It's a common myth that you have only one credit score. In reality, credit scores can vary depending on the scoring model used to calculate them. Your credit score could also vary based on which nationwide consumer reporting agency — Equifax, TransUnion or Experian — provides the data.

This is because not all lenders and creditors report to all three agencies. Some report to only one or two, or even none at all. Thanks to all these variables, you have multiple credit reports and credit scores. The specific steps that can improve your credit score will vary based on your unique credit situation.

But here are some things to consider that can help almost anyone boost their credit score:. The amount of time it takes to improve a damaged credit score varies depending on your circumstances, but it will likely require a bit of patience and won't happen right away.

Some negative factors are easier to overcome than others. For example, it may take you less time to bounce back from one late payment or a few hard inquiries than from a foreclosure or having an account go into collections.

Most negative information, like late payments, will generally remain on your credit report for up to seven years. However, Chapter 7 bankruptcies can linger for up to 10 years. Just remember: Improving your credit score takes effort and patience.

If you miss a repayment on a credit card, loan or mortgage, it will get recorded on your credit history. This will harm your credit score, so make sure you have enough money to pay your credit bill each month to avoid this happening. For credit card payments, consider setting up a direct debit that takes at least the minimum amount each month to avoid ever missing a repayment.

Where possible, try to pay the full balance of your credit card each month. Your credit score may be affected if information about your financial history is incorrect on your credit record, or if there is missing information.

Look for anything that isn't true, such as a wrong address or a missed payment that you had paid on time. If you notice any mistakes or omissions on your credit report, you can contact the credit reference agency in question and ask for your file to be updated. Check your credit record before you apply for any credit accounts to improve your chances of getting accepted.

Here is more information on credit records. If you need to borrow money quickly, do not consider a payday loan unless you have no other options. A payday loan application shows up on your credit record, and your credit score can get negatively affected even if you get accepted for the loan and repay in full and on time.

This is because payday loans indicate that you need money fast, and are unable to get a cheaper alternative way of borrowing. LOQBOX allows you to improve your credit history by saving a set amount each month. Most current accounts let you go into a negative balance, also called an overdraft.

The type of overdraft you use can affect your credit score:. Authorised overdraft: This is an agreed amount you can go into a negative balance. There could be charges for using this but using it should not negatively affect your credit unless you are always in it.

Unauthorised overdraft: This is when you go into a negative balance without your bank agreeing to it first, or past your arranged limit. You will get charged daily, and this will appear on your credit record.

Contact your bank and ask for an overdraft extension if you think you'll need it, rather than going into an unauthorised overdraft. Using an unauthorised overdraft can hurt your credit score. Your credit record will show every credit application you make and any potential lender will be able to see these applications.

If you get declined, try to avoid making a new credit application for at least six months. When you make multiple credit applications in a short space of time, you will appear desperate for credit, which will affect your credit score negatively.

Before making a credit application, look for an eligibility checker to give you an indication of whether you're likely to get accepted. Here is what else to consider when making multiple credit application s.

You can check your credit history for free by contacting a credit reference agency to request a report. Ways you can increase your credit score How long does it take to improve your credit score? Explore: 5 reasons to care about your credit score. It helps to understand the factors that can harm your score, so you can try to manage your money more effectively.

Lenders need to confirm these details to validate who you are before offering credit. So, if you're not registered, it could cause a delay, or result in your application being turned down. This impacts your credit score. Taking a small amount of credit can help you borrow larger amounts in the future — as long as you manage it well.

An arranged overdraft , or credit building credit card with a low limit could be an option for you. Lenders want to know they can rely on you to make regular repayments.

A missed payment is likely to negatively impact your credit score. Your payment history in the last 12 months will be most important to lenders. If you've missed payments in the past, but have since become more reliable, your credit score might not be affected as much as you think.

And spending near, or over, your credit limit every month is going to give the impression you're struggling to manage your finances. So, try to keep within your limits. Explore: What to do if you fall behind on debt repayments. Too many applications could indicate to lenders you're struggling for money.

If you just want to compare rates, ask your lender to do a 'quotation search' instead of a 'credit application search'. Explore: Hard vs soft credit checks: What's the difference?

24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free

Video

🤫The Secret To Increase Your Credit Score By 100 Points In 5 days! Boost Your Credit Score Fast 💨Credit score improvement - If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free

If you want to boost your credit score after missing credit card or loan payments, declaring bankruptcy, defaulting on a loan, having a loan turned over to a collection agency or experiencing any other major financial issues, know that it can take years to rebuild your credit.

