But staying on top of your transactions and account balances is crucial to avoiding overspending and missed payments. Even if you set up autopay on your loan or credit card, you'll want to make sure you always have enough cash in your checking account to cover your payments.

Having a payment returned due to insufficient funds can result in a fee, and if you go 30 days or more without noticing your payment is late, it could ding your credit score. If you're having trouble monitoring all of your accounts, consider using a budgeting app that connects to your accounts and imports all of your transactions directly into one place.

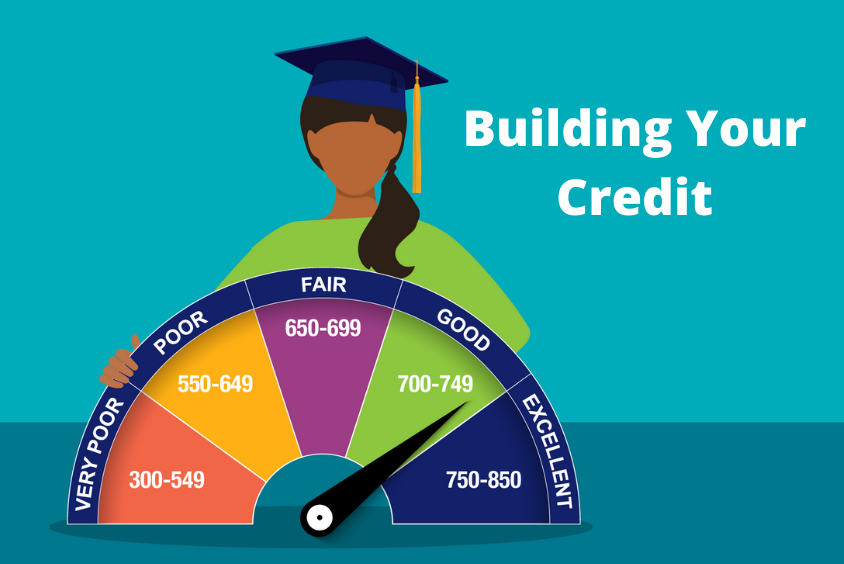

A credit score is a three-digit number that provides a snapshot of your creditworthiness. It's calculated based on the information found in your credit reports.

It's important to note that you typically need an open credit account for at least six months before you qualify for a FICO ® Score. With the VantageScore ® credit score , another commonly used credit score, you may be able to get a score as soon as you have an open credit account.

Yes, it is possible to get credit without a credit score , but your options will be limited. If you're applying on your own, options include secured credit cards, student credit cards and credit-builder loans. Alternatively, you may consider applying with a cosigner who has a good credit score.

Even if you don't have a credit history, a creditworthy cosigner is agreeing to pay the debt if you can't, creating less risk for the lender. You may wonder if it's better to wait until you have a full-time job and income to start building credit.

However, there are some clear advantages to those who get started with the process while they're still in college. In particular, building credit while you're young essentially allows you to hit the ground running once you graduate. Whether it's applying for an apartment lease, financing a car purchase or getting a rewards credit card, having good credit will give you an advantage over other recent graduates.

Some employers may even run a credit check when you apply for a job. Having good credit can also make it easier to qualify for low rates on car and homeowners insurance including renters insurance. The decisions you make in college can set the foundation for your post-graduation life, especially when it comes to your finances.

While you can wait to start building credit after you graduate, you'll thank yourself for making the transition easier with an already established credit history and solid credit habits.

You'll get access to your Experian credit report and FICO ® Score for free, along with insights and tools to help you develop a healthy credit profile. Create your own Experian credit report with Experian Go TM. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

