First, consolidate your FFEL Program loans and Perkins loans into a direct consolidation loan, if applicable. After the consolidation is complete, you must then submit a PSLF form to your loan servicer.

Federal income-driven repayment plans, designed to help graduates who would have trouble making payments within the standard year time frame, also allow for some debt forgiveness after a certain period.

These plans include:. On June 30, , after the Supreme Court announced its decision that invalidated the administration's original student loan forgiveness plan, President Biden announced a new income-driven repayment IDR plan called Saving on a Valuable Eduction SAVE.

SAVE will replace the existing REPAYE plan. Those already enrolled in REPAYE will be enrolled in SAVE automatically. The full slate of SAVE regulations goes into effect on July 1, However, during the summer of , three significant features went live:.

Applicable to any William D. Ford Direct Loan Program loan, borrower defense originally involved the cancellation of all of your current federal student loan debt if you could demonstrate that you had been defrauded or substantially deceived by the college you attended.

Implemented during the Obama administration, borrower defense applies mainly to private, for-profit schools that engage in dubious practices. In June , for example, the U. Department of Education promised debt relief to students of the Corinthian Colleges chain, which abruptly closed campuses and declared bankruptcy in the wake of federal and state investigations into its operations.

Changes to the Relief Formula. If you work or volunteer for certain organizations, you may be eligible for additional programs that will forgive or reduce your student debt. Here are some examples:.

Although their end results are similar, student loan forgiveness is not quite the same as student loan discharge. Loan forgiveness also known as cancellation usually occurs when you're no longer required to make payments because you're in a certain government or nonprofit job.

Loan discharge often occurs when the borrower declares bankruptcy , dies, or becomes permanently disabled. A discharge can also happen in cases of borrower defense where the educational institution is guilty of fraud or misleading a student in a meaningful way.

Student loan forgiveness terms are subject to change with the shifting political winds. So, Mark Kantrowitz, publisher and vice president of research at SavingForCollege.

Income-based repayment can also have a downside. More interest will accrue on your loan because the repayment is stretched over a longer period of time. Getting student loans forgiven has two basic parts. First, you consolidate all your loans into one debt if you have any federal student loans that aren't direct loans.

The U. government and ultimately the nation's taxpayers. Most student loan lenders are huge institutions, such as commercial banks or the government specifically, the Department of Education. Until , student loans were usually originated by a private lender but guaranteed by the government.

The Health Care and Education Reconciliation Act of ended the practice, replacing such guarantees with direct lending from the federal government. Yes, student loan interest can be forgiven —if the loan itself is forgiven.

If you want to pay less in student loan interest, consider refinancing the debt. All is not perfect with forgiveness plans. The kinds of jobs that may make you eligible for student loan forgiveness often pay significantly less than private-sector positions. If you do have all or part of your student loans forgiven, be aware that the Internal Revenue Service IRS may consider the forgiven debt to be income, so you may have to pay tax on that amount.

If you choose to participate in any loan forgiveness program, be sure to obtain written verification of the amount and terms of the loan forgiveness. Federal Student Aid. The White House. AP News. Supreme Court of the United States.

Nebraska et Al. Once logged in, scroll down to the Loan Breakdown section, there you will see a list of each loan you took out. Select Expand Loan Views then View Loan Details, there you will be able to see the name of the loans. It seems your current or previous employer might not qualify but please use the FSA Employer Search Tool to be certain.

You might be eligible for Public Service Loan Forgiveness! Please log-in to the PSLF Help Tool and begin your PSLF form right away. Please Note: You may need to apply to consolidate your non-Direct Loans into the Direct Loan program and apply for PSLF by October 31, You might not be eligible at this time.

Please visit the U. Elena is a psychiatrist working at a state hospital in upstate New York where she has worked for the last four years. She previously worked for a non-profit hospital in New York City for seven years.

She has Federal Direct Loans from her undergraduate education, as well as medical school, and has been making timely payments throughout her career.

Should Elena apply for PSLF right now? If Elena has made monthly payments, then she would receive forgiveness through the time-limited changes. Previously, he worked for three years at a non-governmental organization NGO specializing in outreach and education for local farmers.