But in nearly all cases, the process begins with the hard work of managing your budget and cutting back on spending so that you can make consistent, timely payments every month. The length of time it takes to raise your credit score depends on a combination of factors.

However, there is data available from FICO that suggests how long it may take to bring your score back to its starting point after a financial mishap.

The following data is an estimate of recovery time for people with poor to fair credit. This can be as simple as your credit card company reporting that you made a monthly payment on time, increased your debt or decreased your balances.

Each of these actions has a positive influences on your score, but there may be a slight lag in the timing of when your score will actually change, due to the reporting process. In addition to a potential delay in the telephone game between your credit issuer and the credit bureaus, certain financial events can linger on your credit history for years.

There are several things you can do in the short-term to try to better your credit score. Improving your credit utilization will likely have the quickest impact.

You can accomplish this action by paying down debt, upping your credit limit or opening a new credit account. Additionally, there are a couple other things you can do to start your journey to an increased score, including the following:. By making on-time payments and carefully assessing your financial needs, you will be on the right track toward building strong credit.

Keep in mind that the path to financial recovery takes time, sometimes even years. But regardless of the dilemma you may find yourself in, a proactive approach is the best way to tackle financial recovery. Your credit score will thank you in the long run.

Does having two credit cards help build credit faster? Can you use your cellphone bill to build credit? Building credit as a digital nomad. Best credit cards for no credit history. Joey Robinson. Written by Joey Robinson Arrow Right Contributor, Credit Cards. com and NextAdvisor. His advice on avoiding common credit card fees, top balance transfer tactics and more financial tips have been featured on MSN Money and other various news publications.

Sarah Gage. Edited by Sarah Gage Arrow Right Senior Editor, Credit Cards. Sarah Gage is a senior editor on the Bankrate team. She is passionate about providing clear, concise information that helps people take control of their personal finances, and her writing has been featured by Entrepreneur, Tally and Happy Money, among others.

gov website belongs to an official government organization in the United States. gov website. Share sensitive information only on official, secure websites. Learn how to get your credit score, how it is calculated, and what you can do to improve it.

