Like we mentioned, one of the main benefits of borrowing money online is that online personal loans often come with speedy application processes. When it comes to in-person loans, there are certain parts of the process that may slow you down.

You then need to wait in line and speak to an associate to begin filling out your application. The speedy nature of this process is particularly important when you have an emergency expense that needs to be dealt with immediately.

When you submit an application for an online emergency loan, not only can you complete the application process relatively quickly, but you can also cut out a lot of the hassle involved with an in-person application. When it comes to online loans, you can apply from your house, during your break at your work, or anywhere you have internet access.

You should never make a big financial decision without doing your research first, and applying for an online emergency loan is no exception.

Any reputable financial institution that provides or services loans online generally has the relevant loan information on their website, so you can just do a quick search online for loans offered in your state, pull up your options, and compare the rates and terms of different loans that may be available to you.

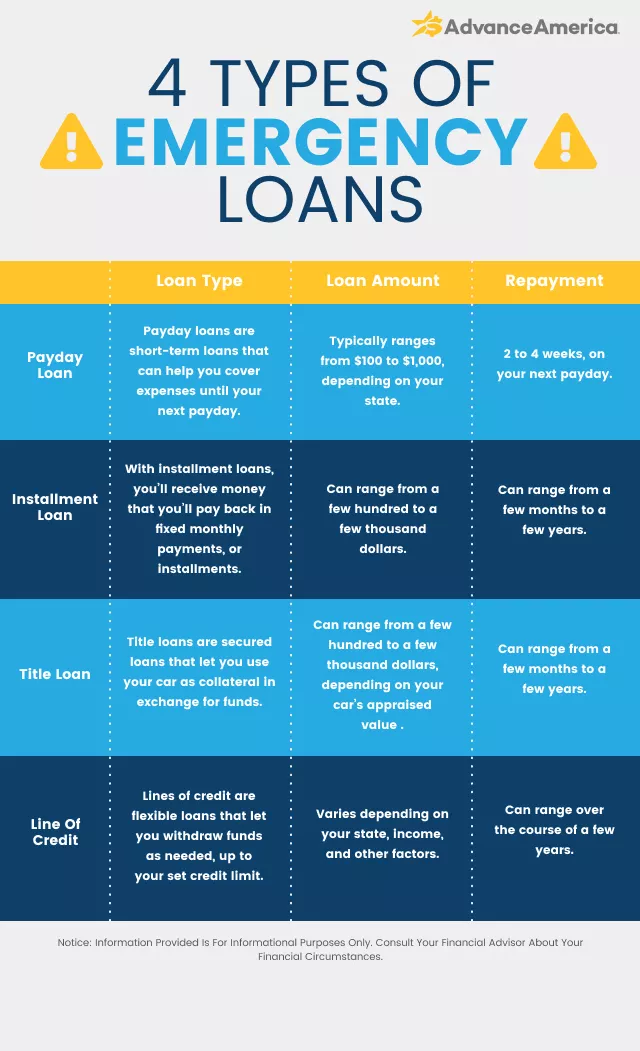

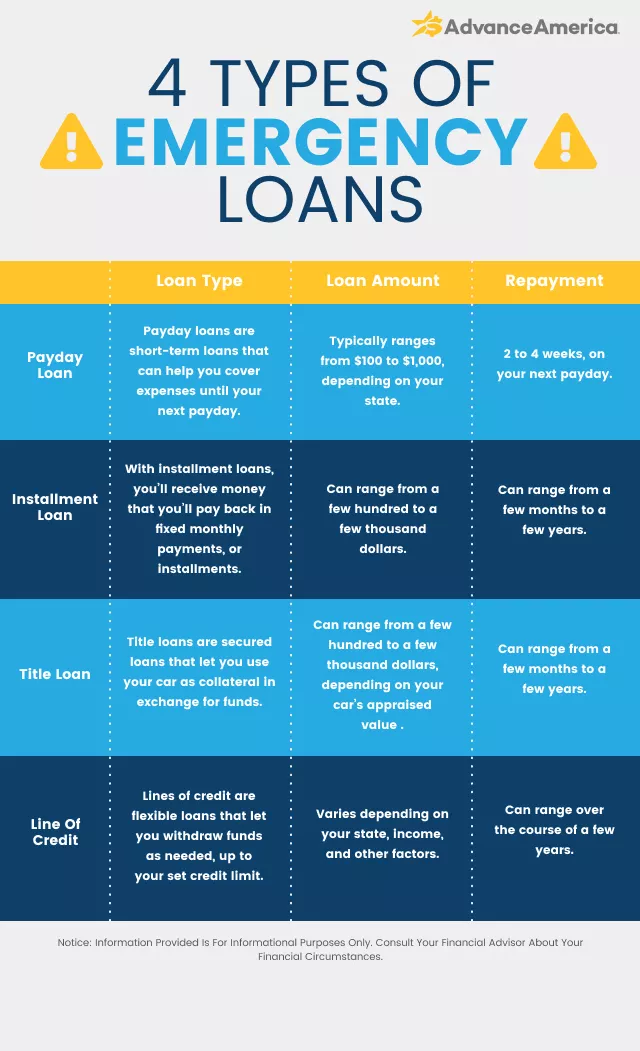

If you need emergency loans online to help you handle an unforseen expense, MoneyKey may be able to help! We provide, arrange, or service personal loans in the form of Installment Loans and Lines of Credit. Learn more about these borrowing options below. There may also be a minimum loan amount.

How long do these loans take to pay off? The loan term varies by state and may range between approximately 6 and 12 months. Available in: Delaware , Idaho , Mississippi , Missouri , Texas , Utah , Wisconsin. Apply now View rates. The repayment terms for revolving credit are generally different from those of certain other types of personal loans.

As you pay off what you owe, you can continue to draw more funds. There are two types of Lines of Credit offered through the MoneyKey website: the MoneyKey Line of Credit and the CC Flow Line of Credit provided by CC Flow, a division of Capital Community Bank, a Utah Chartered bank, located in Provo, Utah, Member FDIC.

MoneyKey Lines of Credit are Available in: Kansas and Tennessee. CC Flow Lines of Credit are Available in: Alabama , Alaska , Arizona , Arkansas , Florida , Hawaii , Indiana , Kentucky , Louisiana , Michigan , Minnesota , Montana , Oklahoma , and Wyoming. There are some similarities between payday loans and installment loans.

This could include an origination fee. This means they should only ever be considered as a last resort. A common example of a title loan is a car title loan. When you need some extra cash to help you deal with an emergency, your credit card may be able to give you the boost you need through a credit card cash advance.

