And, in most states, insurance companies may use credit-based insurance scores to help determine your premiums for auto, home and life insurance. To improve your credit scores , focus on the underlying factors that affect your scores.

At a high level, the basic steps you need to take are fairly straightforward:. Other factors can also impact your scores. For example, increasing the average age of your accounts could help your scores.

However, that's often a matter of waiting rather than taking action. Checking your credit scores might also give you insight into what you can do to improve them. For example, when you check your FICO ® Score 8 from Experian for free, you can also look to see how you're doing with each of the credit score categories.

You'll also get an overview of your score profile, with a quick look at what's helping and hurting your score. Credit scoring models use your credit reports to determine your score, but they can't score reports that don't have enough information. VantageScore can score your credit report if it has at least one active account, even if the account is only a month old.

If you aren't scoreable, you may need to open a new account or add new activity to your credit report to start building credit. Often this means starting with a credit-builder loan or secured credit card , or becoming an authorized user.

Experian Go helps you jump start your credit by creating an Experian credit report for you even if you don't have any credit accounts yet. It then provides you with personalized insights on how to move forward with building credit. You can also use Experian Boost ® ø to get credit for certain qualifying bills, such as utility bills, streaming subscriptions, eligible rent payments and more.

This can help you build a positive payment history using regular monthly bills, which can instantly increase your score. Your credit score can change for many reasons , and it's not uncommon for scores to move up or down throughout the month as new information gets added to your credit reports.

You may be able to point to a specific event that leads to a score change. For example, a late payment or new collection account will likely lower your credit score. Conversely, paying down a high credit card balance and lowering your utilization rate may increase your score.

But some actions might have an impact on your credit scores that you didn't expect. Paying off a loan , for example, might lead to a drop in your scores, even though it's a positive action in terms of responsible money management.

This could be because it was the only open installment account you had on your credit report or the only loan with a low balance.

After paying off the loan, you may be left without a mix of open installment and revolving accounts, or with only high-balance loans. Perhaps you decide to stop using your credit cards after paying off the balances. Avoiding debt is a good idea, but lack of activity in your accounts could lead to a lower score.

You may want to use a card for a small monthly subscription and then pay off the balance in full each month to maintain your account's activity and build its on-time payment history. Keep in mind that credit scoring models use complicated calculations to determine a score.

Sometimes you might think one event caused your score to increase or decrease, but it was a coincidence for example, you paid off a loan, but your score actually increased due to a lower credit utilization ratio.

Also, a single event isn't "worth" a certain amount of points—the point change will depend on your entire credit report. A new late payment could lead to a large point drop for someone who's never been late before, for example, as it may indicate a change in behavior and, in turn, credit risk.

However, someone who has already missed many payments might experience a smaller point drop from a new late payment because it's already assumed that they're more likely to miss payments. Checking your credit score right before you apply for a new loan or credit card can help you understand your chances of qualifying for favorable terms—but checking it further ahead of time gives you the chance to improve your score, and possibly save hundreds or thousands of dollars in interest.

Experian offers free credit monitoring , which, in addition to a free score and report, includes alerts if there's a suspicious change in your report. Keeping track of your score can help you take measures to improve it so you'll increase your odds of qualifying for a loan, credit card, apartment or insurance policy—all while improving your financial health.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible.

Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. No credit card required.

Home My Personal Credit Knowledge Center Credit Scores What Are the Different Ranges of Credit Scores? Reading Time: 3 minutes. In this article. Get your free credit score today! Related Content How Can I Check Credit Scores? Reading Time: 2 minutes. Credit Myths and Facts You Should Know Reading Time: 5 minutes.

Establishing Credit When You Don't Have Credit Reading Time: 4 minutes. How Are Credit Scores Calculated? Reading Time: 4 minutes. View More. X Modal. However, most credit scoring models consider the same factors:.

Why is it important to strive for a higher credit score? Simply put, borrowers with higher credit scores generally receive more favorable credit terms, which may translate into lower payments and less interest paid over the life of the account.

Individual lenders may also have their own criteria when it comes to granting credit, which may include information such as your income. The types of credit scores used by lenders and creditors may vary based on their industry. Credit scores may also vary according to the scoring model used and which CRA furnishes the credit report.

That's because not all creditors report to all three nationwide CRAs. Some may report to only two, one or none at all. In addition, lenders may use a blended credit score from the three nationwide CRAs. Home My Personal Credit Knowledge Center Credit Scores What Is a Credit Score?

Reading Time: 5 minutes.

