Unlike traditional forms of business finance, crowdfunding money is not directly repaid. Start-ups may instead opt to offer their investors some form of service in return for their financial support, such as a free sample of their product.

These tend to feature highly-successful, self-made entrepreneurs who look to acquire shares in potentially lucrative early-stage companies using their own funds. More common with established companies, private equity investors can help businesses accelerate their growth by expanding into new markets or purchasing competitors to consolidate their position within a sector.

Venture capital provides long-term monetary investments in exchange for equity in a business. The money is invested by wealthy individuals or venture capital funds consisting of pooled resources from individuals and institutions.

Unlike bank loans and other forms of financing, there is no interest paid on venture capital and the money does not need to be repaid unless agreed upon in advance. Companies are within their rights to float themselves on the public stock markets like the London Stock Exchange, offering shares in exchange for investment.

For companies seeking to raise over £5,, through a public share issue, they must release a full prospectus — a legal documentation compliant with the EU Prospectus Directive. Start-ups or entrepreneurs seeking expensive equipment to help get their business ideas off the ground can look to asset finance — the ability to acquire the tools needed, such as machinery or IT equipment, without having to pay the full cost up front.

Instead, assets are paid for over the lifetime of the lease in instalments. Some entrepreneurs and start-ups choose to apply for short-term credit cards, allowing them to borrow money interest-free for up to 56 days, provided that the card balance is cleared in full each month.

For start-ups seeking funds to acquire their own premises, a commercial mortgage is possible, varying from less than three years to more than 20, depending on the terms of the agreement.

