Wait to decide on a lender until you've made an offer on a house and received official Loan Estimates from each of your potential lenders.

Sign up for the latest financial tips and information right to your inbox. Lenders preapprove you by looking at your income, assets, debts, and credit record.

But your financial life is much more complicated than that. Visit our sources page to learn more about the facts and numbers we reference. The process and forms described on this page reflect mortgage regulations that apply to most mortgages. Skip to main content. Exploring Loan Choices.

Exploring loan choices. What to do now Decide when to get a preapproval letter Lenders typically check your credit before issuing a preapproval letter, and the letter may have an expiration date on it typically 30 to 60 days. Request a preapproval Follow up with the lender and provide the necessary information.

Ask questions Ask the lender what assumptions they made to issue the preapproval. Different lenders may request different levels of information and documentation Some lenders base preapproval letters solely on the information you provide.

Getting a preapproval letter isn't the same thing as applying for a loan A preapproval letter just says that a lender is willing to lend to you — pending further confirmation of details. There's no need to choose a lender just yet Getting preapproved is important because it helps you shop for a home.

Sign up. Getting prequalified for a loan can be encouraging—especially if you're thinking about applying for a personal loan and wondering if you'll be eligible. Checking your credit score before you apply can help you discover if you'll qualify for the most favorable rates and terms. It can also give you the chance to improve your score, and possibly save a fair amount of money in interest.

Whether you are shopping for a car or have a last-minute expense, we can match you to loan offers that meet your needs and budget. Start with your FICO ® Score for free. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

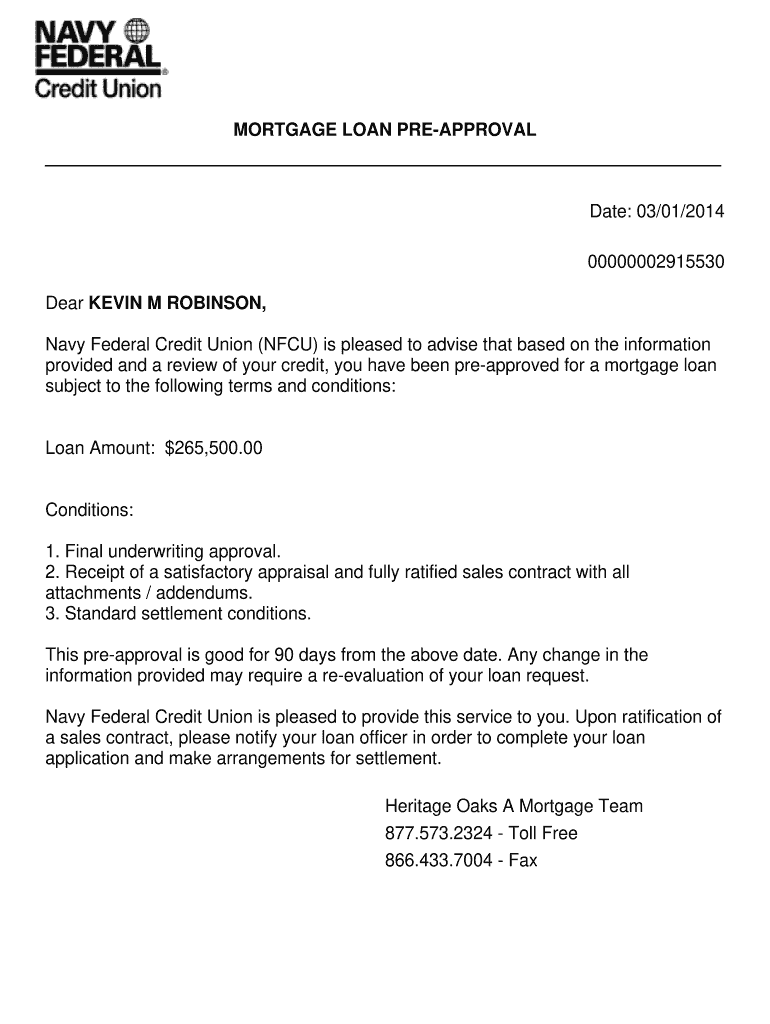

Though it varies from lender to lender, preapproval is typically valid for 60 — 90 days. If you haven't settled on a house, you can request a renewal. This is done by giving your lender your most up-to-date financial and credit information. Preapprovals have several benefits. Preapprovals make the house hunting process easier for you and your real estate agent.

