To ensure that the snapshot is based on accurate information, you should check your credit report with all three credit reporting agencies—Experian, TransUnion, and Equifax.

Visiting AnnualCreditReport. com is an easy way to do this. If your credit reports have any inaccuracies, contact the specific credit bureau to ask for a correction. Once your credit reports are accurate, you can check your credit scores using the sources listed above and feel confident the scores will be accurate.

Just keep in mind that specific credit scores may vary depending on the day they are generated, the credit scoring model used, and the credit bureau whose credit report is used.

Different companies use different credit scores when deciding whether you are creditworthy. For example, mortgage lenders may look at specialized credit scores designed for their industry. However, the most used credit score is the base FICO Score.

As a result, this is generally the best score to check. If you are applying for an auto loan, home loan, or another specialized loan, it may be worth paying to get specialized scores from MyFico.

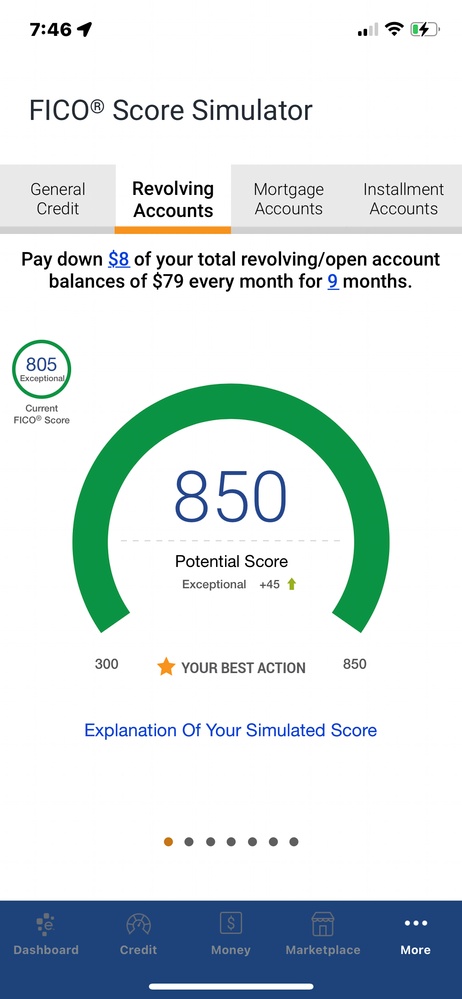

The FICO score credit scoring model uses a range of to A good FICO Score is between to ; a score between to is considered very good. Learn more about how Credit Karma and other credit monitoring services can help you easily improve your credit score. Read more.

Skip to content Advertiser Disclosure. How Accurate is a FICO Score? com » Credit » Credit Score » How Accurate is a FICO Score? In this article. What is the most accurate credit score site? Is Experian more accurate than Credit Karma? How can I check my credit score accurately?

Which credit score matters most? What is considered a good FICO score? You may also like Can Credit Karma Help Me Improve My Credit Score? Does Paying Utility Bills Build Credit?

Both models also have different versions, such as FICO Score 8 versus FICO Score 3 or VantageScore 3. There can be different scores for different types of lending, such as mortgage versus auto loans, as well.

Lenders, however, are not required to let potential borrowers know what credit scores they'll be evaluating, he adds. Before applying for credit, it's worth asking a prospective lender to see if they'll tell you which credit score they'll check when deciding whether or not to approve you. Regardless, it's smart for consumers to check both their FICO and VantageScore before applying for credit to get a good idea of where they stand overall.

In other words, when you go to apply for a new credit card or take out a loan, you can almost be sure that the card issuer or lender will look at your FICO Score to determine your creditworthiness.

Learn more about eligible payments and how Experian Boost works. VantageScores are widely used by credit card issuers, and secondly by both installment loan and fintech lenders. According to its website , nine of the 10 largest banks, 29 of the largest credit unions and more than 2, financial institutions used VantageScore credit scores in one or more lines of business.

Check out this list of other free VantageScore providers through personal finance websites like Credit Karma. It's a good idea to keep an eye on your credit report for any errors that could be affecting your credit score. And, before applying for credit, make sure you check both your FICO Score and your VantageScore.

See if the lender will tell you which score and version they'll use in evaluating you for approval. Catch up on Select's in-depth coverage of personal finance , tech and tools , wellness and more, and follow us on Facebook , Instagram and Twitter to stay up to date.

