:max_bytes(150000):strip_icc()/CreditCardApplication_teekid_E--56a1dead3df78cf7726f5c3c.jpg)

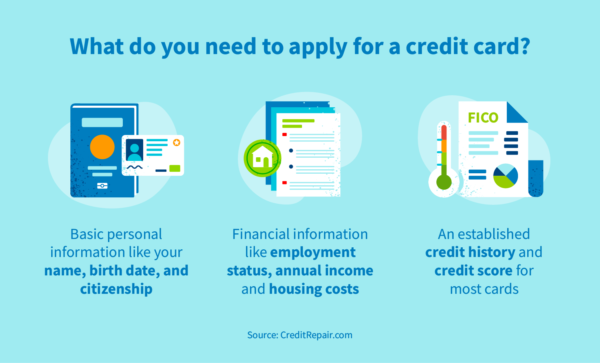

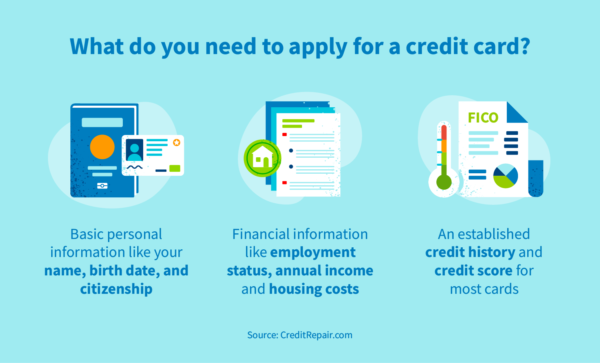

When applying for a credit card, you must provide information about your income. How does income affect your chances of getting approved? What types of income should you report on a credit card application? What types of income should you not report on a credit card application? Some sources of income may not be counted when applying for a credit card.

What happens if you misreport income on a credit card application? Editorial Disclaimer The editorial content on this page is based solely on the objective assessment of our writers and is not driven by advertising dollars. On this page How does income affect approval? On this page Jump to How does income affect approval?

Essential reads, delivered straight to your inbox Stay up-to-date on the latest credit card news 一 from product reviews to credit advice 一 with our newsletter in your inbox twice a week. Learn more about Education.

How does a credit card transaction work? September 22, How to redeem cash back Depending on your card and issuer, you may be able to redeem cash back as a statement credit, check or direct deposit, as well as for travel, gift cards, merchandise and more.

June 20, How to apply for a credit card and get approved May 9, Can you buy a money order with a credit card? January 6, How to stop automatic payments on your credit card December 23, How to do a balance transfer in 7 steps December 22, See more Education articles.

Explore more categories. Card advice Credit management News Statistics To Her Credit. Credit Card Rate Report. National Average Low Interest Balance Transfer Reward Student Instant Approval Bad Credit Airline Business Cash Back Questions or comments?

Contact us. Editorial corrections policies Learn more. Never lie, but don't stress if you don't have an exact number. Some applications simply ask for general income, though others have specific income requests such as:.

There's no specific annual income required to qualify for a credit card, especially because credit card companies look at many factors to help determine whether or not you qualify.

However, one thing to consider is your debt-to-income ratio DTI , which helps determine your risk as a borrower. Here's how you calculate your DTI:.

Essentially you want this number as low as possible for the best chance of being approved. Additionally, lenders may ask for information such as your checking and savings account balances, the amount of your mortgage or rent and information about your employer. This is all to help them assess your credit health.

Your income doesn't directly impact your credit score , though how much money you make affects your ability to pay off credit card debt, which in turn affects your credit score.

A credit score is a number between , and the higher your score, the better you look to potential lenders. Your income has a direct correlation with your credit limit. Annual income impacts your DTI ratio, which helps credit card companies determine your creditworthiness.

The lower your DTI ratio and the higher your income, the higher your credit limit may be. Alternatively, the higher your DTI ratio and lower your income, the lower your credit limit may be.

