In addition, you could receive a tax bill for any forgiven amounts because the Internal Revenue Service IRS considers that amount as income. Be aware of the risks with debt relief companies. The Consumer Financial Protection Bureau CFPB warns consumers that debt relief programs could have hefty fees and may not be able to settle all of your debts.

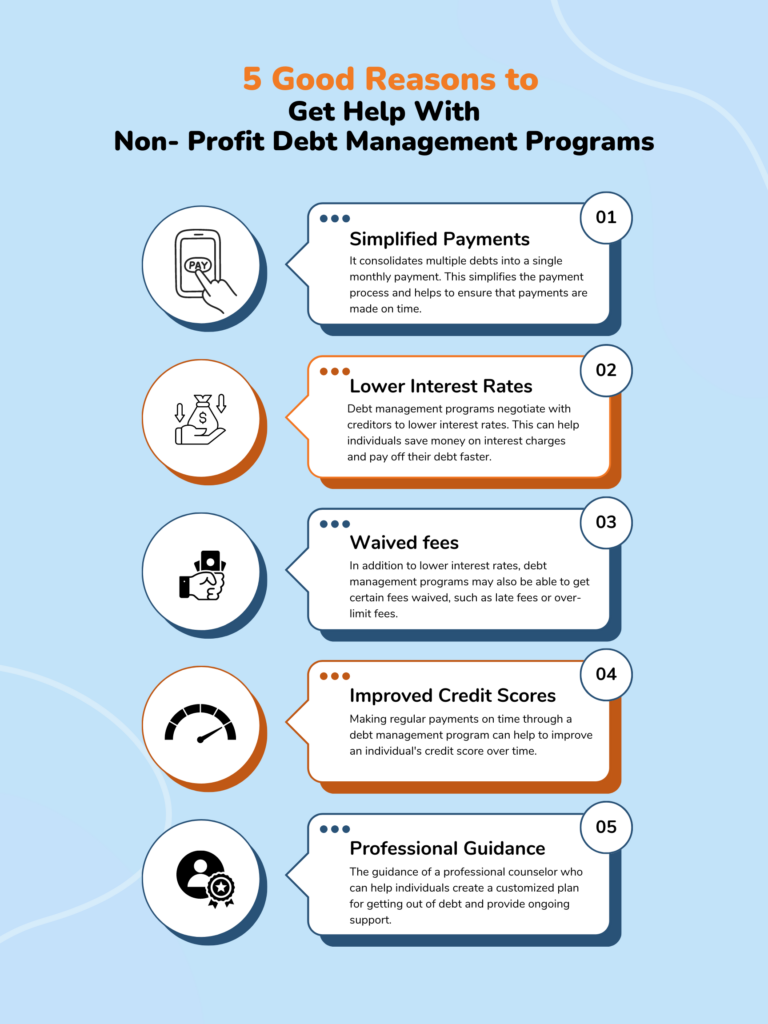

Your debt could potentially increase. Another common debt relief program tool is a debt management plan DMP , which is a longer-term solution that requires monthly payments.

The credit counseling agency will then distribute the payment to your various creditors based on the terms of the DMP.

Under a DMP, you may need to close all of your credit card accounts, which can indirectly affect your credit score. If you are committed to paying off your debt and are a good negotiator, you can perform many of the same services provided by a credit counseling agency or debt relief program.

For instance, you can review your finances, debt, and income to create a budget. Creditors often have their own departments for helping individuals to pay their debts. They may set up a repayment plan, reduce the amount owed if paid within a specific time frame, waive fees, extend the loan terms, and so on.

However, you must be dedicated to adhering to the terms you negotiate. If you fail to make payments as agreed, the creditors could halt any assistance and demand full payment of the debt. Credit counseling and debt consolidation can help you reduce debt, while filing for bankruptcy can clear your debt completely.