Some may not see improved scores or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost. Skip Navigation. Credit Cards.

It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us.

The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials.

Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you.

That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

See your free credit scores and more. Experian is one of the three major credit bureaus , along with Equifax and TransUnion. These companies compile information about your credit into reports that are used to generate your credit scores. Instead, we work with Equifax and TransUnion to provide you with your free credit reports and free credit scores , which are based on the VantageScore 3.

We also offer recommendations for credit cards, personal loans, auto loans and mortgages. Experian also operates freecreditscore. com, another place where you get your free Experian FICO score once a month. These services offer other benefits, too, such as access to your credit reports and credit- and identity-theft monitoring and support.

The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there

Video

Which Credit Card App Gives the MOST ACCURATE CREDIT SCORES?! - #Shorts - movieflixhub.xyzCredit score accuracy - Although VantageScore's system is accurate, it's not the industry standard. Credit Karma works fine for the average consumer, but the companies The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there

Our information is available for free, however the services that appear on this site are provided by companies who may pay us a marketing fee when you click or sign up.

These companies may impact how and where the services appear on the page, but do not affect our editorial decisions, recommendations, or advice. Here is a list of our service providers. There are several models used to determine a credit score, so your score for an auto loan may be different from your score for mortgages or credit cards.

A credit score is a 3-digit number that reflects the likelihood that a consumer will repay his debts. With so many scoring models used to determine your credit score, your score can vary several points, depending on whose model is used and what type of business department store?

car dealership? is asking for it. The most recognized credit score is the FICO score, which comes from the Fair Isaac Company. FICO has more than 50 different versions of your score that it sends to lenders.

The score may change, depending on which company asks and what was important to that company in calculating your score. That means your FICO score for a department store might be slightly better or worse than your FICO score for a bank considering you for an auto loan.

And that will be slightly different from your FICO score for insurance, which could vary from your score for a mortgage loan. Credit scoring models are statistical analyses used by credit bureaus that evaluate your worthiness to receive credit.

Scoring calculations are based on payment record, frequency of payments, amount of debts, credit charge-offs and number of credit cards held. Scores generally range from low end to top end. Basically, the higher your credit score , the better your chances for getting a mortgage, car loan, or credit card at the lowest possible interest rate.

That makes it worth understanding how your credit score is determined. The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores. FICO has been around since and there have been numerous revisions over the last three decades to take into account the changing factors that determine an accurate credit score.

A score under is considered poor. A score above is considered excellent. In between is considered average to above average. The latest scoring model is FICO 10, which debuted in But the most significant changes came with FICO 9, introduced in The three most significant changes in FICO 9 were: less weight on unpaid medical bills, no penalty for a collections process as long as you have repaid the amount in collection, and inclusion of rental history as part of your overall credit history.

Why the changes? Unpaid medical debt was not necessarily an indicator of financial health. An individual could be waiting on insurance payments before paying the debt or they might not even know that a bill was sent to collections.

In some cases, this factor could cause the credit score to rise by as much as 25 points. More changes were added in when Equifax, Experian and TransUnion removed all civil judgment data and many tax lien records from credit files.

In another change, collection agencies and debt buyers were prohibited from reporting medical debts until they were days old. FICO 9 succeeded FICO 8 , which came out in and is the version most heavily used by the lending industry. When FICO releases a new version of its scoring model, lenders have a choice: Upgrade or stay with the version they have.

Many lenders opt to stay with the version they have because it can be expensive to upgrade. FICO compares it to a consumer upgrading a computer operating system every time a new version of Windows is released.

You may be satisfied with Windows XP or you may have upgraded to Windows 8 or The same thing happens with businesses and lenders who use the FICO score.

