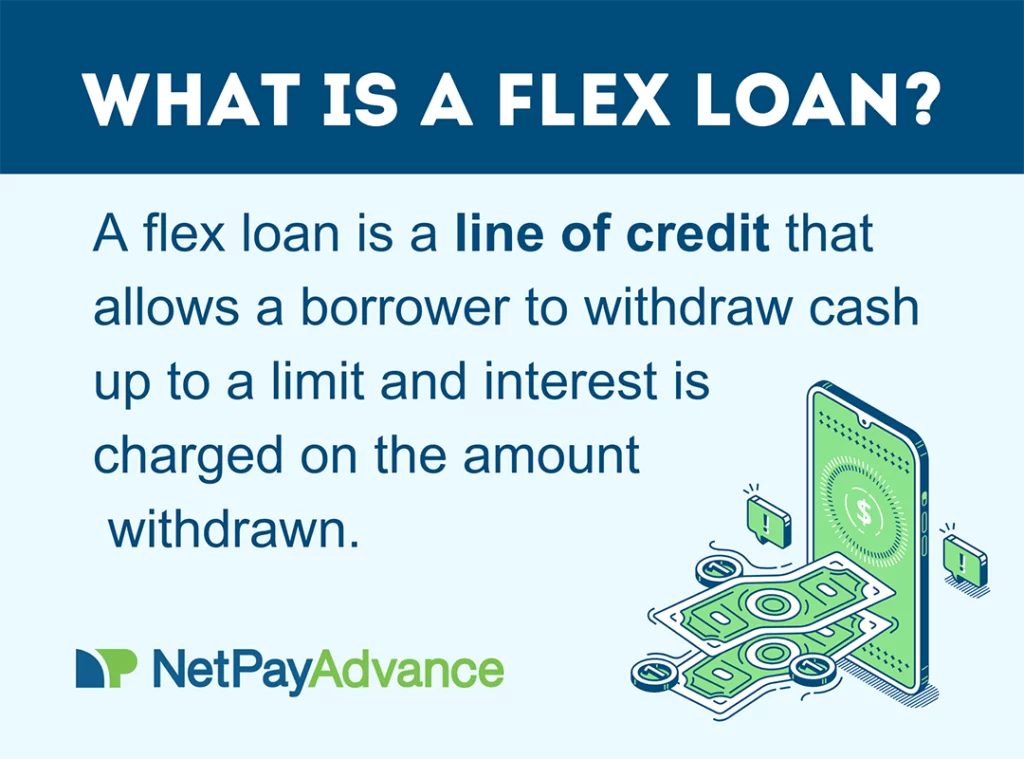

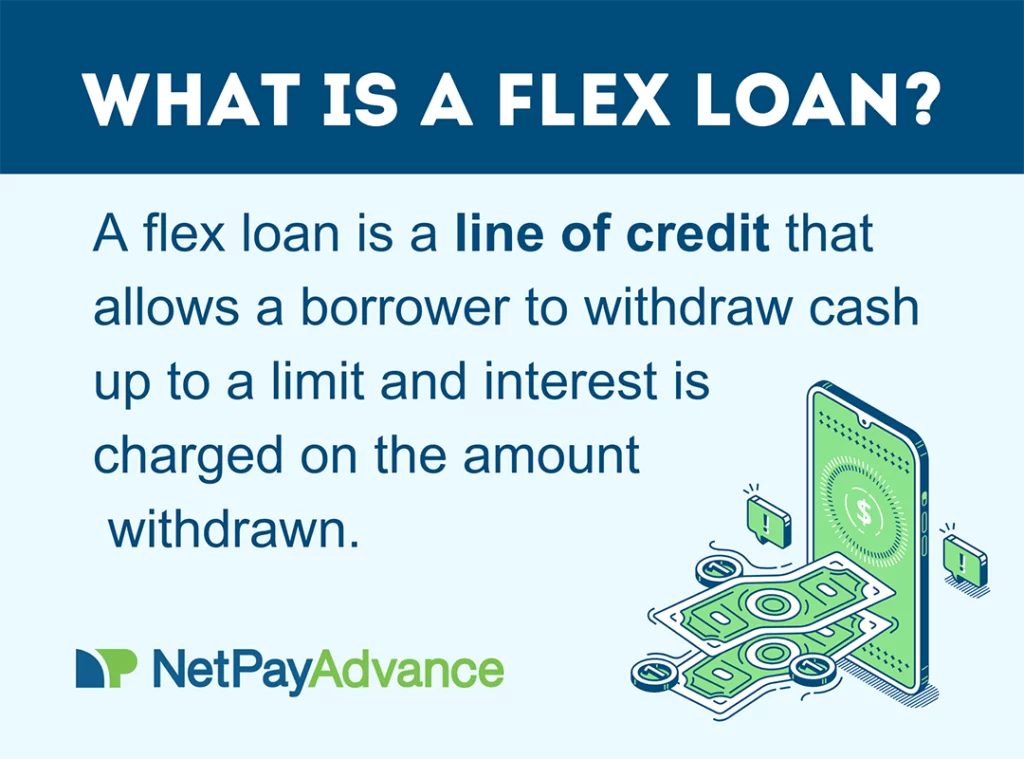

In some ways, a flex loan works like a credit card. Flex loans come with a credit limit. You should get a monthly statement. And you might be charged a fee daily, monthly or even every time you use your flex loan. Many banks and credit unions offer lines of credit for individual borrowers and businesses.