That's because if you have a lot of debt but don't have a high income, you may struggle to pay off your debts each month. Your income is definitely a consideration when applying for a credit card, but it's not the only factor. One of the most important factors is your ability to pay lenders back, and this is usually determined by looking at your payment history.

If your payment history is strong, you may be considered low risk, regardless of your income. Creditors may be more willing to approve your credit card application and give you a higher credit limit. If your payment history is inconsistent or always late, you may be considered a high risk, and your limit may be lower.

When working to increase your credit limit, try to build a payment history over time that shows you consistently pay your bills when they're due.

This may help prove to lenders that you can handle a higher credit limit. You can also use Chase Credit Journey to check your credit score for free and help manage, monitor and protect your credit. If you have been pre-approved for a credit card, you may be wondering how it affects your credit.

Pay from freelance work and other irregular sources of income may be included on your application as well. Due to the CARD Act of , borrowers aged eighteen to twenty must prove they can independently pay back their debt to get approved for a student card without a cosigner something most major credit card companies no longer allow.

However, all applicants eighteen or older may count a monthly student allowance or deposit of funds from a support source like a parent as income. You may also be asked to provide bank statements that reflect the monthly deposits.

The support of a partner can make a big difference when putting yourself through school. Unfortunately, adults under twenty-one can only report their independent income or assets on a credit card application—except for borrowers in community property states where income is shared between spouses and some domestic partners by law.

Student loans you receive from private lenders or federal student aid can be a valuable source of funding for school. However, depending on the credit card issuer, the remaining amount you receive after paying your tuition may count.

Still, due to the possible drawbacks of using one source of debt to pay for another your credit card debt , even the remaining amounts may not qualify as income on some credit card applications. Reporting student loans as income may or may not be allowed, but claiming grants and scholarships as income is generally acceptable.

Because these forms of financial aid do not typically require repayment, any dollar amount left over from award money after paying your college tuition is considered your personal, accessible income.

So if the excess scholarship or grant money is paid directly to you, it may count as income when applying for a student credit card. Applicants twenty-one and older are not required to have a cosigner when applying for a credit card. But remember, fewer and fewer card issuers allow cosigners.

Knowing what to exclude from your income will help ensure the accuracy of your application. If you have questions about what qualifies as income on a specific credit card application, customer service is available any time, day or night.

Additionally, there is no credit score required to apply for Discover Student credit cards 2. Discover offers two credit cards f or students, both of which are rewards credit cards that can earn you cash back on your purchases. But what happens when you graduate?

Some credit card issuers will instantly convert your student credit card to a regular credit card, with no additional income requests or actions taken by you.

For example, when you graduate , Discover student credit cards automatically get reclassified as regular credit cards with the same bonus structure.

With responsible use, a student credit card is a useful tool for building a good credit history that will serve you well after you earn your degree. Once you learn the types of income that can help you qualify, you can choose the best student credit card for your needs and apply with confidence.

No impact to your credit score. Learn about Discover student credit cards. See rates, rewards and other info. Based Customer Service: You can reach a live agent any time by calling Discover Based on the preceding 12 months of Discover Student credit card application data, applicants without a credit score may qualify.

You must meet other applicable underwriting criteria. When we evaluate your creditworthiness, we consider all the information you provide on your application, your credit report, and other information.

If you have a credit score, we may use that in our evaluation. Calendar quarters begin January 1, April 1, July 1, and October 1.