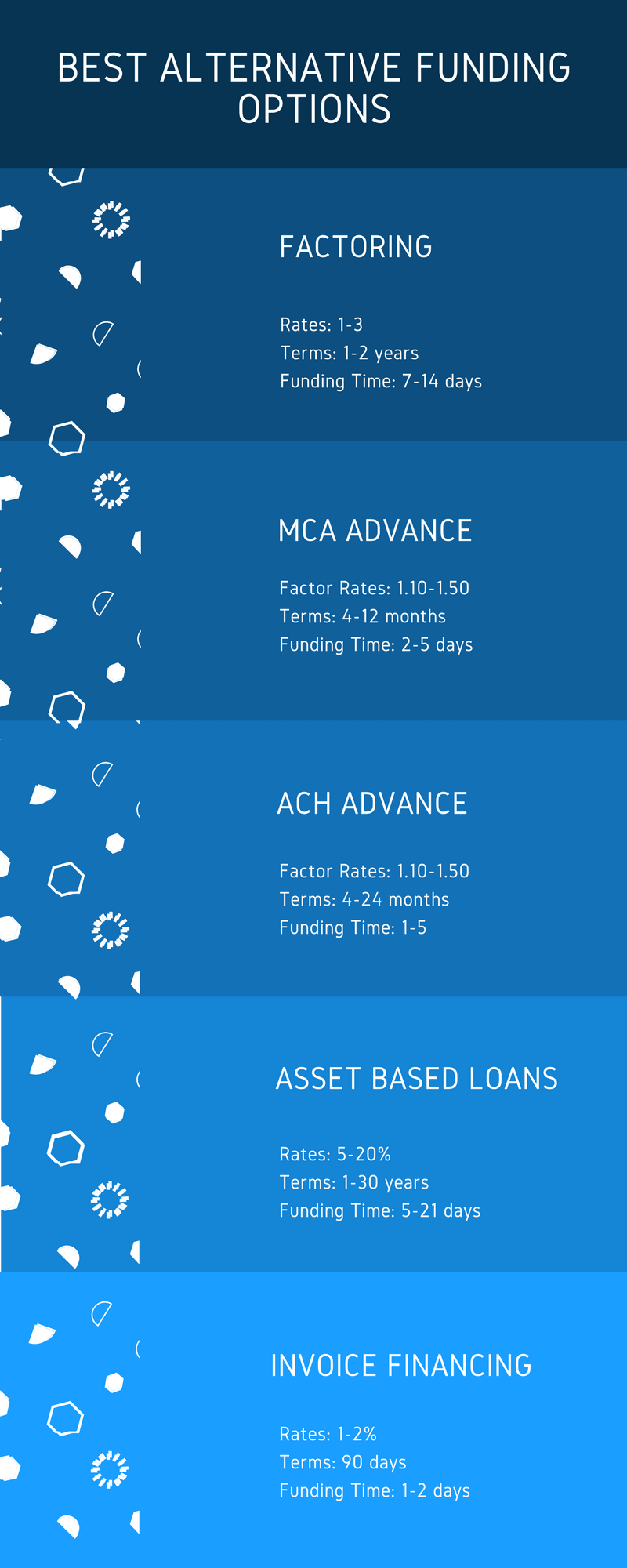

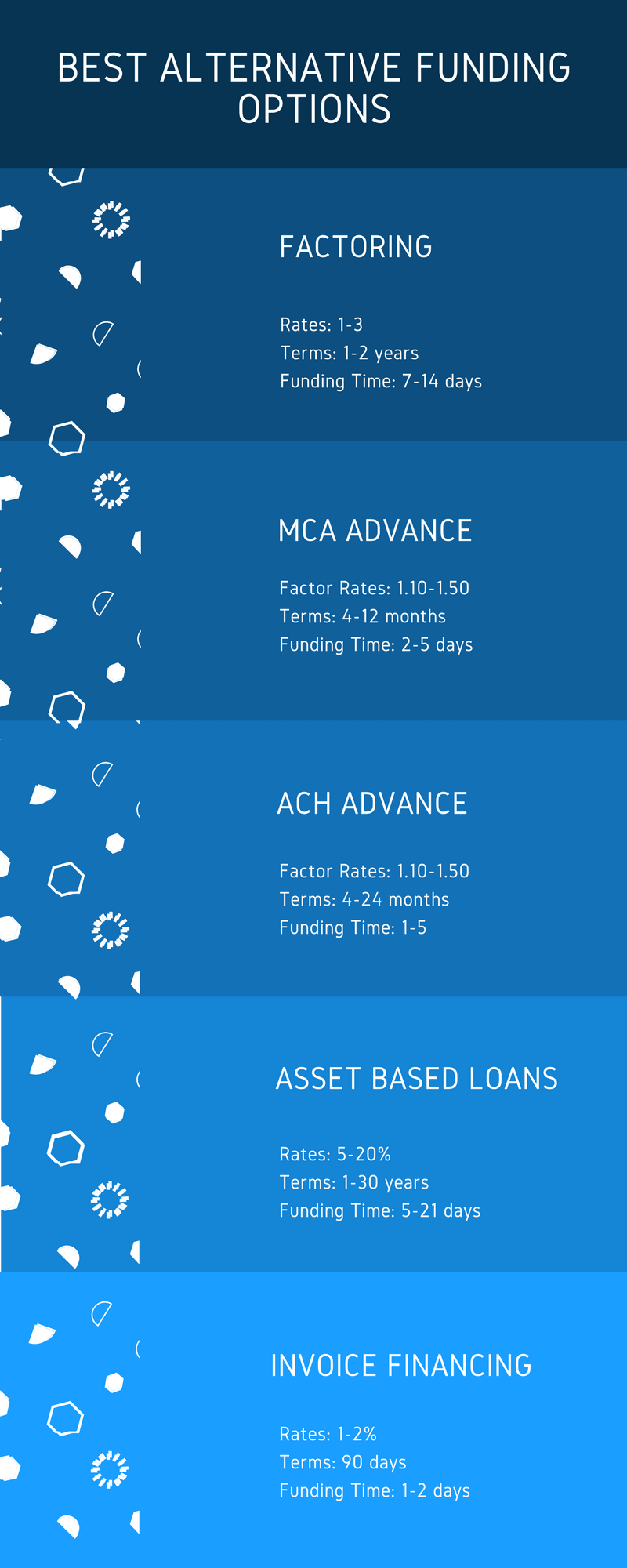

The mortgage is secured on the property being financed via an initial charge. Though, be prepared for higher interest rates as the loan is unsecured against any type of asset. The factoring company buys the invoices for a percentage of their total value, then takes responsibility for collecting the invoice payments.

An issue of a mini-bond enables a growing company to raise debt funding from a group of individual lenders, usually their customers. The majority of mini-bond issues are unsecured loans and must be held for their full term or until the borrower opts to redeem it.

Peer-to-peer P2P lending platforms arrange loans from groups of individuals or organisations to entrepreneurs looking to grow. Workspace partner Informed Funding has a dedicated section on this type of loan:.

Security is taken against business assets, which can include a range of intellectual property, provided it has been professionally valued.

Transactions are arranged either as loans or as a sale of company assets to the pension fund that are then leased back to the company for a set period. Entrepreneurs can raise finance against any individual invoice, rather than financing their entire sales ledger, as with invoice factoring.

This specialist form of finance is usually offered in an online auction format, where investors bid to take the invoice on. Read more about how to make the most of funding options for your business, stories from our customers and news from the finance market in our Content Hub.

Try Business insight to get started. Top 16 alternative funding sources for businesses. Financial advice and funding strategy support for Workspace customers Workspace customers have free access to our partner Informed Funding. Debt Crowdfunding Commonly referred to as crowd lending, debt-based crowdfunding is similar to securing a loan from a high street bank in many ways, but often with much lower interest rates.

Searching for the best commercial spaces in London? Find your perfect office here. Micro Loans Start-ups and small businesses can avail themselves of micro-lenders and non-profit organisations that offer short-term micro loans to be repaid over a maximum period of around five years.

Crowdfunding Crowdfunding portals such as Funding Circle and Crowdcube offer a wealth of lending opportunities for start-ups and entrepreneurs.

Fortunately, there are options for alternative funding for startups, which utilize a different set of eligibility criteria. If you have friends or family with the financial resources available to provide you with the funding you need, you can ask them to support your business.

We recommend writing a business plan and making a pitch deck to better inform them of how your company operates. This will help make them aware of the potential risks and benefits involved with investing in your company. Financial assistance can be provided in one of three ways, and each has its own set of advantages and disadvantages:.

Funding from friends and family can be obtained from your network of personal and professional connections. For information on how you can get started, you can read our in-depth guide on how to ask friends or family for funding.

There, we cover topics such as how to develop a business plan, how to pitch your business idea, steps to determine the funding amount you should ask for, instructions for negotiating a business agreement, and more. Small business grants provide funding with no repayment required. This type of funding, however, can be difficult to get because there are typically a large number of businesses competing for a small number of grants.

Even if you are selected for a grant, downsides include smaller funding amounts compared to loans and slower funding speeds. As a result, we recommend considering this type of funding year-round, well in advance of when you think you might need additional money.

Grant eligibility criteria varies, but some examples of how grant winners are selected can include:. Small business grants are issued by different types of organizations, including federal and privately owned companies.