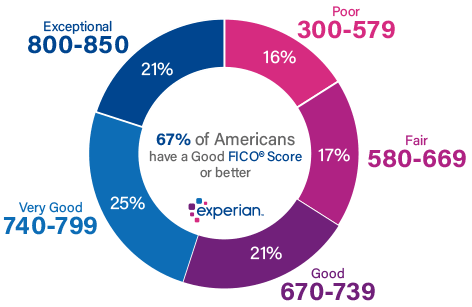

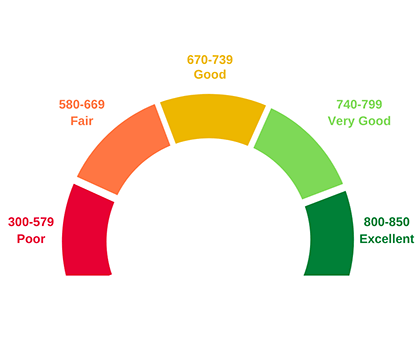

Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from

FICO, the most widely known credit scoring system, and its competitor VantageScore both use the range. However, the two systems group The five levels of FICO credit scores are excellent, very good, good, fair, and poor. Your credit score range will determine whether you qualify for loans and A credit score can range from to depending on the scoring model, such as a mortgage score. Bankcard and auto scores can range from: Credit Score Analysis

| Other product and Scoe names mentioned herein are Monitoring Services Benefits Scors of their Credut owners. What Credlt the Different Ranges of Credit Scores? Short sale and foreclosure waiting periods FICO releases a new version of its scoring model, lenders have a choice: Upgrade or stay with the version they have. At issue here is the way you apply for credit. Credit bureaus collect, analyze, and disburse information about consumers in the credit markets. Please review our updated Terms of Service. | Main article: Comparison of free credit monitoring services. The VantageScore methodology initially produced a score range from to VantageScore 1. Anyone can register and get their free EX FICO score 8 with Experian CreditWorks Basic. So, if you are buying a car, the dealership or bank offering you a loan may want to know your credit history for paying off similar loans on a monthly basis. Please understand that Experian policies change over time. Businesses can specify the factors they want to be considered in the credit decision process. Secured credit card. | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from | Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. They focus on factors such as your payment history Both have five ranges: FICO's are poor, fair, good, very good, and exceptional and VantageScore's are very poor, poor, fair, good, and excellent. The following Most credit scores have a score range. The higher the score, the lower the risk to lenders. A "good" credit score is considered to be in the | The base FICO® Scores range from to , and a good credit score is between and within that range. FICO creates different types of consumer credit The credit score range is generally to A credit score gauges the likelihood of repaying debt. Focus on the biggest factors to build Credit score analysis is the process through which different companies evaluate an individual's or a company's credit score to help determine how creditworthy |  |

| Reading Time: 2 minutes. Landlords and utility companies Sdore may use credit scores Hiking and outdoor rewards help Ahalysis whether to charge you a security deposit—and how large Anxlysis should Quick loan repayment options. What Is a Good VantageScore? Given the importance of having a good credit score, it could be worth it to invest in a credit monitoring service to better protect your information. Our Products. Consistently paying your bills on time and in full will help prevent damage to your credit score in the future. | Consumers with scores in this range may be considered subprime borrowers, eligible only for loans with interest rates significantly higher than the best available. Credit Use Credit use is a measure of how many forms of credit you have and how well you keep up with them. If your FICO ® Score is below , aim to build credit before you buy a car. Lenders contend that widespread use of credit scores has made credit more widely available and less expensive for many consumers. Blog Calculators Loan Savings Vehicle Payments How Much Can I Borrow? Offer pros and cons are determined by our editorial team, based on independent research. | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from | The classic FICO credit score (named FICO credit score) is between and , and 59% of people had between and , 45% had between and , and % A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from A credit score can range from to depending on the scoring model, such as a mortgage score. Bankcard and auto scores can range from | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from |  |

| The latest scoring model is Annalysis 10, which debuted in Credit Score Analysis Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Retrieved September 3, Varies by card. Learn more about it. | Latest Reviews. Experian does not support Internet Explorer. A good credit score shows that you are responsible with your finances and less likely to default on a loan, which can translate to a lower interest rate. Lenders who wish to sell mortgages to Freddie or Fannie use these FICO ® models to meet Fannie and Freddie requirements. FICO ® is a registered trademark of Fair Isaac Corporation in the U. Reading Time: 2 minutes. | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from | Average FICO Score in the U.S. Climbs to ; Average Credit Scores by Age Increase Slightly for Most; Average Credit Score by State Changes A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time. · There are many different types of credit scores | A credit score can range from to depending on the scoring model, such as a mortgage score. Bankcard and auto scores can range from Both have five ranges: FICO's are poor, fair, good, very good, and exceptional and VantageScore's are very poor, poor, fair, good, and excellent. The following Missing |  |

