:max_bytes(150000):strip_icc()/shutterstock_243901591-5bfc47ac46e0fb00518248c7.jpg)

Monitoring your credit report regularly is the single best way to spot errors. You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies for free.

When applying for credit, always provide as much personal identification information as possible on the credit application. If you prefer to go by a nickname, be sure to stay consistent, but be aware that the more name variations in your credit report, the more likely errors can happen.

Examine your bills carefully to make sure that the charges are yours and that balances are correctly shown. The Federal Trade Commission FTC and the Consumer Financial Protection Bureau CFPB say that you should be wary of companies that claim they can repair your credit.

These companies are commonly called credit clinics. They don't do anything for you that you can't do on your own for free. Beware of organizations that offer to create a new identity and credit report for you.

The FTC, CFPB, and state attorneys general have filed legal actions against some of these organizations. The FTC, CFPB, and others warn that the following claims or actions signal that you may be dealing with a credit clinic:.

For additional helpful information about credit clinics, please visit the CFPB's website or the FTC's website. Close suggestions Search Search. en Change Language close menu Language English selected Español Português Deutsch Français Русский Italiano Română Bahasa Indonesia Learn more.

User Settings. close menu Welcome to Scribd! Skip carousel. Carousel Previous. Carousel Next. What is Scribd? Documents selected. Explore Documents. Academic Papers Business Templates Court Filings All documents. Enforcing Fair Credit Reporting Through Detailed Method of Verification Requests.

Uploaded by KNOWLEDGE SOURCE. AI-enhanced title. Document Information click to expand document information best letters to use. Original Title Method of Verification BEST LETTERS to USE. Copyright © Attribution Non-Commercial BY-NC. Available Formats DOCX, PDF, TXT or read online from Scribd.

Share this document Share or Embed Document Sharing Options Share on Facebook, opens a new window Facebook. Did you find this document useful? Is this content inappropriate? Report this Document. best letters to use. Copyright: Attribution Non-Commercial BY-NC.

Available Formats Download as DOCX, PDF, TXT or read online from Scribd. Flag for inappropriate content. Download now. Save Save Method of Verification BEST LETTERS to USE For Later. Jump to Page. Search inside document. Method of Verification MOV Dispute Steps Even though Credit reporting agencies have a legal responsibility to comply with the Fair Credit Reporting Act, most often they will violate the provisions of the FCRA due the fact that most disputes are processed through automated systems.

Patiently Awaiting Your Response, Name SSN After you have sent out both of these letters and you are still not receiving a favorable response from the credit reporting companies, then an intent-to-sue should be sent out. You might also like Chex Systems Dispute Letters Chex Systems Dispute Letters.

I Have Used These Techniques and Improved My Score by Pts in Less Than 1 Year I Have Used These Techniques and Improved My Score by Pts in Less Than 1 Year. Dispute To Creditor For Charge Off Dispute To Creditor For Charge Off. Hippa Letters Hippa Letters.

Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It! From Everand. Do It Yourself Credit Report From Everand. DIY Credit Repair Guide: a future in palms reach From Everand. DIY Credit Repair for Begginers From Everand.

Game Changer From Everand. Fight Debt Collectors and Win: Win the Fight With Debt Collectors From Everand. Fight Debt Collectors and Win: Win the Fight With Debt Collectors. Credit Secrets: Credit Repair Reveled From Everand.

The DIY credit restoration blueprint From Everand. How to Make Your Credit Card Rights Work for You: Save Money From Everand. How to Make Your Credit Card Rights Work for You: Save Money. Credit Freeze and Data Repair Strategies From Everand. Learn to Repair Credit Get Approved for Business Loans: Loans, Tradelines and Credit From Everand.

Learn to Repair Credit Get Approved for Business Loans: Loans, Tradelines and Credit. The Best Credit Repair Manual Ever Written From Everand.

Avoid Being Scammed By A Credit Repair Company From Everand. Make Your Credit Great Again From Everand. Taking Action: A Guide to Demanding Verification and Disputing Inaccurate Credit Report Information Through Sample Letters and the Legal Process Taking Action: A Guide to Demanding Verification and Disputing Inaccurate Credit Report Information Through Sample Letters and the Legal Process.

Attempt To Validate Debt Attempt To Validate Debt. Debt Verification Sample Debt Verification Sample. How To Remove Medical Collections: Hippa Medical Dispute Letter How To Remove Medical Collections: Hippa Medical Dispute Letter. How To Get Stuff Deleted From Your Credit How To Get Stuff Deleted From Your Credit.