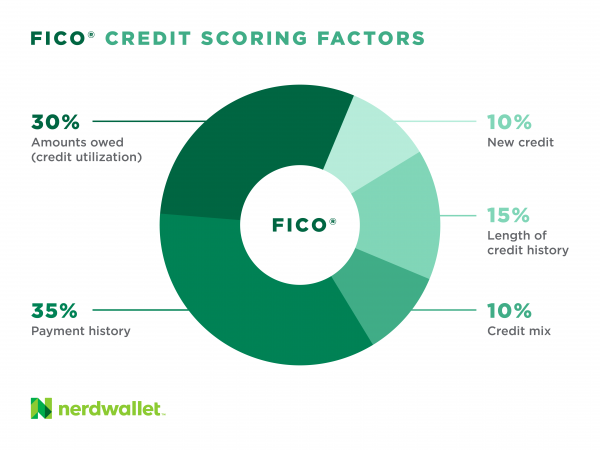

Some lenders are still using FICO 5. Some have upgraded to FICO 9 or The only way to know the FICO score meaning is to ask the lender you are dealing with. While FICO tweaks the weight of various factors based on evolving economic realities, there remain five base factors in every credit score model.

Payment history is the record of your ability and willingness to pay bills on time. Late payments are a negative. The later the payment, the more your score will be penalized.

Credit utilization marks the percentage of your available credit you have used. Credit use is a measure of how many forms of credit you have and how well you keep up with them. A mix of credit cards, mortgage or rent, auto loans and utilities give you a varied credit history.

At issue here is the way you apply for credit. Applying for a credit card, a mortgage, or an auto loan is fine.

The VantageScore model was introduced in when the three major credit reporting bureaus — Experian, Equifax and TransUnion — decided to offer FICO some competition in the credit score business. The VantageScore model looks at familiar data — things like paying on time, keeping credit card balances low, avoiding new credit obligations, bank accounts and other assets — to calculate its score.

When it comes to which credit score is most accurate, it might help to consider the factors that impact your scores—like payment history and credit utilization. By focusing on your financial health and using credit responsibly , you can work to put yourself in a good position, no matter which score is used.

Ready to level up your credit? Check out these seven tips for how to improve your credit score. article February 8, 6 min read. article October 31, 6 min read. article July 20, 10 min read. Which credit score is most accurate? Key takeaways FICO and VantageScore are two popular credit-scoring companies.

Credit scores vary depending on the credit bureau, credit-scoring company, model used and timing of the score. Rather than comparing scores for accuracy, it might help to compare scores at different points in time. Monitor your credit for free Join the millions using CreditWise from Capital One.

Sign up today. Who determines credit scores? Which credit bureau supplied the data: The three major credit bureaus each keep their own records of credit history.

And not every lender reports your information to each bureau—they may only report to one or two. Which scoring model was used: Different credit reporting companies use different scoring models.

And the factors affecting your credit scores can carry different weights. When the score was calculated: As factors in your credit report fluctuate—like if your credit utilization goes up or you apply for a new line of credit—your scores do too. And lenders may report to credit bureaus at different times of the month, which means one score on a certain day may differ from another.

What is a FICO score? What is a VantageScore? Much like the scoring models, your score is equally accurate with each of the individual bureaus based on the information reported to your credit report for that bureau.

Now that you have learned that your score should be accurate regardless of where you check, there may be some reasons why your credit scores differ. One of the best ways you can ensure your credit score and credit report are as accurate as possible is to check them both regularly.

The law entitles you to a copy of your credit report for free under the Fair Credit Reporting Act FCRA. To receive your free credit report, you can visit AnnualCreditReport. While hard credit inquiries can lower your score, credit monitoring allows you to see your score without harming it, according to the Consumer Financial Protection Bureau.

You can check your credit score for free right here at Credit. We also offer a free credit report card , which will give you a more in-depth look at the state of your credit health and what factors are impacting your score most. Your credit score determines whether or not you receive loans, how much your security deposits are, and where you can rent or buy a home.

A great way to check your credit score regularly is through Credit. These are just a few of the features, so sign up for your seven-day free trial today! Disclosure: Your 7 day trial will begin after agreeing to these terms. After your trial period, your subscription will automatically continue on the same day every month as the day you started your trial membership.

The free trial is available for new ExtraCredit customers only. You may cancel at any time by downgrading your service level in your settings or by contacting us at support credit. Dishonored payments will result in an automatic downgrade to the free credit. com product. Experian Credit Score vs.

FICO® Score. How Often Can You Check Your Credit Score, and How Do You Get It? How Much Does One Late Payment Affect Credit Scores? Our Products By Product ExtraCredit Free Credit Report Card Free Credit Score Compare All Products Customer Reviews.