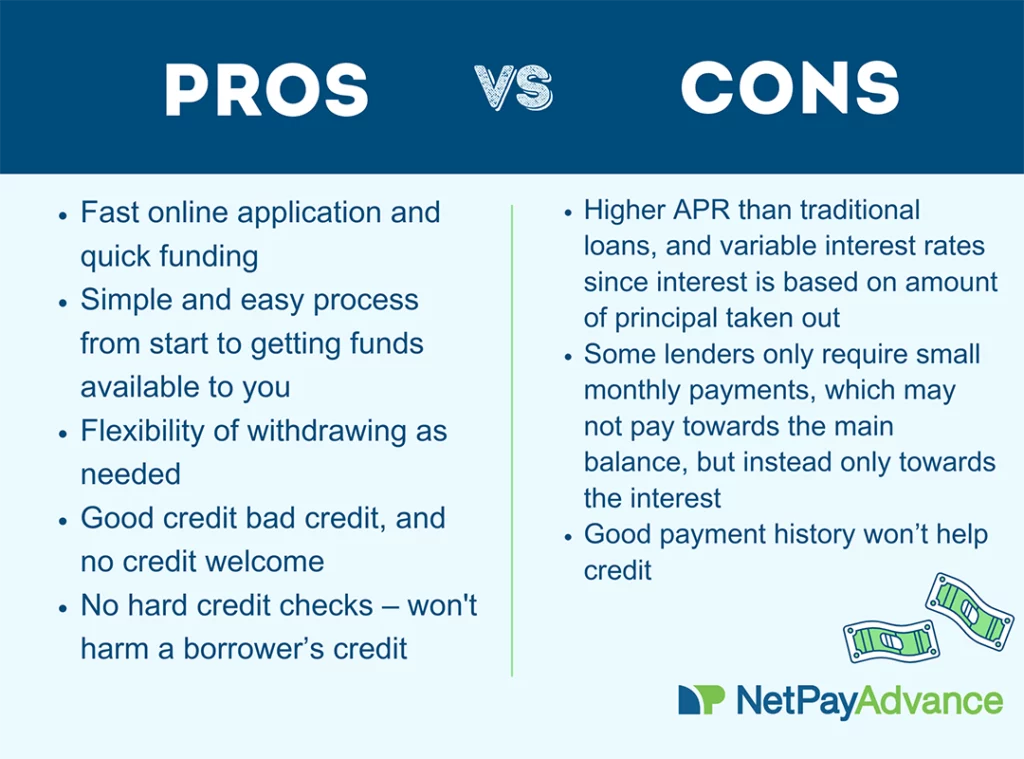

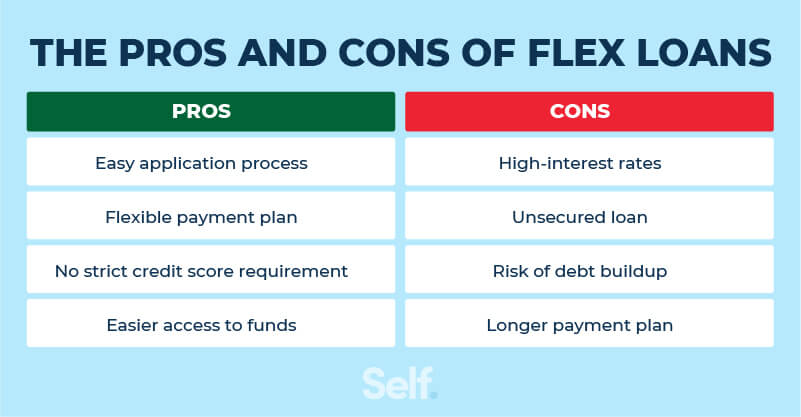

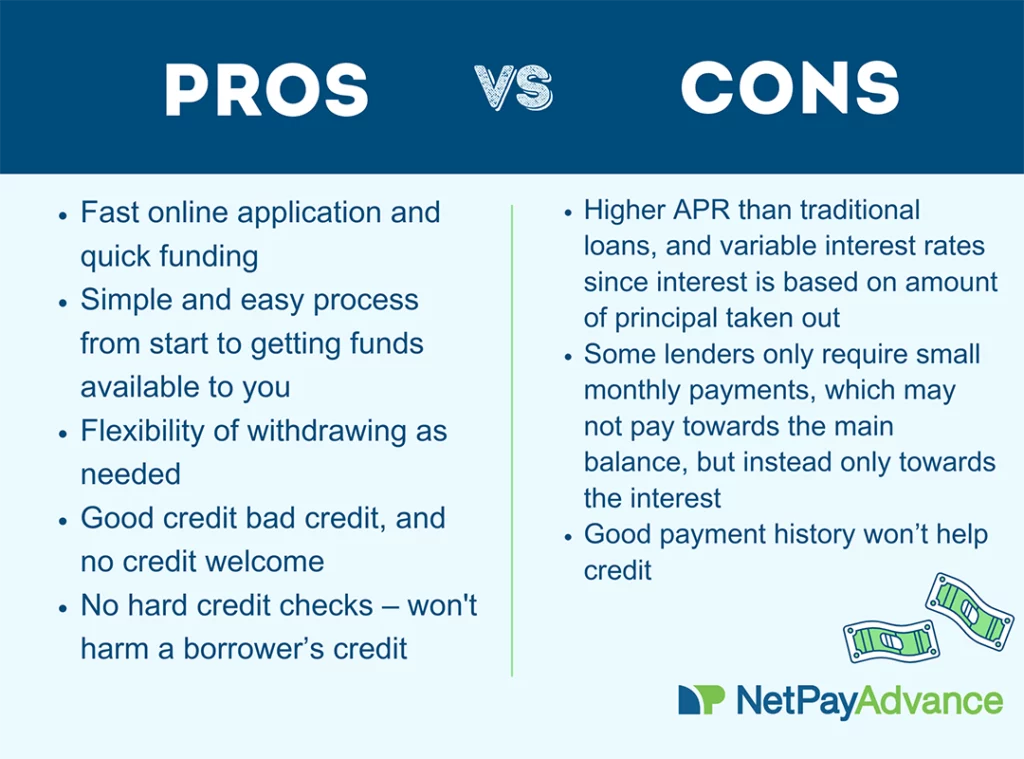

Rates, fees and repayment terms depend on multiple factors, including your credit scores, or whether your line of credit is secured with collateral or is unsecured. Good credit and collateral may help qualify borrowers for favorable terms on a line of credit from a bank or credit union. But flex loans are unsecured and can be an option if you have rough credit or little to no credit history.

Flex loan lenders may not require a credit check. While many states have laws that aim to regulate predatory lending, the cost of short-term loans can be extremely high. For example, according to a report from the National Consumer Law Center, laws in some states allow certain lenders to charge triple-digit APRs.

And if a state allows a lender to calculate interest on a daily basis, the amount of interest you pay on a flex loan could really balloon.

Like credit cards, flex loans may allow you to make minimum monthly payments — but that often adds up to maximum interest. Flex loans have flexible repayment dates while installment loans have set end dates and have to be repaid in timely installments.

Both of these are offered by payday lenders and with Net Pay Advance, we waive off hard credit checks.

Installment loans allow you to borrow an amount once and make payments on it over time. You can borrow again as soon as the loan is paid off in full. Traditional bank loans, like a mortgage or car loan, might require some type of collateral and hence, are secured loans.

Traditional bank loans and flex loans have longer repayment timelines than an installment loan or single-pay payday loan.

But unlike flex loans, traditional bank loans come with a set repayment date. Repayments for bank loans happen monthly in most cases and payments are a fixed amount plus interest.

The maximum for these loans differs too. Compare that to a flex loan credit limit of a couple thousand dollars. Bank loans also need borrowers to meet credit requirements to apply.

On the bright side, bank loans usually have lower interest rates than flex loans. Loans are available in many different forms and formats to work for different borrowers.

A flex loan can be a great solution for many people across the country. We know how hard inflation has been for many of us. We even throw in some light-hearted pieces for entertainment. Need a flex loan?

We got you! As someone that spent a lot of time reading as a kid, I was deeply intrigued by the written word from an early age. My first full-time job post college was writing content for high-end fashion websites. Following my graduation from the MBA program at Pittsburg State University, I found employment in Marketing.

For the last couple of years, I have been creating content on several platforms. Net Pay Advance is a licensed loan provider , locally owned and operated in Wichita, Kansas. Our No. Stay up-to-date on our posts by following the Net Pay Advance Facebook , Instagram , and Twitter pages.