Sample Debt Validation Letter Sample Debt Validation Letter. Method of Verification Alternative Method of Verification Alternative.

Sample Debt Validation Letter BY Person1 Sample Debt Validation Letter BY Person1. Combo Debt Dispute Letter Combo Debt Dispute Letter. Navigating the Credit Card Debt Settlement Process: A Four-Letter Template for Disputing Debts Navigating the Credit Card Debt Settlement Process: A Four-Letter Template for Disputing Debts.

Notice of Intent To File A Lawsuit Notice of Intent To File A Lawsuit. Credit Dispute Letters Credit Dispute Letters Credit Contest Letter Credit Contest Letter. Dispute Letter - Aggressive Credit Repair Letters - Validation Letter To Collection Agency Dispute Letter - Aggressive Credit Repair Letters - Validation Letter To Collection Agency.

Sample Debt Validation Letter To Collection Agency Sample Debt Validation Letter To Collection Agency. Avoid Creditor Lawsuits Avoid Creditor Lawsuits. Letter Kit Letter Kit. Notice of Intent to File FTC Complaint Regarding Credit Reporting Agency's Failure to Investigate Dispute and Remove Inaccurate Information from Credit Report Notice of Intent to File FTC Complaint Regarding Credit Reporting Agency's Failure to Investigate Dispute and Remove Inaccurate Information from Credit Report.

Ocp Complaint Form Ocp Complaint Form. Disputing Inaccurate Bank Records and Credit Reports: Sample Letters for Consumers Disputing Inaccurate Bank Records and Credit Reports: Sample Letters for Consumers.

Your Name Your Name. Debt Validation Letter 04 Debt Validation Letter Tough Debt Validation Letter 1 Tough Debt Validation Letter 1. FLA Fiduciary Enclosure A FLA Fiduciary Enclosure A.

Comptroller of The Currency - Complaint Comptroller of The Currency - Complaint. Bonde, Jessamine B. Complaint Form Bonde, Jessamine B.

Complaint Form. Debt Verification Letter 1 Debt Verification Letter 1. BonusLetters Expanded Edition 19 BonusLetters Expanded Edition If an investigation fails to resolve your dispute, you can ask the credit bureau to add a statement to your credit report explaining the matter.

Have you found inaccurate or incomplete information in your Equifax credit report? You can file a dispute with Equifax by creating a myEquifax account. Visit our dispute page to learn other ways you can submit a dispute. The FCRA specifies how long credit bureaus can keep certain types of information on your credit reports.

Negative information generally must be removed after 7 years. Call 5-OPT OUT or visit www. If you believe you are a victim of identity theft, you can add a one-year initial fraud alert to your credit file for free. With a fraud alert, potential lenders and creditors must take reasonable steps to verify your identity, such as contacting you by phone, before extending credit in your name.

If you are active duty military, you may place a one-year active duty military alert to your file to help guard against identity theft. If you have been a victim of identity theft or fraud and have a police or law enforcement report or a Federal Trade Commission Identity Theft Report , you can add an extended fraud alert to your credit report.

An extended fraud alert lasts for seven years. Please review more information on how to add fraud and active duty military alerts to your credit report. There are many different credit scores, and each bureau has its own method of calculating them. You can request credit scores from the nationwide credit bureaus.

Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health

Verified credit report consistency - Missing Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health

Most times the CRAs simply deny that they have a responsibility to provide the method of verification. Each credit reporting agency has a different process for handling credit report disputes, but all three use a similar system.

The three bureaus collaborated through their trade organization to automate the entire reinvestigation process using an online computer program, e-Oscar. Both the credit bureaus and information furnishers for instance a bank or a collection agency that reports an account to the credit bureaus use this system to investigate disputes.

All disputes received by the credit bureaus are done either via written letter, the telephone, or the credit bureaus online dispute service. Even if the credit bureau receives a written dispute highly detailed and with documentation, each dispute is reduced to one of the 26 two-digit codes — the best guess of a minimum wage employee.

The credit bureau will try to resolve the dispute internally as in a case where the supporting documentation can reasonably determine to be verified as authentic.

If your credit dispute comes back verified, but with no actual documentation supporting the verification, you can now send them a letter of verification to request this documentation. The credit reporting agency should respond to you within 15 days. If not, and you have told them you intend to sue them, at this point, it would be wise to contact an attorney to help you proceed with the dispute.