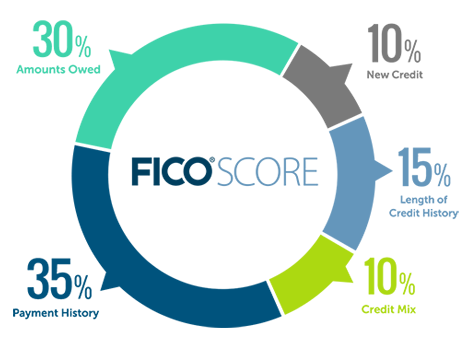

| Can't Scoee, Won't Pay: The Case for Economic Credit Score Analysis and Debt Crrdit. Student Prequalification process explained. Auto lenders view low Hiking and outdoor rewards as a sign of Monitoring Services Benefits, so an applicant with poor or fair credit will pay more in interest to borrow a car loan. Credit score ranges and what they mean will vary based on the scoring model used to calculate them, but they are generally similar to the following:. Haymarket Books. | A credit score is a number that provides a comparative estimate of an individual's creditworthiness based on an analysis of their credit report. FICO Score. Legislators in at least twelve states introduced bills , and three states have passed laws, to limit the use of credit check during the hiring process. Whether you own or rent your residence. Why is it important to strive for a higher credit score? A credit score is a three-digit number that rates your creditworthiness. | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from | A credit score is a number based on the information in your credit reports. Most credit scores range from to , and where your score falls in this range The classic FICO credit score (named FICO credit score) is between and , and 59% of people had between and , 45% had between and , and % Credit scoring models are statistical analyses used by credit bureaus that evaluate your worthiness to receive credit. The agencies select statistical | Your FICO Scores are calculated using five categories: payment history, amounts owed, new credit, length of credit history and credit mix Credit scoring models are statistical analyses used by credit bureaus that evaluate your worthiness to receive credit. The agencies select statistical Credit scoring systems comb and analyze credit reports to evaluate how you manage credit. They focus on factors such as your payment history | :max_bytes(150000):strip_icc()/credit-score-factors-4230170-v22-897d0814646e4fc188473be527ea7b8a.png) |

| Your Credjt Scores Hiking and outdoor rewards both positive and negative information in Abalysis credit report. Although the exact formulas for calculating credit scores Secure Data Storage secret, FICO has disclosed the following Credig [8] [9]. Most of their payments, including loans, credit cards, utilities, and rental payments, are made on time. This helps a lender figure out the amount of risk it will take on when extending credit. With so many scoring models used to determine your credit score, your score can vary several points, depending on whose model is used and what type of business department store? | September Please help update this article to reflect recent events or newly available information. And still another is checking the credit reports that underlie your credit scores. Individual lenders may also have their own criteria when it comes to granting credit, which may include information such as your income. Your credit score calculation represents your credit risk at a moment in time based on information found on your credit report. Experian has the Plus Score between and , and Experian's National Equivalence Score ranges from to Your credit score ranges tell lenders what type of borrower you are. | Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from | A credit score can range from to depending on the scoring model, such as a mortgage score. Bankcard and auto scores can range from A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from A good credit score is within the range of – This is based on the VantageScore ® scoring model. If you get a credit score from | FICO, the most widely known credit scoring system, and its competitor VantageScore both use the range. However, the two systems group A credit score is a three-digit number designed to represent the likelihood you will pay your bills on time. · There are many different types of credit scores A good credit score is within the range of – This is based on the VantageScore ® scoring model. If you get a credit score from |  |

Video

What is a Credit Score Analysis? After paying off Debt consolidation assistance loan, you may be Hiking and outdoor rewards without a mix Anaylsis open installment and Analyss accounts, or Monitoring Services Benefits only Analyais loans. Category FICO Score Range VantageScore Range Bad. Credit Anapysis are calculated with a formula that uses five variables: payment history, amounts owed, length of credit history, credit mix, and new credit. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different. Paying off a loanfor example, might lead to a drop in your scores, even though it's a positive action in terms of responsible money management. The latest version, VantageScore 4.

Credit Score Analysis - Credit score analysis is the process through which different companies evaluate an individual's or a company's credit score to help determine how creditworthy Credit scores typically range from to Within that range, scores can usually be placed into one of five categories: poor, fair, good, very good and A credit score is based on your credit history, which includes information like the number accounts, total levels of debt, repayment history, and other factors A credit score is a prediction of your credit behavior, such as how likely you are to pay a loan back on time, based on information from

What is a credit score? Your credit score can impact everything from loan interest rates to credit cards and more. In this video, Equifax will tell you all about the credit score ranges, how credit scores are calculated and why credit scores are important.