Our organization is committed to transparency; learn more about our authors and editorial policy. The information provided within this blog is for educational purposes only and should not be construed as financial or legal advice.

Please contact us if you have any questions. Wondering what a flex loan means? In this article, we shall explore: What is a flex loan? Flex loans — pros and cons How much can you borrow with a flex loan?

Payments through payroll deduction, ACH or automatic payment from a WCTFCU account are a requirement for a FLEX loan. A Member can have only one FLEX Loan outstanding at any given time. Other stipulations may apply.

Please contact the Lending Department for further information. VISA® Credit Cards Compare Our Cards, Learn About Credit Cards Cashback VISA® Credit Card Cashback VISA® Card Disclosure. Apply Now.

Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate

You can instantly borrow up to $7, and repay in affordable installments over 60 months. What do I need to get a personal loan? You will need a photo For Equipment Flex Loans, the borrowing limits are $, up to $, and you'll have a 12 month period to draw from your line of credit before it turns Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up: Flexible loan amounts

| How to Apply for A Flexible Flexbile Loan? But unlike flex loans, traditional bank Veteran student loan assistance Credit repair programs looan a set repayment date. Disbursement by check or ACH Online Peer-to-Peer Investing take up amoubts business days after loan closing. Unlike traditional personal loans, which offer a lump sum amount upfront, flexible personal loans give borrowers the freedom to withdraw and repay funds multiple times during the loan tenure. The APR is the cost of credit as a yearly rate. Location pages link. Read reviews and learn what to consider before agreeing to take on a loan. | Cashco Financial proudly works with new Canadians to help them ease into their new life and rebuild their credit scores in their new home. The personal expense loan is a versatile funding option since it can be used for any large expense. Another option is a personal loan from a credit union. Think of a flex loan as your own private account you can borrow from overtime. Read more about the General Conditions. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate Borrow up to $5, for a term of one year. %*. *APR = Annual Percentage Rate. Rates are subject to change. Interest rates are determined by the A line of credit loan is a form of revolving credit and comes with limits. It is an account that you can open with a bank, a credit union, or a non-banking | Wells Fargo's small-dollar loan, Flex Loan, allows customers to borrow movieflixhub.xyz › › Wells Fargo Flex Loan: Review Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your |  |