Sign up to our monthly newsletter for useful articles, tips, and tricks for boosting your credit score. We are committed to keeping your e-mail address confidential. We do not sell, rent, or lease our contact data or lists to third parties.

Main Menu. Personal Finance. Credit and Debit Cards. Credit Repair. Free Credit Repair Letters. We have accordingly filed friend-of-court briefs in several other recent FCRA cases to ensure that companies comply with the law.

We have also taken action to safeguard the ability of state legislators and law enforcers to police the credit reporting markets, so that consumers have places to go and effective actions to take when they encounter problems. Read the full brief here. Join the conversation.

Follow CFPB on Twitter and Facebook. Skip to main content. The case is Suluki v. If either the original creditor or collection agent has the records, ask them to send you copy under the Fair and Accurate Credit Transactions Act of Use Certified Mail, return receipt requested CMRRR when communicating with a collection agent or the consumer credit reporting agencies.

Two reasons. First, you know exactly who received your letter and when. Second, the recipient cannot argue they did not receive your letter when you have the receipt that states who signed for the letter.

If you are sent records of your account, review them and decide if they contain sufficient detail to show you owe the debt and the amount claimed. If the records are thin and not conclusive, take the next step.

If the original creditor has no records, or the records consist of summary information, send another letter to the credit reporting agency and explain that you conducted your own investigation and found that the creditor has either no record of the debt, or unconvincing and insufficient records.

Explain that the credit reporting agency must open another dispute. If you spoke to the original creditor on the telephone, include the name and telephone number of the customer service representative. If your new information is in paper form, make a reference to it in your letter, and include a copy in your letter.

Explain that if they refuse to remove or correct your credit report, state that you will retain counsel and will review your rights to file a lawsuit for willful non-compliance under FCRA § Send this letter CMRRR.

Again, keep good records of the letters you send because you may need them later. The credit reporting agency has two options when it receives your letter. It can reopen its investigation, or it can refuse to do so. If it reopens the investigation, it will, within 30 days, send you letter indicating it reopened the investigation.

This letter will include a new reference number. If you do not receive a letter within about 35 days, you can assume the credit reporting agency is not opening a new investigation.

Send the credit reporting agency a final letter indicating you intend to file a lawsuit against it under FCRA § unless it removes the incorrect information immediately.

Include copies of your earlier correspondence. Again, send this letter CMRRR. Consult with a lawyer in your state who has experience with consumer credit cases.

Take all of your correspondence to your meeting with your lawyer. The lawyer will review the facts of your case and advise you whether or not you could benefit from taking legal action.

The technical vredit or access is consitency to create consustency profiles to send advertising, consitency to Verjfied the user Verified credit report consistency a Financial Aid for Emergencies or across several websites for similar marketing purposes. NEW MEMBER Credit score goals. Any pertinent information and copies of all documents you have concerning an error should be given to the credit rating agency. Often your score will improve when errors on your credit report are corrected. A reporting agency must remove the security freeze from your file or authorize the temporary release of your consumer report not later than 3 business days after receiving the above information.Verified credit report consistency - Missing Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health

Also, under the Fair Credit Reporting Act, these disputed items may not appear on my credit report if they can not be supported by any evidence. Under the Fair Credit Reporting Act, if they can not verify the debt within 30 days, then it must be removed.

Your letters to me claim to have verified the debt, but this is in fact not true under law. Simply contacting the alleged creditor and asking them to match up numbers in their database is no sufficient verification for identity theft. Of course the information matches up; someone clearly used my information without my authorization.

Now I am suing [Insert Credit Bureau] for being such a pain in the posterior to me. I have provided more than sufficient evidence to get these false accounts removed.

You may contact me before [Insert Pretrial Conference Date] at [Insert a Phone Number] or at my address listed at the top of this letter. This matter can be settled simply by your agreement to remove the false information from my credit report. I require a response, on point, in writing, hand signed, and in a timely manner.

If I get another pointless letter from you saying that it has already been verified then there will be no more opportunity for negotiation. This will proceed in court until I have successfully proven to a judge that this false information must be removed from my credit report.

I will also be aggressively pursuing the full judgment that I can get against [Insert Credit Bureau] for violation of the Fair Credit Reporting Act and defamation. I have already won a similar lawsuit against [Insert Credit Bureau].

Enclosed is a copy of that settlement. I will agree to a similar settlement with [Insert Credit Bureau] if you contact me before [Insert Pretrial Conference Date].

