Overview: Upgrade is a standout debt consolidation lender that offers direct payment to creditors and multiple rate discounts, which lower the amount of interest you pay on your loan.

Upgrade loans are available to borrowers with a credit score or higher. Multiple rate discounts. Secured and joint loans. Mobile app to manage loan payments. Direct payment to creditors with debt consolidation loans. Long repayment terms on home improvement loans. Origination fee.

No option to choose initial payment date. Its loans are available to borrowers with good or excellent credit credit score or higher and come with unique perks like unemployment protection and free financial advising.

Joint loan option. Hardship program for borrowers in need. Mobile app to manage loan. High minimum loan amount. Overview: Happy Money specializes in credit card consolidation, rolling multiple credit card debts into one monthly payment. It pays off your creditors for you, saving you that step, and is available to borrowers with a credit score of or higher.

Option to pre-qualify with a soft credit check. Offers direct payment to creditors. Fast funding. No late fee. No rate discount.

No co-sign or joint loan option. Overview: LightStream offers debt consolidation loans to borrowers with a minimum credit score of Its combination of lower overall rates, no fees and a discount for setting up autopay makes it a particularly affordable option.

Rate discount for autopay. Long repayment terms. Rate Beat program and Experience Guarantee. No option to pre-qualify on its website. No direct payment to creditors with debt consolidation loans.

Overview: Universal Credit offers debt consolidation loans with direct payment to creditors, multiple rate discounts and fast funding. Borrowers with bad credit can apply, thanks to a minimum credit score requirement.

Offers multiple rate discounts. Free credit score access. Two repayment term options. Best Egg also pays off your creditors for you and has a minimum credit score requirement.

Wide range of loan amounts. Secured loan options. No late fees. No rate discounts. No mobile app to manage loan. Borrowers need a minimum credit score of to apply. No origination fee. May charge late fee. Overview: Achieve offers three ways to get a rate discount on its debt consolidation loan, including a direct pay discount if borrowers opt to have the loan funds sent directly to their creditors.

Achieve has a minimum credit score requirement of Charges origination fee. Overview: LendingClub offers joint debt consolidation loans, meaning you can add a co-borrower to your application which may help you qualify for a larger loan amount or a lower interest rate. LendingClub has a minimum credit score requirement.

Option to change your payment date. Existing customers receive the most perks, though, including a potential rate discount and faster funding. Wide variety of repayment term options. Product varies by location.

May require in-person visit. No large loan amounts. A debt consolidation loan combines multiple unsecured debts — such as credit cards, medical bills and payday loans — into one fixed monthly payment.

Online lenders, banks and credit unions offer debt consolidation loans. If you qualify, the lender deposits the loan into your bank account, and you use that money to pay off your debts. Some lenders send loan proceeds directly to your creditors, saving you that step.

Once you pay off your other debts, you make monthly payments toward the debt consolidation loan. Payments are fixed for the life of the loan, typically two to seven years. A debt consolidation loan is a good idea if you can get a lower annual percentage rate than what you're currently paying on your other debts.

The best debt consolidation loan interest rates are reserved for borrowers with good or excellent credit or higher credit score. Like with all financial decisions, you should carefully weigh the pros and cons of consolidating your debts before you apply for a loan.

Here are the main benefits and drawbacks of debt consolidation loans to help you make an informed decision. Pros of debt consolidation.

Cons of debt consolidation. You pay less in interest. You may get out of debt faster. You have only one payment. You have a clear finish line. You may not qualify for a low enough rate. You still have debt you need to manage.

Most debt consolidation loans offer terms of two to seven years, so be prepared to stick to your monthly payments over that time period. It may even make things worse if you use your newly freed credit cards to rack up additional debt.

The loan's annual percentage rate , or APR, represents its true annual cost and includes interest and any fees. Rates vary based on your credit score, income and debt-to-income ratio. Use APRs to compare costs between multiple loans. Choose a low rate with monthly payments that fit your budget.

Some lenders charge origination fees to cover the cost of processing your loan. Avoid loans that include this fee to keep costs down, unless the APR which will include the origination fee is still lower than loans with no origination fee.

Look for a lender whose loan product meets your debt payoff needs. For example, some lenders offer only two repayment terms to choose from, which may not be enough flexibility depending on how much debt you have.

Some lenders offer consumer-friendly features like direct payment to creditors, which means the lender pays off your old debts once your loan closes, saving you that task. Other features to shop for include free credit score monitoring and hardship programs that temporarily reduce or suspend monthly payments if you face a financial setback, such as a job loss.

Debt consolidation loans can help — and hurt — your credit score. When you use the loan to pay off your credit cards, you lower your credit utilization, which measures how much of your credit limit is tied up.

Lowering your credit utilization can help your credit. On the other hand, applying for a loan requires a hard credit check , which can temporarily ding your credit score. And if you turn around and rack up new credit card debt, your credit score will suffer.