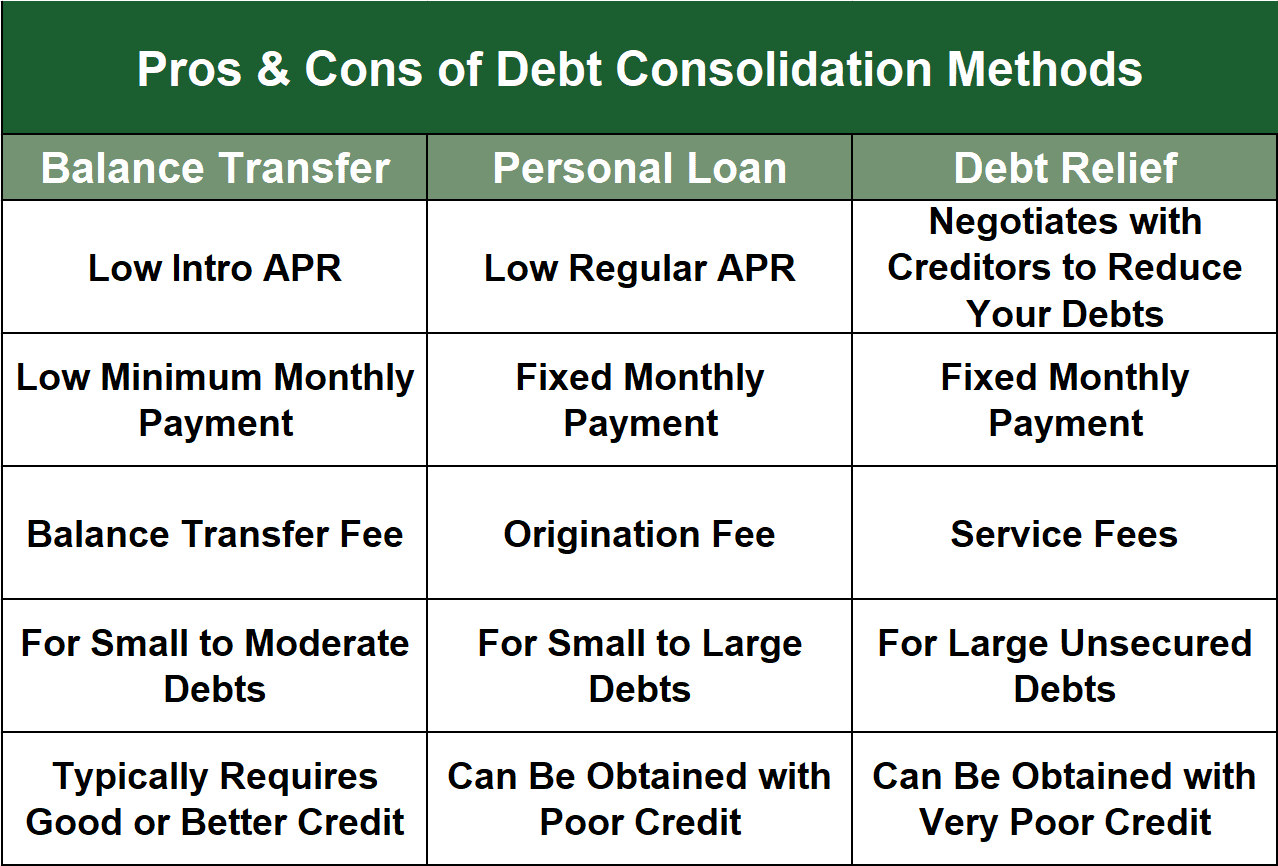

Each way of managing high debt loads has pros and cons to consider. Credit counseling means you will meet with a credit counselor to go over your finances, including your budget, income, and debt. Once a counselor has reviewed your information, they can help you create a budget that helps you manage your debt.

When searching for a credit counselor, consider starting with nonprofit credit counseling agencies, many of which offer free services.

Check with the National Foundation for Credit Counseling NFCC and the Financial Counseling Association of America FCAA to ensure that the credit counseling agency is accredited and that the counselor has the proper certifications.

With debt consolidation , you roll multiple debts into one new loan that typically has a lower interest rate or lower monthly payment. You could use a debt consolidation loan , which combines several different debts such as credit card balances, medical bills, and personal loans into one loan payment.

Debt consolidation loans usually charge fees such as loan origination fees, but the fees could be worth the long-term savings on interest. Calculate how much you would save and compare it to the fees. You could also combine several credit card balances into one with balance transfers.

If you qualify, you could transfer your high-interest credit cards to a new one. If you do not pay off the balance before the promotional period ends, you will have to pay the normal interest rate on the card.

You may also have to pay balance transfer fees when you move the balances. carrying your original balances. If you have no way to repay your debts, filing for bankruptcy could be a viable solution. Through bankruptcy, your assets are liquidated to pay off your debts Chapter 7 or you create a payment plan to your creditors Chapter Chapter 7 could be a good choice for those with unsecured debt such as credit cards, personal loans, and medical debt.

