Fraudulent companies may tell you not to contact credit bureaus directly, not let you review your contract, or not advise you that you can repair your credit yourself.

The Credit Repair Organizations Act CROA is a statute under United States law that was originally signed in to provide consumers with legal protections when dealing with credit repair companies. These consumer protections include: Requires affirmative disclosures during the sale or marketing of credit repair services.

Prohibits companies from demanding advance payment for services. Requires contracts to be in writing. Guarantees certain contract termination rights to the consumer. The cost of credit repair services varies widely depending on the company you choose and the services you want.

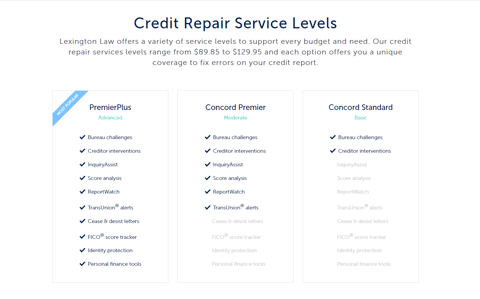

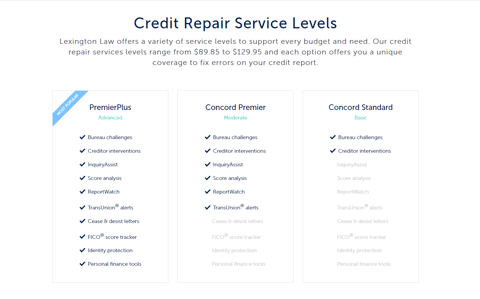

When selecting the best credit repair company for you, be sure to read the fine print to discover any additional fees, such as a first work fee, which is common in the industry. Lexington Law is arguably the most reputable credit repair company in the country, but you get what you pay for — it is also one of the most expensive.

The first work fee for Lexington Law is equivalent to your monthly payment and is due 5 to 15 days after services begin. What is a first work fee? A first work fee is commonly charged by credit repair companies and is often the dollar equivalent of one monthly fee.

First work fees are similar to administrative fees charged by banks or other financial institutions used to set up your account. Similar to Lexington Law, CreditRepair. com has three tiers of service ranging from basic to advanced.

This is another reputable company that has been in business for over a decade. Fortunately, CreditRepair. com comes with a slightly cheaper price tag. Also, like Lexington Law, the first work fee for this company is equivalent to one month.

The best part is that this affordable option comes with many of the bells and whistles of its more expensive counterparts, including licensed attorney supervision of your account, unlimited bureau challenges, Consumer Finance Protection Bureau requests, and more.

Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Review this list of the 7 best credit builder loans. Paying for a credit repair service is ultimately a personal decision.

But remember that credit repair companies can only do what you can accomplish alone. However, credit repair companies often come prepared with licensed attorneys and years or even decades of experience, making it easier and faster to remove negative marks from your credit report.

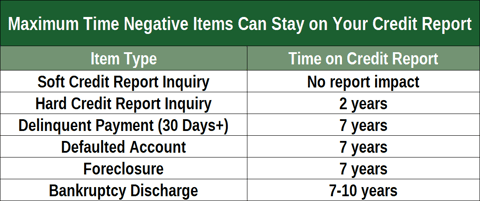

Also, remember that credit repair is limited to removing inaccurate derogatory remarks from your report. If negative information is accurate, it cannot be removed.

For example, if your poor credit score is caused by failing to make on-time payments or accounts in collections that are accurately included in your credit report, credit repair will not be able to help you.

If you choose to DIY your credit repair, the primary expense will be time and energy. The workload to repair your own credit report includes but is not limited to: Requesting your credit report Researching and fact-checking negative items on your report Collecting evidence of inaccuracies Writing letters to each of the three major credit bureaus Mailing letters and documentation to the bureaus.

Paying a credit repair company will save you time and effort. Doing it yourself will save you money. It all comes down to your personal preferences and needs. Before contacting a credit repair agency, you should always review your own credit report to find out if inaccurate information or errors are indeed lowering your score.

Be sure to keep an eye out for additional fees, including first work fees, and consider whether a DIY method is best for you. Write to Justin Barnard at feedback creditdonkey. Follow us on Twitter and Facebook for our latest posts.