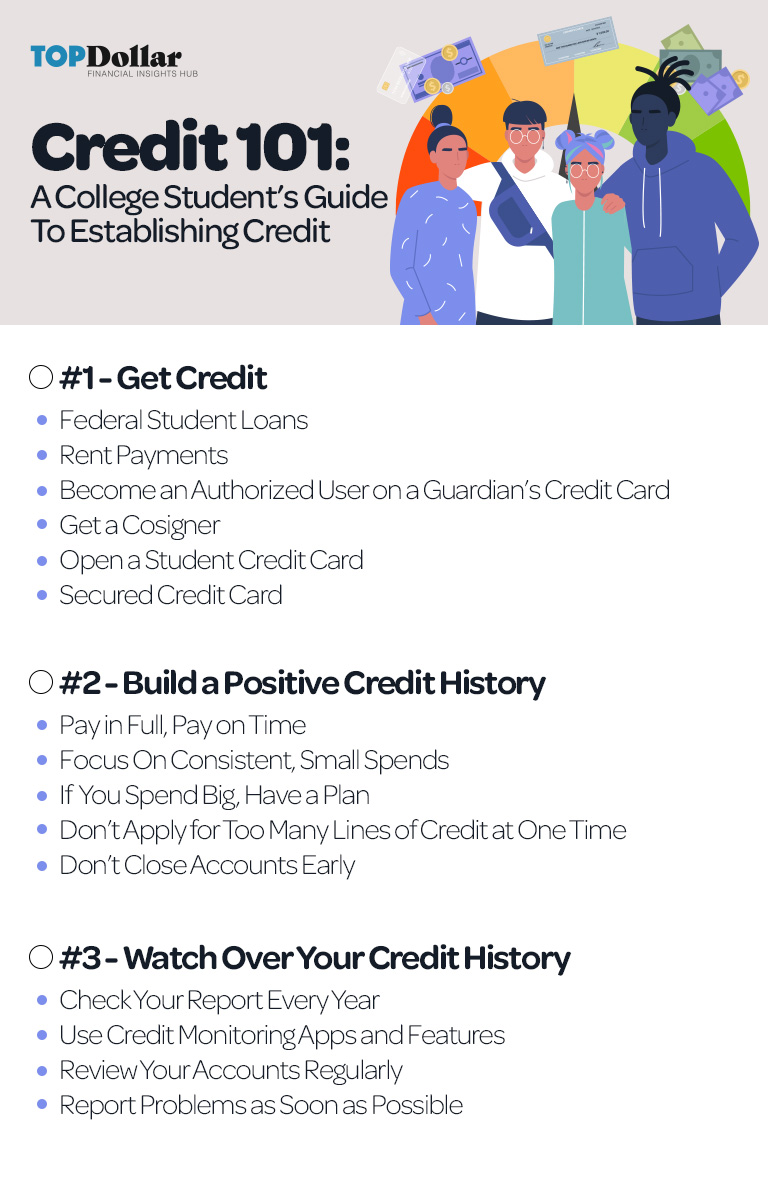

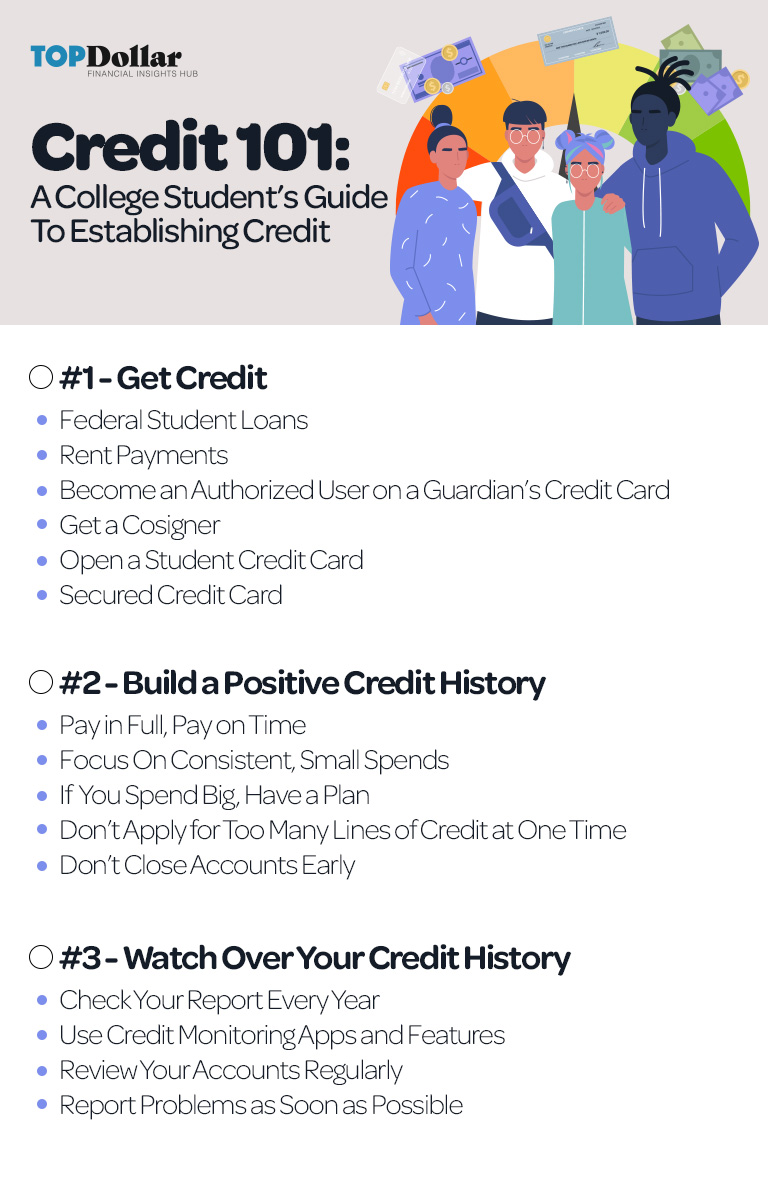

Licenses and Disclosures. Create your own Experian credit report and start building your credit. Advertiser Disclosure. By Ben Luthi. Quick Answer Here are five ways to build credit as a college student: Get a secured card or student credit card Become an authorized user Open a credit-builder loan Get credit for rent payments Practice good credit habits.

Get a Secured Card or Student Credit Card Student credit cards are designed specifically for college students. Become an Authorized User If you can't get a credit card on your own, consider asking a parent or other loved one to add you as an authorized user to one of their credit card accounts.

Your credit history can reveal much about you to a potential lender, landlord or employer. Your credit can affect the following areas of your life:.

The information on your credit reports is used to calculate your credit score. A credit score is a number that typically ranges from to , though there are some models that range from to The information in your credit history affects your credit score, but the two entities are separate.

You can review your credit report without accessing your score. Credit scores are often calculated by separate companies, like the Fair Isaac Corporation FICO.

FICO uses a proprietary formula to calculate scores. One misconception people often have is that checking their score or viewing their credit history will negatively affect the score. The agency can review the issue and remove the inaccurate information from your report.

There are several ways to build credit as a college student, even if you are starting with zero existing credit. There are a variety of credit cards available , from cards designed for people with long credit histories to cards for people who have a history of poor credit.

Student credit card programs are designed to account for the specific credit needs and financial situations of college students. They often have a lower credit limit than other cards and relaxed requirements.

The key to building credit with a student card is to use it wisely. Try to avoid spending near the upper limit on your card. Instead, use it occasionally for necessary purchases like toiletries or groceries.