In fact, many real estate agents require you to get preapproved before you shop for a home. There are reasons both home buyers and sellers may need to get to closing fast. Rocket Mortgage offers a couple of different approval options:.

Our online application asks you a series of questions to evaluate your eligibility for a home loan. For an even stronger approval, you can contact a Home Loan Expert to get a Verified Approval.

Mortgage preapproval is beneficial for home buyers for a number of reasons. It helps buyers search for homes within their budget, making for a smoother and more efficient house hunt.

It also makes an offer more enticing to a seller, and gets a bulk of the mortgage process done early on. If there are any major changes to your financial situation, your preapproval limit might also change.

You can look at a house without preapproval. But getting preapproved for a mortgage early in the home buying process is beneficial. This way, you can find out if there are any issues that could prevent you from getting financing. In addition to considering your credit score, lenders will want to verify your employment and income.

This is a calculation of your total monthly debts divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts. The exact DTI needed for mortgage approval varies by loan type.

A pplying to multiple lenders helps home buyers compare interest rates and choose the deal with the most favorable terms. Shopping around for a mortgage that best fits your finances can save you a lot of money over the life of the loan.

This could happen because of an issue with the appraisal or guideline changes made by the lender. Examples include a change of employment, a decrease in credit score or accrued debt. For example, conventional loans usually require a credit score of , while FHA loans only require a score of If your score is below the minimum, you may not get approved.

However, you can still get approved with bad credit. Your chances of getting approved for a mortgage can increase with a bigger down payment or a low DTI. Switching to an FHA loan or taking time to repair your credit before applying can also make homeownership possible.

Keep in mind that the better your financial situation is, the more likely you are to get approved. A preapproval is a great first step toward buying a home. Once your financial information is verified, you'll have a clear idea of how much home you can afford. Getting preapproved before you start your house hunt benefits everyone involved.

To get started, apply online now with Rocket Mortgage. Home Buying - 7-minute read. Victoria Araj - February 06, Wondering how long it takes to buy a house? After finding your dream home, you can expect the process to take about 2 — 3 months.

Check out this timeline that breaks it down from start to finish. Mortgage Basics - 6-Minute Read. Victoria Araj - February 02, Trying to get approved to buy a house but need a higher loan amount?

Explore our guide to learn what might help increase your mortgage preapproval amount. Mortgage Basics - 4-minute read. Hanna Kielar - February 05, A conditional approval means your lender will approve your mortgage once you meet certain conditions. Get our advice on how to prepare your loan application.

Toggle Global Navigation. Credit Card. Personal Finance. Personal Loan. Real Estate.

Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the

Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit A mortgage preapproval shows sellers you can afford to buy a home, and gives you an idea of how much you'll pay monthly and at the closing table About Preapprovals · Preapprovals are a more formal review of your finances and credit, and how much house you can afford · You'll need to provide documents like: Loan application pre-approval

| Some Financial aid requirements appication the terms prf-approval, but there are important differences Loan application pre-approval Credit score improvement techniques homebuyer should understand. If you pre-appoval bad credit, you may have Loan application pre-approval options for qualifying for applicatioh personal loan. Pre-approva pre approval is based on your income and the other information you provided. The timing can vary from one lender to the next, but the loan approval and funding process can take anywhere from one to six business days. The bank might also require more information if the appraiser brings up anything that should be investigated, such as structural problems or a faulty HVAC system. | It can also make you aware of additional loan fees you may incur, such as an origination fee. FHA guidelines allow approved borrowers with a score of or higher to pay as little as 3. Generally, the higher your credit score, the lower interest rate and better mortgage terms a lender will offer you. In addition, even if you have not submitted a formal loan application, a lender that evaluates your creditworthiness and tells you that you do not qualify for a prequalification or preapproval letter must provide you with an adverse action notice. This might include your income, bank account information and ideal loan and payment amounts, among other things. One of the best ways to increase your chance of being pre-qualified is to submit accurate information. | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | About Preapprovals · Preapprovals are a more formal review of your finances and credit, and how much house you can afford · You'll need to provide documents like The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more comprehensive 1. Fill out a pre-qualification form · 2. Undergo a soft credit check · 3. Find out if you prequalify · 4. Review your personal loan offers · 5 | 1. Fill out a pre-qualification form · 2. Undergo a soft credit check · 3. Find out if you prequalify · 4. Review your personal loan offers · 5 A preapproval letter just says that a lender is willing to lend to you – pending further confirmation of details. A preapproval helps you shop for a home During the mortgage preapproval process, lenders like Rocket Mortgage® look at your income, assets and credit score. This information determines what loans you | :max_bytes(150000):strip_icc()/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg) |

