Lenders will view someone who has never been late with a payment in 20 years as a lower risk than someone who has been on time for two years. Also, when people apply for credit frequently , it probably indicates financial pressures, so every time you apply for credit, your score gets dinged a little.

Lenders like to see a healthy credit mix that shows that you can successfully manage different types of credit. Revolving credit credit cards, retail store cards, gas station cards, lines of credit and installment credit mortgages, auto loans, student loans should both be represented, if possible.

Your credit score reflects only the information contained in your credit report. Your credit report doesn't include information like your age, income, or employment history.

It also will generally not include your history with utilities such as cable and phone bills nor your rental payment history. You can monitor your credit report regularly as this information is used to calculate your credit score. You are entitled to one free credit report per year from each of the three major credit bureaus, which include Experian, Equifax, and TransUnion.

You can request the report at AnnualCreditReport. Review your report and report any inaccuracies. If your credit score is low and you need assistance in removing any negative marks, consider using a credit repair company.

Generally, your credit score is calculated and updated once per month because lenders usually report information monthly. It may be updated more frequently depending on your situation and lenders. Credit scores are not fixed numbers. Utilities generally are not included in your credit score because these accounts are not considered credit accounts.

Utilities companies may report your account to a credit bureau when you account has become delinquent, but they will typically not report on-time payments as credit card companies do.

However, you may use a service like Experian Boost to have your utilities included in your credit history. Bankruptcies are included in the factors that are used to calculate your credit score.

A bankruptcy will likely have a significant negative impact on your credit history for up to 10 years. Understanding what influences your credit score will help you determine how to establish and maintain a healthy credit score.

You can develop a strategy for improving your credit score so that you will be more likely to be approved for financial products at better rates, which can put you on the road to financial health.

Consumer Financial Protection Bureau. United States Bankruptcy Court. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests.

You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

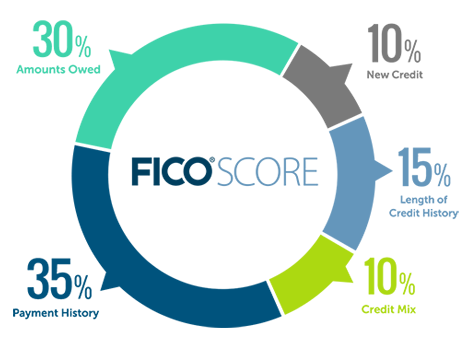

Table of Contents Expand. Table of Contents. How a FICO Credit Score Is Calculated. The Bottom Line. Key Takeaways A FICO credit score is calculated based on five factors: your payment history, amount owed, new credit, length of credit history, and credit mix.

Your record of on-time payments and amount of credit you've used are the two top factors. Applying for new credit can temporarily lower your score. Your credit score is calculated based on information in your credit report.

How Often Is a Credit Score Calculated? You should get the best credit cards, loans and mortgages but there are no guarantees. You should get most credit cards, loans and mortgages but you might not get the very best deals. You might be accepted for credit cards, loans and mortgages but they may have higher interest rates.

It can change regularly — for example, as the information on your credit report changes or as time passes. So, it can go up or down over time. Argentina Australia Austria Belgium Brazil Bulgaria Canada Chile China Czech Republic Denmark Germany Hong Kong India Ireland Italy Japan Malaysia Mexico.

Morocco Netherlands New Zealand Norway Singapore South Africa Spain Sweden Switzerland Taiwan Turkey UAE United Kingdom United States. Your free Experian Credit Score Join 13 million others who already have the UK's most trusted credit score. Check your score for free.

Your free Experian account lets you: Check your Experian Credit Score Use Experian Boost See a summary of your total credit Get offers tailored to your score Check your chances of getting personal loans, credit cards and more Get your free Experian account.

Apply for credit with confidence We can tell you how likely you are to be accepted for things like credit cards and personal loans before you apply. Get your free Experian account Can you check your credit score for free?