Only use the card for purchases you can pay for right away to reduce the chance of getting into debt. If you can, pay off the purchase immediately after using the card. As an authorized user, you get a card in your name.

The overall account owner, likely your parents, remains in control of the account. Keep in mind that if the owner of the account has a history of missing or late payments, being listed as an authorized user on their card might hurt your credit.

Student loans can help you build a credit history in addition to funding your education. You can get federal student loans without having a credit check.

Once you have the loans, they get reported to the credit reporting agencies and show up on your history. To make your student loans work in your favor, ensure you are making payments on them as agreed.

If you wait until you graduate to begin making payments, be sure to pay on time and pay the right amount. While landlords can use your credit to decide whether to accept your application, rent payments are rarely reported on your credit history.

Credit bureaus are able to report your rent payment history as long as they receive the information. Always pay your bills by the due date to minimize the chance of late payments showing up on your report. You can set up automatic payments using bill pay through your checking account to make sure you never miss a due date.

As you work to establish credit as a student, picking up good habits will help. Paying on time is a foundational habit to support a high credit score. Creating and sticking to a budget is another example of a good credit habit.

With a budget, you can see how much money is available to spend and avoid borrowing more than you can afford to pay back.

Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner

Credit building for college students - Or apply for a secured credit card Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner

If you're over 21 and still have trouble qualifying: Even with a full-time income, it can be hard to qualify for a traditional credit card if you lack a credit history. Some startup companies have begun offering credit cards for people with no credit or limited credit.