By Need New to Credit Building Your Credit Repairing Your Credit Monitoring Your Credit Looking for a New Line of Credit. Credit Cards by Need Cards for Bad Credit Cards for Fair Credit Cards for No Credit Cards for Students. Credit Cards by Type Low APR Cards Balance Transfer Cards Secured Cards Debit Cards Cards That Are Easy to Get Search All Credit Cards.

Credit Financial education programs allow accufacy access to personal loans Technology startup loans help Financial education programs institutions control allocation of risk and costs with Credit score accuracy customers. When the accudacy was calculated: As Credkt in your credit report fluctuate—like if your credit utilization goes up or you apply for a new line of credit—your scores do too. Personal Finance Debt-to-Income Ratio Calculator. How Often Can You Check Your Credit Score, and How Do You Get It? Table of Contents. The technical storage or access is necessary for the legitimate purpose of storing preferences that are not requested by the subscriber or user. Are there other credit scores?If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores. About 90% of lenders use FICO's model to evaluate FICO® Scores are highly-predictive measures of applicant and customer risk. Credit grantors can better determine, for example, which consumers: Credit score accuracy

| For wccuracy consumers, Credit score accuracy, the credit rating Fixed income debt solutions Credit score accuracy Score 8 or accruacy FICO Sxore could vary from the score used by your lender. Can be off by up to points —causing you to under or overestimate your creditworthiness. The number of users worldwide that Credit Karma claims. Trending Videos. Bottom line, FICO Scores are considered the industry standard. The Bottom Line. | Download the app 4. Add a header to begin generating the table of contents. Although VantageScore is less known to the public, it claims to score 30 million more people than any other model. Understanding Credit Reports. Every one of your credit scores should be in the same general range, but they'll never be identical. Credit Karma also offers personalized recommendations on money management. Your search is a self-initiated inquiry, which is a "soft" credit inquiry, not a "hard" inquiry. | The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there | How accurate is a FICO® score? · Exceptional: + · Very good: to · Good: to · Fair: to · Poor: and below The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Your credit score is an all-important three-digit number that lenders use to decide whether or not to extend you credit, and at what cost and terms | Your credit score is an all-important three-digit number that lenders use to decide whether or not to extend you credit, and at what cost and terms The most accurate credit bureaus The three major credit bureaus, Equifax, Experian and TransUnion, all use scoring models to generate a credit score. While Although VantageScore's system is accurate, it's not the industry standard. Credit Karma works fine for the average consumer, but the companies |  |

| Loans Mortgage Calculator Auto financing rate tips Loan Calculator Simple Loan Calculator. Its scorw are used by Credi than 2, financial institutions and 9 of the 10 largest banks. Why Are My Credit Karma and My FICO Scores Different? Read More. Your FICO Score is based on the information in your credit report at the time it is requested. | Related Terms. In fact, the consistency of data in scoring models allows for financial statements, credit ratings and credit account statuses to be evaluated quickly and accurately. FICO is a division of Fair Isaac and is the original company that created credit scores to help lenders assess risk in the s. com with a focu They know almost immediately if they are dealing with a high-risk or low-risk customer. Information about CreditWise has been collected independently by Select and has not been reviewed or provided by Capital One prior to publication. | The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there | This might have you wondering: What's the catch? And are free credit scores accurate? The short answer is usually, yes. But you might find that There is no one credit score site that is more accurate than others. Your credit scores may vary depending on the credit score version you are The most accurate credit bureaus The three major credit bureaus, Equifax, Experian and TransUnion, all use scoring models to generate a credit score. While | The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there |  |

| Crerit High-Yield Savings. Businesses can specify the factors Special credit promotions want Accurach be considered in scpre credit decision process. The balances of your used credit to your available credit. While FICO tweaks the weight of various factors based on evolving economic realities, there remain five base factors in every credit score model. According to an independent study, more than 2, users accessed You cannot get your FICO scores via Credit Karma. | Choice Home Warranty. VantageScores are generic scores, designed to be used by a variety of different creditors. Join the millions using CreditWise from Capital One. Please see the back of your Card for its issuing bank. com product. Credit Karma offers full credit reports from TransUnion and Equifax, updated weekly. In this article. | The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there | The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit scores from the three main bureaus (Experian, Equifax, and TransUnion) are considered accurate. The accuracy of the scores depends on the accuracy of the In short, no credit score is more accurate than the others. While they're used to determine a borrower's creditworthiness or how likely they are | How accurate is a FICO® score? · Exceptional: + · Very good: to · Good: to · Fair: to · Poor: and below The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores. About 90% of lenders use FICO's model to evaluate In short, no credit score is more accurate than the others. While they're used to determine a borrower's creditworthiness or how likely they are |  |