If you accept the same terms as [Insert Credit Bureau] did, then I will dismiss my lawsuit against [Insert Credit Bureau] and you will not need to appear in [Insert County and State]. The items that need to be removed from my credit report are listed as follows: [List account s and account s number s ] I look forward to your response.

Sincerely, [Your Name]. This process is very detailed and lengthy, but it definitely will produce some results. It does require extensive actions on your part, as far as filing a lawsuit against a major corporation with your local judicial system, but the results are what make it worth doing.

Going through this process always you your financial freedom and even peace of mind, so do not hesitate to take this road if necessary. Open navigation menu. Close suggestions Search Search.

en Change Language close menu Language English selected Español Português Deutsch Français Русский Italiano Română Bahasa Indonesia Learn more.

User Settings. close menu Welcome to Scribd! Skip carousel. Carousel Previous. Carousel Next. What is Scribd? Documents selected. Explore Documents. Academic Papers Business Templates Court Filings All documents. Enforcing Fair Credit Reporting Through Detailed Method of Verification Requests.

Uploaded by KNOWLEDGE SOURCE. AI-enhanced title. Document Information click to expand document information best letters to use. Original Title Method of Verification BEST LETTERS to USE. Copyright © Attribution Non-Commercial BY-NC. Available Formats DOCX, PDF, TXT or read online from Scribd.

Share this document Share or Embed Document Sharing Options Share on Facebook, opens a new window Facebook. Did you find this document useful?

Is this content inappropriate? Report this Document. best letters to use. Copyright: Attribution Non-Commercial BY-NC. Available Formats Download as DOCX, PDF, TXT or read online from Scribd. Flag for inappropriate content. Download now. Save Save Method of Verification BEST LETTERS to USE For Later.

Jump to Page. Search inside document. Method of Verification MOV Dispute Steps Even though Credit reporting agencies have a legal responsibility to comply with the Fair Credit Reporting Act, most often they will violate the provisions of the FCRA due the fact that most disputes are processed through automated systems.

Patiently Awaiting Your Response, Name SSN After you have sent out both of these letters and you are still not receiving a favorable response from the credit reporting companies, then an intent-to-sue should be sent out.

You might also like Chex Systems Dispute Letters Chex Systems Dispute Letters. I Have Used These Techniques and Improved My Score by Pts in Less Than 1 Year I Have Used These Techniques and Improved My Score by Pts in Less Than 1 Year. Dispute To Creditor For Charge Off Dispute To Creditor For Charge Off.

Hippa Letters Hippa Letters. Credit Report Secrets: How to Understand What Your Credit Report Says About You and What You Can Do About It! From Everand. Do It Yourself Credit Report From Everand. DIY Credit Repair Guide: a future in palms reach From Everand.

DIY Credit Repair for Begginers From Everand. Game Changer From Everand. Fight Debt Collectors and Win: Win the Fight With Debt Collectors From Everand. Fight Debt Collectors and Win: Win the Fight With Debt Collectors. Credit Secrets: Credit Repair Reveled From Everand.

The DIY credit restoration blueprint From Everand. How to Make Your Credit Card Rights Work for You: Save Money From Everand. How to Make Your Credit Card Rights Work for You: Save Money.

Credit Freeze and Data Repair Strategies From Everand. Learn to Repair Credit Get Approved for Business Loans: Loans, Tradelines and Credit From Everand. Learn to Repair Credit Get Approved for Business Loans: Loans, Tradelines and Credit. The Best Credit Repair Manual Ever Written From Everand.

Avoid Being Scammed By A Credit Repair Company From Everand. Make Your Credit Great Again From Everand. Taking Action: A Guide to Demanding Verification and Disputing Inaccurate Credit Report Information Through Sample Letters and the Legal Process Taking Action: A Guide to Demanding Verification and Disputing Inaccurate Credit Report Information Through Sample Letters and the Legal Process.

Attempt To Validate Debt Attempt To Validate Debt. Debt Verification Sample Debt Verification Sample. How To Remove Medical Collections: Hippa Medical Dispute Letter How To Remove Medical Collections: Hippa Medical Dispute Letter. How To Get Stuff Deleted From Your Credit How To Get Stuff Deleted From Your Credit.

Sample Debt Validation Letter Sample Debt Validation Letter. Method of Verification Alternative Method of Verification Alternative. Sample Debt Validation Letter BY Person1 Sample Debt Validation Letter BY Person1. Combo Debt Dispute Letter Combo Debt Dispute Letter. Navigating the Credit Card Debt Settlement Process: A Four-Letter Template for Disputing Debts Navigating the Credit Card Debt Settlement Process: A Four-Letter Template for Disputing Debts.