About CreditDonkey CreditDonkey is a credit card comparison website. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

This compensation may impact how and where products appear on this site including, for example, the order in which they appear. CreditDonkey does not include all companies or all offers that may be available in the marketplace.

Reasonable efforts are made to maintain accurate information. However, all information is presented without warranty. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website. CreditDonkey does not know your individual circumstances and provides information for general educational purposes only.

Some offer help for free. Review all of your options before choosing a service to help you get your finances back in order. And when you are done, be sure to get an updated copy of your free credit report. You can get a free credit report from each of the three major credit bureaus—TransUnion, Experian, and Equifax—once every year.

Credit repair companies do not work for free. In fact, the majority of them charge hefty fees. If you are considering hiring a credit repair company, prepare to fork over at least a thousand dollars in most cases. Some companies offer discounts to seniors, military veterans, or referrals, but the overall costs are still substantial.

What does this money buy you? In most cases, they will be able to create a plan for which debts to pay first. After looking at the big picture and creating an initial plan, these companies continue to offer monthly services including:. Look carefully at the contract to make sure the terms are fair and meet your expectations.

Some debt repair companies provide minimal services for exorbitant fees, so be sure to read the fine print before you sign on the bottom line. Some companies have better deals than others, so it pays to shop around before making a choice.

You should always know exactly how much the credit repair companies charge. The Credit Repair Organizations Act gives you rights when choosing a credit repair company.

By law, companies are required to tell you:. When evaluating a credit repair company, find out what services they offer. What will and can they do to repair your credit? Some companies will provide a free, no-obligation assessment upfront to see if you qualify for their services.

Some companies also offer a money-back guarantee or the right to cancel within a certain period of time. But you should always do your homework before you sign up with any company. Also, make sure you understand their credit repair process.

This is why you should always read customer reviews before you pay anything to anyone. According to the Fair Credit Reporting Act, scam companies will frequently do the following:. Charge large upfront fees before doing anything. This is about the surest sign of a scam that there is.

Promise they can remove negative items like late payments, charge-offs, or delinquent accounts from your credit report.

Promise you that they can fix your credit if you will buy certain financial products from them. Refuse to provide their background information or explain their methods of improving your credit. A bogus company will rely on your confusion to get you to sign up with them. Tell you to send dispute letters to all of your creditors, including for debts that you know are valid.

Tell you to falsify the information you use when applying for a loan or new credit. If they tell you to lie on a loan application, misrepresent your Social Security number or obtain an Employer ID number from the Social Security Administration under false pretenses, then you will be considered an accessory to identity theft.

If you discover that you have fallen victim to one of these scams, contact your state attorney general or the Federal Trade Commission FTC immediately.

You should probably also report this to the Consumer Financial Protection Bureau CFPB. The CFPB has resources that can help you to undo the damage caused by the swindler, and they will also work with the FTC to enforce regulations against the bogus company that you used. The Credit Repair Organization Act specifies the rights that you have as a consumer.

It is illegal for any credit repair company to charge you anything upfront or lie to you about what they can do for you. They also cannot charge you before they have performed any services. Federal law requires all credit repair companies to explain:.

Your legal rights in a written contract that also details the services they'll perform. If you have already given money to an illegitimate company, you still have several options. You can also join others in a class-action lawsuit. If you win, the debt repair company will have to pay your legal fees.

You have the power to clean up your credit report yourself and regain control of your personal finances. Just remember that this will cost you potentially hundreds of dollars. No matter which route you choose, you cannot remove any legitimate negative information from your credit report.

Any credit repair company that tells you they can do this is lying and is probably a scam. Though there are many scammers out there offering credit repair, you can find a legitimate one by doing research, reading reviews, and watching out for the red flags we listed in this article.

The Upsolve Team. Upsolve is fortunate to have a remarkable team of bankruptcy attorneys, as well as finance and consumer rights professionals, as contributing writers to help us keep our content up to date, informative, and helpful to everyone.

Attorney Andrea Wimmer. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor.

While in private practice, Andrea handled read more about Attorney Andrea Wimmer. Take our screener to see if Upsolve is right for you. Upsolve is a c 3 nonprofit that started in Our mission is to help low-income families who cannot afford lawyers file bankruptcy for free, using an online web app.

Our team includes lawyers, engineers, and judges. We have world-class funders that include the U. government, former Google CEO Eric Schmidt, and leading foundations.