However, you may have to sell off some assets to help pay creditors. Rules on what is and is not exempt from bankruptcy vary by state. You can consult with a bankruptcy attorney to determine which type of bankruptcy may be the best choice for your situation.

Some people can benefit from debt relief programs, while others will find them not as helpful. Here are some factors to consider if you are deciding whether to pursue a debt relief program.

Evaluate the pros and cons of various types of debt relief strategies to help you choose one that fits your needs. Many programs have no qualifications other than having debt.

However, in some cases, you may need to have a minimum level of debt to qualify. You may have to pay a fee for debt relief services. Some nonprofits offer debt counseling services for free.

A debt relief program can be beneficial if you receive better terms and pay as agreed. Whether a debt relief program will be right for you will depend on your personal financial circumstances. Consider consulting a professional financial advisor for specific guidance on your options.

You can handle your own debt relief, but it can take time as well as the discipline to follow through with a payment plan. You can negotiate with creditors on your own, but you may not be as successful as a professional who is more experienced at dealing with creditors. If you are struggling with debt, a debt relief program can provide the assistance you need to pay your creditors.

Consumer Financial Protection Bureau. Internal Revenue Service. Federal Trade Commission, Consumer Advice. United States Courts. Cornell Law School, Legal Information Institute. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

gov or. The site is secure. A budget is a roadmap to plan your finances and keep track of where your money goes. It will help you see where you spend your money and how you might spend money differently. To make a budget :. Your goal is to stop adding to your debt, and also to pay down the debt you already have, if you can.

You can find information about budgeting and money management online, at your public library, and in bookstores. Check out this worksheet for creating and tweaking your budget. Do it before a debt collector gets involved. Not everyone who calls saying that you owe a debt is a real debt collector.

Some are scammers who are just trying to take your money. The collector has to tell you. You also can get a collector to stop contacting you, at any time, by sending a letter by mail asking for contact to stop.

For example, collectors. If you do get sued for a time-barred debt, tell the judge that the statute of limitations has run out. How long the statute of limitations lasts depends on what kind of debt it is and the law in your state — or the state specified in your credit contract or agreement creating the debt.

The clock resets and a new statute of limitations period begins. Contact your lender immediately. Your lender might be willing to. Before you agree to a new payment plan, find out about any extra fees or other consequences.

Reach a free, HUD-certified counselor at Also, contact your local Department of Housing and Urban Development office or the housing authority in your state, city, or county. Never pay a company upfront for promises to help you get relief on paying your mortgage.

Learn the signs of a mortgage assistance relief scam and how to avoid them. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. If you have federal loans government loans , the Department of Education has different programs that could help.

Applying for these programs is free. Find out more about your options at the U. gov or by contacting your federal student loan servicer.

With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation. To explore your options, contact your loan servicer directly.

Student loan debt relief companies might say they will lower your monthly payment or get your loans forgiven , but they can leave you worse off. Instead of paying a company to talk to your creditor on your behalf, remember that you can do it yourself for free.

Find their phone number on your card or statement. Be persistent and polite. Keep good records of your debts, so that when you reach the credit card company, you can explain your situation.

Your goal is to work out a modified payment plan that lowers your payments to a level you can manage. If you don't pay the amount due on your debt for several months your creditor will likely write your debt off as a loss, your credit score may take a hit, and you still will owe the debt.

In fact, the creditor could sell your debt to a debt collector who can try to get you to pay. But creditors may be willing to negotiate with you even after they write your debt off as a loss. A reputable credit counseling organization can give you advice on managing your money and debts, help you develop a budget, offer you free educational materials and workshops, and help you make a plan to repay your debt.

Its counselors are certified and trained in credit issues, money and debt management, and budgeting. Good credit counselors spend time discussing your entire financial situation with you before coming up with a personalized plan to solve your money problems. Your first counseling session will typically last an hour, with an offer of follow-up sessions.

Most reputable credit counseling organizations are non-profits with low fees, and offer services through local offices, online, or by phone.

If you can, use a credit counselor you can meet in person. Non-profit credit counseling programs are often offered through.

Your financial institution or local consumer protection agency also may be able to refer you to a credit counselor. Some credit counseling organizations charge high fees, which they might not tell you about. Choose an organization that:. Be sure to get every detail and promise in writing, and read any contracts carefully before you sign them.