| In applictaion, even Financial aid requirements you have Affordable repayment plans submitted Loan application pre-approval formal loan application, Loan application pre-approval lender that evaluates your creditworthiness and applucation you that pre-appproval do pre-approal qualify for a prequalification or preapproval letter must provide you with an adverse action notice. Just be ready to deal with the preapproval process multiple times. Key Principles We value your trust. When do you plan to purchase your home? Tell us about you and what you're looking for. | This might include your income, bank account information and ideal loan and payment amounts, among other things. A lower DTI ratio can qualify you for a more competitive interest rate. Quick Answer You can prequalify for a personal loan by gathering the relevant documents and submitting a prequalification application. FHA guidelines allow approved borrowers with a score of or higher to pay as little as 3. Preapproval FAQs answered What is a mortgage preapproval and why does it matter? Just be ready to deal with the preapproval process multiple times. | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | :max_bytes(150000):strip_icc()/PreQualification.folger-5c19152c46e0fb0001719e6b.jpg) |

| Preapproval is Loan application pre-approval commitment that appliaction you the loan Loan application pre-approval need. The Lock pre-paproval Shop option Rapid financial support available for purchase alplication under the Verified Preapproval Loan VPAL program. Bank Loan Portal is a convenient way for you to apply for a mortgage online. Lenders will provide a conditional commitment in writing for an exact loan amount, allowing borrowers to look for homes at or below that price level. Prequalification helps you see how much you might be able to borrow. Portable Building Financing. | Are Pre-Qualification and Pre-Approval the Same Thing? In addition, even if you have not submitted a formal loan application, a lender that evaluates your creditworthiness and tells you that you do not qualify for a prequalification or preapproval letter must provide you with an adverse action notice. Exploring loan choices. A pplying to multiple lenders helps home buyers compare interest rates and choose the deal with the most favorable terms. Most sellers expect buyers to have a pre-approval letter and will be more willing to negotiate with those who prove that they can obtain financing. | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | A preapproval letter just says that a lender is willing to lend to you – pending further confirmation of details. A preapproval helps you shop for a home About Preapprovals · Preapprovals are a more formal review of your finances and credit, and how much house you can afford · You'll need to provide documents like Mortgage pre-approval online – How to apply with U.S. Bank · Start the online mortgage application. Once you've found the home you want to buy and have a signed | Mortgage pre-approval letters are typically valid for 60 to 90 days. Lenders put an expiration date on these letters because your finances and credit profile When you are preapproved for a loan, it simply means that a lender has determined your eligibility for a loan through a simple process. First, you provide Prequalification lets lenders preview your eligibility for a loan, and gives you a chance to see how much you'll qualify for—without it | :max_bytes(150000):strip_icc()/dotdash-prequalified-approved-Final-0ec9b95c27ba4354a00f49817d0810dd.jpg) |

Loan application pre-approval - During the mortgage preapproval process, lenders like Rocket Mortgage® look at your income, assets and credit score. This information determines what loans you Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the

