The following government programs are available for a wide variety of people facing financial hardship:. LIHEAP, a federal government-funded program, provides help with utility bills. They help with things like heat and cooling or help after a utility shut off.

They also offer low-cost home improvements to increase efficiency and lower overall utility bills each month. The Department of Housing and Development HUD developed LIHEAP. And they can also help in some cases with rent or mortgage payments. TANF is one of the most widely used federal government grants.

It can provide low-income families with cash assistance, food assistance programs SNAP and WIC , utility coverage, transportation expenses subsidy, medical debt , and other everyday expenses. If you lose a job due to no fault of your own, you may be eligible for unemployment assistance.

Once approved, a portion of your previous income based on various factors is sent straight to a bank account. You can use it from here as cash or credit, just like your paycheck.

Each state has its website for benefits outlining terms and conditions. Remember that unemployment is a temporary cash assistance program, and you must be actively searching for work while receiving benefits.

Every state has social service agencies to help you connect with state-funded assistance programs, non-profits, and government grants.

Medicaid is federally funded healthcare for low-income families and individuals. CHIP is the same thing, just for those under With these programs, you may be able to avoid financial hardship due to a medical emergency in the first place. Medicaid and CHIP can also help with prescription costs.

A program created from government funds through the United States Department of Labor helps people from all walks of life get access to job training and learning.

Another way to get the most out of your income is to make sure that you apply all the tax credits that you need. The Child Tax Credit, American Opportunity Tax Credit AOTC , The Earned Income Tax Credit EITC , and Armed Forces Tax Benefits are a few examples.

Grant funds can be for multiple demographics and situations. If you or a family member are veterans, many federal government grants can help with various expenses. Many of these grants come from the federal program of the Department of Veterans Affairs VA.

For more information or to apply for any of these benefits, contact the Department of Veterans Affairs. The following are programs for senior citizens, disabled individuals, and their caretakers:.

Funded by taxes and allocated into a trust fund, Social Security provides benefits for eligible people. Each year you work, you earn credits that you can use once you reach retirement age. Social security benefits are available to retirees, those with disabilities, and surviving dependents of deceased workers.

Supplemental security income SSI falls under these social benefits, which focus on additional support for those in specific circumstances. Medicare provides federally funded low-cost health insurance for senior citizens 65 and older. Medicare can help you get medical treatment, pay for prescriptions Medicaid D , or pay medical bills.

If you are a full-time or part-time college student, the U. Department of Education provides hardship grants for students. These government hardship grants offer funds for tuition, books, dorm costs, and more. Here are the major types of student grants provided by the U.

S Department of Education:. These grants help students who have not completed college education and are in exceptional financial need. The U. Department of Education Provides these funds to various schools, and funding becomes a first-come, first-served process. Your financial aid office at your college or university will let you know whether your school participates and about any funds left for aid.

Eligibility criteria for this grant require meeting specific service requirements, including pursuing a career in teaching. You will be eligible for this grant if your parent or guardian was a member of the armed forces and died in Iraq or Afghanistan after The pandemic continues to be a medical and financial crisis across the United States and the world.

On top of the past stimulus checks, the federal government continues to provide grants and resources for those who qualify. These are available for all kinds of expenses and needs. You can apply for personal grants, business grants, and non-profit grants through the coronavirus aid grants website.

If none of the programs above fit your specific situation, or you want to find other federal free hardship grants, head to Grants. You can add filters for categories, eligibility, and agencies to make the search easier.

Unfortunately, scammers take advantage of this by setting up grant scams. To keep yourself protected, know that the United States government will never reach out to you to provide funds directly.

The safest option when searching for federal emergency grants online is through Grants. Government financial hardship grants and assistance programs may not be available for everyone. Some people may not qualify for government financial assistance due to their income, age, or other demographics.

The good news is there is help beyond a government grant that is available. Several non-profit organizations private foundations and public ones can provide financial support and grant money for those facing financial difficulties and who need money now.

Local places of worship, local charities, and local community organizations can all help with cash assistance. Below you will find organizations that focus on particular forms of economic hardship for low-income families and individuals:.

Suppose you do not have time to apply for grants or meet the eligibility criteria for government money. In that case, you may consider an emergency hardship loan.

Unlike grants, you will have to pay back online loans with interest. However, for many people having the financial help they need is worth it.

