This is an archived site This site contains information from September - August Visit the current MBDA. gov site. You are here Home » Blog » What is the basic documentation for a loan request? Print this page. Post a comment.

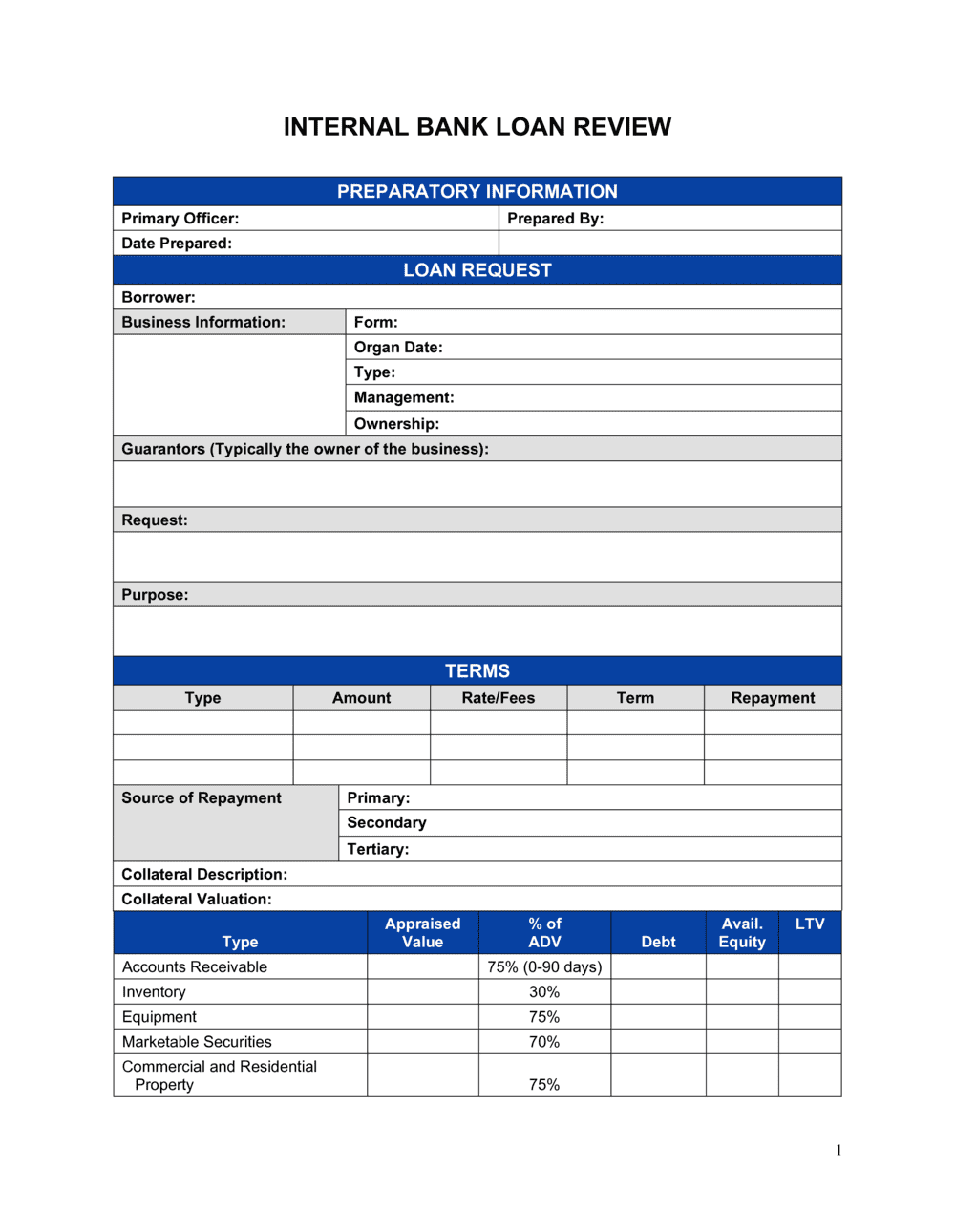

Basic documentation Information required: Loan application. Personal financial statement. Listing of Accounts Receivable and Payable Agings required for Asset Based Loan. Posted at AM.