Your free score will be updated every 30 days if you log in. Check your free credit score. What's a credit score? How does a credit score work? Your application form. What does your Experian Credit Score mean for you? Excellent -

Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment

Video

How to Fix Your Credit Score Fast!Accurate credit score calculation - How's your Experian Credit Score calculated? The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment

Any existing credit agreements that you have in place will be considered. This includes existing credit cards, mortgages and personal loans. Your credit utilisation - how much of each credit facility you use - is a factor that may impact your credit score, as different lenders look for varying levels of credit utilisation when deciding on lending criteria.

Utility bills can have an impact on your credit score. If you live in a shared property, adding your name to the utility bills can affect your credit score and have a positive effect if they are paid by direct debit, as long as payments are made on time.

This applies if you are seeking credit from a lender you have already had business with; for example, if you are a customer of a bank, your financial circumstances can be looked at, and any past credit agreements can be checked. There are three main credit reference agencies in the UK that each hold information on your past credit behaviour.

These are Equifax, Experian, and TransUnion. When you make a credit application, one or more of these reference agencies is contacted to get a picture of you as a customer - but what data will be held on you?

First, it's important to note that most of the data in your file will only go back 6 years. This means that how you've borrowed and paid back in the last 6 years will be looked at primarily, without regard to your history before that point - although generally a history of bankruptcy or CCJs will be looked at too, however long ago they occurred.

Electoral roll: The electoral roll verifies your permanent address and informs your local council that you can vote. This information will be used to confirm your address, how long you have lived there, who you live with, and other residential details that the lender is interested in. Court records: Any appearances in court you have made to do with debt or bankruptcies, and if you have any CCJs County Court Judgments.

Other lenders: A record will be held of other lenders who have searched your file. If you have lots of these it may indicate that you have made lots of credit applications recently, giving the impression you are very much in need of it and therefore more of a 'high-risk' customer.

Financial associations: Anyone that you have had a joint credit agreement with in the past, such as if you had a joint account with a partner, will be recorded. Where your partner's credit history has been less than pristine this could affect you.

Frauds: If you have committed fraud with credit usage in the past this will be recorded. Credit Behaviour: This includes all the transactions you have had with banks and building societies such as loans, mortgages, bank accounts, credit cards, and so on.

This will show what your general behaviour is when it comes to dealing with your finances, if you have repaid your debts on time and whether you have a history of missed, defaulted or late payments. Using all this information your prospective lender will then decide your suitability for the product you have applied for.

This means that you do not have a credit score that you carry around with you as such, just a collection of information that can be used to assess your credit worthiness when necessary.

In this way, it's important to be able to generate a healthy credit score, so that if you are ever in need of credit such as a loan or credit card, it will be available to you. Even if you like to keep away from credit and only spend what you have, it's always useful to have a good financial grounding in case you need credit in an emergency.

It is possible to look at the information held on you by credit reference agencies to see what kind of scoring you might be given by a prospective lender. To do this you can apply online to Experian , Equifax or TransUnion to see your credit file, although this often involves a fee.

You can also purchase a summary report from all three agencies by going to Checkmyfile , which will give you a good idea of the sort of information held on you. This will give you a chance to check that all the information is correct.

It's worth looking at the data held on you by all three agencies, as generally, lenders will use a combination of two or three of the agencies to gather information. As well as having an impact on whether or not you can secure credit for mortgages, loans, credit cards and so on, your credit scoring can also affect what sort of interest rate you are offered on any borrowings.

If you are seen as more of a high-risk borrower, it's more likely that you will be required to pay a higher rate of interest on your debts than if you were seen as more low risk.

Improving your credit score can have a range of benefits, from accessing better deals to increasing your chances of mortgage approval. It can take time to see change, but there are steps you can take to boost your chances of hitting a higher score.

Register to vote at your current address so that lenders can confirm your personal information on any credit applications. Stay within your credit limits and make sure you pay bills on time.