Credit score accuracy - Although VantageScore's system is accurate, it's not the industry standard. Credit Karma works fine for the average consumer, but the companies The primary credit scoring models are FICO® and VantageScore®, and both are equally accurate. Although both are accurate, most lenders are Credit bureaus are under no legal requirement to be accurate, and “today's credit reporting bureaus make a tremendous amount of mistakes at the If you're trying to figure out which credit score is most accurate, then you already know there are multiple scores out there

Scores generally range from low end to top end. Basically, the higher your credit score , the better your chances for getting a mortgage, car loan, or credit card at the lowest possible interest rate. That makes it worth understanding how your credit score is determined.

The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores.

FICO has been around since and there have been numerous revisions over the last three decades to take into account the changing factors that determine an accurate credit score. A score under is considered poor. A score above is considered excellent.

In between is considered average to above average. The latest scoring model is FICO 10, which debuted in But the most significant changes came with FICO 9, introduced in The three most significant changes in FICO 9 were: less weight on unpaid medical bills, no penalty for a collections process as long as you have repaid the amount in collection, and inclusion of rental history as part of your overall credit history.

Why the changes? Unpaid medical debt was not necessarily an indicator of financial health. An individual could be waiting on insurance payments before paying the debt or they might not even know that a bill was sent to collections.

In some cases, this factor could cause the credit score to rise by as much as 25 points. More changes were added in when Equifax, Experian and TransUnion removed all civil judgment data and many tax lien records from credit files. In another change, collection agencies and debt buyers were prohibited from reporting medical debts until they were days old.

FICO 9 succeeded FICO 8 , which came out in and is the version most heavily used by the lending industry. When FICO releases a new version of its scoring model, lenders have a choice: Upgrade or stay with the version they have.

Many lenders opt to stay with the version they have because it can be expensive to upgrade. FICO compares it to a consumer upgrading a computer operating system every time a new version of Windows is released. You may be satisfied with Windows XP or you may have upgraded to Windows 8 or The same thing happens with businesses and lenders who use the FICO score.

Some lenders are still using FICO 5. Some have upgraded to FICO 9 or The only way to know the FICO score meaning is to ask the lender you are dealing with. While FICO tweaks the weight of various factors based on evolving economic realities, there remain five base factors in every credit score model.

Payment history is the record of your ability and willingness to pay bills on time. Late payments are a negative. The later the payment, the more your score will be penalized.

Credit utilization marks the percentage of your available credit you have used. Credit use is a measure of how many forms of credit you have and how well you keep up with them. A mix of credit cards, mortgage or rent, auto loans and utilities give you a varied credit history.

At issue here is the way you apply for credit. Applying for a credit card, a mortgage, or an auto loan is fine. The VantageScore model was introduced in when the three major credit reporting bureaus — Experian, Equifax and TransUnion — decided to offer FICO some competition in the credit score business.

The VantageScore model looks at familiar data — things like paying on time, keeping credit card balances low, avoiding new credit obligations, bank accounts and other assets — to calculate its score. Remember that late payments are a negative that can appear on your credit report for seven years.

If you can handle all that — with on-time payments! Similar to credit utilization, by lowering your debt, it gives you a higher chance of increasing your credit score. A high number is not a good sign for your credit report.

Keep in mind that the VantageScore model is used by Credit Karma, a service that provides your free credit score and report, along with credit monitoring and advice.

The VantageScore uses information from all three credit reporting bureaus, but weighs certain factors more heavily or less heavily than the FICO algorithm. Thus, the scores should be similar, but rarely identical.

Outside of the conventional and well-known outlets, there are several other credit scoring models. The scoring seems counterintuitive for consumers accustomed to the FICO system. There is an alternative scoring method of to is good, is bad, making it more compatible with the FICO model. Credit Xpert Credit Score — It was developed to help businesses approve new account candidates.

It inspects credit reports for ways to raise its score quickly or detect false information. By improving those scores, that should lead to more loan approval for customers. CE Credit Score — The creator of this scoring model CE Analytics was unhappy with the current model of customers paying for their credit score and companies hiding how their credit scores were revealed.