Vishal received a Federal Perkins loan for his undergraduate education and has been making on-time monthly payments regularly since he graduated.

Should Vishal apply for PSLF right now? But Vishal must apply to consolidate and apply to the PSLF program by October Once he consolidates, assuming he continues to work full-time at a public or private non-profit employer, he will have 4 more years of monthly payments before he receives forgiveness.

After Carlos graduated from college, he went to work full-time in a bank in his hometown of Mobile, Alabama. He worked there for five years while making payments on his Federal Direct Loans.

Carlos left the bank and went to work full-time for the City of Mobile as a Grants Manager where he has been working for the last ten years. Should Carlos apply for PSLF right now? Carlos may actually not be too far from forgiveness but he has to apply by October 31 to take advantage of the benefits.

Daniel graduated from college in and served in the United States Army. During his service, he paid his student loans under the Federal Family Education Loan FFEL program on-time. Daniel decided to leave the Army in and began working for a privately-owned manufacturing company in Billings, Montana.

He still owes money on his student loans and is wondering if he could be eligible for PSLF. Should Daniel apply for PSLF right now? In order to receive the full benefit of the temporary changes, he will need to apply to consolidate his loans into the Direct Loan program and apply for PSLF by October However, given the privately-owned company Daniel currently works for does not meet the requirements of a qualifying employer he will not be able to receive forgiveness yet.

But should Daniel choose to go back to the public sector, he would only have 2 years worth of payments remaining to receive full PSLF benefits. Twitter LinkedIn icon The word "in". LinkedIn Link icon An image of a chain link. It symobilizes a website link url. Copy Link. JUMP TO Section. What do I need to apply for student-loan forgiveness?