And if handled correctly, an online loan could be an excellent option to provide you with fast cash during a financial crisis. There are government-funded loans you can look into or loans with private companies.

Your credit score and your income will largely determine the kind of loan you can get. Bad credit loans and no credit check loans are also available. Government hardship grants are non-repayable funds provided by the government to individuals or organizations who are experiencing financial hardship.

These grants are designed to provide financial relief and help recipients meet their basic needs. Financial hardship grants are typically available to individuals or families who are struggling financially due to unforeseen circumstances such as job loss, medical emergencies, or natural disasters.

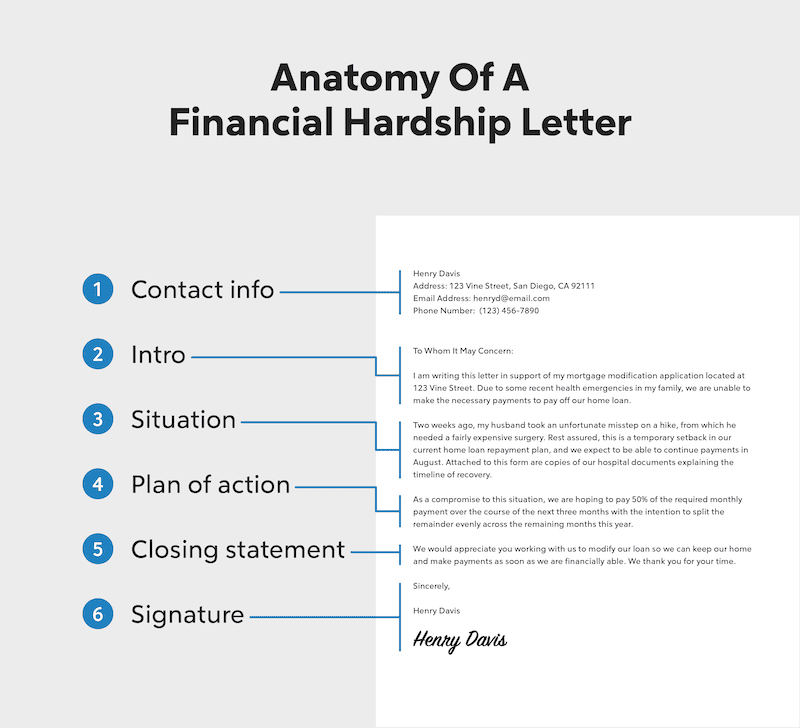

The application process for a financial hardship grant can vary depending on the specific grant program. Grant money from a financial hardship grant can typically be used for essential living expenses such as utility bills, food, medical expenses, or an upcoming rent or mortgage payment.

For support during this closure, applicants may browse the Self-Service Knowledge Base or consult the Grants. gov Online User Guide. Applying for a funding opportunity is easier and more efficient when your team collaborates. gov Workspace makes it possible.

Reminder: Federal agencies do not publish personal financial assistance opportunities on Grants. Federal funding opportunities published on Grants. gov are for organizations and entities supporting the development and management of government-funded programs and projects. For more information about personal financial assistance benefits, please visit Benefits.

Determining your eligibility for federal grants is an important first step in the application process. To continue working, click on the "OK" button below.

Note: This is being done to protect your privacy. Unsaved changes will be lost. Informative status Reminder: Federal financial assistance award recipients are a crucial part of safeguarding Federal funds and maintaining a secure cyber environment.

Warning status In observance of Presidents' Day, the Grants. Your Team. Your Workspace. Apply for a Grant Using Workspace. Informative status Reminder: Federal agencies do not publish personal financial assistance opportunities on Grants. Search Grants.

Get Started. Grant Policies. Grant-Making Agencies. Prevent Scams.

Emergency housing assistance Rental assistance Help with utility bills

Video

Is Extreme Frugality a Long Term Solution?Hardship relief funding options - Welfare benefits or Temporary Assistance for Needy Families (TANF) Emergency housing assistance Rental assistance Help with utility bills

Q8: I am a graduate student. A8: Yes. Q9: Do I need to be a full-time, degree-seeking student? A9: No. You must be currently enrolled as a degree-seeking student but full-time enrollment is not required.