Insurance scores range from — generally, a good score is or higher, while or lower is considered poor — but it varies in different types of insurance. FICO drills deeper into financial data and helps lenders predict how you will do with specific types of loans , such as a mortgage or auto loan or credit cards.

The three major credit bureaus that provide data to FICO all want industry-specific scores as well. Experian and Equifax provide 16 different FICO credit scores to lenders, while TransUnion has More are added each year.

Industry-specific scores are optimized for specific credit products like auto loans or credit cards. So, if you are buying a car, the dealership or bank offering you a loan may want to know your credit history for paying off similar loans on a monthly basis.

The range for industry-specific scores is , while the range for classic scores fall is Companies that develop scoring models prefer to keep details of the models behind closed doors because they consider them privately held and because they make money by selling results of the models. However, given the information that banks and credit card companies ask on their applications, it is not difficult to interpret some factors that weight heavily on your score.

Credit scoring models were first utilized in the credit industry more than 50 years ago. They were developed as a way to determine a repeatable, workable methodology in administering and underwriting credit debt, residential mortgages, credit cards and indirect and direct consumer installment loans.

Early models were based on a greater degree of subjectivity rather than statistical analysis. That resulted in discriminatory and fraudulent loan and credit practices. Over time, a number of state and federal protections were put into place to reduce the subjectivity and make the process fair, equitable and transparent.

Two of the protections are the federal Fair Credit Reporting Act and the Equal Credit Opportunity Act , which outlaw the consideration of marital status, race, religion or sex as factors in making credit-scoring decisions.

Speed is the major benefit to consumers of having credit scoring models. Lenders can evaluate thousands of applications quickly and impartially. Decisions on mortgages, car loans or extended limits on credit cards can be handled in days or even minutes.

In fact, the consistency of data in scoring models allows for financial statements, credit ratings and credit account statuses to be evaluated quickly and accurately. It also reduces the possibility of human error. This helps customers and their orders get processed more quickly. On the flip side, it reduces bad debt losses for companies.

Otherwise, those companies could make bad decisions in whether to extend credit to a customer. Businesses can specify the factors they want to be considered in the credit decision process.

They know almost immediately if they are dealing with a high-risk or low-risk customer. That has allowed the businesses to operate more efficiently and reduce the cost of vital services like mortgages, car loans and credit cards.

Credit scores allow consumers access to personal loans and help financial institutions control allocation of risk and costs with their customers. To use Credit Karma, you have to give the company basic personal information, usually just your name and the last four digits of your Social Security number.

With your permission, Credit Karma then accesses your credit reports, compiles a VantageScore, and makes it available to you. The score range for Credit Karma's credit score is between and Their credit ratings are broken into three types, as follows:.

FICO is a model used to create a score by looking at your files from the three major credit reporting bureaus. Credit Karma's VantageScore follows much the same process, except that its scoring model was created by the credit bureaus.

Although VantageScore is less known to the public, it claims to score 30 million more people than any other model. If you're young or have recently come to live in the U. The credit scores and reports you see on Credit Karma reflect your credit information as reported by TransUnion and Equifax, two of the major consumer credit bureaus.

These scores are not estimates of your credit rating, which makes them accurate and reliable. The credit scores and reports you see on Credit Karma come directly from TransUnion and Equifax, two of the three major consumer credit bureaus.

The credit scores and reports you see on Credit Karma should accurately reflect your credit information as reported by those credit bureaus. Investopedia reached out to Credit Karma to ask why consumers should trust Credit Karma to provide them with a score that is an accurate representation of their creditworthiness.

VantageScore is not FICO. FICO stands for Fair Isaac Corporation, the biggest competitor in the business of creating scoring models that are used to rate the creditworthiness of consumers.

To complicate matters, both update their models occasionally, and lenders use different versions with slightly different results. Your score should be roughly the same on either model.

One model may put slightly more weight on unpaid medical debt. One may take longer to record a loan application. But if your credit is "good" or "very good" according to one system, it should be the same in the other.

VantageScore and FICO are both software programs that calculate credit ratings based on consumers' spending and payment history. FICO is the older and better-known model, having been introduced in VantageScore, released in , was developed by the three leading consumer credit agencies , Experian, Equifax, and TransUnion.