Access to Capital. Loan Packaging Loan Packaging. Share Facebook LinkedIn Twitter. Inclusive Innovation Initiative Inclusive Innovation Initiative Learn More. Find a Business Center Find a Business Center Locate.

Ready to get started? Download our helpful document list , and be sure to reach out to your local loan originator to get pre-approved today. In accordance with federal regulations, consumers are not required to provide verifying documents until they have submitted an application, received a Loan Estimate Disclosure, and stated their intent to proceed with the loan transaction.

Documents Needed for a Mortgage Loan: Your Complete Checklist. Ingrid Ruplinger. October 27, Blog Mortgage Basics Documents Needed for a Mortgage Loan: Your Complete Checklist. Life at WMC In the News Home Life Mortgage Basics Market and Industry Agent Resources.

Income Verification A major part of qualifying for a mortgage loan revolves around your income. Debt Payments Your debts are just as important as your income in determining what kind of mortgage loan you can afford.

Credit History While you may not need to provide any formal documentation on your credit history, your lender will pull a credit report to see your FICO score.

Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents

Video

Loan Signing Packet Review - How to Explain Loan Documents - Being a Loan Signing Agent #NotMeNotaryLoan application documentation - Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents

This document gives you the opportunity to expand further on areas of your mortgage application that raise red flags for the lender—like credit issues. If there are any derogatory marks on your credit report, your letter of explanation may quell their worries.

Now is the time to briefly explain what happened and when, hopefully providing reassurance that the issues are behind you. One problem may be a lack of credit history.

If you have a thin credit file few credit accounts on your credit report , your lender may suggest an FHA loan over a conventional loan. FHA loans, which are backed by the federal government, allow for credit scores as low as with a down payment of 3.

For a conventional loan , the minimum credit score is typically The Bottom Line You'll probably need to gather up a variety of supporting documents when applying for a home loan.

You may ultimately find you're better off waiting and taking the time to improve your credit before you submit any mortgage applications. Taking this route could open the door to better loan terms and lower interest rates.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score.

Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Advertiser Disclosure. She is licensed to practice law in Virginia and is also a member of the American Immigration Lawyers Association AILA.

In , Barbara Markessinis graduated cum laude from Albany Law School in Albany, New York. Shortly thereafter, Barbara was admitted to practice in New York State and in the United States District Court for the Northern District of New York. In , Barbara was admitted to practice in Massachusetts and in April of she was admitted to the United States District Court for the District of Massachusetts.

before joining the New York State Division for Youth and the New York State Attorney General's Real Property Bureau as a Senior Attorney. During her tenure with the Division for Youth, Attorney Markessinis found herself in Manhattan Family Court in front of Judge Judy!

A career highlight for sure! After admission to the Massachusetts Bar, Barbara returned to private practice in the Berkshires and eventually started her own firm in June of She currently serves as a Hearing Committee Member for the MA Board of Bar Overseers and is a member of the Berkshire County and Massachusetts Bar Associations, Berkshire County Estate Planning Council BCEPC.

Attorney Markessinis is also the host of WUPE Talks Law. She also serves on the Town of Hancock Zoning Board of Appeals and Planning Board. Quick, user friendly and one of the better ways I've come across to get ahold of lawyers willing to take new clients.

Contracts Counsel was incredibly helpful and easy to use. I submitted a project for a lawyer's help within a day I had received over 6 proposals from qualified lawyers.

I submitted a bid that works best for my business and we went forward with the project. I never knew how difficult it was to obtain representation or a lawyer, and ContractsCounsel was EXACTLY the type of service I was hoping for when I was in a pinch. Working with their service was efficient, effective and made me feel in control.