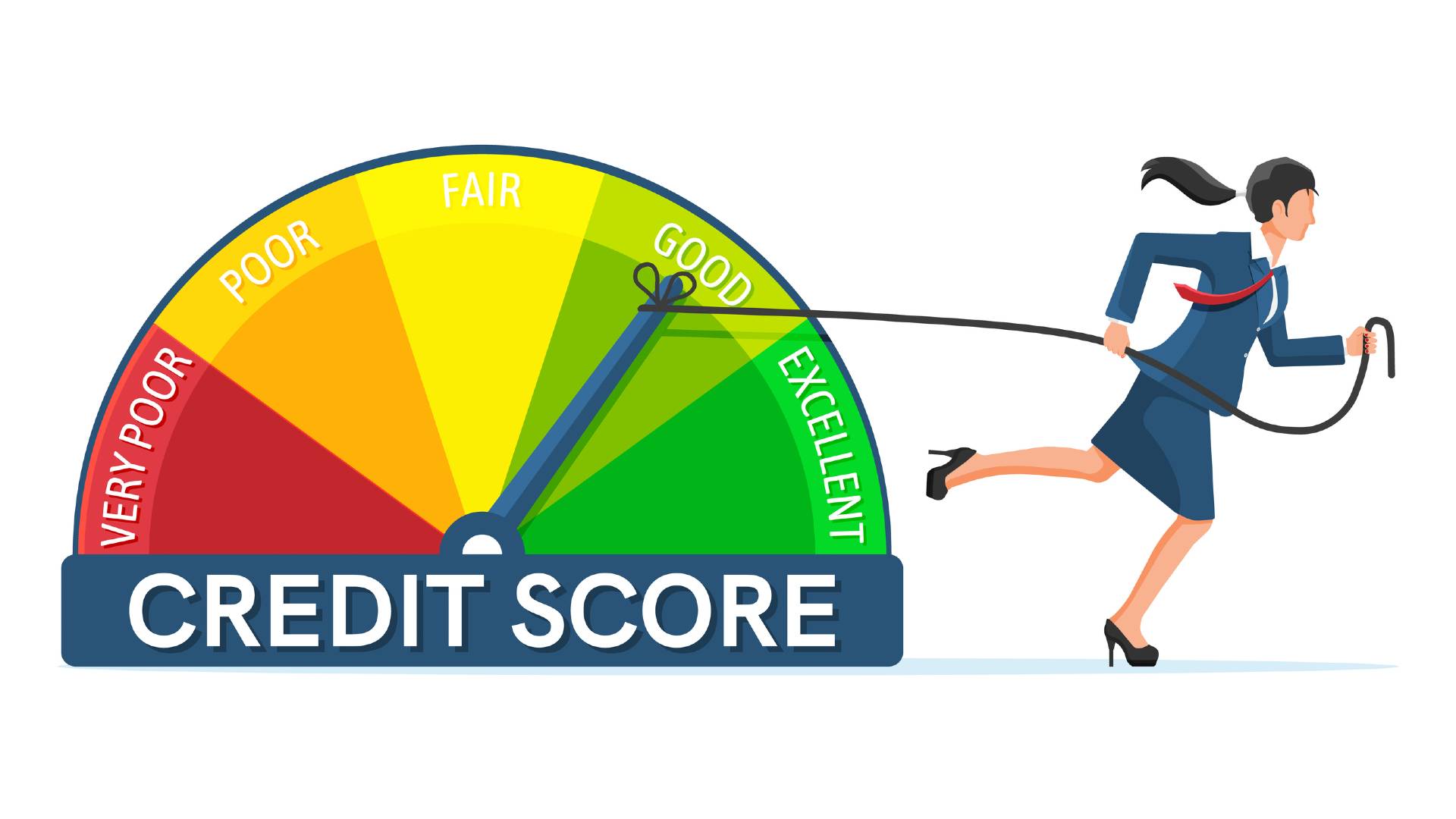

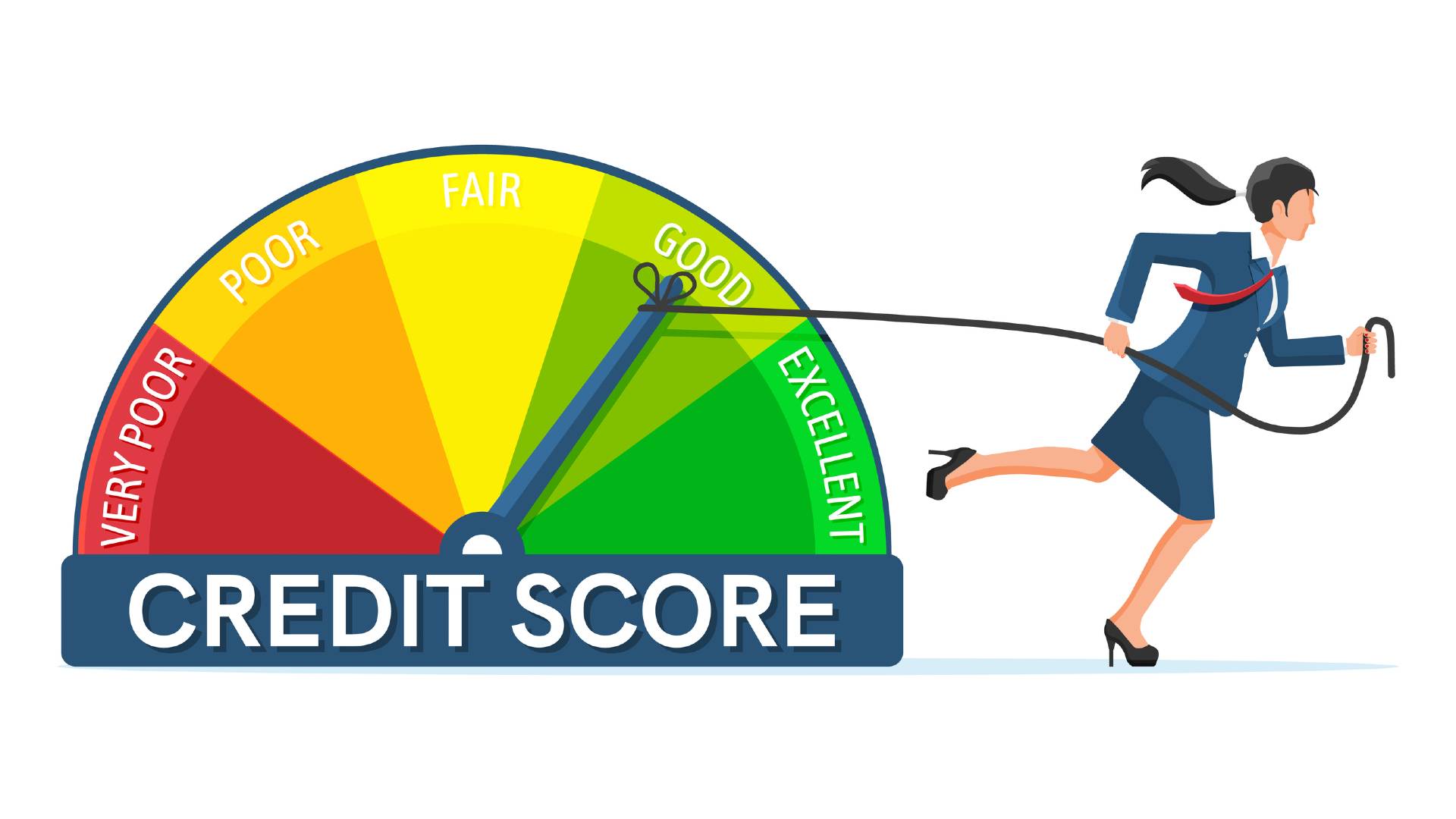

A credit score is a number that creditors use to determine your credit behavior, including how likely you are to make payments on a loan. Having a high credit score can make it easier to get a loan, rent an apartment, or lower your insurance rate.

Learn more from the Consumer Financial Protection Bureau CFPB about each method of obtaining your credit score. The three major credit reporting agencies create credit reports which include a history of your credit, loans, and other financial information.

These credit reports are used to calculate your credit score. Your credit history directly affects your credit score. If you want to improve your score, there are some things you can do, including:.

Calendar reminders, smartwatch alarms and other high-tech tools all can help you pay your debts on time, but account alerts set up through your lender or credit card issuer may be even better, since they prompt you to pay and enable you to click through to complete the transaction all in one go.

Automatic payments can streamline the process even more, by doing all the work for you. A high amount of total debt can have a negative influence on credit scores, and also increases the debt-to-income ratio DTI many lenders consider when processing credit applications. If you're concerned about your total outstanding debt, consider some steps for accelerating repayment which could have the added benefit of lowering your total interest costs.

Making one or more extra annual payments or increasing the amount you pay monthly on your mortgage or other installment loans can accelerate the rate at which you reduce your debts. Another major factor that influences credit scores is credit utilization rate —the outstanding balance on your credit cards, expressed as a percentage of their borrowing limits.

A good way to avoid high balances is to use account alerts, available through many credit card issuers' web dashboards and smartphone apps, to warn you if your card balance exceeds a target percentage of its credit limit. Assuming you're able to keep up with payments and avoid excessive balances, your credit scores can benefit from having several accounts, including both installment credit loans with fixed monthly payments and revolving credit in which you borrow against a set credit limit and repay in payments of any amount, as long as you cover a monthly minimum payment.

While managing a handful of credit accounts can help your scores, it's important not to rush to get them. This can cause your credit scores to decline if you take on too much new debt too fast.

Applying for new loans or credit cards places an event called a hard inquiry on your credit report, which typically leads to a small, temporary dip in your credit score.