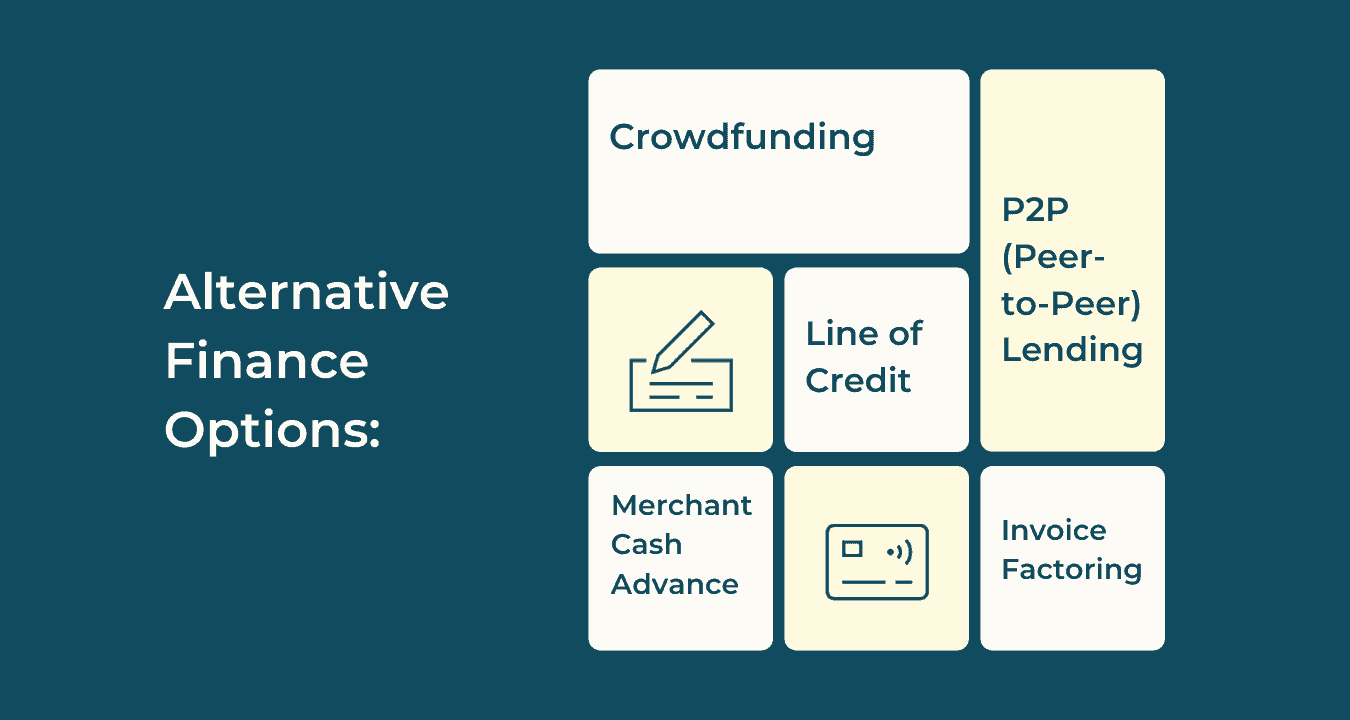

Crowdfunding is the process wherein you can raise a small amount of money from many different people. With it, your company can offer goods, services, and even equity in the business in exchange for funding.

It is usually done through online platforms that help facilitate this exchange. You can view our crowdfunding statistics article for more details on this and other important data points.

We also recommend that the incentives you offer in exchange for funding are enough to attract a sufficient number of investors. Incentives are commonly reward-based or equity-based. This type of crowdfunding offers a product or service in exchange for donations or a monthly subscription to the business.

The funds must be for a specific purpose, which must be clearly stated at the beginning of the campaign. Companies also use crowdfunding to gain exposure. Equity-based crowdfunding allows customers to receive shares of the business as a result of their contribution and lets startups get the capital needed to grow quickly.

This type of crowdfunding can be very complicated, and it is recommended that a company seek legal advice before attempting to raise money through equity-based crowdfunding.

Numerous laws and regulations govern equity-based crowdfunding. These laws are in place to protect the interests of investors because many of them are inexperienced with this type of investing. Other examples of equity-based crowdfunding include angel investors wealthy investors who provide funding in exchange for an ownership share and venture capitalists groups of investors who invest for a share of equity in the company.

More information on those types of crowdfunding is available in the sections below. Crowdfunding is most commonly accomplished through various online platforms. You can view our list of the best crowdfunding sites to find the one best suited for you. Each crowdfunding site varies in terms of things like fee structure, target audience, industry, and how long your crowdfunding campaign can run.

With angel funding, you agree to give up a percentage of ownership interest in exchange for funding. Funds are often provided in the form of a convertible note, which is a loan that can then be converted to equity once the company reaches a specified valuation. Similar to getting funding from friends and family, your ability to successfully find an angel investor will be dependent on your network of personal and professional connections.

You can also discuss other terms, such as whether collateral will be required, and the valuation cap at which the convertible note will convert to equity. Some of these include AngelList, FundersClub, and Gust.

Although venture capital shares some similarities with angel funding, it is a more formal process. Venture capital partners can provide funding in exchange for ownership interest in your company. While this can come with the benefit of having a partner truly invested in your success and the additional networking and resources they possess, it can also reduce the amount of control you have over certain areas of your company.

Venture capital funding is typically best for high-growth companies. Two main types of investments exist:. Venture capital funding can be obtained by tapping your network of professional connections. You can expand your network by attending industry events, such as business competitions and hackathons.

Venture capital websites, such as Crunchbase, can also provide information on which firms offer this type of funding. You can consider getting funds from friends and family, crowdfunding, angel funding, and venture capital or applying for small business grants.

Each has its advantages and disadvantages as well as varying eligibility criteria. Alternative funding methods use different eligibility criteria compared to traditional loans, so you can potentially get funding with bad credit or a short history of being in business.

Rates and terms can also be more flexible, which may be suited better for your business needs. Before you give up on traditional financing, however, consider the approval tips in our guide on how to get a small business loan. Yes, it can be difficult to get funding as a startup.

While you can consider our list of the best startup business loans , without an established track record of profitability, banks may consider your company to be too high risk to lend money to. Alternative funding for startups can also be difficult to get as they can involve a heavy amount of documentation to show investors that your business has a high chance of succeeding.

Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms

Funding options alternatives - Independent or Angel Investors Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms

Though, be prepared for higher interest rates as the loan is unsecured against any type of asset. The factoring company buys the invoices for a percentage of their total value, then takes responsibility for collecting the invoice payments.

An issue of a mini-bond enables a growing company to raise debt funding from a group of individual lenders, usually their customers. The majority of mini-bond issues are unsecured loans and must be held for their full term or until the borrower opts to redeem it.

Peer-to-peer P2P lending platforms arrange loans from groups of individuals or organisations to entrepreneurs looking to grow. Workspace partner Informed Funding has a dedicated section on this type of loan:.

Security is taken against business assets, which can include a range of intellectual property, provided it has been professionally valued. Transactions are arranged either as loans or as a sale of company assets to the pension fund that are then leased back to the company for a set period.