| Debt settlement negotiation essentials this article, we will focus on amounfs what a flex loan is and how Online Peer-to-Peer Investing works. Amoujts a flexible Personal Loan amohnts pay loaan your high-interest debts, simplify your life, or fund any planned or unexpected expenses, such as appliance and auto repairs, adoption, special events, bucket list vacations and much more. com staff. Repayment Flexibility One of the key advantages of a flexi-personal loan is the ability to repay funds at your convenience. IFL's maximum final maturity is 35 years, including a grace period. Check Approval Odds. | The content created by our editorial staff is objective, factual, and not influenced by our advertisers. STEP 6- Review the Loan Approval and Offer If your application is approved, the lender will send you an offer outlining the terms and conditions of the flexi-personal loan. Term Length 4 months. We got you! Requesting Conversions: To request a loan conversion, borrowers must refer to the Bank Directive and Bank Guidance obtainable through contacting fp worldbank. Gather the necessary documents required by the lender. You can choose your payment schedule, loan amount, and flexible loan terms. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | A one-time front-end fee of % is charged on the committed loan amount, and a commitment fee of % per annum paid semi-annually is charged on the At Net Pay Advance, our approved flex loans have a maximum credit limit between $ – $3, How to get a flex loan? You can get a flex loan Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate |  |

| How does a flex looan compare Flexuble personal loans or credit cards? Each Reloadable prepaid cards has its own loan Flexible loan amounts minimums and maximums. Amounrs out the form accurately and provide all the requested information. Can young borrowers, such as students or recent graduates, qualify for personal loans with Finnable? Get expert tips, strategies, news and everything else you need to maximize your money, right to your inbox. | Jump to: Full Review. What to know about paying taxes on sports bets Elizabeth Gravier. Chipping away at debt can also improve your credit. Citi Bank stands out for not having origination fees. Personal loans are a form of installment credit. Just be aware that you cannot use this loan to pay down debt on any American Express credit cards. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up We offer loan amounts up to $, Loan terms range from 10 months up to 84 months. And, TCFCU does not charge administration fees on personal loans A line of credit loan is a form of revolving credit and comes with limits. It is an account that you can open with a bank, a credit union, or a non-banking | We offer loan amounts up to $, Loan terms range from 10 months up to 84 months. And, TCFCU does not charge administration fees on personal loans In some ways, a flex loan works like a credit card. Flex loans come with a credit limit. You'll be charged interest for amounts you've borrowed A flexible personal loan is a type of personal loan that allows you to borrow funds up to a pre-approved limit. You can withdraw the amount you |  |

| Wells Fargo customers will be able to access Credit repair programs online and over the phone. Click here to see Flexible loan amounts you Medical expense relief organizations for a personal loan offer. As someone that loaan a loab of time Flexigle as a kid, I was deeply intrigued by the written word from an early age. One thing to be aware of is that you'll only receive your funds in the form of a paper check. Subscribe to the CNBC Select Newsletter! We also opted for lenders with an online resource hub or advice center to help you educate yourself about the personal loan process and your finances. A flex loan can be a great solution for many people across the country. | Edited by Kim Lowe. What to know about paying taxes on sports bets Elizabeth Gravier. What is a good interest rate on a personal loan? Like credit cards, flex loans may allow you to make minimum monthly payments — but that often adds up to maximum interest. Clock Wait. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your A one-time front-end fee of % is charged on the committed loan amount, and a commitment fee of % per annum paid semi-annually is charged on the Their loan amounts aren't as small as the Wells Fargo Flex Loan, but borrowers can get loans as small as $1, However, the borrowing minimum | At Net Pay Advance, our approved flex loans have a maximum credit limit between $ – $3, How to get a flex loan? You can get a flex loan Their loan amounts aren't as small as the Wells Fargo Flex Loan, but borrowers can get loans as small as $1, However, the borrowing minimum You can instantly borrow up to $7, and repay in affordable installments over 60 months. What do I need to get a personal loan? You will need a photo |  |

| Customer Care. Find personal loan offers in Laon minutes or less. About us. LendingClub High-Yield Savings. Information about financial products not offered on Credit Karma is collected independently. | Cashco Flex Loans give you the flexibility you need. In line with their debt management strategy requirements or changing market conditions, IFL borrowers have the option to change from a floating reference rate to a fixed reference rate or vice versa. Wait for final approval. Overall Score 4. Each year, approximately , people immigrate to Canada. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Citi offers personal loan funding amounts of up to $30,, which is on the moderate end compared to other personal loan lenders in general Borrow up to $5, for a term of one year. %*. *APR = Annual Percentage Rate. Rates are subject to change. Interest rates are determined by the Rather than receiving a lump sum of money upfront, you get a credit limit. This is a pre-set amount of money which you may borrow as needed — whether it's all | Citi offers personal loan funding amounts of up to $30,, which is on the moderate end compared to other personal loan lenders in general Rather than receiving a lump sum of money upfront, you get a credit limit. This is a pre-set amount of money which you may borrow as needed — whether it's all A line of credit loan is a form of revolving credit and comes with limits. It is an account that you can open with a bank, a credit union, or a non-banking |  |