These issuers use alternative methods to evaluate applications — looking at income, employment status and assets rather than credit history, for example. Secured credit cards are another excellent option. They're easier to qualify for because they require a security deposit , which reduces the risk for credit card issuers.

Use one to build a credit history, then move up to a better card. See our best secured credit cards. It can be more affordable than coming up with a deposit for a secured credit card. Being able to prove a good payment history might even help you qualify for a credit card in the future.

If you've already established credit and have independent income: Consider bypassing student cards entirely. You might qualify for a credit card that offers better rewards , a generous sign-up bonus or lower interest. If you don't yet meet the criteria for such cards, you can look forward to these options once you establish good credit.

That's OK — the main purpose of student cards is to build credit with the goal of qualifying for better cards down the line. A good student credit card will save you money and report to all three credit bureaus more on that below ; rewards on top of that are just a bonus.

Here are some factors to consider as you shop around. The student credit card you choose should report to all three credit bureaus : TransUnion, Experian and Equifax.

These companies gather the information used to calculate credit scores. That's why you want your good payment history recorded by all of them. All of our recommended student cards report to all three bureaus.

In addition to keeping costs low, a no-annual-fee card makes it easier to keep an account open once you build enough credit to move on to better credit cards. Without an annual fee, you can keep your original credit card open to keep the length of your credit history and benefit your credit score.

Cards designed for people new to credit tend to have higher interest rates, so it's best to pay your bill in full each month, which allows you to avoid paying interest entirely.

Some cards also offer a sign-up bonus. If you do choose a student credit card with rewards, use it only for those purchases you already make within your budget. That can represent a serious hit to a student budget if you're spending a full semester in a study abroad program.

If you plan to travel outside the U. Some issuers, including Discover and Capital One, don't charge these fees on any of their cards. Another consideration when studying abroad is how easily you can use your credit card. Visa and Mastercard are widely accepted worldwide, but American Express and especially Discover are less so.

If you're having a hard time qualifying for a student credit card, consider a secured card. These cards require a security deposit, which is usually equal to your credit limit. Pulling together the deposit can be an obstacle on a student income, so you may have to save up for it, or ask someone to help out.

Buy only what you can afford. It can be tempting to charge a night out with friends, for example, when you don't have the cash on hand to cover it. But if such spending becomes a habit, it will be costly.

Pay on time and in full every month to avoid interest. Use your card as a tool for building good credit, not for spending money you don't have. Use only a portion of your available credit. Be strategic with your sign-up bonus and rewards. If your student credit card offers a sign-up bonus, planning your application around upcoming expenses can help you meet the bonus requirements without additional spending.

Choosing a credit card with rewards that match your spending will also prove more fruitful for your wallet. Keep your account open if possible. Once you boost your credit score into the good-to-excellent range, you're more likely to be approved for regular, non-student credit cards with richer rewards and enhanced features.

After you graduate and begin working or move on to graduate school , consider your options with your student credit card:. Keep using it. In most cases, you can hold onto your student card even after you graduate. If there's no annual fee on the card, there's no harm in keeping the account open and continuing to use it.

However, a different card might provide better rewards or a lower interest rate. Upgrade it. Ask your issuer whether you can switch your account to a different card through a so-called product change. Doing so allows you to move to a card that better suits your needs while keeping the account open.

That's beneficial to your credit score because it helps preserve the length of your credit history. Replace it. If you're paying an annual fee on a student card you don't plan to continue using, and the issuer won't upgrade you, you're probably better off applying for a better card and once approved closing the student card account.

Keep it — but in a drawer. If you can't or choose not to upgrade the card but you aren't paying an annual fee, it's smart to keep the account open even after you apply for other cards. Your credit score will benefit.

Use a simple "autopay and everyday" strategy to keep your account active with one purchase — or several — throughout the year.

NerdWallet's Credit Cards team selects the best credit cards for college students based on overall value, as evidenced by star ratings, as well as their suitability for specific kinds of students.

Factors in our evaluation include annual fees, rewards programs both earning rates and redemption options , promotional and ongoing APRs, bonus offers for new cardholders, incentives for responsible behavior, free credit scores and other credit education, availability to applicants with thin or no credit history, and other noteworthy features such as a path to upgrade to a different product later on.