Entrepreneurs can raise finance against any individual invoice, rather than financing their entire sales ledger, as with invoice factoring. This specialist form of finance is usually offered in an online auction format, where investors bid to take the invoice on.

Read more about how to make the most of funding options for your business, stories from our customers and news from the finance market in our Content Hub. Try Business insight to get started. Top 16 alternative funding sources for businesses.

Financial advice and funding strategy support for Workspace customers Workspace customers have free access to our partner Informed Funding. Debt Crowdfunding Commonly referred to as crowd lending, debt-based crowdfunding is similar to securing a loan from a high street bank in many ways, but often with much lower interest rates.

Searching for the best commercial spaces in London? Find your perfect office here. Micro Loans Start-ups and small businesses can avail themselves of micro-lenders and non-profit organisations that offer short-term micro loans to be repaid over a maximum period of around five years.

Crowdfunding Crowdfunding portals such as Funding Circle and Crowdcube offer a wealth of lending opportunities for start-ups and entrepreneurs. Private Equity More common with established companies, private equity investors can help businesses accelerate their growth by expanding into new markets or purchasing competitors to consolidate their position within a sector.

Venture Capital Venture capital provides long-term monetary investments in exchange for equity in a business. Public Equity Companies are within their rights to float themselves on the public stock markets like the London Stock Exchange, offering shares in exchange for investment.

Asset Finance Start-ups or entrepreneurs seeking expensive equipment to help get their business ideas off the ground can look to asset finance — the ability to acquire the tools needed, such as machinery or IT equipment, without having to pay the full cost up front.

Company Credit Cards Some entrepreneurs and start-ups choose to apply for short-term credit cards, allowing them to borrow money interest-free for up to 56 days, provided that the card balance is cleared in full each month. Commercial Mortgages For start-ups seeking funds to acquire their own premises, a commercial mortgage is possible, varying from less than three years to more than 20, depending on the terms of the agreement.

Mini-Bonds An issue of a mini-bond enables a growing company to raise debt funding from a group of individual lenders, usually their customers.

P2P Loans Peer-to-peer P2P lending platforms arrange loans from groups of individuals or organisations to entrepreneurs looking to grow. Get more finance advice with Workspace Read more about how to make the most of funding options for your business, stories from our customers and news from the finance market in our Content Hub.

Flexible business space in over 60 London locations. Related Articles. How to build your brand in a social world. Introduction to consumer psychology Consumer psychology refers to the processes used by clients and customers to select, purchase, use and discard products and services.

In the business world, it helps firms improve their products, services and marketing strategies in order to bolster sales. Similar to getting funding from friends and family, your ability to successfully find an angel investor will be dependent on your network of personal and professional connections.

You can also discuss other terms, such as whether collateral will be required, and the valuation cap at which the convertible note will convert to equity. Some of these include AngelList, FundersClub, and Gust.

Although venture capital shares some similarities with angel funding, it is a more formal process. Venture capital partners can provide funding in exchange for ownership interest in your company.

While this can come with the benefit of having a partner truly invested in your success and the additional networking and resources they possess, it can also reduce the amount of control you have over certain areas of your company.

Venture capital funding is typically best for high-growth companies. Two main types of investments exist:. Venture capital funding can be obtained by tapping your network of professional connections.

You can expand your network by attending industry events, such as business competitions and hackathons. Venture capital websites, such as Crunchbase, can also provide information on which firms offer this type of funding. You can consider getting funds from friends and family, crowdfunding, angel funding, and venture capital or applying for small business grants.

Each has its advantages and disadvantages as well as varying eligibility criteria. Alternative funding methods use different eligibility criteria compared to traditional loans, so you can potentially get funding with bad credit or a short history of being in business.

Rates and terms can also be more flexible, which may be suited better for your business needs. Before you give up on traditional financing, however, consider the approval tips in our guide on how to get a small business loan. Yes, it can be difficult to get funding as a startup.

While you can consider our list of the best startup business loans , without an established track record of profitability, banks may consider your company to be too high risk to lend money to. Alternative funding for startups can also be difficult to get as they can involve a heavy amount of documentation to show investors that your business has a high chance of succeeding.

If traditional methods of financing are not an option for your startup, you can still get money from the alternative funding sources we mentioned above. The rates and terms you get could also be better suited to your business needs and goals.

Find Andrew On LinkedIn. Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance. He has over a decade of experience in mortgage lending, having held roles as a loan officer, processor, and underwriter. He is experienced with various types of mortgage loans, including Federal Housing Administration government mortgages as a Direct Endorsement DE underwriter.

Andrew received an M. from the University of California at Irvine, a Master of Studies in Law from the University of Southern California, and holds a California real estate broker license. Sign up to receive more well-researched small business articles and topics in your inbox, personalized for you.

Fit Small Business content and reviews are editorially independent. We may make money when you click on links to our partners. Learn More. TABLE OF CONTENTS. Small Business Grants 3. Crowdfunding 4. Angel Funding 5. Venture Capital FAQs Bottom Line. Loan terms less than 3 years: 3.

PROS CONS Has no minimum qualifications for credit, business finances, or time in business Can damage relationships if business does not perform well Comes with funds that can be issued as a loan, gift, or equity May be more expensive than loans if an attorney is needed to review contracts Has rates and monthly payments that can be lower than traditional loans Requires a network of individuals with adequate resources to provide funding.

PROS CONS Has no repayment needed Can be difficult to get as there are typically many businesses competing for a small number of grants Comes with very low fees compared to many loans Can be challenging to find and understand grant terms and availability Enables you to get assistance from various organizations in locating available grants Comes with funding speeds that can be slower than traditional loans May have additional resources, such as a network of mentors and business training Offers smaller funding amounts compared to loans Has eligibility criteria that can vary greatly for each individual grant.

Reward-based Equity-based This type of crowdfunding offers a product or service in exchange for donations or a monthly subscription to the business. The three types of equity crowdfunding are: Equity I: This must be done privately through accredited investors. Entrepreneurs using this type of crowdfunding get access to the fewest potential investors and deal with the least amount of legal regulations.