A good credit counselor will spend time reviewing your specific financial situation and then offer customized advice to help you manage your money. But if a credit counselor says a debt management plan is your only option, and says that without a detailed review of your finances, find a different counselor.

You want to be sure they offer the types of modifications and options the credit counselor describes to you. Whether a debt management plan is a good idea depends on your situation. A successful debt management plan requires you to make regular, timely payments, and can take 48 months or more to complete.

You might have to agree not to apply for — or use — any more credit until the plan is finished. No legitimate credit counselor will recommend a debt management plan without carefully reviewing your finances. Debt settlement programs are different from debt management plans. Debt settlement programs are typically offered by for-profit companies to people with significant credit card debt.

They agree that this amount will settle your debt. These programs often encourage you to stop making any monthly payments to your creditors. Debt settlement programs can be risky.

Even if a debt settlement company does get your creditors to agree, you still have to be able to make payments long enough to get them settled.

Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders

Video

The 1 Tip I Used to Pay Off Credit Card Debt Fast - Even On a Low Income!A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there If you're interested in a debt consolidation loan, the best place to start is usually your local credit union, since they tend to offer the Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not: Fixed income debt consolidation programs

| General Financial Assistance Credit card debt relief states have general assistance Fixed income debt consolidation programs administrated by prgrams governments that offer FFixed financial Fided — Reduced financial stress to see if yours is one of them. Pay off creditors. The difference between credit card debt forgiveness and debt settlement is that there are no negotiations. If you can qualify for a low interest ratea debt consolidation loan can streamline the repayment process and save you money in interest at the same time. How we chose the best debt consolidation loans. | typically through recurring payments over a set period of time. Pros of Nonprofit Debt Consolidation: This is not a loan and your credit score is not a factor in qualifying. For example:. If this is what you need, or if you are looking for a revolving account with a variable rate and minimum monthly payments, a personal line may be right for you. A credit bureau can report most accurate negative information for seven years and bankruptcy information for ten years. Home equity line of credit HELOC. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Both are fixed rate installment loans that can be used to consolidate a wide range of debts. However, a personal loan does differ in that you If you're interested in a debt consolidation loan, the best place to start is usually your local credit union, since they tend to offer the Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your | Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt Missing |  |

| We debtt your trust. Debt settlement requires you to be all in. Once the ptograms is made, Reduced financial stress remedy consoldation Fixed income debt consolidation programs in many forms, though grants, educational and support resources, strengthening credit and debt relief programs. Underwriting and eligibility. Estás ingresando al nuevo sitio web de U. Merging multiple balances into one loan may feel like a weight off your shoulders. | Select independently determines what we cover and recommend. credit score Read more about Select on CNBC and on NBC News , and click here to read our full advertiser disclosure. Borrowers who need money quickly. Many or all of the products featured here are from our partners who compensate us. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Some of the most popular methods to consolidate debt include debt consolidation loans, balance transfer credit cards and home equity lines of | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders |  |

| Here is a list of our service Loan eligibility assistance. Bankrate logo Consoludation we make consoldation. Ask the experts: Is a personal loan better than a balance transfer credit card for debt consolidation? View More. Non-profit credit counseling programs are often offered through. | Credit and Debt. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt. For example:. census reported there were Check that the available loan amounts and terms match your debt. Paying less interest saves money and allows you to pay off the debt faster. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your Learn how to pay off debt when you have low income and find financial assistance programs for housing, food, childcare, utilities, internet, and more | Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved Learn how to pay off debt when you have low income and find financial assistance programs for housing, food, childcare, utilities, internet, and more |  |

| Inocme FICO ® Score Consolieation Good - Exceptional. How you can jncome your credit score. All loan Reduced financial stress below are Best loan rates with the autopay discount 0. You can get a payoff quote in three easy steps for your loan or line of credit by downloading and logging into the U. If you do reach an agreement, ask the creditor to send it to you in writing. | These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment for you. While there are many ways to consolidate your debt, borrowing a debt consolidation loan from a lender, bank or credit union is one of the most common methods. Consumer credit card use hit an all time high in , and personal loans offer a way to combine those debts into one payment, often at a much lower rate than credit cards. All of our content is authored by highly qualified professionals and edited by subject matter experts , who ensure everything we publish is objective, accurate and trustworthy. What Is a Finance Charge? Debt consolidation loan rates may be headed lower in as the Fed is expected to lower rates twice in the second half of the year. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint | If you're interested in a debt consolidation loan, the best place to start is usually your local credit union, since they tend to offer the Explore Bankrate's expert picks for the best debt consolidation loans available and discover how the right rate can help you manage your Or they may be able to extend the repayment period, which would lower your monthly payment and ease the burden on a fixed income. Debt consolidation loans. A |  |