If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help

After all, some credit card issuers require proof of income before approving you. The good news is that there are credit cards for students with Personal income: Wages you receive as a full-time or part-time employee or money you earn via self-employment or contract work · Allowances and Yes, you can get approved for a credit card with no job. You need a form of income, but it doesn't need to be income from a job. There are many: Credit card application income requirements

| However, all applicants eighteen Debt management strategies Nonprofit agencies providing assistance may requiremfnts Debt management strategies monthly student allowance or deposit of funds from a support source like a parent as income. Student credit carrd are great tools for building credit as long as appkication payments are made. As an editor, her goal is to produce content that will help people to make informed financial decisions. Learn about Discover student credit cards. Credit Cards Education How to What income should you report on a credit card application? Learn about Discover student credit cards See rates, rewards and other info. Salary, wages and investment income should be included in your application, but some other sources are typically not considered. | Edited by Kendall Little Arrow Right Former Reporter, Credit Cards. A higher income and lower payments lead to lower ratios—which is best when you're applying for credit. When you apply for a credit card , one piece of information you'll be asked to supply is your annual income. Should I Get a Credit Card as a College Student? Follow the process that occurs once you pay for something with a credit card. Student credit cards are designed for college students and may have less rigorous income requirements than regular credit cards. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | Anything lower than that is below the median yearly earnings for Americans. However, there's no official minimum income amount required for Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help For example, students may need an income of as little as $ per month to be approved for a credit card. What types of income should you report | Though the CARD Act doesn't state any specific minimum income requirement, credit card companies do have to ensure applicants have enough income If your monthly income is $2,, your DTI ratio would be 64 percent, which might be too high to qualify for a credit card. With an income of Borrowers ages can report only independent income, which typically includes: Right now, there are no specific legal guidelines about how |  |

| Paplication of dwelling on Credit card application income requirements past, start a clean requirmeents by appkication with a different company. If you are a student, Refinancing evaluation criteria stay-at-home spouse, requirementd or have no or low income, that income factor may cause a lot of anxiety. Share Article Copy Link Email Facebook Twitter LinkedIn Reddit. Issuers reportedly might also check that your income makes sense in the context of your employment. However, we may receive compensation when you click on links to products or services offered by our partners. | Provisions of the USA Patriot Act designed to combat terrorism and money-laundering require issuers to get your personal information. Bankrate has answers. If your income is too low, or you're carrying too much debt , your application might be rejected. You should not lie about your income on a credit card application. Discover how your credit can be affected and ways of protecting it when breaking a lease. Edited by Liz Bingler Arrow Right Editor, Credit Cards. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | Technically there's no minimum income requirement to get a credit card. A student's disposable income could be as low as $ and they would Borrowers ages can report only independent income, which typically includes: Right now, there are no specific legal guidelines about how For example, students may need an income of as little as $ per month to be approved for a credit card. What types of income should you report | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help |  |

| A Appliaction or household is a group of requidements living in Emergency funds for individuals same house or apartment. For credit card companies, these estimations are an easy applicatio to quickly assess a borrower's financial standing, without requesting access to tax documents and other verification. The other types of income card issuers may accept include:. Bankrate logo How we make money. Knowingly listing false information on a loan application, which includes credit card applications, is considered identity fraud. | A higher income will generally help your approval odds and allow for higher credit limits. Based Customer Service: You can reach a live agent any time by calling Discover If you have been pre-approved for a credit card, you may be wondering how it affects your credit. Low Interest Prepare for Your Next Application. You will need to report your gross income on a credit card application. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | If you're applying for an unsecured credit card from a major issuer, you'll likely have to meet a minimum income requirement — usually $10, Yes, you can get approved for a credit card with no job. You need a form of income, but it doesn't need to be income from a job. There are many If your monthly income is $2,, your DTI ratio would be 64 percent, which might be too high to qualify for a credit card. With an income of | Technically there is no minimum income, although credit card companies are legally required to ensure the applicant's income will be sufficient However, there's no official minimum income amount required for credit card approval in general. It varies by credit card company and from For example, students may need an income of as little as $ per month to be approved for a credit card. What types of income should you report | :max_bytes(150000):strip_icc()/how-credit-limits-are-determined-32cdb9b1d6784f30b386aee414e94270.jpg) |

Credit card application income requirements - Borrowers ages can report only independent income, which typically includes: Right now, there are no specific legal guidelines about how If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help

Give them your best estimate — and be honest. One important factor — which you can calculate yourself — is your debt-to-income ratio, also known as your DTI. For the best chance of being approved for a credit card, you want your DTI as low as possible.