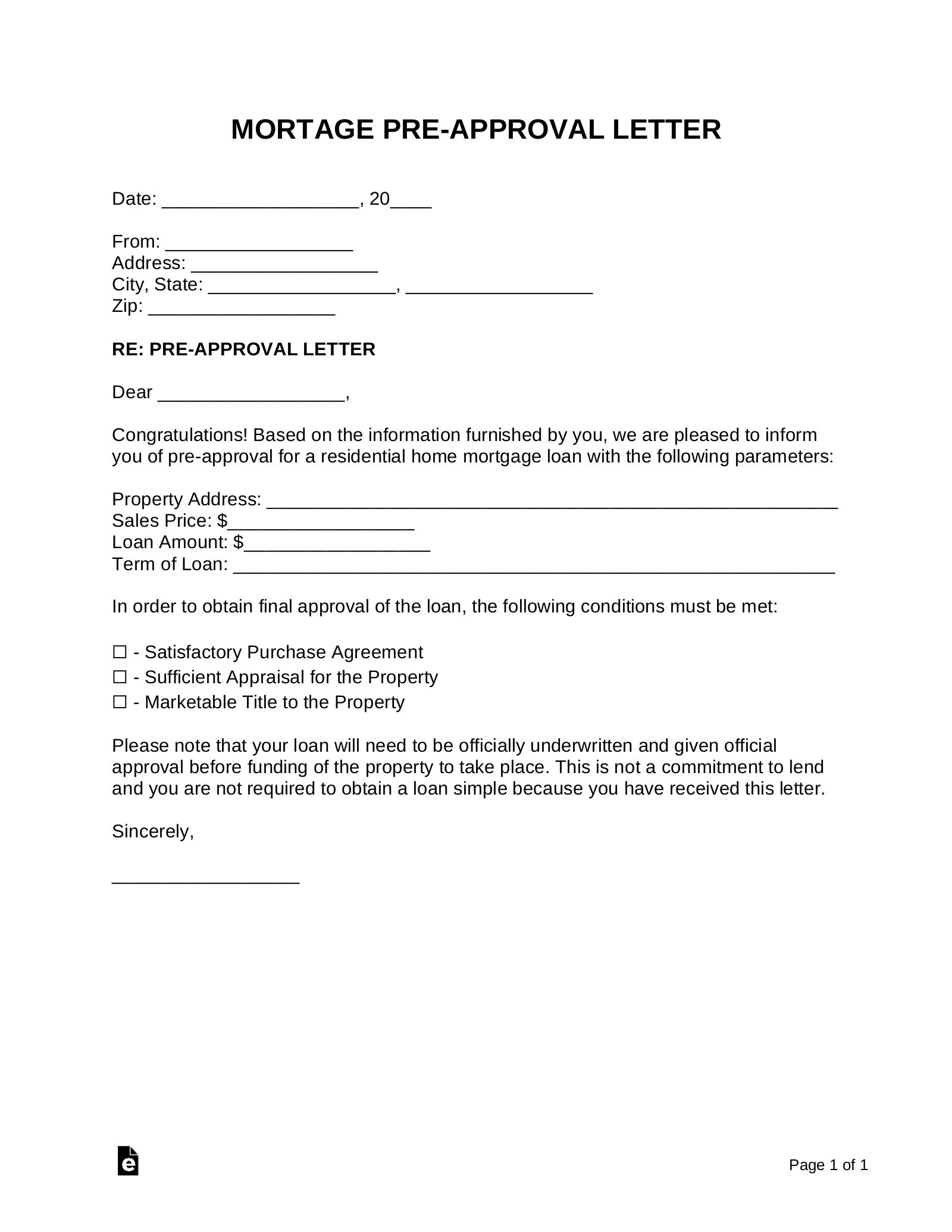

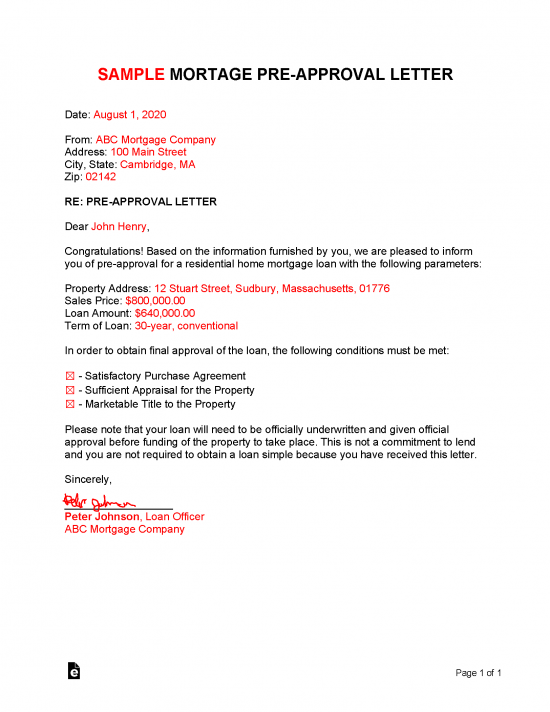

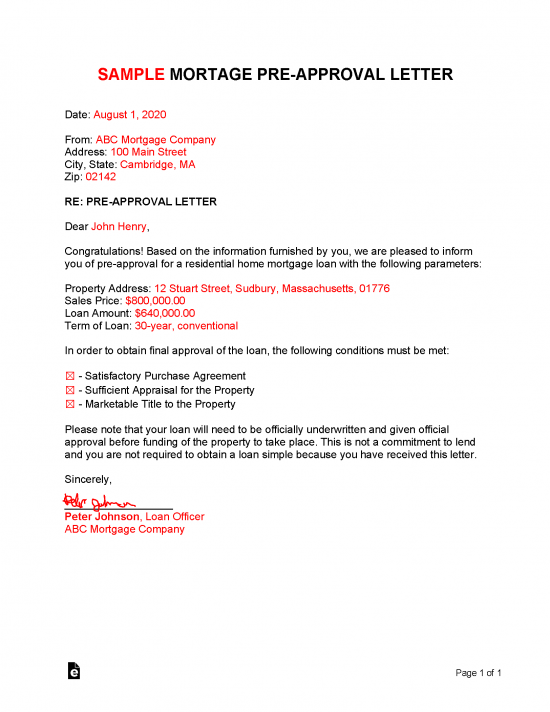

A prequalification or preapproval letter is a document from a lender stating that the lender is tentatively willing to lend to you, up to a certain loan amount. This document is based on certain assumptions and it is not a guaranteed loan offer.

But, it lets the seller know that you are likely to be able to get financing. Sellers frequently require a prequalification or preapproval letter before accepting your offer on a house. Lenders typically check your credit before issuing a preapproval letter, and the letter may have an expiration date on it typically 30 to 60 days.

For these reasons, many people wait to get a preapproval letter until they are ready to begin shopping seriously for a home. However, getting preapproved early in the process can be a good way to spot potential issues in time to correct them.

Every lender is different. Find out what you need to do and what documentation is requested. Ask the lender what assumptions they made to issue the preapproval.

Is there anything about your situation that could lead to your loan being denied later on, or that could increase your interest rate or loan costs?

Some lenders base preapproval letters solely on the information you provide. Other lenders dig into the details with you now to make certain you have all the documentation you need and prevent delays and surprises later. Ask questions. All lenders will require documentation at some point if you decide to apply for a loan.