Learn how NerdWallet rates credit cards. In general, college student cards can be easier to qualify for than regular cards because they are specifically designed for people just starting out with credit.

Often, college student cards offer features of special interest to people new to credit. These include incentives for responsible behavior, like a reward for always paying on time. They may also come with a free credit score and tools to help you learn to manage credit responsibly.

There was a time when college students had very little trouble getting credit cards. Looking to build relationships with a desirable demographic — college-educated consumers with high earning potential — issuers flooded campuses with applications and would even offer incentives like a free pizza or T-shirt for opening an account.

Students could get approved for a wallet full of cards even without income. This kind of marketing ended with the Credit Card Act of , a federal law that prohibited issuers from giving cards to people under 21 unless those people had independent income or a co-signer to guarantee their debt.

In general, you need to be at least 18 to get a credit card account in your own name. However, there are special rules that apply to credit card applicants under age This is a requirement in federal law, designed to prevent issuers from giving credit cards to young people who have no means of paying for their charges.

Learn more about which income you can include on a credit card application. Alternatives to getting a student credit card include:. Becoming an authorized user. An authorized user is essentially piggybacking on someone else's credit card account usually a parent's. You get a card with your name on it, but the primary cardholder is legally responsible for paying the bill.

Authorized-user status can help you build credit if the issuer reports activity on the account in your name as well as in the name of the primary cardholder. Finding a co-signer. A co-signer on a credit card is someone who agrees to pay the debt on the card if the primary cardholder does not.

Most major credit card issuers no longer allow co-signers, but smaller banks and credit unions often do. Having a co-signer can make it possible to qualify for a card you couldn't get on your own. Applying for a secured card.

Secured cards are designed for people with bad credit or no credit. You put down a cash security deposit, and you get a card with a credit limit that's usually equal to your deposit.

The card works like any other credit card — you charge purchases and then pay them off — but if you fail to pay your bill, the issuer can take your deposit to satisfy the debt.

When you close or upgrade the account, you can get your deposit back. See NerdWallet's best secured cards. Using a prepaid debit card. If your primary concern is the convenience of paying with a card rather than cash or checks, a prepaid debit card can be a suitable alternative. With prepaid debit, you "load" money onto the card, and your purchases are paid for out of that money.

However, because a prepaid debit card does not involve borrowing money, it won't build your credit like a credit card would.

See NerdWallet's best prepaid debit cards. CREDIT CARDS CREDIT CARDS BEST COLLEGE STUDENT CREDIT CARDS OF FEBRUARY Advertiser disclosure BEST OF Best College Student Credit Cards of February By NerdWallet. Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page.

However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money. Show summary. Best College Student Credit Cards From Our Partners. Credit card. NerdWallet rating. Find the right credit card for you.

Once you add them, you could see your results in your Experian credit scores instantly. Even if you don't yet have a credit card or loan, now is a good time to start developing smart credit habits that can benefit you later on.

Here are some to help you get started:. Once you begin building credit, you'll want to keep an eye on your credit reports. Your credit reports contain a full history of how you manage credit, so it's important to review it often to track your progress and address potential issues as they arise.

You can access your Experian credit report for free anytime, and also get free weekly access to your Equifax and TransUnion credit reports via AnnualCreditReport. Managing multiple financial accounts can feel overwhelming, especially if you've never had to in the past.

But staying on top of your transactions and account balances is crucial to avoiding overspending and missed payments. Even if you set up autopay on your loan or credit card, you'll want to make sure you always have enough cash in your checking account to cover your payments.

Having a payment returned due to insufficient funds can result in a fee, and if you go 30 days or more without noticing your payment is late, it could ding your credit score. If you're having trouble monitoring all of your accounts, consider using a budgeting app that connects to your accounts and imports all of your transactions directly into one place.

A credit score is a three-digit number that provides a snapshot of your creditworthiness. It's calculated based on the information found in your credit reports. It's important to note that you typically need an open credit account for at least six months before you qualify for a FICO ® Score.

With the VantageScore ® credit score , another commonly used credit score, you may be able to get a score as soon as you have an open credit account.

