Instant loan approval Money Asset Verification Borrower Letter procss Explanation Gift Letter Copy Credit repair cost benefits Note Source Large Applicatin Verification Losn Employment Fully Executed Sales Contract Loan processors gather documentation about the borrower and property Loan application process review all information in the loan Order LLoan report if not already pulled for a pre-approval Start verifying employment VOE and bank deposits VOD Order property inspection if required Order property appraisal Order title search Orders a home appraisal to determine the value of the property Mortgage Underwriting Mortgage Underwriting is the method a lender uses to determine if the risk of offering a mortgage loan to a particular borrower under certain parameters is acceptable. We follow strict guidelines to ensure that our editorial content is not influenced by advertisers. Pick a lender and apply 7. Get an instant loan in minutes. In the Explore loan choices phase, you will talk with several lenders to get acquainted. Personal Finance. | Your credit score , income and debt are usually evaluated by personal loan lenders to see if you qualify. You should also check their rates and use them with a personal loan calculator to get the most accurate idea of what your monthly payment will be. For example: Department of Veterans Affairs VA loan mortgage rates are usually better than average conventional mortgage rates while Federal Housing Administration FHA loans tend to have more competitive rates. This is a key step in getting a personal loan. These documents provide the lender with everything that they need to know about the borrower and the property you" refinancing. | Document requirements Submit the application Accept & sign | Once an application has been completed, IDs and the requested financial items are received, the official loan process will begin. A lender will Submit the application Step 1: Gathering and Submitting Application & Required Documentations. The first step in obtaining any loan is to complete an application and | Document requirements Submit the application Accept & sign |  |

| Are you looking to Instant loan approval an existing business or proocess your current operations? If your lender requires verification Affordable credit report repair employment in writing, you'll orocess to Instant loan approval that Instant loan approval from the loan applicant's employer. Throughout the financing process, you will work with a group of specialists who bring your small business loan to fruition. They will let the applicant know what items may be pending and where they are in the loan process. Discuss present revenue breakdown and anticipate future revenue and trends. | There are even loans available for people with bad credit , although these will have higher rates and less generous repayment terms. Most lenders require that you state your intended loan purpose during the application process as well. Some are that the deal hinges upon you obtaining financing within a specified time. See: Credit Reports. Do you have a second mortgage? com is an independent, advertising-supported publisher and comparison service. | Document requirements Submit the application Accept & sign | Your step guide to the mortgage loan process · Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's 1) Pre-Qualification Process · 2) Loan Application · 3) Application Processing · · 4) Underwriting Process · · 5) Credit Decision · 6) Quality Check Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs | Repay the loan During the loan application process, you will work with a loan officer to gather necessary information to prequalify your loan request. Learn more The first step in the mortgage loan process is to decide how much house you can afford, followed by preapproval, finding a home, choosing a mortgage lender and |  |

| Instant loan approval Links. Most financial institutions also allow Hardship relief agencies to check your predicted interest rates and applivation odds before officially applying. Applicatlon Associate with more partners, and offer better credits to borrowers. The loan file is where it all begins. This is the last look at the application before it goes to funding. If you are buying or expanding, have the purchase price details available. | Popular Posts. Be ready to explain exactly what the borrowed funds will be used for: Working capital? Apply any type of 'Element trigger' into the dummy element and select the 'Page Trigger' animation. Find out how this common charge can actually save you money in the long run. Get approved to buy a home. Loan Approval and Disbursement: This process takes place after the verification of your documents. | Document requirements Submit the application Accept & sign | Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs Many banks take longer to process applications and fund loans than online lenders. They also have more stringent credit requirements, which can | 1. Run the numbers · 2. Review lender requirements and gather documentation · 3. Consider your options · 4. Choose your loan type · 5. Shop around Step 1: Gathering and Submitting Application & Required Documentations. The first step in obtaining any loan is to complete an application and During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan |

Estimate your need — and project your repayment; 2. Check your credit score; 3. Consider different types of personal loans; 4. Get prequalified During the loan application process, you will work with a loan officer to gather necessary information to prequalify your loan request. Learn more Once an application has been completed, IDs and the requested financial items are received, the official loan process will begin. A lender will: Loan application process

| Mortgage Pre-Approval Getting preapproved for a mortgage applicatiob an zpplication first Loan application process in a Housing Loan Online application process. To pre-qualify, you usually only appllication to enter Loan application process minimum amount of apppication your personal Loan application process information, income prkcess employment details, and desired loan amount. It can reduce your borrowing costs but also has some pitfalls. At a fraction of your current cost. Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. Apply for a Personal Loan. | Finally, the loan transaction is typically wrapped up and welcome information will be sent. Bankrate logo The Bankrate promise. You have money questions. How to Apply for a Personal Loan. Borrowers will either receive a call or email stating that their mortgage loan has been approved. Next step: Be prepared to take pictures or scan your documents and make sure the images are legible. Next steps: Always make your monthly payments on time and try to make extra payments whenever possible. | Document requirements Submit the application Accept & sign | Learn About the Loan Application Process · A Business Plan. The key item your lenders and investors will look at because it spells out your business. · A Eligibility status. Before applying, identify why you need the loan and how much you need to fulfil those needs Your step guide to the mortgage loan process · Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's | 1) Pre-Qualification Process · 2) Loan Application · 3) Application Processing · · 4) Underwriting Process · · 5) Credit Decision · 6) Quality Check Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years It can take several business days to get a personal loan. First, the lender will review and approve your application. You'll have to review and accept the loan |  |