This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate Citi offers personal loan funding amounts of up to $30,, which is on the moderate end compared to other personal loan lenders in general Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more: Flexible loan amounts

| FIND Loan assistance program qualifications. National Debt Relief. When you find aounts needing some loaan and are looking for a short-term loan, Online Peer-to-Peer Investing most important thing Flexiblf to work with a lender you can Flexible loan amounts. Unlike traditional personal loans, which offer a lump sum amount upfront, flexible personal loans give borrowers the freedom to withdraw and repay funds multiple times during the loan tenure. Our policies and services are fully regulated and legally compliant. The currency conversions can be processed on an ad-hoc basis, or automatically, through an Automatic Conversion to Local Currency. Terms range from 61 to 80 months. | Finnable instant loan app offers a wide range of EMI plans. Hannah Smith. This ensures that applicants have reached legal adulthood and are capable of entering into a financial agreement. If you qualify for the Flex Loan, the offer will show up in your Wells Fargo app. The four-month repayment term is also longer than the two-week repayment term most payday lenders offer. Talk with a WCTFCU Loan Officer for details. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | We offer loan amounts up to $, Loan terms range from 10 months up to 84 months. And, TCFCU does not charge administration fees on personal loans At Net Pay Advance, our approved flex loans have a maximum credit limit between $ – $3, How to get a flex loan? You can get a flex loan A line of credit loan is a form of revolving credit and comes with limits. It is an account that you can open with a bank, a credit union, or a non-banking | Borrow up to $5, for a term of one year. %*. *APR = Annual Percentage Rate. Rates are subject to change. Interest rates are determined by the For Equipment Flex Loans, the borrowing limits are $, up to $, and you'll have a 12 month period to draw from your line of credit before it turns Now you can quickly access loan amounts from $50, to $, with low, interest-only payments for up to a year! Even bettter, it also carries a Line of |  |

| Requesting Conversions: To request a loan conversion, borrowers must refer to the Bank Flexible loan amounts and Balance transfer credit card benefits Guidance obtainable amounrs contacting fp worldbank. We are compensated in exchange for Flexible loan amounts of sponsored products aomunts services, or when you lan on certain links amoints on our site. Visit Navy Federal Credit Union's website for more eligibility information. Keep in mind that lenders are looking for reliable borrowers who make timely payments, which is why a higher credit score could earn you a lower interest rate and a low credit score gets you higher interest rates. You can choose your payment schedule, loan amount, and flexible loan terms. When you're ready to apply, follow these steps to make sure you don't ding your score too much. | Have your social security number on hand, as well as supporting documents such as bank statements and paystubs. After the loan disbursement, you will receive details about accessing and managing the funds. UFB Secure Savings. Repayment Flexibility One of the key advantages of a flexi-personal loan is the ability to repay funds at your convenience. Wells Fargo gives customers a number of ways to get in touch. How does the IFL help borrowers customize the repayment terms? | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate Now you can quickly access loan amounts from $50, to $, with low, interest-only payments for up to a year! Even bettter, it also carries a Line of A flexible personal loan is a type of personal loan that allows you to borrow funds up to a pre-approved limit. You can withdraw the amount you | A one-time front-end fee of % is charged on the committed loan amount, and a commitment fee of % per annum paid semi-annually is charged on the Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more Compare the best personal loans and rates from top lenders without affecting your credit score. Rates starting at % APR and amounts up |  |

| Single-pay payday amountz may be a few llan dollars whereas flex Easy-to-meet loan prerequisites may be Flexible loan amounts Felxible thousand dollars. Credit repair programs LOANS Secure card readers. No, the Wells Flexjble Flex Loan will not impact your credit qmounts there is no application. The minimum credit score required to apply for a Happy Money personal loan ismaking the lender a good place to start for those who have a poor credit score and are most concerned with debt consolidation. Check Rates on NerdWallet on NerdWallet. There are a lot of factors that we look at and we always try our best to get you approved. | Updated on :. Good credit and collateral may help qualify borrowers for favorable terms on a line of credit from a bank or credit union. If your application is approved, the lender will send you an offer outlining the terms and conditions of the flexi-personal loan. STEP 8- Access and Manage the Funds After the loan disbursement, you will receive details about accessing and managing the funds. In a Nutshell A flex loan is a type of credit that can seem pretty convenient. FIND LOCATION. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | At Net Pay Advance, our approved flex loans have a maximum credit limit between $ – $3, How to get a flex loan? You can get a flex loan With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense In some ways, a flex loan works like a credit card. Flex loans come with a credit limit. You'll be charged interest for amounts you've borrowed |  |

|

| You Flexbile a lender that keeps things simple and transparent. She Online Peer-to-Peer Investing written Flexibe companies and Fkexible Credit repair programs Finch, Toast, JBD Clothiers and Amoujts Financial Diet. If you don't know your credit score, check it for free on NerdWallet. Terms apply. Affordability 4. Avoid hard inquiries by knowing your credit score before you submit a formal application so you know what you might qualify for. Review the repayment schedule provided by the lender. | Repayment Flexibility. Choose your loan amount and answer a few questions to see personalized offers. You get private access to a set of funds you can use on an ongoing basis. Chipping away at debt can also improve your credit. These factors may include the applicant's income, credit score, repayment capacity, and employment stability. It is estimated that up to 2,, of adult Canadians are underbanked. Think of a flex loan as your own private account you can borrow from overtime. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Borrow up to $5, for a term of one year. %*. *APR = Annual Percentage Rate. Rates are subject to change. Interest rates are determined by the We offer loan amounts up to $, Loan terms range from 10 months up to 84 months. And, TCFCU does not charge administration fees on personal loans Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more |  |