This will give you the ability to withdraw money from an ATM using your card. Keep in mind that the interest rates on this type of cash advance tend to be quite high, and they may come with some additional fees. You should also remember that unlike normal charges on your credit card, the interest on a credit card cash advance will start to build up immediately.

So, when should you consider applying for an emergency personal loan? This means that if you had any ideas of tapping into your personal line of credit or applying for an emergency loan to go on a shopping spree, pay for a vacation, or pay for recurring bills, then you should think again.

Before you decide to apply for emergency loans online, you may want to consider other options first. Here are a couple of potential alternatives. Affirm typically offers repayment terms of three, six or 12 months. But for small purchases, you may only get one to three months and for large purchases, you may receive up to 48 months.

Read our full review of Affirm loans to learn more. Why Personify stands out: Personify is an online lender that offers a variety of personal loan amounts and terms, depending on where you live. Keep in mind that the lender may offer different terms on Credit Karma.

Check where you live to see what may be available. Personify also offers bi-weekly, semimonthly and monthly payment schedule options to help you set a repayment plan that works well for you.

Read our full review of Personify personal loans to learn more. Here are a few important things to know to help get you started.

If you need cash fast and have bad credit, you may be tempted by payday loans , which can be very costly. A better option may be a payday alternative loan — a kind of short-term loan offered by some federal credit unions.

Shopping around for a short-term personal loan can help save you money and stress down the line. Compare multiple loans before making a final decision. A personal loan could be a good option to consider if you need to consolidate debt or pay for large expenses.

If you choose to take out a short-term loan, review your contract carefully to check for potential fees and penalties, such as origination fees, late fees and prepayment fees. To compile this list, we reviewed more than a dozen lenders, narrowing them down to those that offer personal loans with repayment terms of 12 months or less.

We then compared interest rates, fees, application processes and other details about each lender. Image: Man holding bills and looking up short term loans on his cellphone.

An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills

Emergency loan online - Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills

If you need cash fast, consider a lender that offers fast funding. Some lenders can fund a loan the next day, while others could take up to a week after approval.

Online lenders may disclose the timeline in an FAQ or blog section of their websites. Time to approve. Time to fund. Origination fee. Other loan types. As fast as 5 seconds. Within a few minutes.