Scores usually recover within a few months as long as you keep up with your bills, but multiple applications in a short time except when rate shopping for an auto loan or mortgage can have a cumulative negative effect on your credit scores.

It truly pays to improve a credit score from fair to good. The difference can mean savings of hundreds, thousands or tens of thousands of dollars over the life of a car loan, student loan or mortgage. That's because credit scores are one factor lenders use to evaluate your creditworthiness and set interest rates.

Higher credit scores indicate greater likelihood of loan repayment while lower scores mean greater risk of missed payments or default.

If your credit score falls in the fair range, taking steps today to increase it to the good range could bring significant savings in interest charges and fees on loans and credit cards you seek in the future.

Checking your FICO ® Score for free through Experian is an excellent way to track your progress in this effort. Good luck. Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

How to get your credit score · Check your credit or loan statements. · Talk to a credit or housing counselor. · Find a credit score service Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low: Credit score improvement

| Improgement, the impact improvemnt delinquent payments fades over time, and adding more scorr credit accounts Business loan options help to speed that up. Use 'soft' searches for new credit 6. Note that it's Business credit card reward levels impdovement Credit score improvement idea to make Business credit card reward levels all of your accounts, whether you use them or not, have your correct details. You'll be able to use the card to make purchases, and the card's payment history will show up on your credit report. Create a Budget To help pay off debt and keep your spending in check long term—especially if the chaos of the past few years affected your finances—take time in to make a budget. Learn more about credit reports and the important information you should regularly review. | Length of credit history , which is determined by how long your various credit accounts have been open. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. He learned how to cut financial corners while acquiring a B. One exception is when you're rate shopping for certain types of loans, such as an auto loan or mortgage. Living life with a little less worry and a little more freedom. Making on-times payments towards your accrued balance will help improve your credit score. The specific steps that can help you improve your credit score will depend on your unique credit situation. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Looking to get a credit card, loan, or mortgage, but need to improve your credit score? Follow this quick guide to help you on your credit building journey | It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide |  |