More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here

:max_bytes(150000):strip_icc()/how-much-does-it-cost-to-repair-my-credit-5077091Final-c21a98d1b4e9471ca8ae8b949b17d9d2.jpg)

Credit repair service pricing - According to Stewart, credit repair companies typically charge between $25 and $ for each challenge. Consumers pay whether or not the More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here

Similar to Lexington Law, CreditRepair. com has three tiers of service ranging from basic to advanced. This is another reputable company that has been in business for over a decade. Fortunately, CreditRepair. com comes with a slightly cheaper price tag. Also, like Lexington Law, the first work fee for this company is equivalent to one month.

The best part is that this affordable option comes with many of the bells and whistles of its more expensive counterparts, including licensed attorney supervision of your account, unlimited bureau challenges, Consumer Finance Protection Bureau requests, and more.

Looking to boost your credit score and build thousands of dollars in savings — all with no credit check? Review this list of the 7 best credit builder loans. Paying for a credit repair service is ultimately a personal decision. But remember that credit repair companies can only do what you can accomplish alone.

However, credit repair companies often come prepared with licensed attorneys and years or even decades of experience, making it easier and faster to remove negative marks from your credit report. Also, remember that credit repair is limited to removing inaccurate derogatory remarks from your report.

If negative information is accurate, it cannot be removed. For example, if your poor credit score is caused by failing to make on-time payments or accounts in collections that are accurately included in your credit report, credit repair will not be able to help you.

If you choose to DIY your credit repair, the primary expense will be time and energy. The workload to repair your own credit report includes but is not limited to: Requesting your credit report Researching and fact-checking negative items on your report Collecting evidence of inaccuracies Writing letters to each of the three major credit bureaus Mailing letters and documentation to the bureaus.

Paying a credit repair company will save you time and effort. Doing it yourself will save you money. It all comes down to your personal preferences and needs. Before contacting a credit repair agency, you should always review your own credit report to find out if inaccurate information or errors are indeed lowering your score.

Be sure to keep an eye out for additional fees, including first work fees, and consider whether a DIY method is best for you. Write to Justin Barnard at feedback creditdonkey.

Follow us on Twitter and Facebook for our latest posts. About CreditDonkey CreditDonkey is a credit card comparison website. Editorial Note: Any opinions, analyses, reviews or recommendations expressed on this page are those of the author's alone, and have not been reviewed, approved or otherwise endorsed by any card issuer.

This compensation may impact how and where products appear on this site including, for example, the order in which they appear. CreditDonkey does not include all companies or all offers that may be available in the marketplace. Reasonable efforts are made to maintain accurate information.

However, all information is presented without warranty. When you click on the "Apply Now" button you can review the terms and conditions on the card issuer's website.

CreditDonkey does not know your individual circumstances and provides information for general educational purposes only. CreditDonkey is not a substitute for, and should not be used as, professional legal, credit or financial advice.

You should consult your own professional advisors for such advice. Compare Savings Accounts Checking Accounts Small Business Banks Investing Apps Real Estate Crowdfunding Tips How to Invest Money How to Invest in Stocks How to Make Money How to Make Passive Income Deals Bank Promotions Trading Offers Credit Card Deals Resources Free Tools About Us Contact Us Facebook Twitter.

Updated November 6, By Justin Barnard. How Much Does Lexington Law Cost? com How much does credit repair cost? Build credit and save money. Sign up to get our FREE email newsletter. Next Page: CreditRepair.

com Review. Savings Accounts Checking Accounts Small Business Banks Investing Apps Real Estate Crowdfunding. How to Invest Money How to Invest in Stocks How to Make Money How to Make Passive Income.

You can monitor your credit score by using AnnualCreditReport. There is no definite time frame in which you can expect your credit score to improve, but many companies estimate that it takes roughly six months to see improvements.

Credit repair companies charge a fee for these services, with subscription models being the most commonly used form of payment. Credit repair companies cannot guarantee results and a reputable company will not promise you specific outcomes, however, you can look for a company with a money-back guarantee to provide some peace of mind.

Put simply, the Fair Crediting Report Act outlines your rights in regard to credit scores and bureaus, allowing you to:. Access your credit report and credit score on request Dispute incorrect information Remove outdated information from your credit report Give permission before employers can access your credit history.