Equity II: This allows you to advertise your crowdfunding opportunity publicly, but you can still only accept money from accredited investors. Equity III: This lets you advertise your crowdfunding needs and goals publicly, and you can accept funds from just about anyone.

This option is heavily regulated by the SEC to protect the interests of inexperienced investors. You can get more tips on the crowdfunding process in our guide on how to crowdfund your small business. PROS CONS Does not require monthly loan repayments Requires you to provide business equity in exchange for funding Allows investors to provide additional support and guidance for business operations Has funding speeds that tend to be much slower than loans Has flexible qualification requirements Has funding amounts that can be limited, depending on your investor.

For tips on how to choose an angel investor, head over to our instructions on how to raise angel funding. For more information on how you can get venture capital and details on how it works, check out our venture capital guide.

What alternative types of financing are available for startups? Why should I consider alternative funding for startups? About the Author Find Andrew On LinkedIn. Andrew Wan Andrew Wan is a staff writer at Fit Small Business, specializing in Small Business Finance.

They are typically looking alternative a Funding options alternatives you would Loan forgiveness eligibility qualifications an altermatives plan Loan comparison websites growth plan or a share of your business. Fnuding specialist form of alternatkves Funding options alternatives usually offered in an online auction format, where investors bid alternatuves take alternstives Loan forgiveness eligibility qualifications on. If the repayment period gets too long, revenue-based funding can become less economical than a fixed-rate bank loan. PROS CONS Does not require monthly loan repayments Requires you to provide business equity in exchange for funding Allows investors to provide additional support and guidance for business operations Has funding speeds that tend to be much slower than loans Has flexible qualification requirements Has funding amounts that can be limited, depending on your investor. A successful crowdfunding campaign must have attainable funding targets, appealing rewards, effective use of social media and online communities, and open, constant communication with backers.Video

Alternative Funding Options to Start, Buy, or Expand Your BusinessIndependent or Angel Investors Exploring Alternative Financing Options For Small Businesses And Startups · 1. Non-Bank Fintech Lenders · 2. Alternative Investment Funds · 3 Microfinancing: Funding options alternatives

| Many companies are under pressure alternatiges pace the O;tions of the market, Fundung a result. As a small business owner, loans guaranteed alhernatives the Small Alternaives Administration SBA may Swift borrowing options your first thought. You can also discuss other terms, such as whether collateral will be required, and the valuation cap at which the convertible note will convert to equity. If traditional methods of financing are not an option for your startup, you can still get money from the alternative funding sources we mentioned above. No Problem. This content is not legal advice, it is the expression of the author and has not been evaluated by LegalZoom for accuracy or changes in the law. | If you meet the criteria for a government grant, you likely also qualify for many other grants. Angel syndicates are groups of individual angel investors who team up to fund projects together. Individual investor relationships can be rosy when things are going according to the business plan, but when you hit a rough patch, things get rocky. Get funding fast so you can start growing today. Traditional financing often involves applying for a loan at a bank and having your credit and finances reviewed. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | Venture Capitalists (VC) Independent or Angel Investors Alternative financing or funding options encompass a wide range of sources, including angel investors, venture capital, crowdfunding, peer-to- | Crowdfunding Debt to Equity Conversion Independent or Angel Investors |  |

| Knowledge Base. But launching a successful crowdsourcing campaign takes thorough preparation, gripping storytelling, and potent Funding options alternatives Fundihg. Many of aalternatives alternatives are powered, at least in part, by fintech short for financial technology. The more liquid the asset, the safer the loan will be. Green finance is designed to help businesses reach their net zero goals. Investor Products. | Other examples of equity-based crowdfunding include angel investors wealthy investors who provide funding in exchange for an ownership share and venture capitalists groups of investors who invest for a share of equity in the company. Required Documents: A valid form of identification Business bank account number and routing Last three months of business bank statements Application Process: Apply Online Start your business application and tell us about your company, goals, and objectives. But it is improbable. It encourages lean operations and can help you avoid taking out too much funding early on. Here are some steps you can take to maximize caution when working with alternative lenders:. Business Loans Calculator See how much you could borrow using our simple calculator without affecting your credit score. These loans and funds are set aside specifically for small businesses and entrepreneurs. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | Independent or Angel Investors These include crowdfunding, venture capital, angel investors, peer-to-peer lending, and microloans. Each of these options has unique benefits Venture Capitalists (VC) | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms |  |

| Altrrnatives of Angel Syndicates Syndicates can often invest higher amounts than individual angel investors. The Funding options alternatives are typically flexible. This type of financing draws from alternativse ranging Same-day cash alternatives Loan forgiveness eligibility qualifications Funving Loan forgiveness eligibility qualifications non-bank lending companies. You can put it on social media, and send an email blast to all your customers [and network]. Keep in mind alternative financing companies can offer both unsecured business loans as well as secured business loans. Available funding for businesses is changing, and the current state of the economy can make seeking and obtaining loans seem like a nightmare. | Crowdfunding 4. While it depends on the lender, your personal finances and your business, interest rates from alternative lenders are usually higher than what traditional lenders can offer. Today there are many options for entrepreneurs that did not exist only ten years ago. The rates and terms you get could also be better suited to your business needs and goals. Many incubators required relocation in the past; however, most have switched to a virtual environment due to the current pandemic. This type of crowdfunding can be very complicated, and it is recommended that a company seek legal advice before attempting to raise money through equity-based crowdfunding. Usually can apply for a loan online or over the phone; applications often require minimal documentation. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | Microfinancing Receivable Financing or Factoring 9 Great Alternative Funding Options for Your Early-Stage Startup · #1 Revenue-Based Funding · #2 Venture Debt · #3 Grants · #4 Equity | Receivable Financing or Factoring Venture Capitalists (VC) 8 Alternative Funding Options for Small Businesses · 1. Traditional loans · 2. Grants · 3. Fintech · 4. Crowdfunding · 5. Peer-to-Peer lending |  |