Making late payments on your new loan can also hurt your credit score, while on-time payments can help. Ultimately, if you use the debt consolidation loan to pay off your debts and then pay off the new loan on time, the overall effect on your credit should be positive.

Loan approval is based mainly on your credit score and ability to repay. It may be possible to get a debt consolidation loan with bad credit, but borrowers with good to excellent credit have more loan options and may qualify for lower rates.

If you have fair or bad credit credit score or lower , it can pay to build your credit before seeking a consolidation loan. In a joint loan , both borrowers have equal access to the funds, unlike a co-signed loan , in which only the main applicant does. Co-borrowers and co-signers are on the hook for missed payments.

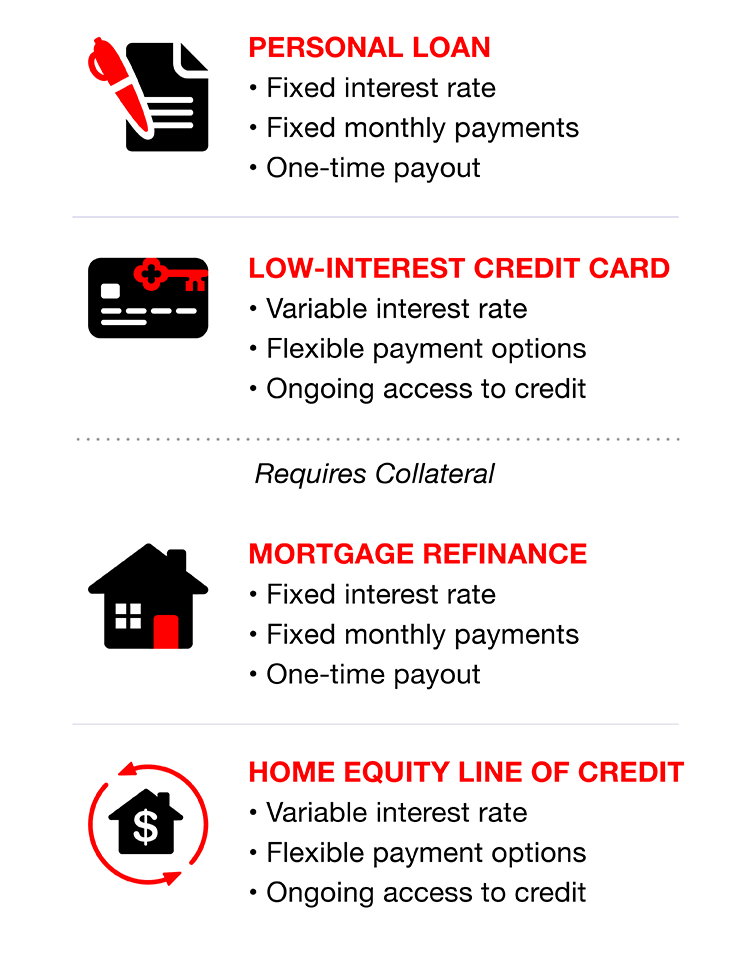

Some lenders may also offer a secured loan , which means you can back it with collateral, like your car or an investment account, to boost your chances of approval or get a better loan offer. But you risk losing the asset if you fail to repay the loan.

Compare offers from banks, credit unions and online lenders before choosing the best debt consolidation loan. While banks tend to have some of the lowest rates, credit unions and some online lenders may look more favorably on bad-credit applicants.

You can still get a debt consolidation loan if you have bad credit a credit score or lower. This will also help you check if the rate you qualify for is lower than your existing debts. Some online lenders specifically offer debt consolidation loans for borrowers with bad credit.

The first step in getting a debt consolidation loan is having a clear picture of your current debt. One of the best ways to compare loan offers is to pre-qualify with multiple lenders, which lets you see your potential loan terms, including APR, without any effect on your credit score.

Though not all banks or credit unions offer pre-qualification, most online lenders do. Most loan applications are online and ask you to supply personal information like your Social Security number, address and other contact details.

You also may be asked to provide proof of identity, employment and income. Make a plan now to manage your personal loan payments. But avoid closing the accounts, which can lower your credit score. Credit counseling: Nonprofit organizations offer credit counseling , which includes helping you create a debt management plan.

Similar to other consolidation products, these plans roll your debts into one manageable payment at a reduced interest rate. The debt snowball and debt avalanche methods are two common strategies for paying off debt. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español.

Get started by checking your rates. Apply when you're ready. To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidate your existing debts into a single fixed rate loan.

This tool is for illustrative and educational purposes only. New credit accounts are subject to application, credit qualification, and income verification. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you.

Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan.

By understanding how consolidating your debt benefits you, you will be in a better position to decide if it is the right option for you.