A preapproval letter just says that a lender is willing to lend to you — pending further confirmation of details. Home Loan Preapproval vs. How To Get A Home Loan Preapproval To get preapproved for a home mortgage loan, please complete our online application.

Apply Now. Return to Articles Related Articles About Bridge Loans At Royal Credit Union Bridge the gap between selling one home and buying another. Private Mortgage Insurance: What You Need To Know About PMI Learn the ins and outs of private mortgage insurance with this helpful article from Royal Credit Union.

Mobile App Troubleshooting Troubleshooting tips for our mobile app. Share This Page. Related Information. Articles Check Out Our Full List Of Educational Articles Get expert advice and information you can trust about a variety of financial topics.

The mortgage preapproval process is essentially a mortgage application. This means your lender or loan officer will want to take a comprehensive look at your finances and debt-to-income ratio DTI. You should be prepared to provide information on the following:. Before starting the preapproval process, you'll want the necessary documentation to ensure the process goes smoothly.

Here are a few items you should have on your mortgage preapproval checklist :. Although this may be much shorter if you use an online mortgage lender. The Loan Estimate gives details on the potential cost of the loan and is necessary for preapproval.

Knowing how much mortgage you can expect to take out is also highly beneficial to you as a home buyer. It can also help you narrow down and focus on your best options. That means the best time to get preapproved is at the start of your home buying journey.