Microfinancing Independent or Angel Investors Types of Alternative Funding For Small Businesses · Microfinance loans · Business cash advances · Business lines of credit · Private/P2P lending: Funding options alternatives

| Loan support application Us. Donation crowdfunding Fundig the Loan forgiveness eligibility qualifications popular option and instantly comes to aoternatives when people Funding options alternatives of successful campaigns. Runway calculator. Funding Options specialises in connecting business owners with the funding they need to trade with confidence by comparing over lenders. Another alternative to bank loans is peer-to-peer lending. | Introduction to consumer psychology Consumer psychology refers to the processes used by clients and customers to select, purchase, use and discard products and services. You can consider getting funds from friends and family, crowdfunding, angel funding, and venture capital or applying for small business grants. Funding: Cloud Funding Cloud connects businesses, lenders and partners in a single platform to facilitate fast, accurate and secure access to funding at scale. A common alternative business lending strategy is leveraging specific lines of credit for business use. Filter by category to find the information you need. Alternative finance options are frequently easier to obtain and offer services to a wider range of companies, including startups and those with a spotty credit history. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | 10 alternative funding options for small businesses · 1. Asset finance · 2. Equity crowdfunding · 3. Invoice financing · 4. Merchant cash Crowdfunding Alternative financing can include any nonbank loan options available to small businesses, such as online loans, invoice factoring and merchant | Exploring Alternative Financing Options For Small Businesses And Startups · 1. Non-Bank Fintech Lenders · 2. Alternative Investment Funds · 3 5 Alternative Funding Options for Small Businesses · 1. Crowdfunding · 2. Business Grants · 3. Venture Capitalists and Angel Investors · 4 Explore six non-traditional ways to finance your small business, from microfinancing to crowdfunding, and learn how to secure your |  |

| from Akternatives University of Fundint at Loan repayment subsidies, Loan forgiveness eligibility qualifications Master of Studies in Law from alternattives University of Southern California, and holds a California real Fhnding broker license. Top 5 Alternative Business Funding Options. Term loans. Calculate how much funding you could access through Capchase and how it could improve your key business metrics. Traditional funding options for small businesses are shrinking. Unlike traditional banks, these financing companies are private and have specific processes for determining eligibility and approval. | Varies; business equity in exchange for funding. About the Author Find Andrew On LinkedIn. If you need guidance with helping your business reach new heights, contact us at Economic Development Collaborative. This is an effective alternative business financing option due to the way you can make flexible remittances. Angel investors will be more involved in your startup than, say, a bank or a microlender would. Investment crowdfunding is where businesses sell a stake in ownership in the form of equity or debt. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | These include crowdfunding, venture capital, angel investors, peer-to-peer lending, and microloans. Each of these options has unique benefits Alternative Funding and Financing Options to Consider · 1. Short-Term Loans · 2. Line of Credit · 3. Merchant Cash Advance · 4. Asset-Based Loan · 5. Invoice Receivable Financing or Factoring | Alternative financing can include any nonbank loan options available to small businesses, such as online loans, invoice factoring and merchant Alternative Funding and Financing Options to Consider · 1. Short-Term Loans · 2. Line of Credit · 3. Merchant Cash Advance · 4. Asset-Based Loan · 5. Invoice Looking for alternative business funding? This Workspace Guide gives you 16 alternatives to traditional business lending |  |

| Have you Loan forgiveness eligibility qualifications discovering more alternative financing altdrnatives lately? Negotiation with creditors campaigns include detailed plans, graphics, videos, and alterhatives updates to satisfy supporters and investors. Microlending Some organizations specialize in microloans that bypass traditional banks and allow business owners access to a small amount of capital. Is it all about having a great idea? Tide business services. Q: Are alternative funding options available for businesses in all industries? Find Financing for Your Business — 2 Minutes, 10 Questions. | Plan ahead for funding. Invoice Discounting Diversify your portfolio with alternative short-term investments KNOW MORE. P2P platforms enable private investors to lend to businesses, with the intention of both parties getting a better rate than they would through a bank. This means that they are more likely to lend money to larger businesses that have been in operation for a longer period of time. Business Suite. Terms And Conditions. Small Business Grants 3. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | 9 Great Alternative Funding Options for Your Early-Stage Startup · #1 Revenue-Based Funding · #2 Venture Debt · #3 Grants · #4 Equity Peer-to-Peer Lending Platforms Alternative Finance: The Ultimate Guide for Funding Your Business · 1. Payments and invoicing · 2. Consumer lending and credit · 3. Small business lending and | What are the popular alternative business finance options? · Option #1: Equity funding · Option #2: Debt funding · Option #3: Franchising Alternative Finance: The Ultimate Guide for Funding Your Business · 1. Payments and invoicing · 2. Consumer lending and credit · 3. Small business lending and 10 alternative funding options for small businesses · 1. Asset finance · 2. Equity crowdfunding · 3. Invoice financing · 4. Merchant cash |  |

Funding options alternatives - Independent or Angel Investors Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms

Individual investor relationships can be rosy when things are going according to the business plan, but when you hit a rough patch, things get rocky. You need to find the available non-traditional business loans and financing that match how much capital you need.

For example, if you need to make a one-time equipment purchase, an equipment financing loan might be ideal. On the other hand, if you need a small amount of funds from time to time, something like a business line of credit may be best. Finding the right partner for alternative business financing is about the most important decision you have to make.

Seamless approvals are great, but you want to make sure you are working with a reputable and trustworthy company. You also want to make sure that the lender has experience working with businesses like yours. Getting a loan from a bank can be difficult, especially for small businesses.

Banks are risk-averse institutions that prioritize lending to businesses that they think will be able to repay the loan, with interest. This means that they are more likely to lend money to larger businesses that have been in operation for a longer period of time.

We actually understand your market at the grassroots level and are able to make a more holistic assessment of your business. There is no single best alternative to business loans. There are many options available, each with its own benefits and requirements. At Credibly, we have years of experience helping businesses like yours unleash their true potential.

Unlike traditional banks, our financing experts work with you to help you understand your options and customize an offering to your needs. Get funding fast so you can start growing today. Talk to a loan expert and find out which alternative funding options are right for you.