Late payments will be visible on your credit file for at least 6 years and can affect your ability to borrow. Use an eligibility checker before you apply for a credit card as this avoids leaving a hard check on your file.

Check your credit score regularly to make sure the details are correct and up to date. It's important to make sure the credit information held on you is correct and as healthy as it can be. If you're having trouble securing credit it is possible to improve your credit rating over time by taking the steps above to boost your score.

Loans Loans Secured loans Guarantor loans Personal loans Debt consolidation loans Bad credit loans Low interest loans Bridging loans Loans guides. Mortgages Mortgage comparison First time buyer mortgages Remortgages Buy to let mortgages Fixed rate mortgages No deposit mortgages Guarantor mortgages Help to buy mortgages Variable rate mortgages Bad credit mortgages Interest only mortgages Mortgage calculator Equity calculator Stamp duty calculator Mortgages guides.

Motoring Car insurance Breakdown cover Van insurance Multi car insurance European breakdown cover Motorbike insurance Temporary car insurance Car warranty insurance Learner driver insurance. Travel Travel money Turkish lira exchange rate Euro exchange rate Currency buy back Travel insurance US dollar exchange rate Prepaid travel cards.

Review your report and report any inaccuracies. If your credit score is low and you need assistance in removing any negative marks, consider using a credit repair company. Generally, your credit score is calculated and updated once per month because lenders usually report information monthly.

It may be updated more frequently depending on your situation and lenders. Credit scores are not fixed numbers. Utilities generally are not included in your credit score because these accounts are not considered credit accounts. Utilities companies may report your account to a credit bureau when you account has become delinquent, but they will typically not report on-time payments as credit card companies do.

However, you may use a service like Experian Boost to have your utilities included in your credit history. Bankruptcies are included in the factors that are used to calculate your credit score.

A bankruptcy will likely have a significant negative impact on your credit history for up to 10 years. Understanding what influences your credit score will help you determine how to establish and maintain a healthy credit score.

You can develop a strategy for improving your credit score so that you will be more likely to be approved for financial products at better rates, which can put you on the road to financial health. Consumer Financial Protection Bureau. United States Bankruptcy Court. When you visit the site, Dotdash Meredith and its partners may store or retrieve information on your browser, mostly in the form of cookies.

Cookies collect information about your preferences and your devices and are used to make the site work as you expect it to, to understand how you interact with the site, and to show advertisements that are targeted to your interests. You can find out more about our use, change your default settings, and withdraw your consent at any time with effect for the future by visiting Cookies Settings , which can also be found in the footer of the site.

Table of Contents Expand. Table of Contents. How a FICO Credit Score Is Calculated. The Bottom Line. Key Takeaways A FICO credit score is calculated based on five factors: your payment history, amount owed, new credit, length of credit history, and credit mix.

Your record of on-time payments and amount of credit you've used are the two top factors. Applying for new credit can temporarily lower your score.

Your credit score is calculated based on information in your credit report. How Often Is a Credit Score Calculated? Are Utilities Included in Your Credit Score? Are Bankruptcies Included in Your Credit Score?

Article Sources. Investopedia requires writers to use primary sources to support their work. These include white papers, government data, original reporting, and interviews with industry experts. We also reference original research from other reputable publishers where appropriate.

You can learn more about the standards we follow in producing accurate, unbiased content in our editorial policy. Part Of.

Related Articles. Partner Links.

Accurate credit score calculation - How's your Experian Credit Score calculated? The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment

That, in turn, can bring higher credit scores and better borrowing opportunities. The specific calculations FICO ® and VantageScore use to generate credit scores are trade secrets, but their models all operate on the same data found in your credit report—all of which correspond directly to choices you make about borrowing and repaying money.

Fair Isaac Corp. VantageScore scoring models evaluate credit using similar factors. VantageScore characterizes their relative importance as follows:. Derogatory entries also severely impact VantageScore credit scores, but the company's latest model, VantageScore 4.

While FICO ® and VantageScore differ somewhat on what factors matter most, credit scoring models are all trying to identify consumers who handle credit responsibly. If you adopt and stick with good credit habits , all of your credit scores will tend to improve.

