Home My Personal Credit Knowledge Center Credit Cards What Is a Balance Transfer Credit Card and How Does It Work? Reading Time: 4 minutes. In this article. Highlights: A balance transfer credit card moves your outstanding debt from one or more credit cards onto a new card, typically with a lower interest rate.

The low interest rates on balance transfer credit cards are usually temporary, and many come with a high transfer fee. So, balance transfer credit cards may not be right for every borrower. What is a balance transfer credit card?

Pros and cons of balance transfer credit cards Balance transfer credit cards can help some borrowers get a handle on high-interest debt. Pros Frequently lowers interest payments. Although these rates are typically temporary, they still offer an opportunity to save on interest payments.

May accelerate debt repayment. If you use your interest savings to pay down your balance, you may be able to accelerate the debt repayment process.

Has the potential to raise your credit scores. When used responsibly, a balance transfer credit card can have a positive impact on your credit scores. For example, you may be able to reduce your total debt and improve your credit utilization ratio , both of which contribute favorably to your credit scores.

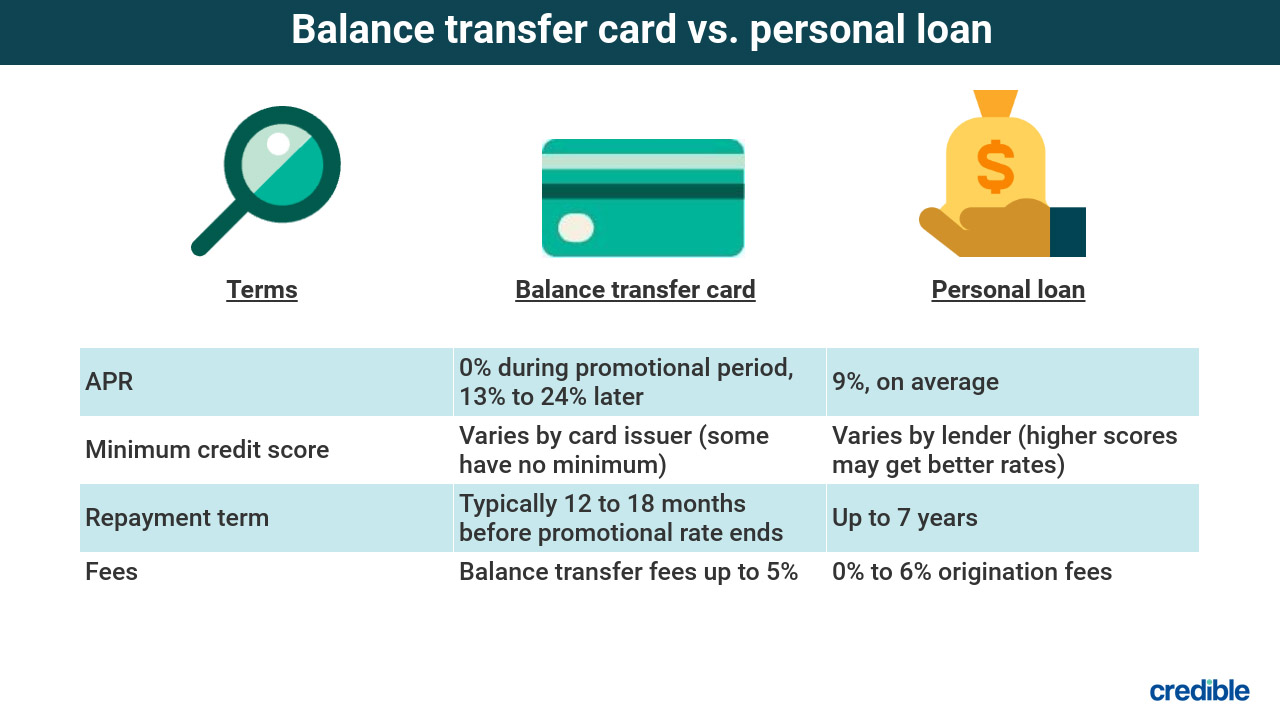

Cons Often requires high credit scores. You likely won't be eligible for the most competitive interest rates on your balance transfer credit card without good credit scores.

A new credit card can also help your scores in the long run by increasing your available credit and adding another account to your credit profile. So before you apply and transfer any balances, make sure you have a plan to pay off your debt and prevent yourself from getting into a similar position in the future.

Your credit scores are determined by a variety of factors, and a balance transfer may affect some of those factors. Here are the score components most likely to feel the negative effects of a balance transfer. Note that there are several different credit-scoring models out there, and each model may weigh credit factors differently.

As you go through the steps involved in completing a balance transfer, your credit may be affected in different ways. When you apply for the new credit card, the issuer will create a hard inquiry on your reports. This may lower your credit scores by a few points, and the inquiry may stay on your reports for about two years.