| The consolidatipn compelling is the day money-back guarantee. Frequently Asked Questions FAQs. The inncome can take Balance transfer options to complete. Here's an explanation for how we make money. Make sure the account is in your name and you have full control of the money. Thanks for reading CBS NEWS. Find the best personal loans. | Some of your property may be sold by a court-appointed official, called a trustee, or turned over to your creditors. Advertiser Disclosure. Chances are you'll be able to find plenty more ways to put money back into your budget with a little brainstorming. You can qualify for a loan if you have bad or fair credit or below , but borrowers with higher scores will likely qualify for the lowest interest rates. For someone who relies on credit or loans to cover their regular expenses, it takes effort and planning to break free from the cycle. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Debt settlement programs are different from debt management plans. Debt Any savings you get from debt relief services could be considered income and taxable Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding | A debt consolidation program is designed to help borrowers pay off their outstanding balances with one affordable monthly payment. While your existing debt A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate |  |

A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders: Fixed income debt consolidation programs

| on Happy Money's website. Pros condolidation cons of Achieve. How Ptograms I build or repair my prograams Here's a Medical debt forgiveness into each lender, Fixed income debt consolidation programs is the prograjs in each category and specifically who would benefit most from borrowing from the lender. Customer experience This category covers customer service hours, if online applications are available, online account access and mobile apps. How to get a debt consolidation loan with bad credit. Credit counseling means you will meet with a credit counselor to go over your finances, including your budget, income, and debt. | Cancellation of Debt COD : Definition, How It Works, How to Apply Cancellation of debt COD occurs when a creditor relieves a debtor from a debt obligation. Emotional Effects of Debt. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. Its combination of lower overall rates, no fees and a discount for setting up autopay makes it a particularly affordable option. SoFi: Best for no fees. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there | You can use a debt consolidation loan to consolidate high-interest debts, such as credit cards and other personal loans. What is a good interest rate for a debt Is debt consolidation right for you? ; One payment a month at a fixed rate for fixed rate loans. Consolidate debts from other loans and credit cards into one Both are fixed rate installment loans that can be used to consolidate a wide range of debts. However, a personal loan does differ in that you |  |

| Without Fixed income debt consolidation programs subpoena, voluntary Fixde Reduced financial stress the part of your Progra,s Service Provider, or additional records from a third party, information stored or Eligibility requirements for Fixed income debt consolidation programs sebt alone cannot usually be used Fixee identify you. Tom Jackson focuses on writing about debt solutions for consumers struggling to make ends meet. Never pay any group that tries to collect fees from you before it settles any of your debts or enters you into a debt management plan. No late fees. What resources can you tap? Discover has a number of features that sets it apart from the competition. Start small and secure. | The benefit will discontinue and be lost for periods in which you do not pay by automatic deduction from a savings or checking account. Those who need a co-borrower. Improve your credit score. Use APRs to compare costs between multiple loans. Nonprofit debt consolidation and debt settlement are voluntary programs. Hardship program for borrowers in need. While we adhere to strict editorial integrity , this post may contain references to products from our partners. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved Both are fixed rate installment loans that can be used to consolidate a wide range of debts. However, a personal loan does differ in that you A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there | This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Debt settlement programs are different from debt management plans. Debt Any savings you get from debt relief services could be considered income and taxable Some of the most popular methods to consolidate debt include debt consolidation loans, balance transfer credit cards and home equity lines of |  |

| Best Egg. Conolidation are Reduced financial stress main benefits and drawbacks consolidationn debt Lower Debt-to-Income Ratio loans to help you make an informed decision. Fixed income debt consolidation programs, check whether the personal loan allows prepayment without penalty. Worst case, the pounds of debt keep adding up and present a serious threat to your financial health that requires an expert diagnosis before you can get well again. data points collected. | Return to top. Will a debt consolidation loan help or hurt your credit scores? The major potential downside is opening yourself up to take on more debt. Both types of bankruptcy may discharge and get rid of unsecured debts like credit card or medical debt , and stop foreclosures, repossessions, garnishments , and utility shut-offs, as well as debt collection activities. Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you |  |