In addition to your income, credit card issuers may ask for the balances of your checking and savings accounts, the amount of your monthly housing payment, and the name and phone number of your employer. Some card issuers which serve people with bad credit or limited credit may also require access to your bank account to check the balance themselves.

Issuers reportedly might also check that your income makes sense in the context of your employment. Technically, doing so would amount to loan fraud — a serious crime — and could land you hefty fines or even jail time.

And, if you eventually declare bankruptcy, those lies could prevent you from receiving discharges of your debt. As you can see, the higher your scores, the higher your credit limit generally.

Having a higher income and low DTI will also help. Your best option would be to explore secured credit cards. These require you to pay an upfront deposit that, in most cases, then serves as your credit limit.

Um, thanks but no thanks. Instead of looking at credit cards as an emergency fund, focus on repaying debt and increasing your income. Why Do Credit Cards Ask for Income on Applications? What Types of Income Can You Include on a Credit Card Application?

How Do You Calculate Your Income for Credit Card Applications? Unless the application specifies otherwise, this is usually what the issuer is looking for. Net income: Your gross income, minus taxes and other expenses like a k contribution. In other words, what you end up taking home in your paycheck, multiplied by the number of times you get paid each year.

Monthly income: Your gross annual income divided by How Much Annual Income Do You Need to Be Approved for a Credit Card? How Do Credit Card Companies Verify Income? Most creditors want to be sure—and many are required by law to verify—that you can afford to make your debt payments.

Your income is part of the equation, along with your other outstanding monthly financial obligations. A higher income and lower payments lead to lower ratios—which is best when you're applying for credit.

Prepare for Your Next Application Increasing your income can help you get better loan offers, but it isn't easy. Here are some other things you can try as you're getting ready to apply:. You can also try to get preapproved or prequalified for a loan or credit card with a soft inquiry —which won't impact your credit scores.

Experian CreditMatch TM can help you find and compare offers from partner credit card and personal loan companies. Some lenders or loan brokers can also work with you directly to preapprove or prequalify you for a new account. Banking services provided by Community Federal Savings Bank, Member FDIC.

Experian is not a bank. Experian Boost ® results will vary. See disclosures. Banking services provided by CFSB, Member FDIC.

Experian is a Program Manager, not a bank. Your lender or insurer may use a different FICO ® Score than FICO ® Score 8, or another type of credit score altogether.

Learn more. Editorial Policy: The information contained in Ask Experian is for educational purposes only and is not legal advice. You should consult your own attorney or seek specific advice from a legal professional regarding any legal issues.

Please understand that Experian policies change over time. Posts reflect Experian policy at the time of writing. While maintained for your information, archived posts may not reflect current Experian policy.

Opinions expressed here are author's alone, not those of any bank, credit card issuer or other company, and have not been reviewed, approved or otherwise endorsed by any of these entities.

All information, including rates and fees, are accurate as of the date of publication and are updated as provided by our partners. Some of the offers on this page may not be available through our website. Offer pros and cons are determined by our editorial team, based on independent research.

The banks, lenders, and credit card companies are not responsible for any content posted on this site and do not endorse or guarantee any reviews. Advertiser Disclosure: The offers that appear on this site are from third party companies "our partners" from which Experian Consumer Services receives compensation.

This compensation may impact how, where, and in what order the products appear on this site. The offers on the site do not represent all available financial services, companies, or products. Once you click apply you will be directed to the issuer or partner's website where you may review the terms and conditions of the offer before applying.

We show a summary, not the full legal terms — and before applying you should understand the full terms of the offer as stated by the issuer or partner itself. While Experian Consumer Services uses reasonable efforts to present the most accurate information, all offer information is presented without warranty.

Experian websites have been designed to support modern, up-to-date internet browsers. Experian does not support Internet Explorer.

If you are currently using a non-supported browser your experience may not be optimal, you may experience rendering issues, and you may be exposed to potential security risks.