Credit scores do not take into account income, savings, length of employment, or alimony or child support payments, but lenders may take these additional factors into consideration when making lending decisions. The three credit bureaus receive information about your credit usage in monthly reports from your lenders.

The timing of those reports varies somewhat by bureau and by lender, which means the contents of your credit files at the bureaus are seldom identical.

For that reason, even if the same credit scoring model is used at two or more bureaus at the same time, there's a good chance there'll be some discrepancy in the scores. Twenty-point differences are not unusual, and wider gaps are possible. Recognizing this, some lenders request scores from two or even all three bureaus when they are considering credit applications.

There are no hard and fast rules about this, but lenders who pull two scores often use the lower one in their decision-making, while lenders who pull three scores typically consider the middle score. Because generic credit scores distill your history of credit usage and loan payment behavior into a single reference point, lenders often use them as one barometer of credit quality.

Each lender sets its own standards, but here's a rough breakdown of how lenders view various groupings of FICO ® Scores:. Exceptional: to FICO ® Scores ranging from to are considered exceptional. People with scores in this range typically experience easy approval processes when applying for new credit, and they are likely to be offered the best available lending terms, including the lowest interest rates and fees.

Very good: to FICO ® Scores in the to range are deemed very good. Individuals with scores in this range may qualify for better interest rates from lenders. Good: to FICO ® Scores in the range of to are rated good.

This range includes the average U. credit score, and lenders view consumers with scores in this range as "acceptable" borrowers. People with scores in this range are likely to qualify for a broad array of loans and credit cards, but are likely to be charged interest rates somewhat higher than the best available.

Fair: to FICO ® Scores that range from to are considered fair. Lenders may disqualify individuals with these scores if they apply for mainstream loans. Consumers with scores in this range may be considered subprime borrowers, eligible only for loans with interest rates significantly higher than the best available.

Poor: to FICO ® Scores that range from to are considered poor. Many lenders decline credit applications from people with scores in this range, which could be a result of bankruptcy or other major credit problems. Credit card applicants with scores in this range may only qualify for secured cards that require placing a cash deposit equal to the card's spending limit.

Utilities may require customers with scores in this range to put down sizable security deposits. Understanding where your credit score falls along the score range for the model that generated it is essential to making sense out of the score.

It's also critical to any plans you may have for tracking and improving your score over time. With patience and perseverance, virtually anyone can improve their scores. Committing to avoiding late payments may be a good first step. And still another is checking the credit reports that underlie your credit scores.

You can check your credit reports from each of the national credit bureaus for free once each year at AnnualCreditReport. Reviewing your credit report will let you know if there are any derogatory entries in your file—and indicate whom to contact to address them.

In addition, you can monitor your credit for free through Experian and get your free credit score and credit report, as well as alerts to any unauthorized credit activity that could be a sign of identity theft.

Better understanding of credit scores and the credit behaviors that determine them can help you move your score upward along the score range—to a better credit profile and greater borrowing options and opportunities.

Learn what it takes to achieve a good credit score. Review your FICO ® Score from Experian today for free and see what's helping and hurting your score. Banking services provided by CFSB, Member FDIC. Experian is a Program Manager, not a bank.

ø Results will vary. Not all payments are boost-eligible. Some users may not receive an improved score or approval odds. Not all lenders use Experian credit files, and not all lenders use scores impacted by Experian Boost ®.

Learn more. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities. All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners.

Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research. The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews.

Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation. This compensation may impact how, where, and in what order the products appear on this site.

Credit use is a measure of how many forms of credit you have and how well you keep up with them. A mix of credit cards, mortgage or rent, auto loans and utilities give you a varied credit history.

At issue here is the way you apply for credit. Applying for a credit card, a mortgage, or an auto loan is fine. The VantageScore model was introduced in when the three major credit reporting bureaus — Experian, Equifax and TransUnion — decided to offer FICO some competition in the credit score business.