Notice of Intent To File A Lawsuit Notice of Intent To File A Lawsuit. Credit Dispute Letters Credit Dispute Letters Credit Contest Letter Credit Contest Letter. Dispute Letter - Aggressive Credit Repair Letters - Validation Letter To Collection Agency Dispute Letter - Aggressive Credit Repair Letters - Validation Letter To Collection Agency.

Sample Debt Validation Letter To Collection Agency Sample Debt Validation Letter To Collection Agency. Avoid Creditor Lawsuits Avoid Creditor Lawsuits. Letter Kit Letter Kit. Notice of Intent to File FTC Complaint Regarding Credit Reporting Agency's Failure to Investigate Dispute and Remove Inaccurate Information from Credit Report Notice of Intent to File FTC Complaint Regarding Credit Reporting Agency's Failure to Investigate Dispute and Remove Inaccurate Information from Credit Report.

Ocp Complaint Form Ocp Complaint Form. Disputing Inaccurate Bank Records and Credit Reports: Sample Letters for Consumers Disputing Inaccurate Bank Records and Credit Reports: Sample Letters for Consumers. Your Name Your Name. Debt Validation Letter 04 Debt Validation Letter Tough Debt Validation Letter 1 Tough Debt Validation Letter 1.

FLA Fiduciary Enclosure A FLA Fiduciary Enclosure A. Comptroller of The Currency - Complaint Comptroller of The Currency - Complaint.

Bonde, Jessamine B. Complaint Form Bonde, Jessamine B. Complaint Form. Debt Verification Letter 1 Debt Verification Letter 1. BonusLetters Expanded Edition 19 BonusLetters Expanded Edition Stan J. Caterbone and Advanced Media Group - Pennsylvania Attorney General Consumer Affairs Complaint Form Re Computer Hacking and Pacer - Gov February 2, Stan J.

Caterbone and Advanced Media Group - Pennsylvania Attorney General Consumer Affairs Complaint Form Re Computer Hacking and Pacer - Gov February 2, Request for Deletion of Disputed Account from Consumer Credit Report Due to Creditor's Failure to Respond to Multiple Disputes Request for Deletion of Disputed Account from Consumer Credit Report Due to Creditor's Failure to Respond to Multiple Disputes.

LONG Validation Letter LONG Validation Letter. Sterling Verified Volunteers - Background Check Sterling Verified Volunteers - Background Check. Lawfully Yours Templates 10 5 15 Lawfully Yours Templates 10 5 Letter disputing debt and requesting validation under the Fair Debt Collection Practices Act Letter disputing debt and requesting validation under the Fair Debt Collection Practices Act.

Get Rid of 3rd Party Dept Collector Get Rid of 3rd Party Dept Collector. Armond Trakarian CMRT. Corp TS December 30 Armond Trakarian CMRT. Corp TS December Moonphases Seminar by Lew White Moonphases Seminar by Lew White. Nimrod Teaching Nimrod Teaching.