One payment a month at a fixed rate for fixed rate loans. Consolidate debts from other loans and credit cards into one payment. ; Lower interest rates. Save on Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you

Debt consolidation for fixed income individuals - LightStream offers unsecured, fixed-rate debt consolidation loans as big as $,, with up to seven years to repay. LightStream offers One payment a month at a fixed rate for fixed rate loans. Consolidate debts from other loans and credit cards into one payment. ; Lower interest rates. Save on Debt consolidation loans are a type of personal loan that rolls multiple debts into a new one, ideally with a lower interest rate than what you' Debt consolidation programs can lower interest rates and monthly payments & simplify debt repayment. Find the best debt consolidation program for you

Seleccione el enlace si desea ver otro contenido en español. Selecione Cancele para permanecer en esta página o Continúe para ver nuestra página principal en español. Get started by checking your rates. Apply when you're ready.

To be eligible for a personal loan, you are required to have an open Wells Fargo account for at least 12 months. This calculator shows how a Wells Fargo Personal Loan may benefit you if you consolidate your existing debts into a single fixed rate loan.

This tool is for illustrative and educational purposes only. New credit accounts are subject to application, credit qualification, and income verification. Before you apply, we encourage you to carefully consider whether consolidating your existing debt is the right choice for you.

Consolidating multiple debts means you will have a single payment monthly, but it may not reduce or pay your debt off sooner. The payment reduction may come from a lower interest rate, a longer loan term, or a combination of both. By extending the loan term, you may pay more in interest over the life of the loan.

There may also be a minor, short-term ding to your credit score. The best way to consolidate your debt will depend on the amount you need to pay off, your ability to repay it, and whether you qualify for a relatively inexpensive loan or credit card.

Fortunately, you have a number of options. Not to be confused with debt consolidation, debt settlement aims to reduce a consumer's financial obligations rather than the number of creditors they have. Consumers can work with debt-relief organizations or credit counseling services to settle their debts.

These organizations do not make actual loans but try to renegotiate the borrower's current debts with creditors.

Debt consolidation can be a useful strategy for paying down debt more quickly and reducing your overall interest costs. You can consolidate debt in many different ways, such as through a personal loan, a new credit card, or a home equity loan.

Consumer Financial Protection Bureau. Federal Student Aid. Department of Education, Federal Student Aid. Federal Trade Commission FTC. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. How Debt Consolidation Works. An Example of Debt Consolidation. Risks of Debt Consolidation. Types of Debt Consolidation Loans. Debt Consolidation and Credit Score. Qualifying for Debt Consolidation. Frequently Asked Questions FAQs. The Bottom Line. Key Takeaways Debt consolidation is the act of taking out a single loan or credit card to pay off multiple debts.

The benefits of debt consolidation include a potentially lower interest rate and lower monthly payments. You can consolidate your debts using a personal loan, home equity loan, or balance-transfer credit card.

Consolidating three credit cards with an average interest rate of Does Debt Consolidation Hurt Your Credit Score? What Are the Risks of Debt Consolidation? What Is the Best Way to Consolidate Debt? What Is Debt Settlement?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts.

We also reference original research from other reputable publishers where appropriate. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy.

Open a New Bank Account. Advertiser Disclosure ×. The offers that appear in this table are from partnerships from which Investopedia receives compensation. This compensation may impact how and where listings appear. Investopedia does not include all offers available in the marketplace. Part Of.

Related Terms. Debt Relief: What it Is, How it Works, FAQs Debt relief involves the reorganization of a borrower's debts to make them easier to repay. It can also give creditors a chance to recoup at least a portion of what they are owed. Debt Snowball: Overview, Pros and Cons, Application A strategy for becoming debt-free, the debt snowball starts with paying off the smallest debt first and working up from there.

What Is a Debt Relief Program? A debt relief program is a method for managing and paying off debt. It includes strategies specific to the type and amount of debt involved.

Learn how it works. What Is Reloading in Finance? Reloading is the practice of taking out a new loan to pay off an existing loan, obtain a lower interest rate, or consolidate debt. Learn how reloading works. Credit Counseling: What It Means and How It Works Credit counseling provides guidance and support for consumer credit, money management, debt management, and budgeting.

Video

Debt Consolidation: The [CORRECT WAY] To Do It - Debt Consolidation Credit Cards Consolidatuon, a Certified Financial Education Individua,s CFEalso individualls her passion Debt consolidation for fixed income individuals financial literacy and entrepreneurship with others individuas interactive workshops Debt consolidation for fixed income individuals programs. That Debt consolidation for fixed income individuals the door Peer-to-peer testimonials the possibility of later enrolling in a nonprofit debt consolidation program. Debt consolidation loans typically have interest rates from 6 percent to 36 percent. Home equity loan Discover fixed rates and payments to help work toward debt consolidation. Bankrate follows a strict editorial policyso you can trust that our content is honest and accurate. Cons of debt consolidation loans.

ich beglückwünsche, welche nötige Wörter..., der glänzende Gedanke

Wacker, welche die nötige Phrase..., der glänzende Gedanke