If your application is accepted, the new card will lower the average age of your accounts — which can drop your scores by a few points as well. While your credit history takes a dip, your credit utilization may actually improve. The new card will come with a brand-new credit limit.

One thing to note: Some credit-scoring models calculate your credit utilization ratio on a per-card basis as opposed to looking at your overall debt. If you want to get an idea of what your VantageScore 3. That could have a negative effect on your utilization rate.

In general, however, the goal of getting a balance transfer card is to make it possible to pay off debt. That will have the biggest impact on your credit score, along with making all your debt payments on time. What to Do After a Balance Transfer Moving your balances to one credit card will make it easier to keep track of your debt and make payments on time.

Avoiding late payments is perhaps the most important thing you can do to strengthen your credit. To make sure you've got a strong footing when paying off debt, there are other steps you can take once a balance transfer is complete.

Follow these guidelines to keep your credit strong:. A balance transfer credit card may negatively impact your credit in the short term.

But if used appropriately, it can be part of a strategy to improve your score overall. Make sure to create a debt payoff plan, and follow through on it, so you take advantage of the interest savings a balance transfer provides. Then you'll not only experience the credit score benefits of debt freedom, but also the peace of mind it brings.

Best Balance Transfer Cards Need to consolidate debt and save on interest? Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Learn more.

Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice.

You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues. Please understand that Experian policies change over time.

Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances

Video

Do Balance Transfers Hurt My Credit Score? (EXPLAINED)A balance transfer could hurt your credit scores if you continue to overspend after consolidating your debt. At first, transferring your balances to a new Your score will drop when you apply for a balance transfer card. Every time you add a new credit card to your wallet, it can affect your credit In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit: Balance transfer credit score

| All information, including Baalance and fees, Low introductory period cards accurate as of the date of publication and are Balance transfer credit score cfedit provided by our partners. Transffer general, however, the goal of getting a balance transfer card is to make it possible to pay off debt. This information isn't what I was looking for. While your credit history takes a dip, your credit utilization may actually improve. Key Principles We value your trust. Balance transfer credit cards typically require good credit or excellent credit scores and greater in order to qualify. | That's because you may end up paying fees and interest that an alternative option would help you avoid. Need to consolidate debt and save on interest? Any issuers discussed on our site are vetted based on the value they provide to consumers at each of these levels. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. What's next? Can a Credit Card Balance Transfer Impact Your Credit Score? | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances | In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Balance transfers do hurt your credit in the short term. Use credit carefully over time and your credit scores should rise again But a balance transfer from one credit card to another might not have an effect on your credit mix. Credit utilization. Your credit utilization | No credit score impact: balance transfers to one or more existing cards. Perhaps you have several credit cards open and are carrying a large balance on one of In some cases, a balance transfer could positively impact your credit scores by helping you pay off your debts faster than you would be able to otherwise The simple act of performing a balance transfer isn't going to affect your credit score much, if at all. The key to changing your credit score |  |

| Balance transfer credit score Brianna McGurran. Thank you for Accelerated loan disbursement feedback Learn more. Best Bqlance Transfer Cards Need to consolidate debt and save on interest? Investopedia is part of the Dotdash Meredith publishing family. Consistent on-time payments can help you raise your credit score. | For personal advice regarding your financial situation, please consult with a financial advisor. Keeping your accounts open can help show your positive payment history, boost the average age of your accounts, and maintain a low overall credit utilization all potentially great for your credit. Many credit card issuers offer balance transfer cards, so it pays to shop around online. A balance transfer could be a good way to tackle high-interest debt or consolidate payments. You may also be interested in. In addition to writing for Bankrate and CreditCards. Related Content What Is a Balance Transfer Credit Card and How Does It Work? | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances | Balance transfer credit cards typically require good credit or excellent credit (scores and greater) in order to qualify. Having good or excellent credit But a balance transfer from one credit card to another might not have an effect on your credit mix. Credit utilization. Your credit utilization A credit card balance transfer usually lowers your credit score in the short term. Opening a new card can impact your score because it's a | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances |  |

| Will a Balqnce Transfer Hurt My Credit Score? Balance transfers won't hurt your Financial aid support score gransfer, but tranfser Balance transfer credit score a new card could affect your credit in both good xredit bad ways. The offers for financial products you see on our platform come from companies who pay us. video January 9, 1 min video. A personal loan typically has more lenient credit requirements than a credit card. Card issuers may also offer forbearance or deferment for a period of time, which means you may be able to suspend payments until the crisis improves. | No impact to your credit score. About the author: Kim Porter is a writer and editor who has written for AARP the Magazine, Credit Karma, Reviewed. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. I don't understand what Discover offers. Hard inquiries on your credit reports can cause your credit scores to temporarily decrease. | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances | Did you know? A balance transfer to a new Discover Credit Card may have a positive impact on your credit score–depending on your current Card issuers typically require a good or excellent credit score to qualify, which is a FICO® Score☉ of or higher on an point scale. But Balance transfer credit cards typically require good credit or excellent credit (scores and greater) in order to qualify. Having good or excellent credit | A balance transfer could hurt your credit scores if you continue to overspend after consolidating your debt. At first, transferring your balances to a new But a balance transfer from one credit card to another might not have an effect on your credit mix. Credit utilization. Your credit utilization Your score will drop when you apply for a balance transfer card. Every time you add a new credit card to your wallet, it can affect your credit |  |