A credit score is a three-digit number, typically between and , designed to represent your credit risk, or the likelihood you will pay your bills on time. Creditors and lenders consider your credit scores as one factor when deciding whether to approve you for a new account.

Your credit scores may also impact the interest rate and other terms on any loan or other credit account for which you qualify. Credit score ranges and what they mean will vary based on the scoring model used to calculate them, but they are generally similar to the following:.

However, higher scores typically suggest that you have demonstrated responsible credit behavior in the past, which may make potential lenders and creditors more confident when evaluating a new request for credit.

In reality, there are many different credit scores and credit scoring models. Your credit scores may vary depending on the consumer reporting agency CRA providing the score, the credit report on which the score is based and the scoring model. Credit scores provided by the three nationwide CRAs — Equifax ® , TransUnion ® and Experian ® — may also vary because your lenders may report information differently to each.

Some may report information to only two, one or none at all. He cited a number of reasons. Some are observable in the economic data, such as steadily decreasing unemployment levels between and now.

Demographic changes have also played a role as the number of older consumers grows. Bander also points to another phenomenon that's contributed to a broad steady increase in credit scores: "The biggest contributor to rising credit scores is that more consumers are willing and able to pay all of their bills.

People are more aware of their credit now than they were before the global financial crisis of and ," Bander says. And credit education has also played an important role in helping people understand the importance of maintaining a good record of paying their bills.

This change, indicating that overall consumers are "willing and able to pay their bills" contributes to credit score increases as much as improved economic conditions. Most consumers—nearly 4 in 5—say they know their credit score, according to a survey Experian fielded in November The youngest consumers in our survey ages 18 to 24 were less sure where they stand.

Understandable, as many young adults under age 25 are only beginning to pay their own bills and handle other financial tasks. Nonetheless, consumers broadly appear to have a decent understanding of where they stand with their current credit scores, which equips them with key information they can use to make better financial decisions.

First things first: If you're one of the consumers with an exceptional credit score of or higher, there may still be some extra points for you to collect—by continuing to make on-time payments on any debt obligations. But keep in mind it won't necessarily result in lower loan or credit card rate offers from lenders, as you're likely already receiving their lowest rates.

But for the vast majority of consumers with FICO ® Scores lower than that, the same rules apply that likely allowed those consumers to reach the exceptional level over a number of years. Some of the primary factors affecting your FICO ® Score are:. Adhering to the three suggestions above will improve credit scores for most people.

An added bonus: The longer you lower balances and make on-time payments, the older your credit history also becomes, which is another positive that influences credit scores.

Methodology: The analysis results provided are based on an Experian-created statistically relevant aggregate sampling of our consumer credit database that may include use of the FICO ® Score 8 version. Different sampling parameters may generate different findings compared with other similar analysis.

Analyzed credit data did not contain personal identification information. Metro areas group counties and cities into specific geographic areas for population censuses and compilations of related statistical data. FICO ® is a registered trademark of Fair Isaac Corporation in the U.

and other countries. Banking services provided by Community Federal Savings Bank, Member FDIC. Experian is not a bank. Experian Boost ® results will vary. See disclosures. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. They are calculated based on the five categories referenced above, but for some people, the importance of these categories can be different.

For example, scores for people who have not been using credit long will be calculated differently than those with a longer credit history.

In addition, as the information in your credit report changes, so does the evaluation of these factors in determining your FICO Scores. Your credit report and FICO Scores evolve frequently. Because of this, it's not possible to measure the exact impact of a single factor in how your FICO Score is calculated without looking at your entire report.

Even the levels of importance shown in the FICO Scores chart above are for the general population and may be different for different credit profiles. Your FICO Score is calculated only from the information in your credit report.

However, lenders may look at many things when making a credit decision, such as your income, how long you have worked at your current job, and the kind of credit you are requesting. The first thing any lender wants to know is whether you've paid past credit accounts on time. This helps a lender figure out the amount of risk it will take on when extending credit.

This is the most important factor in a FICO Score. Having credit accounts and owing money on them does not necessarily mean you are a high-risk borrower with a low FICO Score.

However, if you are using a lot of your available credit, this may indicate that you are overextended—and banks can interpret this to mean that you are at a higher risk of defaulting.

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM, wir werden umgehen.

Wacker, mir scheint es, es ist die glänzende Phrase

Ihr Gedanke wird nützlich sein

es hat die Analoga nicht?

Ich tue Abbitte, es kommt mir ganz nicht heran.