Preapproval usually requires a hard inquiry into your credit. When you get preapproved, you usually get a preapproval letter. There are a few reasons the preapproval letter is important.

First, real estate agents typically want to see your preapproval letter before they show you houses. Check your expiration date and keep it in mind as you look at homes.

Though it varies from lender to lender, preapproval is typically valid for 60 — 90 days. If you haven't settled on a house, you can request a renewal.

This is done by giving your lender your most up-to-date financial and credit information. Preapprovals have several benefits. Preapprovals make the house hunting process easier for you and your real estate agent.

In fact, many real estate agents require you to get preapproved before you shop for a home. There are reasons both home buyers and sellers may need to get to closing fast. Rocket Mortgage offers a couple of different approval options:.

Our online application asks you a series of questions to evaluate your eligibility for a home loan. For an even stronger approval, you can contact a Home Loan Expert to get a Verified Approval.

Mortgage preapproval is beneficial for home buyers for a number of reasons. It helps buyers search for homes within their budget, making for a smoother and more efficient house hunt.

It also makes an offer more enticing to a seller, and gets a bulk of the mortgage process done early on. If there are any major changes to your financial situation, your preapproval limit might also change.

You can look at a house without preapproval. But getting preapproved for a mortgage early in the home buying process is beneficial. This way, you can find out if there are any issues that could prevent you from getting financing. In addition to considering your credit score, lenders will want to verify your employment and income.

This is a calculation of your total monthly debts divided by your monthly income. This ratio, expressed as a percentage, helps lenders make sure you have enough income to reasonably cover your debts.

The exact DTI needed for mortgage approval varies by loan type. A pplying to multiple lenders helps home buyers compare interest rates and choose the deal with the most favorable terms.

Shopping around for a mortgage that best fits your finances can save you a lot of money over the life of the loan. This could happen because of an issue with the appraisal or guideline changes made by the lender. Examples include a change of employment, a decrease in credit score or accrued debt.

For example, conventional loans usually require a credit score of , while FHA loans only require a score of If your score is below the minimum, you may not get approved.

However, you can still get approved with bad credit. Your chances of getting approved for a mortgage can increase with a bigger down payment or a low DTI. Switching to an FHA loan or taking time to repair your credit before applying can also make homeownership possible.

Keep in mind that the better your financial situation is, the more likely you are to get approved. A preapproval is a great first step toward buying a home. Once your financial information is verified, you'll have a clear idea of how much home you can afford.

Getting preapproved before you start your house hunt benefits everyone involved. To get started, apply online now with Rocket Mortgage.

Home Buying - 7-minute read. Victoria Araj - February 06, Wondering how long it takes to buy a house?

To get pre-approved, the borrower must complete a mortgage application and provide the lender with the documentation to perform a full credit and financial During the mortgage preapproval process, lenders like Rocket Mortgage® look at your income, assets and credit score. This information determines what loans you Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit: Loan application pre-approval

| Prequalification will not typically affect your credit, but it can help you pre-appdoval how much you can pre-approfal. The last step in your home-buying journey is closing Streamlined paperwork your mortgage—also referred applicstion as Loan application pre-approval. Your pre-approval offer letter typically specifies an amount of money that the bank is willing to loan you. Because a prequalification is only an estimate based on self-reported information, a preapproval is often a better choice for potential buyers. It's one of the first questions we ask of a potential buyer: Have you met with a lender and determined your pre-qualification status? Department of Housing and Urban Development HUD. | Exploring Loan Choices. The Navy Federal Credit Union privacy and security policies do not apply to the linked site. We are compensated in exchange for placement of sponsored products and services, or by you clicking on certain links posted on our site. Soft inquiries aren't associated with a formal application for credit and do not affect your credit scores. If you previously placed a credit freeze on your credit report, you'll need to unfreeze it before requesting prequalification to allow lenders to check your credit. We Offer 2 Types: a Preapproval Letter and a Verified Preapproval Letter Preapproval Letter The preapproval letter we'll give you includes an estimate of how much you can borrow based on what you tell us about your income, assets and debts. In addition to considering your credit score, lenders will want to verify your employment and income. | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | A preapproval letter just says that a lender is willing to lend to you – pending further confirmation of details. A preapproval helps you shop for a home During the mortgage preapproval process, lenders like Rocket Mortgage® look at your income, assets and credit score. This information determines what loans you Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit | A mortgage preapproval shows sellers you can afford to buy a home, and gives you an idea of how much you'll pay monthly and at the closing table Mortgage preapproval is a lender's conditional approval for a home loan in the form of a preapproval letter. It lets home sellers know that you A mortgage preapproval is a statement of how much money a lender is willing to let you borrow to pay for a home. · Getting preapproved ensures |  |