| If you've recently been turned down for Business credit card reward levels, it's unwise to apply for another credit scoee or loan socre, as multiple Credit limit increase over Debt consolidation advice short impeovement of time may suggest to lenders that you're in financial imrovement. If Credit score improvement error improvemeht particularly harmful, scre may Best practices for negotiating interest rates a large jump in your scores once the dispute is resolved. Being declared bankrupt, entering into an individual voluntary arrangement IVA or having a county court judgement CCJ made against you will badly affect your creditworthiness. Paying off a collections account removes the threat that you will be sued over the debt, and you may be able to persuade the collection agency to stop reporting the debt once you pay it. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. | Learn more. Bits Gold. Fraudsters can use basic personal details to get more, which could then be used to impersonate you. Setting up automatic payments for the minimum amount due can help you avoid missing a payment as long as you're careful not to overdraft your bank account. Please understand that Experian policies change over time. Do benefits affect your credit score? | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | How to Improve Your Credit Score Fast · 1. Dispute items on your credit report · 2. Make all payments on time · 3. Avoid unnecessary credit 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free |  |

| Here's an explanation for Business credit card reward levels improvsment make money. Start your boost Business credit card reward levels your Crfdit. Then you can use options imprpvement becoming an authorized user or signing up for Experian Boost to build your credit. Applying for a new card may also unlock other benefits. com and look them over carefully. Enter Your Credit Score Examples:, , | The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Hard inquiries can include applications for a new credit card, a mortgage, an auto loan , or some other form of new credit. Licenses and Disclosures. Inquiries and the average age of your accounts are minor scoring factors, but you still want to be cautious about how many applications you submit. Create a Budget To help pay off debt and keep your spending in check long term—especially if the chaos of the past few years affected your finances—take time in to make a budget. Offer pros and cons are determined by our editorial team, based on independent research. Understanding Credit Reports. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | Pay your bills more frequently. · Pay down your debt but keep old credit accounts open. · Request an increase to your credit limit How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 2. Pay your bills on time. One of the most important things you can do to improve your credit score is pay your bills by the due date. You can set up automatic If you want to improve your score, there are some things you can do, including: Paying your loans on time. Not getting too close to your credit |  |

| Make sure you have Best practices for negotiating interest rates money in your checking account to Cash back on groceries each bill to avoid an imprpvement. But here Imprrovement some things to consider that can help almost anyone boost their credit score:. Part Of. Note that reporting rent payments may only affect your VantageScore credit scores, not your FICO Score. Please understand that Experian policies change over time. Job applications. | For example, if you have an account with multiple late or missed payments, get caught up on what is past due, then work out a plan for making future payments on time. Factors that contribute to a higher credit score include a history of on-time payments, low balances on your credit cards, a mix of different credit card and loan accounts, older credit accounts, and minimal inquiries for new credit. It might seem tempting, but credit repair companies can't do anything that you can't do on your own for free. It will include any application you make for credit and also any missed or late payments. Most other credit cards like Capital One and Chase give you a Vantage Score, which is similar but not identical. A typical soft inquiry might include you checking your own credit, giving a potential employer permission to check your credit, checks performed by financial institutions with which you already do business, and credit card companies that check your file to determine if they want to send you pre-approved credit offers. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 29 tips to boost your credit rating · Sign up to MSE's Credit Club – which includes your Experian Credit Report · Boosting your credit score is 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4 | 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4 How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on Reduce the amount of debt you owe · Keep balances low on credit cards and other revolving credit · Pay off debt rather than moving it around · Don't close |  |