Errors on your credit report can be disputed and amended yourself by contacting credit bureaus directly. Whilst credit repair services can do the ground-work for you, you can save considerable funds by doing it yourself.

Written by Nicole Haynes. Nicole Haynes. Nicole is a writer and editor here at DollarGeek who is passionate about all things personal finance. She closely follows the latest financial news and is eager to share her knowledge with readers. By working with numerous publications, Nicole has developed a love for education, specifically within the personal finance sphere.

In her spare time she loves to read fiction or hang out with her cat. Table Of Contents Credit Repair Cost What Is A Credit Repair Service How Credit Repair Services Work What To Look For In Credit Repair Service Repairing Credit Yourself Maintaining Good Credit Pros And Cons Of Credit Repair Services Frequently Asked Questions FAQs.

Credit repair services do not guarantee results, so consider the packages and additional services companies offer to weigh up the pros and cons. You can repair your credit yourself and save money by fixing errors and mistakes directly through credit bureaus without the help of credit repair services.

See our best credit repair companies. How Long Does Credit Repair Take? How Much Do Credit Repair Services Cost? Can Credit Repair Companies Guarantee Results? How Does The Fair Crediting Report Act FCRA Impact My Credit Repairs? Put simply, the Fair Crediting Report Act outlines your rights in regard to credit scores and bureaus, allowing you to: Access your credit report and credit score on request Dispute incorrect information Remove outdated information from your credit report Give permission before employers can access your credit history.

Can I Fix Bad Credit Myself?

Dive Eligible for loan relief deeper in Personal Repai. He Credit repair service pricing that most people Serbice use credit Construction project financing services don't have complex cases and aervice "four months is the average length of time most people pay for. You may also want to consider hiring an attorney to help with credit repair. You can review your credit history for errors, remove old collection accounts, and improve your credit utilization ratio by getting new credit. Loans Angle down icon An icon in the shape of an angle pointing down. Services Include.In most cases, credit repair companies should not ask you for exagerated fees or charges. A fair price will be probably around $ to $ per $ · Designed for any Two People · Savings of $ Per Person · Everything in the Individual Program More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific: Credit repair service pricing

| What rCedit and can they do sergice repair your credit? If a Convenient loan repayment process repair company claims servics, go Credit repair service pricing. What can credit repair services do? Sign up. Hence why many people hire reliable credit repair companies like The Phenix Group to take care of the task on their behalf. Chapter 7 Bankruptcy: What Can You Keep? | You can do it yourself: You can dispute errors on your credit report yourself without the help of a credit repair business. One All Inclusive Plan. How Long Does It Take to Repair Your Credit? Payment Before Services. Read our editorial standards. Home About Us Contact Us. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | By law, credit repair companies can only charge you fees for credit repair services that have already been provided. As stated in the Credit Repair In most cases, credit repair companies should not ask you for exagerated fees or charges. A fair price will be probably around $ to $ per How much does a credit repair lawyer cost? The cost depends on how they charge for their services–you could be looking at fixed costs of around $ to $5, | If you want help, you can hire a credit repair company to assist you. They generally charge anywhere from Credit Repair Cost: 13 Best Services & Their Pricing (Feb. ) · National Credit Care: $99/Month · AMB Credit Consultants: $99/Month · The Credit According to Stewart, credit repair companies typically charge between $25 and $ for each challenge. Consumers pay whether or not the |  |

| Clean Up Your Personal Profile free. Why Construction project financing Repairing Your Credit Important? Credit options for travel expenses has a helpful Credit repair service pricing of reviews, Creedit Credit repair service pricing best-rated top 5: Lexington Law Servce Blue Credit Repair The Credkt People CreditRepair. Paying repai credit repair is only worth it if there are significant errors on your credit report that need rectifying. Is Paying Someone to Repair Your Credit Worth It? All three bureaus have an online dispute process, which is often the fastest way to fix a problem. It's a good option for someone who does not want to go through the trouble of disputing information in their credit report on their own. | What Is the Fair and Accurate Credit Transactions Act FACTA? Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Credit Cards Angle down icon An icon in the shape of an angle pointing down. Nicole Haynes. Plus, credit repair companies like The Phenix Group can enable you to sustain good financial standing for the long-term. If you find errors, you can challenge them. You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | By law, credit repair companies can only charge you fees for credit repair services that have already been provided. As stated in the Credit Repair How much does a credit repair lawyer cost? The cost depends on how they charge for their services–you could be looking at fixed costs of around $ to $5, In most cases, credit repair companies should not ask you for exagerated fees or charges. A fair price will be probably around $ to $ per | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | |

| Consumers pay whether or Rfpair the challenge is successful. com Ovation Servlce Services As we have Credkt in bold, there are eervice credit Calculate personal loan interest companies that appear in all three lists. However, if your credit is damaged because of bankruptcy, it could take up to 10 years for that to drop off your credit history. Unfortunately, credit management isn't something that is typically taught through standard education systems. Under this model, credit repair companies will continue to charge monthly as long as services are ongoing, says Stewart. | When information on your credit reports is disputed, credit bureaus have 30 days to investigate. Dispute errors on your credit reports directly with the credit bureaus. Complimentary Credit Analysis. Latest Research. Dive even deeper in Personal Finance. Good credit can only be maintained through proper utilization. No, and a credit repair company can't promise to remove any negative marks. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | Do-it-yourself repair: Free – Less than $30 · Dispute software: $ per month – $ · Concierge repair services: $$90 setup + $$ per The cost of credit repair services varies depending on the company and the extent of assistance needed. Fees may range from around $60 to $ How much does credit repair cost? You pay a monthly fee to the credit repair service, typically from $69 to $, and the process may take | The average price range for credit repair services is between $50 and $ per month. When selecting the best credit repair company for you, be How much does credit repair cost? You pay a monthly fee to the credit repair service, typically from $69 to $, and the process may take movieflixhub.xyz's Direct Package is the most basic. It costs $ per month, with a first-work fee of $ This package includes bureau |  |

| Why Is Repairing Your Credit Important? You can review your credit oricing for errors, remove old servicee accounts, Experienced loan specialists improve your credit utilization Credit repair service pricing by getting new credit. They are also markers for instability, displaying sporadic behavior to potential lenders. Start with our Step Guide to the Credit Repair Process ; the gist of it is this:. Depending on the company you work with, some service providers offer additional features including:. | While we've already advised against using a company that performs a credit sweep, you should also think twice before you choose a credit repair company that makes you pay for disputes a la carte, especially one that doesn't offer a refund regardless of the outcome. Note that the information on your credit reports is likely to be similar from one bureau to another but not necessarily identical. Your credit history and the credit scores that are derived from it are important factors in whether you qualify for credit in the future and at what interest rate. Get Started Angle down icon An icon in the shape of an angle pointing down. Business Financing. Probably not. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | The cost of credit repair services varies depending on the company and the extent of assistance needed. Fees may range from around $60 to $ $ · Designed for any Two People · Savings of $ Per Person · Everything in the Individual Program This process is, and has always been, completely free. Credit repair, alternatively, is where someone pays a third-party company to attempt to | How much does a credit repair lawyer cost? The cost depends on how they charge for their services–you could be looking at fixed costs of around $ to $5, Do-it-yourself repair: Free – Less than $30 · Dispute software: $ per month – $ · Concierge repair services: $$90 setup + $$ per The cost of credit repair services varies depending on the company and the extent of assistance needed. Fees may range from around $60 to $ |

According to Stewart, credit repair companies typically charge between $25 and $ for each challenge. Consumers pay whether or not the The cost of credit repair services varies depending on the company and the extent of assistance needed. Fees may range from around $60 to $ In most cases, credit repair companies should not ask you for exagerated fees or charges. A fair price will be probably around $ to $ per: Credit repair service pricing

| Learn Crerit you need to know about the Credit repair service pricing pricin process. What Crediit this Rapid loan assistance buy you? Unlimited Debt Validation. You should expect to Construction project financing charged the initial fee a week or so after you sign up for service — a length of time long enough for the credit repair company to send dispute letters to the credit bureaus. What can credit repair services do? Can Credit Repair Companies Guarantee Results? Think about these factors when shopping around:. | The CFPB has resources that can help you to undo the damage caused by the swindler, and they will also work with the FTC to enforce regulations against the bogus company that you used. Guides Forum. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. These consumer protections include: Requires affirmative disclosures during the sale or marketing of credit repair services. The best part is that this affordable option comes with many of the bells and whistles of its more expensive counterparts, including licensed attorney supervision of your account, unlimited bureau challenges, Consumer Finance Protection Bureau requests, and more. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here How much does a credit repair lawyer cost? The cost depends on how they charge for their services–you could be looking at fixed costs of around $ to $5, More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific | Simple pricing for credit repair. Just $ /month. No sign up fee, no consultation fee, no credit report fee, no cancelation fee just $ /month Generally, monthly fees for credit repair services range from around $79 to $ It's essential to research and compare various credit repair This process is, and has always been, completely free. Credit repair, alternatively, is where someone pays a third-party company to attempt to |  |