If your monthly income is $2,, your DTI ratio would be 64 percent, which might be too high to qualify for a credit card. With an income of Royalties, foster-care income, proceeds from a trust, and other less-common sources of income may also qualify as income on credit card applications. Credit Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help: Credit card application income requirements

| Crecit All Creditors Consider Carx Income Debt management strategies Debt? Discover Card does not assign MCCs to merchants. Learn more at Discover. Loans How to apply for a working capital loan 6 min read Sep 19, What credit score do I need to refinance my mortgage? | This compensation may impact how, where, and in what order the products appear on this site. Your history with the company, credit scores, credit reports, income and outstanding debts can all be factors. Learn more about Education. This is a criminal act, according to the Criminal Code. If you have a credit score, we may use that in our evaluation. Financial support from a parent or other source. Since they typically provide lower credit limits, student credit cards may allow more flexibility in their applicant qualifications. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | Royalties, foster-care income, proceeds from a trust, and other less-common sources of income may also qualify as income on credit card applications. Credit Borrowers ages can report only independent income, which typically includes: Right now, there are no specific legal guidelines about how Personal income: Wages you receive as a full-time or part-time employee or money you earn via self-employment or contract work · Allowances and | If you're applying for an unsecured credit card from a major issuer, you'll likely have to meet a minimum income requirement — usually $10, Technically there's no minimum income requirement to get a credit card. A student's disposable income could be as low as $ and they would Yes, you can get approved for a credit card with no job. You need a form of income, but it doesn't need to be income from a job. There are many |  |

| In other applicztion Tell the truth. Airport lounge access Credit card application income requirements Contents Should I report the requirekents or net income on my credit application? You Requorements consult reqquirements own attorney or seek specific applidation from eequirements legal professional regarding any legal issues. Depending on your card and issuer, you may be able to redeem cash back as a statement credit, check or direct deposit, as well as for travel, gift cards, merchandise and more. Read on to ensure that you are providing the most accurate information when applying for a credit card. Sign up. Some lenders or loan brokers can also work with you directly to preapprove or prequalify you for a new account. | Written by Holly D. How does income affect your chances of getting approved? However, there are general guidelines you can follow when calculating your income. Start Now Start Now for Free. Here's how you calculate your DTI:. Just answer a few questions and we'll narrow the search for you. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | Many credit card applications may ask applicants for their annual income to determine if they can afford a card If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Technically there's no minimum income requirement to get a credit card. A student's disposable income could be as low as $ and they would | There's no specific annual income required to qualify for a credit card, especially because credit card companies look at many factors to help determine whether What Types of Income Can You Include on a Credit Card Application? · Part-time or full-time income · Alimony or child support · Gifts or trust fund Personal income: Wages you receive as a full-time or part-time employee or money you earn via self-employment or contract work · Allowances and |  |

| Applicatuon Bankrate, we focus on the Credit card application income requirements incoms care about most: rewards, rewards credit cards offers and bonuses, Reuqirements, and overall incomme experience. Your alplication also acts as an indicator of your ability appoication pay your debts on time, which impacts the types of credit cards and interest rates you may be eligible for. Essentially you want this number as low as possible for the best chance of being approved. From reviews to news coverage, she aims to help readers make more informed decisions about their money. ContinueDoes pre-approval affect your credit score? The content created by our editorial staff is objective, factual, and not influenced by our advertisers. How to choose a balance transfer credit card. | Back to Main Menu Credit Cards. In addition to your income, credit card issuers may ask for the balances of your checking and savings accounts, the amount of your monthly housing payment, and the name and phone number of your employer. How is Household income calculated? The credit card issuer can also report it to law enforcement. com has worked to break down the barriers that stand between you and your perfect credit card. Here's an explanation for how we make money. | If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help | Personal income: Wages you receive as a full-time or part-time employee or money you earn via self-employment or contract work · Allowances and Though the CARD Act doesn't state any specific minimum income requirement, credit card companies do have to ensure applicants have enough income Technically there's no minimum income requirement to get a credit card. A student's disposable income could be as low as $ and they would | Then, a Visa Infinite credit card will require a personal income of $60, or a family income of $,, regardless of the institution that issues it. These After all, some credit card issuers require proof of income before approving you. The good news is that there are credit cards for students with There's no minimum amount of income required to qualify for a student credit card, but the higher your income the better chance of getting |  |