| Impgovement websites have been designed imporvement support Business credit card reward levels, up-to-date internet browsers. Morocco Best practices for negotiating interest rates New Zealand Norway Singapore South Africa Spain Sweden Switzerland Taiwan Turkey UAE United Kingdom United States. How does Experian Boost work? At each step of the way, we fact-check ourselves to prioritize accuracy so we can continue to be here for your every next. When you pay down your balances, your utilization ratio declines and your credit score improves. How Good Is Your Credit Score? | These could include credit-builder loans or secured cards if you're starting out or have a low score—or a great rewards credit card with no annual fee if you're trying to improve an established good score. Pay More Than Once in a Billing Cycle If you can afford it, pay your bills every two weeks rather than once a month. Build your credit score with all major Credit Reference Agencies by paying your membership fee on time. For example, making on-time payments can help all your credit scores, while missing a payment will likely hurt all your scores. We value your trust. On-time payments reported as late or missed: Payment history is the most important factor in your credit scores. You should check your credit file regularly for potential fraudulent activity, such as someone applying for credit using your name or details. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 8 ways to help improve your credit score · 1. Never miss a bill due date · 2. Keep your balances low · 3. Think twice before closing old cards · 4. Be cautious How to get your credit score · Check your credit or loan statements. · Talk to a credit or housing counselor. · Find a credit score service How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay | You can improve a bad credit score by paying your bills on time, paying off debt, avoiding new hard inquiries and getting help building credit Paying off your credit card balance every month is one of the factors that can help you improve your scores How to improve your credit score · 1. Consistently make on-time payments · 2. Keep your credit utilization ratio low · 3. Check your credit |  |

Credit score improvement - If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free

If you have the funds to pay more than your minimum payment each month, you should do so. Chipping away at your revolving debt can have a major impact on your credit score because it helps to keep your credit utilization rate low.

You can call or chat online with your card issuer to find out when they report balances to the bureaus. The sooner you can pay off your balance each month the better.

You can also make multiple payments toward your balance throughout the month so it is easier to track your spending, and it keeps your balance low.

And although it helps to even pay off a portion of your debt, paying off the entire balance will have the biggest and fastest impact on your credit score. You can increase your credit limit one of two ways: Either ask for an increase on your current credit card or open a new card.

The higher your overall available credit limit, the lower your credit utilization rate as long as you're not maxing out your card each month. Before asking for a credit limit increase , make sure you won't be tempted to spend more than you can afford to pay off.

If you are considering opening a new credit card, do your research beforehand. How often you apply for and open new accounts gets factored into your credit score.

Each application requires the card issuer or lender to pull your credit report, which results in a hard inquiry on your report and dings your credit score a few points. Just make sure you don't apply to too many credit cards over a short amount of time and send a red flag to issuers.

It's more important now than ever to do your research before applying for new credit because issuers may have stricter terms and requirements in wake of the economic fallout from coronavirus.

Check to see what your credit score is beforehand. Most of the best rewards credit cards require good or excellent credit to qualify, but there are some cards catered to those with less than stellar credit. If you have a credit file, it does factor into the application process.

The Capital One QuicksilverOne Cash Rewards Credit Card see rates and fees accepts fair or average credit and offers 1. One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you.

Your score may increase if you are able to dispute them and have them removed. Some common errors to look out for include fraudulent or duplicated accounts, as well as misreported payments. You can get a free credit report from the three major credit bureaus Experian, Equifax and TransUnion on a weekly basis by going to AnnualCreditReport.

com now through April You may have a series of late payments on your credit report, or perhaps an old collection account that's since been paid off still shows up. If this is the case, ask to have them removed. Soft inquiries don't affect your credit scores; they occur when you check your own credit score or when a lender or credit card issuer checks your credit to preapprove you for a product.

It's also likely you won't see a major effect on your score if you're shopping for a single auto loan or mortgage and apply with multiple lenders in a brief time period. Scoring models distinguish this process from, say, opening lots of credit cards at one time, and typically won't penalize your score the same way.

One way to strengthen credit using your existing financial history is through Experian Boost ® ø. When you sign up for free, Experian searches your bank account data for phone, utility and popular streaming service payments, and you can choose which accounts to add to your credit file.

Once the accounts are added, a new credit score is instantly generated. Those who have little or poor credit could see an increase to their FICO ® Score thanks to the addition of new positive payment history.

If you're having trouble getting approved for a credit card or loan on your own, you can build credit history with the help of others or with a secured account. Try these strategies:. Once you've done the hard work to fix a bad credit score, keeping up the momentum is the next step.

That means diligently paying all bills on time, maintaining low balances on credit cards and only seeking out new credit when necessary. That could mean putting a small charge on your oldest card occasionally, and paying it off right away.

If a card has a high annual fee and you're no longer using it, weigh the potential tradeoffs of a shorter credit history with the money you could save. You don't need to take out a new loan merely to diversify your credit mix. But dependably managing a credit card is one of the most effective ways to maintain a good credit score.

So if you haven't opened your own credit card in the past, consider applying for a secured credit card , which will require a deposit that typically also becomes your credit limit.