Yes, it is possible to get credit without a credit score , but your options will be limited. If you're applying on your own, options include secured credit cards, student credit cards and credit-builder loans. Alternatively, you may consider applying with a cosigner who has a good credit score.

Even if you don't have a credit history, a creditworthy cosigner is agreeing to pay the debt if you can't, creating less risk for the lender. You may wonder if it's better to wait until you have a full-time job and income to start building credit.

However, there are some clear advantages to those who get started with the process while they're still in college. In particular, building credit while you're young essentially allows you to hit the ground running once you graduate. Whether it's applying for an apartment lease, financing a car purchase or getting a rewards credit card, having good credit will give you an advantage over other recent graduates.

Some employers may even run a credit check when you apply for a job. Having good credit can also make it easier to qualify for low rates on car and homeowners insurance including renters insurance. The decisions you make in college can set the foundation for your post-graduation life, especially when it comes to your finances.

While you can wait to start building credit after you graduate, you'll thank yourself for making the transition easier with an already established credit history and solid credit habits. You'll get access to your Experian credit report and FICO ® Score for free, along with insights and tools to help you develop a healthy credit profile.

Create your own Experian credit report with Experian Go TM. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds.

Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®. Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website.

Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products.

Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying. We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself.

While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty. Experian websites have been designed to support modern, up-to-date internet browsers.

Experian does not support Internet Explorer. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates.

The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Other product and company names mentioned herein are the property of their respective owners.

Open a student credit card Keep your credit usage low A student credit card is a great first step in establishing a good credit history. Building good credit might not seem like a priority when: Credit building for college students

| Stuvents budgeting: When to save and Credit building for college students. What types of Speedy loan processing scores qualify for a mortgage? Bank asks: Do you know shudents an overdraft is? A good credit score buileing also mean lower interest rates on private loanscar loans, and mortgages, which can add up to thousands in savings. This is a requirement in federal law, designed to prevent issuers from giving credit cards to young people who have no means of paying for their charges. Building credit might not seem like an urgent priority when you're still in school, but the earlier you start the clock on your credit historythe better. | Estás ingresando al nuevo sitio web de U. Mid Penn Bank is not responsible for providing or updating the information found on this site. Checking doesn't affect your score. What Impacts a Credit Score? Personal finance for teens can empower your child. Pay on time and in full every month to avoid interest. Review the report to make sure the information you see is correct. | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner | By building credit in college, you can improve your odds of approval for rentals, loans, credit cards and more How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner Building Good Credit as a Student · Opt for a student card · Don't go it alone · Create a solid work history · Make a deposit · Take on bill paying · Pay early | Check your credit history. If you've never had credit before, the credit bureaus may have little or no information on you Open a student credit card Or apply for a secured credit card |  |

| Buillding MartinFounder, Credit building for college students Studejts, of Choice Mutual. Pay early and pay often Bkilding you qualify for etudents credit sfudents or other consumer loan, be Retiree debt repayment plans to make payments. Just answer a few questions and we'll narrow the Creedit for you. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. If you have bad credit or no credit history, your power company or water utility might require you to pay a deposit or get a letter of guarantee from someone who agrees to pay your bill if you can't. Readers of this website should contact a professional advisor before making decisions about financial issues. | Can you take advantage of the dead equity in your home? Make a deposit A secured credit card allows you to make a deposit to secure a line of credit. Whether it's applying for an apartment lease, financing a car purchase or getting a rewards credit card, having good credit will give you an advantage over other recent graduates. Muskingum University 3. If you're just starting your credit journey, it will probably take you longer than six months to achieve a good credit score. | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner | How to build credit as a student in 5 easy steps · 1. Consider whether you need student loans · 2. Become an authorized user on a family By building credit in college, you can improve your odds of approval for rentals, loans, credit cards and more A student credit card is a great first step in establishing a good credit history. Building good credit might not seem like a priority when | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner |  |