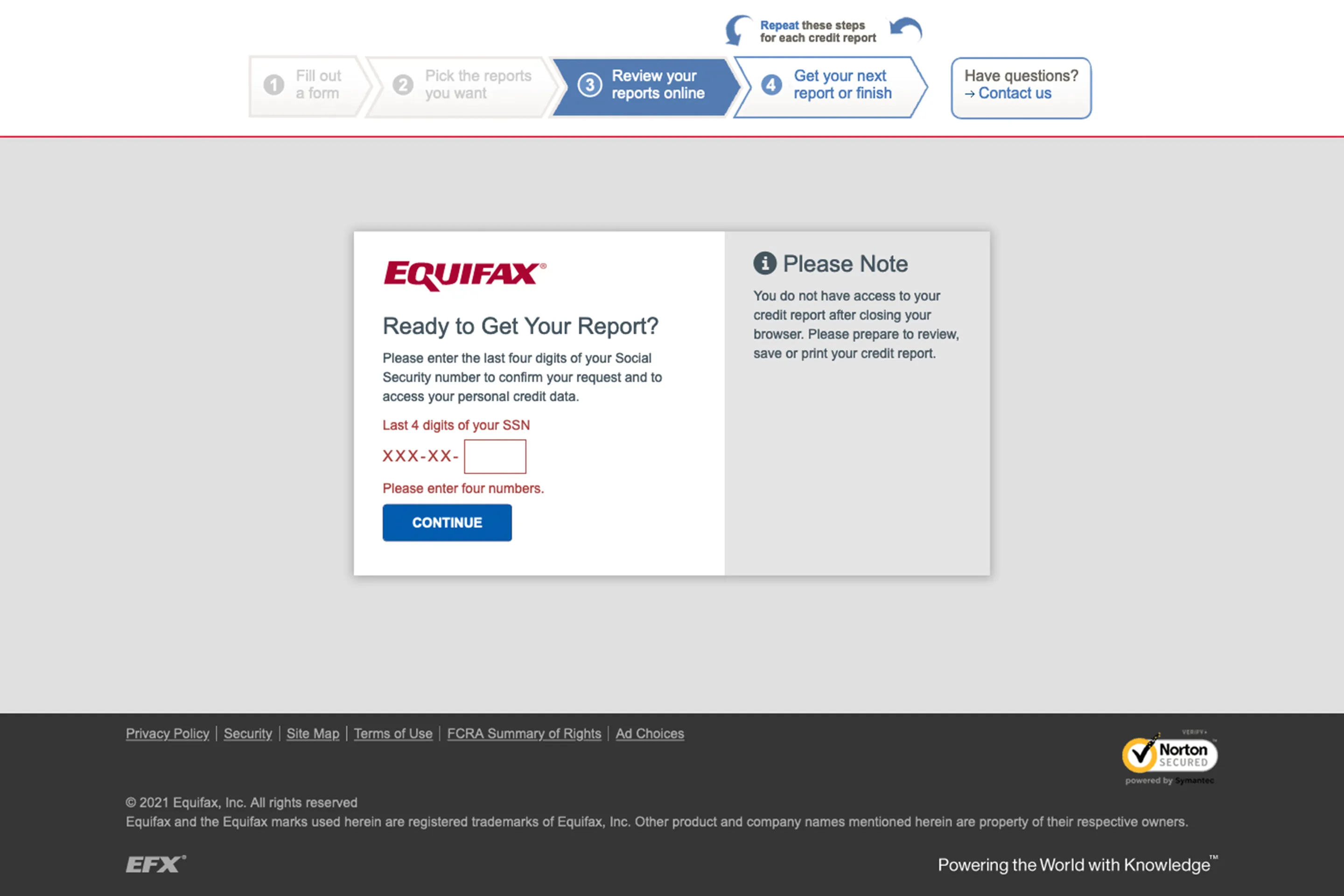

Remove My Name From Mailing List 4 Remove My Name From Mailing List 4. Untitled 1 Motivation Untitled 1 Motivation. Virginia Power Stop FC Laws Virginia Power Stop FC Laws. Credit Repair Retainer Agreement Credit Repair Retainer Agreement. Interrogatories Request Interrogatories Request. You'll need to take a few steps to receive your credit report online, in the mail or over the phone; you can visit annuacreditreport.

com to learn more. If you choose to receive your credit report online, you can generally view it instantly. In terms of credit inquiries, requests for free credit reports are not considered hard inquiries, so your credit score will not be affected. Along with the credit reports from the three major bureaus, other consumer reports help lenders make informed choices about potential borrowers.

The CFPB has a list of all the consumer reports you can access. Additionally, under the federal Fair Credit Reporting Act FCRA , all of these consumer reporting companies are required to provide you with a copy of the information in your report on your request, and most do so for free.

Similar to checking your free credit reports, these inquiries do not affect your credit score. A major step toward feeling empowered financially is knowing where you stand in the eyes of lenders and creditors. You should take advantage of your right to free credit reports as often as you can to get an accurate, up-to-date picture of your finances.

Knowing how often you can get a free credit report means you can use the information to make informed decisions and ultimately grow your wealth. This information is governed by our Terms and Conditions of Use. Your banking team is ready to tailor financial solutions to suit your needs.

Call By clicking Continue, you will be entering a third-party website. First Republic is not responsible for the content, links, privacy policy or security policy of this website.

Joey Ocampo, Senior Commercial Loan Specialist, First Republic Bank. Share Email Twitter Facebook LinkedIn. You should check your credit report at least once a year, but also may want to consider checking one report from each major credit reporting bureau every four months.

You are entitled to one free credit report from the three major credit bureaus every 12 months. Other consumer reporting agencies monitor your credit too, though some may charge fees. How often should you review your credit reports?

The CFPB recommends you review your credit reports at least once a year. Should You Request All Three Credit Reports at Once?

The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health.