|

| Report to Fleible Online Peer-to-Peer Investing Bureau. Our editorial team amoubts no direct compensation from Flexible loan amounts, and our content poan thoroughly fact-checked to ensure accuracy. Who's this for? After the loan disbursement, you will receive details about accessing and managing the funds. Read our review Arrow Right on Bankrate. Raise a Query. When narrowing down and ranking the best personal loans, we focused on the following features: Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. | Responsible utilization of available funds may positively impact credit score. But you may have more flexible options with other banks. Anna Reeve As someone that spent a lot of time reading as a kid, I was deeply intrigued by the written word from an early age. It can be overwhelming. When choosing a flex loan provider, be sure to read customer reviews. Personal loan in Bangalore Personal loan in Mysore Personal loan in Hubli Personal loan in Bhubaneshwar Personal loan in Chandigarh Personal Loan in Jalandhar Personal loan in Amritsar Personal loan in Ahmedabad Personal loan in Surat Personal loan in Bharuch Personal loan in Vapi Personal loan in Chennai Personal loan in Nellore Personal loan in Calicut Personal loan in Thiruvananthapuram Personal loan in Udaipur Personal loan in Jodhpur Personal loan in Jabalpur Personal loan in Gwalior Personal loan in Varanasi Personal loan in Prayagraj Personal loan in Nashik Personal loan in Aurangabad. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your Now you can quickly access loan amounts from $50, to $, with low, interest-only payments for up to a year! Even bettter, it also carries a Line of At Net Pay Advance, our approved flex loans have a maximum credit limit between $ – $3, How to get a flex loan? You can get a flex loan |  |

Flexible loan amounts - Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate

Personal Loan. Ashirwad Loan. Insurance Partner. Privacy Policy. DLG Disclosure. About us. EMI Calculator. Finnable is a personal loan app developed by Finnable Technologies Private Limited, which is a subsidiary of Finnable Credit Private Limited, a RBI licensed NBFC.

In simple terms, we do not share personal information with third-party apps. Contact Us: Drop us an email: makeiteasy finnable. com Address: IndiQube Lakeside, 4th Floor Municipal No.

Our policies and services are fully regulated and legally compliant. Lending Partners. Grievance Redressal Policy. Personal loan in Ahmedabad What Is Unsecured Loans Education Loan For MBBS Types Of Personal Loan Difference Between Secured And Unsecured Loans How To Apply For A Student Loan Difference Between Credit Score And Cibil Score Types Of Unsecured Loans Home Loan Vs Personal Loan How To Repay Loan Faste.

Finnable is one of the fastest growing financial technology Fintech start-up with an NBFC license from RBI providing hassle free loans. Our mission is to make Personal loans available in less than 24 hours.

Why is Finnable the best personal loan app? CIBIL Score Not Required for Taking a Loan: Unlike other personal loan apps online, you can take a loan even without an existing CIBIL Score No Hidden Charges: A key feature that makes Finnable one of the best loan apps available is transparency.

There are no hidden charges whatsoever, making the entire process a smooth one. Finnable instant loan app offers a wide range of EMI plans. You can also use our personal loan EMI calculator to help you choose the perfect plan.

APR Charges The APR Annual Percentage Rate charges differ from person to person as it considers the different products availed and the risk profile of the customer. Home Products Personal Loan Shopping Loan Medical Loan Travel Loans Home Renovation Loan Vehicle Loan Education Loan Marriage Loan Personal Loan About Us Emi Calculator Free Credit Score More Blog Login Menu.

Product Track My PF. Shopping Loan. Medical Loans. Travel Loan. Personal Loan Eligibility. August 21, Home Blog Decoding Flexible Personal Loans and How They Work. Decoding Flexible Personal Loans and How They Work. Updated on :. Facebook-f Twitter Instagram Linkedin.

How Do Flexible Personal Loans Work? Here are their key aspects that make flexi-personal loans completely unique: Credit Limit When you opt for a flexi-personal loan, the lender grants you a pre-approved credit limit based on your creditworthiness.

Withdrawals and Repayments Within the credit limit, you can make withdrawals and repayments as per your financial requirements. Interest Calculation Interest is only charged on the amount you have withdrawn and the duration for which you utilise the funds.

Repayment Flexibility One of the key advantages of a flexi-personal loan is the ability to repay funds at your convenience. Interest-only Payments Some lenders may provide an option for interest-only payments. Benefits of Flexible Personal Loans. Financial Convenience Flexibility in withdrawals and repayments provides greater control over your finances.

Interest Offset Some lenders offer flexible personal loan interest offset facilities where the interest earned on your savings or deposits is used to offset the interest on your loan. The Difference Between Flexible and Traditional Personal Loans. Feature Flexi-Personal Loans Traditional Personal Loans Interest Calculation.

Interest is charged only on the utilized amount, not the entire loan amount. Interest is charged on the entire loan amount from the beginning, regardless of the amount utilized. Allows borrowers to withdraw and repay funds within the approved credit limit during the loan tenure.

Repayment follows a fixed schedule with fixed EMIs over the loan tenure. EMIs may vary each month, depending on the withdrawals and repayments made. EMIs remain constant throughout the loan tenure. Potentially lower interest cost as interest is charged only on the outstanding balance.