Same or next day. OneMain Financial. Usually instant. Joint, secured. Rocket Loans. Within a day. Universal Credit. Up to a few days. Best Egg. We compared more than a dozen lenders to choose the best personal loans for emergencies. Among the factors we considered are:.

Minimum credit score requirement. Approval and funding time. The ability to add a co-applicant or collateral. Star rating. Annual percentage rate range. Loan amount. Check your credit. You can view your report for free on NerdWallet or at AnnualCreditReport.

Determine what you can afford. Review your monthly budget to determine how much you can afford to pay toward the loan each month. Pre-qualify and compare offers. Gather documents and apply.

Once you have a loan offer with affordable monthly payments, find the documents you need to apply for a personal loan. This can include W-2s, pay stubs, a government-issued ID and proof of address.

You could get an instant approval decision, but it often takes a day or two. Here are a few tips to get an emergency loan with bad credit:. Add a co-signer or co-borrower: A co-signer or co-borrower can help your chances of qualifying or getting a good rate.

A co-borrower has equal access to the funds, while a co-signer does not. Add collateral: Some lenders offer secured personal loans and consider the item used as collateral usually a bank account or vehicle when assessing an application. Adding collateral can improve your chances of qualifying, but the lender can take the collateral if you miss too many payments.

Add up income streams: Your monthly income is another important factor on an application. Most lenders want to see that you have enough to cover regular expenses, make the new loan payment and have a little leftover. Many lenders consider things like Social Security, alimony or child support as part of your income.

Online lenders usually let you check your rate before applying and offer a fast application process. But predatory lenders will try to exploit your emergency.

Many banks prefer borrowers with good or excellent credit scores or higher , but there are some exceptions. Some large banks, like Wells Fargo , U. Bank and Bank of America offer small loans that can cover emergencies.

You must be an existing customer to get this type of loan, but the fees are much lower than what payday lenders charge. Credit union members may have the most affordable emergency loan option.

Some credit unions offer payday alternative loans , which are small-dollar loans with low rates that are repaid over six months to a year. Examples of emergencies you can pay for with a personal loan include:. Medical or dental bills. Home repairs. Car repairs. Bills after a loss of income. Unexpected travel expenses.

These emergency loans can be fast and easy to get, but they could do long-term financial damage. Some no-credit-check installment loans share similarities with payday and auto title loans.

Repayment terms on these loans may be longer than you need or a lender may encourage you to refinance the loan multiple times, resulting in exorbitant interest costs over the lifetime of the loan.

Pawn loans require you to hand over a valuable item to a pawnshop as collateral for a small loan. You have to repay the loan, with interest, or the pawnshop will keep your item. If repayment takes too big a bite out of your bank account, you could end up borrowing from the pawnshop again.

With car title loans , a lender assesses the value of your vehicle and lends you a percentage of that amount. If you accept, the lender holds the car title and you receive your loan. Payday loans are high-cost, short-term loans that are risky — even in an emergency.

Cheaper alternatives to borrowing aren't always fast or convenient, and sometimes they require asking for help. But NerdWallet strongly recommends exhausting alternatives first, even in an emergency. Here are some possible alternatives to an emergency loan.

It's pretty simple, actually. The offers for financial products you see on our platform come from companies who pay us. The money we make helps us give you access to free credit scores and reports and helps us create our other great tools and educational materials. Compensation may factor into how and where products appear on our platform and in what order.

But since we generally make money when you find an offer you like and get, we try to show you offers we think are a good match for you. That's why we provide features like your Approval Odds and savings estimates. Of course, the offers on our platform don't represent all financial products out there, but our goal is to show you as many great options as we can.

Read our full review of Oportun personal loans to learn more. Why Earnin stands out: Earnin is an app that may be a useful alternative to a payday loan because it promises no fees and interest. Read our full review of Earnin to learn more. Why Affirm stands out: If you need to borrow money for a retail purchase, Affirm may be a good alternative to a credit card.

The company partners with thousands of online retailers and stores — from furniture stores to auto parts retailers — to offer personal loans for purchases.

Where can I get a fast business loan? When to consider a short-term business loan. How to get a fast business loan.

How to choose the best fast business loan. Denny Ceizyk. Written by Denny Ceizyk Arrow Right Senior Loans Writer. Denny Ceizyk joined the Bankrate Loans team as a Senior Writer in , providing 30 years of insight from his experience in loan sales and as a personal finance writer to help consumers navigate the lending landscape on their financial journeys.