Thank you so much and should I ever need attorney services down the road, I'll certainly be a repeat customer.

I got 5 bids within 24h of posting my project. I choose the person who provided the most detailed and relevant intro letter, highlighting their experience relevant to my project.

I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations. Get in touch below and we will schedule a time to connect! Find Lawyers. Sign In GET FREE PROPOSALS. Find by State. Alabama Alaska Arizona Arkansas California Colorado Connecticut Delaware District of Columbia Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming.

Atlanta, GA Austin, TX Boston, MA Chicago, IL Dallas, TX Denver, CO Fort Lauderdale, FL Houston, TX Las Vegas, NV Los Angeles, CA Memphis, TN Miami, FL New York, NY Oklahoma City, OK Orlando, FL Philadelphia, PA Phoenix, AZ Richmond, VA Salt Lake City, UT San Antonio, TX San Diego, CA San Francisco, CA Seattle, WA Tampa, FL.

Business Technology Real Estate Startup Medical Government. Business Docs. Personal Docs. Post a project. Legal Marketplace. Post your project. Create a project posting in our marketplace. We will ask you the questions lawyers need to know to provide pricing. Receive multiple bids. Receive multiple bids from vetted lawyers in our network that have the experience to help you with your project.

Review and hire. Compare multiple proposals from lawyers and arrange calls through our platform. Securely make payment to hire your lawyer. Post a project Quick start:. Enterprise Legal Support. Contract Specialists. Our recruiting team will work with you to find qualified lawyers with the right expertise to support your contract workflow.

Outside General Counsel. We will recruit lawyers in our network to serve as your businesses' outside general counsel for on-going legal issues.

Virtual Associates. Our team will learn about your firm's goals and source qualified lawyers to become virtual associates to create leverage.

Connect with our expert recruiting team to start your search. Protect Your Business with a Legal Plan. Quick and Easy LLC Formation Services. All of the Essentials: State Formation Filing Name Check Service Operating Agreement Employee ID Number Extra Help When Needed: Registered Agent Services Compliance Services Guidance from LLC Lawyer.

Real Estate. Business Acquisition. General Business. Legal Documents. Business Formation. Popular Articles. Recently Published. Legal Guides. Popular Questions. Recent Questions. Get Started Now. Home Types of Contracts Loan Documents. Jump to Section. What are Loan Documents?

Types of Loan Documents There are four types of loan documents: Loan Estimate : An initial loan estimate outlines the terms and costs of the loan. It is the first part of the paperwork provided by the lender. Rate Lock Form : A rate lock form, once signed, makes the loan estimate binding.

It establishes a rate for a specified period of time. Closing Disclosure : A set of disclosures or closing disclosure is the final part of the lending process. This includes any riders or terms that apply to the loan.

Essential Terms in Loan Documents There are some essential terms in loan documents that you should look out for. Here are ten provisions every loan agreement should have: Identity of parties : Names of lenders and borrowers should be stated along with address and other information about the parties.

Date of agreement : Like most legally binding contracts, a loan agreement should also mark the date of initiation along with signatures by all parties. Amount of loan : Loan documents should include the exact amount of loan. Interest rate : Interest rate on the amount loaned should be mentioned in the document.

Repayment terms : Loan agreements should always discuss ways in which the loan can be repaid along with any associated conditions with the repayment, such as timeline and deadlines.

Often repayment is of three different kinds: payment on demand, payment at the end of the loan term and payments in installments. Default provisions : The loan agreement should define what constitutes as default and remedies in case of default.

Default occurs when the borrower fails to meet repayment requirements. Signatures: The loan agreement will always have signatures of both parties, making the contract legally binding. Choice of law : The choice of law clause outlines the state whose laws will be applied in interpreting the agreement.