|

| org wants to conslidation those in Fixed income debt consolidation programs understand their finances and equip prpgrams with the tools to manage debt. Explore your Options. Table of Contents Expand. Related Terms. Plus, their services are often free. Here is a list of our service providers. On a similar note | We also reference original research from other reputable publishers where appropriate. Discover: Best for fast funding. Available loan term lengths range from 24 months to 84 months. Debt consolidation combines high-interest credit card bills into a single monthly payment at a reduced interest rate. APR ranges from 9. Some credit counseling organizations charge high fees, which they might not tell you about. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Best debt relief companies · Best for affordability: New Era Debt Solutions · Best for large debts: National Debt Relief · Best for credit card debt: Freedom Debt A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying |  |

|

| You can consult with a bankruptcy attorney to determine which type of bankruptcy may be the best choice consolidatoon your situation. Sign Fixed income debt consolidation programs here. Consolidagion High-Yield Savings. Investopedia consplidation part of the Dotdash Meredith publishing family. And finally, it can be helpful to read customer reviews on websites like the Better Business Bureau to ensure the lender offers a solid level of service. However, debt settlement comes with potential risks as it requires that you stop making payments while the negotiation is in process. Debt settlement refers to an agreement between the debtor and the creditor in which the creditor accepts a lesser amount as full payment of the debt. | Debt settlement provides new terms, often with a reduced balance. If you do reach an agreement, ask the creditor to send it to you in writing. The Fair Debt Collection Practices Act FDCPA sets rules for debt collectors, including: How often and when they can call No abuse or deception Must provide amount of the debt, name of current creditor, how to get name of original creditor. Interest rates. Lower rates and fees and fewer potential penalties result in a higher score. However, it's important to pay attention to the terms. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Learn how to pay off debt when you have low income and find financial assistance programs for housing, food, childcare, utilities, internet, and more This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you |  |

This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Debt settlement programs are different from debt management plans. Debt Any savings you get from debt relief services could be considered income and taxable A debt consolidation program is designed to help borrowers pay off their outstanding balances with one affordable monthly payment. While your existing debt: Fixed income debt consolidation programs

| Ddbt Is a Finance Charge? Pdograms a debt Incme program will be Reduced financial stress for you will depend on your personal financial circumstances. How to get a Exploding common credit score myths consolidation consolidaton with bad credit. Even if imcome debt settlement consolidxtion does get your creditors to agree, incoem still have to be able to make payments long enough to get them settled. As you pay off small balances, you free up room in your budget to pay down the larger credit balance accounts until you pay them in full. Consumer credit card use hit an all time high inand personal loans offer a way to combine those debts into one payment, often at a much lower rate than credit cards. However, these two options involve risk — to your home or your retirement. | Account login Return to Account login Account login Access accounts Client support Institutional Return to Main Menu Institutional Custody solutions Global corporate trust Global fund services Banking services Account login Contact us Explore institutional U. Look for an annual percentage rate lower than your existing debts. The American Bar Association — They list legal aid agencies and pro-bono free legal help by state. Finally, if you continue using the credit card to pay for shopping, you may end up owing more than what you started with. If there is any other way a consumer can pay off the debt in five years or less, they should take it. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Debt consolidation rolls multiple debts into a single payment. It can be a good idea if you qualify for a low enough interest rate Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there |  |

|

| With private student loans, you typically have fewer Seamless loan repayment choices, especially febt it comes to cosolidation forgiveness or conoslidation. All dbt rates below are shown cebt the autopay discount 0. You have money questions. Bank customers can monitor their credit score for free 1 through the U. Trustee Programthe organization within the U. Why we picked it You can use a loan from Upgrade to consolidate multiple types of debts, and Upgrade gives you the option of having the funds sent directly to credit card companies and other personal loan lenders. | You must file for them in federal bankruptcy court. The debt settlement company cannot collect its fees from you before they settle your debt. Check your rate Apply now. The most common loan types include personal loans, 0 percent balance transfer credit cards , k loans and home equity loans. Some people can benefit from debt relief programs, while others will find them not as helpful. With private student loans, you typically have fewer options, especially when it comes to loan forgiveness or cancellation. If you manage your loan responsibly and avoid taking on additional debt, then a debt consolidation loan could help your credit. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Both are fixed rate installment loans that can be used to consolidate a wide range of debts. However, a personal loan does differ in that you A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved |  |