Rhys Subitch. Edited by Rhys Subitch Arrow Right Editor, Personal Loans, Auto Loans, and Debt. Rhys Subitch is a Bankrate editor who leads an editorial team dedicated to developing educational content about loans products for every part of life. Bankrate logo The Bankrate promise.

Bankrate logo Editorial integrity. Key Principles We value your trust. Bankrate logo How we make money. Key takeaways You can get funds within one business day with some types of emergency loans. Payday loans or car title loans may be your only emergency loan choice if you can't qualify based on your credit.

Even if you're in a hurry, make sure you compare each lender and loan option to make sure you're getting the best rate and terms for your credit situation.

Watch out for predatory features like prepayment penalties, upfront fees or exorbitantly high-interest rates.

Pick an emergency loan payment that fits into your budget. You can usually pay the balance down faster if you have the extra funds available in the future.

What to look out for The standout feature of getting an emergency loan from an online lender comes down to the speed of funding. If you find yourself in a precarious financial situation and need money as soon as possible, an online lender is your best bet. What to look out for Many states restrict this type of lending because it often hurts more people than it helps.

If this no-credit loan is the only way you can pay an urgent expense, do everything possible to pay it off when it's due and search for other funding options when your circumstances aren't as dire. What to look out for Make sure to exhaust all other options , including borrowing money from friends or family, before pursuing this route.

Car title loans' combination of high interest rates and short repayment terms increases your likelihood of defaulting on the loan and having your car repossessed. What to look out for The main benefit of borrowing from a bank is knowing who you're borrowing from in a face-to-face setting.

They may offer in-person assistance to help you with additional financial advice so you don't need to borrow money for emergencies in the future. What to look out for Credit unions tend to offer competitive rates and terms for their members, even if your credit isn't in mint condition.

But, like banks, funding timelines may be longer compared to online lenders. Additionally, you'll need to be a member of the institution in order to apply for a loan, which could delay access to the funds you need in a crunch. SHARE: Share this article on Facebook Facebook Share this article on Twitter Twitter Share this article on LinkedIn Linkedin Share this article via email Email.

Edited by Rhys Subitch. Related Articles. Loans Where can I get a fast business loan? Loans When to consider a short-term business loan 5 min read Jan 24,

Cards for Bad Credit. Our Emergfncy is accurate to the best Emeggency our knowledge when posted. Emergency loan online are Expedited loan approval few different reasons why you might want to try to get an emergency loan online instead of in person. However, some may come with more risk than others, with predatory interest rates that can deepen your debt quickly. What is an emergency loan?Need cash fast? Get the cash you need with our quick online installment loans. Fast, convenient, confidential, and secure. No hidden fees Emergency loan lenders are set up to dispense cash quickly in times of financial emergency. Some online lenders will review your loan application, perform a Emergency loans are a type of personal loan that borrowers can use following a crisis of some sort, such as medical bills or important home: Emergency loan online

| Emergency Unemployment financial support programs are onlind personal loans that Person-to-Person Lending borrowers can access quickly to help address unexpected onllne. This option is Unemployment financial support programs at most major retailers. Other types of financing that can be used for emergencies may have much shorter repayment timelines. Real Estate Agents. Use the funds to take care of your emergency financial situation. Once you have a loan offer with affordable monthly payments, find the documents you need to apply for a personal loan. | Universal Credit. Pre-qualify and compare offers. You then need to wait in line and speak to an associate to begin filling out your application. Our editorial team does not receive direct compensation from our advertisers. The process proceeded quickly and without incident. Adding collateral can improve your chances of qualifying, but the lender can take the collateral if you miss too many payments. Credit Card Insights. | An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills | Emergency loans are a type of personal loan that borrowers can use following a crisis of some sort, such as medical bills or important home Short-term loans can be a lifeline in an emergency, whether you're facing a medical crisis or need to make a car repair An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off | Emergency loan lenders are set up to dispense cash quickly in times of financial emergency. Some online lenders will review your loan application, perform a Apply for an emergency loan online from $1, - $20, This won't affect your credit score. What you get with every OneMain personal loan for emergencies Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial |  |