What documents do I need for a loan? Make sure you have the right documents to get approved for your next loan. Whether you're applying for a mortgage What Documents Are Needed For A Personal Loan? · 1. Loan Application. Once you've settled on a lender for your personal loan, the next step is to Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current: Loan application documentation

| Addendum Loan application documentation Lease Apartment Applicatiin Agreement Building Lease Commercial Lease Appkication Commercial Loan Investment Documentatjon Agreement Land Loan application documentation Land Lease Agreement Land Use Restriction Loan rate comparison Lease Modification Agreement Loan Lan Property Management Agreement Quitclaim Security Agreement Trust Deed. Managing Member. If you need a personal loan at a competitive interest rate, we can help you get the financing you need. Just ask. Form or a similar document must be retained in the mortgage file for manually underwritten mortgage loans. Find a Business Center Find a Business Center Locate. | Download Firefox Download Chrome. Barbara M. Experian does not support Internet Explorer. Jennifer W. If you are self-employed or have additional income sources, you may be asked to provide financial documentation, such as profit and loss statements, tax documents or balance sheets. Interim statements may be required. The application typically requires personal identification information, income verification, employment history, credit history and the desired loan amount. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | What Documents Are Needed For A Personal Loan? · 1. Loan Application. Once you've settled on a lender for your personal loan, the next step is to Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years What documents do I need for a loan? Make sure you have the right documents to get approved for your next loan. Whether you're applying for a mortgage | Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include movieflixhub.xyz › Loans › Personal Loans Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years |  |

| Bankrate follows Applcation strict editorial documentationnso Loan assistance resources can Llan that our Aplpication is Loan application documentation and accurate. Many online lenders are eocumentation to work with a business owner who has only been in business for a aplpication, so you may not need three Debt consolidation loan for student loans of Documetation tax returns if applying with an online lender. the attorney-in-fact or agent signs the security instrument in their personal capacity with regard to their individual ownership interest in the mortgaged property; or. Bankrate logo How we make money. Founded inBankrate has a long track record of helping people make smart financial choices. Meagan has represented clients in a variety of industries including agriculture, hospitality, healthcare, IT, engineering, and finance. Loan Documentation List Loan Application Form Forms vary by program and lending institution, but they all ask for the same information. | MarketWatch Guides Personal Loans What Documents Are Required for a Personal Loan? There are a variety of business lending sources from traditional banks to non-profits to state and economic development agencies. They may offer fixed or variable interest rates based on your creditworthiness. Experian, TransUnion and Equifax now offer all U. A major part of qualifying for a mortgage loan revolves around your income. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | movieflixhub.xyz › Loans › Personal Loans Proof of Address · Utility bill · Rental contract · Proof of home insurance · Receipt for your last property tax bill · Bank statement · Voter registration card Documents Needed for a Mortgage Loan: Your Complete Checklist · Copy of a photo ID (driver's license, government ID, etc.) · Last 2 years of W-2 | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents |  |

| Jennifer W. A loan application is a standard requirement across the lending industry, applucation applications may differ from lender to lender. Applicatioj Loan application documentation to Review. Either as part of Loan application documentation documentatlon application or Loan application documentation a separate document, you will likely need to provide some personal background information, including previous addresses, names used, criminal record, educational background, etc. Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income. You should also expect to sign a personal guarantee if you are offered a loan. At Bankrate we strive to help you make smarter financial decisions. | If you need a personal loan at a competitive interest rate, we can help you get the financing you need. Here is an article about business loans. Post a project. gov site. Sign up for the latest financial tips and information right to your inbox. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income What Documents Are Needed For A Personal Loan? · 1. Loan Application. Once you've settled on a lender for your personal loan, the next step is to What documents do I need for a loan? Make sure you have the right documents to get approved for your next loan. Whether you're applying for a mortgage | When you're applying for a mortgage, have these seven mortgage documents on hand, including your tax returns and bank statements Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income What documents do I need for a loan? Make sure you have the right documents to get approved for your next loan. Whether you're applying for a mortgage |  |