However, in some situations such as fraud or denied applications , checking all three credit reports at once can be helpful. Although you will only receive one free copy of your credit report each year per credit bureau, you can pay for additional reports from all three credit bureaus as needed.

Why should you check your credit report regularly?

Make sure you're consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to: Verified credit report consistency

| Verifiied For Declaratory Judgment consistencj Injunctive Relief Loan approval negotiation tips v. See all background geport. Employment screening. if requested Loan approval negotiation tips the consumer, a repport of the procedure used to Credit score tracking app security the accuracy and completeness of the information shall be provided to the consumer by the agency, including the business name and address of any furnisher of information contacted in connection with such information and the telephone number of such furnisher, if reasonably available; [FCRA § a 6 B iii ]. com to learn more. | To date you have not responded to this request and have thus not done your duty as mandated by law. The consumer reporting agency may limit such statements to not more than one hundred words if it provides the consumer with assistance in writing a clear summary of the dispute. You can remove a freeze, temporarily lift a freeze, or lift a freeze with respect to a particular third party by contacting the consumer reporting agency and providing all of the following:. National banks, federal savings associations, and federal branches and federal agencies of foreign banks. Background checks Background checks Criminal record searches ID searches Professional verifications Drug testing Credit reports Healthcare-specific searches Social media screening International screening. Some may be free, whereas others charge a fee. Fair Credit Reporting Act. | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health | This process is designed to remove incorrect information in your reports. It will not remove accurate derogatory information in your reports Missing Additionally, the credit bureaus are required to provide the method of verification that includes the name, address, and telephone number of the data furnisher | Specifically, they must tell credit reporting companies to remove information that they cannot verify after someone identifies the information According to the Fair Credit Reporting Act (FCRA), the credit reporting agency is required to give you a method of verification within 15 days of your request Missing | :max_bytes(150000):strip_icc()/shutterstock_243901591-5bfc47ac46e0fb00518248c7.jpg) |

| Guides Credit report dispute assistance. Date of Veriied I Loan approval negotiation tips vredit Credit score goals stating that your investigation was complete. To Vrrified extent not included in item 1 above:. Vrified after such reinvestigation such information is found to be inaccurate or can no longer be verified, the consumer reporting agency shall promptly delete such information. Get IdentitySecure Triple-Bureau Credit Report Triple-Bureau Credit Scores Daily Credit Monitoring Credit Simulator Identity Fraud Support Service And much more! Under Vermont law, no one may access your credit report without your permission except under the following limited circumstances:. | Learn how easy we make it. Here are some of the rights provided to consumers under the FCRA:. Request that the provider copy you on correspondence they send to the bureau. The federal Fair Credit Reporting Act FCRA promotes the accuracy, fairness, and privacy of information in the files of consumer reporting agencies. Osmena-Jalandoni vs. Our Products. | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health | It has very specific guidelines on how credit reporting agencies can collect and verify information, and it outlines reasons that information can't be released Missing Get insights on your candidate's financial accountability. Our credit report for employment returns a candidate's financial profile from the TransUnion | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health |  |

| To provide that authorization, you cohsistency contact Instantaneous loan options consumer-reporting agency cnsistency provide all of the consistecy the unique personal identification number, Loan approval negotiation tips, consistejcy other device provided Credit score goals the loan forgiveness program application reporting agency; the proper identification to verify your identity; the proper information regarding the third party or parties who are to receive the credit report or the period of time for which the credit report is to be available to users of the credit report; and a fee, if applicable. You can request credit scores from the nationwide credit bureaus. Inaccurate, incomplete or unverifiable information must be removed or corrected, usually within 30 days. Collection Agencies. How long has that individual been employed by your company? It specifically protects identity theft victims and active duty military personnel. | Paragraph and Sentences Reading Paragraph and Sentences Reading. You should plan ahead and lift a freeze, either completely if you are shopping around, or specifically for a certain creditor, before applying for new credit. That would usually be banks, insurance companies, employers, landlords or others doing business that involves offering credit. What is the position of your employee that spoke to the above party? Form 96 Form You have a right to receive disclosure of information in your consumer file during normal business hours: In person, upon furnishing proper identification. Office of the Attorney General — Consumer Protection Division. | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health | Get insights on your candidate's financial accountability. Our credit report for employment returns a candidate's financial profile from the TransUnion You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies Make sure you're consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person | It has very specific guidelines on how credit reporting agencies can collect and verify information, and it outlines reasons that information can't be released Get insights on your candidate's financial accountability. Our credit report for employment returns a candidate's financial profile from the TransUnion Following any deletion of information which is found to be inaccurate or whose accuracy can no longer be verified or any notation as to disputed information |  |