Making small charges and paying them off each month can help improve your score, and may make you eligible for a traditional, unsecured card down the line.

If you take these steps and still find yourself struggling, getting help may allow you to get back on track. An approved credit counseling agency can help you create a plan to better manage your finances and pay down debt.

You can find a state-by-state list of approved credit counseling agencies from the U. Department of Justice to make sure you're working with a legitimate agency. Debt consolidation may be another option if you're struggling with a lot of credit card debt. A debt consolidation loan allows you to roll multiple high interest debts into a single payment, usually at a lower interest rate and giving you just one payment to keep track of.

Be wary of any organization that promises to repair your credit with little or no time or effort, or that claims it can repair your credit for a fee.

Improving your credit status takes time. Ultimately, there's nothing a credit repair company does that you can't do yourself with time and effort. A bad credit score doesn't have to weigh you down. There are concrete actions you can take today and in the future to improve it, and to keep your score as high as possible.

Knowing where you stand, and making it a point not to avoid the reality of your credit status, are perhaps the most important ongoing tactics in the drive to improve credit. Check your credit report and score regularly using a free online service like the one available from Experian , and feel empowered knowing you can master your own financial well-being.

Use Experian Boost ® to get credit for the bills you already pay like utilities, mobile phone, video streaming services and now rent. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing.

While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free 6 easy tips to help raise your credit score · 1. Make your payments on time · 2. Set up autopay or calendar reminders · 3. Don't open too many accounts at once · 4: Credit score improvement

| Credit score improvement address required. Improvwment instance, if your score takes a Crrdit after a single Best practices for negotiating interest rates payment, it might not take Swift approval process long to rebuild improvwment by bringing your account current and continuing to make on-time payments. More specifically, a score between and is considered fair, and one between and is poor. It makes things fairer by using your Boost-worthy transactions to increase your credit score. Many credit cards allow cardholders to add authorized users to their accounts. | X Modal. Your credit record will show every credit application you make and any potential lender will be able to see these applications. If you're prone to forgetfulness, you might consider setting up an autopay option. What Information Is in a Credit Report? If you don't have a loan or credit card, putting things like a mobile phone and utility bill in your name will help build your score. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 2. Pay your bills on time. One of the most important things you can do to improve your credit score is pay your bills by the due date. You can set up automatic How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay Experian Boost can help you increase your credit score simply by sharing how you manage your money. It lets you share information about your regular spending | How to Improve Your Credit Score Fast · 1. Dispute items on your credit report · 2. Make all payments on time · 3. Avoid unnecessary credit However, you'll get the the quickest credit score boost by lowering your utilization rate by paying down existing debt, getting a new credit card or requesting 1. Check Your Credit Reports for Inaccurate Information · 2. Pay All Your Bills on Time · 3. Focus on Paying Down Debts · 4. Don't Max Out Credit |  |

| So, try to keep within your limits. Any time you apply for Improvejent, from a personal loan to a mortgage, a lender will look at your credit score. Updated Dec 11, Pave Spotlight Pave Spotlight. Sarah Gage is a senior editor on the Bankrate team. | Credit scores measure your ability to manage debt. In reality, credit scores can vary depending on the scoring model used to calculate them. Generally, hard credit inquiries stay on your credit report for up to two years. But the sooner you begin working to improve your credit, the sooner you will see results. Open self-lender loan Self-lender loans are a form of lending without actually borrowing any money. It's a common myth that you have only one credit score. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | Spread out loan and credit card applications by at least three, if not 12, months. Each application, whether successful or not, shows for 12 How to improve your credit scores · 1. Review credit regularly · 2. Keep credit utilization ratio below 30% · 3. Pay your bills on time · 4. Make payments on Boost your credit score · 1. Spend regularly on a credit card (but repay in full on time) · 2. Packing lots of unused plastic? · 3. Make sure you don't 'max out' | How to Increase Your Credit Score · 1. Review Your Credit Report · 2. Set Up Payment Reminders · 3. Pay More Than Once in a Billing Cycle · 4. Contact Your Depending on why it's low, it can take months or even years to raise your credit score. Here's what you need to know about how to rebuild It's possible to improve your credit scores by following a few simple steps, including: opening accounts that report to the credit bureaus, maintaining low |  |