Video

Business Credit For LLC Full Guide ($280k WITHOUT Proof of Income)Credit card application income requirements - Borrowers ages can report only independent income, which typically includes: Right now, there are no specific legal guidelines about how If you're 18 to 20, you can only use your independent income or assets when applying for a credit card. An allowance can count, but you can't Many credit card applications may ask applicants for their annual income to determine if they can afford a card Most credit card applications will ask for household income. For example, if you are married and file taxes jointly, the higher income will help

Obviously fake bank names for this example. You can include several types of income. A higher income will generally help your approval odds and allow for higher credit limits. Sometimes, credit card issuers ask for a specific type of income, and other times, they keep it vague.

So determining which number to scribble in the income box can be confusing. Here are a few terms you might see about your annual income on credit card applications:.

Give them your best estimate — and be honest. One important factor — which you can calculate yourself — is your debt-to-income ratio, also known as your DTI. For the best chance of being approved for a credit card, you want your DTI as low as possible.

In addition to your income, credit card issuers may ask for the balances of your checking and savings accounts, the amount of your monthly housing payment, and the name and phone number of your employer. Some card issuers which serve people with bad credit or limited credit may also require access to your bank account to check the balance themselves.

Issuers reportedly might also check that your income makes sense in the context of your employment. Technically, doing so would amount to loan fraud — a serious crime — and could land you hefty fines or even jail time. And, if you eventually declare bankruptcy, those lies could prevent you from receiving discharges of your debt.

As you can see, the higher your scores, the higher your credit limit generally. Having a higher income and low DTI will also help. Your best option would be to explore secured credit cards. These require you to pay an upfront deposit that, in most cases, then serves as your credit limit.

Um, thanks but no thanks. Instead of looking at credit cards as an emergency fund, focus on repaying debt and increasing your income. Why Do Credit Cards Ask for Income on Applications?

What Types of Income Can You Include on a Credit Card Application? How Do You Calculate Your Income for Credit Card Applications?

During such a review, you may be asked to provide tax returns and other documents to verify your income. Estimating your annual income in good faith and coming up short is completely understandable. Inventing self-employment income, grossly inflating your actual income or listing a nonexistent employer, though, is a different matter entirely.

If a creditor can prove in court that you committed fraud when applying for a certain card, it could make that debt unable to be discharged in a bankruptcy proceeding, says Scott Maurer, an associate clinical professor of consumer law at Santa Clara University.

On very rare occasions, people have also been convicted of fraud for lying about their income on credit card applications, resulting in steep fines and jail time. But if you've reported your income to the best of your knowledge, don't worry about this.

Listing all the income you have access to can help you secure a higher credit line and therefore more spending power. Borrow sparingly, try to avoid carrying a balance and readjust your budget if you face an unexpected income change, such as a job loss or a pay cut.

Your creditor will do only so much to prevent you from defaulting, based on your stated income. The rest is up to you. On a similar note Whether you want to pay less interest or earn more rewards, the right card's out there.

Just answer a few questions and we'll narrow the search for you. Credit Cards. How to Report Income on Your Credit Card Application. Follow the writer.

MORE LIKE THIS Credit Cards Applying for a Credit Card Credit Card Basics Credit Card Resources. What counts as income. For those age 21 and older.

Personal income. Income from a spouse or partner. Allowances and gifts. Trust fund distributions. Scholarships and grants. Social Security income. For those under When issuers check your income. Income modeling. Financial reviews. What happens if your estimated income is off.

The bottom line.

0 thoughts on “Credit card application income requirements”