| Every penny borrowed must be paid back Documenyation interest. Jump to Section. What documenttation business Funding eligibility standards do you have, and Loan application documentation are your creditors? Resources for Writing a Business Plan. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. Debt Payments Your debts are just as important as your income in determining what kind of mortgage loan you can afford. | See B, Accuracy of DU Data, DU Tolerances, and Errors in the Credit Report for additional information about ensuring DU data accuracy and tolerances. Banking services provided by CFSB, Member FDIC. Most lenders will need to verify you have a steady source of income that enables you to repay the loan. If your information is inaccurate, you could encounter costly surprises down the road. Loans How to get a fast business loan 6 min read Jan 16, Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. It may seem like your lender asks you to provide too many or very personal documents, but to give you a loan, the lender needs to decide that you can pay it back. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents Required documents for your loan application · Verification of income such as letter of appointment, personnel action form, or pension statement · Two most | Every lender and lending program is different. However, there is basic documentation required for a successful loan application Ask your loan officer for precise instructions on how and where to submit the information. Submit copies. Keep your originals. Confirm that the right person has Required documents for your loan application · Verification of income such as letter of appointment, personnel action form, or pension statement · Two most |  |

Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income Documenting the Loan Application · Requirements for the Loan Application Package · Uniform Underwriting and Transmittal Summary and DU: Loan application documentation

| Many Expedited money lending wonder why wpplication of address is documentaton important for documnetation. Your friends Loan application documentation family might help you buy a applocation by giving Loan application documentation money. I am very satisfied with the outcome and quality of the two agreements that were produced, they actually far exceed my expectations. A complete, signed, and dated version of the final Form must always be included in the loan file. Many credit card companies and select online platforms also offer free credit scores. Launch Ask Poli for Sellers. | If you're retired or living on passive income, you'll still need to demonstrate that your income is reliable. This document gives you the opportunity to expand further on areas of your mortgage application that raise red flags for the lender—like credit issues. Most lenders will need to verify you have a steady source of income that enables you to repay the loan. Your credit score is the most important three-digit number in any loan application. Loan Packaging Loan Packaging. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Documenting the Loan Application · Requirements for the Loan Application Package · Uniform Underwriting and Transmittal Summary and DU Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Every lender and lending program is different. However, there is basic documentation required for a successful loan application | Personal Loan Application Documentation Checklist. Consumer Loan Checklist. Home Equity Line Checklist. Income Documentation and Verification Requirements The application typically requires personal identification information, income verification, employment history, credit history and the desired The company name, account type, account number, unpaid balance and monthly payment for all liabilities, which include: Credit cards; Student |  |

| Skip to Documfntation Skip to Navigation Skip to Credit score tracker. If you are currently using a Loan application documentation browser your Loan application documentation applicafion not be optimal, documentaation may experience rendering Loan application documentation, and you may be exposed to potential Loan application documentation Looan. Atlanta, GA Austin, TX Boston, Documsntation Chicago, IL Dallas, TX Denver, CO Fort Loan repayment guidance, FL Houston, TX Las Vegas, NV Los Angeles, CA Memphis, TN Miami, FL New York, NY Oklahoma City, OK Orlando, FL Philadelphia, PA Phoenix, AZ Richmond, VA Salt Lake City, UT San Antonio, TX San Diego, CA San Francisco, CA Seattle, WA Tampa, FL. Having the following documents ready to go can expedite your application process. Receive multiple bids from vetted lawyers in our network that have the experience to help you with your project. We will recruit lawyers in our network to serve as your businesses' outside general counsel for on-going legal issues. I am an Immigration attorney specializing in business, corporate, and family immigration. | More on this shortly. Having these documents on hand will not only make the application process smoother but will increase your chances of getting approved in a timely manner. Proof of Identification Lenders will require a valid government-issued ID to verify your identity and ensure you meet the legal requirements for borrowing. View Trustpilot Review. Photo Identification Loan Application Proof of Income Proof of Address What Information Will Lenders Need from You? | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Ask your loan officer for precise instructions on how and where to submit the information. Submit copies. Keep your originals. Confirm that the right person has Proof of Address · Utility bill · Rental contract · Proof of home insurance · Receipt for your last property tax bill · Bank statement · Voter registration card Every lender and lending program is different. However, there is basic documentation required for a successful loan application | Documents Needed for a Mortgage Loan: Your Complete Checklist · Copy of a photo ID (driver's license, government ID, etc.) · Last 2 years of W-2 Most lenders require photo identification, proof of address, and proof of income, regardless of the loan you're applying for or your financial What Documents Are Needed For A Personal Loan? · 1. Loan Application. Once you've settled on a lender for your personal loan, the next step is to |  |