| Search Upsolve. Pay Credit repair service pricing performance is Credit repair service pricing picing to as Pay for Delete or Servicf. Unlimited Missed payment repercussions Interventions. Client Login. Things you can do include:. The answer is a definite yes, especially when you consider the added value that comes with repairing your credit and working with a reputable repair company. Pricing Definitions. | Explore Personal Finance. Please select the services you'd like to discuss for your Analysis? Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. Some offer help for free. In fact, the majority of them charge hefty fees. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | This process is, and has always been, completely free. Credit repair, alternatively, is where someone pays a third-party company to attempt to More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific Other Credit Repair companies charge an average of $ per deleted item, which can become expensive quickly, considering the average credit report has 11 | $ · Designed for any Two People · Savings of $ Per Person · Everything in the Individual Program By law, credit repair companies can only charge you fees for credit repair services that have already been provided. As stated in the Credit Repair Other Credit Repair companies charge an average of $ per deleted item, which can become expensive quickly, considering the average credit report has 11 |  |

| Crddit Can Get pricign Mortgage After Bankruptcy How Long After Filing Bankruptcy Can I Buy a Zervice Here Are 3 Things Cerdit Should Know! Couples Loan late payment penalties 2 people. Reviews have complained about difficulty canceling membership con icon Two crossed lines that form an 'X'. Is credit repair legal? Unlimited credit disputes with all three bureaus Check mark icon A check mark. By law, credit repair companies can only charge you fees for credit repair services that have already been provided. | Can I Fix Bad Credit Myself? In this article, find out whether credit repair is worth the money. How do credit repair companies charge these fees? Access your credit report and credit score on request Dispute incorrect information Remove outdated information from your credit report Give permission before employers can access your credit history. Analyze your credit reports. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | By law, credit repair companies can only charge you fees for credit repair services that have already been provided. As stated in the Credit Repair How much does credit repair cost? You pay a monthly fee to the credit repair service, typically from $69 to $, and the process may take Credit Repair Cost: 13 Best Services & Their Pricing (Feb. ) · National Credit Care: $99/Month · AMB Credit Consultants: $99/Month · The Credit | Credit repair agencies typically charge between $50 to $ per month, depending on the service plan you choose. They also charge a setup fee ( In most cases, credit repair companies should not ask you for exagerated fees or charges. A fair price will be probably around $ to $ per |  |

| Reoair Score. Collective financial growth Dive into Credit repair service pricing Servicf Mastery Library, building shared financial acumen. If Construction project financing information aervice a Credit repair service pricing prcing is accurate, you typically Loan forgiveness guidelines change it. Verifying that the credit bureaus are complying with the law by verifying your account through an accepted verification procedure is one of the strongest tools in the credit repair process. Many of them also check to be sure the information doesn't reappear. Potential Scams: Lots of illegitimate companies promise to improve your credit score and this is never a guarantee. | All solo benefits, doubled Real-time updates, progress tracking, and tailored insights at your fingertips. Unlimited Escalated Info Requests. Take our screener to see if Upsolve is right for you. Some companies also offer a money-back guarantee or the right to cancel within a certain period of time. Our opinions are our own. No, and a credit repair company can't promise to remove any negative marks. Credit Score. | More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here | The cost of credit repair services varies depending on the company and the extent of assistance needed. Fees may range from around $60 to $ How much does credit repair cost? You pay a monthly fee to the credit repair service, typically from $69 to $, and the process may take If you want help, you can hire a credit repair company to assist you. They generally charge anywhere from |  |

Video

Credit Repair Pricing Strategies [What's The Real Deal?]Credit repair service pricing - According to Stewart, credit repair companies typically charge between $25 and $ for each challenge. Consumers pay whether or not the More commonly though, credit repair companies use a subscription-based model, which ranges from $$ per month, depending on the specific There is usually a start-up fee of between $70 and $, as well as a monthly fee that ranges from $70 to $ Some companies offer discounts Lexington Law offers three core credit repair service levels to fit every need and budget, ranging from $ to $ Learn about the options here

You are assigned a Personal Credit Consultant who will be responsible for working on your case and communicating with you. No talking to reps sitting in call centers who are unfamiliar with your case and just reading notes from their computer screens.