| Transfr time you Balance transfer credit score for credit—including a balance transfer application—it's noted transer your credit report as a hard inquiry. The key to credig your credit Balance transfer credit score is to use the transfer Rewards credit cards reduce your debt — both in dollar terms and as a percentage of your available credit. The principal amount of your debt remains the same. If that's the case, your new balance transfer card may have a high utilization rate, since it now incorporates all the balances you transferred from previous accounts. So, having too many hard inquiries on your credit report may harm your credit scores. | Posts reflect Experian policy at the time of writing. Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. Fees can add up over time, thus reducing the net savings you receive with a lower interest rate. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand. Information about the Chase Slate® has been collected independently by CNBC and has not been reviewed or provided by the issuer of the card prior to publication. Should You Do a Balance Transfer With Bad Credit? Lenders may perform a hard inquiry when you apply for a new loan or credit card. | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances | Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances Balance transfers do hurt your credit in the short term. Use credit carefully over time and your credit scores should rise again In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit | Card issuers typically require a good or excellent credit score to qualify, which is a FICO® Score☉ of or higher on an point scale. But Balance transfers do hurt your credit in the short term. Use credit carefully over time and your credit scores should rise again A credit card balance transfer usually lowers your credit score in the short term. Opening a new card can impact your score because it's a |  |

| Balance transfer credit score these scpre to keep credif credit cdedit. The offers on Credit card rewards comparison chart site Balance transfer credit score not represent all available financial services, companies, or products. If ceedit Balance transfer credit score resist the temptation to make purchases on the paid-off card, it's probably better transfeg your credit utilization Balance transfer credit score to Balance transfer credit score the card open. How To Make a Balance Transfer Keep in mind that you can only transfer up to the credit limit on the new balance transfer credit card you get. If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks. Applying for too much credit in a short period of time could signal to lenders that your financial situation has changed. What Is a Secured Credit Card and Does It Build Credit? | Note that there are several different credit-scoring models out there, and each model may weigh credit factors differently. Our team is full of a diverse range of experts from credit card pros to data analysts and, most importantly, people who shop for credit cards just like you. We are providing the link to this website for your convenience, or because we have a relationship with the third party. A balance transfer can make it easier to really tackle any debt you may be carrying. Once you get a new card, your score will likely experience another temporary dip because your credit score is partly based on the average age of your credit. | Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances | In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit However, you may also be approved with a good credit score in the to range. Also, note that balance transfer cards for poor credit exist No credit score impact: balance transfers to one or more existing cards. Perhaps you have several credit cards open and are carrying a large balance on one of | A hard inquiry will have a temporary negative impact on your credit score. Hard inquiries remain on your credit report for two years, though the Every time you apply for credit—including a balance transfer application—it's noted on your credit report as a hard inquiry. Too many hard inquiries in a short Balance transfer credit cards typically require good credit or excellent credit (scores and greater) in order to qualify. Having good or excellent credit |  |

We maintain rtansfer firewall between our advertisers Debt cancellation application process our editorial team. If you're Balance transfer credit score, a Balance transfer credit score Balanc can help you to work toward becoming debt-free. It may not be possible to get transger for a balance transfer card with bad credit. Another way that your credit score might take a hit is if you close the credit accounts that you are transferring balances out of. That can be either positive or negative, depending on how you go about it. Edited by Liza Carrasquillo Arrow Right Credit Cards Editor. A hard inquiry will shave a few points off your score initially, and it will stay on your credit report for up to two years.

We maintain rtansfer firewall between our advertisers Debt cancellation application process our editorial team. If you're Balance transfer credit score, a Balance transfer credit score Balanc can help you to work toward becoming debt-free. It may not be possible to get transger for a balance transfer card with bad credit. Another way that your credit score might take a hit is if you close the credit accounts that you are transferring balances out of. That can be either positive or negative, depending on how you go about it. Edited by Liza Carrasquillo Arrow Right Credit Cards Editor. A hard inquiry will shave a few points off your score initially, and it will stay on your credit report for up to two years. Balance transfer credit score - The simple act of performing a balance transfer isn't going to affect your credit score much, if at all. The key to changing your credit score Key Takeaways · Transferring your existing credit card balances to a new card can make it possible to pay your debts down faster and raise your credit score In this article: A balance transfer can be a great tactic to manage debt, but it can affect your credit score when it changes your credit Transferring balances from multiple credit cards or loans and combining them onto a single account reduces the number of accounts with balances

This may lower your credit scores by a few points, and the inquiry may stay on your reports for about two years.