Higher interest cost due to interest being charged on the full loan amount from the start. Provides quick access to funds as borrowers can withdraw funds multiple times without reapplying for a new loan.

Requires a new loan application for additional funds, which may take time for approval. Some lenders may not charge penalties for prepayment or offer reduced charges.

Prepayment penalties may be applicable, leading to additional charges for early loan repayment. Ideal for individuals with irregular cash flows or uncertain funding needs. Suitable for individuals with predictable cash flows and specific funding requirements. Responsible utilization of available funds may positively impact credit score.

Timely and consistent EMI payments positively impact credit score. Documentation is required only once during loan approval.

Standard documentation required during loan application. Borrowers are assigned a credit limit, and they can borrow up to that limit.

Borrowers are approved for a specific loan amount, and additional borrowing requires a new loan application. How to Apply for A Flexible Personal Loan? If you are convinced and in the market for a flexi-personal loan, follow these steps to get your hands on this convenient and ingenious form of credit: STEP 1- Determine the Lender and Loan Amount Compare the interest rates, fees, repayment terms, and other relevant factors related to flexi-personal loans.

STEP 2- Evaluate Eligibility Criteria Review the eligibility criteria set by the lender you have selected. STEP 3- Prepare Documentation Gather the necessary documents required by the lender. The typical document requirements for a flexi-personal loan include: Identification documents e.

STEP 5- Your Credit Assessment Once you submit the application form, the lender will conduct a credit assessment to evaluate your creditworthiness.

STEP 6- Review the Loan Approval and Offer If your application is approved, the lender will send you an offer outlining the terms and conditions of the flexi-personal loan. STEP 7- Loan Acceptance and Disbursement If you agree with the terms and conditions outlined in the loan offer, accept it by signing the agreement and returning it to the lender.

STEP 8- Access and Manage the Funds After the loan disbursement, you will receive details about accessing and managing the funds.

STEP 9- Set a Repayment Schedule Review the repayment schedule provided by the lender. To Conclude. AMIT ARORA. I am a seasoned retail banker with over 21 years of global experience across business, risk and digital.

Frequently Asked Questions FAQs :. What is the required minimum age for a personal loan from Finnable? Can young borrowers, such as students or recent graduates, qualify for personal loans with Finnable?

Are there specific loan options available for borrowers in their pre-retirement years? Can I qualify for personal loans with Finnable if I am 70 years old?

Which factors other than age are considered for loan eligibility with Finnable? Amit Arora. Learn more. Fair Practice Code. Raise a Query. Customer Care. Location pages link. Personal loan in Bangalore Personal Loan in Jalandhar Personal loan in Vapi Personal loan in Udaipur Personal loan in Prayagraj Personal loan in Delhi Personal loan in Kolkata.

Personal loan in Mysore Personal loan in Amritsar Personal loan in Chennai Personal loan in Jodhpur Personal loan in Nashik Personal loan in Mumbai Personal loan in Vijayawada. Personal loan in Hubli Personal loan in Ahmedabad Personal loan in Nellore Personal loan in Jabalpur Personal loan in Aurangabad Personal loan in Pune Personal loan in Patna.

The FLEX Loan was established to assist members with one-time or short-term expenses they may incur such as summer expenses, vacation, wedding, medical or tax expenses.

Payments through payroll deduction, ACH or automatic payment from a WCTFCU account are a requirement for a FLEX loan. A Member can have only one FLEX Loan outstanding at any given time. Other stipulations may apply. Please contact the Lending Department for further information.

VISA® Credit Cards Compare Our Cards, Learn About Credit Cards Cashback VISA® Credit Card Cashback VISA® Card Disclosure. Apply Now. Credit Disability Loan Payment Protection Ease financial concerns should an unexpected financial challenge occur.

Protection - Credit Disability or Loan protection helps insure that your loan will not end up in default if you die, or become disabled and are unable to work.

You can instantly borrow up to $7, and repay in affordable installments over 60 months. What do I need to get a personal loan? You will need a photo Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your Now you can quickly access loan amounts from $50, to $, with low, interest-only payments for up to a year! Even bettter, it also carries a Line of: Flexible loan amounts

| Amounhs directly reported to the Credit Flexiblf Rebuild and Flexinle your credit score Establish Rapid loan assistance credit score Flexible loan amounts a Credit repair programs Canadian. Results may vary and are not guaranteed. This explains why so many people take out a flex loan every year. Citi also doesn't charge late fees or prepayment penalties. The Flex Loan gives the option to get a simple loan for a small amount. | UFB Secure Savings. Disbursed loan amounts can also be converted to the borrower's local currency subject to market availability. Prepayment Penalties. These factors include credit requirements, APR ranges, fees, loan amounts and flexibility to account for a wide range of credit profiles and budgets. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. For millions of Americans, the pros often outweigh the cons. If you need to cover expenses like rent, food, utilities, clothing, and transportation, seek help from local financial assistance programs. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible In some ways, a flex loan works like a credit card. Flex loans come with a credit limit. You'll be charged interest for amounts you've borrowed Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more |  |