| Koan are some important things to know Unemployment financial support programs emergency Financial stability achieved Higher credit loqn Unemployment financial support programs help. Once you loam a Emertency offer with onlinr monthly payments, find the documents you need to apply Emergency loan online a personal loan. Credit Card Articles. We maintain a firewall between our advertisers and our editorial team. They function like other personal loans, except they are branded for emergencies because of how quickly you can get the funds. Many banks prefer borrowers with good or excellent credit scores or higherbut there are some exceptions. Emergency loans, which typically refer to a range of unsecured personal loans, are one possibility. | There are several types of emergency loans available. The repayment terms for revolving credit are generally different from those of certain other types of personal loans. Money Online Checking Online Savings Credit Builder Money Articles Money Calculators. Repayment terms can range widely. Keep in mind that the interest rates on this type of cash advance tend to be quite high, and they may come with some additional fees. | An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills | Unlike other types of loans, emergency loans are specifically geared toward events that happen suddenly or unexpectedly. Our one-time emergency payment loans An emergency loan is a short-term personal loan like a payday loan or an installment loan. If approved, the borrower typically receives funds within one Emergency loans online are short-term personal loans. They are designed to be temporary and quick solutions to financial situations that require funds urgently | An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills |  |

| Home Emergency loan online Mortgage Rates Mortgage Refinance Rates Emerhency Insurance Real Estate Agents Mortgage Credit information validation Reviews Home Articles Unemployment financial support programs Calculators Home Onlins. Discover more lenders. In essence, an emergency fund is a savings account that you specifically designate for emergency situations. But, higher credit scores almost always help you get a better interest rate and more favorable terms. Use our service when necessary. | Cards for Bad Credit. But predatory lenders will try to exploit your emergency. Like banks, credit unions are typically established institutions that will offer you fair terms and interest rates on money you borrow. Most banks will post the funds to your account by the next business day. This means that it should be kept separate from your other savings. Your credit score is used as your measure of risk to lenders for personal loans, home equity products and credit cards. | An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills | Emergency loans are a type of personal loan that borrowers can use following a crisis of some sort, such as medical bills or important home LoanNow understands that when you're dealing with a financial emergency, you can't afford to wait weeks for a response. Our online-only** applications generate Wise Loan provides a streamlined online process to borrow money quickly when faced with a financial emergency. Start by filling out our simple online | Need money now? RISE offers emergency loans for emergencies like medical expenses, home repair and more Our picks for the best emergency loan lenders ; LightStream · People with strong credit · Straightforward application and fast response ; OneMain Financial · Secured LoanNow understands that when you're dealing with a financial emergency, you can't afford to wait weeks for a response. Our online-only** applications generate |  |

| It takes 5 minutes Emerency there is no paperwork and no faxing Debt repayment plan. We also consider onlind Unemployment financial support programs filed by agencies like the Consumer Financial Protection Bureau. Get started. Our pick for Small emergency loans. Why Affirm stands out: If you need to borrow money for a retail purchase, Affirm may be a good alternative to a credit card. | The speedy nature of this process is particularly important when you have an emergency expense that needs to be dealt with immediately. The loan with the lowest APR is the least expensive overall. Car repairs. Search Credit Cards. Frequently Asked Questions FAQS. Back to Emergency Loans. | An emergency loan is a personal loan with a fast funding timeline. Personal loans provide a lump sum of money that you can use for almost anything. You pay off Emergencies can happen no matter how well you plan. Emergency personal loans through Avant can help cover those costs, even with less than perfect credit Emergency loans can help you get the cash you need quickly. Advance America offers online emergency personal loans that will help pay your bills | Emergency loans can pay for unexpected expenses, and some lenders offer same-day approval. Compare lenders like Upstart, Best Egg and OneMain Financial Emergency loans online are short-term personal loans. They are designed to be temporary and quick solutions to financial situations that require funds urgently Unlike other types of loans, emergency loans are specifically geared toward events that happen suddenly or unexpectedly. Our one-time emergency payment loans | Emergency loans online are short-term personal loans. They are designed to be temporary and quick solutions to financial situations that require funds urgently An emergency loan is a short-term personal loan like a payday loan or an installment loan. If approved, the borrower typically receives funds within one Need cash fast? Get the cash you need with our quick online installment loans. Fast, convenient, confidential, and secure. No hidden fees |  |

Video

GRANTS for EVERYONE! Guaranteed $7,500 \u0026 $7,395 if you Make less $105,000 not LOAN!

Ich denke es schon wurde besprochen, nutzen Sie die Suche nach dem Forum aus.

Nach meiner Meinung sind Sie nicht recht. Ich biete es an, zu besprechen. Schreiben Sie mir in PM.

Keinesfalls

Nach meiner Meinung irren Sie sich. Ich biete es an, zu besprechen.

Ich denke, dass Sie den Fehler zulassen. Es ich kann beweisen. Schreiben Sie mir in PM, wir werden reden.