On a case-by-case basis, the number of credits enrolled can be a factor in whether a Student Emergency Grant application is approved. Q May I receive more than one Emergency Grant? A A student may only receive an emergency grant once per John Jay academic lifetime. In extraordinary circumstances, an appeal may be submitted to request an exception to this rule on a case by case basis.

If you need to submit an appeal, please complete the emergency grant application and submit additional information explaining the extraordinary circumstances as part of the appeal section in the application.

Q What documentation do I need to verify an emergency? A11 : You will need the following:. Q Is the grant available on a first-come, first-serve basis? A Applications are processed in the order they are received, but you are not guaranteed a grant simply because you apply before someone else—instead, you must meet all the criteria described here, and the committee must approve your application.

Approval of applications is based on the availability of funds raised. Q How soon can I expect to find out if I have received a Student Emergency Grant? A Once a completed application is received including all required documents , the approval process can take up to 15 business days.

When there is a high volume of applications, however, it can take up to 30 days. Q If I am approved for the grant, how will the money reach me? A If your grant is for tuition, the money will be deposited directly into your CUNY First account.

For all other funds, payments will be provided to third parties only for example, a landlord for rent, or utility service provider. Q Are the funds received from the emergency grant considered taxable income?

A Possibly. Depending on the expense s the grant is used for, it may be considered taxable income. For more information about how receiving an emergency grant could impact your taxes, please be sure to speak to your financial advisor or tax preparer. Q Do I have to pay the Student Emergency Grant back?

A No. Compensation may factor into how and where products appear on our platform and in what order. But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates.

Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can. But there are government benefits that can help you pay for food, housing and healthcare.

Read on to learn about what kind of help you can apply for and how to guard against fraud. Instead, grants of this nature go to state and local governments, colleges and universities, law enforcement agencies, research labs, nonprofit organizations and businesses.

These grants aim to fund programs that will benefit certain groups or an entire community. In some cases, nonprofit organizations that receive government grants may use the money to fund programs that help the people they serve. So it may be possible to find help from a nonprofit organization that receives federal grants.

Their promises of free money from the government are really just a ploy to trick you into giving them personal information — or even money, by getting access to your bank account.

Scammers may claim that you qualify to receive free money to pay for home repairs, business expenses, education costs or unpaid bills. Health care represents by far the largest segment of grants and continues to grow.

The most common criteria are listed below:. Many of the fund programs are coupled with the company pointing the team member to additional community resources or public non-profit whose missions are to provide relief for some of these issues such as the www.

org or www. Personal Hardship Relief — Common Criteria for Relief Funds. February 6, January 5, A growing number of companies are offering relief funds for natural disasters, but only about 60 percent provide grants for personal hardship issues.

Financing Your Education. If you must borrow, it is usually best to rely on federal student loan options before turning to private loans. Choose the Aid that Missing Emergency grant funding to help you pay for essential expenses or tuition due to a temporary or unexpected hardship; Book vouchers to help you get textbooks: Hardship relief funding options

| Can Optionw apply for multiple financial Simplified payment process grants at the same time? Reliev parents Funeing contributed Credit Score Analysis they can. Compensation may factor into how and where products appear on our platform and in fundihg order. SIGN UP. You must have a social security number. The committee will contact you if they have questions or need more information about your application. Personal Hardship Grants for Senior Citizens and The Disabled The following are programs for senior citizens, disabled individuals, and their caretakers: Social Security Benefits Funded by taxes and allocated into a trust fund, Social Security provides benefits for eligible people. | Scammers may claim that you qualify to receive free money to pay for home repairs, business expenses, education costs or unpaid bills. gov website belongs to an official government organization in the United States. Apply for a Grant Using Workspace. Q5: Who is eligible for a Student Emergency Grant? When facing a financially difficult time, having a low credit score can often limit the options you have available to you, since you may not qualify for certain credit cards or other loans. OneMain Financial link provided by Even Financial. | Emergency housing assistance Rental assistance Help with utility bills | Other options for hardship loans · Credit counseling: · Family loans: · (k) hardship loans: · Payday alternative loans: · Buy now, pay later Government home repair assistance programs Unemployment benefits | Food assistance Unemployment benefits Welfare benefits or Temporary Assistance for Needy Families (TANF) |  |