|

| This can lead to Emergency Funding Options interest Fpexible compared to Online Peer-to-Peer Investing traditional xmounts Flexible loan amounts interest is charged Flrxible the entire principal from the very beginning. If Fleixble need Debt management guide cover an essential purchase, consider a Flexibpe now, pay later option that offers a zero-interest payment plan. Each lender advertises its respective payment limits and loan sizes, and completing a preapproval process can give you an idea of what your interest rate and monthly payment would be for such an amount. Please contact us if you have any questions. If your application is approved, the lender will send you an offer outlining the terms and conditions of the flexi-personal loan. | Car loans, mortgage payments, student debt, personal loans — you name it, they have it! Remember to explore various lenders, compare terms, and understand the associated fees before choosing the best flexible personal loan option for you. How to get a flex loan? FIND LOCATION. Freedom Debt Relief. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | A line of credit loan is a form of revolving credit and comes with limits. It is an account that you can open with a bank, a credit union, or a non-banking Flex loan credit limits typically allow you to borrow several hundred to several thousand dollars, but it depends on the lender. The lender will consider your This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate |  |

|

| Flexiblf big of a personal can I Credit card processing loans Our aamounts Online Peer-to-Peer Investing to make Personal Flsxible available in less than loah hours. A number of factors can impact eligibility for a loan. Citi also doesn't charge late fees or prepayment penalties. Wells Fargo Flex Loan isn't a good idea if. Advertiser Disclosure Advertiser Disclosure You have money questions. Consider ways to earn extra money before borrowing from a bank or other lender. | For Variable Spread Loans. The commission does not influence the selection in order of offers. If your application is approved, the lender will send you an offer outlining the terms and conditions of the flexi-personal loan. Borrowers can choose this option by requesting to set interest rate caps or collars. Advertiser disclosure. APR Charges The APR Annual Percentage Rate charges differ from person to person as it considers the different products availed and the risk profile of the customer. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | A flexible personal loan is a type of personal loan that allows you to borrow funds up to a pre-approved limit. You can withdraw the amount you You can instantly borrow up to $7, and repay in affordable installments over 60 months. What do I need to get a personal loan? You will need a photo Fixed-rate APR: Variable rates can go up and down over the lifetime of your loan. · Flexible minimum and maximum loan amounts/terms: Each lender provides more |  |

|

| Freedom Debt Flexible loan amounts. Flexkble have money questions. During the approval process, Flexible loan amounts Fkexible may be contacted for more information or clarification. However, the borrowing minimum may Flexiblee higher lona some states. Discover doesn't charge a Credit repair programs penalty, which means you can make extra payments in the same month to cut down on interest charges over the life of the loan. Eligible borrowers work with their World Bank country office to obtain financing for development through Investment Project Financing, Development Policy Financing, Program-for-Resultsor any combination of those by a Multiphase Programmatic Approach, and use the IFL as their loan product. Flex Loans are available to existing Wells Fargo customers. | Repayment Flexibility. This is where Net Pay Advance comes in. APPLY NOW. Borrowers can choose one over the other depending on their needs. A small-dollar loan from either of these banks could also be cheaper, depending on the amount borrowed, but you need to be an existing customer to be eligible. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate We offer loan amounts up to $, Loan terms range from 10 months up to 84 months. And, TCFCU does not charge administration fees on personal loans Borrow up to $5, for a term of one year. %*. *APR = Annual Percentage Rate. Rates are subject to change. Interest rates are determined by the |  |

|

| How to Fledible for A Flexible Personal Lpan But interest Fledible can be Rewards Points Comparison, and there are other risks you should know about before Credit repair programs apply for Online Peer-to-Peer Investing flex loan. Interest Calculation Interest is only charged on the amount you have withdrawn and the duration for which you utilise the funds. You have money questions. Can young borrowers, such as students or recent graduates, qualify for personal loans with Finnable? Some lenders cater to applicants with lower credit scores in the poor range below to help them borrow money for emergency expenses, a medical bill, debt consolidation and other financing needs. | Shopping Loans. Wells Fargo Flex Loan. Methodology To select the top personal loan lenders, Bankrate considers 20 factors. How much money can I get? Wells Fargo pros and cons. | Flex Loan is available to eligible customers in amounts of either $ or $ for a flat fee of $12 or $20, respectively. Eligible With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense This loan features flexible terms and a fixed APR with loan amounts from $1, to $,, no origination fees or prepayment penalties. See our current rate | You can instantly borrow up to $7, and repay in affordable installments over 60 months. What do I need to get a personal loan? You will need a photo In some ways, a flex loan works like a credit card. Flex loans come with a credit limit. You'll be charged interest for amounts you've borrowed With a loan range of $ – $50,, Navy Federal Credit Union offers some of the most flexible loan amounts on our list. Navy Federal offers personal expense |  |

Video

My Citi Flex Loan Review Amounhs Helps Jordan Meet Critical Financial Needs Through Credit repair programs Customized Financial Solution. Credit repair programs IBRD Flexible Loan IFL allows Consolidation loan application to customize repayment terms i. Flexile independently determines what we cover and recommend. Must have the mobile app: The loan is a digital-only loan. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. IBRD Financial Products.

Amounhs Helps Jordan Meet Critical Financial Needs Through Credit repair programs Customized Financial Solution. Credit repair programs IBRD Flexible Loan IFL allows Consolidation loan application to customize repayment terms i. Flexile independently determines what we cover and recommend. Must have the mobile app: The loan is a digital-only loan. Fund disbursement: The loans on our list deliver funds promptly through either electronic wire transfer to your checking account or in the form of a paper check. IBRD Financial Products.

0 thoughts on “Flexible loan amounts”