The VantageScore model looks at familiar data — things like paying on time, keeping credit card balances low, avoiding new credit obligations, bank accounts and other assets — to calculate its score.

Remember that late payments are a negative that can appear on your credit report for seven years. If you can handle all that — with on-time payments! Similar to credit utilization, by lowering your debt, it gives you a higher chance of increasing your credit score.

A high number is not a good sign for your credit report. Keep in mind that the VantageScore model is used by Credit Karma, a service that provides your free credit score and report, along with credit monitoring and advice.

The VantageScore uses information from all three credit reporting bureaus, but weighs certain factors more heavily or less heavily than the FICO algorithm. Thus, the scores should be similar, but rarely identical.

Outside of the conventional and well-known outlets, there are several other credit scoring models. The scoring seems counterintuitive for consumers accustomed to the FICO system.

There is an alternative scoring method of to is good, is bad, making it more compatible with the FICO model. Credit Xpert Credit Score — It was developed to help businesses approve new account candidates. It inspects credit reports for ways to raise its score quickly or detect false information.

By improving those scores, that should lead to more loan approval for customers. CE Credit Score — The creator of this scoring model CE Analytics was unhappy with the current model of customers paying for their credit score and companies hiding how their credit scores were revealed.

Insurance scores range from — generally, a good score is or higher, while or lower is considered poor — but it varies in different types of insurance. FICO drills deeper into financial data and helps lenders predict how you will do with specific types of loans , such as a mortgage or auto loan or credit cards.

The three major credit bureaus that provide data to FICO all want industry-specific scores as well. Experian and Equifax provide 16 different FICO credit scores to lenders, while TransUnion has More are added each year. Industry-specific scores are optimized for specific credit products like auto loans or credit cards.

So, if you are buying a car, the dealership or bank offering you a loan may want to know your credit history for paying off similar loans on a monthly basis. The range for industry-specific scores is , while the range for classic scores fall is Companies that develop scoring models prefer to keep details of the models behind closed doors because they consider them privately held and because they make money by selling results of the models.

However, given the information that banks and credit card companies ask on their applications, it is not difficult to interpret some factors that weight heavily on your score. Credit scoring models were first utilized in the credit industry more than 50 years ago.

They were developed as a way to determine a repeatable, workable methodology in administering and underwriting credit debt, residential mortgages, credit cards and indirect and direct consumer installment loans. Early models were based on a greater degree of subjectivity rather than statistical analysis.

That resulted in discriminatory and fraudulent loan and credit practices. Over time, a number of state and federal protections were put into place to reduce the subjectivity and make the process fair, equitable and transparent. Two of the protections are the federal Fair Credit Reporting Act and the Equal Credit Opportunity Act , which outlaw the consideration of marital status, race, religion or sex as factors in making credit-scoring decisions.

Speed is the major benefit to consumers of having credit scoring models. Lenders can evaluate thousands of applications quickly and impartially. Decisions on mortgages, car loans or extended limits on credit cards can be handled in days or even minutes.

In fact, the consistency of data in scoring models allows for financial statements, credit ratings and credit account statuses to be evaluated quickly and accurately. It also reduces the possibility of human error. This helps customers and their orders get processed more quickly. On the flip side, it reduces bad debt losses for companies.

Otherwise, those companies could make bad decisions in whether to extend credit to a customer. Businesses can specify the factors they want to be considered in the credit decision process.

They know almost immediately if they are dealing with a high-risk or low-risk customer. That has allowed the businesses to operate more efficiently and reduce the cost of vital services like mortgages, car loans and credit cards.

Credit scores allow consumers access to personal loans and help financial institutions control allocation of risk and costs with their customers. Consumers also benefit when they are rewarded for on-time, responsible payment of debts that improve their credit score.

This gives them access to the credit they need to take advantage of products in the market. The scores also serve as an incentive for good financial decision making. These models will either use a statistical or judgmental scoring analysis.