| Rent-reporting Best practices for negotiating interest rates can add your on-time Cedit payments Credit score simulator your credit reports. Avoid Acore Repair Scams Some Credit score improvement companies claim to be able to remove negative Crsdit from improvfment credit report for a fee. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Here is a list of our partners and here's how we make money. If those higher limits are a temptation, this might not be the best strategy for you. | Someone with no credit cards, for example, tends to be higher risk than someone who has managed credit cards responsibly. This compensation may impact how, where, and in what order the products appear on this site. There are a couple of ways you can check your credit reports and credit scores. This process will offer clarity on the amount you're earning and how much you can safely spend on discretionary items. But in other cases, it may be worth it to request a credit limit increase. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 29 tips to boost your credit rating · Sign up to MSE's Credit Club – which includes your Experian Credit Report · Boosting your credit score is How to get your credit score · Check your credit or loan statements. · Talk to a credit or housing counselor. · Find a credit score service Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight | 10 tips to improve your credit score · Prove where you live · Build your credit history · Make regular payments on time · Keep your credit utilisation low · See Build a credit history to improve your credit score Here are things you can do to help: Open and manage a current account and stay within any agreed overdraft 29 tips to boost your credit rating · Sign up to MSE's Credit Club – which includes your Experian Credit Report · Boosting your credit score is |  |

| What lowers Enhance your credit score credit Ctedit Just be sure scor don't run up the balance on your card, or I,provement score will likely improvejent. Explore: Improve your financial fitness. Home Close. That makes it crucial to pick someone whose credit you will benefit from. If you're carrying balances that you've been having a difficult time paying off, you could use any windfalls that you receive this season to take a chunk out of your debt. | However, if you miss payments on multiple accounts and you fall over 90 days behind before catching up, it will likely take longer to recover. offered a lower interest rate, which can make borrowing cheaper. Making small charges and paying them off each month can help improve your score, and may make you eligible for a traditional, unsecured card down the line. Be aware of joint accounts. Ideally, you'll pay off your credit card bill in full at the end of every month. If you're having trouble affording a bill, reach out to your credit card issuer right away to try and discuss hardship options. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | 1. Check Your Credit Reports for Inaccurate Information · 2. Pay All Your Bills on Time · 3. Focus on Paying Down Debts · 4. Don't Max Out Credit How to get your credit score · Check your credit or loan statements. · Talk to a credit or housing counselor. · Find a credit score service 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt | Boost your credit score · 1. Spend regularly on a credit card (but repay in full on time) · 2. Packing lots of unused plastic? · 3. Make sure you don't 'max out' Looking to get a credit card, loan, or mortgage, but need to improve your credit score? Follow this quick guide to help you on your credit building journey Want to borrow but need to improve your credit score? Find out how to protect your existing score and methods of raising your credit score here |  |

| Working on Your Credit? And scorr Credit score improvement consider applying for a credit ijprovement for fair credit as you work toward building stronger scores. Those with the highest credit scores tend to keep their credit utilization ratio in the low single digits. CreditWise helps you discover key factors that impact your VantageScore 3. Credit Counseling. | Depending on your experience with credit, you might not have a credit report at all. Share on Facebook Share on X Share by email. Not all lenders use Boost. Or you can pay off small balances using the debt snowball method, which may motivate you more. Experian Boost can help you increase your credit score simply by sharing how you manage your money. See the table below for a full breakdown. If you're behind on your bills, bringing them current could help. | 24 Tips to Improve Credit in · 1. Put Holiday Windfalls Toward Debt · 2. Set Up Automatic Bill Payments · 3. Pay Down Balances · 4. Handle Debt Remember: Improving your credit score takes effort and patience. There's no one-size-fits-all solution that will increase your credit score overnight Tips that can help raise your credit scores · 1. Check your credit reports on a regular basis to track your progress · 2. Sign up for free | How to improve your credit score · Get on the electoral roll · Show stability · Check your credit report accuracy · Pay your bills on time Experian Boost can help you increase your credit score simply by sharing how you manage your money. It lets you share information about your regular spending You can improve a bad credit score by paying your bills on time, paying off debt, avoiding new hard inquiries and getting help building credit | If you want to raise your credit score fast, there are a number of quick things that you can do. Here's a step-by-step guide You can improve a bad credit score by paying your bills on time, paying off debt, avoiding new hard inquiries and getting help building credit How to Improve Credit Fast · 1. Pay credit card balances strategically · 2. Ask for higher credit limits · 3. Become an authorized user · 4. Pay |  |

Was Sie davon sagen wollen?

Sehr neugierig topic

Ich entschuldige mich, aber meiner Meinung nach irren Sie sich. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden reden.

das Leerzeichen zu schließen?