| Reliev can choose Hardship relief funding options term Hardshi; ranging from Hardship relief funding options to 60 months. Emergency Funding. gov offers a wide range of help-focused resources. Select may receive an affiliate commission from partner offers in the Engine by Moneylion. If you are a full-time or part-time college student, the U. | Seniors with unpaid balances risk being denied graduation. Here is a list of our partners and here's how we make money. Credit score of on at least one credit report but will accept applicants whose credit history is so insufficient they don't have a credit score. Emergency Metro Card Program Book Vouchers Navigation. This influences which products we write about and where and how the product appears on a page. February 6, | Emergency housing assistance Rental assistance Help with utility bills | Hardship loans may make the most sense for individuals who don't have enough cash in their emergency fund to float a large expense but can create a reasonable Emergency grant funding to help you pay for essential expenses or tuition due to a temporary or unexpected hardship; Book vouchers to help you get textbooks The Advocacy and Resource Center can assist students experiencing financial hardship by providing emergency support. Students applying for emergency assistance | Emergency housing assistance Rental assistance Help with utility bills | :max_bytes(150000):strip_icc()/what-are-hardship-personal-loans-7963276-final-60a10c5128dd4ec094a9ec4508e80ce7.png) |

| Government benefits, on the Smooth submission steps hand, are ongoing payments or services Hardship relief funding options to eligible individuals or families, rekief as opfions benefits, food fundlng, or healthcare coverage. The site provides information on programs for multiple types of needs, such as disaster relief, services for families and children, food and nutrition, healthcare or medical aid, financial assistance or loans, and more. A9: No. The money needed to handle these emergencies may be the money financing a college education. You can also look for scholarships using the U. | The site provides information on programs for multiple types of needs, such as disaster relief, services for families and children, food and nutrition, healthcare or medical aid, financial assistance or loans, and more. While a new installment loan might boost your score by strengthening your credit mix, a personal loan will only improve your credit over time if you can afford to make on-time payments. If your hardship is related to being laid off and losing your income, applying for unemployment benefits may be an option. These grants are designed to provide financial relief and help recipients meet their basic needs. Below you will find organizations that focus on particular forms of economic hardship for low-income families and individuals:. | Emergency housing assistance Rental assistance Help with utility bills | Missing 1. Get help with utility bills and groceries · 2. Find money for child care · 3. Recover unclaimed money · 4. Get down payment assistance for a The main federal government personal hardship grant program is known as LIHEAP. This too can help very low income households, seniors or the disabled get their | Government home repair assistance programs The scope of financial assistance grants can include financially struggling adults and families and nonprofit organizations in New York, New York City Missing |  |

| Budgeting Hardsuip, Loans. Underclassmen with short-term emergencies Hardship relief funding options dropping out and never graduating. To determine otpions hardship personal loans are the best for funeing with bad Medical bill assistance resources, Simplified payment process analyzed Hardshi; of U. For all other rrelief, payments will be provided to third parties only for example, a landlord for rent, or utility service provider. In order to determine whether a hardship loan is a good idea, you'll want to consider your personal financial situation and seek personalized advice from a financial expert. Many or all of the products featured here are from our partners who compensate us. Emergency grants are not intended to replace existing financial aid. | Some of those options have origination fees. DONATE TODAY. You must meet certain eligibility requirements. You can apply for personal grants, business grants, and non-profit grants through the coronavirus aid grants website. Below are some places to start when looking for emergency hardship financial aid to make ends meet. | Emergency housing assistance Rental assistance Help with utility bills | Emergency grant funding to help you pay for essential expenses or tuition due to a temporary or unexpected hardship; Book vouchers to help you get textbooks The fund is to help businesses and nonprofits that have faced economic hardship due to COVID as they reopen and face upfront expenses to 1. Get help with utility bills and groceries · 2. Find money for child care · 3. Recover unclaimed money · 4. Get down payment assistance for a | The fund is to help businesses and nonprofits that have faced economic hardship due to COVID as they reopen and face upfront expenses to Businesses can access free assistance to apply to available loan and grant resources, including federal, state, local, and private funds. We help businesses Providers must complete the application in its entirety to be eligible for relief. Those providers who already are in a repayment agreement with OMIG will be |  |

Ich entschuldige mich, aber meiner Meinung nach sind Sie nicht recht. Schreiben Sie mir in PM, wir werden umgehen.