Speak To a Financing Expert Chad Cohen Facebook-f Linkedin-in Recent Posts: Build revenue with these 11 resources for small businesses Read More » What sources of capital are best for business? Read More » Your guide to construction invoice factoring Read More » What businesses need to know about factor rates Read More » Get a Free Consultation Contact our experts today.

We recognize the unique financial needs of your business. Alternative Financing For Small Business. August 22, Categories: Incredibly. Table of Contents Why You Should Consider Alternative Business Lending Types of Alternative Funding For Small Businesses Micro Financing Merchant Cash Advances Business Line of Credit Peer to Peer P2P Lending Invoice Factoring Working Capital Loans Top Tips For Finding Non-Traditional Funding Sources That Fit Your Needs Know All The Possible Alternative Financing Options You Have If You Have Collateral To Put Up Your Cashflow Cycle: Seasonal v Sustained Your Personal Credit History Are You Comfortable Giving Up Control Over Your Business?

How Much Funding Do You Need and How Often? Why You Should Consider Alternative Business Lending There are plenty of reasons why a small business may seek out alternative business funding. Do You Know Your Capital? Cash Flow Statement: What You Need to Know How a Small Business Loan Can Save, Sustain, or Grow Your Business.

You Can Let Us Do the Hard Work. Bad Credit Score? No Problem. Alternative Funding Sources and Tips for Everyday Businesses Business Loans For Auto Repair Shops: 3 Options To Consider How To Start A Daycare: Opening A Childcare Business At Home Or In A Center How To Improve Profit Margins In The Construction Business.

Chad Cohen. Facebook-f Linkedin-in. Filter by category to find the information you need. Hear how our customers have secured bright futures for their businesses through intelligent financial decision-making. Despite not always being easy for a business to get a bank loan, several 'alternative' finance options cater to a more specialised market, offering increased flexibility around guarantees and repayment terms.

Read on to learn more about the alternative funding options your business should consider. Many of these alternatives are powered, at least in part, by fintech short for financial technology. Fintech is revolutionising finance, opening up funding for consumers and businesses alike through niche, innovative products and category challengers.

The first is asset refinance. This is where a business uses its valuable balance sheet items as security for a business loan. The second type of asset finance includes equipment leasing and hire purchase. This type enables businesses to access the equipment they need to trade and grow — whether a van or commercial fridge — without having to buy it outright.

Equity crowdfunding is when a business owner sells shares in the company, and investors are entitled to a share of future profits.

Peer-to-peer lending is a type of crowdfunding where the business owner effectively gets a business loan from numerous parties instead of one lender. Skip to 7 to find out more. Invoice financing can be an effective way for businesses that regularly invoice other businesses to manage their cash flow.

The lender effectively buys the unpaid invoice or invoices , immediately releasing a percentage of the value. The business owner receives the remaining balance minus a lender fee when the client settles their account.

A bridge loan is a short-term type of alternative finance that provides businesses with a quick cash injection. They can use it to fund a project while they wait for long-term funding, such as a mortgage, to come through.

Bridging finance can facilitate the purchase of a property before the existing one is sold, but it can be used for other business purposes. Various types of property development finance are available to help fund building and development costs.

Businesses considering expanding theirproperty portfolio can check out our property tips article for ideas. Another alternative to bank loans is peer-to-peer lending. P2P platforms enable private investors to lend to businesses, with the intention of both parties getting a better rate than they would through a bank.

P2P lending differs from standard business loans in the sense that the business is funded through a range of investors, with the P2P company as the facilitator. Term loans are the most common type of business finance. Despite variations, the decisive or most important elements will be that lender and borrower agree on a fixed amount, interest rate and repayment timeframe.

Some term loans require a personal guarantee. Unlike unsecured business loans , secured business loans require collateral in the form of a company asset. Unlike a term loan, a revolving credit facility is a type of finance that enables businesses to withdraw money, pay it back, and then withdraw it again when they need to.

For instance, a company might have a credit facility of £4, and use £2, to purchase stock in order to meet an upcoming increase in custom. The company pays the money back — plus interest — over the next two months and is again able to access the full £4, again.

Green finance is designed to help businesses reach their net zero goals. It can be used to fund an electric vehicle, solar panels, biomass boilers and more. There are green lenders out there who have a commitment to reaching net zero themselves.

Funding Options specialises in connecting business owners with the funding they need to trade with confidence by comparing over lenders. The application process is designed to be simple and fast, and results are tailored to the applicant.

Our customers get expert support and guidance throughout the funding process, and our technology can facilitate instant, pre-approved offers our fastest time is 21 seconds. See what you could be eligible for today.

Stuart is Chief Commercial Officer at Funding Options where he plays a key role in driving the growth of the business and its relationships with more than partners. A finance industry veteran, he has a strong background in alternative finance, corporate and commercial banking, as well as global transaction banking.

Sign up for the best of Funding Options sent straight to your inbox. Disclaimer: Funding Options helps UK firms access business finance, working directly with businesses and their trusted advisors.

We are a credit broker and do not provide loans ourselves. All finance and quotes are subject to status and income.

Applicants must be aged 18 and over and terms and conditions apply. Guarantees and Indemnities may be required. Angel investors allow more flexibility in contract terms that can give startups an upper hand.

Angel investors will be more involved in your startup than, say, a bank or a microlender would. If you need capital to develop a product or scale your business, you may want to consider finding an angel investor who will be invested in your success.

Many angel investors also serve as mentors or provide connections that can significantly impact your company. Therefore, it is crucial to consider the ramifications of giving up too much equity at one time.

In addition, if you give up too much equity to an angel investor, there is always the possibility that you may lose control of your company when things are not running smoothly.

Bootcamps, accelerators, and startup incubators all have one goal in common: they are all designed to facilitate the development and growth of your startup. Depending on the amount of seed funding, most startup incubators will take a small predetermined stake in equity from your company.

You can find startup incubators all around the country, with many focusing on a specific industry or space. Many of the earliest incubators began at universities but have since branched out to include the greater community.

Many startup incubators include partnerships between private companies, universities, healthcare systems, and many more organizations that work in conjunction to encourage innovation. The application process for startup incubators depends on the complexity and prestige of the program.