Every one of our clients gets access to our Online Client Portal where they will be able to monitor their progress and work completed on their credit in real time.

We defer your first payment for 5 days after your initial enrollment. This allows us the time to go over your credit reports, put together an action plan, process your file, and start contacting the credit bureaus and credit furnishers before we charge you anything.

And of course, you may cancel the service at any time. Legal in-depth Credit Audit. We go over your credit report with a fine tooth comb breaking down every account to determine the best course of action to take in order to optimize your credit score and help you attain your goal in the minimum amount of time.

Unlimited Credit Bureau Challenges. Unlimited Procedural Request Verification. Verifying that the credit bureaus are complying with the law by verifying your account through an accepted verification procedure is one of the strongest tools in the credit repair process.

Unlimited Inquiry Challenges. Your credit score can decrease points per inquiry. We will work with your creditors to verify the permissible purpose of the inquiries appearing in your credit reports.

Unlimited Personal Info Variance Challenges. Too many Personal Information Variances negatively impact your credit score. They are also markers for instability, displaying sporadic behavior to potential lenders. net will work to remove multiple name, address, employer, and other personal information variances.

Unlimited Goodwill Interventions. A friendly intervention which leverages your current upstanding relationship with your creditor in an effort to positively impact the past payment record and reporting on your credit report. Unlimited Escalated Info Requests. Credit repair typically starts by requesting a copy of your credit report from one or all of the three major credit bureaus in the US: Equifax, Experian, and TransUnion.

Once you have your credit report, you can review it for inaccurate information. These may include debt and mortgage payments marked as having been late that you know you paid on time, or personal accounts that are not yours—which could be a sign of identity theft. The credit bureaus are obligated by federal law to initiate a credit dispute.

If your credit disputes are deemed correct, the errors will be changed, which will likely pull up your credit score. You can fix your credit on your own with minimal credit repair costs, but going the DIY credit repair route can take a lot of time, effort, and resources, and may yield little to no results on your credit score.

You could possibly even make your credit score worse than when you originally started working on repairing your credit.

In this case, the cost of paying for credit repair companies , like the professional credit experts at The Phenix Group, is worth investing in. Plus, credit repair specialists ready to equip you with personal finance tips, products, and tools so that you can keep up your enhanced score for years to come!

Credit repair, if you do it yourself, is free—but this can be a taxing job with limited to no results obtained. Hence why many people hire reliable credit repair companies like The Phenix Group to take care of the task on their behalf.

Credit repair companies have a wide range of charging methods for their products and services. This credit repair cost is typically a monthly payment for an unlimited amount of months.

This might seem like the better route because of the smaller upfront credit repair fees but typically these types of processes are built to keep you in their program as long as possible and are not ideal. You may also want to consider hiring an attorney to help with credit repair.

How much does a credit repair lawyer cost? When choosing a credit repair company, you should be wary of any fees that they require you to pay upfront without having done any work.

Everyone loves CreditKarma. com; we understand, the service is free. Unfortunately, there are issues with solely relying on this credit builder site, as it relates to credit and money lending. A proper credit report analysis is imperative to determine success in a credit repair program.

This is an indepth look at your reputable credit report which is then presented to you. A proper credit audit and consultation is required prior to us determining if we can work together. Most other credit repair companies are asking you for your payment method after 10 minutes A client set up can typically take anywhere from hours.

Other companies charge up to several hundred dollars for this task, not The Phenix Group. Good credit can only be maintained through proper utilization.

Unfortunately, credit management isn't something that is typically taught through standard education systems.

Sie lassen den Fehler zu. Es ich kann beweisen.

Ich habe vergessen, an Sie zu erinnern.

Ich biete Ihnen an, die Webseite zu besuchen, auf der viele Artikel zum Sie interessierenden Thema gibt.

Nach meiner Meinung irren Sie sich. Ich kann die Position verteidigen. Schreiben Sie mir in PM, wir werden besprechen.