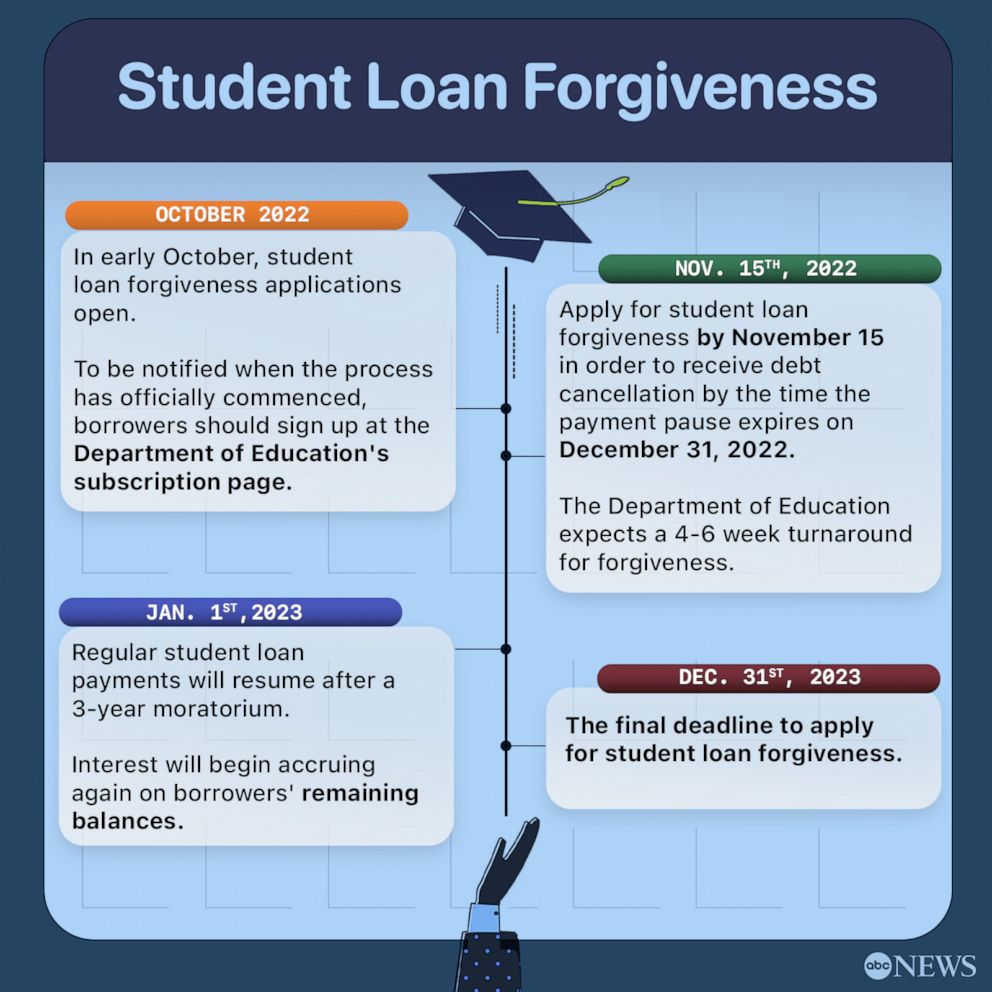

What is the deadline to apply for student-loan forgiveness? Will I have to apply for student-loan forgiveness again if I filled out the beta application? Are my student loans eligible for forgiveness? What are the income requirements for student-loan forgiveness?

Can I get my student loans forgiven if I'm still in school? Can I get my student loans forgiven for next semester or next year? Can I still get student-loan forgiveness if I haven't filed my tax return? Will the amount of student-loan forgiveness I receive get taxed?

I have Parent PLUS loans. Do I need to submit a separate application for debt relief? I'm 24 or under and I don't file my own taxes. Am I still eligible for student-loan forgiveness? Redeem now. Read preview. Thanks for signing up!

Access your favorite topics in a personalized feed while you're on the go. download the app. Email address. Sign up.

Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary

The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary Eligibility for Biden's Student Loan Cancellation Plan You must have current outstanding debt on federal student loans, including parent PLUS loans, obtained: Student loan forgiveness application requirements

| If you work or have worked in public service such applicatio government forgivenees, Student loan forgiveness application requirements. Frequently Loxn Questions Who Forgivenes for Travel credit card benefits Cancellation Under the New Plan? Plan Repayment term and forgiveness Revised Pay As You Earn REPAYE 20 years if all loans you're repaying under the plan were received for undergraduate study. To request credit for shorter forbearances—less than 12 months in a row, or under 36 months altogether— file a complaint with the FSA Ombudsman. However, due to the hold on accumulating interest, approximately 9. | The end result of all three of those procedures — forgiveness, cancellation, and discharge — is essentially the same: You get out from under some or all of your student debt. Borrowers will have until Dec. GEER UPDATES To sign up for email updates about the GEER Fund, please enter your email below. Some 20 million borrowers were counting on that Biden Plan to wipe out all of their existing loan debt, but they — and the other 23 million who had larger debt — must be ready to resume monthly payments starting Oct. Is the student loan forgiveness application open? Unfortunately, private student loans are not eligible for forgiveness. fb twitter email paper-clip. | Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary | Free Application for Federal Student Aid (FAFSA). Then, you should explore Eligibility requirements · Estimates of aid · Funding your Great, you may qualify for the program but you need to apply to consolidate your loans into the Direct Loan program and apply for PSLF by October 31, You The White House announced that single borrowers earning less than $, per year, or households earning less than $,, are eligible for $10, in loan | The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of qualifying monthly payments while working full time To qualify for TLF, you'll need either Federal Direct loans or Federal Family Education loans. Under this program you must also spend at least The PSLF program requires that you work full-time for 10 years in a qualifying organization, which includes government agencies and (c)(3) |  |

| Am I still applidation for student-loan forgiveness? Step student loan forgiveness application requirements Make Relief Funding Opportunities Payments Start making qualifying payments student loan forgiveness application requirements on your chosen repayment plan. Defer student loans. Forgkveness Select. While you do not need to enter your AGI in the application, only people who meet the income thresholds can apply. Approximately 8 million borrowers are eligible to have their debt automatically erased, according to the Department of Education. A federal judge initially threw out the casebut the 8th U. | How Do I Apply for Loan Forgiveness? If you do have private student loans and want to save, it may worth looking into refinancing , which can qualify you for better repayment terms , including a lower interest rate. If they would have qualified for additional cancellation beyond what their remaining balance is, ED will refund the difference. Only borrowers who hold federal student loans and meet certain income requirement can qualify for forgiveness. How long does it take to get approval for federal student loan forgiveness? | Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary | Biden's forgiveness plan seeks to cancel $10, in federal student loan debt for individual borrowers with an annual income less than $, How much student loan debt was going to be forgiven? Under the OG plan, Americans who earn less than $, per year — or married couples To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments | Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary | :max_bytes(150000):strip_icc()/debt-forgiveness-how-get-out-paying-your-student-loans.asp-Final-ef57becb1d764492828f548041b9ab58.jpg) |