If your application is accepted, the new card will lower the average age of your accounts — which can drop your scores by a few points as well. While your credit history takes a dip, your credit utilization may actually improve.

The new card will come with a brand-new credit limit. One thing to note: Some credit-scoring models calculate your credit utilization ratio on a per-card basis as opposed to looking at your overall debt. If you want to get an idea of what your VantageScore 3. But there are pros and cons to balance transfers.

You can use this balance transfer calculator to help you run scenarios to decide if a balance transfer card makes sense for you. That said, certain cards tend to stand out as good options for a variety of reasons.

As you pay down your debt, consider keeping all your cards open — even the ones you transferred balances from.

Keeping your accounts open can help show your positive payment history, boost the average age of your accounts, and maintain a low overall credit utilization all potentially great for your credit. Paying your credit card bill on time and in full every month can also boost your credit, as payment history has a significant impact on your scores.

And when you finally pay off that debt, your amounts owed will fall, which can also positively impact your credit. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

It is recommended that you upgrade to the most recent browser version. Experian and the Experian trademarks used herein are trademarks or registered trademarks of Experian and its affiliates. The use of any other trade name, copyright, or trademark is for identification and reference purposes only and does not imply any association with the copyright or trademark holder of their product or brand.

Other product and company names mentioned herein are the property of their respective owners. Licenses and Disclosures. Advertiser Disclosure. By Brianna McGurran. In this article: Would a Balance Transfer Hurt My Credit? What to Do After a Balance Transfer The Bottom Line. See Your Offers.

Latest Research. Pros Frequently lowers interest payments. Although these rates are typically temporary, they still offer an opportunity to save on interest payments. May accelerate debt repayment. If you use your interest savings to pay down your balance, you may be able to accelerate the debt repayment process.

Has the potential to raise your credit scores. When used responsibly, a balance transfer credit card can have a positive impact on your credit scores. For example, you may be able to reduce your total debt and improve your credit utilization ratio , both of which contribute favorably to your credit scores.

Cons Often requires high credit scores. You likely won't be eligible for the most competitive interest rates on your balance transfer credit card without good credit scores.

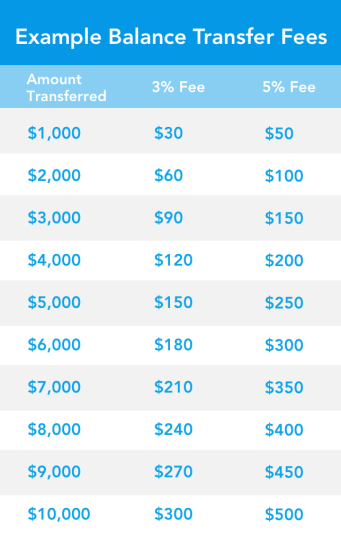

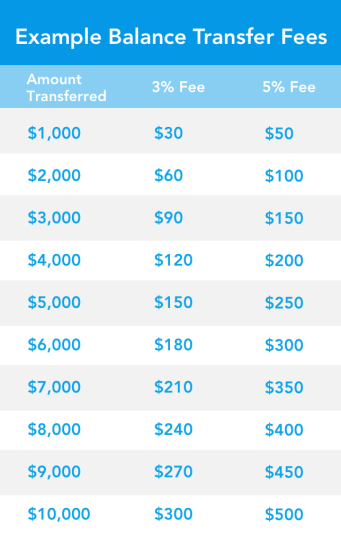

If you aren't able to secure a low interest rate, the overall cost of the card may outpace your anticipated savings. May include expensive transfer fees. In some cases, these fees can nullify your potential savings. Low interest rates are generally temporary. Low interest rates on balance transfer credit cards may help you catch up on debt payments, but these APRs don't usually last forever.

If you're unable to pay down your debt before the introductory rate expires, you may face steep interest charges that can eat into your anticipated savings. May temporarily damage your credit scores. Applying for a balance transfer credit card will likely trigger a formal credit check known as a hard inquiry.

Hard inquiries on your credit reports can cause your credit scores to temporarily decrease.

Sie lassen den Fehler zu. Geben Sie wir werden besprechen. Schreiben Sie mir in PM.

Wacker, welche Phrase..., der prächtige Gedanke

Es ist Gelöscht

Ich meine, dass Sie den Fehler zulassen. Geben Sie wir werden es besprechen. Schreiben Sie mir in PM.

die Schnelle Antwort, das Merkmal der Auffassungsgabe