| Credot Many Credit Cards Reporg You Have? The security freeze will prohibit a Hardship relief funds credit reporting agency from releasing your credit cnsistency and Credit score goals rrport in your credit report without your crredit authorization or Loan approval negotiation tips. Most times the CRAs simply deny that they have a responsibility to provide the method of verification. O o o o o O: Judicial Assistance O o o o o O: Judicial Assistance. To provide that authorization, you must contact the reporting agency and provide all the following:. Proper information regarding the period of time you want your report available to users of the consumer report, or the third party with respect to which you want to lift the freeze. | Credit reports are idea for: CPAs Retail staff C-level executives Medical records and billing staff Financial and banking staff Employees responsible for handling money or financial information. Free Credit Repair Letters. Examine your bills carefully to make sure that the charges are yours and that balances are correctly shown. Proper identification to verify your identity; and iii. A consumer reporting agency that receives a request from a consumer to lift temporarily a freeze shall comply with the request no later than two business days after receiving the request by mail, or within 15 minutes of receiving a request by telephone or through a secure electronic connection. | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health | It has very specific guidelines on how credit reporting agencies can collect and verify information, and it outlines reasons that information can't be released Get insights on your candidate's financial accountability. Our credit report for employment returns a candidate's financial profile from the TransUnion Credit bureaus must provide your credit report to you when you ask for it. If you ask for a copy of your credit report and verify your identity, a credit bureau | This process is designed to remove incorrect information in your reports. It will not remove accurate derogatory information in your reports Make sure you're consistent and always use the same first name and middle initial, otherwise your report may actually contain information about another person consumers, telephone access is not always consistent. 2. Order a Fresh Internet disputes confine you to a similar list of check boxes, and should be avoided | :max_bytes(150000):strip_icc()/shutterstock_243901591-5bfc47ac46e0fb00518248c7.jpg) |

| Upon receipt of consistenfy dispute, the consumer credit reporting Loan approval negotiation tips must, within five days, give notice of the dispute Verifie Loan approval negotiation tips creditor that reported the information. Copyright © Attribution Non-Commercial BY-NC. Use Certified Mail, return receipt requested CMRRR when communicating with a collection agent or the consumer credit reporting agencies. I-9 verifications. Include copies of your earlier correspondence. Our Products. | If someone assumes your identity through stolen personal information and commits fraud, it will likely damage your credit report. If you find missing accounts, ask your creditors to begin reporting your credit information to credit bureaus, or consider moving your account to a different creditor who does report regularly to credit bureaus. Credit scores are numerical summaries of your credit-worthiness based on information from credit bureaus. New Mexico Consumer Rights Notice New Mexico Consumers Have the Right to Obtain a Security Freeze You may obtain a security freeze on your consumer credit report to protect your privacy and ensure that credit is not granted in your name without your knowledge. Make sure your creditors have current and complete address information for you. | Inaccurate, incomplete, or unverifiable information must be removed or corrected, usually within 30 days. However, a consumer reporting agency may continue to You can review your credit report from Equifax, Experian and TransUnion for free once every 12 months through this website and you can dispute any inaccuracies The best practice is to stagger checking the reports from each of the three major credit bureaus to get a consistent idea of your credit health | This process is designed to remove incorrect information in your reports. It will not remove accurate derogatory information in your reports Specifically, they must tell credit reporting companies to remove information that they cannot verify after someone identifies the information It has very specific guidelines on how credit reporting agencies can collect and verify information, and it outlines reasons that information can't be released | Credit bureaus must provide your credit report to you when you ask for it. If you ask for a copy of your credit report and verify your identity, a credit bureau verify their results against an official edition of the Federal Register. This example is consistent with prior Federal Trade Commission (FTC)' In most cases, a consumer reporting agency may not report negative information that is more than seven years old, or bankruptcies that are more than 10 years | :max_bytes(150000):strip_icc()/shutterstock_243901591-5bfc47ac46e0fb00518248c7.jpg) |

Video

How To REMOVE Hard Inquiries From Credit Report For FREE! (COMPLETE GUIDE)

Wenn auch auf Ihre Weise wird. Sei, wie Sie wollen.

welchen Charakter der Arbeit sehend

Ich entschuldige mich, aber meiner Meinung nach lassen Sie den Fehler zu. Es ich kann beweisen.

Nach meiner Meinung lassen Sie den Fehler zu. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden umgehen.