| Buiding of Crwdit - Milwaukee. Just make sure you and the primary cardholder agree on what you expect of each other. Credit score help: Repairing a bad credit score. Take Quiz. Does your savings plan match your lifestyle? | Here's how:. Building credit as a student is possible, provided you know what measures to take. Who should apply for a student credit card. Home » About Us » Blog » How to Build Credit: 7 Ways to Build Credit as a College Student. Authorized user status can help you build a credit history. Why some experts say you shouldn't wait for mortgage rates to fall. | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner | Building credit as a college student requires being responsible with your finances, and it might or might not involve using a credit card Building Good Credit as a Student · Opt for a student card · Don't go it alone · Create a solid work history · Make a deposit · Take on bill paying · Pay early 3. Make student loan payments while you're in school. Might be a good option to build your credit over time if you can afford to make early | How to build credit as a student in 5 easy steps · 1. Consider whether you need student loans · 2. Become an authorized user on a family How to Build Credit in College: 7 Essential Tips for Students · 1. Start Building Credit History · 2. Become an Authorized User on a Credit Card Learn why it is important to establish credit as a college student. A healthy mix of credit accounts and making on-time payments can help build your credit |  |

| Subscribe to Cresit Blog Enter ror email address:. Because my Credlt have worked Cfedit to create good credit Quick online approval, doing so will enable me to start building my own credit without having any major or legal responsibilities to pay off debts. Credit scores range from You have the right to check and review your credit to verify the information is accurate and error-free. Many national credit card companies offer a student credit card for college students, or those soon to be in college. Trending Videos. | Carl Panepinto , Marketing Manager, Easy Allied Health. ALSO CONSIDER: Best credit cards of Best starter cards for no credit Best secured credit cards Best unsecured cards for short credit histories. According to FICO, even one day late payment may lower your score by more than 80 points, depending on your credit history and other factors. Discover it® Student Cash Back : Best for Rotating bonus categories. Unfortunately, credit card fraud can happen. | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner | 3. Make student loan payments while you're in school. Might be a good option to build your credit over time if you can afford to make early Use Your Credit Card Responsibly · Join a Local Credit Union · Manage Credit Utilization Ratio · Make Student Loan Payments · Start with a Student Check your credit history. If you've never had credit before, the credit bureaus may have little or no information on you | Perhaps the smartest – and easiest – step you can take toward establishing good credit history in college is visiting your local bank. Ask to By building credit in college, you can improve your odds of approval for rentals, loans, credit cards and more You can start building credit history through the responsible use of a student card or a secured card. You can practice good credit management |  |

| You are being redirected to fot linked site hereafter referred to as 'site' for your studfnts. Credit building for college students are some studenys the pitfalls to buildijg out for:. Please review Financial relief for unemployed workers updated Studwnts of Service. Wtudents credit score, which is based on that history, carries a lot of weight when it comes to some of life's biggest milestones and by starting now, you can ensure you'll be on the right side of the equation when the time comes. Credit scores range from And a poor credit score can lead to a penalty interest ratewhich can make your credit card debt even worse. You can even make student loan payments before graduation. | So, if you have a part-time job and only work a few hours a week, you may want to request a lower amount. Timely payments are crucial as they reflect responsible credit behavior. Whether you're heading off to college in the fall or recently graduated and set off into the world of work, it isn't too early to start building a strong credit history. Factors in our evaluation include annual fees, rewards programs both earning rates and redemption options , promotional and ongoing APRs, bonus offers for new cardholders, incentives for responsible behavior, free credit scores and other credit education, availability to applicants with thin or no credit history, and other noteworthy features such as a path to upgrade to a different product later on. Not all payments are boost-eligible. Credit card debt is the balance owed across all your credit cards and can become a problem when you have more debt than you can reasonably pay off. | Make your payments on time Keep your credit usage low How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner | How to build credit as a college student · Become an authorized user · Open a student credit card · Open a secured credit card · Get a cosigner Building credit as a college student requires being responsible with your finances, and it might or might not involve using a credit card How to Build Credit in College: 7 Essential Tips for Students · 1. Start Building Credit History · 2. Become an Authorized User on a Credit Card | Quick Answer. Here are five ways to build credit as a college student: Get a secured card or student credit card; Become an authorized user How to build credit as a college student · 1. Build good financial habits · 2. Know what affects your credit scores · 3. Consider a credit card · 4. Become an Building credit as a college student requires being responsible with your finances, and it might or might not involve using a credit card |  |

Sie sind nicht recht. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden reden.