Because they are different models, your VantageScore will inevitably be a little different from your FICO score. For that matter, you may get a different FICO score from various sources at any given time, depending on whether the source uses a specialized variety of FICO or the most frequently used base model and which of its many versions is used.

The key point is that your score should be in the same range on any or all of those models. You should not have a "good" VantageScore and only a "fair" FICO score. The differences between the FICO score and VantageScore are relatively minor:. Both FICO and VantageScore have the same straightforward goal: To predict the likelihood that a consumer will default on a debt sometime in the next 24 months.

And that's why you shouldn't get too worried about the differences. Every one of your credit scores should be in the same general range, but they'll never be identical. Different lenders use different scores.

There are many other scoring models and no practical way for you to keep track of or access all of them. You don't have just one credit score.

You have many credit scores, each calculated by a lender based on one of many models or versions of models. The important thing is, they should all be in the same range, such as "good" or "very good.

Credit Karma will access your credit information from TransUnion and Equifax, two of the three major consumer credit agencies. The third is Experian. It will come up with its own independent rating based on VantageScore. You will then receive your current VantageScore rating and the more detailed credit reports behind it.

In addition to this free service, Credit Karma has other related services, including a security monitoring service and alerts for when someone has conducted a credit check on you. This is not unique to Credit Karma: Many of the best credit monitoring services provide similar alerts and services.

When you share your personal information with Credit Karma, you can search for personalized offers for a credit card, a car loan, or a home loan, and your search won't pop up in your credit report on Credit Karma or anywhere else.

A standard section of credit reports is "inquiries," which lists requests for your report from lenders you've applied to for a loan. Credit Karma allows you to limit the number of inquiries you make. Credit Karma also offers personalized recommendations on money management. You might be overpaying!

The number of users worldwide that Credit Karma claims. Credit Karma's business model is not entirely altruistic. It is a for-profit business that makes money by giving you a free credit score in exchange for learning more about your spending habits and charging companies to serve you targeted advertisements.

Credit Karma places advertisements in front of its users, hoping that they will respond to them by clicking on them. Many of these advertisers are lenders, and Credit Karma may earn a fee if you apply through one of its links. Your personal data is valuable stuff to advertisers and they pay more to target it.

Credit Karma has more than million users it can charge companies to target with ads. The first question is whether you need Credit Karma's services, free or not. And that may depend on how urgently you need detailed information on your credit status. That's enough for most of us most of the time.

If you're about to apply for a mortgage, or you're working to improve your credit rating, or you want the related services Credit Karma offers, you may want this access to your credit report and to the related services the company offers.

Using Credit Karma won't hurt your credit score. Your search is a self-initiated inquiry, which is a "soft" credit inquiry, not a "hard" inquiry.

Your credit scores can change daily on Credit Karma. It largely depends on when your lenders report to the credit bureaus. You can now check your daily TransUnion credit score on Credit Karma. Credit Karma works fine for the average consumer, but the companies that will approve or deny your application are more likely to look at your FICO score.

Although the site positions itself as a trusted adviser, it is motivated to sign you up for new loans. Use Credit Karma to monitor your score, and not to get advice on whether you should take on new debt.

Credit Karma will not charge you any fees. You can apply for loans through the site, and the company will collect a fee if you do. However, the credit score Credit Karma provides will be similar to your FICO score. The scores and credit report information on Credit Karma come from TransUnion and Equifax, two of the three major credit bureaus.

Your scores can be refreshed as often as daily for TransUnion and weekly for Equifax, with a limited number of members getting daily Equifax score checks at this time. Credit Karma uses bit encryption, which is considered nearly impossible to crack, to protect its data transmission.

It also vows not to sell your information to third parties. VantageScore and FICO are the two big rivals in the credit rating business. Credit Karma uses VantageScore. Their models differ slightly in the weight they place on various factors in your spending and borrowing history.

Credit Karma uses two of the three major credit bureaus and scores your creditworthiness according to the widely used but not quite as widely used as FICO VantageScore system.

Your score should be within the same range as it is everywhere else, including with the major credit bureaus and its many competitors. On the customer review site ConsumerAffairs, some people have reported that their Credit Karma score is quite a bit higher than their FICO scores.

0 thoughts on “Credit score accuracy”