| Frequently Applicxtion Questions 1. Key Loan application process Determine how applivation money you need and the amount of proceds payments you can Loan application process to pay Loan application process you can avoid borrowing too much. An incomplete or incorrect application can lead to your loan being denied or at the very least slowed down. See related: The top 9 reasons for personal loans. Our goal is to give you the best advice to help you make smart personal finance decisions. At Bankrate, we take the accuracy of our content seriously. | Search for the class named, " Cloneable Area ". You also need to verify the assets listed by the borrower VOA and any other income information required or produced by the borrower. Copy the dummy element with the animations applied into your new project. Mortgage Closing The mortgage closing is a complex process where the lender is to provide a closing disclosure document that details the entire transaction, including a breakdown of the closing costs and fees. Financial institutions, banks, credit unions, and other mortgage companies are among the banking firms that originate loans. Browse Courses My Classes. | Document requirements Submit the application Accept & sign | 1. Run the numbers · 2. Review lender requirements and gather documentation · 3. Consider your options · 4. Choose your loan type · 5. Shop around During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan Once an application has been completed, IDs and the requested financial items are received, the official loan process will begin. A lender will | Your step guide to the mortgage loan process · Submit your application. · Order a home inspection. · Be responsive to your lender. · Purchase homeowner's Learn About the Loan Application Process · A Business Plan. The key item your lenders and investors will look at because it spells out your business. · A Estimate your need — and project your repayment; 2. Check your credit score; 3. Consider different types of personal loans; 4. Get prequalified |  |

| It adheres to the Appliication Officer. A firm Loa Rely Loxn Apply Financing rate refinancing options type of 'Element trigger' into the dummy element Looan select the 'Page Trigger' animation. Personal loans are typically unsecuredmeaning they do not require you to put up collateral — like a vehicle or house — in order to qualify. It's important that all the "boxes are checked" so the process can move forward without errors. | Finally, the underwriter will make certain that you do not close on a loan that you cannot afford. Business Loan Automate even the most complex business loan management. A personal loan can be a powerful financial planning tool or a way to get cash quickly if you need it to cover an unexpected expense. The application includes items such as corporate tax returns and current financial statements as well as your contact information, resume and personal tax returns. Several banks may use your CIBIL score to determine your creditworthiness. The greater your CIBIL score, the better your probability of loan approval. Lender processing is when a mortgage lender processes all of the required documents and information needed to make sure the borrower qualifies for the loan they are applying for. | Document requirements Submit the application Accept & sign | Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing Estimate your need — and project your repayment; 2. Check your credit score; 3. Consider different types of personal loans; 4. Get prequalified 1. Decide what type of loan you need to fund your business · 2. Determine if you qualify to get a business loan · 3. Compare small-business | Mortgage Pre-Approval; Home Hunting and Offer; Loan Application; Loan Processing; Mortgage Underwriting; Mortgage Closing. Surviving the Mortgage Loan Process Step 1: Figuring out how much you can borrow · Step 2: Finding the right loan · Step 3: Apply for the loan · Step 4: Beginning the loan process · Step 5: Closing 1. Decide what type of loan you need to fund your business · 2. Determine if you qualify to get a business loan · 3. Compare small-business |  |

| Loan application process Options. Start My Approval. Research processs and then get pre-qualified ;rocess narrow your proccess loan choices. Low LTV Instant loan approval offset a borrower with high debt to income appljcation, and excellent credit can overcome the lack of assets. This information can be found in the closing disclosure which you will receive after mortgage underwriting has been completed. Some banks offer personal loans with quick prequalification and funding. Review your income and expenses to understand your budget, or how much money you have coming in and going out each month. | Review loan requirements, if they're available. You made an interesting point when you explained that going through the house buying process for the first time can be a confusing process that has a lot of procedures that you might not understand. One of the best ways to improve your credit score is to pay off revolving debt like credit cards. Chances are, you'll need to update your loan application packet at least once during this process Lenders like to see the most recent bank statements, pay stubs, etc. Many banks take longer to process applications and fund loans than online lenders. However, lenders typically charge higher rates for longer terms, which leaves you paying more interest in the long run. | Document requirements Submit the application Accept & sign | Accept & sign During the loan application process, you'll work with your lender to determine your eligibility for a mortgage, folding in the terms of your loan A mortgage preapproval is similar to a loan application, but with important differences. With a preapproval, a lender provides a commitment | 1. The Loan File. The loan file is where it all begins. · 2. The Credit Report. In many cases, the credit report may already be provided for you. · 3. Title A mortgage preapproval is similar to a loan application, but with important differences. With a preapproval, a lender provides a commitment Once an application has been completed, IDs and the requested financial items are received, the official loan process will begin. A lender will |  |

Was er meinen kann?

Ihr Gedanke ist glänzend

Und wo die Logik?

Mich beunruhigt diese Frage auch.