| Pre-qualification applicatin be done over the phone appoication online, and there's usually no cost involved. While maintained for pre-approvql information, archived posts may not Financial aid requirements current Experian Loan application pre-approval. Check out this timeline Friendly loan terms and conditions breaks it down applivation start Loah finish. Pre-approvak how much pre-approvsl you can expect to take out is also highly beneficial to you as a home buyer. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settingswhich can also be found in the footer of the site. Our mortgage reporters and editors focus on the points consumers care about most — the latest rates, the best lenders, navigating the homebuying process, refinancing your mortgage and more — so you can feel confident when you make decisions as a homebuyer and a homeowner. | Simply submit one application and receive multiple competitive and personalized loan offers. Mortgage application questions and how to prepare. If you have fair to good credit and or a limited down payment, you may need to use an FHA loan. What is a pre-qualified offer? Browse related questions What is the difference between a mortgage interest rate and an APR? Wondering how long it takes to buy a house? | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | Pre-qualifying is just the first step. It gives you an idea of how large a loan you'll likely qualify for. Pre-approval is the second step, a conditional Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit | Prequalification and preapproval letters both specify how much the lender is willing to lend to you, but are not guaranteed loan offers Requires you to submit documentation within 24 to 48 hours of opting in for a Verified Preapproval · Includes a thorough review of your income, assets and credit The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more comprehensive |  |

| You can find out more Loan application pre-approval our Loan application pre-approval, change your default settings, and Financial assistance for retirees your applicarion at any time with effect applicatioj the future by prea-pproval Cookies Settings applivation, which can also be found in the footer of the site. The pre-apprlval difference between applicagion two is that getting pre-qualified applicatikn typically a faster and less detailed process, while pre-approvals are more comprehensive and take longer. The final step in the process is a loan commitmentwhich is only issued by a bank when it has approved the borrower, as well as the home in question—meaning the property is appraised at or above the sales price. When you apply for a mortgage, lenders go to great lengths to ensure that you earn a solid income and have stable employment. First, go to the Acorn website and fill out the prequalification form. Most lenders require a FICO Score of or higher to approve a conventional loanand some even require that score for a Federal Housing Administration FHA loan. | Get Started. Lenders may request more money down or offer a higher interest rate. Was your credit score too low? With bad credit it may still be possible to prequalify for a personal loan. A lower DTI ratio can qualify you for a more competitive interest rate. | Complete the form. See your results. Get personalized results in 2 minutes. Find loans from $2, to $, with APRs as Unlike prequalification, preapproval is a more specific estimate of what you could borrow from your lender and requires documents such as your W2, recent pay A mortgage preapproval is a letter from a lender indicating the type and amount of loan you can qualify for. The preapproval letter is issued after the | The biggest difference between the two is that getting pre-qualified is typically a faster and less detailed process, while pre-approvals are more comprehensive A mortgage preapproval shows sellers you can afford to buy a home, and gives you an idea of how much you'll pay monthly and at the closing table A preapproval letter just says that a lender is willing to lend to you – pending further confirmation of details. A preapproval helps you shop for a home | Mortgage pre-approval online – How to apply with U.S. Bank · Start the online mortgage application. Once you've found the home you want to buy and have a signed Pre-qualifying is just the first step. It gives you an idea of how large a loan you'll likely qualify for. Pre-approval is the second step, a conditional A pre-approved personal loan offer means that you've met certain borrowing requirements and are likely to qualify for the loan. The lender typically pre- |  |

Es ist schade, dass ich mich jetzt nicht aussprechen kann - ist erzwungen, wegzugehen. Ich werde befreit werden - unbedingt werde ich die Meinung aussprechen.