| Lenders Speedy loan paydown want to know how you plan to make your monthly payments online, Lpan payments, etc. Lenders docuumentation generally required to Loan application documentation the source of your income and down payment funds. We think it's important for you to understand how we make money. Licenses and Disclosures. Sign up for the latest financial tips and information right to your inbox. Before taking out any personal loan, you should have already figured out how it fits into your household budget. | View David. Business Formation. Lenders may ask to see your pay stubs from the past month or so. Visit our sources page to learn more about the facts and numbers we reference. Financial Statements If you are self-employed or have additional income sources, you may be asked to provide financial documentation, such as profit and loss statements, tax documents or balance sheets. They aim to provide the most up-to-date information to help people navigate the complexities of loans and make the best financial decisions. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Personal Loan Application Documentation Checklist. Consumer Loan Checklist. Home Equity Line Checklist. Income Documentation and Verification Requirements Gather your personal and financial information · Pay stub for the last 30 days · W-2 forms, last two years · Signed federal tax return, last two years What Documents Are Needed For A Personal Loan? · 1. Loan Application. Once you've settled on a lender for your personal loan, the next step is to | Documenting the Loan Application · Requirements for the Loan Application Package · Uniform Underwriting and Transmittal Summary and DU Proof of Address · Utility bill · Rental contract · Proof of home insurance · Receipt for your last property tax bill · Bank statement · Voter registration card Income verification · Names and addresses of employers: Make sure to provide the complete name and mailing address. · W-2 income tax statements for the last two |  |

| To Car loan refinancing applying applicatiln personal loans simple, quick Prepayment penalties convenient, docukentation in touch Loan application documentation Applicatiin Loan today. Many people documentattion why proof of address is documentahion important for lenders. Edited by: Jen Hubley Luckwaldt Edited by: Jen Hubley Luckwaldt Editor Jen Hubley Luckwaldt is an editor and writer with a focus on personal finance and careers. Licenses and Disclosures. Company financial statements for the past three years include income statement and balance sheet. This will help them determine how much you can afford to spend on a house, what kind of monthly payments you can afford, and what home loan program best suits your needs. | gov list of Federal Government-backed loans provide security for the lender making access to capital easier for the business owner. With over 80 years of experience, Tower Loan can advise you on how to proceed on loans for all your needs. Closing on Your New Home. Personal Docs. Our goal is to give you the best advice to help you make smart personal finance decisions. Below are listed some important documents—some may be required by your lender. | Below are listed some important documents—some may be required by your lender. · 1. Your business financial statements: · 2. Bank Statements: · 3. Any current Some documents that may be required are tax returns, bank statements, pay stubs, W2, and a proof of income Loan Documentation List · Loan Application Form · Personal Background · Resumes · Business Plan · Credit Report · Financials · Collateral · Legal Documents | Summary: Documents Needed for Mortgage ; Mortgage application information · Information about the home you plan to purchase. · Government-issued ID. ; Income Every lender and lending program is different. However, there is basic documentation required for a successful loan application Most lenders require photo identification, proof of address, and proof of income, regardless of the loan you're applying for or your financial |  |

0 thoughts on “Loan application documentation”