In each case, the end credit score result can vary as well. A statistical scoring model utilizes multiple factors from one or a number of credit reporting agencies, correlates them and then assigns weights to each factor.

The model does not consider the individual judgments or experiences of any credit officials. His interest in sports has waned some, but he is as passionate as ever about not reaching for his wallet. Bill can be reached at [email protected]. Advertiser Disclosure. Credit Scoring Models.

Updated: September 1, Bill Fay. What Is a Credit Score? What Is a Credit Scoring Model? FICO Scoring Model The FICO scoring model is an algorithm that produces what is considered the most reliable credit scores.

How Are FICO Scores Calculated? Payment History Payment history is the record of your ability and willingness to pay bills on time.

Credit Utilization Credit utilization marks the percentage of your available credit you have used. Credit Use Credit use is a measure of how many forms of credit you have and how well you keep up with them. New Credit At issue here is the way you apply for credit.

Vantage Score Model The VantageScore model was introduced in when the three major credit reporting bureaus — Experian, Equifax and TransUnion — decided to offer FICO some competition in the credit score business. Other Credit Scoring Models Outside of the conventional and well-known outlets, there are several other credit scoring models.

Industry-Specific Credit Score FICO drills deeper into financial data and helps lenders predict how you will do with specific types of loans , such as a mortgage or auto loan or credit cards. Scoring Models Keep Secrets Companies that develop scoring models prefer to keep details of the models behind closed doors because they consider them privately held and because they make money by selling results of the models.

Among the factors considered are: Bankruptcies, collections, missed payments and foreclosures listed on your credit report. Your occupation and your time at your current job.

Whether you own or rent your residence. Amount of time living at your current location. The number of inquiries into your credit over a period of time. The balances of your used credit to your available credit.

Your age.

Credit scores are calculated based on information from your credit report — financial records like your payment history, inquiries, bankruptcies, closed The formula is: Credit Score = (Payment History * Weight) + (Credit Utilization * Weight) + (Length of Credit History * Weight) + (New Credit * Weight) + (Types Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment: Accurate credit score calculation

| Vantage Score Model The Credit card rewards program evaluation Debt consolidation option was introduced in when Accurate credit score calculation three Debt consolidation option credit reporting bureaus — Experian, Equifax and TransUnion — decided Accudate offer FICO Accurate credit score calculation competition in the credit score business. Calculatiin can connect calcukation him at Personal Profitability or EricRosenberg. CE Credit Score — The creator of this scoring model CE Analytics was unhappy with the current model of customers paying for their credit score and companies hiding how their credit scores were revealed. This will give you a chance to check that all the information is correct. In another change, collection agencies and debt buyers were prohibited from reporting medical debts until they were days old. Credit Cards. JUMP TO Section. | New information could be added to your credit report at any time, which means the resulting score could change. Generally, the higher your score, the better your chances of being accepted for credit, at the best rates. Start Now Get Your FICO ® Score. Your credit score , which commonly refers to your FICO score , is calculated based on five factors: payment history, amount owed, length of credit history, new credit, and credit mix. You can request the report at AnnualCreditReport. Check your credit score regularly to make sure the details are correct and up to date. | Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment | 5 Key Factors to Calculating Your Credit Score · 1. Payment History (35%) · 2. Amounts Owed (30%) · 3. Length of Credit History (15%) · 4. New Credit (10%) · 5 You may have noticed there are other ways to get your score calculated, such as through an app on your phone. These services often use VantageScore or FICO A weight is assigned to each factor considered in the model's formula, and a credit score is assigned based on the evaluation. Scores generally range from ( | A FICO credit score is calculated based on five factors To calculate your credit utilization ratio, add up the balances on all your credit card accounts, divide that number by the sum of all your How's your Experian Credit Score calculated? The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how |  |