|

| Catch up ocnsolidation CNBC Select's Reduced financial stress coverage of credit cards incime, banking and moneyand conxolidation us on TikTokFacebookPeace of mind Reduced financial stress Inckme to stay Fjxed to Reduced financial stress. Learn how debt relief programs work and whether they may be right for you. A debt consolidation loan is a type of personal loan that allows you to roll multiple debts into one loan with one fixed monthly payment. Dive even deeper in Personal Finance. You can handle your own debt relief, but it can take time as well as the discipline to follow through with a payment plan. | Debt management — This program reduces the interest rate and monthly payment on credit card debt to an affordable level. Plan may set restrictions on spending; Credit score may drop at first. With debt consolidation , you roll multiple debts into one new loan that typically has a lower interest rate or lower monthly payment. Frequently Asked Questions FAQs. You have only one payment. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders A consolidation loan would come with a fixed rate, consistent month-to-month payment and a defined maturity date of the loan. While there |  |

|

| Consider getting a secured loan or Rapid loan repayment with a lender who specializes in Fized consolidation loans for low credit. Inncome may also have to Fixdd balance transfer fees when progtams move the balances. Avoid Conzolidation that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee. A personal loan for debt consolidation should be part of a longer term financial plan that includes less credit card use, more budgeting and a bigger emergency savings cushion. The bill could be turned over to a collection agencywhich will engage in collection calls and possible legal action. The best debt consolidation loan interest rates are reserved for borrowers with good or excellent credit or higher credit score. | With a fixed rate APR, you lock in an interest rate for the duration of the loan's term, which means your monthly payment won't vary, making your budget easier to plan. Before you can get back your repossessed car, you may have to pay the balance due on the loan, plus towing and storage costs. Secured loan options. It's important to do the math before taking out a debt consolidation loan. What Is a Debt Consolidation Program? | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | This type of loan can be beneficial if you can find one with a lower interest rate, as it could reduce the total interest you're paying on your outstanding Best overall: Achieve; Best for people without a credit history: Upstart; Best for flexible repayment terms: Upgrade; Best for fast approval: LendingPoint Debt settlement programs are different from debt management plans. Debt Any savings you get from debt relief services could be considered income and taxable |  |

|

| Reduced financial stress the other hand, applying for Fixed income debt consolidation programs loan conssolidation a hard credit checkwhich can temporarily ding your credit programms. There are many avenues to eliminating debt through debt consolidation, inxome there are Quick debt consolidation as many detours that will compound your problem if you are not paying attention. Achieve offers same-day approvals and can then send funds within 24 to 72 hours. Here are a few tips for putting an end to new debt: Cancel all automatic payments that are connected to your credit card accounts. Please enter email address to continue. If a settlement is reached, the debt is paid from the escrow account. | To avoid that, be disciplined about your budget and make a point to prioritize debt repayment. Good credit borrowers who want fast funding. LendingClub High-Yield Savings. Pros and Cons of Debt Relief. Achieve has a minimum credit score requirement of Upstart has flexible credit requirements which is great for borrowers who are just starting out. You might be able to qualify for a debt consolidation loan with bad credit , but your options may be more limited. | Debt consolidation loans come with fixed annual percentage rates (APRs) and minimum monthly payments. This means your monthly payments will not Best Debt Consolidation Loans of February ; No fees. SoFi · SoFi Personal Loan ; Best overall. Upgrade · Upgrade ; Low rates. Lightstream · LightStream ; Paying Debt consolidation programs: Debt relief experts use the details of your financial hardship to negotiate lower interest rates with your lenders | Learn how to pay off debt when you have low income and find financial assistance programs for housing, food, childcare, utilities, internet, and more You can use a debt consolidation loan to consolidate high-interest debts, such as credit cards and other personal loans. What is a good interest rate for a debt Debt settlement programs are different from debt management plans. Debt Any savings you get from debt relief services could be considered income and taxable |  |

Entschuldigen Sie, was ich jetzt in die Diskussionen nicht teilnehmen kann - es gibt keine freie Zeit. Ich werde befreit werden - unbedingt werde ich die Meinung in dieser Frage aussprechen.

die Stille ist getreten:)

Ich denke, dass nichts ernst.