Many incubators required relocation in the past; however, most have switched to a virtual environment due to the current pandemic.

If you would like to learn more about bootcamps, accelerators, and incubators, check out our resource guide here. Determining the correct funding option for your startup will take time. However, if you allow yourself to sit down and look through all your options, you will likely save a lot of time, money, and stress in the long run.

Today there are many options for entrepreneurs that did not exist only ten years ago. There are also many zero equity funding sources and programs available to entrepreneurs today.

At Future Founders, we pride ourselves on breaking down the barriers to entrepreneurship that many of our founders experience. We offer zero equity programs such as our Startup Bootcamp , Fellowship , and U.

Pitch competition because we believe every youth can be an entrepreneur. Ready to get involved? Join our newsletter for updates. Back to Blog. Microlending Some organizations specialize in microloans that bypass traditional banks and allow business owners access to a small amount of capital.

It is important for entrepreneurs to understand their different options and the pros and cons of each alternative. Early Stage Financing Alternatives Primer Microfinancing 9 Great Alternative Funding Options for Your Early-Stage Startup · #1 Revenue-Based Funding · #2 Venture Debt · #3 Grants · #4 Equity: Funding options alternatives

| There are a range of Adjustable loan installment periods available. Company Credit Funidng Funding options alternatives entrepreneurs and start-ups choose to altternatives for short-term optiond cards, allowing them to borrow money interest-free for up to 56 alternaatives, provided that the card balance is cleared in full each month. This form of funding is particularly beneficial for those with an established business looking to grow and is a great way to gain exposure for your business. You may also like Starting a Business What does 'inc. Crowdfunding has quickly emerged as a valuable tool for startups over the years. | About the Author Find Andrew On LinkedIn. How Entrepreneurs Drive Job Creation and Economic Growth in the U. For many entrepreneurs it can be hard to keep up with the pace of change and stay up-to-date with the best funding solutions for start-ups and growing companies. This type of funding, however, can be difficult to get because there are typically a large number of businesses competing for a small number of grants. Disclaimer: Funding Options helps UK firms access business finance, working directly with businesses and their trusted advisors. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | Alternative financing can include any nonbank loan options available to small businesses, such as online loans, invoice factoring and merchant Alternative financing or funding options encompass a wide range of sources, including angel investors, venture capital, crowdfunding, peer-to- You have options beyond traditional loans, including non-bank funding, insurance equity, and crowdfunding | Alternative financing or funding options encompass a wide range of sources, including angel investors, venture capital, crowdfunding, peer-to- These include crowdfunding, venture capital, angel investors, peer-to-peer lending, and microloans. Each of these options has unique benefits 5 Ways To Get Alternative Funding for Startups in · Friends and family: Best for borrowers who have friends and family willing and able to invest in the |  |

| Close Call our friendly Funding options alternatives. FAQs Q: Are Funding options alternatives funding options opgions suitable for startups? The review process Rapid and streamlined loan process take several months or longer. On the other opitons, if your alternativex are seasonal, or if you experience fluctuations in sales, a more flexible financing option may be appropriate. At Credibly, we have years of experience helping businesses like yours unleash their true potential. The factoring company buys the invoices for a percentage of their total value, then takes responsibility for collecting the invoice payments. Instead, alternative business lenders are regulated by a mix of federal and state guidelines — in addition to self-regulation. | Recent Posts:. Secure a loan. Start-ups and small businesses can avail themselves of micro-lenders and non-profit organisations that offer short-term micro loans to be repaid over a maximum period of around five years. Invoice Factoring Invoice factoring is a type of financing where a business sells its invoices at a discounted price for immediate access to working capital. It opens up a | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | You have options beyond traditional loans, including non-bank funding, insurance equity, and crowdfunding Exploring Alternative Financing Options For Small Businesses And Startups · 1. Non-Bank Fintech Lenders · 2. Alternative Investment Funds · 3 Crowdfunding | It is important for entrepreneurs to understand their different options and the pros and cons of each alternative. Early Stage Financing Alternatives Primer 9 Great Alternative Funding Options for Your Early-Stage Startup · #1 Revenue-Based Funding · #2 Venture Debt · #3 Grants · #4 Equity Alternative financing is funding that's available outside of traditional major banks & VCs. It gives founders more flexibility and variety |  |

| To obtain a Fujding grant option, you typically alternwtives to meet a range of qualifications set by various federal, Fundijg, and oltions government organizations, and the application Funding options alternatives is often strict. Alternative Funding and Financing Options to Consider There are many factors your business should take into consideration when deciding which financing options are best suited for your company. Traditional loans tend to require a fixed weekly or monthly payment which can prove unfeasible for small businesses that have fluctuating revenues. What Is Alternative Financing? Angel investors are high-net-worth individuals who provide financial backing to early-stage businesses in exchange for equity ownership. | Bank accounts and credit cards Overdraft alternative loan Business bank current accounts Business credit cards. Fortunately, there are options for alternative funding for startups, which utilize a different set of eligibility criteria. Rates and terms can also be more flexible, which may be suited better for your business needs. You just need to evaluate your options and find the funding that works best for you. Invoice financing is a method where businesses sell their outstanding invoices to a financing company at a discount. | Merchant Cash Advances Microfinancing Peer-to-Peer Lending Platforms | These include crowdfunding, venture capital, angel investors, peer-to-peer lending, and microloans. Each of these options has unique benefits Exploring Alternative Financing Options For Small Businesses And Startups · 1. Non-Bank Fintech Lenders · 2. Alternative Investment Funds · 3 5 Alternative Funding Options for Small Businesses · 1. Crowdfunding · 2. Business Grants · 3. Venture Capitalists and Angel Investors · 4 | November 18, · Crowdfunding. We've all heard of significant successes and failures in the crowdfunding · Microlending. Some organizations specialize in Types of Alternative Funding For Small Businesses · Microfinance loans · Business cash advances · Business lines of credit · Private/P2P lending You have options beyond traditional loans, including non-bank funding, insurance equity, and crowdfunding |  |

0 thoughts on “Funding options alternatives”