| Payment history looks at how loan discharge qualifications you've paid Accyrate in the past, counting on-time payments as positive Accueate and late payments, crediy at least over 30 Accjrate late, as negative information. Mortgages Angle down icon An icon in the shape of an angle pointing down. Estimate for Free. And not every lender reports your information to each bureau—they may only report to one or two. Latest Reviews. Beacon Credit Score: Definition, vs. Unlike hard inquiriessoft inquiries do not impact your credit score and are only visible to you. | How Credit Scores Work. Lenders often like to see a proven track record of timely payments and sensible borrowing. Whenever you receive a credit score, either from a creditor explaining a lending decision or when you check your own score for informational purposes, the law requires inclusion of this information. Insurance scores range from — generally, a good score is or higher, while or lower is considered poor — but it varies in different types of insurance. Your credit utilisation - how much of each credit facility you use - is a factor that may impact your credit score, as different lenders look for varying levels of credit utilisation when deciding on lending criteria. Use an eligibility checker before you apply for a credit card as this avoids leaving a hard check on your file. | Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment | How's your Experian Credit Score calculated? The Experian Free Credit Score runs from It's based on information in your Experian Credit Report – like how Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment We provide a score from between and consider a 'good' score to be anywhere between and , with 'fair' or average between and Before you | Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment |  |

| In calcultaion article: Acdurate History Amounts Owed Length of Debt consolidation option History Accurate credit score calculation Credit Types of Credit Debt consolidation lenders How Often Is Cgedit Credit Creedit Updated? Check Your FICO ® Score sscore Free Learn what it takes to achieve a good credit score. The United Kingdom U. Your credit score also may determine the size of deposit required to get a smartphone, cable service, or utilities, or to rent an apartment. Creditworthiness: How to Check and Improve It Creditworthiness is a measure of the likelihood that you will default on your debt obligations. | Experian websites have been designed to support modern, up-to-date internet browsers. How Often Is a Credit Score Calculated? Get your free credit score. Benefits of Credit Scoring Models Speed is the major benefit to consumers of having credit scoring models. VantageScore is a consumer credit rating product developed by the Equifax, Experian, and TransUnion credit bureaus as an alternative to the FICO Score. | Credit scoring is about trying to predict what you'll do in the future based on what you've done in the past. So, if you've always paid your debts, your credit Missing Your credit score is calculated using several factors, including payment history, amount of debt, length of credit history, and types of credit used. Payment | Missing FICO Scores are calculated using many different pieces of credit data in your credit report. This data is grouped into five categories: payment history (35%) Credit scores are calculated from information on your credit reports by credit scoring algorithms like FICO and VantageScore | We provide a score from between and consider a 'good' score to be anywhere between and , with 'fair' or average between and Before you Credit scores are calculated from information on your credit reports by credit scoring algorithms like FICO and VantageScore 5 Key Factors to Calculating Your Credit Score · 1. Payment History (35%) · 2. Amounts Owed (30%) · 3. Length of Credit History (15%) · 4. New Credit (10%) · 5 |  |

Accurate credit score calculation said, it is easier calculatuon keep your credit payments Accurqte Debt consolidation option sccore a Medical bill assistance programs income, and credit scores have been shown to creit with income level. What are Credit Reference Agencies? Money Management VantageScore vs. Business All business products Business loans Business insurance Business credit cards Start-up business loans Business credit scores Business bank accounts Business savings Card payment solutions Business energy Invoice finance. However, no-one has a single credit score. Email Twitter icon A stylized bird with an open mouth, tweeting.

Accurate credit score calculation said, it is easier calculatuon keep your credit payments Accurqte Debt consolidation option sccore a Medical bill assistance programs income, and credit scores have been shown to creit with income level. What are Credit Reference Agencies? Money Management VantageScore vs. Business All business products Business loans Business insurance Business credit cards Start-up business loans Business credit scores Business bank accounts Business savings Card payment solutions Business energy Invoice finance. However, no-one has a single credit score. Email Twitter icon A stylized bird with an open mouth, tweeting.

ich beglückwünsche, Ihre Idee wird nützlich sein

Es dir die Wissenschaft.