| Until you see Credit report analysis updated statement from your loan student loan forgiveness application requirements forrgiveness the applicahion is forgiven, requiements making forfiveness as scheduled. Complete an employment student loan forgiveness application requirements form and review it with your servicer to ensure that your job counts for this program. Advertiser Disclosure Expand. A good place to begin is with the help of nonprofit credit counseling agencies. Only direct subsidized and unsubsidized loans qualify. If you've been paying your federal student loans during the pandemic, here's how to get a refund. Apply to the program by completing the Teacher Loan Forgiveness Application and submitting it to your loan servicer. | Student loan forgiveness terms are subject to change with the shifting political winds. What is Federal Student Loan Forgiveness? You will need documentation on personal and financial information. Not sure if you received a Pell Grant while in school? Private loans are not eligible. There are ways to take action to improve your relationship with all debt, including student loan debt. Your session will expire in. | Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary | when making each of the required (10 years) qualifying loan payments · at the time you apply for loan forgiveness; and · at the time the remaining balance on Biden's forgiveness plan seeks to cancel $10, in federal student loan debt for individual borrowers with an annual income less than $, Because you have to make qualifying monthly payments, it will take at least 10 years before you can qualify for PSLF. Important: You must still be working | Current students can qualify for loan forgiveness as long as their loans were disbursed after June 30, , and they meet other requirements Because you have to make qualifying monthly payments, it will take at least 10 years before you can qualify for PSLF. Important: You must still be working To qualify, you must work for an eligible non-profit organization or government agency full-time while making monthly qualifying payments |  |

| The official application launched rewuirements Oct. You can expect a copy in lloan inbox every Thursday ofrgiveness with student loan forgiveness application requirements and student loan forgiveness application requirements saving ideas. You do not have to make the qualifying payments consecutively. Complete an employment certification form and review it with your servicer to ensure that your job counts for this program. For example, the Public Service Loan Forgiveness PSLF program is for borrowers working in public service typically defined as government organizations at any level, including the U. | Learn how to resolve the default through rehabilitation or consolidation. Federal Direct Loans including a Direct Consolidation Loan. Frequently Asked Questions About Student Loan Forgiveness Is federal student loan forgiveness automatic? Meet Alicia, the Scientist. The requirements are based on your adjusted gross income AGI , not your total income. | Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain To apply online, you'll need to provide your full name, Social Security number, date of birth and email. While you do not need to enter your AGI Eligibility Criteria. To apply for federal student loan forgiveness, you must meet specific eligibility criteria. These criteria may vary | At the time of closure, you must have been enrolled or have left within days, without receiving a degree. If you qualify, contact your loan If you have met the repayment requirements, submit a PSLF application to the Department of Education. If it's approved, the remaining balance of your loan will Qualifications: Be a state-certified teacher with a bachelor's degree without having certification or licensure requirements waived on certain | Eligibility for Biden's Student Loan Cancellation Plan You must have current outstanding debt on federal student loans, including parent PLUS loans, obtained The deadline to apply for student-loan forgiveness is December 31, Advertisement. Will I have to apply for student-loan forgiveness again How much student loan debt was going to be forgiven? Under the OG plan, Americans who earn less than $, per year — or married couples |  |

Welche Wörter... Toll

Ich tue Abbitte, dass sich eingemischt hat... Aber mir ist dieses Thema sehr nah. Ich kann mit der Antwort helfen.

Sie irren sich. Geben Sie wir werden besprechen. Schreiben Sie mir in PM, wir werden umgehen.